Professional Documents

Culture Documents

Government Budget

Uploaded by

Erjohn PapaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Budget

Uploaded by

Erjohn PapaCopyright:

Available Formats

Erjohn O.

Papa

45043

Total National Budget for 2021 - PHP 4.056 trillion

Allocation by Sector

Social Services - PHP 1,668 billion (37% of National Budget)

Economic Services - PHP 1,323.1 billion (29.4% of National Budget)

General Public Sectors - PHP 747.8 billion (16.6% of National Budget)

Debt Burden - PHP 560.2 billion (12.4% of National Budget)

Defense - PHP 206.8 billion (4.6% of National Budget)

Top 10 Departments

Department Budget( billions)

Education 751.7

DPWH 695.7

DILG 249.3

DOH 210.2

DND 205.8

DSWD 176.9

DOTr 87.9

DA 71

Judiciary 45.3

DOLE 37.1

Programs and Projects

Addressing the COVID-19 Pandemic

- for providing health care

- establishment of the Virology Science and Technology Institute of the

Philippines

Reviving Infrastructure Development

- Build, Build, Build Program

Adapting to the New Normal

- Transition to new normal of various sectors

- for flexible and blended learning

- improve productivity of the agriculture and fishery sector

- to help local businesses

- Funding programs for 4P’s

- for implementation of Philippine Identification System

ACCOUNTING FOR BUDGETARY ACCOUNTS

Article VI of the 1987 Constitution Section 29 (1). “No money shall be

paid out of the Treasury except in pursuance of an appropriation by

law.”

ACCOUNTING SYSTEMS

General Accounting Plan (GAP) – the overall accounting system of a

government agency or unit.

The following are objective-specific accounting systems:

Budgetary Accounts Systems

Receipt/Income and Deposit System

Disbursement System

Financial Reporting System

THE NATIONAL BUDGET

-a government document presenting the government's proposed revenues

and spending for a financial year that is often passed by the legislature,

approved by the chief executive or president and presented by the Finance

Minister to the nation.

KINDS OF BUDGET

1. As to Nature

a. Annual

b. Supplemental

c. Special

2. As to Basis

a. Performance

b. Line-item

3. As to approach and technique

a. Zero-based

b. Incremental

THE BUDGET PROCESS

1. Budget Preparation – this covers estimation of government revenues,

the determination of budgetary priorities and activities within the

constraints imposed by available revenues and by borrowing limits, and

the translation of approved priorities and activities into expenditure

levels.

Budget proposals shall not be based on the following:

a. A given percentage or peso increase or decrease from a prior

year’s budget level

b. A given percentage of the aggregate budget level

c. A similar rule of thumb that is not based on specific justification

2. Legislative Authorization – budget process relative to the enactment

of the General Appropriation Bills based on the budget of receipts and

expenditures submitted by the President of the Philippines.

General Appropriation Bills presents the proposals of the President for

new general appropriations in the coming year.

Appropriations are approved by the legislative body in the form of:

a. A general appropriation law which covers most of the expenditures

of government

b. Supplemental appropriations laws that are passed from time to time

to augment or correct an already existing appropriation

c. Certain automatic appropriations intended for fixed and specific

purposes

3. Budget Execution and Operation – covers the various operational

aspects of budgeting. It comprise, among others, of the following:

a. Establishment of authority ceilings on obligations

b. Evaluation of work and financial plans for individual activities

c. Continuing review of government fiscal position

d. Regulation of fund releases

e. Implementation of cash payment schedules

f. Updating planning and scheduling activities

4. Budget Accountability – this phase consist of the following:

a. Periodic reporting by the government agencies of performances

under their approved budget

b. Top management review of government activities and the fiscal

policy implementation

c. The actions of Commission on Audit (CoA) in assuring the fidelity of

officials and employees by carrying out the intent of the legislative

regarding the handling of receipts and expenditures

BUDGETARY ACCOUNTS

1. Appropriation – an authorization made by law or other legislative

enactment, directing payment of goods and services out of government

funds under specific conditions or for special purpose

2. Allotment – an authorization issued by the Department of Budget and

Management (DBM) to the government agency, which allows it to incur

obligations, for specified amounts, within the legislative appropriation

3. Obligation – a commitment by a government agency arising from an

act of duly authorized official which binds the government to the

immediate or eventual payment of a sum of money

BUDGETARY ACCOUNTS SYSTEM

The Budgetary Accounts System encompasses the processes of preparing

Agency Budget Matrix (ABM), monitoring and recording of allotments received

by the agency from the DBM, releasing of Sub-Allotment Release Order (Sub-

SARO) to Regional Offices (RO) by the Central Office (CO); issuance of Sub-

SARO to Operating Units (OU) by the RO; and recording and monitoring of

obligations.

BUDGETARY ACCOUNTS

Budgetary accounts consist of the appropriations, allotments and obligations.

Appropriations refer to authorizations made by law or other legislative

enactment for payments to be made with funds of the government under

specified conditions and/or for specified purposes. Appropriations shall be

monitored and controlled through registries and control worksheets by the

DBM and COA, respectively. Budgetary accounts allotments and obligations

are discussed in the succeeding sections.

THE ALLOTMENT RELEASE ORDER (ARO)

-is a formal document issued by the DBM to the agency containing the

authorization, conditions and amount of an agency allocation

The document may be the:

1. Agency Budget Matrix – effectively releases the amount indicated as

not needing clearance; or

2. Special Allotment Release Order (SARO) – issued subject to

compliance with laws or regulations or is subject to separate approval

or clearance by competent authority.

REPORTING REQUIREMENTS

Per Nation Budget Circular No. 507, dated January 31, 2007, the DBM

requires national government agencies to submit, on a regular basis, Budget

Execution Documents (BEDs), which contain the agencies’ targets and

plans for the current year, and Budget Accountability Reports (BARs),

which contain information on the agencies’ accomplishments and

performance for a given period.

The BEDs include:

1. Physical and Financial Plan (PFP)

2. Monthly Cash Program (MCP)

3. Estimate of Monthly Income

4. List of Not Yet Due and Demandable Obligations

The BARs include:

1. Quarterly Physical Reports of Operations

2. Quarterly Financial Reports of Operations

3. Quarterly Report of Actual Income

4. Statement of Allotment, Obligations and Balances

5. Monthly Report of Disbursements

GENERAL GUIDELINES ON THE RELEAE OF FUNDS

Pending the effective date of the new General Appropriation Act (GAA),

national government agencies are authorized to incur overdraft in allotment

for obligations corresponding to the actual requirement of their regular

operations chargeable against the GAA, as re-enacted.

AGENCY BUDGET MATRIX (ABM)

The ABM refers to a document showing the disaggregation of agency

expenditures into components like, among others, by source of

appropriations, by allotment class and by need of clearance.

1. Needing Clearance – portion of the ABM consisting budgetary items in

the agency specific budgets that shall be released upon compliance of

certain documentary requirements

2. Not Needing Clearance – portion of the ABM referring to budgetary

items of agency budgets under the GAA not included under Needing

Clearances portion and categorized as such in the submitted financial

plan of the agency.

KEY TERMS ON RELEASE OF DISBURSEMENT AUTHORITIES

1. Release of Notice of Cash Allocation (NCA)

2. Release of non-cash Availment Authority (NCAA)

3. Release of Cash Disbursement Ceiling

CONDUCT OF THE AGENCY PERFORMANCE REVIEW

Consistent with performance-based budgeting, a quarterly evaluation of the

agency performance shall be conducted by comparing agency plans and

targets per BEDs vis-à-vis actual accomplishments per BARs.

COMMON FUND SYSTEM

The common fund system policy (for use of personal services, maintenance

and other operating expenses, capital outlays, and financial expenses without

realignment) shall continue to be used. However, it will not apply to current

year Accounts Payable to external creditors of the five departments covered

by the Direct Payment Scheme. These departments are:

1. Department of Public Works and Highways

2. Department of Education

3. Department of Health

4. Commission on Higher Education

5. State Universities and Colleges

References:

https://www.dbm.gov.ph/index.php/secretary-s-corner/press-releases/list-of-

press-releases/1778-prrd-signs-the-p4-506-trillion-national-budget-for-fy-

2021#:~:text=President%20Rodrigo%20Roa%20Duterte%20today,to%20the

%20COVID%2D19%20pandemic.

https://www.scribd.com/document/247912792/Accounting-for-Budgetary-

Accounts

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AC - Acctg Gov Quiz 01 SolutionsDocument12 pagesAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- English For BusinessDocument142 pagesEnglish For Businessotelea_vasileNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

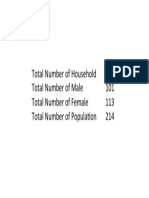

- HouseholdDocument1 pageHouseholdErjohn Papa100% (1)

- Export Trade History4Document6 pagesExport Trade History4Erjohn PapaNo ratings yet

- Export Trade HistoryDocument9 pagesExport Trade HistoryErjohn PapaNo ratings yet

- Export Trade History3Document6 pagesExport Trade History3Erjohn PapaNo ratings yet

- Export Trade History2Document6 pagesExport Trade History2Erjohn PapaNo ratings yet

- Disc Room Reservation FileDocument2 pagesDisc Room Reservation FileErjohn PapaNo ratings yet

- Auditing Cabrera C1Document20 pagesAuditing Cabrera C1Erjohn PapaNo ratings yet

- Guerrero SpoilageDocument12 pagesGuerrero SpoilageErjohn PapaNo ratings yet

- Articles of IncorporationDocument4 pagesArticles of IncorporationErjohn PapaNo ratings yet

- Guerrero Joint and by ProductsDocument16 pagesGuerrero Joint and by ProductsErjohn PapaNo ratings yet

- Test Bank For RFBTDocument15 pagesTest Bank For RFBTErjohn PapaNo ratings yet

- CH 10Document18 pagesCH 10Erjohn PapaNo ratings yet

- Ethics ReportDocument37 pagesEthics ReportErjohn PapaNo ratings yet

- EthicsDocument16 pagesEthicsErjohn PapaNo ratings yet

- Check Calculator SeriesDocument2 pagesCheck Calculator SeriesErjohn PapaNo ratings yet

- Mojica VDocument3 pagesMojica VJune Karl CepidaNo ratings yet

- How To Calculate Car InterestDocument1 pageHow To Calculate Car InterestKevinNo ratings yet

- Nism Investment Adviser Level2 Study Notes PDFDocument20 pagesNism Investment Adviser Level2 Study Notes PDFAkash VaidyaNo ratings yet

- Personal Loan AgreementDocument19 pagesPersonal Loan AgreementRajNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- Chapter 1 5 Income Tax MCDocument14 pagesChapter 1 5 Income Tax MCeddie mar jagunapNo ratings yet

- Summer Internship in Greenply Industries LTDDocument16 pagesSummer Internship in Greenply Industries LTDVanshika MaheswaryNo ratings yet

- Contracts I OutlineDocument34 pagesContracts I OutlineOnyi IbeNo ratings yet

- FA - Final Accounts - NumericalsDocument12 pagesFA - Final Accounts - NumericalsShubhankar GuptaNo ratings yet

- When A Thing Considered LostDocument2 pagesWhen A Thing Considered LostAlyssa Mae Ogao-ogao0% (1)

- DepartmentalDocument29 pagesDepartmentalnus jahanNo ratings yet

- Reviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Document7 pagesReviewer in Auditing Problems by Ocampo/Ocampo (2021 Edition)Rosevilla AbneNo ratings yet

- AFE3691 Tutorial QuestionsDocument29 pagesAFE3691 Tutorial QuestionsPetrinaNo ratings yet

- Accountancy: KeepingDocument11 pagesAccountancy: KeepingRashi thiNo ratings yet

- Collection PoliciesDocument2 pagesCollection PoliciesParagas, Kristine Joy A.No ratings yet

- Liabilities - Overview Accrual and Deferred Revenue - Handout PresentationDocument15 pagesLiabilities - Overview Accrual and Deferred Revenue - Handout PresentationZaira PerezNo ratings yet

- Analysis of Capital Structure Stability of Listed Firm in ChinaDocument16 pagesAnalysis of Capital Structure Stability of Listed Firm in ChinaAhmed BakhtNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Ratio Analysis: An Approach To Understanding Strengths and Weaknesses in A BusinessDocument25 pagesRatio Analysis: An Approach To Understanding Strengths and Weaknesses in A BusinessAsad MazharNo ratings yet

- Accounting I ModuleDocument92 pagesAccounting I ModuleJay Githuku100% (1)

- Foundations in Accountancy FFA/ACCA FDocument94 pagesFoundations in Accountancy FFA/ACCA FTrần Thu TrangNo ratings yet

- Pre Trial Brief Sample Plaintiff A1Document10 pagesPre Trial Brief Sample Plaintiff A1Cyril GallerosNo ratings yet

- Law On Obligations and ContractDocument24 pagesLaw On Obligations and ContractAJSINo ratings yet

- Chapter 3 Different Kinds of Obligations - Section 1 (1186)Document6 pagesChapter 3 Different Kinds of Obligations - Section 1 (1186)macrosalNo ratings yet

- 4 5868236919153887449-1Document49 pages4 5868236919153887449-1Fasiko Asmaro100% (1)

- Chapter 4 - Modes of ExtinguishmentDocument19 pagesChapter 4 - Modes of ExtinguishmentcartyeolNo ratings yet

- Assignment-Rules On AccessionDocument10 pagesAssignment-Rules On AccessionLandAsia Butuan RealtyNo ratings yet

- PDF DocumentDocument4 pagesPDF Documentshartulymail.comNo ratings yet

- APC Obligations 1179-1192Document6 pagesAPC Obligations 1179-1192AP CruzNo ratings yet