Professional Documents

Culture Documents

Pay Stub Template 2

Uploaded by

Antwain UtleyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pay Stub Template 2

Uploaded by

Antwain UtleyCopyright:

Available Formats

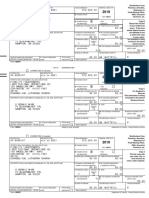

ABC Corp.

Employee Name: Mary Smith

450 Chamber Street Social Security #: 999-99-9999

Somewhere, USA 01010 Period End Date: 01/07/05

Wages Deductions

Current Y-T-D Current Y-T-D

Description Hours Rate Amount Amount Description Amount Amount

Regular 40.00 10.00 400.00 400.00 Federal Withholdings 37.29 37.29 1

Overtime 1.00 15.00 15.00 15.00 Social Security Tax 24.83 24.83

Holiday 0.00 Medicare 5.81 5.81 Details of

Tuition 37.43* 37.43 Tax 8.26 8.26 applicable

1 federal,

NY State 5.11 5.11

Income Tax 0.61 0.61 state, and

NYC Income Tax local taxes

NY SUI/SDI Tax paid.

Other

401(k)

2 27.15* 27.15

Life Insurance 2.00 2.00

Loan 30.00 30.00

Dental 2.00* 2.00 2

HMO 20.00* 20.00

Dep Care FSA 30.00* 30.00 401(k)

3 savings is a

pre-tax

deduction.

Totals 452.43 452.43 Deduction Totals 193.06 193.06

3

Taxable Gross 335.85 335.85 Flexible

NET PAY 259.38 259.38 Spending

Accounts

(for health

• Excluded from federal taxable wages care, child

or

dependant

care,

parking

expenses)

ABC Corp. Payroll Advice # 00000000

are pre-tax

450 Chamber Street Advice of Credit Date 1/07/2005

deductions.

Somewhere, USA 01010

Pay TWO HUNDRED FIFTY NINE AND 38/100 DOLLARS

To the MARY SMITH

Order of 215 MAIN STREET

ANYTOWN, USA 98765

NON-NEGOTIABLE

Downloaded from http://www.tidyforms.com

You might also like

- A Grain of Wheat - Ngugi Wa Thiong'o PDFDocument277 pagesA Grain of Wheat - Ngugi Wa Thiong'o PDFMima2400082% (33)

- Pay Stub Template FreeDocument1 pagePay Stub Template FreeMichael ShortNo ratings yet

- Rent Ledger YEVDocument1 pageRent Ledger YEVRobert KeyNo ratings yet

- Pay Stub Template 03 PDFDocument1 pagePay Stub Template 03 PDFchairgraveyardNo ratings yet

- Payslip TemplateDocument7 pagesPayslip TemplateSusaine Sinohin100% (2)

- Toggle Renters Insurance Policy TOK48D622F DocumentsDocument22 pagesToggle Renters Insurance Policy TOK48D622F DocumentsDominique LangstonNo ratings yet

- July Pay Stub - STEWART SANDRA LDocument1 pageJuly Pay Stub - STEWART SANDRA LjamesNo ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- PayStub - California ExampleDocument1 pagePayStub - California ExampleanthonyzallerNo ratings yet

- Tax RecordDocument1 pageTax RecordmicantbabyNo ratings yet

- Cost SheetDocument15 pagesCost SheetSandeep SinghNo ratings yet

- SOP - Housekeeping - Departmental Policy Setup: Department OrientationDocument36 pagesSOP - Housekeeping - Departmental Policy Setup: Department OrientationAntwain UtleyNo ratings yet

- Read Republicans' Biden ReportDocument87 pagesRead Republicans' Biden Reportkballuck194% (103)

- Bridge Loan AgreementDocument65 pagesBridge Loan AgreementKnowledge GuruNo ratings yet

- Opening Range Breakout Trading StrategyDocument3 pagesOpening Range Breakout Trading Strategyamveryhot09100% (5)

- Income Statement Template V3Document21 pagesIncome Statement Template V3Third WheelNo ratings yet

- Rent Ledger PDFDocument1 pageRent Ledger PDFJahziel KwonNo ratings yet

- Internet Att BillDocument4 pagesInternet Att Billben tenNo ratings yet

- Account Transcript - NICH - 103569728089Document2 pagesAccount Transcript - NICH - 103569728089Ashley Marie NicholsNo ratings yet

- November 2019Document4 pagesNovember 2019Astrid MeloNo ratings yet

- Statement of Earnings: NON NegotiableDocument1 pageStatement of Earnings: NON NegotiableireneNo ratings yet

- ReportDocument2 pagesReportapi-462242419No ratings yet

- Report PDFDocument2 pagesReport PDFJBStringerNo ratings yet

- Foodstamp LetterDocument6 pagesFoodstamp LetterTemisha BrownNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableanandsoggyNo ratings yet

- Jill Weber, DO: Illness InjuryDocument1 pageJill Weber, DO: Illness Injurynatalie goodjoinesNo ratings yet

- Earn StatementDocument1 pageEarn StatementKhu RehNo ratings yet

- 4600229175 - CopyDocument2 pages4600229175 - CopyData BaseNo ratings yet

- Rent Receipt: (Signature)Document1 pageRent Receipt: (Signature)Akhil RaviNo ratings yet

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocument4 pagesGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNo ratings yet

- Ihg Logo Folio467820Document1 pageIhg Logo Folio467820Irshad AliNo ratings yet

- 2010 08 15 - BillDocument2 pages2010 08 15 - Billteporocho9No ratings yet

- Rossi Construction Inc: Single Tammy Jo Gentile 302 Vermont Way Lehigh Acres, FL 33936 02/12/2022Document1 pageRossi Construction Inc: Single Tammy Jo Gentile 302 Vermont Way Lehigh Acres, FL 33936 02/12/2022olaNo ratings yet

- Mallard Glen Lease, Centerville, OhioDocument5 pagesMallard Glen Lease, Centerville, OhiogaryNo ratings yet

- Sample InsuranceDocument4 pagesSample InsuranceShashanth Kumar (CS - OMTP)No ratings yet

- Carissa Baker: Employee Info Tax DataDocument2 pagesCarissa Baker: Employee Info Tax Datawhat is thisNo ratings yet

- Rental Agreement - Copy JHVKHBLNJH PLDocument10 pagesRental Agreement - Copy JHVKHBLNJH PLDedra Faye Vining-McDanielNo ratings yet

- Pay Stub Edmondson - 1Document1 pagePay Stub Edmondson - 1Mary AndresonNo ratings yet

- Doctors Note OutlineDocument2 pagesDoctors Note OutlineRoohid ParastNo ratings yet

- Customer 11-20-2019 131357707 PDFDocument2 pagesCustomer 11-20-2019 131357707 PDFBrandon BachNo ratings yet

- Public Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012Document72 pagesPublic Storage Inc /ca: Quarterly Report Pursuant To Sections 13 or 15 (D) Filed On 08/06/2012 Filed Period 06/30/2012got.mikeNo ratings yet

- Bemis Co Check Date Check Number: VOID - This Is Not A CheckDocument1 pageBemis Co Check Date Check Number: VOID - This Is Not A Checkfreeman p. donNo ratings yet

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDocument1 pageConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNo ratings yet

- Item Qty Price Amount RB3025 58 AVIATOR LARG, GLD SHN, BRN GRDDocument3 pagesItem Qty Price Amount RB3025 58 AVIATOR LARG, GLD SHN, BRN GRDKoolter PolskieNo ratings yet

- CORRECTED (If Checked)Document2 pagesCORRECTED (If Checked)Dennis100% (1)

- Non - Negotiable: Notification of DepositDocument1 pageNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့No ratings yet

- Invoice 768412885Document3 pagesInvoice 768412885MD Ziaul HaqueNo ratings yet

- ResponseDocument48 pagesResponseAlfred ReynoldsNo ratings yet

- 941 1st QTR 2010Document2 pages941 1st QTR 2010Larry BartonNo ratings yet

- Internet and Phone Sample Bill GuideDocument1 pageInternet and Phone Sample Bill GuideleenevNo ratings yet

- Lili Monthly Statement 2022-08 2Document2 pagesLili Monthly Statement 2022-08 2Robert Wilson100% (1)

- NNNNNDocument4 pagesNNNNNeproveNo ratings yet

- UL PayStub 2019.01.15Document1 pageUL PayStub 2019.01.15Marcus GreenNo ratings yet

- Application Tenant Rental&UtilityAssistance 40403Document25 pagesApplication Tenant Rental&UtilityAssistance 40403Taira ClackNo ratings yet

- 2024 12 31 StatementDocument4 pages2024 12 31 StatementAlex NeziNo ratings yet

- Erie County Ny Certificate of Insurance PDFDocument2 pagesErie County Ny Certificate of Insurance PDFMonicaNo ratings yet

- View Paycheck: Employee InformationDocument4 pagesView Paycheck: Employee InformationJohn January0% (1)

- CCR 14-15 q4 Paystub ExampleDocument1 pageCCR 14-15 q4 Paystub Exampleapi-232724808No ratings yet

- Check Ais-3Document1 pageCheck Ais-3JOHNNo ratings yet

- Screenshot 2023-06-22 at 9.22.08 AMDocument1 pageScreenshot 2023-06-22 at 9.22.08 AMSharon SmithNo ratings yet

- Attachment 1 4Document1 pageAttachment 1 4Tabbitha CampfieldNo ratings yet

- Jason Miller - Financial Affidavit, April 28, 2020Document15 pagesJason Miller - Financial Affidavit, April 28, 2020A.J. DelgadoNo ratings yet

- Check StubDocument1 pageCheck StubBonnie GeneralNo ratings yet

- Paystub 3Document1 pagePaystub 3GlendaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- California Folklore Society Meeting, 1970-1971Document18 pagesCalifornia Folklore Society Meeting, 1970-1971Antwain UtleyNo ratings yet

- Native American Democrats Brooklyn-Americancausepro00natiDocument12 pagesNative American Democrats Brooklyn-Americancausepro00natiAntwain UtleyNo ratings yet

- David LivingstonDocument438 pagesDavid LivingstonAntwain Utley100% (1)

- Nativehousesofwe00wate 0-Nativehousesofwe00wate 0Document116 pagesNativehousesofwe00wate 0-Nativehousesofwe00wate 0Antwain UtleyNo ratings yet

- The Book of The NativeDocument164 pagesThe Book of The NativeAntwain UtleyNo ratings yet

- South African Folklore by James A. HoneyDocument172 pagesSouth African Folklore by James A. HoneyAntwain UtleyNo ratings yet

- California Folklore Society Meeting, 1968-1969Document64 pagesCalifornia Folklore Society Meeting, 1968-1969Antwain UtleyNo ratings yet

- South African Folklore by James A. HoneyDocument172 pagesSouth African Folklore by James A. HoneyAntwain UtleyNo ratings yet

- Africa and The Discovery of America (IA Cu31924088419803)Document360 pagesAfrica and The Discovery of America (IA Cu31924088419803)mlphtxNo ratings yet

- From Heru To Shaka Zulu The Spirit BeyonDocument13 pagesFrom Heru To Shaka Zulu The Spirit BeyonAntwain UtleyNo ratings yet

- Anth 340 PPT Lecture 8 EB IV MB I CanaanDocument136 pagesAnth 340 PPT Lecture 8 EB IV MB I CanaanAntwain UtleyNo ratings yet

- Thans Deal Analyzer BonusDocument6 pagesThans Deal Analyzer BonusAntwain UtleyNo ratings yet

- Cash Envelope Register LongDocument3 pagesCash Envelope Register LongAntwain UtleyNo ratings yet

- Black Light Newsletter Black Light Newsl 2Document8 pagesBlack Light Newsletter Black Light Newsl 2Antwain Utley0% (1)

- Project Task List TemplateDocument4 pagesProject Task List TemplategcldesignNo ratings yet

- Bible ChronologicalDocument8 pagesBible ChronologicalAntwain Utley100% (1)

- PassPortApplication PDFDocument6 pagesPassPortApplication PDFvcvnoffjNo ratings yet

- Egypt PDFDocument10 pagesEgypt PDFSagarNo ratings yet

- WF147 Loan Amortization TemplateDocument26 pagesWF147 Loan Amortization TemplateAntwain UtleyNo ratings yet

- Documents of West Indian HistoryDocument384 pagesDocuments of West Indian HistoryAntwain Utley100% (1)

- You Are The Boss Now. Talk Like ItDocument6 pagesYou Are The Boss Now. Talk Like ItAntwain UtleyNo ratings yet

- Lead List Template - Someka V4FDocument36 pagesLead List Template - Someka V4FAntwain UtleyNo ratings yet

- Vehicle Maintenance Log: Make: Model: Year: Vehicle ID Number: Engine: Total Cost: 155.12Document1 pageVehicle Maintenance Log: Make: Model: Year: Vehicle ID Number: Engine: Total Cost: 155.12LuisAlbertoNo ratings yet

- African American LiteratureDocument41 pagesAfrican American LiteratureAntwain Utley100% (1)

- Frances HarperDocument21 pagesFrances HarperAntwain UtleyNo ratings yet

- Guidance For Cleaning and Disinfecting: Public Spaces, Workplaces, Businesses, Schools, and HomesDocument9 pagesGuidance For Cleaning and Disinfecting: Public Spaces, Workplaces, Businesses, Schools, and Homes'Jose Antonio AguilarNo ratings yet

- BHEL Ranikut 10T Crane PDFDocument27 pagesBHEL Ranikut 10T Crane PDFamarNo ratings yet

- Tugas 2Document4 pagesTugas 2calvin sijabatNo ratings yet

- Leave W/ Pay Leave W/ Pay Holiday Pay Holiday Pay: Total Deductions Total DeductionsDocument1 pageLeave W/ Pay Leave W/ Pay Holiday Pay Holiday Pay: Total Deductions Total DeductionsVic CumpasNo ratings yet

- CTA Crim. Case No. O-454Document48 pagesCTA Crim. Case No. O-454Rieland CuevasNo ratings yet

- نموذج ميزانية تدريبDocument2 pagesنموذج ميزانية تدريبعمولةNo ratings yet

- Salary SlipDocument3 pagesSalary SlipPooja GuptaNo ratings yet

- CH 13 SMDocument31 pagesCH 13 SMapi-267019092No ratings yet

- Baba Markting Form Vat 240 2010-2011Document5 pagesBaba Markting Form Vat 240 2010-2011arunupadhyaNo ratings yet

- Amalgamation of CompaniesDocument22 pagesAmalgamation of CompaniesSmit Shah0% (1)

- Krispy Kreme Case Study PDFDocument6 pagesKrispy Kreme Case Study PDFashish borahNo ratings yet

- Problems in Financial Reporting of JolliDocument38 pagesProblems in Financial Reporting of JolliAlvin BaternaNo ratings yet

- TX01 General Principles of TaxationDocument9 pagesTX01 General Principles of TaxationAce DesabilleNo ratings yet

- B.E Analysis: Dr. Raza Ali KhanDocument7 pagesB.E Analysis: Dr. Raza Ali KhanMustajab KhanNo ratings yet

- Caylum Beat The Market Issue 2 Vol 4Document11 pagesCaylum Beat The Market Issue 2 Vol 4zeebugNo ratings yet

- Promoters of A CompanyDocument4 pagesPromoters of A CompanyMansangat Singh KohliNo ratings yet

- The Ultimate Budget Routine - Budget With Rachel 2 PDFDocument23 pagesThe Ultimate Budget Routine - Budget With Rachel 2 PDFDianeNo ratings yet

- Medusa Mining Limited ABID Report 18may15Document20 pagesMedusa Mining Limited ABID Report 18may15kamaraNo ratings yet

- FAC 1502 Tutorial Letter 101-2015 PDFDocument96 pagesFAC 1502 Tutorial Letter 101-2015 PDFVinny Hungwe0% (1)

- Nature of Transactions in A Service BusinessDocument2 pagesNature of Transactions in A Service BusinessYanela YishaNo ratings yet

- UNIT I - PPT Managerial EconomicsDocument17 pagesUNIT I - PPT Managerial EconomicsDr Linda Mary Simon100% (4)

- PTSMN - Bilingual - Konsol - 31 Dec 2019 - Released PDFDocument153 pagesPTSMN - Bilingual - Konsol - 31 Dec 2019 - Released PDFwardah arofahNo ratings yet

- Mas Cpar Reviewer in 5th Year AccDocument67 pagesMas Cpar Reviewer in 5th Year AccCykee Hanna Quizo Lumongsod100% (1)

- Test Bank For Managerial Economics Applications Strategy and Tactics 11th Edition by McGuiganDocument4 pagesTest Bank For Managerial Economics Applications Strategy and Tactics 11th Edition by McGuiganeric0% (2)

- ACCT3101 Tutorial 5 Solutions Arens Chapter 6: 6.4 6.15 6.28 6.30Document4 pagesACCT3101 Tutorial 5 Solutions Arens Chapter 6: 6.4 6.15 6.28 6.30Xinran WangNo ratings yet

- Budgetary Control, Mar Cost c0st ST, Res AcDocument29 pagesBudgetary Control, Mar Cost c0st ST, Res AcYashasvi MohandasNo ratings yet

- Sample PDF of STD 11th Organization of Commerce and Management Smart Notes Book Commerce Maharashtra BoardDocument28 pagesSample PDF of STD 11th Organization of Commerce and Management Smart Notes Book Commerce Maharashtra BoardAahhNo ratings yet

- AMPPSolution To The Sample Questions MidtermDocument18 pagesAMPPSolution To The Sample Questions MidtermPyan AminNo ratings yet

- Financial Statements, Taxes and Cash Flow Chap02pptDocument18 pagesFinancial Statements, Taxes and Cash Flow Chap02pptNashwa Saad100% (1)