Professional Documents

Culture Documents

Ahmed Ice Creamb

Uploaded by

Infinity LoverOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ahmed Ice Creamb

Uploaded by

Infinity LoverCopyright:

Available Formats

Ahmed Ice Cream Sdn Bhd (AICE)

Episode 1:

Ahmed intends to start a business. He intends to open a factory to produce non-dairy ice creams

(AICE). He has a saving of $150,000 which he wants to use as capital for the business. He

wants to immediately record all his transactions and intend to complete all his records within

a week.

He then went on to purchase the necessary machines and equipment which he needs to pay

cash. The cost of the machines and equipment total to $120,000. Now, Ahmed has a dilemma.

He only has $150,000. Furthermore, he needs to pay a deposit rent of $30,000 for the factory,

as well as $10,000 for the utility deposits. So, he decided to borrow $100,000 from his father.

His father agreed to lend him the money, and made Ahmad promise to pay him return of 4%

every year and pay the money back within 5 years.

He has a saving of $150,000 which he wants to use as capital for the business.

Purchase the necessary machines and equipment which he needs to pay cash. The cost of the

machines and equipment total to $120,000.

Furthermore, he needs to pay a deposit rent of $30,000 for the factory,

$10,000 for the utility deposits.

So, he decided to borrow $100,000 from his father. His father agreed to lend him the money,

and made Ahmad promise to pay him return of 4% every year and pay the money back within

5 years.

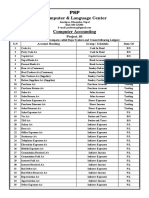

Episode 2:

The following transactions occurred in the Month of January.

Record the journal for the transactions and entries into the appropriate ledger accounts. New

ledger accounts need to be set up.

1. Paid workers salaries $ 5,000 on 31st January.

2. Appointed Johan as Manager on a salary of $ 4,000 per month

3. Purchased materials from Sen & Co. for production for $ 15,000. Received the goods from

Sen & Co but has not paid for the purchase.

4. Purchased materials from Oden Suppliers $7,500 and paid cash.

5. Sold $10,000 of product to JM Co for cash.

6. Sold $10,000 of product to Dino Co. Dino Co said they will only pay in March.

7. Sold $30,000 of product to JND. JND paid 50% with cash.

8. Paid Insurance on 1st January 2020 for business shop lot $12,000 for the next 2 years.

9. Paid Johan salary $2,000 on 31st January and the balance to be paid at end of February.

10. Ahmed withdraw $2,000 from the company on 31st January.

11. Paid Interest $333 to Father

12. Paid Principal Loan $1,666 to Father.

13. There are still $500 worth of purchased materials (ending Inventory) still in the factory at the

end of January.

14. The company tax is 25% of the Earnings Before Tax. The tax will only be paid in March.

1. Prepare the journal entries for Ahmad from the day he started the business and for the

whole month of January.

2. Enter the information from the journals into related ledger accounts.

3. Calculate the balance on each ledger accounts.

4. Prepare the trial balance.

5. Prepare the Income statement

6. Prepare the Balance Sheet.

You might also like

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Eyden - Air Transport Management PDFDocument526 pagesEyden - Air Transport Management PDFLê Đức Anh100% (1)

- Distribution Network Models and Case StudyDocument9 pagesDistribution Network Models and Case Studyyellow fishNo ratings yet

- Accounting Cycle of A Service BusinessDocument8 pagesAccounting Cycle of A Service BusinessNiziU MaraNo ratings yet

- Accounting Equation Problems and SolutionDocument7 pagesAccounting Equation Problems and SolutionNilrose EscartinNo ratings yet

- Valuation of ContributionDocument2 pagesValuation of ContributionsunshineNo ratings yet

- CostDocument30 pagesCostTrois65% (17)

- SPIT Abella SamplexDocument5 pagesSPIT Abella SamplexJasperAllenBarrientosNo ratings yet

- BTap-TCDN 2Document22 pagesBTap-TCDN 2baonguyen.31211022084No ratings yet

- Sales Management Case Study AnalysisDocument19 pagesSales Management Case Study AnalysisDevesh Rajak100% (1)

- Financial Feasibility: Financial Assumptions of Dry Laundry ExpressDocument3 pagesFinancial Feasibility: Financial Assumptions of Dry Laundry ExpressLosing Sleep100% (1)

- Group Assignments - OfinDocument11 pagesGroup Assignments - Ofinbe zeeNo ratings yet

- Accountancy XI - Project WorkDocument1 pageAccountancy XI - Project WorkVaibhav MahawarNo ratings yet

- Accounting Ex3.0Document3 pagesAccounting Ex3.0Kanishka Singh RaghuvanshiNo ratings yet

- Midterm 1Document1 pageMidterm 1Trang TranNo ratings yet

- Exercises On Accounting EquationDocument4 pagesExercises On Accounting EquationNeelu AggrawalNo ratings yet

- Assignment of Business MathsDocument2 pagesAssignment of Business MathsIrfanNo ratings yet

- Bake and Bite Inc.Document1 pageBake and Bite Inc.Simaran MalikNo ratings yet

- LogicDocument4 pagesLogicAiman Aslam KhanNo ratings yet

- Problem Set 1 UpdatedDocument2 pagesProblem Set 1 UpdatedRubab MirzaNo ratings yet

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- Opportunity CostDocument1 pageOpportunity Costvaibhav67% (3)

- Project Management Case StudyDocument2 pagesProject Management Case StudyrohitbhopaleNo ratings yet

- Sum On Salary 27.08.2022Document3 pagesSum On Salary 27.08.2022Nilay ShethNo ratings yet

- AccountancyDocument15 pagesAccountancyShreyaaNo ratings yet

- De bai-DN BINH MINH-DN THUONG MAIDocument3 pagesDe bai-DN BINH MINH-DN THUONG MAITiến Thành HoàngNo ratings yet

- FA ProblemsDocument6 pagesFA ProblemsdishaNo ratings yet

- Single SystemDocument7 pagesSingle SystemRobert HensonNo ratings yet

- Dac 212:principles of Taxation Revision Questions Topics 1-4Document6 pagesDac 212:principles of Taxation Revision Questions Topics 1-4Nickson AkolaNo ratings yet

- Case For DiscussionDocument3 pagesCase For DiscussionRudra GoyalNo ratings yet

- Case Study 1: Make A Financial Report Part 1: Make A Balance SheetDocument3 pagesCase Study 1: Make A Financial Report Part 1: Make A Balance SheetThảo LêNo ratings yet

- Problem 1Document14 pagesProblem 1SyedNo ratings yet

- 5th Semester - Assignment Test 2Document3 pages5th Semester - Assignment Test 2Devender DuaNo ratings yet

- Dac 212 Ass.1Document3 pagesDac 212 Ass.1Nickson AkolaNo ratings yet

- Financial SolutionDocument4 pagesFinancial Solutionnilesh bharadwajNo ratings yet

- Taxation Law Review Final ExaminationsDocument4 pagesTaxation Law Review Final ExaminationsRufino Gerard MorenoNo ratings yet

- FM-Math, Time Value of MoneyDocument2 pagesFM-Math, Time Value of Moneymaher213No ratings yet

- CF Assignment - 2Document2 pagesCF Assignment - 2vishnu607No ratings yet

- Financial Calculation QuestionsDocument2 pagesFinancial Calculation QuestionspriyavlNo ratings yet

- Math Warm UpDocument1 pageMath Warm Upapi-475334671No ratings yet

- Labor 2011Document3 pagesLabor 2011Ejaz KhanNo ratings yet

- De Bai-Dn Binh Minh-Dn Thuong MaiDocument4 pagesDe Bai-Dn Binh Minh-Dn Thuong MaiĐức TiếnNo ratings yet

- Problem Set IIDocument8 pagesProblem Set IIVynz JoshuaNo ratings yet

- CBSE Class 11 Accountancy Basava International School Unit Test-1Document1 pageCBSE Class 11 Accountancy Basava International School Unit Test-1Dinesh Bothra Res-commerce AccountancyNo ratings yet

- RDocument3 pagesRAminul Haque RusselNo ratings yet

- Tax Planning & Financial Reporting 2nd Mid TermDocument6 pagesTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNo ratings yet

- Exercises 1 and 2Document3 pagesExercises 1 and 2Raymond Gicalde RementillaNo ratings yet

- Journal EntryDocument1 pageJournal EntryPrabhleen KaurNo ratings yet

- Mr. Ali: Use The Following Information For The Question Numbers 5 To 10Document2 pagesMr. Ali: Use The Following Information For The Question Numbers 5 To 10rajguptaNo ratings yet

- FM Assignment (TyBms)Document3 pagesFM Assignment (TyBms)TAJ26No ratings yet

- Acconts Preliminary Paper 2Document13 pagesAcconts Preliminary Paper 2AMIN BUHARI ABDUL KHADERNo ratings yet

- Case Study (Trading Company)Document7 pagesCase Study (Trading Company)Sajid Iqbal100% (1)

- Computer Accounting Project WorkDocument7 pagesComputer Accounting Project Workapi-319474134No ratings yet

- Uas Mkbip Ganjil 23-24Document8 pagesUas Mkbip Ganjil 23-24H1-65Anggi SeptianaNo ratings yet

- Accounting Equations ProblemsDocument3 pagesAccounting Equations Problemsmaheshbendigeri5945No ratings yet

- Accounts Question2Document2 pagesAccounts Question2Manpreet Sachdeva33% (3)

- CH 2 Service BusinessDocument10 pagesCH 2 Service BusinessNicole AshleyNo ratings yet

- Adjusting Entries ReviewerDocument1 pageAdjusting Entries ReviewerLouiseNo ratings yet

- CEI MOCK TEST v2Document8 pagesCEI MOCK TEST v2faqhrulraziNo ratings yet

- Long Quiz in Basic FinanceDocument3 pagesLong Quiz in Basic FinanceJo MalaluanNo ratings yet

- Problem SetsDocument4 pagesProblem SetsMichael PantonillaNo ratings yet

- Fall 2023 - FIN611 - 1Document3 pagesFall 2023 - FIN611 - 1businesswitholiviaaNo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- Casey Barnett - IAS 41 and Latex Harvest in CambodiaDocument15 pagesCasey Barnett - IAS 41 and Latex Harvest in CambodiaVuthy DaraNo ratings yet

- CHAPTER 1 The Role of Human Resources NotesDocument2 pagesCHAPTER 1 The Role of Human Resources NotesRicardo SanchezNo ratings yet

- Global Demography and MigrationDocument76 pagesGlobal Demography and MigrationTaraKyleUyNo ratings yet

- Case Study - 修平Document44 pagesCase Study - 修平mellindaNo ratings yet

- Trade Lifecycle Management With TIBCO Business Events and TIBCO IprocessDocument27 pagesTrade Lifecycle Management With TIBCO Business Events and TIBCO IprocessAnil KumarNo ratings yet

- New Rules of MoneyDocument2 pagesNew Rules of MoneyTKNo ratings yet

- Digital Transformation Template-PlayfulDocument14 pagesDigital Transformation Template-PlayfulvinothdeviNo ratings yet

- Saraswat Co-Operative Bank LTDDocument2 pagesSaraswat Co-Operative Bank LTDVijay DevhareNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

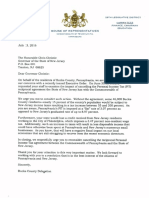

- Reciprocity Letters To New Jersey GovernorDocument3 pagesReciprocity Letters To New Jersey GovernorBucksLocalNews.comNo ratings yet

- Marxism and The Law - Preliminary AnalysesDocument27 pagesMarxism and The Law - Preliminary AnalysesRubensBordinhãoNetoNo ratings yet

- The Wasatch Front Green Infrastructure PlanDocument12 pagesThe Wasatch Front Green Infrastructure PlanRick LeBrasseurNo ratings yet

- Burberry PESTLE AnalysisDocument6 pagesBurberry PESTLE AnalysisMyo Pa Pa NyeinNo ratings yet

- 2017 Sustainability Report: Huawei Investment & Holding Co., LTDDocument85 pages2017 Sustainability Report: Huawei Investment & Holding Co., LTDoluwoleNo ratings yet

- Five of The Most Common Challenges Faced by South African EntrepreneursDocument147 pagesFive of The Most Common Challenges Faced by South African Entrepreneursvictor thomasNo ratings yet

- Spice Hub - Values NewDocument17 pagesSpice Hub - Values NewJohn ShrinksNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- BFC5935 - Tutorial 4 SolutionsDocument6 pagesBFC5935 - Tutorial 4 SolutionsXue XuNo ratings yet

- Case Assignment MNGMNT BirhaassasaDocument9 pagesCase Assignment MNGMNT BirhaassasaBirhanu BerihunNo ratings yet

- One Dollar VentureDocument2 pagesOne Dollar VentureAjanta KNo ratings yet

- Home Loan Application IDBIDocument10 pagesHome Loan Application IDBIMuthuKumaran NadarNo ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- KSA Education Sector Report - AljaziraDocument16 pagesKSA Education Sector Report - Aljaziraaliahmed.iba95No ratings yet

- Role of Law and Legal Institutions in Cambodia Economic DevelopmentDocument410 pagesRole of Law and Legal Institutions in Cambodia Economic DevelopmentThach Bunroeun100% (1)

- Information System Used by Hindustan Unilever LimitedDocument3 pagesInformation System Used by Hindustan Unilever LimitedSaanjana G PNo ratings yet

- Modernizing The Three Lines of Defense Model - Deloitte USDocument4 pagesModernizing The Three Lines of Defense Model - Deloitte USFirst_LastNo ratings yet