Professional Documents

Culture Documents

Determine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by Pia

Uploaded by

Ma. Alexandra Teddy Buen0 ratings0% found this document useful (0 votes)

22 views1 pageOriginal Title

Accounting 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageDetermine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by Pia

Uploaded by

Ma. Alexandra Teddy BuenCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

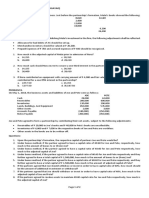

Problem 3:

The partnership accounts of Kevin, Rosi, and Pia who share earnings in a 4:3:3 ratio are as follows on

Dec. 31, 2010

Kevin, drawing (debit) P 30,000

Rosi, drawing (credit) 10,000

Pia, Loan 50,000

Kevin, Capital 160,000

Rosi, Capital 130,000

Pia, Capital 140,000

Total assets amounted to P 700,000 including P 80,000 cash and liabilities total P 240,000. The

partnership was liquidated in January 2011 and Rosi received 110,000 cash payment in the liquidation.

Determine the following:

1. The loss on realization.

2. The amount of cash received by Pia.

You might also like

- AccountingDocument6 pagesAccountingMarjon Villanueva0% (1)

- A Stiptick for a Bleeding Nation: Or, a safe and speedy way to restore publick credit, and pay the national debtsFrom EverandA Stiptick for a Bleeding Nation: Or, a safe and speedy way to restore publick credit, and pay the national debtsNo ratings yet

- Practical Accounting 2Document16 pagesPractical Accounting 2Rowena NijNo ratings yet

- Partnership Liquidation Practice Problems - W CorrectionsDocument10 pagesPartnership Liquidation Practice Problems - W CorrectionsSarah BalisacanNo ratings yet

- Prelim - PART 2Document6 pagesPrelim - PART 2Dan RyanNo ratings yet

- Lump Sum LiquidationDocument4 pagesLump Sum LiquidationKara Manansala LayuganNo ratings yet

- Business Combination Test Bank Part 2Document21 pagesBusiness Combination Test Bank Part 2School Worksandfiles100% (1)

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- Final - Adv Accounting2 - July 19 - 2021Document3 pagesFinal - Adv Accounting2 - July 19 - 2021Eleonora VinessaNo ratings yet

- Part and Corporation FormationDocument7 pagesPart and Corporation FormationMaila loquincioNo ratings yet

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- Chap 1 Part 4 - Installment Liquidation ProblemsDocument3 pagesChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- Soal Bab 16Document7 pagesSoal Bab 16AnsarNo ratings yet

- Partnership Formation ADocument1 pagePartnership Formation AclaudellerosetteNo ratings yet

- Problems For Cash and Cash EquivalentsDocument1 pageProblems For Cash and Cash EquivalentsTine Vasiana DuermeNo ratings yet

- Cash and Cash Equivalents Sample ProblemsDocument3 pagesCash and Cash Equivalents Sample ProblemsGee Lysa Pascua VilbarNo ratings yet

- Use The Following Information For The Next 2 QuestionsDocument2 pagesUse The Following Information For The Next 2 QuestionsAprilyn BatayoNo ratings yet

- ACC111 Partnership AccountingDocument3 pagesACC111 Partnership AccountingDinah Mae ClarNo ratings yet

- Unit 1 - Partnership-AccountingDocument3 pagesUnit 1 - Partnership-AccountingChristine Alysza AnquilanNo ratings yet

- Aklan DakDocument39 pagesAklan DakConi AyuNo ratings yet

- Answer Key POD Cup Jr. Final RoundDocument6 pagesAnswer Key POD Cup Jr. Final RoundRitsNo ratings yet

- Refresher Illustrative Problems - Partnership Liquidation LumpsumDocument2 pagesRefresher Illustrative Problems - Partnership Liquidation LumpsumLeiNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Partnership Formation: AssignmentDocument6 pagesPartnership Formation: AssignmentLee SuarezNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- PARTNERSHIPDocument153 pagesPARTNERSHIPJoen SinamagNo ratings yet

- Quiz On Partnership LiquidationDocument4 pagesQuiz On Partnership LiquidationTrisha Mae AlburoNo ratings yet

- MOD 4 Partnership LiquidationDocument3 pagesMOD 4 Partnership LiquidationCharles GainNo ratings yet

- Advanced Financial Accounting and ReportingDocument5 pagesAdvanced Financial Accounting and Reportingaccounting prob100% (1)

- Test Bank Auditng ProbDocument11 pagesTest Bank Auditng ProbTinne PaculabaNo ratings yet

- Abuscom:: Consolidated Financial Statements at The Date of AcquisitionDocument1 pageAbuscom:: Consolidated Financial Statements at The Date of AcquisitionMarynelle SevillaNo ratings yet

- 1 1 4-Partnership-LiquidationDocument7 pages1 1 4-Partnership-LiquidationCundangan, Denzel Erick S.100% (2)

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADocument33 pagesPractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- AFAR - PartnershipDocument19 pagesAFAR - PartnershipAlisonNo ratings yet

- BS4Document4 pagesBS4Von Andrei MedinaNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationMa Teresa B. CerezoNo ratings yet

- Midterm Exam Accntg For Special TransactionsDocument8 pagesMidterm Exam Accntg For Special TransactionsJustine FloresNo ratings yet

- Discussion and Application Word FileDocument4 pagesDiscussion and Application Word FileRJ 1No ratings yet

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- Midterm Exam Accntg For Special TransactionsDocument8 pagesMidterm Exam Accntg For Special TransactionsJustine Flores100% (1)

- Cash & Cash Equivalent TheoryDocument17 pagesCash & Cash Equivalent Theoryjoneth.duenasNo ratings yet

- 4th Year QuizDocument9 pages4th Year QuizJoshua UmaliNo ratings yet

- Practical AccountingDocument2 pagesPractical AccountingMichelle ValeNo ratings yet

- Far (Q)Document14 pagesFar (Q)Jee Pare100% (1)

- Case. 1: Cash 15.000 $ Other Assets 185.000 $Document2 pagesCase. 1: Cash 15.000 $ Other Assets 185.000 $RAJA JEFRY ERWIN YOSHUA S.No ratings yet

- p1 Review With AnsDocument7 pagesp1 Review With AnsJiezelEstebeNo ratings yet

- Estimation of Doubtful Accounts - Activity 1Document1 pageEstimation of Doubtful Accounts - Activity 1asffghjkNo ratings yet

- Acp 101Document3 pagesAcp 101Lyca SorianoNo ratings yet

- C2 BuscombiDocument2 pagesC2 BuscombiApa-ap, CrisdelleNo ratings yet

- AfarDocument14 pagesAfarPaulo MiguelNo ratings yet

- FarDocument8 pagesFarnivea gumayagay71% (7)

- Practical Accouniting ProblemsDocument3 pagesPractical Accouniting ProblemsMichelle ValeNo ratings yet

- Accounting QuizDocument5 pagesAccounting QuizLloyd Lameon0% (1)

- Bsa 3101 - Accounting For Special Transactions Seatwork No. 2 InstructionsDocument2 pagesBsa 3101 - Accounting For Special Transactions Seatwork No. 2 InstructionsZihr EllerycNo ratings yet

- Advanced Accounting ProblemsDocument4 pagesAdvanced Accounting ProblemsAjay Sharma0% (1)

- Multiple ChoiceDocument14 pagesMultiple Choiceايهاب غزالة100% (2)

- ACCT 2A&B: Accounting For Partnership & Corporation BCSVDocument1 pageACCT 2A&B: Accounting For Partnership & Corporation BCSVMa. Alexandra Teddy BuenNo ratings yet

- Accounting 20Document1 pageAccounting 20Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 12Document1 pageAccounting 12Ma. Alexandra Teddy BuenNo ratings yet

- Multiple Choice: P2.06 P1.96 P2.00 P2.058Document10 pagesMultiple Choice: P2.06 P1.96 P2.00 P2.058Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 5Document1 pageAccounting 5Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 8Document1 pageAccounting 8Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 2Document1 pageAccounting 2Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 3Document1 pageAccounting 3Ma. Alexandra Teddy BuenNo ratings yet

- A. Multiple ChoicesDocument2 pagesA. Multiple ChoicesMa. Alexandra Teddy BuenNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Examines The Behavior of Total Revenues, TotalDocument1 pageCost-Volume-Profit (CVP) Analysis Examines The Behavior of Total Revenues, TotalMa. Alexandra Teddy BuenNo ratings yet

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldFrom EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldRating: 3.5 out of 5 stars3.5/5 (129)

- The Habits of Winning Poker PlayersFrom EverandThe Habits of Winning Poker PlayersRating: 4.5 out of 5 stars4.5/5 (10)

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningFrom EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningRating: 5 out of 5 stars5/5 (5)

- Basic Bridge: Learn to Play the World's Greatest Card Game in 15 Easy LessonsFrom EverandBasic Bridge: Learn to Play the World's Greatest Card Game in 15 Easy LessonsNo ratings yet

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerFrom EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerRating: 5 out of 5 stars5/5 (49)

- The Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesFrom EverandThe Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesNo ratings yet

- Poker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsFrom EverandPoker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsRating: 4.5 out of 5 stars4.5/5 (6)

- Mental Card Mysteries - Thirty-Five Weird And Psychic EffectsFrom EverandMental Card Mysteries - Thirty-Five Weird And Psychic EffectsNo ratings yet

- Your Worst Poker Enemy: Master The Mental GameFrom EverandYour Worst Poker Enemy: Master The Mental GameRating: 3.5 out of 5 stars3.5/5 (1)

- Earn $30,000 Per Month Playing Online Poker: A Step-By-Step Guide to Single Table TournamentsFrom EverandEarn $30,000 Per Month Playing Online Poker: A Step-By-Step Guide to Single Table TournamentsRating: 2 out of 5 stars2/5 (6)

- Self-Working Close-Up Card Magic: 56 Foolproof TricksFrom EverandSelf-Working Close-Up Card Magic: 56 Foolproof TricksRating: 4 out of 5 stars4/5 (7)

- Poker: The Best Techniques for Making You a Better PlayerFrom EverandPoker: The Best Techniques for Making You a Better PlayerRating: 4.5 out of 5 stars4.5/5 (73)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emRating: 4 out of 5 stars4/5 (64)

- The Only Poker Book You'll Ever Need: Bet, Play, And Bluff Like a Pro--from Five-card Draw to Texas Hold 'emFrom EverandThe Only Poker Book You'll Ever Need: Bet, Play, And Bluff Like a Pro--from Five-card Draw to Texas Hold 'emRating: 2 out of 5 stars2/5 (1)

- How to Play Spades: A Beginner’s Guide to Learning the Spades Card Game, Rules, & Strategies to Win at Playing SpadesFrom EverandHow to Play Spades: A Beginner’s Guide to Learning the Spades Card Game, Rules, & Strategies to Win at Playing SpadesNo ratings yet

- Cards and Card Tricks, Containing a Brief History of Playing Cards: Full Instructions with Illustrated Hands, for Playing Nearly all Known Games of Chance or Skill; And Directions for Performing a Number of Amusing TricksFrom EverandCards and Card Tricks, Containing a Brief History of Playing Cards: Full Instructions with Illustrated Hands, for Playing Nearly all Known Games of Chance or Skill; And Directions for Performing a Number of Amusing TricksNo ratings yet

- How to Play Rummy and Gin Rummy: A Beginners Guide to Learning Rummy and Gin Rummy Rules and Strategies to WinFrom EverandHow to Play Rummy and Gin Rummy: A Beginners Guide to Learning Rummy and Gin Rummy Rules and Strategies to WinNo ratings yet

- Straight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How it All Came Crashing Down…From EverandStraight Flush: The True Story of Six College Friends Who Dealt Their Way to a Billion-Dollar Online Poker Empire--and How it All Came Crashing Down…Rating: 4 out of 5 stars4/5 (33)

- Phil Gordon's Little Blue Book: More Lessons and Hand Analysis in No Limit Texas Hold'emFrom EverandPhil Gordon's Little Blue Book: More Lessons and Hand Analysis in No Limit Texas Hold'emRating: 4.5 out of 5 stars4.5/5 (7)

- The Everything Bridge Book: Easy-to-follow instructions to have you playing in no time!From EverandThe Everything Bridge Book: Easy-to-follow instructions to have you playing in no time!No ratings yet