Professional Documents

Culture Documents

Forex Flashcards

Uploaded by

sting74Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex Flashcards

Uploaded by

sting74Copyright:

Available Formats

Flashcard Bonus

In general, it’s a method of predicting price movements and future market trends

by studying charts of past market action.

Technical analysis is concerned with what has actually happened in the market,

rather than what should happen and takes into account the price of instruments

and the volume of trading, and creates charts from that data to use as the primary

tool. One major advantage of technical analysis is that experienced analysts can

follow many markets and market instruments simultaneously.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

1.) Market Action Discounts everything

2.) Prices move in Trends

3.) History Repeats itself

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

In general, it’s a method of forecasting the future price movements of a financial

instrument based on economic, political, environmental and other relevant factors

and statistics that will affect the basic supply and demand of whatever underlies

the financial instrument.

In practice, many market players use technical analysis in conjunction with

fundamental analysis to determine their trading strategy

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A speculator is a person who trades derivatives, commodities, bonds, equities or

currencies with a higher than average risk in return for a higher-than-average profit

potential. Speculators take large risks, especially with respect to anticipating future

price movements, in the hope of making quick, large gains.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Brokers are legal or private persons that represent agents or negotiators in trading

who meet buyer and seller of securities or currency together. Broker works in the

name, by order and at the expense of his client and may provide some additional

services. Brokers get a commission bonus for fulfilling customer’s orders.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

It’s a sustained increase in the general level of prices for goods and services. It is

measured as an annual percentage increase. As inflation rises, every dollar you own

buys a smaller percentage of a good or service.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

In times of deflation, the purchasing power of currency and wages are higher than

they otherwise would have been. This is distinct from but similar to price deflation,

which is a general decrease in the price level, though the two terms are often

mistaken for each other and used interchangeably.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Liquidity describes the degree to which an asset or security can be quickly bought

or sold in the market without affecting the asset's price.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

It’s the movement of cash in and out of a business from day-to-day direct trading

and other non-trading or indirect effects, such as capital expenditure, tax and

dividend payments.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

In general, NPV is a significant measurement in business investment decisions. NPV

is essentially a measurement of all future cashflow (revenues minus costs, also

referred to as net benefits) that will be derived from a particular investment

(whether in the form of a project, a new product line, a proposition, or an entire

business), minus the cost of the investment. Logically if a proposition has a positive

NPV then it is profitable and is worthy of consideration. If negative then it's

unprofitable and should not be pursued.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Diversification is a risk management technique that mixes a wide

variety of investments within a portfolio. The rationale behind this technique

contends that a portfolio constructed of different kinds of investments will, on

average, yield higher returns and pose a lower risk than any individual investment

found within the portfolio.

Further diversification benefits can be gained by investing in foreign securities

because they tend to be less closely correlated with domestic investments.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Foreign exchange, commonly known as 'Forex' or 'FX', is the exchange of one

currency for another at an agreed exchange price on the over-the-counter (OTC)

market. Forex is the world's most traded market, with an average turnover in excess

of US $5.3 trillion per day.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

EUR/USD (Euro to the US Dollar), USD/JPY (US Dollar to the Japanese Yen),

GBP/USD (British Pound to the US Dollar), AUD/USD (US Dollar to the Australian

Dollar), USD/CHF (US Dollar to the Swiss Franc), USD/CAD (US Dollar to the

Canadian Dollar), EUR/JPY (Euro to the Japanese Yen), EUR/GBP (Euro to the British

Pound)

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

An investment technique of buying a fixed dollar amount of a particular investment

on a regular schedule, regardless of the share price. The investor purchases

more shares when prices are low and fewer shares when prices are high. The

premise is that DCA lowers the average share cost over time, increasing the

opportunity to profit. The DCA technique does not guarantee that an investor won't

lose money on investments. Rather, it is meant to allow investment over time

instead of investment as a lump sum.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The capital asset pricing model (CAPM) describes the relationship between risk and

expected return, and it serves as a model for the pricing of risky securities. ...

Required (or expected) Return = RF Rate + (Market Return - RF Rate)*Beta.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

In a nutshell, it is net sales less the cost of goods sold. The gross margin reveals the

amount that an entity earns from the sale of its products and services, before the

deduction of any selling and administrative expenses. The figure can vary

dramatically by industry. For example, a company that sells electronic downloads

through a website may have an extremely high gross margin, since it does not sell

any physical goods to which a cost might be assigned. Conversely, the sale of a

physical product, such as an automobile, will result in a much lower gross margin.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Equity = Assets - Liabilities

Because of the variety of types of assets that exist, this simple definition can have

somewhat different meanings when referring to different kinds of assets.

Example:

A stock or any other security representing an ownership interest. This may be in

a private company (not publicly traded), in which case it is called private equity.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

They are costs that are independent of output. These remain constant throughout

the relevant range and are usually considered sunk for the relevant range (not

relevant to output decisions). Fixed costs examples often include rent, buildings,

machinery, etc.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

They are costs that vary with output. Generally variable costs increase at a constant

rate relative to labor and capital. Variable costs may include wages, utilities,

materials used in production, etc.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Asset allocation is the implementation of an investment strategy that attempts to

balance risk versus reward by adjusting the percentage of each asset in an

investment portfolio according to the investor's risk tolerance, goals and an

investment time frame.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Historically, currencies were traded in specific amounts called lots. The standard

size for a lot is 100,000 units. There are also mini-lots of 10,000 and micro-lots of

1,000.

To take advantage of relatively small moves in the exchange rates of currency, we

need to trade large amounts in order to see any significant profit (or loss).

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A currency pair is the quotation and pricing structure of the currencies traded in

the forex market; the value of a currency is a rate and is determined by its

comparison to another currency. The first listed currency of a currency pair is called

the base currency, and the second currency is called the quote currency.

For example, the currency pair EUR/US means the base currency is the Euro while

the quote currency is the US Dollar.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Pip = "price interest point"

A pip measures the amount of change in the exchange rate for a currency pair.

For currency pairs displayed to four decimal places, one pip is equal to 0.0001. Yen-

based currency pairs are an exception and are displayed to only two decimal places

(0.01).

Some brokers now offer fractional pips to provide an extra digit of precision when

quoting exchange rates for certain currency pairs. A fractional pip is equivalent to

1/10 of a pip.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

In Forex, arbitrage allows retail forex traders to make a profit with no open currency

exposure. The strategy involves acting fast on opportunities presented by pricing

inefficiencies, while they exist.

This type of arbitrage trading involves the buying and selling of different currency

pairs to exploit any inefficiency of pricing.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The quick ratio is an indicator of a company’s short-term liquidity. It measures a

company’s ability to meet its short-term obligations with its most liquid assets. For

this reason, the ratio excludes inventories from current assets, and is calculated as

follows:

Quick ratio = (current assets – inventories) / current liabilities, or = (cash and equivalents

+ market securities + accounts receivable) / current liabilities

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The RSI measures the ratio of up-moves to down-moves and normalizes the

calculation so that the index is expressed in a range of 0-100. If the RSI is 70 or

greater, then the instrument is assumed to be overbought (a situation in which

prices have risen more than market expectations). An RSI of 30 or less is taken as a

signal that the instrument may be oversold (a situation in which prices have fallen

more than the market expectations).

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This is used to indicate overbought/oversold conditions on a scale of 0-100%. The

indicator is based on the observation that in a strong up trend, period closing prices

tend to concentrate in the higher part of the period's range. Conversely, as prices

fall in a strong down trend, closing prices tend to be near to the extreme low of the

period range. Stochastic calculations produce two lines, %K and %D that are used to

indicate overbought/oversold areas of a chart.

Divergence between the stochastic lines and the price action of the underlying

instrument gives a powerful trading signal.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Fibonacci retracement lines are based on the Fibonacci Sequence and are

considered a "predictive" technical indicator providing feedback on possible future

exchange rate levels. There are some traders who swear by the accuracy by which

Fibonacci Retracements can predict future rates, while others argue that Fibonacci

numbers are more art, than science.

Given their popularity and widespread usage by technical analysts, you should at

least know how to interpret Fibonacci numbers. "

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A trend refers to the direction of prices. Rising peaks and troughs constitute an up

trend; falling peaks and troughs constitute a downtrend that determines the

steepness of the current trend. The breaking of a trend line usually signals a trend

reversal. Horizontal peaks and troughs characterize a trading range.

Moving averages are used to smooth price information in order to confirm trends

and support and resistance levels. They are also useful in deciding on a trading

strategy, particularly in futures trading or a market with a strong up or down trend.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

1. Line charts

2. Bar charts

3. Candlestick charts

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A simple line chart draws a line from one closing price to the next closing price.

When strung together with a line, we can see the general price movement of a

currency pair over a period of time.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A bar chart shows closing prices, while simultaneously showing opening prices, as

well as the highs and lows. The bottom of the vertical bar indicates the lowest

traded price for that time period, while the top of the bar indicates the highest

price paid. So, the vertical bar indicates the currency pair’s trading range as a

whole.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Candlestick bars still indicate the high-to-low range with a vertical line. However, in

candlestick charting, the larger block in the middle indicates the range between the

opening and closing prices. Traditionally, if the block in the middle is filled or

colored in, then the currency closed lower than it opened.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

If the price closed higher than it opened, the candlestick would be green. If the price

closed lower than it opened, the candlestick would be red. In our later lessons, you

will see how using green and red candles will allow you to “see” things on the charts

much faster, such as uptrend/downtrends and possible reversal points.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The purpose of candlestick charting is strictly to serve as a visual aid, since the exact

same information appears on other charts.

• Candlesticks are easy to interpret, and are a good place for a beginner to start figuring out chart

analysis.

• Candlesticks are easy to use. Your eyes adapt almost immediately to the information in the bar notation.

• Candlesticks and candlestick patterns have cool names such as the shooting star, which helps you to

remember what the pattern means.

• Candlesticks are good at identifying marketing turning points – reversals from an uptrend to a downtrend

or a downtrend to an uptrend.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

MACD is a tool used to identify moving averages that are indicating a new trend,

whether it’s bullish or bearish. After all, our #1 priority in trading is being able to find

a trend, because that is where the most money is made.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

With an MACD chart, you will usually see three numbers that are used for its

settings. The first is the number of periods that is used to calculate the faster moving

average. The second is the number of periods that are used in the slower moving

average and the third is the number of bars that is used to calculate the moving

average of the difference between the faster and slower moving averages.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A head and shoulders pattern is also a trend reversal formation. It is formed by a

peak (shoulder), followed by a higher peak (head), and then another lower peak

(shoulder). A “neckline” is drawn by connecting the lowest points of the two

troughs. The slope of this line can either be up or down. In our experience, when the

slope is down, it produces a more reliable signal.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This type of formation occurs when there is a resistance level and a slope of higher

lows. What happens during this time is that there is a certain level that the buyers

cannot seem to exceed. However, they are gradually starting to push the price up as

evident by the higher lows.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A CDO is a type of structured asset-backed security (ABS). Originally developed for

the corporate debt markets, over time CDOs evolved to encompass the mortgage

and mortgage-backed security ("MBS") markets.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This particular type of swap is designed to transfer the credit exposure of fixed

income products between two or more parties. In a credit default swap, the buyer

of the swap makes payments to the swap’s seller up until the maturity date of a

contract. In return, the seller agrees that, in the event that the debt issuer

defaults or experiences another credit event, the seller will pay the buyer the

security’s premium as well as all interests payments that would have been paid

between that time and the security’s maturity.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

These are financial intermediaries that accept deposits from legal and private

persons, take advantage of investing this money, return it to depositors, close and

operate bank accounts. Every country has some big commercial banks that are able

to influence currency rates.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This refers to a financial market of a group of securities in which prices are rising or

are expected to rise. The term "bull market" is most often used to refer to the stock

market but can be applied to anything that is traded, such as bonds, currencies

(forex market) and commodities.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This refers to a condition in which securities prices fall and widespread pessimism

causes the stock market's downward spiral to be self-sustaining. Investors anticipate

losses as pessimism and selling increases. Although figures vary, a downturn of 20%

or more from a peak in multiple broad market indexes, such as the Dow Jones

Industrial Average (DJIA) or Standard & Poor's 500 Index (S&P 500), over a two-

month period is considered an entry into a bear market.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Anything owned by the company having a monetary value; eg, 'fixed' assets like

buildings, plant and machinery, vehicles (these are not assets if rented and not

owned) and potentially including intangibles like trade marks and brand names, and

'current' assets, such as stock, debtors and cash.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This is one of the three essential measurement reports for the performance and

health of a company along with the Profit and Loss Account and the Cashflow

Statement. It is a 'snapshot' in time of who owns what in the company, and what

assets and debts represent the value of the company. (It can only ever be a snapshot

because the picture is always changing.) In addition, the Balance Sheet is where to

look for information about short-term and long-term debts, gearing (the ratio of

debt to equity), reserves, stock values (materials and finished goods), capital assets,

cash on hand, along with the value of shareholders' funds.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

One of the three essential reporting and measurement systems for any company.

This statement provides a third perspective alongside the Profit and Loss account

and Balance Sheet. It also shows the movement and availability of cash through and

to the business over a given period, certainly for a trading year, and often also

monthly and cumulatively.

The availability of cash in a company that is necessary to meet payments to

suppliers, staff and other creditors is essential for any business to survive, and so the

reliable forecasting and reporting of cash movement and availability is crucial.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

One of the three principal business reporting and measuring tools (along with the

balance sheet and cashflow statement). The P&L is essentially a trading account for a

period, usually a year, but also can be monthly and cumulative. It shows profit

performance, which often has little to do with cash, stocks and assets (which must

be viewed from a separate perspective using balance sheet and cashflow statement).

The P&L typically shows sales revenues, cost of sales/cost of goods sold, generally a

gross profit margin (sometimes called 'contribution'), fixed overheads and or

operating expenses, and then a profit before tax figure (PBT).

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This term means different things to different people (often depending on

perspective and what is actually being judged) so it's important to clarify

understanding if interpretation has serious implications. Many business managers

and owners use the term in a general sense as a means of assessing the merit of an

investment or business decision. 'Return' generally means profit before tax, but

clarify this with the person using the term - profit depends on various circumstances,

not least the accounting conventions used in the business. In this sense most CEO's

and business owners regard ROI as the ultimate measure of any business

proposition.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The addition of interest to the principal sum of a loan or deposit is

called compounding. Compound interest is interest on interest. It is the result of

reinvesting interest, rather than paying it out, so that interest in the next period is

then earned on the principal sum plus previously-accumulated interest.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

This is the process by which the monetary authority of a country, like the central

bank or currency board, controls the supply of money, often targeting an inflation

rate or interest rate to ensure price stability and general trust in the currency.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

1.) If it looks too good to be true then it most likely is.

2.) Talk to people about potential offer.

3.) Google the product and search for problems:

4.) Check the people on LinkedIn

5.) Regulation: A serious participant in the market will be regulated by at least one

authority. The American NFA is the toughest authority (sometimes too tough).

6.) Sign-up for a free Forex Demo Account

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

Also known as the Federal Reserve or simply the Fed, is the central banking system

of the United States. It was created on December 23, 1913, with the enactment of

the Federal Reserve Act in response to a series of financial panics that showed the

need for central control of the monetary system if crises are to be avoided.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

An instrument of monetary policy adjustment employed by the Federal Reserve

System is the fractional reserve requirement, also known as the required reserve

ratio.

The required reserve ratio sets the balance that the Federal Reserve System requires

a depository institution to hold in the Federal Reserve Banks, which depository

institutions trade in the federal funds market.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The Federal Reserve System directly sets the "discount rate", which is the interest

rate for "discount window lending", overnight loans that member banks borrow

directly from the Fed. This rate is generally set at a rate close to 100 basis

points above the target federal funds rate. The idea is to encourage banks to seek

alternative funding before using the "discount rate" option.

The equivalent operation by the European Central Bank is referred to as the

“Marginal Lending Facility.”

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The SEC is an agency of the United States Government and it holds primary

responsibility for enforcing the federal securities laws, proposing securities rules, and

regulating the securities industry, the nation's stock and options exchanges, and

other activities and organizations, including the electronic securities markets in the

United States.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

A CRA, also called a ratings service, is a company that assigns credit ratings, which

rate a debtor's ability to pay back debt by making timely interest payments and the

likelihood of default. An agency may rate the creditworthiness of issuers of debt

obligations, of debt instruments, and in some cases, of the servicers of the

underlying debt, but not of individual consumers.

Credit rating is a highly concentrated industry, with the “Big Three" credit rating

agencies controlling approximately 95% of the ratings business. Moody's Investors

Service and Standard & Poor's (S&P) together control 80% of the global market,

and Fitch Ratings controls a further 15%.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The (WACC) is a calculation of a firm’s cost of capital in which each category

of capital is proportionately weighted. All sources of capital, including common

stock, preferred stock, bonds and any other long-term debt, are included in a WACC

calculation.

A firm’s WACC increases as the beta and rate of return on equity increase, as an

increase in WACC denotes a decrease in valuation and an increase in risk.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

To calculate WACC, multiply the cost of each capital component by its proportional

weight and take the sum of the results. The method for calculating WACC can be

expressed in the following formula:

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The FTC is an independent agency of the United States Government and it’s principal

mission is the promotion of consumer protection and the elimination and prevention

of anticompetitive business practices, such as coercive monopoly.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

The IMF is an international organization headquartered in Washington DC, of 189

countries that work together to foster global monetary cooperation, secure financial

stability, facilitate international trade, promote high employment and sustainable

economic growth, and reduce poverty around the world.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

1.) You are your biggest asset; treat yourself accordingly.

2.) Find a partner.

3.) Avoid the shackles of debt.

4.) Appreciate the immense power of cash.

5.) Be wary of tax-deferred investment accounts.

© Copyright 2017 Forex Education Foundation, All Rights Reserved

Flashcard Bonus

1.) Write Your Budget Down

2.) Develop a Plan

“Remember that the only way to have peace of mind is financial flexibility”

© Copyright 2017 Forex Education Foundation, All Rights Reserved

You might also like

- Trading and Investing in the Forex Markets Using Chart TechniquesFrom EverandTrading and Investing in the Forex Markets Using Chart TechniquesNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- My Investment Journey: How I failed in stock trading and the lesson learnedFrom EverandMy Investment Journey: How I failed in stock trading and the lesson learnedRating: 5 out of 5 stars5/5 (1)

- Options for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesFrom EverandOptions for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesNo ratings yet

- How To Master Your Investment In 30 Minutes A Day (Preparation)From EverandHow To Master Your Investment In 30 Minutes A Day (Preparation)No ratings yet

- Common Sense Methods to Inexpensively Get Started In Trading the Financial MarketsFrom EverandCommon Sense Methods to Inexpensively Get Started In Trading the Financial MarketsRating: 3 out of 5 stars3/5 (1)

- Making Lemonade: A Bright View on Investing, on Financial Markets, and on the EconomyFrom EverandMaking Lemonade: A Bright View on Investing, on Financial Markets, and on the EconomyNo ratings yet

- How to Trade and Win in any market with High ProbabilityFrom EverandHow to Trade and Win in any market with High ProbabilityRating: 1 out of 5 stars1/5 (1)

- Online Investing Everything You Need to Know Explained SimplyFrom EverandOnline Investing Everything You Need to Know Explained SimplyNo ratings yet

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- Rocking Wall Street: Four Powerful Strategies That will Shake Up the Way You Invest, Build Your Wealth And Give You Your Life BackFrom EverandRocking Wall Street: Four Powerful Strategies That will Shake Up the Way You Invest, Build Your Wealth And Give You Your Life BackRating: 1 out of 5 stars1/5 (1)

- Ebook FunForexDocument19 pagesEbook FunForexবিনায়ক পালNo ratings yet

- Asset Class Mastery: Maximize Profits From Forex, Futures, and CryptosFrom EverandAsset Class Mastery: Maximize Profits From Forex, Futures, and CryptosNo ratings yet

- Do-It-Yourself Technical Analysis Simplified by Trained AccountantFrom EverandDo-It-Yourself Technical Analysis Simplified by Trained AccountantNo ratings yet

- The Complete Options Trader: A Strategic Reference for Derivatives ProfitsFrom EverandThe Complete Options Trader: A Strategic Reference for Derivatives ProfitsNo ratings yet

- The Empowered Forex Trader: Strategies to Transform Pains into GainsFrom EverandThe Empowered Forex Trader: Strategies to Transform Pains into GainsNo ratings yet

- Options Trading: Quick Starters Guide to Options Trading: Quick Starters Guide To Trading, #3From EverandOptions Trading: Quick Starters Guide to Options Trading: Quick Starters Guide To Trading, #3No ratings yet

- Mastering Forex Fundamentals: A Comprehensive Guide in 2 HoursFrom EverandMastering Forex Fundamentals: A Comprehensive Guide in 2 HoursRating: 5 out of 5 stars5/5 (1)

- Timing Techniques for Commodity Futures Markets: Effective Strategy and Tactics for Short-Term and Long-Term TradersFrom EverandTiming Techniques for Commodity Futures Markets: Effective Strategy and Tactics for Short-Term and Long-Term TradersNo ratings yet

- Traders Mindset: Tips and strategies to mastering the marketFrom EverandTraders Mindset: Tips and strategies to mastering the marketNo ratings yet

- Stock Market For Beginners: Stock and Options A Simple Guide to candlesticks, Support & Resistance, Indicators & ScannersFrom EverandStock Market For Beginners: Stock and Options A Simple Guide to candlesticks, Support & Resistance, Indicators & ScannersNo ratings yet

- Exam Facts: Series 34 Retail Off-Exchange Forex Exam Study GuideFrom EverandExam Facts: Series 34 Retail Off-Exchange Forex Exam Study GuideRating: 1 out of 5 stars1/5 (2)

- Electronic Exchanges: The Global Transformation from Pits to BitsFrom EverandElectronic Exchanges: The Global Transformation from Pits to BitsNo ratings yet

- Barbara Hand Clow - Pleiadian CosmologyDocument152 pagesBarbara Hand Clow - Pleiadian CosmologyAtma Jnani67% (3)

- Forex TrendyDocument31 pagesForex Trendygann_144No ratings yet

- SharpShooterScalpingStrategy ForexDocument24 pagesSharpShooterScalpingStrategy ForexRJ Zeshan Awan100% (1)

- Inner Circle Trader - The Power of ThreeDocument2 pagesInner Circle Trader - The Power of ThreeKagan Can100% (5)

- Uncle Lee-Zero Hero Plus StrategyDocument12 pagesUncle Lee-Zero Hero Plus Strategysting74No ratings yet

- Festus Omoemu - BTMMvsICTDocument20 pagesFestus Omoemu - BTMMvsICTjcarlm201790% (20)

- A Complete Guide To Volume Price Analysi - A. CoullingDocument242 pagesA Complete Guide To Volume Price Analysi - A. CoullingGiundat Giun Dat97% (129)

- FXL Cheat Sheet - Market PatternsDocument4 pagesFXL Cheat Sheet - Market Patternssting74100% (1)

- Organic Bath Beuty RecipesDocument21 pagesOrganic Bath Beuty RecipesClara Mateo MorrosNo ratings yet

- WyckoffDocument26 pagesWyckofftawhid anamNo ratings yet

- Masonic & Occult SymbolsDocument438 pagesMasonic & Occult Symbolssting7487% (54)

- Multi Pinbar Hunter ReferenceDocument34 pagesMulti Pinbar Hunter Referencerogerrod61No ratings yet

- Coconut Mamas Coconut Flour CookbookDocument23 pagesCoconut Mamas Coconut Flour Cookbookmarianha100% (1)

- Handbook of Prophetic Trading PDFDocument310 pagesHandbook of Prophetic Trading PDFLibert YoungNo ratings yet

- Inside Bar Trading Strategy GuideDocument18 pagesInside Bar Trading Strategy Guidesnmathad233% (3)

- Survival NutritionDocument106 pagesSurvival Nutritionsting7467% (3)

- Gut Healing Gummies EbookDocument23 pagesGut Healing Gummies Ebooksting74No ratings yet

- Triple Speed Profit SystemDocument28 pagesTriple Speed Profit Systemsting74No ratings yet

- Biology PDFDocument29 pagesBiology PDFThePhantomStranger100% (1)

- 042-0107 Paw Paw LeafDocument1 page042-0107 Paw Paw Leafsting74No ratings yet

- Diet ADocument2 pagesDiet AkapczukNo ratings yet

- Powerful VFX Forex Trading System With 90% AccuracyDocument13 pagesPowerful VFX Forex Trading System With 90% Accuracysting74No ratings yet

- Atlas of Home RemediesDocument176 pagesAtlas of Home Remediessting74100% (2)

- Practicing His Presence PDFDocument135 pagesPracticing His Presence PDFso77No ratings yet

- The Secret Teachings of Christ Revealed and ExplainedDocument37 pagesThe Secret Teachings of Christ Revealed and ExplainedKnights Templar100% (6)

- BodyBuilding - Secret ExercisesDocument29 pagesBodyBuilding - Secret Exercisesed1969gar91% (11)

- Bodyweight Training Program Beginners Intermediate and Advanced Levels PDFDocument32 pagesBodyweight Training Program Beginners Intermediate and Advanced Levels PDFGaston Saint-HubertNo ratings yet

- Step - 48 - Candida & Autoimmune DiseasesDocument5 pagesStep - 48 - Candida & Autoimmune Diseasessting74No ratings yet

- Us Navy Seal Sniper Training Program - Manual Military Elite Doctrine GuidDocument301 pagesUs Navy Seal Sniper Training Program - Manual Military Elite Doctrine GuidEvan Marshall100% (5)

- Risk Disclaimer and Futures Trading GuideDocument171 pagesRisk Disclaimer and Futures Trading Guideazam sumra100% (6)

- UiTM Melaka Technical Analysis ResearchDocument11 pagesUiTM Melaka Technical Analysis ResearchAzrul IkhwanNo ratings yet

- 52patterns - 7 Chart PatternsDocument64 pages52patterns - 7 Chart PatternspravinyNo ratings yet

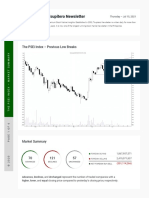

- Tsupitero Newsletter: The Psei Index - Previous Low BreaksDocument6 pagesTsupitero Newsletter: The Psei Index - Previous Low BreaksEdsel LoquillanoNo ratings yet

- Prelims Finals InvestmentDocument45 pagesPrelims Finals InvestmentGelo AgcaoiliNo ratings yet

- Technical AnalysisDocument16 pagesTechnical AnalysisIkhwan Nasir IsmailNo ratings yet

- Insights on momentum investing strategy in correction phasesDocument84 pagesInsights on momentum investing strategy in correction phasesvatsal shahNo ratings yet

- 26086130294Document2 pages26086130294Whales CallNo ratings yet

- Profitable Candlestick PatternsDocument53 pagesProfitable Candlestick Patternsrkwathlist100% (1)

- PR Wave59 PDFDocument0 pagesPR Wave59 PDFHmt NmslNo ratings yet

- Technical Analysis of MahindraDocument3 pagesTechnical Analysis of MahindraRipunjoy SonowalNo ratings yet

- Reversal Bar Pattern: What Does It Look Like?Document40 pagesReversal Bar Pattern: What Does It Look Like?Sen Hoa100% (1)

- Blue-chip stocks best for long termDocument2 pagesBlue-chip stocks best for long termLei JardinNo ratings yet

- Best Fibonacci Ratio and Shape Ratio For Winning Technical AnalysisDocument11 pagesBest Fibonacci Ratio and Shape Ratio For Winning Technical AnalysisYoungh SeoNo ratings yet

- RB Vye Ch6 SW Q&answersDocument5 pagesRB Vye Ch6 SW Q&answersAira Estalane100% (8)

- Project Report On Technical AnalysisDocument97 pagesProject Report On Technical Analysisvishalnabde80% (59)

- Indicator Volume Profile FR mt.4Document6 pagesIndicator Volume Profile FR mt.4suyonoNo ratings yet

- Stock Market Analysis With The Usage of Machine Learning and Deep Learning AlgorithmsDocument9 pagesStock Market Analysis With The Usage of Machine Learning and Deep Learning Algorithmstushar sundriyalNo ratings yet

- Master the Ichimoku Kinko Hyo System with Confidence and DisciplineDocument38 pagesMaster the Ichimoku Kinko Hyo System with Confidence and DisciplinePhạm Nam86% (7)

- Mock Exam Solutions - FinQuizDocument81 pagesMock Exam Solutions - FinQuizFerran Mola ReverteNo ratings yet

- Money ManagementDocument5 pagesMoney ManagementOLIVARI MARIO0% (2)

- Step by Step Beginner Guide For TradingDocument11 pagesStep by Step Beginner Guide For TradingHeron DanielNo ratings yet

- Rules of the Trade - NassarDocument4 pagesRules of the Trade - Nassartomallor101No ratings yet

- NCCMP BrochureDocument4 pagesNCCMP BrochureArun RadhaKrishnanNo ratings yet

- The Ultimate Technical Analysis Handbook PDFDocument54 pagesThe Ultimate Technical Analysis Handbook PDFsaingthy100% (3)

- Evolving Rule-Based Trading Systems: Abstract. in This Study, A Market Trading Rulebase Is Optimised Using Genetic ProDocument10 pagesEvolving Rule-Based Trading Systems: Abstract. in This Study, A Market Trading Rulebase Is Optimised Using Genetic PropostscriptNo ratings yet

- Trading Options With Bollinger Bands and The Dual CCIDocument9 pagesTrading Options With Bollinger Bands and The Dual CCIsttbalan100% (15)

- The basics of stock market tradingDocument26 pagesThe basics of stock market tradingSubhransuNo ratings yet

- Chapter 06 International PaDocument59 pagesChapter 06 International PaLiaNo ratings yet

- Jim Wyckoff - Trading Smart by CQG - Com Data ServiceDocument209 pagesJim Wyckoff - Trading Smart by CQG - Com Data Servicelaccindos100% (1)