Professional Documents

Culture Documents

51% Attack: What Is A 51% Attack?

Uploaded by

Gna OngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

51% Attack: What Is A 51% Attack?

Uploaded by

Gna OngCopyright:

Available Formats

51% Attack

By JAKE FRANKENFIELD

Updated May 6, 2019

What Is a 51% Attack?

A 51% attack refers to an attack on a blockchain—most commonly bitcoins,

for which such an attack is still hypothetical—by a group of miners controlling

more than 50% of the network's mining hash rate or computing power.

The attackers would be able to prevent new transactions from gaining

confirmations, allowing them to halt payments between some or all users.

They would also be able to reverse transactions that were completed while

they were in control of the network, meaning they could double-spend coins.

They would almost certainly not be able to create new coins or alter old

blocks. A 51% attack would probably not destroy bitcoin or another

blockchain-based currency outright, even if it proved highly damaging.

KEY TAKEAWAYS

Blockchains are distributed ledgers that record every transaction made

on a cryptocurrency's network.

A 51% attack is an attack on a blockchain by a group of miners who

control more than 50% of the network's mining hash rate.

Attackers with majority control of the network can interrupt the recording

of new blocks by preventing other miners from completing blocks.

Changing historical blocks is difficult due to the hard-coding of past

transactions into the bitcoin software.

How a 51% Attack Works

Bitcoin and other cryptocurrencies are based on blockchains, a form of a

distributed ledger. These digital files record every transaction made on a

cryptocurrency's network and are available to all users—and the general

public—for review. As a result, no one can spend a coin twice. (So-called

"private blockchains" introduce permissions to prevent certain users in the

general public from seeing all the data on a blockchain.)

As its name implies, a blockchain is a chain of blocks, which are bundles of

data that record all completed transactions during a given period. For bitcoin,

a new block is generated approximately every 10 minutes. Once a block is

finalized or mined, it cannot be altered since a fraudulent version of the public

ledger would quickly be spotted and rejected by the network's users.

However, by controlling the majority of the computing power on the network,

an attacker or group of attackers can interfere with the process of recording

new blocks. They can prevent other miners from completing blocks,

theoretically allowing them to monopolize the mining of new blocks and earn

all of the rewards.

Bitcoin

For bitcoin, the reward is currently 12.5 newly-created bitcoins, though it will

eventually drop to zero. They can block other users' transactions, and they

can send a transaction and then reverse it, making it appear as though they

still had the coin they just spent. This vulnerability, known as double-spending,

is the digital equivalent of a perfect counterfeit and the basic cryptographic

hurdle the blockchain was built to overcome. So a network that allowed for

double-spending would quickly suffer a loss of confidence.

Changing historical blocks—transactions locked-in before the start of the

attack—would be extremely difficult even in the event of a 51% attack. The

further back the transactions are, the more difficult it would be to change

them. It would be impossible to change transactions before a checkpoint, past

which transactions are hard-coded into bitcoin's software.

On the other hand, a form of a 51% attack is possible with less than 50% of

the network's mining power, but with a lower probability of success.

The mining pool gHash.IO briefly exceeded 50% of the bitcoin network's

computing power in July 2014, leading the pool to voluntarily commit to

reducing its share of the network. It said in a statement that it would not reach

40% of the total mining power in the future.

51% Attack Real-World Examples

Krypton and Shift, two blockchains based on ethereum, suffered 51% attacks

in August 2016.

In May of 2018, Bitcoin Gold, at the time the 26th-largest cryptocurrency,

suffered a 51% attack. The malicious actor or actors controlled a vast amount

of Bitcoin Gold's hash power, such that even with Bitcoin Gold repeatedly

attempting to raise the exchange thresholds, the attackers were able to

double-spend for several days, eventually stealing more than $18 million

worth of Bitcoin Gold.

51% Attack vs. 34% Attack

The tangle, a distributed ledger that is fundamentally distinct from a

blockchain but designed to accomplish similar goals, could theoretically

succumb to an attacker deploying over a third of the network's hash rate,

referred to as a 34% attack.

Reference:

https://www.investopedia.com/terms/1/51-attack.asp

You might also like

- The First Comprehensive Guide To Blockchain: Bitcoin, Cryptocurrencies, Smart Contracts, and the Future of BlockchainFrom EverandThe First Comprehensive Guide To Blockchain: Bitcoin, Cryptocurrencies, Smart Contracts, and the Future of BlockchainNo ratings yet

- Difinition Attack 51%Document1 pageDifinition Attack 51%mask.smileNo ratings yet

- What Is A 51% Attack On Blockchain? How Does A 51% Attack Work?Document3 pagesWhat Is A 51% Attack On Blockchain? How Does A 51% Attack Work?Farhan AhmedNo ratings yet

- Understanding Blockchain: Explore the Full Circle Effect Blockchain Technology Has on The World And Our Future Generations: Blockchain, #1From EverandUnderstanding Blockchain: Explore the Full Circle Effect Blockchain Technology Has on The World And Our Future Generations: Blockchain, #1No ratings yet

- The Anatomy of A 51% Attack and How You Can Prevent OneDocument8 pagesThe Anatomy of A 51% Attack and How You Can Prevent OneGilmar AraujoNo ratings yet

- Blockchain: A Guide To Blockchain, The Technology Behind Bitcoin, Ethereum And Other Cryptocurrency: Blockchain, #1From EverandBlockchain: A Guide To Blockchain, The Technology Behind Bitcoin, Ethereum And Other Cryptocurrency: Blockchain, #1No ratings yet

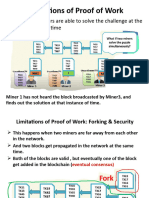

- Disadvantages: Proof of Work Consensus Algorithm BitcoinDocument2 pagesDisadvantages: Proof of Work Consensus Algorithm BitcoinAtta Ur Rahman AfridiNo ratings yet

- 51% Attack - Definition, Who Is at Risk, Example, and CostDocument1 page51% Attack - Definition, Who Is at Risk, Example, and CostShaina BustosNo ratings yet

- Blockchain SC Technology WP FINAL March 2017 1Document5 pagesBlockchain SC Technology WP FINAL March 2017 1EdwardNo ratings yet

- Secure High-Rate Transaction Processing in BitcoinDocument31 pagesSecure High-Rate Transaction Processing in BitcoinamandaNo ratings yet

- Block ChainDocument10 pagesBlock ChainVu Trung QuanNo ratings yet

- Definition:: Block-Chain TechnologyDocument4 pagesDefinition:: Block-Chain TechnologyHypersting GamingNo ratings yet

- Topic 50 Major Cyber Attacks On Blockchain SystemDocument4 pagesTopic 50 Major Cyber Attacks On Blockchain SystemPrabhkeert MalhotraNo ratings yet

- SSRN Id4258114Document24 pagesSSRN Id4258114milagros santamariaNo ratings yet

- Bitcoin Firewall 1.1 (Whitepaper) (BATA)Document13 pagesBitcoin Firewall 1.1 (Whitepaper) (BATA)Justin PercyNo ratings yet

- ms151 ProjectDocument10 pagesms151 ProjectHamza YousafzaiNo ratings yet

- 7 Ways Blockchain Technology Could Disrupt The Post-Trade Ecosystem. Kynetix White Paper. Written by - Paul Smyth, CEODocument10 pages7 Ways Blockchain Technology Could Disrupt The Post-Trade Ecosystem. Kynetix White Paper. Written by - Paul Smyth, CEOChild TraffickingNo ratings yet

- LImitations PoWDocument8 pagesLImitations PoWMeenakshi RajputNo ratings yet

- Bitcoin: What Is A Blockchain?Document10 pagesBitcoin: What Is A Blockchain?Amit KumarNo ratings yet

- FMF 2014 How Bitcoin WorksDocument6 pagesFMF 2014 How Bitcoin WorksMasterNo ratings yet

- BLockchainDocument24 pagesBLockchainQADEER AHMADNo ratings yet

- Bitcoin Mining Vulnerability PaperDocument17 pagesBitcoin Mining Vulnerability PaperLorenzo Franceschi-BicchieraiNo ratings yet

- Once Hailed As Unhackable, Blockchains Are Now Getting Hacked - MIT Technology Review 19-2-2019Document7 pagesOnce Hailed As Unhackable, Blockchains Are Now Getting Hacked - MIT Technology Review 19-2-2019Maggy62dNo ratings yet

- E-Commerce Assignment 1Document4 pagesE-Commerce Assignment 1Hypersting GamingNo ratings yet

- Cypherium: A Scalable and Permissionless Smart Contract PlatformDocument19 pagesCypherium: A Scalable and Permissionless Smart Contract PlatformChakravartthi UrsNo ratings yet

- Lecture 3.2.0 - Attacks On BlockchainsDocument29 pagesLecture 3.2.0 - Attacks On BlockchainsSenior GamingNo ratings yet

- Blockchain and Cryptocuurency AttacksDocument14 pagesBlockchain and Cryptocuurency AttacksAhsan RamzanNo ratings yet

- O M P B: AC S: The Indian Journal of Law and TechnologyDocument11 pagesO M P B: AC S: The Indian Journal of Law and TechnologyAbhishek Kumar ShahNo ratings yet

- CryptoDocument37 pagesCryptoHARSH GAIKWAD100% (1)

- Dragonfly Tech BlockchainsDocument13 pagesDragonfly Tech BlockchainsTapiwamNo ratings yet

- Blockchains in DetailsDocument25 pagesBlockchains in Detailsdineshgomber100% (2)

- Israel A Hotspot For Blockchain InnovationDocument33 pagesIsrael A Hotspot For Blockchain InnovationSyndicated NewsNo ratings yet

- A Blockchain Is A Distributed Database That Is Shared Among The Nodes of A Computer NetworkDocument31 pagesA Blockchain Is A Distributed Database That Is Shared Among The Nodes of A Computer Networkrishabh ranjanNo ratings yet

- Cypherium Whitepaper v1.0Document19 pagesCypherium Whitepaper v1.0WaleedNo ratings yet

- Research Report Efforce 2Document32 pagesResearch Report Efforce 2Vanshika SharmaNo ratings yet

- Bootstrapping BlockchainsDocument6 pagesBootstrapping Blockchainszero 1No ratings yet

- Accelerating Bitcoin's Transaction Processing Fast Money Grows On Trees, Not ChainsDocument31 pagesAccelerating Bitcoin's Transaction Processing Fast Money Grows On Trees, Not ChainsWarren Smith QC (Quantum Cryptanalyst)No ratings yet

- Rahman's Technical ReportDocument14 pagesRahman's Technical ReportMohammed Abdur RahamanNo ratings yet

- Blockchain GlossaryDocument19 pagesBlockchain GlossaryAjayNo ratings yet

- Avis D'expert - BLOCKCHAIN-EN COM PDFDocument5 pagesAvis D'expert - BLOCKCHAIN-EN COM PDFauth.maui73No ratings yet

- Blockchain SecurityDocument24 pagesBlockchain SecurityVenkatraman KrishnamoorthyNo ratings yet

- Unit 2 1Document35 pagesUnit 2 1rocky2003rajkumarNo ratings yet

- BITCOINDocument18 pagesBITCOINMislav DumancicNo ratings yet

- Blockchain Facts What Is It, How It Works, and How It Can Be UsedDocument14 pagesBlockchain Facts What Is It, How It Works, and How It Can Be UsedJeffreyNo ratings yet

- Why Bitcoin Is Not A Viable Currency Option: August 2018Document7 pagesWhy Bitcoin Is Not A Viable Currency Option: August 2018freaherNo ratings yet

- Assign # 5Document5 pagesAssign # 5drutNo ratings yet

- Blockchain Technology NewDocument23 pagesBlockchain Technology NewKshitij NayakNo ratings yet

- Extended Essay Madiba EditsDocument12 pagesExtended Essay Madiba EditsWagah HayangaNo ratings yet

- Deloitte NL Innovatie Blockchain Israel A Hotspot For Blockchain Innovation PDFDocument33 pagesDeloitte NL Innovatie Blockchain Israel A Hotspot For Blockchain Innovation PDFThomazBarrosNo ratings yet

- Blockchain PresentationDocument24 pagesBlockchain PresentationAnitha TNo ratings yet

- Discovering Bitcoin's Public Topology and Influential NodesDocument17 pagesDiscovering Bitcoin's Public Topology and Influential NodesNouman KhanNo ratings yet

- MinorprojectDocument58 pagesMinorprojectAnshul DiwakarNo ratings yet

- BlockchainDocument2 pagesBlockchainSeun OgunlaNo ratings yet

- Use of Blockchain Technology: By-Kunal Khandelwal Vikas Saini Arshdeep Rajnish KumarDocument8 pagesUse of Blockchain Technology: By-Kunal Khandelwal Vikas Saini Arshdeep Rajnish KumarRaj NishNo ratings yet

- Cryptocurrency Security Survey ZhuDocument8 pagesCryptocurrency Security Survey ZhuMatthew ZhuNo ratings yet

- Intro To Blockchain and CryptocurrencyDocument21 pagesIntro To Blockchain and CryptocurrencyAnonymous j43lc8rdNo ratings yet

- Assgn Web Technology (TH) : Submitted To: Sir Jaleel Submitted By: Hamna Iftikhar (19CS426)Document6 pagesAssgn Web Technology (TH) : Submitted To: Sir Jaleel Submitted By: Hamna Iftikhar (19CS426)nimra ghafoorNo ratings yet

- What Is BlockchainDocument13 pagesWhat Is BlockchainRai MasamuneNo ratings yet

- When The "Crypto" in Cryptocurrencies Breaks: Bitcoin Security Under Broken PrimitivesDocument9 pagesWhen The "Crypto" in Cryptocurrencies Breaks: Bitcoin Security Under Broken PrimitivesnviscaqNo ratings yet

- 30 Year TreasuryDocument2 pages30 Year TreasuryGna OngNo ratings yet

- 457 Plan: What Is A 457 Plan?Document3 pages457 Plan: What Is A 457 Plan?Gna OngNo ratings yet

- What Is Average Life?Document3 pagesWhat Is Average Life?Gna OngNo ratings yet

- What Is The 183-Day Rule?Document2 pagesWhat Is The 183-Day Rule?Gna OngNo ratings yet

- What Is An Axe?: Put HedgeDocument2 pagesWhat Is An Axe?: Put HedgeGna OngNo ratings yet

- What Is Ask?: Will KentonDocument2 pagesWhat Is Ask?: Will KentonGna OngNo ratings yet

- What Is Austerity?Document5 pagesWhat Is Austerity?Gna OngNo ratings yet

- What Is An Available Balance?Document3 pagesWhat Is An Available Balance?Gna OngNo ratings yet

- 10 Years Treasury NoteDocument2 pages10 Years Treasury NoteGna OngNo ratings yet

- 06-Accidental Death BenefitDocument2 pages06-Accidental Death BenefitGna OngNo ratings yet

- 03 Adverse SelectionDocument3 pages03 Adverse SelectionGna OngNo ratings yet

- 02 Angel InvestorDocument2 pages02 Angel InvestorGna OngNo ratings yet

- 08 Air WaybillDocument2 pages08 Air WaybillGna OngNo ratings yet

- 05 Abnormal ReturnDocument2 pages05 Abnormal ReturnGna OngNo ratings yet

- 04-Acid Test RatioDocument2 pages04-Acid Test RatioGna OngNo ratings yet

- Super Simple Cryptocurrency ArbitrageDocument64 pagesSuper Simple Cryptocurrency ArbitrageZahirabbas Bhimani100% (1)

- The Web3 Cheat Sheet by Web3 Simplified V2Document13 pagesThe Web3 Cheat Sheet by Web3 Simplified V2Lone SurvivorNo ratings yet

- x52 Cuentas Peacock TV (Kepahoo) (31!12!22)Document2 pagesx52 Cuentas Peacock TV (Kepahoo) (31!12!22)Willian KrostyNo ratings yet

- Solidity, Blockchain, and Smart Contract Course - Beginner To Expert Python TutorialDocument1 pageSolidity, Blockchain, and Smart Contract Course - Beginner To Expert Python TutorialJayu2690No ratings yet

- Week 3 Lec Material WatermarkDocument105 pagesWeek 3 Lec Material WatermarkDinesh YadavNo ratings yet

- Example of Swaps On Trading PlatformsDocument40 pagesExample of Swaps On Trading PlatformsgagyNo ratings yet

- 05 Bitcoin Evolution and ChallengesDocument30 pages05 Bitcoin Evolution and ChallengesTessaNo ratings yet

- A New Era For BitcoinDocument44 pagesA New Era For BitcoinRodrix DigitalNo ratings yet

- CryptoDocument1 pageCryptovgq47eplkyy8No ratings yet

- Free AirdropDocument3 pagesFree AirdropGanesh Kumar100% (1)

- Blockchain - Potentes NexusDocument2 pagesBlockchain - Potentes NexusdavidNo ratings yet

- Titan369 Presentation EnglishDocument18 pagesTitan369 Presentation Englishmcosmin1179No ratings yet

- DEX Whitepaper ENGLISH - v2Document31 pagesDEX Whitepaper ENGLISH - v2lisandro martinezNo ratings yet

- Cryptocurrency Fundamentals Ebook 2023Document41 pagesCryptocurrency Fundamentals Ebook 2023Ali 1No ratings yet

- Idoc - Pub - New Freebitcoin ScripttxtDocument1 pageIdoc - Pub - New Freebitcoin ScripttxtSree ProsantoNo ratings yet

- Blockchain From Bitcoin To The InternetDocument15 pagesBlockchain From Bitcoin To The InternetGréta KovácsNo ratings yet

- Tether BTC Scam SSRN Id3195066 PDFDocument119 pagesTether BTC Scam SSRN Id3195066 PDFJohn NovakNo ratings yet

- Bear Markets in Perspective FINAL DesignedDocument22 pagesBear Markets in Perspective FINAL Designed4444444444444-311661No ratings yet

- Nick Szabo - WikipediaDocument3 pagesNick Szabo - WikipediaAriadna MercadoNo ratings yet

- Video Portfolio - Black Swan Finances YouTube ChannelDocument13 pagesVideo Portfolio - Black Swan Finances YouTube ChannelOscar MendezNo ratings yet

- New Freebitcoin ScriptDocument3 pagesNew Freebitcoin Scripttrmagic24283No ratings yet

- BITCOIN Pub KeyDocument2 pagesBITCOIN Pub KeyDileep Kumar100% (1)

- Ilovepdf MergedDocument178 pagesIlovepdf Mergedjackie pascualNo ratings yet

- How To Claim Free $32,000 BNB, Eth, BTC, For Free Trust Wallet Scam! I'm Quitting YouTube - YouTubeDocument1 pageHow To Claim Free $32,000 BNB, Eth, BTC, For Free Trust Wallet Scam! I'm Quitting YouTube - YouTubeIbrahim ambaliNo ratings yet

- Crypto Currency:: The History of CryptocurrencyDocument5 pagesCrypto Currency:: The History of CryptocurrencyAli hamzaNo ratings yet

- Web 3.0 User GuideDocument162 pagesWeb 3.0 User GuidePower HackerNo ratings yet

- Cryptocurrency BitcoinDocument193 pagesCryptocurrency BitcoinShahid ImranNo ratings yet

- Spacechain A Modest Sidechain ProposalDocument15 pagesSpacechain A Modest Sidechain ProposalisnullNo ratings yet

- BlockchainDocument7 pagesBlockchainBritneyLovezCandyNo ratings yet

- How Is Ripple Different From Bitcoin - QuoraDocument7 pagesHow Is Ripple Different From Bitcoin - Quorasebab1No ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!From EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Rating: 4.5 out of 5 stars4.5/5 (8)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Excel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsFrom EverandExcel 2019: The Best 10 Tricks To Use In Excel 2019, A Set Of Advanced Methods, Formulas And Functions For Beginners, To Use In Your SpreadsheetsNo ratings yet

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Computer Networking: The Complete Beginner's Guide to Learning the Basics of Network Security, Computer Architecture, Wireless Technology and Communications Systems (Including Cisco, CCENT, and CCNA)From EverandComputer Networking: The Complete Beginner's Guide to Learning the Basics of Network Security, Computer Architecture, Wireless Technology and Communications Systems (Including Cisco, CCENT, and CCNA)Rating: 4 out of 5 stars4/5 (4)

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- The Compete Ccna 200-301 Study Guide: Network Engineering EditionFrom EverandThe Compete Ccna 200-301 Study Guide: Network Engineering EditionRating: 5 out of 5 stars5/5 (4)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- AWS Certified Solutions Architect Study Guide: Associate SAA-C01 ExamFrom EverandAWS Certified Solutions Architect Study Guide: Associate SAA-C01 ExamRating: 4 out of 5 stars4/5 (1)

- Evaluation of Some Websites that Offer Virtual Phone Numbers for SMS Reception and Websites to Obtain Virtual Debit/Credit Cards for Online Accounts VerificationsFrom EverandEvaluation of Some Websites that Offer Virtual Phone Numbers for SMS Reception and Websites to Obtain Virtual Debit/Credit Cards for Online Accounts VerificationsRating: 5 out of 5 stars5/5 (1)

- Cybersecurity: The Beginner's Guide: A comprehensive guide to getting started in cybersecurityFrom EverandCybersecurity: The Beginner's Guide: A comprehensive guide to getting started in cybersecurityRating: 5 out of 5 stars5/5 (2)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackFrom EverandThe Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, And Keep Your Books in the BlackRating: 1 out of 5 stars1/5 (1)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- CWNA Certified Wireless Network Administrator Study Guide: Exam CWNA-108From EverandCWNA Certified Wireless Network Administrator Study Guide: Exam CWNA-108No ratings yet