Professional Documents

Culture Documents

Module III Intrest Rate and Currency Swap

Uploaded by

J BCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module III Intrest Rate and Currency Swap

Uploaded by

J BCopyright:

Available Formats

Interest Rate and Currency Swap:

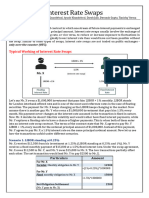

Interest Rate Swap:

An interest rate swap is a forward contract in which one stream of future interest

payments is exchanged for another based on a specified principal amount.

Interest rate swaps usually involve the exchange of a fixed interest rate for a

floating rate, or vice versa, to reduce or increase exposure to fluctuations in

interest rates or to obtain a marginally lower interest rate than would have been

possible without the swap.

A swap can also involve the exchange of one type of floating rate for another,

which is called a basis swap/plain vanilla swap.

LIBOR: London Inter-bank Offer Rate

MIBOR: Mumbai Inter-Bank Offer Rate

Swap Mechanism:

1. If a borrower who has borrowed at fixed rate expects that interest will

rise, then the borrower would want to continue with the existing interest

rate arrangement. In case the borrower expects the interest rate to fall, the

borrower will be better-off by swapping his existing arrangement against

a floating rate loan.

2. If the borrower has borrowed at floating rate and expects the interest

rate to fall, then the borrower would want to continue with the existing

interest rate arrangement. If the borrower expects interest rate to rise, he

will be better-off by swapping his floating rate loan against a fixed rate.

Note: Reverse will be in the case of investors in above 1 and 2 point.

E.g.: Doctor:

Mr. A (Ahmedabad) Mr. M (Mumbai)

Fixed Rate/ Drumsticks: ₹100 Floating Int/Broccoli: ₹100

Broccoli = ₹20 Drumsticks = ₹20

Swap Bank/MR. S (SURAT): Mr. M Gives me Drumsticks = ₹25

MR. A gives Broccoli = ₹25 (i.e. ₹20 plus ₹5 transportation cost)

Mr. C gives respective items to both the parties at ₹30 each.

Mr. A and Mr. B benefit (100-30) = ₹70 and Mr. C will benefit ₹10

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

Amber has obtained a loan at fixed rate of 8% from HDFC. She expects

the interest rates to decline and is willing to take the benefit of declining

interest rates. She wants to convert her loan into a floating rate. HDFC

offers her the floating rate of MIBOR + 2%.

Another party, Sarika has borrowed from Yes Bank at floating rate of

MIBOR + 1.2%. She expects the interest rates to rise in future and this

will increase her commitment towards interest expenses. She is

therefore willing to convert her loans into a fixed rate. Yes bank offers

her fixed rate 10% p.a.

Both the parties approaches “Union Bank” (a swap bank) to find out

whether any swap deal can be effected and decide to swap their interest

obligations and the overall benefit of swap shall be shared by the 3

parties including the swap bank in the ratio of 5:5:4.

You are required to

1. Determine whether the interest rate swap deal can be affected

2. Determine the differential surplus that benefits each of the 3

parties

3. Show how the interest rate swap deal will be arranged

4. Show how each party is benefited from the swap deal

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Answer:

Swap Bank (Union Bank)

Ms. Amber Ms. Sarika

FIXED 8% M + 1.2% Floating

HDFC Yes Bank

M + 2% 10%

Revised Rate = M + 2% + 10% = M +12%

Existing Rate = 8% + M +1.2%= M + 9.2%

Revised Rate – Existing Rate = (M + 12%) – (M + 9.2%) = 2.8%

Amber: Sarika: Swap Bank = 5:5:4

Amber = 2.8 x 5/14 = 1%

Sarika = 2.8 x 5/14 = 1%

Swap Bank = 2.8 x 4/14 = 0.8%

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Determine whether a swap deal can be effected:

Existing Aggregate = 8 + (M+1.2) = M + 9.2

Revised Aggregate = (M+2) + 10 = M + 12

Revised – Existing = (M+12) – (M+9.2) = +2.8

Positive Difference

Swap Deal can be effected

If the differential surplus of 2.8% is to be shared among 3 parties i.e.

Amber, Sarika and Swap Bank, in the ratio of 5:5:4, then the interest

differential surplus for each will be:

Amber = 2.8 x 5/14 = 1

Sarika = 2.8 x 5/14 = 1

Swap bank = 2.8 x 4/14 = 0.8 2.8

Swap Bank

8% 9%

Amber M+1% M+1.2% Sarika

8% M+1.2%

HDFC Yes Bank

M + 2% 10%

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Amber (Fixed Leg):

The Swap Bank shall borrow from Amber on Notional Basis at the

same rate that Amber pays to her bank i.e. 8%.

Thereby swap bank shall reimburse the interest of same amount to

Amber that she has paid to her bank.

In turn, Amber shall borrow from the swap bank on Notional Basis at

an interest rate which is 1% lower than the rate offered by her bank i.e.

@ M+1%.

With this arrangement, Amber could convert her fixed rate loan into a

Floating rate loan, that too at lower rate.

Sarika (Floating Leg):

The Swap Bank shall borrow from Sarika on Notional Basis at the

same rate that Amber pays to her bank i.e. M+1.2%.

Thereby swap bank shall reimburse the interest of same amount to

Sarika that she has paid to her bank.

In turn, Sarika shall borrow from the swap bank on Notional Basis at

an interest rate which is 1% lower than the rate offered by her bank i.e.

@ 9%

With this arrangement, Sarika could convert her fixed rate loan into a

Fixed rate loan, that too at lower rate.

Swap Bank: M = 8%: 50,00,000

Interest Income: 9% + (M+1%) = M + 10% = 18% = 900,000

Interest Expenses: 8% + (M+1.2%) = M+ 9.2% = 17.2% = 860,000

Differential Surplus = 0.8% = 40,000

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

In the above question assume that both Amber and Sarika have

borrowed their respective Banks an amount of ₹50,00,000 each. For

interest rate swap arrangement consider a notional loan of ₹ 50,00,000.

Determine the net payoff under both the legs for each of the following

situations:

Case 1: MIBOR = 8% p.a.

Case 2: MIBOR = 9% p.a.

Swap Bank

8% 9%

Amber M+1% M+1.2% Sarika

8% M+1.2%

HDFC Yes Bank

M + 2% 10%

Without swap 8 + 2% = 10% 10%

500,000 500,000

With Swap: 450,000 450,000

50,000 50,000

Without Swap: 9 + 2 = 11% 10%

550,000 500,000

With Swap: 500,000 450,000

Profit 50,000 50,000

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Answer:

Case 1: MIBOR = 8% p.a.

Amber:

Interest paid to own Bank (50,00,000 x 8%) (Actual) (A)₹400,000

Interest received from swap bank (notional) ₹400,000

(50,00,000 x 8%)

Interest paid to swap bank (50,00,000 x (M +1%)9%) (notional) ₹450,000

Net Paid from Swap Bank (Actual) (B)₹50,000

Interest cost (Net) (A-B) = ₹450,000 (i.e. at M+1% of loan

50,00,000)

At 9% MIBOR = Int cost = 500,000

Sarika:

Interest paid to own bank (50,00,000 x (M+1.2%)9.2%) (Actual)(A)₹460,000

Interest received from swap bank (notional) ₹460,000

(50,00,000 x(M+1.2%) 9.2%)

Interest paid to Swap Bank (50,00,000 x 9%) (notional)₹450,000

Net Receipt from Swap Bank (Actual) (B) ₹10,000

Interest cost (Net) (A-B) = 450,000 (i.e. at 9% of loan 50,00,000)

At 9% MIBOR = Int. Cost = 450,000

Swap Bank: M = 8%

Net Receipt from Amber (9% - 8%) 50,00,000 x 1% = ₹50,000

Net Payment from Sarika (9% - 9.2%) 50,00,000 x 0.2% = (₹10,000)

Swap Bank will earn ₹ 40,000 (i.e. 0.8% of 50,00,000)

Calculate for Case 2: MIBOR = 9% p.a.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

In the above case, if swap bank is not involved as the intermediary

then Amber and Sarika could have shared the overall benefit of

2.8% just between two of them. How would you arrange a swap deal

in such a case where Amber and Sarika decide to share the net

differential equally without involving Union Bank as intermediately?

Explain how the internet rate swap deal will be arranged. Also specify

the benefit flowing to each party.

Consider the notional amount of loan as ₹80,00,000 and MIBOR = 7%.

Specify how much differential will be settled between the two parties

by the end of the year.

Answer:

Revised Rate = M + 2% + 10% = M +12%

Existing Rate = 8% + M +1.2%= M + 9.2%

Revised Rate – Existing Rate = (M + 12%) – (M + 9.2%) = 2.8%

Profit Sharing = 1.4% each (2.8%/2)

Amber Sarika

8% M+1.2%

HDFC Yes Bank

M+2% 10%

Step 1: Sarika pays to Amber 8%

Step 2: Amber pays to Sarika M+0.6% (M+2% - 1.4%)

Net Interest Expenses to Amber:

= (M+0.6%) + 8% – 8% = M+0.6%

This M + 0.6% is the target interest for Amber [(M+2%) – 1.4%]

Net Interest Expenses to Sarika:

= 8% + (M + 1.2%) – (M+0.6%) = 8.6%

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

This 8.6% is the target interest rate for Sarika [(10-1.4%) = 8.6%]

In this arrangement, Sarika shall re-borrow from Amber on notional

basis at the same rate that Amber pays to her bank i.e. 8%

Thereby Sarika shall reimburse the interest of same amount to Amber

that she has paid to her bank.

In turn, Amber shall re-borrow from Sarika on Notional basis at an

interest rate which is 1.4% lower than the rate offered by her bank, i.e.

@ M+0.6%.

With this arrangement, Amber could convert her fixed rate loan into a

Floating rate loan and Sarika could convert her floating rate loan into a

fixed rate loan, that too at lower rates as compared to what was offered

by their respective banks.

Net Interest Expenses to Amber:

= (M+0.6%) + 8% – 8% = M+0.6%

This M + 0.6% is the target interest for Amber [(M+2%) – 1.4%]

Net Interest Expenses to Sarika:

= 8% + (M + 1.2%) – (M+0.6%) = 8.6%

This 8.6% is the target interest rate for Sarika [(10-1.4%) = 8.6%]

If notional loan amount is ₹80,00,000 and if MIBOR = 7%, then net

result will be as follows:

Particulars Amber Sarika

Interest Expenses (Without swap) (8%) 640,000 656,000 (M+1.2%)

Interest Expenses (With Swap) (M+0.6)608,000 688,000(8.6%)

Net Gain/Loss 32,000 (32,000)

End of the year Amber will pay ₹32000 to Sarika.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

Big Ltd. having very good credit rating offered by its bank, a fixed rate

of 8% or a floating rate of M + 1.5%. This company wants fixed rate.

Small Ltd. having very poor credit rating is offered by its bank, a fixed

rate of 10% or a floating rate of M + 2%. This company wants floating

rate to verify whether a swap can be affected.

Answer:

Big Ltd: Fixed

This company desires a fixed rate loan, it has two different options”

Option 1: Borrow at 8% p.a. Fixed rate directly from own bank

(without swap)

Option 2: Borrow from own bank at floating rate of M+1.5% & then

swap the same with Small Ltd. for fixed rate. (with Swap)

Small Ltd: Floating

This company desires a floating rate of interest, it has two different

options”

Option 1: Borrow at M+2% floating rate directly from own bank

(without swap)

Option 2: Borrow from own bank at fixed rate of 10% & then swap

the same with Big Ltd. for floating rate. (with Swap)

Determine whether swap deal can be effected.

Aggregate interest rate without swap

= 8% + M +2% = M + 10%

Aggregate interest rate with swap

= M + 1.5% + 10% = M + 11.5%

The aggregate interest rate with swap is (M+11.5%) higher than the

aggregate interest without swap (M+10%).

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Therefore, a swap deal is not advisable.

Both the parties are recommended to borrow from their respective

banks at their desired interest arrangements.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

Mr. A has obtained a loan at fixed rate of 7% from Kotak Mahindra

Bank. He expects the interest rates to decline and is willing to take the

benefit of declining interest rates. He wants to convert her loan into a

floating rate.

Another party, Mr. B has borrowed from IDFC Bank at floating rate of

MIBOR + 1%. He expects the interest rates to rise in future and this

will increase her commitment towards interest expenses. He is

therefore willing to convert his loans into a fixed rate.

Both the parties approaches “PNB Bank” (a swap bank) to find out

whether any swap deal can be effected and decide to swap their interest

obligations and the overall benefit of swap shall be shared by the 3

parties including the swap bank in the ratio of 4:4:4.

You are required to

1. Determine whether the interest rate swap deal can be affected

2. Determine the differential surplus that benefits each of the 3

parties

3. Show how the interest rate swap deal will be arranged

4. Show how each party is benefited from the swap deal

5. Calculate the payoff if the MIBOR rate is 6% and borrowing

amount from both the parties are ₹50,00,000 each.

6. If they want to remove the swap bank and share the swap profit

equally then how the payoff can be done?

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Swap Bank (50,00,000 & MIBOR = 6%)

Pay to Mr. A 7% Pay to Mr. B M+1%

Receive Mr. A M+0.6% Receive Mr. B 8.2%

Mr. A (Pay M + 0.6%) (Receive 7%) Mr. B (Pay 8.2%) (Receive M+1%)

(330,000) 350,000 (410,000) 350,000

20,000 (60,000)

Kotak Notional Difference IDFC

Revised: M + 1.4% (370,000) 50,00,000 x 9% = 450,0000

Swap bank:

Interest Expenses:7% + M+1% = M + 8% = 14% X 50,00,000 =

700,000

Interest Income: M + 0.6% + 8.2% = M +8.8% = 14.8% = 740,000

Profit = 40,000 (50,00,000 x 0.8%)

Mr. A

Bank offers him the floating rate of MIBOR + 1.4%. 330,000 (350,000

- 20,000) _ 370,000 (50,00,000 x 7.4%) = 40,000 profit

Mr. B

IDFC bank offers her fixed rate 9% p.a. 410,000 (350,000 +60,000) –

450,000 (50,00,000 x 9%) = 40,000

Existing Rate = 7% + M+1% = M + 8%

Revised Rate = M + 1.4% + 9% = M + 10.4%

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Revised – Existing = (M + 10.4%) - (M +8%) = 2.4%

4:4:4

Mr. A = 2.4 x 4/12 = 0.8%

Mr. B = 2.4 x 4/12 = 0.8%

Mr. Swap Bank = 2.4 x 4/12 = 0.8%

2.4% benefit amongst Mr A Mr. b equally = 1.2%

Mr. A pays to Mr. B (M+1%)

Mr. B pays to Mr. A (7%)

Mr. A Mr. B

Existing: 7% M+1%

Kotak IDFC

Revised: M +1.4% 9%

Mr B pays to Mr. A (7.8%)

Mr. A pays to Mr. B (M+0.2%)

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Speculative Interest Rate Swaps:

If the speculator expects interest rates to rise, he will prefer receiving interest at

floating rate and paying interest at fixed rate.

(Floating Rate Receiver and Fixed Rate Payer)

If the speculator expects interest rates to fall, he will prefer receiving interest at

fixed rate and paying interest at floating rate.

(Fixed Rate Receiver and Floating Rate Payer)

Example: (Receiver 6% & Pay at 8%) (Rec. 10% & pay 8%

Mr. Suresh expects interest rates to rise. (Receive at Floating & Pay at Fixed Rate)

Mr. Hiren expects interest rate to fall. (Pay at Floating & Receive at Fixed Rate)

(Pay at 6% & Receive at 8%) (Pay at 10% & Rec. 6%)

They enter a swap deal whereby Mr. Suresh becomes floating rate receiver at

MIBOR flat and payer at fixed rate of 8% p.a. Notional loan amount is ₹ 10 crore

and contract period is 1 year.

Determine the net pay-off at both the legs under following cases:

Case 1: MIBOR = 6% p.a. Hiren

Case 2: MIBOR = 10% p.a. Suresh

Answer:

Case 1: MIBOR = 6% p.a.

Mr. Suresh (Fixed rate payer and floating rate receiver)

Interest received from Mr. Hiren (Notional) ₹60,00,000

(₹100,00,000 x 6%)

Interest paid to Mr. Hiren (Notional) (₹80,00,000)

(₹100,00,000 x 8%)

Net differential paid to Mr. Hiren (Actual) ₹20,00,000

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Mr. Hiren (Floating rate payer and fixed rate receiver)

Interest received from Mr. Suresh (Notional)

(₹10,00,000 x 8%) 80,00,000

Interest paid to Mr. Suresh (Notional) (60,00,000)

(₹10,00,000 x 6%)

Net differential received from Mr. Suresh (Actual) ₹20,00,000

Case 2: MIBOR = 10% p.a.

Mr. Suresh (Fixed Rate Payer and Floating Rate Receiver)

Interest Rate received from Mr. Hiren (Notional) ₹10,00,000

(₹100,00,000 x 10%)

Interest paid to Mr. Hiren (Notional) (₹8,00,000)

(₹100,00,000 x 8%)

Net difference received from Hiren (Actual) ₹200,000

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

A dealer quotes “All-in-Cost” for a generic swap at 6% against six months

LIBOR flat if the notional principal amount of swap is ₹10,00,000.

I. Calculate semi-annual fixed payment.

II. Find the first floating rate payment for (I) above, if the six-month period

from the effective date of swap to the settlement date comprises 181 days

and that the corresponding LIBOR was 4% on the effective date of swap.

At 360 days.

III. In (II) above, if the settlement is on NET basis, how much the fixed rate

payer would pay to the floating rate payer? Generic swap is based on

30/360 days.

Answer:

I. Semi-annual fixed payment:

₹10,00,000 x 6% x 6/12 = ₹30,000

II. Floating rate payment

₹10,00,000 x 4% x 181/360 = ₹20,111

III. If the settlement is on the net basis, the Net differential paid by fixed rate

payer to floating rate payer.

i.e. ₹ 9889 (₹30,000 - ₹20,111)

Example:

Derivative Bank entered a plain vanilla swap through an OIS (Overnight Index

Swap) on a principal of ₹1 crores and agreed to receive MIBOR overnight

floating rate for a fixed payment on the principal. The swap was entered into on

Monday, 19th October 2020 and was to commence on 20th October 2020 and run

for a period of 7 days. Respectively MIBOR rates for Tuesday to Monday were:

6.5%, 7%; 6.75%, 6.6%, 6.7% and 7%.

If derivative bank received ₹500 net on settlement, calculate fixed rate and

interest under both legs.

Notes:

I. Sunday is Holiday.

II. Working in rounded rupees and avoid decimal working.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Answer:

Day Rate Notional Balance Interest

Tuesday 6.5% 100,00,000 1781

Wednesday 7% 100,01,781 1918

Thursday 6.75% 100,03,699 1850

Friday 6.6% 100,05,549 1809

Saturday & Sunday 6.7% (2 days) 100,07,358 3674

Monday 7% 100,11,032 1920

Floating Int. 12952

Less: Net payoff 500

Fixed Int 12452

12452/100,00,000 x 365/7 = 6.49% p.a.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Currency Swap:

A currency swap is an agreement in which two parties exchange the principal

amount of a loan and the interest in one currency for the principal amount of a

loan and the interest in one currency for the principal and interest in another

currency.

It is an advance level swap than plain vanilla or generic swap (int. rate swap)

because in currency swap not only interest but also principal is swap.

For currency swap it is mandatory to have borrowings and borrowing must be

equivalent of both the parties.

Example:

AB Ltd. is an Indian company having a subsidiary in U.S. and is looking to raise

$100,000 for funding its subsidiary. It can borrow at the following rates:

$ 3%

₹ 8%

PQ Ltd. is a US based company having a subsidiary in India and is looking to

raise ₹75,00,000 for funding its subsidiary. It can borrow at the following fixed

rates:

$ 2%

₹ 10%

The current spot rate is $1=₹75. Show how a currency swap would work in the

circumstances described, assuming the swap is only for one year and that interest

is paid at the end of the year concerned.

Answer:

Interest Cal. AB PQ

Without Swap ($100,000 x 3%) $3000 (7500,000 x 10%) ₹750,000

With Swap ($100,000 x 2%) $2000 600,000(75 lacs x 8%)

Saving in Int. Cost $1000 ₹150,000

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Swap Process: AB Ltd. PQ Ltd.

Now:

Step 1: Borrowing from Banks ₹75,00,000 @ 8% $100,000 @2%

Step 2: Exchange principal Pay 75 lacs to PQ Pay $1lac to AB

Receive $1 Lac Receive 75 lacs

End of one Year:

Step 3: Pay interest to banks Pay ₹600,000 int Pay $2000 Int.

Step 4: Exchange Int. Pay $ 2000 & Rec. ₹6 lacs Pay 6 lacs &

PQ. Ltd AB Ltd Receive $2000

Step 5: Swap Bank Principal Pay $ 1 lac to PQ Ltd. Pay ₹7500,000 to AB Ltd.

Receive 75 lacs Receive $ 1 lac

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

Example:

US Ltd. is a US based company having a subsidiary in India and is looking to

raise ₹80,00,000 for funding its subsidiary. It can borrow at the following fixed

rates:1% x 80,00,000 = ₹100,000

$ 1.50%

₹ 8.50%

IN Ltd. is an Indian company having a subsidiary in U.S. and is looking to raise

$100,000 for funding its subsidiary. It can borrow at the following rates:

$ 2.25%

₹ 7.25%

The current spot rate is $1=₹80. Show how a currency swap would work in the

circumstances described, assuming the swap is only for one year and that interest

is paid at the end of the year concerned.

Example:

In the above example US Ltd and IN Ltd. don’t know one another so, UI Ltd.

(Swap Bank) arranged the swap between the two companies and earn 0.50%

profit sharing in 1:1 proportion from both the parties.

Example:

Derivative Bank entered into a plain vanilla swap through an OIS (Overnight

Index Swap) on a principal of ₹10 crores and agreed to receive MIBOR overnight

floating rate for a fixed payment on the principal. The swap was entered into on

Monday, 23rd November 2020 and was to commence on 24th November 2020 and

run for a period of 7 days. Respectively MIBOR rates for Tuesday to Tuesday

were: 3.5%, 5.25%; 4.85%, 4.9%, 4.75% and 5.5%.

If derivative bank paid ₹1000 net on settlement, calculate fixed rate and interest

under both legs.

Notes:

I. Sunday is Holiday and on 30th holiday due to Shri Guru Nanak Jayanti.

II. Working in rounded rupees and avoid decimal working.

Dr. Amish B. Soni for any Query: soni_amish@yahoo.com (M):9898372500

You might also like

- Fixed Rate Mortgage Homework ProblemsDocument2 pagesFixed Rate Mortgage Homework ProblemscjNo ratings yet

- 395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30Document6 pages395 38 Solutions Numerical Problems 30 Interest Rate Currency Swaps 30blazeweaverNo ratings yet

- Module 5 Exercises - JFCDocument7 pagesModule 5 Exercises - JFCJARED DARREN ONGNo ratings yet

- Interest Rate SwapsDocument10 pagesInterest Rate Swapssagar mNo ratings yet

- Chapter 7 DerrivsDocument7 pagesChapter 7 DerrivsMbusoThabetheNo ratings yet

- AkshatJain 0008 ACFDocument5 pagesAkshatJain 0008 ACFAkshat JainNo ratings yet

- Exs Done in Session 2 SOLVEDDocument7 pagesExs Done in Session 2 SOLVEDJordiNo ratings yet

- Corporate Finance - Group Work - Lecture 2 - Time Value of MoneyDocument3 pagesCorporate Finance - Group Work - Lecture 2 - Time Value of MoneyNguyễn HưngNo ratings yet

- WN 1: Computation of FRA RateDocument5 pagesWN 1: Computation of FRA RateBharat GudlaNo ratings yet

- FIN30014 Financial Risk Management Interest Rate Currency SwapsDocument33 pagesFIN30014 Financial Risk Management Interest Rate Currency SwapsJason DanielNo ratings yet

- My Family's Relative Is Planning To Borrow P95,000 and Earned It Within 3 Years From A Bank or Institution To Start A BusinessDocument2 pagesMy Family's Relative Is Planning To Borrow P95,000 and Earned It Within 3 Years From A Bank or Institution To Start A BusinessRea StyleNo ratings yet

- Security Analysis & Portfolio Management: Name Muqaddas ZubairDocument7 pagesSecurity Analysis & Portfolio Management: Name Muqaddas ZubairMahlab RajpootNo ratings yet

- Effective Rate and Compensating Balance CalculationsDocument4 pagesEffective Rate and Compensating Balance CalculationsLalaina EnriquezNo ratings yet

- Practice Problems On Yield To MaturityDocument2 pagesPractice Problems On Yield To MaturityCharl PontillaNo ratings yet

- P:本金/Principal r%:利率/Interest rate r% p.a.:年利率/Interest rate (per annual) n:期數/Number of period I:利息/Interest A:本利和/Amount T:時間/Time of depositDocument14 pagesP:本金/Principal r%:利率/Interest rate r% p.a.:年利率/Interest rate (per annual) n:期數/Number of period I:利息/Interest A:本利和/Amount T:時間/Time of depositKwan To HoNo ratings yet

- Hull OFOD10 e Solutions CH 07Document12 pagesHull OFOD10 e Solutions CH 07Vishal GoyalNo ratings yet

- Interest RaInterest Rate Derivative Case Analysiste Derivative Case AnalysisDocument8 pagesInterest RaInterest Rate Derivative Case Analysiste Derivative Case AnalysisSreenandan NambiarNo ratings yet

- Swaps: Practice Questions Problem 7.9Document4 pagesSwaps: Practice Questions Problem 7.9Sang Nguyễn TấnNo ratings yet

- Tybsc C Ag3 ReportDocument11 pagesTybsc C Ag3 ReportAryaman JainNo ratings yet

- Financial management module 2 cost of debt problemsDocument1 pageFinancial management module 2 cost of debt problemsRamya GowdaNo ratings yet

- Swap - Worked Out Examples V02Document32 pagesSwap - Worked Out Examples V02Harshit DwivediNo ratings yet

- Exercises Topic 2 With AnswersDocument2 pagesExercises Topic 2 With AnswersfatehahNo ratings yet

- Solutions to textbook recommended problems and exercisesDocument14 pagesSolutions to textbook recommended problems and exercisesMunira TurarovaNo ratings yet

- 1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Document6 pages1 Exercises On Swaps: 5:3% 5:4% Libor +0:6%Rimpy SondhNo ratings yet

- Session 3-Summary PDFDocument4 pagesSession 3-Summary PDFRajAt D Everaj EverajNo ratings yet

- Tutorial 3 PFPDocument6 pagesTutorial 3 PFPWinjie PangNo ratings yet

- Managerial Finance - Session 3Document6 pagesManagerial Finance - Session 3Ahmed el GhandourNo ratings yet

- FNCE 4040 Spring 2012 Midterm 2 With AnswersDocument6 pagesFNCE 4040 Spring 2012 Midterm 2 With AnswersAustin LindseyNo ratings yet

- Principles of Financial Market: Chapter 6: Interest RateDocument81 pagesPrinciples of Financial Market: Chapter 6: Interest RateThùy Vân NguyễnNo ratings yet

- Calculate bond prices and yieldsDocument14 pagesCalculate bond prices and yieldsPranoy SarkarNo ratings yet

- chapter six 2024Document15 pageschapter six 2024Romario KhaledNo ratings yet

- CT1 Sol 0605Document15 pagesCT1 Sol 0605AmitNo ratings yet

- Exam Practice Question MBADocument11 pagesExam Practice Question MBAsudhakar dhunganaNo ratings yet

- Tutorial 4 Answer Mfrs123 Borrowing CostsDocument5 pagesTutorial 4 Answer Mfrs123 Borrowing CostsannabelleNo ratings yet

- Quantitative Problems Chapter 10Document5 pagesQuantitative Problems Chapter 10Nurainey Maraya100% (1)

- TVM Exercises: - in The First Year: - in The Second YearDocument2 pagesTVM Exercises: - in The First Year: - in The Second YearCu Thi Hong NhungNo ratings yet

- FinanceDocument9 pagesFinanceNikhil MittalNo ratings yet

- Banking, Inflation and Exchange Rates Notes and QuestionsDocument22 pagesBanking, Inflation and Exchange Rates Notes and QuestionsKelvinNo ratings yet

- Designing An Interest Rate SwapDocument8 pagesDesigning An Interest Rate SwapRohit Kumar PandeyNo ratings yet

- Midterm Review Winter 2019Document11 pagesMidterm Review Winter 2019Gurveen Kaur100% (1)

- Finance - Solved Exercises 2Document7 pagesFinance - Solved Exercises 2safura aliyevaNo ratings yet

- FM - 3Document14 pagesFM - 3akesingsNo ratings yet

- Bond Valuation SolutionsDocument7 pagesBond Valuation SolutionsShubham AggarwalNo ratings yet

- CfbondDocument1 pageCfbondAayush ChopraNo ratings yet

- Note On FRA 8lxfUBjR4HDocument9 pagesNote On FRA 8lxfUBjR4HAnosh ModyNo ratings yet

- Calculating Present Value of Cash FlowsDocument2 pagesCalculating Present Value of Cash FlowsTrọng PhạmNo ratings yet

- Calculating Present Value of Cash FlowsDocument2 pagesCalculating Present Value of Cash FlowsNhư Quỳnh Nguyễn NgọcNo ratings yet

- Companies Swap Rates to Match NeedsDocument4 pagesCompanies Swap Rates to Match NeedsHana LeeNo ratings yet

- Vn1001630 - Vo Thi Phuong Thuy - CFDocument9 pagesVn1001630 - Vo Thi Phuong Thuy - CFThunder StormNo ratings yet

- FD Swap 2Document6 pagesFD Swap 2Gayu RkNo ratings yet

- MCM Tutorial 6&7Document6 pagesMCM Tutorial 6&7SHU WAN TEHNo ratings yet

- NBruk Week 2 Problem SetDocument4 pagesNBruk Week 2 Problem SetNat Ali100% (1)

- Service Charges and Fees-Federal BankDocument10 pagesService Charges and Fees-Federal Bankakhil kurianNo ratings yet

- Blank 3e ISM Ch06Document45 pagesBlank 3e ISM Ch06Sarmad Kayani100% (1)

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsDocument3 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Isvishal nigamNo ratings yet

- FINA3203 Solution 3Document3 pagesFINA3203 Solution 3simonsin6a30No ratings yet

- Chapter 7Document10 pagesChapter 7rcraw87No ratings yet

- Financial MGMT, Ch3Document29 pagesFinancial MGMT, Ch3heysemNo ratings yet

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- HR TAK Issue 12Document6 pagesHR TAK Issue 12J BNo ratings yet

- Sustainability 12 00108 v2 PDFDocument21 pagesSustainability 12 00108 v2 PDFSaki Saki SakiNo ratings yet

- KP Nadi SyllabusDocument15 pagesKP Nadi SyllabusJ BNo ratings yet

- E4 Bisleri Internshala Written AssessmentDocument4 pagesE4 Bisleri Internshala Written AssessmentJ BNo ratings yet

- Pestel Analysis of Insurance Sector in IndiaDocument2 pagesPestel Analysis of Insurance Sector in IndiaJ BNo ratings yet

- Young Housing Finance Company Providing Home LoansDocument12 pagesYoung Housing Finance Company Providing Home LoansJ BNo ratings yet

- CBA Order Processing SystemDocument13 pagesCBA Order Processing SystemLina Marie BesaNo ratings yet

- Amalda Aulia 1810533004 Int - AccountingDocument11 pagesAmalda Aulia 1810533004 Int - AccountingAmalda AuliaNo ratings yet

- Citi Trade May14Document23 pagesCiti Trade May14Marlon RelatadoNo ratings yet

- LDI Explained - 2017 FinalDocument44 pagesLDI Explained - 2017 Finaladonettos4008No ratings yet

- BankingDocument49 pagesBankingRitu BhatiyaNo ratings yet

- Demat Services Project ReportDocument35 pagesDemat Services Project Reportjyoti raghuvanshi100% (2)

- Cadillac Ventures Inc.: Consolidated Financial Statements May 31, 2007 and 2006Document22 pagesCadillac Ventures Inc.: Consolidated Financial Statements May 31, 2007 and 2006CadVentNo ratings yet

- Ecovis CAG GuideDocument68 pagesEcovis CAG GuidemahletNo ratings yet

- Project ReportDocument65 pagesProject ReportstafanaNo ratings yet

- BPI Investment Corporation vs. Court of Appeals, 377 SCRA 117, February 15, 2002Document2 pagesBPI Investment Corporation vs. Court of Appeals, 377 SCRA 117, February 15, 2002Robinson MojicaNo ratings yet

- Internal Audit Procedures ManualDocument11 pagesInternal Audit Procedures ManualLeizza Ni Gui DulaNo ratings yet

- IS-LM (Session 6, 7 & 8)Document23 pagesIS-LM (Session 6, 7 & 8)fdjuNo ratings yet

- Birch Gold Information KitDocument20 pagesBirch Gold Information KitRexrgisNo ratings yet

- How To Start A Trucking Business PDFDocument2 pagesHow To Start A Trucking Business PDFMagoo MarjonNo ratings yet

- The Importance of AccountingDocument3 pagesThe Importance of AccountingMathias MikeNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- BWWB, Bessemer Objection To Jefferson County Bankruptcy PlanDocument34 pagesBWWB, Bessemer Objection To Jefferson County Bankruptcy PlanKyle WhitmireNo ratings yet

- International Logistics, Risks, and Insurance ClaimsDocument26 pagesInternational Logistics, Risks, and Insurance ClaimsNgọc YếnNo ratings yet

- Best Practices 1-25Document23 pagesBest Practices 1-25Khai Dinh Tran50% (2)

- SMGTDocument19 pagesSMGTKevin FerdiansyahNo ratings yet

- (Circular E), Employer's Tax Guide: Future DevelopmentsDocument49 pages(Circular E), Employer's Tax Guide: Future DevelopmentsJoel PanganibanNo ratings yet

- Private and confidential payslip for Miss V GlibiciucDocument2 pagesPrivate and confidential payslip for Miss V GlibiciucGlibiciuc IlieNo ratings yet

- Unit 2: Final Accounts of Manufacturing Entities: Learning OutcomesDocument17 pagesUnit 2: Final Accounts of Manufacturing Entities: Learning OutcomessajedulNo ratings yet

- ENTRP Week 11 20Document46 pagesENTRP Week 11 20Jr ReforbaNo ratings yet

- Worksheet May 2020 BS Y10 Understanding BusinessDocument6 pagesWorksheet May 2020 BS Y10 Understanding Businessbosoj congNo ratings yet

- John Neff 22 Sep 2020 1116Document5 pagesJohn Neff 22 Sep 2020 1116Debashish Priyanka SinhaNo ratings yet

- Super Bond Adhesives Private LimitedDocument22 pagesSuper Bond Adhesives Private Limitedvikasaggarwal01No ratings yet

- Seven principles of insurance including utmost good faith, indemnity and causationDocument8 pagesSeven principles of insurance including utmost good faith, indemnity and causationanilnair88No ratings yet

- Does Capital Intensity, Inventory Intensity, Firm Size, Firm Risk, and Political Connections Affect Tax Aggressiveness?Document10 pagesDoes Capital Intensity, Inventory Intensity, Firm Size, Firm Risk, and Political Connections Affect Tax Aggressiveness?KurniaNo ratings yet