0% found this document useful (0 votes)

5K views3 pagesVertical and Horizontal Analysis Activity

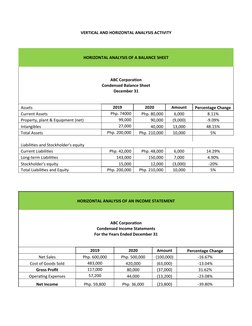

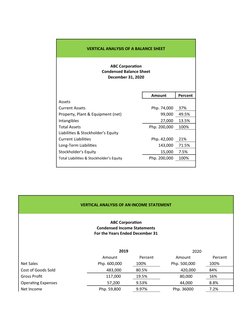

The document discusses horizontal and vertical analysis of balance sheets and income statements. Horizontal analysis compares line items from two periods to analyze changes over time in amounts and percentages. Vertical analysis expresses each line item as a percentage of a total to analyze the composition and internal structure of financial statements. The document provides examples of condensed balance sheets and income statements from ABC Corporation for the years 2019 and 2020 and calculates horizontal and vertical analyses.

Uploaded by

Kenneth FulguerinasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

5K views3 pagesVertical and Horizontal Analysis Activity

The document discusses horizontal and vertical analysis of balance sheets and income statements. Horizontal analysis compares line items from two periods to analyze changes over time in amounts and percentages. Vertical analysis expresses each line item as a percentage of a total to analyze the composition and internal structure of financial statements. The document provides examples of condensed balance sheets and income statements from ABC Corporation for the years 2019 and 2020 and calculates horizontal and vertical analyses.

Uploaded by

Kenneth FulguerinasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Horizontal Analysis of Financial Statements: Analyzes balance sheets and income statements for variance in assets, liabilities, and other entries over multiple years.

- Vertical Analysis of Financial Statements: Assesses the proportional breakdown of financial statement entries, offering insights into each item's impact on total figures.