Professional Documents

Culture Documents

Test Questions in Fabm2 4th Qtr333

Uploaded by

Rosanno DavidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Questions in Fabm2 4th Qtr333

Uploaded by

Rosanno DavidCopyright:

Available Formats

43.

Which financial statement will allow you to determine the gross margin for a retailer or

manufacturer? a. Balance Sheet b. Income Statement c. Statement Of Cash Flows

d. Statement Of Comprehensive Income e. Statement Of Stockholders’ Equity

44. Does the heading of a balance sheet indicate a period of time or a point in time?

a. Period Of Time b. Point In Time c. Bound in Time d. Specific Time

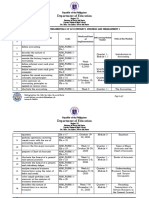

Name:___________________________________________ Date: _____________

45. The amount spent for capital expenditures will be reported in which section of the statement of

Grade/Section: Grade 11 – Blue Rating: ____________

cash flows? a. Cash Provided/used In Financing Activities b. Cash Provided/used In

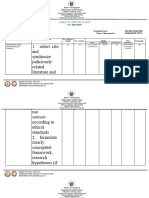

Investing Activities c. Cash Provided/used In Operating Activities d. Supplemental Prepare the journal entry to record the following independent transactions:

Information

46. Outstanding checks. a. Add To BOOK Balance b. Deduct From BOOK Balance 1. Siopao Queen paid its P1,390 electric bill for the month.

c. Add To BANK Balance d. Deduct From BANK Balance

47. Bank service charge. a. Add To BOOK Balance b. Deduct From BOOK Balance 2. Friendly Store sold for cash, P4,5000 worth of merchandise. The cost of goods sold is P2,300.

c. Add To BANK Balance d. Deduct From BANK Balance The company uses perpetual inventory system.

48. Interest credited to bank account a. Add To BOOK Balance b. Deduct From

c. BOOK Balance d. Add To BANK BalancFrome e. Deduct From BANK 3. Waldo Merchandising purchased on account P23,000 goods for resale from Melody Inc.

Balance The company uses periodic inventory system.

49. Interest charged to bank account. a. Add To BOOK Balance b. Deduct From

BOOK Balance c. Add To BANK Balance d. Deduct From BANK Balance 4. Butch Auto Repair purchased a building for his business at a cost of P500,000.

50. Deposit in transit. A. Add To BOOK Balance c. Deduct From BOOK Balance Butch paid P300,000 and for the balance he issued a promissory note payable 60 days after.

Add to BANK Balance Deduct From Bank Balance

Prepared by: 5. Seth Laundry Company paid advertising contract for one month, P2,000.

ROSSANO C. DAVID, CPA / MBA Multiple Choice Problems:

Subject Teacher (For numbers 6 to 10) The financial statements of Merdana Trading Ltd. are given below:

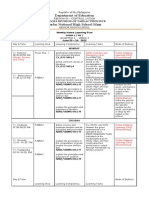

2014 2013

Cash and Cash Equivalents 12,250 10,470

Checked and Reviewed by:

Receivables 9,065 8,055

HENRY A. CABACUNGAN Inventory 6,620 5,300

Head Teacher VI Prepaid Expenses 8,545 10,600

Total Curent Assets 36,480 34,425

Other Assets 92,500 78,685

Noted: Total Assets 128,980 113,110

Total current liabilities 36,150 42,335

DR. EPIFANIA B. DUNGCA Long-term Liabilities 23,990 18,960

PRINCIPAL IV Mercedes Aldana, Capital 68,840 51,815

Total Liabilities and Equity 128,980 113,110

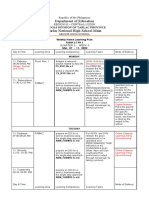

16. Which statement best describes Merdana Trading Ltd.’s acid-test ratio?

a Greater than 1 b Equal to 1 c Less than 1 d None of the above

17. Merdana Trading Ltd.’s inventory turnover during 2014 was (amounts rounded) a 6

times. b 7 times c 8 times d Not determinable from the data given.

2014 18. During 2014, Merdana Trading Ltd.’s days’ sales in receivables ratio was (amounts rounded)

Sales 104,705 a 34 days b 30 days c 32 days d 28 days

19. Which measure expresses Merdana Trading Ltd.’s times-interest-earned ratio? (amounts

Cost of Sales 32,275

rounded) a 54.7% b 20 times c 34 times d 32 times

Gross Profit 69,430

20. Merdana Trading Ltd.’s rate of return on equity can be described as

Selling Expenses 35,325 a 33.55% b 16.72% c 35.29% d None of the above

Administrative Expenses 12,815 21. Merdana Trading Ltd.’s rate of return on asset can be described as

Operating Income 21,290 a 33.55% b 16.72% c. 35.29% d None of the above

Interest Expense 1,050 22. Merdana Trading Ltd.’s gross profit rate can be described as

Net Income 20,240 a 34% b 19% c. 20% d 66%

23. What is stockholders' equity? a Sales of products or services b Owners' claims to resources

6. Horizontal analysis of 2014 Merdana’s balance sheet would report c. Resources owned d Costs of selling products or services e Amounts owed

a. Cash as 9.50% of total assets. c. 19% increase in Cash. 24. What's revenue? a Costs of selling products or services b Expense to run business

b. 17% increase in Prepaid Expenses. d. All of the above. c Sales of products or services d Distributions to stockholders e Assets purchased to run

7. Vertical analysis of 2014 Merdana’s balance sheet would report business

a. Cash as 9.50% of total assets. c. 19% increase in Cash. 25. What are expenses? a Costs of selling products or services b Sales of products or

b. 17% increase in Prepaid Expenses. d. All of the above services c Amounts owed d Distributions to stockholders e Owners' claims to

8. A common-size income statement for Merdana would report (amounts rounded) resources

a Net income of 19%. b. Sales of 100%. c. Cost of sales at 34%. d All of the above 26. A business organization compose by a group and has separate legal personality from its

9. A common-size balance sheet for Merdana would report (amounts rounded) owners a Sole Proprietorship b Corporation c Partnership d Cooperative

a Current liabilities as 28% of total assets c Receivables is 7% of total liabilities and equity 27. Are a business’ source of raw materials, intermediate goods or final products and services.

b Owner’s capital is 53% of total liabilities & equity d All of the above a Vendors b Suppliers c buyers d Vendee

10. Trend analysis will show which of the following? 28. What is the accounting equation? a Assets - liabilities = stockholders equity b Assets +

a. 15% increase in Current Liabilities c 19% increase in Long Term Liabilities . liabilities = stockholders equity c Liabilities - stockholders equity = assets d NOTA

b 33% increase in Owner’s Capital. d All of the above 29. What is an example of an expense? a Bank loan b Interest paid to a credit union

11. If current assets are ₱270,000 and total assets are ₱810,000, what percentage of total assets c Principle paid to Lehman bank d Monthly rent on office space

are current assets? a 3.5 percent b 30 percent c 25 percent d 33 percent 30. What is the statement called that measures activities involving cash recipts and cash payments

12. Comparing the amount of a balance sheet item in one year to the amount for the same item in a over an interval of time? a Income Statement b Balance Sheet c The Statement of

prior year is a common-size analysis. . c horizontal analysis Stockholders' Equity d The Statement of Cash Flows

b vertical analysis. d ratio analysis. 31. What piece of company information better explains companies stock price performance?

13. A firm has liabilities of ₱30,000 and owner’s capital of ₱90,000. The percentage of total a. Balance Statement b. Financial accounting net income c. Revenues d. Expenses

liabilities to total assets is a 25 percent. b 20 percent. c 50 percent. d 75 percent. 32. Which of the following will cause owner's equity to increase? a. Expenses b Owner’s Draws

14. A firm had owner’s capital of ₱150,000 in 2013 and ₱187,500 in 2013. The increase in owner’s c Revenue d NOTA

capital from 2013 to 2014 is a 12.5 percent. b 20 percent. c 25 percent. d 125 percent. 33. Which of the following will cause owner's equity to decrease?

15. If long-term liabilities are ₱300,000 and total assets are ₱2,100,000, what percentage of total a. Net Income b. Net Loss c. Revenue d. Expenses

assets are long-term liabilities? a 7 % b 16.7 % c 12.5 % d 14.3 %

34. The personal assets of the owner of a company will not appear on the balance sheet because

of which principle? a. Cost b. Economic Entity c. Monetary Unit d. All of the above.

35. Which principle requires a company's balance sheet to report its land at the amount the

company paid to acquire the land, even if the land could be sold today at a significantly higher

amount? a. Cost b. Economic Entity c. Monetary Unit d. All of the above.

36. Which principle allows a company to ignore the change in the purchasing power of the peso

over time? a. Cost b. Economic Entity c. Monetary Unit d. All of the above.

37. Which principle requires the company's financial statements to have footnotes containing

information that is important to users of the financial statements?

a. Conservatism b. Economic Entity c. Full Disclosure d. Monetary Unit

38. Which principle justifies a company violating an accounting principle because the amounts are

immaterial? a. Conservatism b. Full Disclosure c. Materiality d. Monetary Unit

39. Which of the following will be included in the adjusting entry to accrue interest expense?

a. A Debit To Cash b. A Credit To Interest Payable

c. A Debit To Interest Payable d. A Debit To Prepaid Interest

40. Which of the following will be included in the adjusting entry to accrue interest income or

interest revenues? a. A Debit To Cash b. A Debit To Interest Income

c. A Credit To Interest Receivable d. A Debit To Interest Receivable

41. The adjusting entry that reduces the balance in Prepaid Insurance will also include which of the

following? a. A Credit To Cash b. A Credit To Insurance Expense

c. A Debit To Insurance Expense d. A Debit To Insurance Payable

42. The adjusting entry that reduces the balance in Deferred Revenues or Unearned Revenues will

also include which of the following? a. A Debit To Cash b. A Credit To Fees Earned

c. A Debit To Fees Earned d. A Credit To Fees Receivable

You might also like

- Fabm2 Law q1 Week 1 To 9Document21 pagesFabm2 Law q1 Week 1 To 9Karen, Togeno CabusNo ratings yet

- 3 RdquarterDocument7 pages3 RdquarterRylan Yani OlshpNo ratings yet

- 4th FABM 2Document2 pages4th FABM 2Keisha MarieNo ratings yet

- 04 PRE-TEST OR POST-TEST Jeremy OrtegaDocument14 pages04 PRE-TEST OR POST-TEST Jeremy OrtegaJeremy OrtegaNo ratings yet

- Tos in FABM2 Second QuarterDocument2 pagesTos in FABM2 Second QuarterLAARNI REBONGNo ratings yet

- Fabm1 Summative ExamDocument8 pagesFabm1 Summative ExamAbegail PanangNo ratings yet

- Journalizing TransactionsDocument5 pagesJournalizing TransactionsSatvik Bisht100% (1)

- Fabm1 LPDocument2 pagesFabm1 LPRaul Soriano CabantingNo ratings yet

- WHLP Week 4 Business FinanceDocument2 pagesWHLP Week 4 Business FinanceggonegvftNo ratings yet

- Quiz 4 Types of Major Accounts Without AnswerDocument5 pagesQuiz 4 Types of Major Accounts Without AnswerHello KittyNo ratings yet

- First Quarter Test Grade 12: Fundamental of ABM-2Document2 pagesFirst Quarter Test Grade 12: Fundamental of ABM-2manuel hipolitoNo ratings yet

- Fabm1 TQDocument7 pagesFabm1 TQMAYCAROL TUMALIUANNo ratings yet

- Accounting Worksheet Number OneDocument4 pagesAccounting Worksheet Number OneJevoun Tyrell100% (1)

- Fabm2 Sce Week 6-8Document61 pagesFabm2 Sce Week 6-8mary rose aragonNo ratings yet

- Diagnostic Test Business Finance - CorrectedDocument5 pagesDiagnostic Test Business Finance - CorrectedWilson MoralesNo ratings yet

- FABM2 1stqtr UploadDocument4 pagesFABM2 1stqtr Uploadjay reamonNo ratings yet

- Topic 14 - Income and Business TaxationDocument71 pagesTopic 14 - Income and Business TaxationFrancez Anne Guanzon100% (1)

- Buss 203 Business FinanceDocument2 pagesBuss 203 Business FinanceTevin67% (3)

- QUIZ - FS - SolutionDocument3 pagesQUIZ - FS - SolutionRichelle ManocayNo ratings yet

- FABM1 Module 4 Types of Major AccountsDocument26 pagesFABM1 Module 4 Types of Major AccountsKISHANo ratings yet

- FMA PPT-3 Accounting Cycle & Journal EntriesDocument17 pagesFMA PPT-3 Accounting Cycle & Journal EntriesArpit VermaNo ratings yet

- A. Review Activity: B. Springboard/MotivationDocument3 pagesA. Review Activity: B. Springboard/MotivationsweetzelNo ratings yet

- Idea Lesson Nancy - Fabm2 FinalDocument4 pagesIdea Lesson Nancy - Fabm2 FinalNancy AtentarNo ratings yet

- ABM - FABM11-IIIg - J - 28Document2 pagesABM - FABM11-IIIg - J - 28Mary Grace Pagalan Ladaran0% (1)

- Pre and Post of Accounting 2Document14 pagesPre and Post of Accounting 2Nancy AtentarNo ratings yet

- Quiz Bee Problems Version 1Document68 pagesQuiz Bee Problems Version 1Lalaine De JesusNo ratings yet

- First Quarter ExaminationDocument5 pagesFirst Quarter Examinationwindell arth MercadoNo ratings yet

- Diagnostic Test FABM 1Document2 pagesDiagnostic Test FABM 1Marjorie BadiolaNo ratings yet

- DLL FABM Week3Document3 pagesDLL FABM Week3sweetzelNo ratings yet

- FABM1 Week1Document5 pagesFABM1 Week1TrixieNo ratings yet

- Daily-Lesson LogDocument3 pagesDaily-Lesson LogFaith Tulmo De Dios100% (1)

- Fabm1 Quarter4 Module 10 Week 2Document16 pagesFabm1 Quarter4 Module 10 Week 2Princess Nicole EsioNo ratings yet

- Fundamentals of Accountancy, Business & Management 2Document8 pagesFundamentals of Accountancy, Business & Management 2Homer EscalicasNo ratings yet

- Business Finance Summative Test 3Document3 pagesBusiness Finance Summative Test 3Juanito II Balingsat100% (1)

- DLL Fabm1 Week 7 - 4TH - WEEKDocument4 pagesDLL Fabm1 Week 7 - 4TH - WEEKRosanno DavidNo ratings yet

- Final Exam in Fundamental of Accounting, Business and Management 2 Grade 12 Name: - Date: - Section: - ScoreDocument2 pagesFinal Exam in Fundamental of Accounting, Business and Management 2 Grade 12 Name: - Date: - Section: - ScoreLeylaNo ratings yet

- DLL - Abm Oct 16-20Document3 pagesDLL - Abm Oct 16-20Michelle Vinoray PascualNo ratings yet

- Chapter 1Document15 pagesChapter 1Rhodessa CotengNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelNo ratings yet

- FABM2 1st QTR Exam (2022)Document2 pagesFABM2 1st QTR Exam (2022)Noel CalicdanNo ratings yet

- Accounting1 Midterm Exam 1st Sem Ay2017-18Document13 pagesAccounting1 Midterm Exam 1st Sem Ay2017-18Uy SamuelNo ratings yet

- Final G12-FABM2 Q2 W1 ForprintDocument19 pagesFinal G12-FABM2 Q2 W1 ForprintLeighsen VillacortaNo ratings yet

- 3FABM1 DLL Nov 20-23Document5 pages3FABM1 DLL Nov 20-23Marilyn Nelmida TamayoNo ratings yet

- DLL FabmDocument4 pagesDLL FabmjoanNo ratings yet

- LeaP ABM Business Enterprise Simulation 3RD QTR WEEK 4Document4 pagesLeaP ABM Business Enterprise Simulation 3RD QTR WEEK 4Asheng ManaloNo ratings yet

- Entrepreneurship LAS 5 Q4 Week 5 6Document10 pagesEntrepreneurship LAS 5 Q4 Week 5 6Desiree Jane SaleraNo ratings yet

- Book of Accounts Part 1. JournalDocument12 pagesBook of Accounts Part 1. JournalJace AbeNo ratings yet

- Fabm 1 Lesson 4Document3 pagesFabm 1 Lesson 4Joey Agnas67% (3)

- SHS ABM BF Q1 Mod-11 RISK-RETURN-TRADE-OFF FINAL-1Document11 pagesSHS ABM BF Q1 Mod-11 RISK-RETURN-TRADE-OFF FINAL-1Kimberly LagmanNo ratings yet

- Accounting I Test: Questions 1-30: True/FalseDocument10 pagesAccounting I Test: Questions 1-30: True/FalseDayton 66No ratings yet

- 01 FabmDocument32 pages01 FabmMavs MadriagaNo ratings yet

- Chapter 2 - Statement of Comprehensive IncomeDocument12 pagesChapter 2 - Statement of Comprehensive IncomeAmie Jane MirandaNo ratings yet

- Chapter 4 - Statement of Cash FlowsDocument14 pagesChapter 4 - Statement of Cash FlowsRocky Pacpaco100% (1)

- Acchievement Test Fabm2Document5 pagesAcchievement Test Fabm2Carmelo John Delacruz100% (1)

- Business Finance - 12 - Third - Week 4Document10 pagesBusiness Finance - 12 - Third - Week 4AngelicaHermoParasNo ratings yet

- Business Finance DLL W9Document5 pagesBusiness Finance DLL W9Michael CortezNo ratings yet

- Module Abm1 FinalDocument69 pagesModule Abm1 FinalLANY T. CATAMINNo ratings yet

- Business Enterprise SimulationDocument12 pagesBusiness Enterprise SimulationCha Eun WooNo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- ARC-FAR May 2022 Batch - 1st PreboardDocument11 pagesARC-FAR May 2022 Batch - 1st PreboardjoyhhazelNo ratings yet

- Leadership Styles and Generational Effects Examples of US Companies in VietnamDocument24 pagesLeadership Styles and Generational Effects Examples of US Companies in VietnamRosanno DavidNo ratings yet

- Sample-Tos-21st Century-Second-Qtr - MCNDocument1 pageSample-Tos-21st Century-Second-Qtr - MCNRosanno DavidNo ratings yet

- RCD Daily-Lesson-Log-Fabm 1 Fifth WeekDocument3 pagesRCD Daily-Lesson-Log-Fabm 1 Fifth WeekRosanno DavidNo ratings yet

- 2000 Words Law AssignmentDocument3 pages2000 Words Law AssignmentRosanno DavidNo ratings yet

- Sample-Tos-21st Century-Second-Qtr.... MCNDocument1 pageSample-Tos-21st Century-Second-Qtr.... MCNRosanno DavidNo ratings yet

- RCD TEST QUESTIONS Third Quarterly Test RetakeDocument4 pagesRCD TEST QUESTIONS Third Quarterly Test RetakeRosanno DavidNo ratings yet

- BUS702 - Law Group PresentationDocument12 pagesBUS702 - Law Group PresentationRosanno DavidNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Document3 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Rosanno DavidNo ratings yet

- Select, Cite, and Synthesize Judiciously Related Literature andDocument9 pagesSelect, Cite, and Synthesize Judiciously Related Literature andRosanno DavidNo ratings yet

- Second Sem - Tos-R&w-First-Qtr RCDDocument1 pageSecond Sem - Tos-R&w-First-Qtr RCDRosanno DavidNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Document3 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Rosanno DavidNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Document3 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Rosanno DavidNo ratings yet

- Second Quarterly Exam In-The-21st-Century-Literature SPECIAL TESTDocument6 pagesSecond Quarterly Exam In-The-21st-Century-Literature SPECIAL TESTRosanno DavidNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Document3 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Rosanno DavidNo ratings yet

- Declaration of Anti-PlagiarismDocument1 pageDeclaration of Anti-PlagiarismMaestro VarixNo ratings yet

- WHLP4 Week5 David Rossano, C.Document3 pagesWHLP4 Week5 David Rossano, C.Rosanno DavidNo ratings yet

- Department of Education: Individual Performance Commitment and Review Form (Ipcrf) Part I-IvDocument42 pagesDepartment of Education: Individual Performance Commitment and Review Form (Ipcrf) Part I-IvRea AkmadNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK FIFTHDocument2 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK FIFTHRosanno DavidNo ratings yet

- RCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Document3 pagesRCD DAILY-LESSON-LOG-READINGSem 2023 2024 SECOND SEM WEEK SECOND333Rosanno DavidNo ratings yet

- WHLP3 Week3 David Rossano, C.Document3 pagesWHLP3 Week3 David Rossano, C.Rosanno DavidNo ratings yet

- DLL Fabm1 Week 7 - 4TH - WEEKDocument4 pagesDLL Fabm1 Week 7 - 4TH - WEEKRosanno DavidNo ratings yet

- WHLP4 Week5 David Rossano, C.Document3 pagesWHLP4 Week5 David Rossano, C.Rosanno DavidNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- Question or The Best Completes The Statements. Write The Letter of Your ChoiceDocument8 pagesQuestion or The Best Completes The Statements. Write The Letter of Your ChoiceRosanno David100% (3)

- DLL Sir Daviddiscipline and Ideas RCDDocument3 pagesDLL Sir Daviddiscipline and Ideas RCDRosanno DavidNo ratings yet

- Action Plan in FABM - Modified - Template333Document3 pagesAction Plan in FABM - Modified - Template333Rosanno DavidNo ratings yet

- FABM2 PreTest - 1stQtrDocument4 pagesFABM2 PreTest - 1stQtrRossano DavidNo ratings yet

- Action Plan in School LibraryDocument3 pagesAction Plan in School LibraryRosanno David93% (15)

- Action Plan in School LibraryDocument3 pagesAction Plan in School LibraryRosanno David93% (15)

- Business EthicsDocument6 pagesBusiness EthicsSupah LookieNo ratings yet

- Accounts ListDocument45 pagesAccounts ListShaan0% (1)

- Swot Analysis of SkodaDocument23 pagesSwot Analysis of SkodaGaurav JaiswalNo ratings yet

- Inv DS-030 Application Setup Document PT PDFDocument271 pagesInv DS-030 Application Setup Document PT PDFMauriceNo ratings yet

- Fabm 1Document2 pagesFabm 1hours cityNo ratings yet

- To Do Path: How To Define Company StructureDocument55 pagesTo Do Path: How To Define Company Structurepragyaa4No ratings yet

- Security AnalysisDocument305 pagesSecurity AnalysisAoc HyderporaNo ratings yet

- ADM 016 ACRS Certification Agreement (Version 3.1) WebDocument23 pagesADM 016 ACRS Certification Agreement (Version 3.1) WebMonica SinghNo ratings yet

- Cooperative BanksDocument8 pagesCooperative Banksmetmmsa2014No ratings yet

- Hazardous Substance Management& PredefServiceDocument67 pagesHazardous Substance Management& PredefServiceheyravikumarNo ratings yet

- Capturing Project Requirements and KnowledgeDocument8 pagesCapturing Project Requirements and KnowledgeefiolNo ratings yet

- Law Offices of Harry Finkle, A Professional Corporation Proposal - RedactedDocument5 pagesLaw Offices of Harry Finkle, A Professional Corporation Proposal - RedactedL. A. PatersonNo ratings yet

- Busines Plan On Poultry Farming PDFDocument54 pagesBusines Plan On Poultry Farming PDFDeep & Minimal Tech House Music UnionHouseMusicNo ratings yet

- The Issues On Corporate GovernanceDocument15 pagesThe Issues On Corporate Governanceanitama_aminNo ratings yet

- Dolphin Hotels PLC and Eden Hotel Lanka PLCDocument7 pagesDolphin Hotels PLC and Eden Hotel Lanka PLCreshadNo ratings yet

- Definition & Scope of Human Resource Management: Gwendolyn Q. Eborde, LPT MasterandDocument17 pagesDefinition & Scope of Human Resource Management: Gwendolyn Q. Eborde, LPT MasterandNewgleer WengNo ratings yet

- January 2024Document2 pagesJanuary 2024Vikram Kumar GuptaNo ratings yet

- HRIS PresentationDocument20 pagesHRIS PresentationShahjahan Mushtaq100% (1)

- Tugas 2 - Unit 3 System Wide ConceptDocument19 pagesTugas 2 - Unit 3 System Wide ConceptRista RistaNo ratings yet

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesNo ratings yet

- Petissu (Final)Document51 pagesPetissu (Final)Patricia SantosNo ratings yet

- WOLFGANG AURBACH v. SANITARY WARES MANUFACTURING CORPORATIONDocument17 pagesWOLFGANG AURBACH v. SANITARY WARES MANUFACTURING CORPORATIONkhate alonzoNo ratings yet

- Entrepreneur USA - MayJune 2023Document112 pagesEntrepreneur USA - MayJune 2023amandaNo ratings yet

- 11 Technical Analysis & Dow TheoryDocument9 pages11 Technical Analysis & Dow TheoryGulzar AhmedNo ratings yet

- WHSmith Indonesia Shortened Presentation Mar 2014Document28 pagesWHSmith Indonesia Shortened Presentation Mar 2014Benjamin James SmithNo ratings yet

- 1 Purpose and ScopeDocument5 pages1 Purpose and ScopeSivananthaa MurtheeNo ratings yet

- Aas 2Document3 pagesAas 2Rishabh GuptaNo ratings yet

- Case Study 2 - AccountingDocument5 pagesCase Study 2 - AccountingThrowaway TwoNo ratings yet

- Oriental Engineering Works PVTDocument20 pagesOriental Engineering Works PVTDarshan DhimanNo ratings yet

- Unit 1 ECom MCQDocument4 pagesUnit 1 ECom MCQvishal GAYNo ratings yet