Professional Documents

Culture Documents

INT ACC I Accounts Receivable 1

INT ACC I Accounts Receivable 1

Uploaded by

kianamarie0 ratings0% found this document useful (0 votes)

197 views8 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

197 views8 pagesINT ACC I Accounts Receivable 1

INT ACC I Accounts Receivable 1

Uploaded by

kianamarieCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

PRACTICAL ACCOUNTING 1 - REVIEW

RECEIVABLES.

PROF. Uc. VALLADOLIO

Multiple choice

deny the lero he choice that bes! completes the statement or answers the question

1. On December 31, 2020, the accounts receivable control account of Kala Company had a balance of

2,888,000 An analy ofthe accounts receable account showed the folowng

‘Accounts known tobe wetless (wnt. ) P 37500

‘Advance payments to reators on purchase orders (WR "180,000

Avanoes to afiate companies (YC Faughe) 1 375000

Customers accounts feporing cet balance arsing

‘fom sales etn {aman Labo) (225,000)

Interest recevabe on bonds. 180.000,

eran cst ema E Ly 730,000

‘Subscriptions recelvabie due n 90 cays 228,000

Trade accounts ecatvabie = assigned (Kala cpmpany's

foqutyin assigned accounts P150,000) (Rul) 75.000

‘Trade instalment recavabie sue

Incuing uneamed trance cnarges 330.900

Trade recovabios fom oficers due curety (me Waseda /22.500

‘Trade accounts on which post-dated checks ae held (no

fenties were made on receiis of chee) mal Maur _/ 75000

REoo

‘Based onthe above information, detemine the adusted balance of allowing!

1. The rage accounts recewable as of December 31,2020 is

Pse7 500 Praes.000

Pus22 500, & rae s00

2. The net curent wade and oterreceables a8 of Dacember 3, 2020 4

a passer 500 2272 500,

3. Pa810,000, & Pi22 800

‘3. How much of he foregoing wil be presente under noncurent assets a8 of December 21, 20207

3. P1,200,000| © s25.000

BP s7sc00 apo

2. Presented below ar a series of unrelated stuatons. Answer the following questions eating o each of

the independent stuatons as requested

1 Kala Companys rate al bare at December 3, 270, ned flowing secur:

‘ret

Accounts receivable ro08 380

‘Alowance for doubt accounts 0,000,

Saioe 15.000,000

‘Sales rtums and allowances 700,000

Kala Company estimates ts bad dett expense tobe 1 12% af nt sales. Determine is bad debt

‘expanse for 2020.

3'P226,000 of 214,500

Pasa soo 35,00

2. Ananabsi and song of Connie Corp. accounts recauaba at December 31, 2020, dslosed the

ng

‘Amounts estinated to be uneotectible 1,900,000

‘Account receivable “500,000

‘Alowance for doubt accounls (per books)" 1.250,000,

"Whats the nat realaabe value of Connie reeirabes at Decombe 3, 20207

‘P35 700 000. = P8250 000

iy Prrsoo.oc0 15, Pr44s0.000,

2. ‘Connie Company provides or doubt acount based 3%-otredi-eies, The folowing data ae

ral for 2020,

eat sates aunng 2020 2s.000000

‘Abwance fo dou acount 11/2020 ‘70000

Colleton of aecouts wt of in ps years

(Custamer coat was eetalished) 20.000

customer aezount witan of a uncolectble

rng 2020 300,000

‘mais he vatance in alowance fr doubt secouts a December 31, 20207

‘3 630,000 00000.

B pez0000 400

44 Abbe nd oft feat yer of operations, December 31, 2020, Joseph nc reared the folowing

‘eration

‘Accounts eceable, net of aowance for

‘Sout! accounts 9.500000,

tomer sccouris wien of as urcaletie

‘zing 2020 240 000

Bed debs expense or 2020 40.000

‘What shoud be the balance in aecounts ecevate at Deamber 31, 2020 before subtracting he

tonance fr oul sceurie?

GF noo = P 9740000

r3e0.000 ‘& Pro.s0.000

5. The{otowng accounts were taken tom Joseph rcs statement of fancial sion at December 31

2020,

Dest cosa

‘counts recavabe 30000,

Net rea sies °° 750,000

outst! accounts ae 33 of zou reclabe determin he bad deb expense tbe repr

for 00,

ay P123,000, © P223.000

2! P2300 226000

3: Joseph Compan’ statement nari ostn shows he account reel balance a Deere?

31, 201925 atoms:

‘Accounts rcovabe 3.600900

‘Aowance for cout accounts 7200

mame

During 2020, ansacton clang to he accounts were a ows

1. Sales on acount, P38 400000.

1 ash received rm coleton of current eeabe fold P31, 360.00, ater count of PEAD00

were alowed for promet payment

1 customer accounts of PY60000 were ascensines tte wortess and were wren ot

Bod accounts previously waite of pra to 2020 anourting te P4000 were recoveres

1 The company decked to provide P184,000 for Seu accounts by una enya the end of he

veer.

1 conunts recehvable of PS 60.000 have been pledged o 2 loca bank on a loan of P5,200,000

2 Gieatone ar 200 O00 were made on these racevatle (rc neluded he colecton previous

Sven) and ppl as pari payment fo te lan.

‘seg onthe above data answer he folowing

1. Tne accounts ecahati as of December 3, 2020's

3" eeec 000 te px340000

psec. 000 6 Paeaco

2, The alowance or dovtil aezauns aso December 3%, 2020's

ap eo00 © Pieaco0,

Co Pista Pr7ec00

1. The net ealabl value of accounts reeuable a of camber 31, 202015

2 pase 000 ‘peso4 000

4 tfrecenabes are hypohecated again baovngs, the amount of receivables involved should be

‘iscoeed a he eats or oles

cured om be ol recevaies, wth dsclsure

Exculded fom the fal reclvabls, wth ro dss.

5, Ekgudes fom he toa recoables anda ain or oss reogrzed between the face value and

the amount of borowings

‘For the year ended December 31, 2020, Kala Corporation revealed thatthe Accounts Receivable account

const he folowing.

‘Trade accounts receivable (cure) 3.40000

Pest de ade accounts, 40,000

Ureolete aceouns ‘26000

Cred ances in customer’ acount (20.000)

Notes ecshvabie sahonored 240.000

Conant shen cost

“Tre conspne sa gods cst PB,000 fr

ea c00"A iO cormision me charged

Eenagnee andres he ance Rana fe

‘aonwne recaveain nay, 201 _ 320000

Teta Pr

‘The balance ofthe alonanc for doubtful accounts belore aul austen is a crest of P8000. Is

estimate hal an alewance sue be mantane o equ 53 of fade racehrables. net of amount Se

from te consign wo bonded The company hae nit proved yt athe 2020 Gos cab expense

Based on he above intermaton, elermine eal irc folowing

1. Trae accounts reeivate

24080 000 Q ressuooo

5 a0 000 Pas 00

2. Allowance for doubt accounts

204000 e. Pr72000

G Pat8000 178200,

3. pub accounts expense

ae o00 fe P2szo00

©. pxz000 4. 727200,

5. Jere Company was organized 2020, Forhe yet endedDecemer’3, 2020, fre made avalatle

the flowing information,

“Total merenanice purchases forthe year 7.600000

Meronanie ventory at December 31 143000

‘At metenanise was maredto sel a 40% above cost Assuring tha al ses ae on cesta nd

fecowabies are cole wht should be he blanc in acauts receivable at December 37, 20207,

21 000,000

340.000

© 6000000

4 §800000

6 Joseph Company proved orn information on hes nancial records on December 31,2020

Accounts reclabe January 1 1.920000

Ceectone of acount eave 6240000

Bas deve “00000

‘ventory, Janay 1 -2a80.000

Inventory, December 31 ‘ooo

‘Accounts payable, ruse 1 41000000

‘counts payable, Dace 31 1500000,

Cah sl 1200000

arena 44300.000

Grose Prt on Saas 2180 000

‘Wats the ending balance o accounts receivable on Oecarber 31, 20207

©.3:3120000

«44080000

eat Co, puchased fom Oak Co. 8 20,000 8%, fee nol tat equ fy Gal aol year-end

‘ayments of 008, The note wat ciscouned oye rate Leal Ate date of puchase Cea

"eeordedtho not tts preset value ot 18485 Wha! enous be the tal iter venue eam By

eat over tet ot tha not?

‘5048

560

000

9.000

‘On sanvary 1, 2020, JP Co sls ts equement wth a carting vale of PY60000 The company

‘eceives a non-inerest bear ate ave 3 ears tha face srr ef P200.000 There 8a

siablshed mare vale fre equipment the prevatng restate 8 ate! Ps pe 12%,

‘The folowing are the present vate aca af 12%

Preset valu of fo 3 perioss one

Present valu of an ora arty of for 9 prods 240188

se oat

treet

4000050

8 \wnatis tne gan or loss tobe recegized on he sl othe equip?

92. he iscount on nteeceable on January 1,202, ¢

sree

°

© 49000

ire

(29.Thesisount arbor at the ad fhe ne Yo using he ecbve ners! metre

2938

Jason Co, assigned 1,000,000 of accounts acai o Quek Fnance Co a sear for @ loan of

240,000 Quix charge a 2% conmisacan onthe arau ofhe loa, theres ‘te ote nla at

10%. Dusng the fat math Jason clei 220,000 on atsgned accounts afer ceducing 160 ot

scours vasonaccepies etre worh 2.700 an wrote of eines ccna talng 7.200,

121. Te amount cath Jason eceved tom Quick athe time ofthe ale was

3" 759,000,

b a2n.00

2 223200

4 s40.000

(22. Enis uring the frst moth #8 cde

eb to Cash of 20 70.

‘eb fo B38 Debt Expense of 7 00

{abet Alowance for Doubt Account of 7,400,

debt Accounts Receabie of 730860.

10. On December 1, 2020, Hero Company assigned P400 000 of accounts receivable in consideration for 3

. asso accounts receabe in

lean of 335,000 to Halo Company charged a 2% commission onthe aroun ofthe loan the terest te

ign the note was 10% During December, Hare caletasP110,000 on assigned accounts ae deducing

F980 of escouns. Hero acceped returns woth PY, 380 and wrte of assigned accounts oP2.960

Question 1

How much cash di Hero receive tom Halo at he te fhe raneler?

3) P08 500. 228 300,

3) 327.000 336000

Question 2

‘ina she caying value ofthe account receivable aelgned as of December 31, 20207

Nove ©) 268 620

285.200) P36,000,

11. Ontho February 1, 2020, New York Corporation factored recavales wih a caying of 2,000,000

Chicago Corperaton. New York Corporation abcesse aa nance charge ofS ofthe recevables and

felane 5% ofthe revansbies

Question t:

Ifthe tactorng rested a 2 ele, wnat aroun of ss rom ela sul he company repot ins 2020

Statement of eomprebensive name forthe ya 20207,

none prov 000

000 13) 160,000

Question 2:

_Assue tat New York Company relines signifier amount of tk and rear of ownership and had

‘3 contnang involvement onthe factored francal sete wat amount oss factorng shoud the

pany recognize?

os «P1000

000 ‘9°160,000

12, Cala Recowved tom a custome 3 ita, P75 b0 ole bearing anvil nro 8% Aer haling

the nl or sir month, Cara sseaunle the noe at Bank at an alocbe eret ate of 10%

(1. How much snbuir cara receive Ho Bik?

a 37120 0

(22 tthe ecountng ie teats 9 al, what amour on scouting shoud Car recognize?

5250

2 a7e0

20250

13, Pink Bank granted @ 10-yoar loan to Bide Company in tho amount of Pt,500,000 with a stated interest

‘ate, Payments se ve mandy and are computes to be 16650. Prk Bank ncured P40,C00 of

‘ect lean origination cxet and P20,000 of nec loan oigaion cos. n adaion, the Bank charg

‘Blue Company a 434 nonetunadi oan engnaton fee

Pang, be nde, hae caring amount ot

4.000

e 1a0000

{Soom

‘S200

448000

11480000,

1500000

a ofr the borower, as caring amount of

.1820,000

14. + sc Bank granted a loan toa borawer inthe amount of P5\000,000 on January 1, 2020. The interest

‘ate onthe loan is 10% payable annually staring December 31,2020. The loan matures in five years oo

December 3, 2022. PN Bank incur P39,400 a direct lan oginaton cost and P10,000 of incre: oan

fenton coat In aditon, PNB Bank charges te barewer an pont rrrfingabe lan oration

‘Based on the above information, answer the flowing (Round off present valve factors to four decimal

places)

1. The carying amount ofthe loan a8 of January 1, 2020 is

"5.000000, ©, P5080 400

b/Pa.639,400, 4 Pa.ee9.400

2, The efectve interest ate ofthe loans

2" y.00% 12.00%

Bre “a80%

3. The lnterest come to be recognized in 2020 is

"ps00,000 c Pagse6:

. P555,138, 4 P96 728

4. The carying amount ofthe loan as of December 31, 2020 is

a" p5,000,000 © P5035.281

5, Pa.90.128 3 Pa708 536

15. OnJanuary 1.2019, Omar Company loaned Alex Company amounting oP2,000,000 and eceved atwo

oor, 60 P200,600 nats. The note cal fo" annual Ineost fo be pad eatn Oscerber 31 Om

Colca the 2019 nest on schedule. Howeveron December 3%, 2020, based onthe Alex's recent

Financia difcties, Omar expects thatthe 2020 terest, which was recorded in the books, wil net be

Cotected an tat oly P.200,000 of te pncpa wil be recovered. The P1,200,000 principal amount

‘ipectod to be coleced lo two equa istaurmens on Decomber 31, 2022 and December 34,2024. The

‘revang restate for slr fype of note as of December 81,2020 1 8%,

‘Based onthe above nfo ais De followin” (Round af preset value factor to four decinas

places)

1 The present value ofthe expected ture cash Nows

t December 31,2020 is

oP 955,900, ¢/ 81,008 260 |

B. P2070:060, 080.920,

2, Theloan inpatment oss in 2020 is

a pitesz0, e/ P1.110740

3 P'960.740, Pr 4o,s40

‘3. How much s the interest income forthe year 20217

ay P 80.56 ©. 57.323,

BY Pazera apo

4 Carying amount ofthe loan a8 of Dacomber 31,2022 is

3 parses ePi,738 032

By saan: 3 PHt3¢008

16. At December 21,2020, Josh Co. had a receivabie from A Compiy i 400,000 that has been

‘utstanding fr gute some time, Further vestigation revealed hat F Company is taking ovr to run ang

porate the business atfars OFA Company. However F Company is mee than wllng fo assure ony

SEC orA'company’s sblgaton and pay fy the end ot 2021 Althetime the recelvabe was ecognaes

the prevading fate of noes! or simlar financial asset is 14%

7

hat anc shu canes esha on Decanter 31,220 sateen! aca

2. 135.849,

283,187

300,000

‘400,000

(22. How much impsiment loss shou be recognize related its accounts ecsvabe in

owmuch imal cogrze related is accounts

9, 136849,

¥ 263,157

300,000

400.000

(On December 31,2020, generat edger of Marin Company's account ecavale showed a tlance of

400,000 Because of contnung decrease n expected cash fows ons financial ess. Marin

‘Company nas geaies to estate he cash fom of the oustanding recawstias, The estas ae

based onthe expected peso aroun ob recov on the oustanding recavables. the category 298)

wien ase cludes the lngth and patio feasts an me face for mar borowers

Gateaon amount Time Factor

Paceeto

* 8

8 300000826

e 250000 751

5 ‘sooo ea

Question 1: How much should Marin Company reports account recivabl nits December 31,2020

statement of franca poster?

3)Pres.ts0e)P%200000,

pPvoreco§——«)Pi-ao.on0

‘Queston 2: What amount floss impaiment on acento should Marin Company ecogizin its

December 31,2020 statment of compranansie come?

‘ye200,000 )ps00 880

)e300,000 9Pa08.400

is equpmont used in manufacunng prarmacevtcals. On Decambor 31,2020, Rosall's accounts

‘ecelvable areas alow

(ndttuatysanficantacaabies

Firiey Company 0.000

Rese 200,000

FratelCo ‘0000

ante ine 00.000

‘Alor receivabies 500.000

faa 1.400800

Resale Corporation determines that Frey Company resevale is mpaies by 40,000 and Huser,

Inc's recavabia'Yotaly mpaved. The aber recsvables ror Rafal and Ris ae not Consors

Impaves Rosle detormines Dats compost rat f 2% ls aporoprate o measure mpaiment cn 3

(er ecpvalos What the lll mpamert of resiabes ar Rorae Corporation for 20207

"56 400

40000

© s0c00

25600,

‘en ins GIB 000.00 of ts ezourtsreceais wih gurarie(ecarse) 3 rane rage of

5 Toe trane company reams an aman equa 010k of he ser acewase fer posse

‘Sueent Wat wos be recoded 98 gan fos) nha Want ofreabien?

Gant 000

ema Eo

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

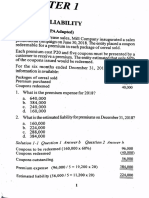

- 1 Liabpdf PDF FreeDocument25 pages1 Liabpdf PDF FreekianamarieNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- IM For ACCO 20073 Cost Accounting and ControlDocument102 pagesIM For ACCO 20073 Cost Accounting and ControlkianamarieNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Imp LosssDocument17 pagesImp LossskianamarieNo ratings yet

- HBO Chapter 9 PDFDocument10 pagesHBO Chapter 9 PDFkianamarieNo ratings yet

- Living in The It EraDocument13 pagesLiving in The It ErakianamarieNo ratings yet

- HBO Chapter 6Document24 pagesHBO Chapter 6kianamarieNo ratings yet

- UTS Reviewer PDFDocument10 pagesUTS Reviewer PDFkianamarieNo ratings yet

- Chapter 7 ApurposiveDocument19 pagesChapter 7 ApurposivekianamarieNo ratings yet

- Form 1. Physical Activity Readiness QuestionnaireDocument1 pageForm 1. Physical Activity Readiness QuestionnairekianamarieNo ratings yet

- Chapter 8Document10 pagesChapter 8kianamarieNo ratings yet

- The Ethics of Tax Accounting: Chapter NineDocument9 pagesThe Ethics of Tax Accounting: Chapter NinekianamarieNo ratings yet

- Ethics in Accounting and The Reliability PDFDocument9 pagesEthics in Accounting and The Reliability PDFkianamarieNo ratings yet