Professional Documents

Culture Documents

Problem Set #2

Uploaded by

Ryan GuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem Set #2

Uploaded by

Ryan GuCopyright:

Available Formats

Economics of Global Business

Problem Set #2

DUE: @ 11am on March 04

Submit via Assignments at NYU Classes. Make sure you submit one single file with all your

answers (pdf file is preferred). Submissions by email will not be accepted. You may work in a

group of up to 5 people. Whatever you hand in should be the work of your group and it should

take to form of a professional piece of work. Submit one assignment per group.

1. Labor Market

Consider an economy with production function given by Y = AK 0.5 L0.5 where A is the total factor

productivity (TFP), K is the capital stock and L is the labor input. For simplicity assume capital is

fixed and equal to 1. Assume A=100.

a. Write the firm’s problem of choosing labor demand. Derive the demand for labor as a function

of the real wage.

b. Assume labor supply is inelastic and fixed at L̄ = 25. Find the equilibrium values of the wage

and the employment level for this economy. Display graphically the labor supply and the labor

demand curves. Carefully label your graph.

c. Suppose the economy faces a positive productivity shock and TFP is now A=150. Display

graphically the new labor demand function. What are the equilibrium values of employment and

the real wage?

d. Compute the total output when A=100 and when A=150. What is the output’s growth rate?

Compare that growth rate with the growth rate in A. How does the growth rate of output per

capita compares to the growth rate in A? Explain carefully.

2. Emerging Market Forecasting and Growth Accounting

What drives GDP growth in China and India? How do they compare to each other? Data on real

GDP, capital, employment, are in the country data file, available on the course website. Assume

that payments to labor make up two-thirds of GDP in both countries, i.e., 1 − α = 2/3.

a. How has GDP per worker evolved in the two countries? Turn in one well-labeled graph that

plots GDP per worker (1979–2019) for both countries.

b. Compute TFP for each year. Create a TFP index for each country by dividing the value of TFP

in each year by the value of TFP in 1979 and multiplying by 100. Turn in one well-labeled graph

showing (1979–2019) the two TFP indices.

c. Compute the marginal product of capital (i.e. the MPK) for each year. Turn in one well-labeled

graph showing (1979–2019) the MPKs for each country.

Revised: February 16, 2021

Economics of Global Business Emerging Market Forecasting and Growth Accounting

China Y /L αK/L TFP

1979–1990

1990–2019

India Y /L αK/L TFP

1979–1990

1990–2019

d. Separate each country’s growth experience into two periods: 1979-1990 and 1990-2019. De-

compose the growth in output per worker into contributions from TFP, capital per worker, and

these two periods. Report your findings in the tables below.

e. Prepare a short summary of growth in China and India, highlighting the similarities and differences

between the two countries (including any differences that arise in the two periods). In your report,

please address several questions

• Which of the growth accounting elements are most important?

• How have returns on capital evolved over this time period? How do the evolution of returns

relate to the accounting exercise?

• What are possible reasons for the evolution of productivity in these two countries. In doing

so, you should explore the World Bank’s Doing Business reports and Governance Indicators.

Revised: February 16, 2021

You might also like

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Macro 21 MT RudraDocument7 pagesMacro 21 MT RudraHashmita MistriNo ratings yet

- Economy: Cse Prelims 2020: Value Addition SeriesDocument83 pagesEconomy: Cse Prelims 2020: Value Addition SeriesKailash KhaliNo ratings yet

- Instructions For ECON1102 Chart Book - 2014 Session 1Document7 pagesInstructions For ECON1102 Chart Book - 2014 Session 1christine_liu0110No ratings yet

- Economy Byju's IAS PDFDocument85 pagesEconomy Byju's IAS PDFvishalNo ratings yet

- CCCH9007 - Spring2021 - Problem Set 2Document1 pageCCCH9007 - Spring2021 - Problem Set 2Chunming TangNo ratings yet

- 2021 en Tutorial 7Document5 pages2021 en Tutorial 7Hari-haran KUMARNo ratings yet

- Assignment+4 Using+FRED+-+Winter 2023Document2 pagesAssignment+4 Using+FRED+-+Winter 2023zhuozhi fangNo ratings yet

- MGEB06 Assignment 1 (Winter 2021)Document5 pagesMGEB06 Assignment 1 (Winter 2021)Kenneth Daniel0% (1)

- Model Questions - 2018 - Macroeconomics FinalDocument9 pagesModel Questions - 2018 - Macroeconomics FinalSomidu ChandimalNo ratings yet

- Practice Problems 9-2-11Document3 pagesPractice Problems 9-2-11Adel KamalNo ratings yet

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- Accounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsDocument37 pagesAccounting For Growth: Comparing China and India: Barry Bosworth and Susan M. CollinsChand PatelNo ratings yet

- MCD 2090 Tutorial Questions T6-Wk6Document7 pagesMCD 2090 Tutorial Questions T6-Wk6Leona AriesintaNo ratings yet

- OL L K: Indian Institute of Technology KharagpurDocument2 pagesOL L K: Indian Institute of Technology KharagpurmaimslapNo ratings yet

- Ac Task 1Document19 pagesAc Task 1Priyanga RajanNo ratings yet

- T2. ProductivityDocument5 pagesT2. ProductivityNothing ThereNo ratings yet

- TERM 1-Credits 3 (Core) TAPMI, Manipal Session 4: Prof Madhu & Prof RajasulochanaDocument24 pagesTERM 1-Credits 3 (Core) TAPMI, Manipal Session 4: Prof Madhu & Prof RajasulochanaAnishNo ratings yet

- ECO136 Problem Set IDocument4 pagesECO136 Problem Set IFeyza DökmeciNo ratings yet

- ECON 203 Midterm 2013W FaisalRabbyDocument7 pagesECON 203 Midterm 2013W FaisalRabbyexamkillerNo ratings yet

- OVWL 2021 Take Home ProjectDocument5 pagesOVWL 2021 Take Home ProjectPhạm Hoàng Phương NguyênNo ratings yet

- Home Assignment 2 PDFDocument3 pagesHome Assignment 2 PDFГеоргий РакNo ratings yet

- 1.1 Consider Graph A, Where Technology Is Evolving But GDP Appears To Be Falling. How 1.2Document2 pages1.1 Consider Graph A, Where Technology Is Evolving But GDP Appears To Be Falling. How 1.2ALBA RUS HIDALGONo ratings yet

- Final Exam MACRO Jan 21 2019Document4 pagesFinal Exam MACRO Jan 21 2019benrjebfatma18No ratings yet

- MIT14 02F09 Pset1Document3 pagesMIT14 02F09 Pset1Bella NovitasariNo ratings yet

- Economic Environment Question Paper To Be Sent To SirDocument6 pagesEconomic Environment Question Paper To Be Sent To SirK.N. RajuNo ratings yet

- Mbecon 2019-21 Macroeconomics Mid Term Exam InstructionsDocument3 pagesMbecon 2019-21 Macroeconomics Mid Term Exam InstructionsMudasir AliNo ratings yet

- Solution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W JohnsonDocument6 pagesSolution Manual For Macroeconomics 6 e 6th Edition Olivier Blanchard David W JohnsonVanessaMerrittdqes100% (35)

- Ujian Akhir Semester Pascasarjana Usu (Ekonomi Pembangunan)Document4 pagesUjian Akhir Semester Pascasarjana Usu (Ekonomi Pembangunan)RamaNo ratings yet

- Macro PSet2 Anjou-Lenhov Tan ZhangDocument5 pagesMacro PSet2 Anjou-Lenhov Tan ZhangChangeBunnyNo ratings yet

- Econ 203 Tt2Document7 pagesEcon 203 Tt2examkillerNo ratings yet

- Macro AssignmentDocument3 pagesMacro Assignmentyitayihtafere8No ratings yet

- Econ 203 Midterm Fall 2011 VBDocument8 pagesEcon 203 Midterm Fall 2011 VBJonathan RuizNo ratings yet

- Intro To Macroeconomics and GDP Problem Set Answer KeyDocument5 pagesIntro To Macroeconomics and GDP Problem Set Answer KeySid JhaNo ratings yet

- Focus Economics Grade 10 Exam Practice BookDocument24 pagesFocus Economics Grade 10 Exam Practice BookMmapontsho Tshabalala100% (8)

- Cambridge International AS & A Level: Economics 9708/43Document5 pagesCambridge International AS & A Level: Economics 9708/43Melissa ChaiNo ratings yet

- Solution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonDocument24 pagesSolution Manual For Macroeconomics 5 e 5th Edition Stephen D WilliamsonSpencerLutznwype100% (35)

- Practice Solow IDocument3 pagesPractice Solow ICaíque MeloNo ratings yet

- PDTN FXNDocument9 pagesPDTN FXNrachmmmNo ratings yet

- Country ReportDocument9 pagesCountry ReportD LVNo ratings yet

- Macroeconomics Canadian 5th Edition Mankiw Solutions ManualDocument25 pagesMacroeconomics Canadian 5th Edition Mankiw Solutions ManualMrJosephCruzMDfojy100% (53)

- Macroeconomics Canadian 5th Edition Mankiw Solutions ManualDocument20 pagesMacroeconomics Canadian 5th Edition Mankiw Solutions Manualjakeabbottrlcmjn100% (19)

- Dwnload Full Macroeconomics Canadian 5th Edition Mankiw Solutions Manual PDFDocument35 pagesDwnload Full Macroeconomics Canadian 5th Edition Mankiw Solutions Manual PDFmichelettigeorgianna100% (9)

- Ib Economics Study Guide MacroDocument43 pagesIb Economics Study Guide Macroapi-196719233No ratings yet

- Anexo 2. C2 - David Ricardo PDFDocument5 pagesAnexo 2. C2 - David Ricardo PDFLaura EscobarNo ratings yet

- PS1 (20-21) Solutions UniversityDocument7 pagesPS1 (20-21) Solutions UniversityALBA RUS HIDALGONo ratings yet

- Macroeconomics - MondayDocument3 pagesMacroeconomics - MondayAhmad Sina SabawoonNo ratings yet

- MacroEconomics Group 2 Assignment 1Document10 pagesMacroEconomics Group 2 Assignment 1Arindam MandalNo ratings yet

- ECON 446 First AssinmentDocument2 pagesECON 446 First AssinmentFrancisco WilliamsNo ratings yet

- E - Portfolio Assignment Mike KaelinDocument9 pagesE - Portfolio Assignment Mike Kaelinapi-269409142No ratings yet

- I. Ii. Iii. Iv. V.: VU Lesson 28 Macroeconomic Data & National Income Accounting The Use of Macroeconomic DataDocument4 pagesI. Ii. Iii. Iv. V.: VU Lesson 28 Macroeconomic Data & National Income Accounting The Use of Macroeconomic DataSusheel KumarNo ratings yet

- E - Portfolio Assignment-1 Econ 2020 Valeria FinisedDocument7 pagesE - Portfolio Assignment-1 Econ 2020 Valeria Finisedapi-317277761No ratings yet

- Practice Questions (Micoreconomics)Document18 pagesPractice Questions (Micoreconomics)Jing YingNo ratings yet

- Exam3 SolDocument18 pagesExam3 SolKalen CarneyNo ratings yet

- Isi PebDocument70 pagesIsi PebsivaNo ratings yet

- Macroeconomics For Today 8Th Edition Tucker Solutions Manual Full Chapter PDFDocument40 pagesMacroeconomics For Today 8Th Edition Tucker Solutions Manual Full Chapter PDFcharles.tirabassi984100% (12)

- Bài tập ôn tậpDocument7 pagesBài tập ôn tậpLinh NguyễnNo ratings yet

- Econ 201 Tutorial 1 2023Document2 pagesEcon 201 Tutorial 1 2023NomveloNo ratings yet

- Assignment Mitra, Haniya, Mehreen, TalhaDocument17 pagesAssignment Mitra, Haniya, Mehreen, Talhavotodex924No ratings yet

- E - Portfolio Assignment 2Document8 pagesE - Portfolio Assignment 2api-248058538No ratings yet

- Look at Camera, Not The ScreenDocument4 pagesLook at Camera, Not The ScreenRyan GuNo ratings yet

- Ritz CaseDocument2 pagesRitz CaseRyan GuNo ratings yet

- Target FSADocument6 pagesTarget FSARyan GuNo ratings yet

- Marketing NotesDocument5 pagesMarketing NotesRyan GuNo ratings yet

- UG22-2020 - Fall - Perishable Inventories - Part ADocument27 pagesUG22-2020 - Fall - Perishable Inventories - Part ARyan GuNo ratings yet

- UG18-2020 - Fall - Ritz-Carlton - StudentDocument13 pagesUG18-2020 - Fall - Ritz-Carlton - StudentRyan GuNo ratings yet

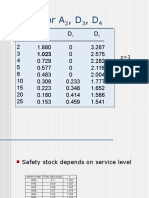

- Tables Control Charts and Safety StockDocument2 pagesTables Control Charts and Safety StockRyan GuNo ratings yet

- Regression Examples ch14 Filled inDocument30 pagesRegression Examples ch14 Filled inRyan GuNo ratings yet

- Sample Data For L L Bean Containing Demand Forecasts and Actual Demand For 85 ItemsDocument3 pagesSample Data For L L Bean Containing Demand Forecasts and Actual Demand For 85 ItemsRyan GuNo ratings yet

- Process Model Evaluation:: Clarity of StepsDocument14 pagesProcess Model Evaluation:: Clarity of StepsZeeshan NasirNo ratings yet

- Principles of Natural Resources ManagementDocument35 pagesPrinciples of Natural Resources ManagementMukesh MuraliNo ratings yet

- 1NH18MBA42Document44 pages1NH18MBA42Hà NhiNo ratings yet

- Ghana Banking Survey 2012Document57 pagesGhana Banking Survey 2012Kofi Appiah-Danquah100% (2)

- Capital Market-15th MarchDocument28 pagesCapital Market-15th MarchVenkat Narayan RavuriNo ratings yet

- ANDS PIP Vol 1 Final 15julyDocument62 pagesANDS PIP Vol 1 Final 15julyahmad20KvNo ratings yet

- SID Abridged Small Version Final ReportDocument56 pagesSID Abridged Small Version Final ReportMaskani Ya TaifaNo ratings yet

- Logistics of Tractor Distribution in An Agriculture-Driven Economy: An Indian Case StudyDocument15 pagesLogistics of Tractor Distribution in An Agriculture-Driven Economy: An Indian Case StudyNiraj PatleNo ratings yet

- An VesakDocument77 pagesAn Vesakdaoria14No ratings yet

- Free Trade Vs ProtectionDocument18 pagesFree Trade Vs Protectionatre100% (4)

- J.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页Document85 pagesJ.P. 摩根-美股-保险行业-2021年财险预览:商业再保险保险价格和自动频率顺风顺水-2021.1.4-83页HungNo ratings yet

- Financial Performance of Lease Firms in BangladeshDocument57 pagesFinancial Performance of Lease Firms in BangladeshAnika TabassumNo ratings yet

- JU BBA 25th 142454 2121-1Document41 pagesJU BBA 25th 142454 2121-1Tasfia HaqueNo ratings yet

- White Star Capital 2020 Industrial Technology Sector ReportDocument47 pagesWhite Star Capital 2020 Industrial Technology Sector ReportWhite Star CapitalNo ratings yet

- Microfinance Annual Report 2018Document53 pagesMicrofinance Annual Report 2018PanasheNo ratings yet

- ECON MACRO 5th Edition McEachern Test Bank DownloadDocument46 pagesECON MACRO 5th Edition McEachern Test Bank DownloadJeremy Leng100% (23)

- Krueger 1990Document29 pagesKrueger 1990L Laura Bernal HernándezNo ratings yet

- 2012 Coca-Cola HBC Integrated ReportDocument68 pages2012 Coca-Cola HBC Integrated ReportFrank Hayes100% (1)

- Dalal Street English Magazine Preview Issue 15Document14 pagesDalal Street English Magazine Preview Issue 15deba11sarangiNo ratings yet

- Foreign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalityDocument13 pagesForeign Direct Investment Inflows and Financial Development in Central and Eastern European Union Countries: A Panel Cointegration and CausalitymuthiaNo ratings yet

- President Fidel RamosDocument5 pagesPresident Fidel RamosMaria Lucy MendozaNo ratings yet

- Malaysia Builders Directory 2016.2017 EditorialDocument9 pagesMalaysia Builders Directory 2016.2017 EditorialshirleyNo ratings yet

- Wipro Annual Report 2011 12Document244 pagesWipro Annual Report 2011 12Hariharasudan HariNo ratings yet

- Kurukshetra January 2024Document52 pagesKurukshetra January 2024CarbidemanNo ratings yet

- AEC Blueprint Implementation Performance and Challenges: Trade FacilitationDocument76 pagesAEC Blueprint Implementation Performance and Challenges: Trade FacilitationERIA: Economic Research Institute for ASEAN and East AsiaNo ratings yet

- Borda 2019Document12 pagesBorda 2019SYAHRUL ROBBIANSYAH RAMADHANNo ratings yet

- F & V ExportDocument188 pagesF & V ExportNandkishor SahuNo ratings yet

- 12 Population PDFDocument12 pages12 Population PDFMahroof YounasNo ratings yet

- Tugas 1 Bahasa Inggris NiagaDocument1 pageTugas 1 Bahasa Inggris NiagaYoga PratamaNo ratings yet

- Rehabilitation of Sick SME-Working Group-ReportDocument115 pagesRehabilitation of Sick SME-Working Group-ReportAmit MaisuriyaNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- Economics 101: How the World WorksFrom EverandEconomics 101: How the World WorksRating: 4.5 out of 5 stars4.5/5 (34)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- This Changes Everything: Capitalism vs. The ClimateFrom EverandThis Changes Everything: Capitalism vs. The ClimateRating: 4 out of 5 stars4/5 (349)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Anarchy, State, and Utopia: Second EditionFrom EverandAnarchy, State, and Utopia: Second EditionRating: 3.5 out of 5 stars3.5/5 (180)

- The Meth Lunches: Food and Longing in an American CityFrom EverandThe Meth Lunches: Food and Longing in an American CityRating: 5 out of 5 stars5/5 (5)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (3)

- Poor Economics: A Radical Rethinking of the Way to Fight Global PovertyFrom EverandPoor Economics: A Radical Rethinking of the Way to Fight Global PovertyRating: 4.5 out of 5 stars4.5/5 (263)