Professional Documents

Culture Documents

Additional Capital - PT Pratama TBK Corporation On March 10

Uploaded by

nur fitri melatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Additional Capital - PT Pratama TBK Corporation On March 10

Uploaded by

nur fitri melatiCopyright:

Available Formats

Nama: Nur Fitri Melati

NIM: 041811333089

2. The dissolution of all but one of the separate legal entities is not necessary for a business

combination. An example of one form of business combination in which the separate legal entities

are not dissolved is when one corporation becomes a subsidiary of another. In the case of a

parent-subsidiary relationship, each combining company continues to exist as a separate legal

entity even though both companies are under the control of a single management team.

3. A business combination occurs when two or more previously separate and independent

companies are brought under the control of a single management team. Merger and consolidation

in a generic sense are frequently used as synonyms for the term business combination. In a

technical sense, however, a merger is a type of business combination in which all but one of the

combining entities are dissolved and a consolidation is a type of business combination in which a

new corporation is formed to take over the assets of two or more previously separate companies

and all of the combining companies are dissolved.

5. In a business combination, goodwill is the excess of investment cost over the fair value of the

investee’s identifiable net assets. Under the GAAP and IFRS, goodwill arising from a business

combination should be recorded as an asset. Goodwill should not be amortized because it has

indefinite useful life, rather, it should be tested for any impairment at least annually.

E1-3

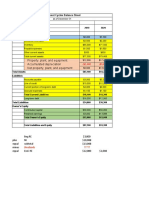

Additional Capital — PT Pratama Tbk Corporation on March 10

Excess of fair value over par value of each share: $40 - $20 = $20

Additional paid-in capital from stocks issuance $20,000,000

[1,000,000 shares x $20]

Less: cost of registering and issuing, printing and delivering the shares $270,000

[$200,000 + $50,000 + $20,000]

Additional paid-in capital that should be recorded $19,730,000

P1-2

Preliminary computations

Additional paid-in capital from additional stock issuance [200,000 shares x $2,000,000

$10]

Common stock, $10 par from additional stock issuance $8,000,000

[$10,000,000 - $2,000,000]

Purchase price: Cost of investment in Carlos SA $10,000,000

Less: Fair value of Carlos SA at December 31 $9,000,000

[$1,000,000 + $12,000,000 +$13,000,000 - $4,000,000

- $13,000,000]

Excess of purchase price over fair value (goodwill) $1,000,000

Jose SA

Balance Sheet

At December 31 (After the Business Combination)

Assets

Current assets

Cash [$2,000,000 + $1,000,000] $3,000,000

Other current assets [$13,000,000 + $12,000,000] $25,000,000

Plant assets [$15,000,000 + $13,000,000] $28,000,000

Goodwill $ 1,000,000

Total assets $57,000,000

Liabilities and Stockholders’ Equity

Liabilities

Current liabilities [$5,000,000 + $4,000,000] $ 9,000,000

Other liabilities [$12,000,000 + $13,000,000] $25,000,000

Stockholders’ equity

Additional paid-in capital $2,000,000

Common stock, $10 par ($10,000,000 +$8,000,000) $18,000,000

Retained earnings $3,000,000

Total liabilities and stockholders’ equity $57,000,000

You might also like

- CH 01 SMDocument13 pagesCH 01 SMSpaet HendraNo ratings yet

- B. Woods Chapter 1Document16 pagesB. Woods Chapter 1Dareen AyeshaNo ratings yet

- Business Combinations: Answers To Questions 1Document13 pagesBusiness Combinations: Answers To Questions 1BriandLukeNo ratings yet

- Solution - Chapter 1Document8 pagesSolution - Chapter 1Nezo Qawasmeh75% (4)

- AKL1 TugasDocument2 pagesAKL1 TugasFarrell DmNo ratings yet

- Advance Accounting Beams 10th eDocument15 pagesAdvance Accounting Beams 10th eHecel OlitaNo ratings yet

- Ch02 Tool KitDocument16 pagesCh02 Tool KitAdamNo ratings yet

- Solution Manual Advanced Accounting Beams 11e Chp1 PDFDocument14 pagesSolution Manual Advanced Accounting Beams 11e Chp1 PDFArifta Nur Rahmat100% (21)

- Ch01 Beams12ge SMDocument11 pagesCh01 Beams12ge SMWira MokiNo ratings yet

- Chapter 5Document17 pagesChapter 5Belay MekonenNo ratings yet

- Business Combinations: Answers To Questions 1Document12 pagesBusiness Combinations: Answers To Questions 1Sin TungNo ratings yet

- ECU Topic 4Document8 pagesECU Topic 4Pinky RoseNo ratings yet

- Ch02 Tool Kit 2016-03-31Document19 pagesCh02 Tool Kit 2016-03-31LordTanjNo ratings yet

- Mid Term Review v.1 - 1582027809Document28 pagesMid Term Review v.1 - 1582027809Amanda Pasti Santos MandaNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1Rury NoeripahNo ratings yet

- Answers To Exercises Fs AnalysisDocument8 pagesAnswers To Exercises Fs AnalysisGrace RoqueNo ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (40)

- Beams9esm Ch01Document13 pagesBeams9esm Ch01zandra SumbarNo ratings yet

- How To Read Financial Statement PDFDocument31 pagesHow To Read Financial Statement PDFMazen AlbsharaNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Analyzing Balance SheetDocument29 pagesAnalyzing Balance Sheetpark_site_atNo ratings yet

- Exercise 1-3: (Assets - Liabilities Shareholders' Equity)Document9 pagesExercise 1-3: (Assets - Liabilities Shareholders' Equity)Syed RaashidNo ratings yet

- FINMA - Tools of Financial Analysis and ControlDocument15 pagesFINMA - Tools of Financial Analysis and ControlChloekurtj DelNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument25 pagesCorporate Finance Canadian 7th Edition Ross Solutions ManualToniSmithmozr100% (62)

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Module 3 - Understanding Financial Statements PDFDocument25 pagesModule 3 - Understanding Financial Statements PDFemmanvillafuerteNo ratings yet

- Solution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysDocument6 pagesSolution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysKyla Ramos DiamsayNo ratings yet

- Consolidation HandoutDocument29 pagesConsolidation HandoutMulugeta NiguseNo ratings yet

- Chapter 3 Problems - FinmgtDocument11 pagesChapter 3 Problems - FinmgtLaisa Vinia TaypenNo ratings yet

- Business Combinations: Answers To Questions 1Document14 pagesBusiness Combinations: Answers To Questions 1MUFC SupporterNo ratings yet

- CH1&2 Homework AnswersDocument5 pagesCH1&2 Homework AnswersGabriel Aaron DionneNo ratings yet

- Solutions Unit 2,8,9,10,11,16,19Document58 pagesSolutions Unit 2,8,9,10,11,16,19Thảo TrangNo ratings yet

- Full Download Corporate Finance Canadian 7th Edition Ross Solutions ManualDocument35 pagesFull Download Corporate Finance Canadian 7th Edition Ross Solutions Manualkisslingcicelypro100% (34)

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Tugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 1 - Alya Sufi Ikrima - 041911333248Alya Sufi Ikrima0% (1)

- Accounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1Document15 pagesAccounting Statements, Taxes, and Cash Flow: Answers To Concepts Review and Critical Thinking Questions 1RabinNo ratings yet

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeDocument14 pagesSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- B326 MTA Fall 2013-2014Document2 pagesB326 MTA Fall 2013-2014Ahlam AbbaqNo ratings yet

- Sample Computation of Capital Gains Tax On Sale of Real PropertyDocument9 pagesSample Computation of Capital Gains Tax On Sale of Real PropertyNardsdel RiveraNo ratings yet

- ACT 1600 Fundamental of Financial Accounting The Basic Accounting EquationDocument34 pagesACT 1600 Fundamental of Financial Accounting The Basic Accounting EquationAbu AhmedNo ratings yet

- SemissDocument3 pagesSemissSam VNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Group Assignment: Financial AccountingDocument4 pagesGroup Assignment: Financial AccountingNguyen HuongNo ratings yet

- Solution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575Document36 pagesSolution Manual For Corporate Finance Canadian 7th Edition by Ross Westerfield Jaffe Robertsl ISBN 0071339574 9780071339575stephanievargasogimkdbxwn100% (20)

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- IPWEA Asset - Management - Plan - 2014Document284 pagesIPWEA Asset - Management - Plan - 2014KhairahMukhlisahHertantoNo ratings yet

- ReceivablesDocument31 pagesReceivablesKate MercadoNo ratings yet

- Accounting (2) Chapter (2) : LevelDocument9 pagesAccounting (2) Chapter (2) : LevelMohamed DiabNo ratings yet

- CH 13 TBDocument52 pagesCH 13 TBHasanNo ratings yet

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- DCUMENTSDocument4 pagesDCUMENTSStephanie CruzNo ratings yet

- Full Disclosure in Financial Reporting: NtroductionDocument6 pagesFull Disclosure in Financial Reporting: NtroductionKim EllaNo ratings yet

- en1592472208-TRAINING ADVERT - JULY 2020Document2 pagesen1592472208-TRAINING ADVERT - JULY 2020AmaniNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- Job Description - Staff AccountantDocument1 pageJob Description - Staff AccountantFlordeliza SalvadorNo ratings yet

- Unit 9: Indian Accounting Standards: Learning OutcomesDocument13 pagesUnit 9: Indian Accounting Standards: Learning OutcomesSukhmeet SinghNo ratings yet

- Entrepreneur Chapter 18Document6 pagesEntrepreneur Chapter 18CaladhielNo ratings yet

- Take Home Examination Bdfa1103Document7 pagesTake Home Examination Bdfa1103zul arifNo ratings yet

- PJI 003653 Hayco Dominican Republic IPC Relocations PO 4500195119 PDFDocument1 pagePJI 003653 Hayco Dominican Republic IPC Relocations PO 4500195119 PDFSteven LeeNo ratings yet

- Tally Erp 9-1Document14 pagesTally Erp 9-1Pallavi GuptaNo ratings yet

- Time Table of MBADocument42 pagesTime Table of MBALatha JujariNo ratings yet

- Chemtrol Docs Invoice 009 HSS-InR (PO-B1F170110, B1F170164) - MinDocument27 pagesChemtrol Docs Invoice 009 HSS-InR (PO-B1F170110, B1F170164) - MinRaj N Eesh VatsNo ratings yet

- CA Final Audit Q MTP 1 May 2024 Castudynotes ComDocument16 pagesCA Final Audit Q MTP 1 May 2024 Castudynotes Comsonytvhome112233No ratings yet

- In BusinessDocument6 pagesIn BusinessPhoebe LlameloNo ratings yet

- Accounting Problems 2234Document3 pagesAccounting Problems 2234Camille G.No ratings yet

- 15 Business CombinationDocument6 pages15 Business CombinationTinNo ratings yet

- FiverDocument2 pagesFiverHazem ElseifyNo ratings yet

- Receivables: Class Discussion QuestionsDocument46 pagesReceivables: Class Discussion QuestionsYudhiCopoeSiregarNo ratings yet

- Group 2: Dakshayani Biscuits (: Cost Sheet)Document6 pagesGroup 2: Dakshayani Biscuits (: Cost Sheet)Vinu DNo ratings yet

- Tire CityDocument5 pagesTire CitySudip BrahmacharyNo ratings yet

- Accounting Literature ReviewDocument5 pagesAccounting Literature Reviewapi-559224122No ratings yet

- Education CatalogDocument76 pagesEducation Catalogvenkat7tallyNo ratings yet

- Comparative Study On FifoDocument5 pagesComparative Study On FifoAziz Bin AnwarNo ratings yet

- Call For INSETA Bursary ApplicationsDocument2 pagesCall For INSETA Bursary ApplicationsayandahNo ratings yet

- Punong Bayan and Araullo Firm PresentationDocument12 pagesPunong Bayan and Araullo Firm PresentationBianca Jane MaaliwNo ratings yet