Professional Documents

Culture Documents

Chapter 6 Emplooyee Benefit Part 2

Uploaded by

maria isabella0 ratings0% found this document useful (0 votes)

577 views8 pagesMillan 2020

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMillan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

577 views8 pagesChapter 6 Emplooyee Benefit Part 2

Uploaded by

maria isabellaMillan 2020

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

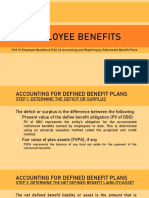

Chapter 6 Employee Benefits (Part 2)

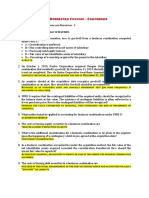

Accounting for defined benefit plan

The employer’s obligation under a defined benefit plan is to provide the agreed

benefits. Therefore, the employer bears the risk that the promised benefits will cost

more than expected if actuarial or investment experience is worse than expected. In

such case, the related obligation may need to be increased.

Consequently, the accounting for defined benefits plans is complex because

actuarial assumptions are necessary to measure the obligation on a discounted basis,

This results to actuarial gains or losses. Also, the retirement benefit cost is not

necessarily equal to contribution due for the period.

The accounting for defined benefit plan involves the following steps:

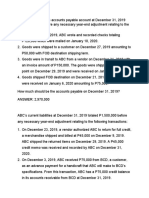

Step #1: Determine the deficit or surplus

The deficit or surplus is the difference between the following:

a. Present value of the defined benefit obligation (PV of DBO)

b. Fair value of plan assets (FVPA), if any

PV of DBO represents the entity's obligation for the accumulated retirement

benefits earned by employees to date. This is determined using an actuarial

valuation method called the projected unit credit method.

FVPA represents the balance of any fund set aside for payment of the

retirement benefits.

-If FVPA is less than PV of DBO, the difference is a deficit.

-If FVPA is greater than PV of DBO, the difference is a surplus.

Step #2: Determine the Net defined benefit liability/asset

The net defined benefit liability or asset is the amount that presented in the

statement of financial position.

-If there is a deficit, the deficit is a net defined benefit liability.

-If there is a surplus, the net defined benefit asset is the lower the:

a. surplus, and

b. asset ceiling

The asset ceiling is "the present value of any economic benefits available in the

form of refunds from the plan or reductions in future contributions to the plan." (PAS

19.8)

Step #3: Determine the Defined Benefit Cost

The defined benefit cost is determined using the formula below:

Service cost: (recognized in P/L)

(a) Current service cost xxx

(b) Past service cost xxx

(c) Any (gain) or loss on settlement xxx xxx

Net interest on the net defined benefit liability (asset): (recognized in P/L):

(a) Interest cost on the defined benefit obligation xxx

(b) Interest income on plan assets xxx

(c) Interest on the effect of the asset ceiling xxx xxx

Remeasurements of the net defined benefit liability (asset); (recognized in OCI)

(a) Actuarial (gains) and losses xxx

(b) Difference between interest income on plan assets and

return on plan assets xxx

(c) Difference between the interest on the effect of the asset

ceding and change in the effect of the asset ceiling xxx xxx

Total Defined Benefit Cost: xxx

Service cost:

Current service cost

a. Current service cost — is the increase in the PV of DBO resulting from employee

service in the current period. (PAS 198)

An employee's retirement benefit increases as he/she renders service. For

example, an employee who has rendered 20 years of service would have higher

retirement benefits than an employee who has rendered only 10 years of service,

assuming they have similar position and salary levels. Current service cost represents

the increase in the employee's retirement benefit because of the services he/she has

rendered during the current year.

Past service cost

b. Past service cost — is the change in the PV of DBO for employee service in prior

periods resulting from a plan amendment or curtailment.

Past service cost (whether vested or unvested) is recognized immediately as

expense (a) when the plan amendment or curtailment occurs; or (b) when the entity

recognizes related restructuring costs or termination benefits; whichever comes earlier.

Unvested past service costs are not deferred and amortized.

A plan amendment occurs when an entity:

a. Introduces or withdraws a defined benefit plan, or

b. Changes the benefits payable under an existing defined benefit plan

A curtailment occurs when an entity significantly reduces the number of

employees covered by a plan. A curtailment may arise from an isolated event,

such as the closing of a plant, discontinuance of an operation or termination or

suspension of a plan.

Past service cost can be positive (when PV of DBO increases) or negative (when

PV of DBO decreases).

Gain or loss on settlement

c. Gain or loss on settlement — arises when the employer' s obligation to provide

benefits is eliminated other than from payment of benefits according to the terms of

the plan.

The gain or loss on a settlement is the difference between:

a. the present value of the defined benefit obligation being as determined on the date of

settlement; and

b. the settlement price, including any plan assets transferred and any payments made

directly by the entity in connection with the settlement. The gain or loss is recognized

when the settlement occurs.

Net interest on the net defined benefit liability (asset):

Net interest on the net defined benefit liability (asset) — is the change in the

net defined benefit liability (asset) during the period that arises from the passage of

time. It comprises the three items listed in the formula above.

The same discount rate is used for the three items. This discount rate is based

on high quality corporate bonds or in the absence thereof, on government bonds,

determined at the start of the annual reporting period.

Remeasurements of the net defined benefit liability (asset):

Actuarial gains and losses

a. Actuarial gains and losses — are changes in the PV of DBO resulting from

changes in actuarial assumptions.

Actuarial assumptions are estimates of variables used in determining the ultimate

cost of providing post-employment benefits. These include demographic assumptions

(e.g., employee turnover rate, mortality or lifespan and health condition) and financial

assumptions (i.e., discount rate, future salary levels, and future medical costs).

Demographic assumptions -Pertain to the employee.

Financial assumptions -Pertain to money matters, such as costs and market rates.

The discount rate used in measuring defined benefit obligations and costs is

based on high quality corporate bonds.

PAS 19 encourages, but does not require, involving a qualified actuary in

measuring defined benefit obligations,

In practice, actuarial valuations are usually obtained every 3 years.

Return on plan assets

b. Return on plan assets — represents the investment income earned by the plan

assets during the year after deducting the costs of managing the fund and taxes.

Remember the following: Accounting for defined benefit plan

1. Determine the deficit or surplus: FVPA of DBO- deficit; FVPA> PV of DBO =

Surplus

2. Determine the Net defined benefit liability/asset: A deficit represents a net

defined benefit liability. The lower between a surplus and the 'asset ceiling'

represents a net defined benefit asset.

3. Determine the defined benefit cost. Defined benefit cost Service cost + Net

interest + Remeasurements

Notes:

-The PV of DBO has a normal credit balance (obligations have normal credit balance).

Thus, the beginning balance is placed on the credit side. The ending balance is placed

on the opposite side to facilitate squeezing,

-Current service cost and interest cost are placed on the credit side because these

items increase the obligation.

-Benefits paid are placed on the debit side because this item decreases the obligation.

-The PV of DBO is also affected by adjustments resulting from plan amendment,

curtailment or settlement.

Fair value of plan assets T-account

Fair value — is "the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at the

measurement date." (PFRS 13. Appdx. A)

Plan assets comprise:

a. Assets held by a long-term employee benefit fund; and

b. Qualifying insurance policies.

Assets held by a long-term employee benefit fund are assets held by an

entity (a fund) that is legally separate from the employer.

A qualifying insurance policy is an insurance policy issued by an insurer that is

not related to the employer.

Both the assets held by a long-term employee benefit fund and the proceeds

from a qualifying insurance policy are intended solely for paying employee benefits, are

not available to the employer's creditors even in bankruptcy, and cannot be returned to

the employer except when the amount returned represents surplus assets that are not

needed in settling employee benefit obligations or a reimbursement to the employer for

employee benefits already paid.

Plan assets exclude unpaid contributions due from the employer, as well as any

non-transferable financial instruments issued by the employer and held by the fund.

Plan assets are reduced by any liabilities of the fund that do not relate employee

benefits.

Notes:

-The FVPA has a normal debit balance (assets have normal debit balance). Thus, the

beginning balance is placed on the debit side; the ending balance on the opposite side

to facilitate squeezing.

-Return on plan assets and Contributions to the fund are placed on the debit side

because these items increase the plan assets.

-Benefits paid are placed on the credit side because this item decreases the plan

assets.

Determining the ultimate cost of a defined benefit

The ultimate cost of a defined benefit plan may be influenced by many variables,

such as final salaries, employee turnover and mortality, employee contributions and

medical cost trends. The ultimate cost of the plan is uncertain and this uncertainty is

likely to persist over a long period of time. In order to measure the present value of the

post-employment benefit obligations and the related current service cost, it is

necessary:

a. to apply an actuarial valuation method;

b. to attribute benefit to periods of service; and

c. to make actuarial assumptions.

Actuarial valuation method — Projected Unit Credit Method

The Projected unit Credit Method "(sometimes known as the accrued benefit method

pro-rated on service or as the benefit/years of service method) sees each period of

service as giving rise to an additional unit of benefit entitlement and measures each unit

separately to build up the final obligation." (PAS 19.67)

Under the projected unit credit method, retirement benefit obligations are

measured based on future salary levels of employees (projected salaries). Assumptions

are made to estimate the salary level of employees on their expected retirement date.

Attributing benefit to periods of service

Benefits are attributed to the periods of service using the plan formula.

However, if benefits are materially higher for services rendered in later years

than in earlier years, the benefits are attributed on a straight-line basis from the date the

employee's entitlement to benefits starts to accrue until the date where future services

will no longer lead to material amount of benefits.

Benefits are attributed to the current period in order to determine the current

service cost, and current and prior periods in order to determine the PV of DBO.

PAS 19 requires that interest income on plan assets shall be determined based

on the beginning balance of the FVPA, taking account of any changes in the plan assets

held during the period as a result of contributions and benefit payments.

Reimbursements

When it is virtually certain that another party will reimburse some or all of the

expenditure required to settle a defined benefit obligation, an entity recognizes its right

to reimbursement as a separate asset, measured at fair value. That asset is treated in

the same way as plan assets. Any gain or loss on the changes in the carrying amount of

the reimbursement asset is recognized as an addition to (or deduction from) the defined

benefit cost.

Overfunding I Underfunding

The retirement plan is said to be overfunded if there is net defined benefit asset

and underfunded if there is net defined benefit liability. If the fair value of the plan assets

is equal to or greater than the present value of the defined benefit obligation, the

retirement plan is said to be fully funded.

Offsetting

An asset relating to one plan is offset against a liability relating to another plan only

when the entity has both:

a. A legally enforceable right to use a surplus in one plan to settle obligations under

the other plan; and

b. An intention to either settle the obligations on a net basis, or to realize the surplus in

one plan and settle its obligation under the other plan simultaneously.

Other long-term employee benefits

Other long-term employee benefits are employee benefits (other than post-

employment benefits and termination benefits) that are due to be settled beyond 12

months after the end of the period in which the employees have rendered the related

service. Examples:

a. Long-term compensated absences, e.g., sabbatical leave

b. Jubilee or other long-service benefits

c. Long-term disability benefits

d. Profit-sharing, bonuses, and deferred compensation payable beyond 12 months after

the end of the period in which the benefits were earned

Other long-term employee benefits are accounted for similar to defined benefit

plans except that all the components of the defined benefit cost are recognized in profit

or loss, including the remeasurements of the net defined benefit liability/asset.

Termination benefits

Termination benefits are those provided as a result of either

a. the entity's decision to terminate the employee before normal retirement date; or

b. the employee's decision to accept the employees offer of benefits in exchange for

termination.

Unlike the other types of employee benefits, the to pay termination benefits

arises from the employer's act of terminating an employee rather than from employee

service.

Accordingly, benefits resulting from termination at the employee's request without

the employer's offer are not termination benefits but rather post-employment benefits.

Recognition

Termination benefits are recognized as a liability and expense at the earlier of the

following dates:

a. When the entity can no longer withdraw the offer of those benefits; and

b. When the entity recognizes restructuring costs under PAS 37 that involve payment of

termination benefits. (PAS 19.65)

Measurement

Termination benefits are accounted for according to their nature.

Termination benefits that are:

a. payable within 12 months are accounted as short-term benefits.

b. payable beyond 12 months are accounted for as other long-term benefits.

c. enhancement to post-employment benefits are accounted for as post-employment

benefits.

Chapter 6: Summary

Accounting for defined benefit plan

I. Determine the deficit or surplus: (FVPA < PV of DBO (FVPA > PV of OBO = surplus

2. Determine the Net defined benefit liability/asset: (Deficit net defined benefit liability);

(Lower of surplus and 'asset ceiling' = net defined benefit asset)

3. Determine the benefit cost

You might also like

- Chapter 7 Leases Part 1Document16 pagesChapter 7 Leases Part 1maria isabellaNo ratings yet

- Chapter 1 IADocument43 pagesChapter 1 IAEloisaNo ratings yet

- MT Quiz 1 MasterDocument2 pagesMT Quiz 1 MasterChristine Dela Rosa CarolinoNo ratings yet

- Quiz - Provisions Cont. Liab. Cont. AssetsDocument3 pagesQuiz - Provisions Cont. Liab. Cont. AssetsJhanelle Marquez60% (5)

- tenSAI pension notesDocument4 pagestenSAI pension noteslooter198No ratings yet

- Bonds Payable ConceptsDocument20 pagesBonds Payable ConceptsThalia Rhine AberteNo ratings yet

- Chapter 8 Leases Part 2Document14 pagesChapter 8 Leases Part 2maria isabellaNo ratings yet

- Quiz 4Document4 pagesQuiz 4cece ceceNo ratings yet

- Learning MaterialsDocument38 pagesLearning MaterialsBrithney ButalidNo ratings yet

- Module 1 Relevant CostingDocument6 pagesModule 1 Relevant CostingJohn Rey Bantay RodriguezNo ratings yet

- Shareholders' Equity ProblemsDocument5 pagesShareholders' Equity Problemsjooo0% (1)

- Chapter 4 Non Current Assets Held For Sale Discontinued Operations - PPTX RepairedDocument21 pagesChapter 4 Non Current Assets Held For Sale Discontinued Operations - PPTX Repaireddianne ballonNo ratings yet

- Chapter 6Document5 pagesChapter 6Angelita Dela cruzNo ratings yet

- Liabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive ObligationDocument40 pagesLiabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive Obligationmaria isabellaNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument10 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- IFRIC 2 Shares in Cooperative EntitiesDocument12 pagesIFRIC 2 Shares in Cooperative EntitiesTopy DajayNo ratings yet

- Financial Assets Guide - Cash, Receivables, Investments & DerivativesDocument5 pagesFinancial Assets Guide - Cash, Receivables, Investments & DerivativesYami HeatherNo ratings yet

- AIR - CorporateDocument5 pagesAIR - CorporateRaz JisrylNo ratings yet

- Accounting CycleDocument21 pagesAccounting CycleJc GappiNo ratings yet

- Employee Benefits Chapter SummaryDocument29 pagesEmployee Benefits Chapter SummaryDudz MatienzoNo ratings yet

- LeasesDocument3 pagesLeasesBrian Christian VillaluzNo ratings yet

- Chap 12 Lessee Accounting Fin Acct 2Document9 pagesChap 12 Lessee Accounting Fin Acct 2Abigail TumabaoNo ratings yet

- Which Statement Is Incorrect Regarding Identification of AssociatesDocument1 pageWhich Statement Is Incorrect Regarding Identification of AssociatesJAHNHANNALEI MARTICIONo ratings yet

- ACCOUNTING 3B HomeworkDocument11 pagesACCOUNTING 3B HomeworkRheu Reyes75% (4)

- Employee benefits accounting standardsDocument3 pagesEmployee benefits accounting standardsJAY AUBREY PINEDANo ratings yet

- Module 11 - Employee BenefitsDocument8 pagesModule 11 - Employee BenefitsLuiNo ratings yet

- Liab, SHE, CashvsAccrual, BV & EPSDocument5 pagesLiab, SHE, CashvsAccrual, BV & EPSMimiNo ratings yet

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IINo ratings yet

- Chapter 8 - Deductions From Gross IncomeDocument36 pagesChapter 8 - Deductions From Gross IncomejohnNo ratings yet

- Quiz Chapter+3 Bonds+PayableDocument3 pagesQuiz Chapter+3 Bonds+PayableRena Jocelle NalzaroNo ratings yet

- Assignment 01 Bonds PayableDocument6 pagesAssignment 01 Bonds PayableMinie KimNo ratings yet

- Cash Management EssentialsDocument6 pagesCash Management EssentialsNiña Rhocel YangcoNo ratings yet

- Types of LiabilitiesDocument11 pagesTypes of LiabilitiesJayson Manalo GañaNo ratings yet

- Accountancy Refresher Course on Quantitative TechniquesDocument4 pagesAccountancy Refresher Course on Quantitative Techniquesshamel marohom100% (2)

- Book Value Per Share Basic Earnings PerDocument61 pagesBook Value Per Share Basic Earnings Perayagomez100% (1)

- CORPORATIONDocument14 pagesCORPORATIONcpacpacpaNo ratings yet

- A. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectDocument5 pagesA. Declaration, Record, Payment: The Correct Answer Is "A". Your Choice of "B" Was IncorrectJere Mae MarananNo ratings yet

- CH 12 Operating Lease - LessorDocument2 pagesCH 12 Operating Lease - LessorGenebabe LoquiasNo ratings yet

- Employee Benefits Part 2: Name: Date: Professor: Section: Score: Quiz 1Document4 pagesEmployee Benefits Part 2: Name: Date: Professor: Section: Score: Quiz 1Jamie Rose Aragones0% (1)

- Accounting InformationDocument3 pagesAccounting Informationnenette cruzNo ratings yet

- Borrowing Cost Capitalization RulesDocument2 pagesBorrowing Cost Capitalization RulesAlexander Dimalipos100% (1)

- 1231231231231231Document11 pages1231231231231231JV De VeraNo ratings yet

- Leases (PART I)Document28 pagesLeases (PART I)Carl Adrian Valdez100% (1)

- Chapter 16-Financial Statement Analysis: Multiple ChoiceDocument19 pagesChapter 16-Financial Statement Analysis: Multiple ChoiceRodNo ratings yet

- Chapter 24 - Notes PayableDocument10 pagesChapter 24 - Notes PayableJay Cee GuecoNo ratings yet

- Operating Lease Vs Finance LeaseDocument5 pagesOperating Lease Vs Finance LeasexjammerNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Leases Part 2: Name: Date: Professor: Section: Score: Quiz 1Document2 pagesLeases Part 2: Name: Date: Professor: Section: Score: Quiz 1Jamie Rose AragonesNo ratings yet

- Understanding IFRS 12 on Service Concession ArrangementsDocument7 pagesUnderstanding IFRS 12 on Service Concession ArrangementsPolinar Paul MarbenNo ratings yet

- #Test Bank - Adv Acctg 2 - PDocument43 pages#Test Bank - Adv Acctg 2 - PJames Louis BarcenasNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Post Employment BenefitsDocument31 pagesPost Employment BenefitsSky SoronoiNo ratings yet

- Topic 3.2 Employee BenefitsDocument15 pagesTopic 3.2 Employee BenefitsJayson KlineNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Module 1 - Employee BenefitsDocument38 pagesModule 1 - Employee BenefitsMitchie Faustino100% (1)

- FARAP-4413 (Post-Employment Benefits)Document5 pagesFARAP-4413 (Post-Employment Benefits)Dizon Ropalito P.No ratings yet

- Pas 19Document5 pagesPas 19elle friasNo ratings yet

- Employee Benefit PlanDocument8 pagesEmployee Benefit PlantinydmpNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- Ias 19Document9 pagesIas 19Hammad SarwarNo ratings yet

- Should Marcia start an ice cream businessDocument1 pageShould Marcia start an ice cream businessmaria isabellaNo ratings yet

- SalerioDocument28 pagesSalerioRizqaFebrilianyNo ratings yet

- My CV on Video: About Me and Job ExperienceDocument20 pagesMy CV on Video: About Me and Job Experiencemaria isabellaNo ratings yet

- University Digital Choice BoardsDocument8 pagesUniversity Digital Choice Boardsmaria isabellaNo ratings yet

- Orange MemphisDocument28 pagesOrange Memphismaria isabellaNo ratings yet

- Example Business Profit and Economic ProfitDocument2 pagesExample Business Profit and Economic Profitmaria isabellaNo ratings yet

- Should Marcia start an ice cream businessDocument1 pageShould Marcia start an ice cream businessmaria isabellaNo ratings yet

- Chalkboard Background by SlidesgoDocument51 pagesChalkboard Background by Slidesgopaulina cardenasNo ratings yet

- Abstract CV Yellow VariantDocument21 pagesAbstract CV Yellow Variantmaria isabellaNo ratings yet

- Goal 16Document1 pageGoal 16maria isabellaNo ratings yet

- Total Revenue - Explicit Cost: Business ProfitDocument1 pageTotal Revenue - Explicit Cost: Business Profitmaria isabellaNo ratings yet

- LinkDocument1 pageLinkmaria isabellaNo ratings yet

- Market Demand FunctionDocument49 pagesMarket Demand Functionmaria isabellaNo ratings yet

- Global T RadeDocument16 pagesGlobal T Rademaria isabellaNo ratings yet

- Top 10 Business Mergers and Acquisitions of All TimeDocument4 pagesTop 10 Business Mergers and Acquisitions of All Timemaria isabellaNo ratings yet

- Global 2Document14 pagesGlobal 2maria isabellaNo ratings yet

- IP Law Bar QsDocument14 pagesIP Law Bar QsIELTSNo ratings yet

- Chapter 16 Non Profit OrganizationDocument12 pagesChapter 16 Non Profit Organizationmaria isabellaNo ratings yet

- Audit of PPE Assets and DepreciationDocument10 pagesAudit of PPE Assets and DepreciationJarra AbdurahmanNo ratings yet

- Advance Accounting Book 1Document206 pagesAdvance Accounting Book 1genc22185% (13)

- Accounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsDocument24 pagesAccounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsArtisan82% (11)

- L - R I 11. at XMR Al Maintenance Gamma Were Detetioratir.g 7erairg Salami Rte R I R o P e R T y Was IrDocument1 pageL - R I 11. at XMR Al Maintenance Gamma Were Detetioratir.g 7erairg Salami Rte R I R o P e R T y Was Irmaria isabellaNo ratings yet

- Liabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive ObligationDocument40 pagesLiabilities: Legal Obligation Constructive Obligation A. Legal Obligation B. Constructive Obligationmaria isabellaNo ratings yet

- AFAR-01 (Partnership Formation & Operation)Document6 pagesAFAR-01 (Partnership Formation & Operation)Jezzie Santos100% (1)

- Chapter 14 Financial StatementsDocument12 pagesChapter 14 Financial Statementsmaria isabella100% (1)

- Chapter 15 Miscellaneous TopicsDocument8 pagesChapter 15 Miscellaneous Topicsmaria isabellaNo ratings yet

- Globalization Is A PhenomenonDocument2 pagesGlobalization Is A Phenomenonmaria isabellaNo ratings yet

- Chapter 12 LiabilitiesDocument4 pagesChapter 12 Liabilitiesmaria isabella0% (1)

- Chapter 12 LiabilitiesDocument4 pagesChapter 12 Liabilitiesmaria isabella0% (1)

- Chapter 13 LeaseDocument4 pagesChapter 13 Leasemaria isabella100% (2)

- Book Bhagavat Online - 2 PDFDocument406 pagesBook Bhagavat Online - 2 PDFShukla RoyNo ratings yet

- SME Finance and Hometown Investment Trust FundsDocument50 pagesSME Finance and Hometown Investment Trust FundsADBI EventsNo ratings yet

- Principles of Accounting IIDocument10 pagesPrinciples of Accounting IIEnusah AbdulaiNo ratings yet

- Intro to LCsDocument5 pagesIntro to LCsJara SadarNo ratings yet

- Laxmibai v. Anasuya Case AnalysisDocument15 pagesLaxmibai v. Anasuya Case AnalysisAnkit KumarNo ratings yet

- RishabhDocument38 pagesRishabhpooja rodeNo ratings yet

- Structuralism - AnthropologyDocument3 pagesStructuralism - Anthropologymehrin morshed100% (1)

- Airport Arrival and Hotel Check-In ConversationDocument4 pagesAirport Arrival and Hotel Check-In Conversationfeira fajar100% (1)

- Code of Ethics Caselet AnalysisDocument2 pagesCode of Ethics Caselet AnalysisBSA3Tagum MariletNo ratings yet

- Financial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )Document17 pagesFinancial Analysis of AUTOMOBILE COMPANIES (BMW & Daimler (Mercedes-Benz) )GUDDUNo ratings yet

- Effects of Result-Based Capability Building Program On The Research Competency, Quality and Productivity of Public High School TeachersDocument11 pagesEffects of Result-Based Capability Building Program On The Research Competency, Quality and Productivity of Public High School TeachersGlobal Research and Development ServicesNo ratings yet

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- A Statement of Commitment To The Profession of TeachingDocument2 pagesA Statement of Commitment To The Profession of TeachingMICHELLE ORGENo ratings yet

- Neptel Company ProfileDocument12 pagesNeptel Company Profileghe12No ratings yet

- PetrozuataDocument13 pagesPetrozuataMikhail TitkovNo ratings yet

- TCS Configuration PDFDocument20 pagesTCS Configuration PDFrishisap2No ratings yet

- Tentative Academic Calendar 2021-22 03 Sep 27 2021Document1 pageTentative Academic Calendar 2021-22 03 Sep 27 2021Ral RalteNo ratings yet

- Metaphysical Foundation of Sri Aurobindo's EpistemologyDocument25 pagesMetaphysical Foundation of Sri Aurobindo's EpistemologyParul ThackerNo ratings yet

- Torts FinalsDocument54 pagesTorts FinalsAlyza Montilla BurdeosNo ratings yet

- David Redman InterviewDocument2 pagesDavid Redman InterviewSue Fenton at F Words Journalism & CopywritingNo ratings yet

- Report On Sexual Abuse in The Catholic Church in FloridaDocument19 pagesReport On Sexual Abuse in The Catholic Church in FloridaABC Action NewsNo ratings yet

- Removal of Corporate PresidentDocument5 pagesRemoval of Corporate PresidentDennisSaycoNo ratings yet

- Supreme Court of the Philippines upholds constitutionality of Act No. 2886Document338 pagesSupreme Court of the Philippines upholds constitutionality of Act No. 2886OlenFuerteNo ratings yet

- Main Suggestions With MCQ Gaps AnswersDocument4 pagesMain Suggestions With MCQ Gaps Answersapi-275444989No ratings yet

- Global Business Strategy ChallengesDocument11 pagesGlobal Business Strategy ChallengesDAVIDNo ratings yet

- Public auction property saleDocument1 pagePublic auction property salechek86351No ratings yet

- Shapers Dragons and Nightmare An OWbN Guide To Clan Tzimisce 2015Document36 pagesShapers Dragons and Nightmare An OWbN Guide To Clan Tzimisce 2015EndelVinicius AlvarezTrindadeNo ratings yet

- Mendoza V CADocument2 pagesMendoza V CAranNo ratings yet

- Roblox Creator HubDocument1 pageRoblox Creator Hubp2mrhhskwbNo ratings yet

- BSU Legal Writing Class 2019 - AssignmentsDocument1 pageBSU Legal Writing Class 2019 - AssignmentsDianne Hershey San AntonioNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Minimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingFrom EverandMinimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingNo ratings yet

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)