Professional Documents

Culture Documents

SIMPLE GUIDE FOR QUARTERLY INCOME TAX RETURN-3RD QTR 2020

Uploaded by

Francis NicorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SIMPLE GUIDE FOR QUARTERLY INCOME TAX RETURN-3RD QTR 2020

Uploaded by

Francis NicorCopyright:

Available Formats

SIMPLE GUIDE FOR QUARTERLY INCOME TAX

RETURN (1701Q updated as 1701Qv2018 ) FILING

- 3rd QTR ITR 2020

- TO EXISTING MOA STAFF as of 3rd QTR 2020 WITH

MONTHLY INCOME OF MORE THAN PHP20,500.00

- Deadline on November 15, 2020

1. Go to BIR website www.bir.gov.ph (HOME PAGE)

2. Download updated or use your existing Offline eBIRForms

Program version 7.6

(Those who can’t download have program-computer incompatibility. Use a

different PC or laptop if necessary)

3. Before you start, please get your Annual ITR 2019

(1701A/1701) filed last April/May or June 2020

-only for those with refund for 2019 and selected “to be carried over to next

year/qtr”, if no refund carried-over, disregard 2019 ITR for this filing

4. Open the BIR program version 7.6

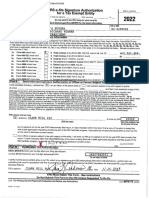

BIR PROGRAM

ICON

(print screen of program once opened)

5. Fill out the following:

a. TIN NO.

b. RDO - ex. 074 (for Iloilo only)

c. Line of Business – Professional/Other Supplier-Job Hire (to avoid

confusion; to be specifically identified by BIR that staff is a Job Hire)

d. Full Name - strictly follow FORMAT (Last Name, First Name, Middle

Name)- don’t forget the COMMA

e. Registered Address

f. Zip Code

g. Contact No. ( Tel No./CP no) –should be valid

h. Email Address (should be valid and existing)

6. Select BIR Form 1701Qv2018 (Quarterly ITR) in the List of

BIR Forms then click the Fill-up button

7. Confirm TIN and email address (should be valid and existing)

8. Click Fill-up button again to open the form

9. Fill-up needed details from PART 1 no 1 to 16 (Other nos. are

already filled-up by the system

10. For Item no. 2, select Quarter: 1st, 2nd or 3rd (depending on

which quarter you will file)

1st Qtr – Jan-March 2020

2nd Qtr - April-June 2020

3rd Qtr- July-September 2020 (deadline November 15, 2020)

11.For Item no. 7, Single Proprietor or Professional (depending on

your BIR registration/Certificate of registration)

12.For Item no. 8, Select

a. II017 Income from Profession – 8% IT Rate OR

b. II015 Business Income-8% IT Rate (if you’ve selected

single proprietor on item no. 7)

13.For Item no. 11, type your date of birth

14.For Item no. 13, type your citizenship

15.For Item no. 16, select 8% on gross sales/receipts & other

non-operating income (tax-applicable once income exceed

P250K only)

16.Click Save and proceed to page 2

17. In Item no. 47, 47A type total income for the 3rd quarter

(income received from July-Sept 2020) – base amount on MOA

Income Monitoring attached to my email (round-off to

nearest peso)

18.In Item no. 50, type total income from 1st and 2nd Qtr 2020

(round-off to nearest peso)

19. In Item no. 51, check if amount is equivalent to your total

income from January-Sept (1st-3rd Qtr) 2020

20.In Item no. 52, type P250,000.00 allowable deduction

21. In no 54, there will be an automatic tax due amount

22. In no. 55, for those with tax refund carried-over from 2019

Annual ITR (1701A/1701), indicate here the total tax credit.

2019

Refund

Amount

REFUND-

marked to be

carried over to

next year/qtr

23. In Item no. 56, Indicate Cash Payment/s made through

bank/online from previous quarterly ITR 2020 filing (1st and 2nd).

If none, leave blank.

24.In Item no. 57, indicate tax withheld from 1st and 2nd Qtr 2020

(base amount on MOA Income Monitoring attached to my

email) -round-off to nearest peso

25.In Item no. 58, indicate tax withheld from 3rd Qtr 2020; if

there’s no tax withheld, skip it

26. Amounts are provided in the MOA Income Monitoring file

attached to my email

27.Click save

28.Go Back to Page 1

29.If in no. 31 the amount is positive, there is tax payable; if

negative amount, it’s tax over withheld*.

*Negative tax payable amount maybe due to tax withheld from mixed income

earners (with moa and contractual status within the same year). Taxable

amount of mixed income earners are relatively higher than purely MOA/COS

staff depending on the period they became mixed income earners.

30.Click Save

31. Click Validate

32. Make sure that there’s internet connection before

submission

33.If ITR is final, Click SUBMIT/FINAL COPY

34.Wait for BIR email confirmation (It may take a number of hours

or days)

35.Print 3rd Quarter ITR 2020 in 3 copies and sign the form

(sign below Item No. 31)

36.Print BIR email confirmation in 3 copies

37.No need to submit Quarterly ITR hard copies to BIR if tax

amount is “zero or negative”. Just keep your copies. This will

be your proof for Quarterly ITR online filing.

38. If with tax payable, pay at the BIR authorized agent banks (e.g.

LBP, Metrobank near your BIR RDO) or pay online. Always

secure proof of payment. Always secure a copy of your ITR/s.

Notes:

To return to main menu, click File Toolbar at the upper left corner and select main screen

You can only open your saved files on the PC/Laptop/Program you’ve encoded it

To open the saved file after closing the program,

a. Click the program and encode TIN and RDO No.

b. Those with saved info automatically reflect the profile of the taxpayer

c. Then select the BIR Form 1701Qv2018 in the LIST of BIR FORMS

d. The file you saved will then be reflected at the lower portion of the main screen

e. Select the file by clicking the circle before the file name and click view

To copy Saved File

1. Go to Drive “C:” or locate folder where you save your eBIRFORMS program

2. Open eBIRFORMS folder

3. Open “savefile” folder

4. Locate “.xml” file (full file name depends on your TIN and type of form saved)

5. Copy file

You might also like

- The Leverage EquationDocument17 pagesThe Leverage EquationJosh Kiefer100% (1)

- ITR AssignmentDocument8 pagesITR AssignmentEkta VermaNo ratings yet

- 1700 Job AidDocument12 pages1700 Job AidAljohn Stephen Dela cruzNo ratings yet

- BIR FORM 1701Q QUARTERLY TAX RETURNDocument9 pagesBIR FORM 1701Q QUARTERLY TAX RETURNAce MarjorieNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- Step 1: Bir Form 2551QDocument7 pagesStep 1: Bir Form 2551QAce MarjorieNo ratings yet

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Document6 pagesGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- Manual Book 1770 PDFDocument46 pagesManual Book 1770 PDFHafiedz SNo ratings yet

- 16thFeb2019EIA Skill DetailsDocument19 pages16thFeb2019EIA Skill Detailssubitha samyNo ratings yet

- Guidelines TaxRelatedDeclarations2022 23 ENCOREDocument24 pagesGuidelines TaxRelatedDeclarations2022 23 ENCOREwishliyaNo ratings yet

- Manual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitDocument29 pagesManual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitshaouluNo ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- Goods and Services Tax Refund Tutorial PDFDocument27 pagesGoods and Services Tax Refund Tutorial PDFMOHANNo ratings yet

- How to File Asset Declaration OnlineDocument15 pagesHow to File Asset Declaration OnlineTechytoo oNo ratings yet

- E-Filing of Vat ReturnDocument43 pagesE-Filing of Vat Returnanoop kumarNo ratings yet

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- Form 46G: Return of Third Party Information For The Year 2010Document4 pagesForm 46G: Return of Third Party Information For The Year 2010billyhorganNo ratings yet

- Tax Declaration GuidelinesDocument6 pagesTax Declaration GuidelinesThamilvallluvan BalakrishnanNo ratings yet

- Form 16 Details for Offshore EmployeesDocument11 pagesForm 16 Details for Offshore EmployeesrajeshmsitNo ratings yet

- BIR Clarification On 8%Document10 pagesBIR Clarification On 8%FABURRITO FOOD GROUP INCNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesDocument2 pagesGuidelines and Instructions For BIR Form No. 2200-S Excise Tax Return For Sweetened BeveragesKarlNo ratings yet

- BIR Job - Aid - How - To - Fill - Up - 1701 - v2013 PDFDocument35 pagesBIR Job - Aid - How - To - Fill - Up - 1701 - v2013 PDFRoselyn LichangcoNo ratings yet

- How To Fill-Up ITR Using EBIRForm - 2022 - v1Document10 pagesHow To Fill-Up ITR Using EBIRForm - 2022 - v1Michael PantonillaNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- Job Aid For Form 1701-OfflineDocument20 pagesJob Aid For Form 1701-OfflineRozen Jake Domingo ValenaNo ratings yet

- 1702-EX June 2013 GuidelinesDocument4 pages1702-EX June 2013 GuidelinesAnonymous m6sKy4100% (1)

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- 1702 RTsasaDocument4 pages1702 RTsasaEysOc11No ratings yet

- GST Registration Guide for Normal TaxpayersDocument24 pagesGST Registration Guide for Normal Taxpayersbharat2goodNo ratings yet

- File GSTR-3B and pay GST onlineDocument23 pagesFile GSTR-3B and pay GST onlineBala VinayagamNo ratings yet

- Process Refund Applications (RFD-01) on GST PortalDocument142 pagesProcess Refund Applications (RFD-01) on GST PortalutkarshNo ratings yet

- Bir Form 1702Document16 pagesBir Form 1702Christine Ann GamboaNo ratings yet

- E-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyDocument38 pagesE-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyRaj Kumar M0% (2)

- VAPP Webinar HandoutsDocument17 pagesVAPP Webinar HandoutsMarlon De NiñaNo ratings yet

- IRS Form 8879 e-file Signature AuthorizationDocument2 pagesIRS Form 8879 e-file Signature AuthorizationKatia AlvezNo ratings yet

- IRS E-File Signature Authorization For Form 1041: Employer Identification NumberDocument2 pagesIRS E-File Signature Authorization For Form 1041: Employer Identification NumberJerry MandorNo ratings yet

- GST User ManuelDocument195 pagesGST User Manuelsakthi raoNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- File GSTR-9: Getting Details For Annual ReturnsDocument30 pagesFile GSTR-9: Getting Details For Annual ReturnsHarendra KumarNo ratings yet

- Guide On GSTR 1 Filing On GST PortalDocument53 pagesGuide On GSTR 1 Filing On GST PortalCA Naveen Kumar BalanNo ratings yet

- Guidelines Tax Related DeclarationsDocument16 pagesGuidelines Tax Related DeclarationsRaghul MuthuNo ratings yet

- ITR-7 InstructionsDocument26 pagesITR-7 InstructionsUttam K SharmaNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Guide To Understanding Form 16: Structure and Parts of Form 16 - A Form-16 Part A/Traces Form-16Document5 pagesGuide To Understanding Form 16: Structure and Parts of Form 16 - A Form-16 Part A/Traces Form-16Priya AnandNo ratings yet

- 1701Q Filing: 1. Open The BIR Website atDocument10 pages1701Q Filing: 1. Open The BIR Website atOLshoppe Ni AishNo ratings yet

- Instructions For Filling in Return Form & Wealth Statement Form Sr. InstructionDocument15 pagesInstructions For Filling in Return Form & Wealth Statement Form Sr. InstructionTausif ArshadNo ratings yet

- Final Assessment Payroll Tax AssistantDocument5 pagesFinal Assessment Payroll Tax AssistantCamilo AndrésNo ratings yet

- RMC No 14-2015Document12 pagesRMC No 14-2015anorith88No ratings yet

- Instructions For Filling Out FORM ITR-2Document8 pagesInstructions For Filling Out FORM ITR-2Ganesh KumarNo ratings yet

- Instruction ITR1 Sahaj 2018Document8 pagesInstruction ITR1 Sahaj 2018MadNo ratings yet

- 4 Goods and Services TaxDocument21 pages4 Goods and Services TaxKumarVelivelaNo ratings yet

- RMC No. 76-2020Document11 pagesRMC No. 76-2020Bobby LockNo ratings yet

- ISO 9001:2015 ITR GuideDocument3 pagesISO 9001:2015 ITR GuideKennedy MbuviNo ratings yet

- WT IT - Declarations - Guidelines - FY - 2019-20 PDFDocument11 pagesWT IT - Declarations - Guidelines - FY - 2019-20 PDFGautham ReddyNo ratings yet

- Guidelines TaxRelatedDeclarations2021 22 - MAILDocument22 pagesGuidelines TaxRelatedDeclarations2021 22 - MAILLalit mohan PradhanNo ratings yet

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- File ITR-2 Online User ManualDocument43 pagesFile ITR-2 Online User ManualsrtujyuNo ratings yet

- Goods and Services TaxDocument79 pagesGoods and Services TaxhatimNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Reflection 1Document1 pageReflection 1Francis NicorNo ratings yet

- Reflection 101Document1 pageReflection 101Francis NicorNo ratings yet

- The Kruskal Wallis or One Way AnovaDocument3 pagesThe Kruskal Wallis or One Way AnovaFrancis NicorNo ratings yet

- The Kruskal Wallis or One Way AnovaDocument3 pagesThe Kruskal Wallis or One Way AnovaFrancis NicorNo ratings yet

- Soil Erosion: Get The Huge List of More Than 500 Essay Topics and IdeasDocument1 pageSoil Erosion: Get The Huge List of More Than 500 Essay Topics and IdeasFrancis NicorNo ratings yet

- Public SpeakingDocument1 pagePublic SpeakingFrancis NicorNo ratings yet

- Reflection 101Document1 pageReflection 101Francis NicorNo ratings yet

- Soil Erosion: Get The Huge List of More Than 500 Essay Topics and IdeasDocument1 pageSoil Erosion: Get The Huge List of More Than 500 Essay Topics and IdeasFrancis NicorNo ratings yet

- The Kruskal Wallis or One Way AnovaDocument3 pagesThe Kruskal Wallis or One Way AnovaFrancis NicorNo ratings yet

- Perfromance Task FilipinoDocument2 pagesPerfromance Task FilipinoFrancis NicorNo ratings yet

- Report On Attendance: No. of School Days No. of Days Present No. of Days AbsentDocument5 pagesReport On Attendance: No. of School Days No. of Days Present No. of Days AbsentFrancis NicorNo ratings yet

- Pampanga: Imparayan Elementary School Music 6 1 Summative Test - 3 QuarterDocument2 pagesPampanga: Imparayan Elementary School Music 6 1 Summative Test - 3 QuarterFrancis NicorNo ratings yet

- Perfromance Task FilipinoDocument2 pagesPerfromance Task FilipinoFrancis NicorNo ratings yet

- Report On Attendance: No. of School Days No. of Days Present No. of Days AbsentDocument5 pagesReport On Attendance: No. of School Days No. of Days Present No. of Days AbsentFrancis NicorNo ratings yet

- Perfromance Task - MathDocument3 pagesPerfromance Task - MathFrancis NicorNo ratings yet

- I. Make Your Own Daily Time Schedule in A Bond Paper.: 1. A Coconut Shell Coin Bank 2. A Coconut BroomDocument1 pageI. Make Your Own Daily Time Schedule in A Bond Paper.: 1. A Coconut Shell Coin Bank 2. A Coconut BroomFrancis NicorNo ratings yet

- Pampanga: Imparayan Elementary School Music 6 1 Summative Test - 3 QuarterDocument2 pagesPampanga: Imparayan Elementary School Music 6 1 Summative Test - 3 QuarterFrancis NicorNo ratings yet

- RA NO. 10647 Sec 4-6Document1 pageRA NO. 10647 Sec 4-6Francis NicorNo ratings yet

- Report On Attendance: No. of School Days No. of Days Present No. of Days AbsentDocument5 pagesReport On Attendance: No. of School Days No. of Days Present No. of Days AbsentFrancis NicorNo ratings yet

- DepEd issues guidelines for 2020-2021 school calendar amid COVID-19Document16 pagesDepEd issues guidelines for 2020-2021 school calendar amid COVID-19DomingoRmgJedahArmadaJr.50% (18)

- I. Make Your Own Daily Time Schedule in A Bond Paper.: 1. A Coconut Shell Coin Bank 2. A Coconut BroomDocument1 pageI. Make Your Own Daily Time Schedule in A Bond Paper.: 1. A Coconut Shell Coin Bank 2. A Coconut BroomFrancis NicorNo ratings yet

- Perfromance Task - MathDocument3 pagesPerfromance Task - MathFrancis NicorNo ratings yet

- Impressionmanagement Latest 090507111957 Phpapp02Document15 pagesImpressionmanagement Latest 090507111957 Phpapp02Francis NicorNo ratings yet

- Mind Mapping: A Prelude To Paragraph DevelopmentDocument15 pagesMind Mapping: A Prelude To Paragraph DevelopmentFrancis NicorNo ratings yet

- Tesda Region VIDocument3 pagesTesda Region VIFrancis NicorNo ratings yet

- REPUBLIC ACT NO 10647 Sec 1-3Document2 pagesREPUBLIC ACT NO 10647 Sec 1-3Francis NicorNo ratings yet

- Impression Management: - by Yash Vardhan SinghDocument16 pagesImpression Management: - by Yash Vardhan SinghRabi KantNo ratings yet

- Tulong Trabaho ActDocument1 pageTulong Trabaho ActFrancis NicorNo ratings yet

- Tulong Trabaho ActDocument1 pageTulong Trabaho ActFrancis NicorNo ratings yet

- RA NO. 10647 Sec 4-6Document1 pageRA NO. 10647 Sec 4-6Francis NicorNo ratings yet

- Fro Programming GuideDocument9 pagesFro Programming GuideTeam 5401No ratings yet

- Computational Fluid Dynamics Analysis On Race Car Scale Model Compared With Wind Tunnel TestsDocument13 pagesComputational Fluid Dynamics Analysis On Race Car Scale Model Compared With Wind Tunnel TestsVyssionNo ratings yet

- MM ConclusionDocument2 pagesMM ConclusionAyanilNo ratings yet

- The Importance of Additive ManufacturingDocument9 pagesThe Importance of Additive ManufacturingraviNo ratings yet

- Usb C Buck Boost Battery ChargingDocument5 pagesUsb C Buck Boost Battery ChargingMark ManzanasNo ratings yet

- 2xxx Compatibility - Reset Ni MaxDocument7 pages2xxx Compatibility - Reset Ni Maxpreetharajamma6025No ratings yet

- Project Name Test PlanDocument21 pagesProject Name Test PlanSunilkumar KotturuNo ratings yet

- Hyper QDocument9 pagesHyper QUltimate AltruistNo ratings yet

- Instructions Watts Thermostat XeluxDocument2 pagesInstructions Watts Thermostat Xeluxmeegs_roNo ratings yet

- AEC Lab ManualDocument70 pagesAEC Lab ManualRohan BoseNo ratings yet

- 20 G 1 Anc 140 Aa 0 NNNNNDocument12 pages20 G 1 Anc 140 Aa 0 NNNNNWriterNo ratings yet

- Remotely Operated Underwater Vehicle With 6DOF Robotic ArmDocument14 pagesRemotely Operated Underwater Vehicle With 6DOF Robotic ArmMethun RajNo ratings yet

- Math CorrigerDocument1 pageMath CorrigerLeïla PNo ratings yet

- cst-336 Fa-2022 - Final Project DocumentationDocument3 pagescst-336 Fa-2022 - Final Project Documentationapi-595755064No ratings yet

- Pid ArduinoDocument6 pagesPid ArduinoJohn MurrayNo ratings yet

- EcE-21014 Lecture NotesDocument40 pagesEcE-21014 Lecture NotesKyal SinNo ratings yet

- UPU Addressing Conference: Including S42 Recognition CeremonyDocument4 pagesUPU Addressing Conference: Including S42 Recognition CeremonycbetterNo ratings yet

- Kongsberg PulSAR ApplicationsDocument2 pagesKongsberg PulSAR ApplicationsReynaldo PulidoNo ratings yet

- Cmyk 100 66 0 2: Mobile Radio User GuideDocument9 pagesCmyk 100 66 0 2: Mobile Radio User GuideMario Javier GonzalesNo ratings yet

- WikiLeaks Podesta Email Findings As of October 30, 2016Document99 pagesWikiLeaks Podesta Email Findings As of October 30, 2016Joe SmithNo ratings yet

- PWC 1010 Workplace Communication Finalized ReportDocument25 pagesPWC 1010 Workplace Communication Finalized Reportcharlie simo100% (1)

- Bangalore University PDFDocument2 pagesBangalore University PDFSandeep KumarNo ratings yet

- Postgis-1 5 3Document334 pagesPostgis-1 5 3Aladar BeshescuNo ratings yet

- Arduino Based Smart Glove PRO 2Document23 pagesArduino Based Smart Glove PRO 2faisal aminNo ratings yet

- Sum of series terms and logarithmic expressionsDocument3 pagesSum of series terms and logarithmic expressionsiamrockyNo ratings yet

- LogDocument27 pagesLognonhaunNomeNo ratings yet

- Scc-1 Smartcraft Connect Gateway Installation Manual: Components in KitDocument23 pagesScc-1 Smartcraft Connect Gateway Installation Manual: Components in KitJosh WolfeNo ratings yet

- CA Service Desk Manager 14.1: Configuring Incident and Problem Management 200Document39 pagesCA Service Desk Manager 14.1: Configuring Incident and Problem Management 200Carlos HuertasNo ratings yet

- TourismDocument39 pagesTourismDinesh Vashisth D C50% (6)