Professional Documents

Culture Documents

Introduction Financial Inclusion

Introduction Financial Inclusion

Uploaded by

sarikaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction Financial Inclusion

Introduction Financial Inclusion

Uploaded by

sarikaCopyright:

Available Formats

Introduction

The origin of the current approach to financial inclusion can be traced to the

United Nations initiatives, which broadly described the main goals of inclusive

finance as access to a range of financial services including savings, credit,

insurance, remittance and other banking/ payment .

services to all ‘bankable’ households and enterprises at a reasonable cost.

Financial inclusion may be defined as the process of ensuring access to financial

services and timely and adequate credit where needed by vulnerable groups

such as weaker sections and low income groups at an affordable cost (The

Committee on Financial Inclusion, Chairman:

Dr. C. Rangarajan).

Financial Inclusion refers to universal access to a wide range of

financial services at a reasonable cost. These include not only banking

products but also other financial services such as insurance and equity products

(The Committee on Financial Sector Reforms, Chairman:

Dr.Raghuram G. Rajan).

Efforts for financial inclusion started with the nationalization of 14 commercial

banks in July 1969 and 6 commercial banks in 1980. With a view to provide

more banking services in rural

areas, regional rural banks were established in 1975. To enhance more access

to financial services by rural population, post liberalization banking reforms

started to take place in April 2010, which includes issue of universal and

differentiated banking licenses.

To deepen the financial inclusion process and to undertake digital banking,

Reserve Bank of

India issued differentiated banking licenses (in-principal approval) to:

Payments Banking license to 11 players – August 2015

Small Finance Banking license to 10 players – September 2015

Differentiated bank license policy is the new form of guidelines by the

RBI inviting individuals/entities to start either small finance banks or payment

banks. These are different

licenses in contrast to the existing conventional banks (like SBI, AXIS, ICICI

etc).

The existing conventional banks, including public and private sector can

provide all banking

services and products. While differentiated banks like payment banks and small

finance banks

can provide only select banking services and products.

RBI has adopted differentiated banking license policy to promote financial

inclusion and to enable quick payment services using new

banking technologies.

Payments Banks

On, August 19, 2015, Reserve Bank of India granted ‘in-principle’ approval to

11 applicants to start a payments bank. The Committee of the Central Board

(CCB) of RBI has selected 11 entities that have the reach and the technological

and financial strength to provide service to

the customers and promote government’s initiative of financial inclusion across

the country.

These banks are expected to reach customers mainly through their mobile

phones rather than traditional bank branches. Out of these 11 applicants, Tech

Mahindra Ltd, Cholamandalam Investment and Finance Co and billionaire Dilip

Shanghvi have opted out.

Small Finance Banks

On September 17, 2015 The Reserve Bank of India (RBI) has granted in

principle approval to 10 entities to set up small finance banks to provide basic

banking services to small farmers and

micro industries. The in-principle approval will enable these entities

comply with the guidelines on Small Finance Banks and will be valid for 18

months.

10 entities are:

1. Au Financiers (India) Ltd

2. Capital Local Area Bank

3. Disha Microfin Private Ltd

4. Equitas Holdings P Limited

5. ESAF Microfinance and Investments Private Ltd

6. Janalakshmi Financial Services Private Limited

7. RGVN (North East) Microfinance Limited

8. Suryoday Micro Finance Private Ltd

9. Ujjivan Financial Services Private Ltd

10. Utkarsh Micro Finance Private Ltd.

As per RBI guidelines, the small finance banks can provide basic banking

services in order to promote financial inclusion. It will include services like

accepting deposits and lending to the unbanked sections such as micro

business enterprises, small farmers, micro and small

industries and unorganized sector entities.

RBI Guidelines for Small Finance Banks:

Take small deposits and disburse loans

Distribute mutual funds, insurance products another simple third-party

financial

products

Lend 75% of their total adjusted net bank credit to priority sector

Maximum loan size would be 10% of capital funds to single borrower, 15% to

a

group

Minimum 50% of loans should be up to 25 lakhs

Cannot lend to big corporate and groups

Other financial activities of the promoter must not mingle with the bank

It cannot set up subsidiaries to undertake non-banking financial services

activities

Cannot be a business correspondent of any bank

Common Features of both Payments Banks and Small Finance Banks

In regard to both Payments Banks and Small banks the draft guidelines have

some common

features. As per the guidelines, the minimum paid-up capital is Rs.100 crore.

Promoters’ initial

contribution will be at least 40 per cent to be locked in for five years. The

banks can be

promoted by individuals who have at least 10 years of experience / expertise in

financial or

banking field or by private sector companies or societies with good track record.

The promoters

will have to be resident Indians or owned and controlled by resident Indians.

They will have to

conform to stringent ‘fit and proper’ criteria.

In case of small banking finance existing MFIs, NBFCs or LABs can opt for

conversion, and

that of payment banks existing PPIs can opt for conversion.

The capital adequacy framework is same for both type of banks --

Minimum Capital

Requirement (15 per cent) and Common Equity Tier 1 (6 per cent).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Working Hours and Overtime Pay in PakistanDocument39 pagesWorking Hours and Overtime Pay in Pakistansajid50% (6)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Understanding Actuarial Practice (UAP) Online ResourcesDocument3 pagesUnderstanding Actuarial Practice (UAP) Online ResourcesDale ChenNo ratings yet

- Advanced Accounting by Sohail Afzal Keybook Solution PDF PDFDocument9 pagesAdvanced Accounting by Sohail Afzal Keybook Solution PDF PDFDaud Khan0% (1)

- Bond Market in BangladeshDocument11 pagesBond Market in Bangladeshmisopstu100% (26)

- "Customer Perception On Credit Card With Special Referance To Sbi Credit Card Nagpur 'Document51 pages"Customer Perception On Credit Card With Special Referance To Sbi Credit Card Nagpur 'shiv infotechNo ratings yet

- Living LegendsDocument8 pagesLiving LegendsTBP_Think_Tank100% (3)

- Dividend Decision AT Icici: Master of Business AdministrationDocument71 pagesDividend Decision AT Icici: Master of Business AdministrationSaas4989 Saas4989No ratings yet

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDocument4 pagesHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- Due DiligenceDocument7 pagesDue Diligenceanand guptaNo ratings yet

- RB Group Case StudyDocument1 pageRB Group Case Studyanand gupta100% (1)

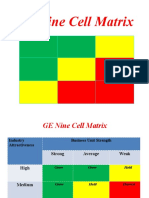

- GE MatrixDocument13 pagesGE Matrixanand guptaNo ratings yet

- CAMELS Ratios MethodologyDocument4 pagesCAMELS Ratios Methodologyanand guptaNo ratings yet

- Child LaborDocument15 pagesChild Laboranand guptaNo ratings yet

- AOLDocument3 pagesAOLanand guptaNo ratings yet

- GE MatrixDocument13 pagesGE Matrixanand guptaNo ratings yet

- A Functional Project Done In: Analysis On Performance of Wipro and Infosys"Document29 pagesA Functional Project Done In: Analysis On Performance of Wipro and Infosys"anand guptaNo ratings yet

- Promotional Strategy of Dmart Influencing Consumer Buying BehaviourDocument15 pagesPromotional Strategy of Dmart Influencing Consumer Buying Behaviouranand guptaNo ratings yet

- Internship Report On "Audit Procedures of A Chartered Accountant Firm"Document2 pagesInternship Report On "Audit Procedures of A Chartered Accountant Firm"anand guptaNo ratings yet

- Chapter 1: Introduction of The Project 1.1conceptDocument37 pagesChapter 1: Introduction of The Project 1.1conceptanand guptaNo ratings yet

- A Summer Internship Project (SIP) Done in Asset Villa Financial AdvisorDocument33 pagesA Summer Internship Project (SIP) Done in Asset Villa Financial Advisoranand guptaNo ratings yet

- Ap Gov Unit 4 - Political Ideologies and Policy PowerpointDocument21 pagesAp Gov Unit 4 - Political Ideologies and Policy Powerpointapi-491855539No ratings yet

- S K Enterprise BLDocument4 pagesS K Enterprise BLVinay ChawlaNo ratings yet

- Intermediate Accounting - Module 1Document3 pagesIntermediate Accounting - Module 1Jcel JcelNo ratings yet

- Accountancy Bbs 1st Year - Oweisme PDFDocument21 pagesAccountancy Bbs 1st Year - Oweisme PDFPratima Upreti100% (1)

- 01 - Traditional Chinese - Welcome and Introduction To The SessionDocument8 pages01 - Traditional Chinese - Welcome and Introduction To The SessionRyan ChenNo ratings yet

- HOW DOES ASSET-BACKED CREDIT-LINKED NOTES (CLN) WORKS - Keval ShahDocument5 pagesHOW DOES ASSET-BACKED CREDIT-LINKED NOTES (CLN) WORKS - Keval ShahKeval ShahNo ratings yet

- Caia Next Decade Alternative Investments 2020Document32 pagesCaia Next Decade Alternative Investments 2020Mainumby ConstantinoNo ratings yet

- Papa V ValenciaDocument1 pagePapa V ValenciaCistron ExonNo ratings yet

- Case 09-48: #REF! #REF!Document20 pagesCase 09-48: #REF! #REF!saad bin sadaqatNo ratings yet

- Your Credit Card: Statement Date Statement Period Payment Due DateDocument2 pagesYour Credit Card: Statement Date Statement Period Payment Due DateG RajakannuNo ratings yet

- Chapter - 8 International CompensationDocument33 pagesChapter - 8 International CompensationTheAuraMysticNo ratings yet

- Financial Management MCQsDocument11 pagesFinancial Management MCQsmadihaadnan150% (2)

- New Government Accounting System & Non-Profit Organization #0005Document7 pagesNew Government Accounting System & Non-Profit Organization #0005Dardar AlcantaraNo ratings yet

- MENAGERIAL ACCOUNTING - p1Document30 pagesMENAGERIAL ACCOUNTING - p1Mit MecwanNo ratings yet

- Sample CONTRACT OF LOANDocument2 pagesSample CONTRACT OF LOANRosalyn Mary QueridaNo ratings yet

- CM Group 5, Janalakshmi SevicesDocument13 pagesCM Group 5, Janalakshmi Sevicesvivek mithraNo ratings yet

- Daftar Saham - 20240120Document38 pagesDaftar Saham - 202401202xtf448275No ratings yet

- Ashish Project Report On Icici BankDocument134 pagesAshish Project Report On Icici BankAshish Goyal82% (11)

- Insolvency Law Study Guide 2014 - UNISADocument219 pagesInsolvency Law Study Guide 2014 - UNISADawn McGowan100% (1)

- Bank Reconciliation Summary NotesDocument3 pagesBank Reconciliation Summary NotesSong Ji HyoNo ratings yet

- Margin TradingDocument14 pagesMargin TradingNicholas Sudan100% (1)

- Credit Management Policy On AB Bank LTDDocument81 pagesCredit Management Policy On AB Bank LTDShuvro DattaNo ratings yet