Professional Documents

Culture Documents

F3 MTQS

Uploaded by

Ehsan ElahiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F3 MTQS

Uploaded by

Ehsan ElahiCopyright:

Available Formats

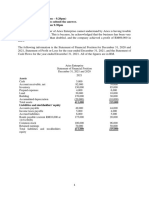

Lirik's Co Trial Balance For the Year ended 31 Jan 20X2

$ $

000' 000'

Property,Plant & Equipment (PPE) 1078

Sales 1042

Bank 738

Discount Received 20

Allowance For Receivables 60

Receivables 150

Payables 1500

Purchases 170

Inventory at 1st Feb 20X1 60

Administration Expenses 200

Distribution Expenses 170

Finance Cost 40

Prepaid Cleaning Expense 16

Total 2622 2622

1) During the year a machinery was sold for $22000 which was

bought on 1st Feb 20X0 costing $50000. The company's policy to

depreciate machinery on straight line method over useful life of 5

years. The only entry made was debit to cash account and credit

to PPE . Any Profit or Loss should be added in admin expense.

2) Lirik's Co recorded a sale invoice of $100000 assuming that

customer was not expected to take discount but when the cash

was received subsequently customer takes the discount. No entry

was made for the cash reciept. The settlement discount rate is

2%.

3) Bank statement includes bank charges of $2000 which was not

yet recorded in cash book. Bank charges belongs to finance cost.

4) Closing inventory was valued at $50000

4) Closing inventory was valued at $50000

5) Company paid $120000 For cleaning expense in advance for

the year ended 1st april 20X2 . The prepaid expense included in

trial balance relates to 20X1. Prepaid expense relates to admin

expense.

6) Estimated tax for the year was $ 50000.

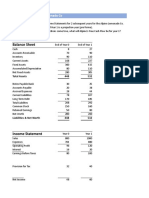

TASK 1

The carrying amount of machinery $000 50

Loss on disposal of machinery $000 8

TASK 2

Lirik's Co Statement of Profit & Loss For the year ended 31 Jan

20X2

$

000'

Revenue 1040

Cost of Sales -160

Gross Profit 880

Distribution Expense -170

Administration Expense -212

Operating Profit 498

Finance Cost -42

Profit before Tax 456

Tax Expense -50

Net Profit 406

You might also like

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Cashflow Tutorial 2Document1 pageCashflow Tutorial 2Tadiwa ZamaniNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- CH 21 in Class Exercises Day 2Document2 pagesCH 21 in Class Exercises Day 2Abdullah alhamaadNo ratings yet

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- CH 21 in Class Exercises Day 2 SOLUTIONSDocument3 pagesCH 21 in Class Exercises Day 2 SOLUTIONSAbdullah alhamaadNo ratings yet

- HW C23 U Can Read But NoDocument2 pagesHW C23 U Can Read But NoLăng Quân VươngNo ratings yet

- Advanced Accounting 2aDocument4 pagesAdvanced Accounting 2aHarusiNo ratings yet

- Bài tập buổi 12Document7 pagesBài tập buổi 12Huế ThùyNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- 6 PracticeProblems-IntercompanyExDocument6 pages6 PracticeProblems-IntercompanyExtheheckwithitNo ratings yet

- Business Accounting & Finance-Assignment-1Document6 pagesBusiness Accounting & Finance-Assignment-1Zay Yar PhyoNo ratings yet

- 3 Beethoven Schubert Bach Text 2018Document11 pages3 Beethoven Schubert Bach Text 2018djaaaamNo ratings yet

- Tugas Personal Pertama AKDocument7 pagesTugas Personal Pertama AKerni75% (4)

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- BFA301 Solution For Lecture Example 3-2Document6 pagesBFA301 Solution For Lecture Example 3-2erinNo ratings yet

- 6104 - 2022 - Accounting For ManagersDocument3 pages6104 - 2022 - Accounting For ManagersVaibhav KumarNo ratings yet

- Module-2-Exercises Final - JFCDocument10 pagesModule-2-Exercises Final - JFCJARED DARREN ONGNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- Quiz - Consolidated FS Part 2Document3 pagesQuiz - Consolidated FS Part 2skyieNo ratings yet

- Cashflow ActivityDocument2 pagesCashflow ActivityHannie CaratNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Patrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTDocument12 pagesPatrice R. Barquilla 12 Gandionco Business Finance CHAPTER 2 ASSIGNMENTJohnrick RabaraNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Practice For Test 3 - Copy (1) EbiDocument9 pagesPractice For Test 3 - Copy (1) EbireynaldohizkiaNo ratings yet

- MMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsDocument7 pagesMMZ Accountancy School PH 09 453197062: 15 Mark Questions: Preparing Simple Consolidated Financial StatementsSerena100% (1)

- KABURIDocument3 pagesKABURIarnoldobonyoNo ratings yet

- Consolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeDocument4 pagesConsolidated Income Statement or Statement of Profit or Loss and Other Comprehensive IncomeOmolaja IbukunNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- CCH Corporation Statement of Financial PositionDocument4 pagesCCH Corporation Statement of Financial PositionCarl Yry BitengNo ratings yet

- Module 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionDocument10 pagesModule 3-Separate & Consolidated Financial Statements - Subsequent To Date of AcquisitionApril Ross TalipNo ratings yet

- Ho2 SciDocument2 pagesHo2 SciAbdullah JulkanainNo ratings yet

- Thegodfather CF Student CdADocument8 pagesThegodfather CF Student CdAPablo MichavilaNo ratings yet

- Solution Alpine DataDocument4 pagesSolution Alpine DataShalabh DongaonkarNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Recognition of Current Assets and EquityDocument8 pagesRecognition of Current Assets and EquityMd. N UraminNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- Exercises JanuaryDocument3 pagesExercises JanuaryNameanxa AngelsNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Ias 12 QDocument2 pagesIas 12 QPinias ShefikaNo ratings yet

- The Accounting Cycle: Reporting Financial ResultsDocument8 pagesThe Accounting Cycle: Reporting Financial ResultsOmar KhanNo ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- Income Statement Practice ProblemsDocument6 pagesIncome Statement Practice ProblemsmikeNo ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Cases Chapter 5Document2 pagesCases Chapter 5Rifqi FarhanNo ratings yet

- Financial Accounting-I Assignment 2: InstructionsDocument3 pagesFinancial Accounting-I Assignment 2: InstructionsMemes CreatorNo ratings yet

- Quiz 2 - CFR2018Document4 pagesQuiz 2 - CFR2018Ananya DevNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Bookkeeping Practice SetDocument31 pagesBookkeeping Practice SetSittie NorhanizahNo ratings yet

- 5000LBSAF Workbook 2 2021-22 - DraftingDocument65 pages5000LBSAF Workbook 2 2021-22 - DraftingeldargarchaNo ratings yet

- ACCA F3 Exam Kit 2013 Emile Woolf PDFDocument181 pagesACCA F3 Exam Kit 2013 Emile Woolf PDFTinh Linh90% (20)

- Financial Accounting (For Exams From February 2014 To August 2015) - SQBDocument394 pagesFinancial Accounting (For Exams From February 2014 To August 2015) - SQBAsadMughal80% (10)

- ACCA F2 Becker Study Material PDF F2Document1 pageACCA F2 Becker Study Material PDF F2Ehsan ElahiNo ratings yet

- Management AccountingDocument164 pagesManagement AccountingEhsan ElahiNo ratings yet

- SKANS School of Accountancy, MultanDocument6 pagesSKANS School of Accountancy, MultanEhsan ElahiNo ratings yet

- Petty Cash TestDocument6 pagesPetty Cash TestEhsan Elahi100% (4)

- Earth Science NAME - DATEDocument3 pagesEarth Science NAME - DATEArlene CalataNo ratings yet

- Volcanoes Sub-topic:Volcanic EruptionDocument16 pagesVolcanoes Sub-topic:Volcanic EruptionVhenz MapiliNo ratings yet

- Catalogue - Central Battery SystemDocument12 pagesCatalogue - Central Battery SystemarifzakirNo ratings yet

- On The Wings of EcstasyDocument79 pagesOn The Wings of Ecstasygaya3mageshNo ratings yet

- Or HandoutDocument190 pagesOr Handoutyared haftu67% (6)

- MCC333E - Film Review - Myat Thu - 32813747Document8 pagesMCC333E - Film Review - Myat Thu - 32813747Myat ThuNo ratings yet

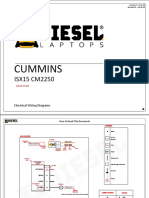

- Cummins: ISX15 CM2250Document17 pagesCummins: ISX15 CM2250haroun100% (4)

- Present Perfect Simp ContDocument14 pagesPresent Perfect Simp ContLauGalindo100% (1)

- Kingroon ConfiguracoesDocument3 pagesKingroon ConfiguracoesanafrancaNo ratings yet

- Data Mining in IoTDocument29 pagesData Mining in IoTRohit Mukherjee100% (1)

- Presentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022Document9 pagesPresentation LI: Prepared by Muhammad Zaim Ihtisham Bin Mohd Jamal A17KA5273 13 September 2022dakmts07No ratings yet

- Class 1 KeyDocument3 pagesClass 1 Keyshivamsingh.fscNo ratings yet

- Gandhi and The Non-Cooperation MovementDocument6 pagesGandhi and The Non-Cooperation MovementAliya KhanNo ratings yet

- Big Brother Naija and Its Impact On Nigeria University Students 2 PDFDocument30 pagesBig Brother Naija and Its Impact On Nigeria University Students 2 PDFIlufoye Tunde100% (1)

- Furniture AnnexDocument6 pagesFurniture AnnexAlaa HusseinNo ratings yet

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocument2 pagesSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuNo ratings yet

- Unit 1 Building A Professional Relationship Across CulturesDocument16 pagesUnit 1 Building A Professional Relationship Across CulturesAlex0% (1)

- Chapter 1 INTRODUCTION TO LITERATUREDocument4 pagesChapter 1 INTRODUCTION TO LITERATUREDominique TurlaNo ratings yet

- The Determinants of Corporate Dividend PolicyDocument16 pagesThe Determinants of Corporate Dividend PolicyRutvikNo ratings yet

- Prometric Questions-1 AnswersDocument45 pagesPrometric Questions-1 AnswersNina Grace Joy Marayag-Alvarez100% (1)

- Charles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)Document441 pagesCharles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)joan82% (17)

- Introduction To Microelectronic Fabrication PDFDocument332 pagesIntroduction To Microelectronic Fabrication PDFChristy Moore92% (13)

- Antenatal Care (ANC)Document77 pagesAntenatal Care (ANC)tareNo ratings yet

- The Ethics of Peacebuilding PDFDocument201 pagesThe Ethics of Peacebuilding PDFTomas Kvedaras100% (2)

- Academic Performance of Senior High School Students 4Ps Beneficiaries in VNHSDocument19 pagesAcademic Performance of Senior High School Students 4Ps Beneficiaries in VNHSkathlen mae marollanoNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- 1en 02 PDFDocument96 pages1en 02 PDFAndrey100% (2)

- Banin Cawu 1: Panitia Ujian Perguruan Islam Mathali'Ul FalahDocument4 pagesBanin Cawu 1: Panitia Ujian Perguruan Islam Mathali'Ul FalahKajen PatiNo ratings yet

- High Speed Power TransferDocument33 pagesHigh Speed Power TransferJAYKUMAR SINGHNo ratings yet

- DeadlocksDocument41 pagesDeadlocksSanjal DesaiNo ratings yet