Professional Documents

Culture Documents

Book - Transfer Journal Entries

Uploaded by

rose gabonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book - Transfer Journal Entries

Uploaded by

rose gabonCopyright:

Available Formats

TRANSFER JOURNAL ENTRIES

Journalizing is the process of recording a business transaction in the accounting

records. This activity only applies to the double-entry bookkeeping system. The steps

involved in journalizing are as follows:

1. Examine each business transaction to determine the nature of the transaction.

For example, the receipt of a supplier invoice means that an obligation has been

incurred. Or, throwing out obsolete inventory means that the inventory asset

will be reduced.

2. Determine which accounts will be affected. This calls for the identification of the

general ledger accounts that will be altered as a result of the transaction. For

example, recording a supplier invoice could mean that the office supplies

expense account will be increased, as well as the offsetting accounts payable

account.

3. Prepare a journal entry. This involves not just entering the transaction in the

accounting system, but also documenting it sufficiently so that someone

reviewing the entry later will understand why it was created. Ideally, the entry

should note the impacted accounts, the debits and credits entered, a journal

entry number, and a narrative comment.

Journalizing can result in entries to the general ledger or to subsidiary ledgers. An

entry is made to a subsidiary ledger when it involves a high-volume transaction that

management has decided to summarize separately from the general ledger.

As an example of the journalizing process, ABC International has just signed a

contract with a maintenance contractor to pay it $1,000 per month in exchange for

routine preventive maintenance services. The nature of the transaction is a recurring

obligation. The affected accounts will be a debit of $1,000 to the maintenance expense

account, and a credit of $1,000 to the accounts payable account. This will be a

recurring monthly entry. The journal entry is created as just noted, and flagged to

recur automatically at the beginning of each subsequent month.

Transfer Entries

Journal is the primary book of accounts in which we originally record transactions in

chronological order. It is a book of original entry because we first enter a transaction

in the Journal from where we then post it to the ledger. Ledger is a book or register

which contains, in a summarized and classified form, a permanent record of all

transactions. It is the most important book of accounts since we draw the trial balance

from it. Learn transfer entries here

Types of Entries

There are the following types of entries in accounting :

1. Opening entries

2. Transfer entries

3. Adjustment entries

4. Closing entries

Transfer Entries

Sometimes it is necessary to transfer an amount or balance of one account to some

other account. We do this by means of a transfer journal entry in the Journal Proper.

We use a Transfer Journal Entry to allocate an expense or revenue from one account

to another. It is used to transfer funds between object codes within an account or

sponsored project.

Browse more Topics under Special Entries

• Closing Entries

• Adjustment Entries

Transfers journal entries shall include a description of the items and an explanation of

why the transfer is necessary.

Transfers journal entries shall include a description of the items and an explanation of

why the transfer is necessary.

Source: freepik.com

1. Amount withdrawn from Capital

xx Capital A/c Dr. xxx

To Drawings A/c xxx

( Being amount is withdrawn from capital)

2. Amount withdrawn from the bank

xx Cash A/c Dr. xxx

To Bank A/c xxx

( Being amount withdrawn from the bank)

Learn more about Closing Entries here in detail.

3. Cash deposited at the bank

xx Bank A/c Dr. xxx

To Cash A/c xxx

( Being deposit of cash at the bank)

4. Amount received for petty cash

xx Petty Cash A/c Dr. xxx

To Cash A/c xxx

( Being amount received for petty cash)

You might also like

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Chequing Statement-1606 2023-07-04Document2 pagesChequing Statement-1606 2023-07-04Kashif AhmedNo ratings yet

- Basic AccountsDocument51 pagesBasic AccountsNilesh Indikar100% (1)

- Accountancy - Class 11Document151 pagesAccountancy - Class 11Ketan ThakkarNo ratings yet

- Notes of Double Entry System and Journal EntryDocument35 pagesNotes of Double Entry System and Journal Entryjune100% (1)

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Financial Statement PreprationDocument63 pagesFinancial Statement PreprationGraceann Casundo100% (2)

- Chapter Two: Accounting Cycle For Service-Giving BusinessDocument35 pagesChapter Two: Accounting Cycle For Service-Giving BusinessMathewos Woldemariam Birru100% (2)

- Theory FA1Document27 pagesTheory FA1talha ShakeelNo ratings yet

- Accounts BasicsDocument144 pagesAccounts Basicsjdon100% (1)

- Accounting BasicsDocument144 pagesAccounting BasicsSabyasachi Srimany100% (1)

- Accounting Basics 1 2016 2017Document50 pagesAccounting Basics 1 2016 2017NSHIMIRIMANA YvanNo ratings yet

- 15 Financial AccountsDocument111 pages15 Financial AccountsRenga Pandi100% (1)

- 12 - Tolentino V GonzalesDocument3 pages12 - Tolentino V GonzalesAthanasia Zoe Gonzales100% (2)

- Grade 11, Accounting, Chapter 3 Recording of Transaction IDocument75 pagesGrade 11, Accounting, Chapter 3 Recording of Transaction Ihum_tara1235563100% (1)

- World Leader Twitter Directory-V51Document40 pagesWorld Leader Twitter Directory-V51piccola_bee0% (1)

- IFA Chapter 2Document17 pagesIFA Chapter 2Suleyman TesfayeNo ratings yet

- Accounting Chapter 3Document6 pagesAccounting Chapter 3Yana PrihartiniNo ratings yet

- Bsbfia401 2Document2 pagesBsbfia401 2nattyNo ratings yet

- MANACC-Accounting Records and Systems (Narrative Form)Document14 pagesMANACC-Accounting Records and Systems (Narrative Form)TinNo ratings yet

- The Accounting Cycle: Step 1: Analyze Business TransactionsDocument4 pagesThe Accounting Cycle: Step 1: Analyze Business TransactionsUnkownamousNo ratings yet

- Prepared by B.Jayaram, Lecturer For Commerce, SGDC CollegeDocument65 pagesPrepared by B.Jayaram, Lecturer For Commerce, SGDC CollegerajanikanthNo ratings yet

- Accounting Principles - AllDocument104 pagesAccounting Principles - AllAHMED100% (1)

- Course: Principles of Accounting and Economics Chapter 3: Accounting CycleDocument23 pagesCourse: Principles of Accounting and Economics Chapter 3: Accounting CyclemoallimNo ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- Unit IiDocument20 pagesUnit IinamianNo ratings yet

- Handouts Chapter 4 56 7 CombinedDocument21 pagesHandouts Chapter 4 56 7 CombinedShane Khezia Abriol BaclayonNo ratings yet

- Accounting Introduction p20Document14 pagesAccounting Introduction p20varadu1963No ratings yet

- Double Entry Book Keeping System Notes (Autorecovered)Document6 pagesDouble Entry Book Keeping System Notes (Autorecovered)Hamdi Omar Osman100% (1)

- Group 3: Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessDocument25 pagesGroup 3: Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessPrincess Ariane CasioNo ratings yet

- Lesson 5Document31 pagesLesson 5Glenda DestrizaNo ratings yet

- 28892cpt Fa SM Cp2 Part1Document0 pages28892cpt Fa SM Cp2 Part1Vikas ZurmureNo ratings yet

- ACCT Accounting Chapter 2Document5 pagesACCT Accounting Chapter 2Lemopi Emelda MandiNo ratings yet

- Chapter IVDocument13 pagesChapter IVMariel OroNo ratings yet

- Clear Vs SotaDocument27 pagesClear Vs Sotaahb3411No ratings yet

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- Module Business Finance Chapter 2Document25 pagesModule Business Finance Chapter 2Atria Lenn Villamiel BugalNo ratings yet

- The Accounting Process: Recording and Classifying Business TransactionsDocument15 pagesThe Accounting Process: Recording and Classifying Business TransactionsSykkuno ToastNo ratings yet

- Bba 1sem Financial Accounting Important NotesDocument38 pagesBba 1sem Financial Accounting Important Notestyagiujjwal59No ratings yet

- Fund AccountingDocument26 pagesFund AccountingFethi ADUSS100% (1)

- Chapter 2Document10 pagesChapter 2mayhipolito01No ratings yet

- First Chapter TwoDocument18 pagesFirst Chapter TwoAbdiraxman MaxamedNo ratings yet

- Basic of AccountingDocument0 pagesBasic of AccountingpriteshpatNo ratings yet

- CHAPTER 2 - Accounting CycleDocument11 pagesCHAPTER 2 - Accounting CycleFranz Josef MereteNo ratings yet

- Preview of Summary Financial Accounting 1 - Part 1 MidtermDocument11 pagesPreview of Summary Financial Accounting 1 - Part 1 Midtermaebel1574No ratings yet

- 1 Debit and Credit in AccountingDocument3 pages1 Debit and Credit in AccountingmamakamilaikasiNo ratings yet

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- Cfas 3Document10 pagesCfas 3Bea charmillecapiliNo ratings yet

- Audit of CashDocument23 pagesAudit of CashmeseleNo ratings yet

- Accounting Cycle MechanicsDocument6 pagesAccounting Cycle MechanicsAnjali BalmikiNo ratings yet

- Accounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceDocument28 pagesAccounting Cycle: Transaction Analysis Journalizing Posting Unadjusted Trial BalanceLOURIE JANE GULLEMNo ratings yet

- Journal EntriesDocument7 pagesJournal Entriesmanthansaini8923No ratings yet

- Accountancy ProjectDocument14 pagesAccountancy ProjectKshitize NigamNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleddoc.mimiNo ratings yet

- Guide To Bookkeeping ConceptsDocument18 pagesGuide To Bookkeeping ConceptsJudiana TreviñoNo ratings yet

- Source Document: The Accounting Process (The Accounting Cycle)Document4 pagesSource Document: The Accounting Process (The Accounting Cycle)rap_rrc75No ratings yet

- Week 2 - Principle of AccountingDocument58 pagesWeek 2 - Principle of AccountingMai NgocNo ratings yet

- Unit 3 Financial AccountingDocument21 pagesUnit 3 Financial AccountingSanjeev KumarNo ratings yet

- Accounting Cycle For PostingDocument14 pagesAccounting Cycle For PostingJerrald Meyer L. BayaniNo ratings yet

- Lesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsDocument7 pagesLesson 5 - Basic Financial Accounting & Reporting: Lesson 5 - 1 Recording Business TransactionsJulliene Sanchez DamianNo ratings yet

- Cash Holdin BalanceDocument22 pagesCash Holdin Balancesimon yaikobNo ratings yet

- Accounting For Service Business Lecture 04Document4 pagesAccounting For Service Business Lecture 04Wrhed ValentinNo ratings yet

- Accounting Cycle StepsDocument4 pagesAccounting Cycle StepsAntiiasmawatiiNo ratings yet

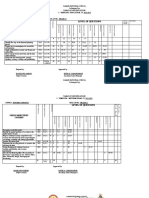

- Level of Questions: Skills/Objectives/ ContentDocument3 pagesLevel of Questions: Skills/Objectives/ Contentrose gabonNo ratings yet

- Level of Questions: Skills/Objectives/ ContentDocument4 pagesLevel of Questions: Skills/Objectives/ Contentrose gabonNo ratings yet

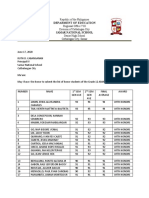

- Achievement/Post Test For Business FinanceDocument5 pagesAchievement/Post Test For Business Financerose gabonNo ratings yet

- Assets Graduating Students Batch 2021Document3 pagesAssets Graduating Students Batch 2021rose gabonNo ratings yet

- Level of Questions: Skills/Objectives/ ContentDocument4 pagesLevel of Questions: Skills/Objectives/ Contentrose gabonNo ratings yet

- Fundamental Accountancy, Business and Management II: Deparment of EducationDocument3 pagesFundamental Accountancy, Business and Management II: Deparment of Educationrose gabonNo ratings yet

- Assessment Exam For UcspDocument3 pagesAssessment Exam For Ucsprose gabonNo ratings yet

- Bookkeeping PresentationDocument20 pagesBookkeeping Presentationrose gabonNo ratings yet

- Grade 12 Equity Ayuda EskwelaDocument534 pagesGrade 12 Equity Ayuda Eskwelarose gabonNo ratings yet

- Budget of Lesson in PR2 SampleDocument2 pagesBudget of Lesson in PR2 Samplerose gabonNo ratings yet

- Accounting Presentation Jan 3Document24 pagesAccounting Presentation Jan 3rose gabonNo ratings yet

- Deparment of Education: Samar National SchoolDocument2 pagesDeparment of Education: Samar National Schoolrose gabonNo ratings yet

- Quarter 1: Understanding Culture, Society and PoliticsDocument3 pagesQuarter 1: Understanding Culture, Society and Politicsrose gabonNo ratings yet

- Abm ADocument1 pageAbm Arose gabonNo ratings yet

- TM (Session Plan)Document9 pagesTM (Session Plan)rose gabonNo ratings yet

- Application Form For MSEsDocument5 pagesApplication Form For MSEsSenthil_kumar_palaniNo ratings yet

- Assignment: Palash SahaDocument6 pagesAssignment: Palash SahaMehedi HasanNo ratings yet

- What Are Different Types of Savings Bank Accounts?: Suddhadeb Chakraborti View Summary CommentsDocument2 pagesWhat Are Different Types of Savings Bank Accounts?: Suddhadeb Chakraborti View Summary CommentsFarii KhanNo ratings yet

- STRAMAN - Workbookfinal2 (1) JESSA MAY R, CABATINGADocument38 pagesSTRAMAN - Workbookfinal2 (1) JESSA MAY R, CABATINGAWazzup BatangeñioNo ratings yet

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Effects of Technological Innovations On Financial Performance of Commercial BanksDocument85 pagesEffects of Technological Innovations On Financial Performance of Commercial BanksNagireddy Kalluri100% (1)

- Synopsis: A Study On Investment Management at UberDocument11 pagesSynopsis: A Study On Investment Management at UberRishabh Pande92% (12)

- Pooja Final 100 MarksDocument92 pagesPooja Final 100 MarksPooja BansalNo ratings yet

- Ricardo's Theory of Comparative Advantage - International TradeDocument10 pagesRicardo's Theory of Comparative Advantage - International TradeAnkita ShettyNo ratings yet

- Advanced Pattern Recognition Technologies With Applications To Bio MetricsDocument385 pagesAdvanced Pattern Recognition Technologies With Applications To Bio MetricspraveenlequidNo ratings yet

- CH 10. Money Its Functions and PropertiesDocument12 pagesCH 10. Money Its Functions and PropertiesMr RamNo ratings yet

- Referance of Merger & AcquitionDocument3 pagesReferance of Merger & Acquitionsujal_sharma28No ratings yet

- Banking Laws: Bpi vs. Iac 206 Scra 408Document2 pagesBanking Laws: Bpi vs. Iac 206 Scra 408morningmindsetNo ratings yet

- Basel II.5, Basel III, and Other Post-Crisis ChangesDocument5 pagesBasel II.5, Basel III, and Other Post-Crisis ChangesMinh TâmNo ratings yet

- Report Text About CatDocument33 pagesReport Text About CatNur AFNINo ratings yet

- Chapter 13, The Financing Business Process Chapter 13, The Financing Business ProcessDocument6 pagesChapter 13, The Financing Business Process Chapter 13, The Financing Business ProcessSibusisoNo ratings yet

- Definition of TermsDocument4 pagesDefinition of TermsMeditacio MontoNo ratings yet

- Overview of The BSPDocument22 pagesOverview of The BSPelaineNo ratings yet

- Account Activity: Transaction Date Value Date Reference Description Debit Credit BalanceDocument9 pagesAccount Activity: Transaction Date Value Date Reference Description Debit Credit BalanceAmin KhanNo ratings yet

- FT EuropeDocument22 pagesFT Europesonia87No ratings yet

- Accountancy, Business, and Management: Wha T Is ABM?Document3 pagesAccountancy, Business, and Management: Wha T Is ABM?Reyzaleen Ochona ParcutelaNo ratings yet

- Nepal Major Contracts PDFDocument1,057 pagesNepal Major Contracts PDFgau shresNo ratings yet

- SMEs Access To Finance PhilippinesDocument61 pagesSMEs Access To Finance PhilippinesJR GabrielNo ratings yet

- Sharia Stock Screening: A Fund Manager's ConundrumDocument10 pagesSharia Stock Screening: A Fund Manager's ConundrumCognizantNo ratings yet

- Student Information: Check Centre Lot S.NO. Student NameDocument232 pagesStudent Information: Check Centre Lot S.NO. Student NameVijayant GautamNo ratings yet

- Investment Appraisals Research Proposal 11% FinalDocument19 pagesInvestment Appraisals Research Proposal 11% FinalgishaqueNo ratings yet