Professional Documents

Culture Documents

Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007

Uploaded by

April NaidaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007

Uploaded by

April NaidaCopyright:

Available Formats

A Sole Proprietor and an Individual with NO Business Form a Partnership

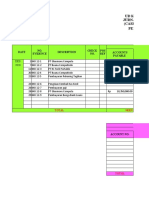

Espanol Operated a specialty shop that sold fishing equipment and accessories. post-closing trial balance on Dec. 31) 2007 is as follows:

Fish R Us

Post Closing Trial Balance

December 31, 2007

Cash 36,000

Accounts Receivable 150,000

Allowance for Uncollectible Accounts 16,000

Inventory 440,000

Equipment 135,000

Accumulated Depreciation 75,000

Accounts Payable 30,000

Espanol, Capital 640,000

Total 761,000 761,000

Espanol plans to enter into a partnership with trusted associate, Quino, effective Jan. 1, 2008. Profits or losses will be shared equally. Espanol is to transfer all assets

and liabilities of her shop to the partnership after revaluation.

Quino will invest cash equal to Espanol’s investment after revaluation. The agreed values are as follows: accounts receivable (net), P140,OOO; inventory, P460,OOO;

and equipment (net), P124,OOO, The partnership will' operate under the business name of Fish R Us.

Required:

1 Prepare the opening journal entries in the books of the partnership.

2 Prepare the partnership’s statement of financial position as at the date of formation of the partnership.

Fish R Us Books of Espanol Books of the Partnership

Post Closing Trial Balance ((1))

December 31, 2007 Cash 36,000

Allowance for Uncollectible Accounts 6,000 Accounts Receivable 150,000

Cash 36,000 Inventory 20,000 Inventory 460,000

Accounts Receivable 150,000 Accumulated Depreciation 64,000 Equipment 124,000

Allowance for Uncollectible Accounts 16,000 Espanol, Capital 90,000 Allowance for Uncollectible Accounts 10,000

Inventory 440,000 To record adjustments in assets Accounts Payable 30,000

Equipment 135,000 Espanol, Capital 730,000

Accumulated Depreciation 75,000 Fish R Us To record investment of Espanol

Accounts Payable 30,000 Adjusted Trial Balance

Espanol, Capital 640,000 December 31, 2007 Cash 730,000

Total 761,000 761,000 Quino Capital 730,000

Cash 36,000 To record investment of Quino

Adjustments Accounts Receivable 150,000

Agreed per books Inc./(dec.) Allowance for Uncollectible Accounts 10,000 Fish R Us

Accounts Receivable, net 140,000 134,000 6,000 Inventory 460,000 Statement of Financial Position

Inventory 460,000 440,000 20,000 Equipment 135,000 Jan. 1, 2008

Equipment, net 124,000 60,000 64,000 Accumulated Depreciation 11,000

Accounts Payable 30,000 Assets

Adjusting Entries Espanol, Capital 730,000 Cash 766,000

Total 781,000 781,000 Accounts Receivable 150,000

Allowance for Uncollectible Accounts 6,000 Allowance for Uncollectible Accounts - 10,000 140,000

Espanol, Capital 6,000 ((2)) Inventory 460,000

Equipment 124,000

Inventory 20,000 Allowance for Uncollectible Accounts 10,000 Total Assets 1,490,000

Espanol, Capital 20,000 Accumulated Depreciation 11,000

Accounts Payable 30,000 Liabilities

Accumulated Depreciation 64,000 Espanol, Capital 730,000 Accounts Payable 30,000

Espanol, Capital 64,000 Cash 36,000 Espanol, Capital 730,000

Accounts Receivable 150,000 Quino, Capital 730,000

Inventory 460,000 Total 1,490,000

Equipment 135,000

To close the books of Espanol

On October l, 2001, Allan and Irene decide to pool their assets and form a partnership. The firm is to take over business assets and assume business liabilities

and capitals are to be based on net assets transferred after the following adjustments:

1. Irene’s inventory is to be valued at 35,000

2. An allowance for doubtful accounts of 5% is to be established on the accounts receivable of each party.

3. Accrued expenses ofP2,000 are to be recognized on Allan’s books.

4. Irene is to be allowed goodwill of P25,000 and is to invest additional cash so that she will have a 60% interest in the new firm.

Allan Irene

Cash P 18,750 P 11,250

Accounts Receivable 45,000 37,500

Merchandise Inventory 40,000 30,000

Equipment 25,000 30,000

Accumulated Depreciation ( 11,250) ( 3,750)

Total Assets PI 17 500 PI 05 000

Accounts Payable P 34,500 P 25,000

Capital 83,000 80,000

Total Liabilities and Capital PI 17 500 P105 000

The books of Irene will be used by the new partnership.

Required:

Give the entries to adjust and close the books of Allan.

Give the entries required on the books of Irene upon the formation of the partnership

Prepare a balance sheet for the firms of Allan and Irene as of October 1

Adjustments Books of the Partnership Buddy N Sol

Buddy Agreement Adjustment Statement of Financial Position

Cash 10,500 10,500 - ((1)) October 31, 200Y

Accounts Receivable 41,600 41,600 - Cash 10,500

Allowance for Doubtful Accounts 2,080 (2,080) Accounts Receivable 41,600 Assets

Merchandise Inventory 89,400 109,950 20,550 Merchandise Inventory 109,950 Cash 69,500

Accounts Payable 40,350 40,350 - Allowance for Doubtful Accounts 2,080 Accounts Receivable 41,600

Accrued Salaries 1,620 (1,620) Accounts Payable 40,350 Allowance for Doubtful Accounts (2,080) 39,520

Buddy, Capital 101,150 118,000 16,850 Accrued Salaries 1,620 Merchandise Inventory 109,950

Buddy, Capital 118,000 Total Assets 218,970

Books of Buddy To record investment of Buddy

Liabilities and Owner's Equity

Merchandise Inventory 20,550 Buddy's Investment 118,000 x3/2 Accounts Payable 40,350

Allowance for Doubtful Accounts 2,080 Interest 2/3 Accrues Salaries 1,620

Accrued Salaries 1,620 Total Partnership Capital 177,000 x1/3 Total Liabilities 41,970

Buddy, Capital 16,850 Sol's interest in the Partnership 1/3 Buddy, Capital 118,000

To record adjustments in Buddy's Capital Sol's cash investment 59,000 Sol, Capital 59,000

Total Owner's Equity 177,000

Buddy Capital 118,000 Total liabilities and owner's equity 218,970

Allowance for Doubtful Accounts 2,080 ((2))

Accounts Payable 40,350 Cash 59,000

Accrued Salaries 1,620 Sol, Capital 59,000

Cash 10,500 To record investment of Sol

Accounts Receivable 41,600

Merchandise Inventory 109,950

To close the books of Buddy

Allan Agreement Adjustment Allan's net investment 78,750 Allan and Irene Partnership

Cash 18,750 18,750 Divide by Allans Partnership Interest 40% Statement of Financial Position

Acccounts Receivable 45,000 45,000 Implied Partnership Valuation 196,875 October 1, 2001

Allowance for Doubtful Accounts (2,250) (2,250) x Irene's Partnership Interest 60%

Merchandise Inventory 40,000 40,000 Irene's net investment 118,125 Assets

Equipment 25,000 25,000 Irene's adjusted capital before cash investment Cash 40,000

Acc. Depreciation (11,250) (11,250) Irene, Capital 80,000 Accounts Receivable 82,500

Total Assets 117,500 115,250 (2,250) Allowance for Doubtful Accounts (1,875) Allowance for Doubtful Accounts (4,125) 78,375

Merchandise Inventory 5,000 Merchandise Inventory 75,000

Accounts Payable 34,500 34,500 Goodwill 25,000 108,125 Equipment 40,000

Accrued Expenses 2,000 2,000 Additional cash investment 10,000 Goodwill 25,000

Allan, Capital 83,000 78,750 (4,250) Total Assets 258,375

Total Liabilities and Capital 117,500 115,250 (2,250) Irene's Book/Partnership Books

Liabilities and Owner's Equity

Allan's Book Merchandise Inventory 5,000 Accounts Payable 59,500

Goodwill 25,000 Accrued Expenses 2,000

Allan, Capital 4,250 Allowance for Doubtful Accounts 2,875 Total Liabilities 61,500

Allowance for Doubtful Accounts 2,250 Irene, Capital 28,125

Accrued Expenses 2,000 To record adjustments in Irene's books Allan, Capital 78,750

To record adjustments in Allan's books Irene, Capital 118,125

Cash 10,000 Total Owner's Equity 196,875

Allowance for Doubtful Accounts 2,250 Irene, Capital 10,000

Accumulated Depreciation 11,250 To record Irene's additional investment Total Liabilities and Owner's Equity 258,375

Accounts Payable 34,500

Accrued Expenses 2,000

Allan, Capital 78,750 Cash 18,750

Cash 18,750 Acccounts Receivable 45,000

Accounts Receivable 45,000 Merchandise Inventory 40,000

Merchandise Inventory 40,000 Equipment 13,750

Equipment 25,000 Allowance for Doubtful Accounts 2,250

To close Allan's Books Accounts Payable 34,500

Accrued Expenses 2,000

Allan, Capital 78,750

To record Allan's investment

You might also like

- #5 Partnership and Corporation Accounting by Win Ballada 2019 CHAPTER 1 PROBLEM #5 SOLUTION Page 39 SolvedDocument2 pages#5 Partnership and Corporation Accounting by Win Ballada 2019 CHAPTER 1 PROBLEM #5 SOLUTION Page 39 Solvedspp89% (9)

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- Problem #6 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument1 pageProblem #6 A Sole Proprietorship and An Individual With No Business Form A Partnershipstudentone93% (14)

- This Study Resource WasDocument2 pagesThis Study Resource WasMaster Nistro0% (1)

- Medina and DalanginDocument3 pagesMedina and DalanginHoneybunch beforeNo ratings yet

- Chapter 2 #20Document3 pagesChapter 2 #20spp50% (2)

- Chapter 1 - Solution PDFDocument6 pagesChapter 1 - Solution PDFEllaine100% (8)

- Multiple Choice Practice 1Document3 pagesMultiple Choice Practice 1sppNo ratings yet

- #2 Partnership and Corporation Accounting by Win Ballada 2019 CHAPTER 1 PROBLEM #2 SOLUTION Page 37 SolvedDocument1 page#2 Partnership and Corporation Accounting by Win Ballada 2019 CHAPTER 1 PROBLEM #2 SOLUTION Page 37 Solvedspp63% (8)

- Chapter 2 # 8 NsDocument1 pageChapter 2 # 8 Nsspp100% (2)

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDocument8 pagesGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNo ratings yet

- PROBLEMDocument3 pagesPROBLEMSam VNo ratings yet

- Chapter 2 (Prob.1-10) - Partnership and Corp.Document10 pagesChapter 2 (Prob.1-10) - Partnership and Corp.Andrea Joy ReyNo ratings yet

- Problem #2 Lump-Sum Liquidation With Loss On RealizationDocument4 pagesProblem #2 Lump-Sum Liquidation With Loss On Realizationjelai anselmoNo ratings yet

- Chapter 2 10Document2 pagesChapter 2 10graceNo ratings yet

- Learning Task 1 - Shareholders Equity TransactionsDocument3 pagesLearning Task 1 - Shareholders Equity TransactionsFeiya Liu100% (1)

- Problem #21 Preparation of Financial StatementsDocument4 pagesProblem #21 Preparation of Financial Statementsspp33% (3)

- Chapter 3 ProblemsDocument11 pagesChapter 3 Problemsahmed arfan100% (1)

- Prob 3 Ch. 1 ParcorDocument2 pagesProb 3 Ch. 1 Parcorstudentone100% (1)

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- Problem #10 Two Sole Proprietorship Form A PartnershipDocument2 pagesProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Sample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersDocument8 pagesSample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersRachel Green0% (1)

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A Partnershipstudentone60% (15)

- Parcor Proj (Version 1)Document33 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- Problem #3 Rules For The Distribution of Profits or LossesDocument1 pageProblem #3 Rules For The Distribution of Profits or LossessppNo ratings yet

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Problem #5 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #5 Distribution of Profits or Losses Based On Partners' Agreementspp100% (2)

- Problem #4 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #4 Distribution of Profits or Losses Based On Partners' Agreementspp100% (1)

- Lumen AlmacharDocument21 pagesLumen AlmacharbelliissiimmaaNo ratings yet

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- PROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipDocument7 pagesPROBLEM 2 - Two Sole Proprietors Form A Partnership PROBLEM 2 - Two Sole Proprietors Form A PartnershipRudy LugasNo ratings yet

- Prob.#5 - Medina and DalanginDocument4 pagesProb.#5 - Medina and DalanginAndrea Tugot50% (2)

- Chapter 2 #17Document1 pageChapter 2 #17sppNo ratings yet

- Problem #7 Rules For The Distribution of Profits or LossesDocument1 pageProblem #7 Rules For The Distribution of Profits or Lossesspp100% (3)

- Chapter 2 #9Document2 pagesChapter 2 #9spp75% (4)

- Problem #6 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #6 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Answer KeysDocument6 pagesAnswer KeysDiana Mark AndrewNo ratings yet

- FISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007Document4 pagesFISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007MayaNo ratings yet

- Fish R Us PDFDocument7 pagesFish R Us PDFMCM EnterpriseNo ratings yet

- Fish R UsDocument3 pagesFish R UsJenny Pearl Dominguez CalizarNo ratings yet

- Partnership Formation SampleDocument6 pagesPartnership Formation SampleKate ClidoroNo ratings yet

- Fish R UsDocument2 pagesFish R UsJohn Clinton PeñafloridaNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- PARCORDocument5 pagesPARCORjelai anselmoNo ratings yet

- ACCOUNTING FORMATION (Fish R' Us and Falco)Document2 pagesACCOUNTING FORMATION (Fish R' Us and Falco)Querecia IsidroNo ratings yet

- Problem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsDocument4 pagesProblem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsJessa0% (1)

- PArtnership FormationDocument6 pagesPArtnership FormationJasmine ActaNo ratings yet

- If Both Are IndividualsDocument6 pagesIf Both Are IndividualsRegineNo ratings yet

- Answer KeyDocument10 pagesAnswer KeyEvelina Del RosarioNo ratings yet

- Instructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Document10 pagesInstructions: Compute The Amount of Ayesa's Capital Account at September 1, 2014Nicole Fidelson0% (1)

- ACFAR Partnership ExercisesDocument12 pagesACFAR Partnership ExercisesJhannamae PamugasNo ratings yet

- Partnership - FormationDocument5 pagesPartnership - FormationJay Mayca TyNo ratings yet

- Chapter 1 Practice ProblemsDocument5 pagesChapter 1 Practice ProblemsChristine Joyce SalvadorNo ratings yet

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Chapter 12, Assignment 2Document4 pagesChapter 12, Assignment 2Gedelle Marie GaleraNo ratings yet

- Bajao-Activity 1-AccountingDocument21 pagesBajao-Activity 1-AccountingShen Calotes50% (2)

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- TF 5Document1 pageTF 5April NaidaNo ratings yet

- TF 6Document1 pageTF 6April NaidaNo ratings yet

- TF 1Document1 pageTF 1April NaidaNo ratings yet

- TF 2Document1 pageTF 2April NaidaNo ratings yet

- TF 3Document1 pageTF 3April NaidaNo ratings yet

- TF 7Document1 pageTF 7April NaidaNo ratings yet

- TF 8Document1 pageTF 8April NaidaNo ratings yet

- ACCT 101 Module 1 - The World of AccountingDocument53 pagesACCT 101 Module 1 - The World of AccountingApril Naida100% (1)

- TF 4Document1 pageTF 4April NaidaNo ratings yet

- D. Has Considerably More Guidance Than IAS 19Document1 pageD. Has Considerably More Guidance Than IAS 19April NaidaNo ratings yet

- AFAR BOOKLET 2 AutoRecovered AutoRecoveredDocument222 pagesAFAR BOOKLET 2 AutoRecovered AutoRecoveredEmey CalbayNo ratings yet

- E 10Document2 pagesE 10April NaidaNo ratings yet

- RF 8Document1 pageRF 8April NaidaNo ratings yet

- E 11Document2 pagesE 11April NaidaNo ratings yet

- Drawings AccountDocument1 pageDrawings AccountApril NaidaNo ratings yet

- Partnership ContractDocument1 pagePartnership ContractApril NaidaNo ratings yet

- Classes of PartnersDocument1 pageClasses of PartnersApril NaidaNo ratings yet

- Characteristics of A PartnershipDocument1 pageCharacteristics of A PartnershipApril NaidaNo ratings yet

- Disadvantages of A PartnershipDocument1 pageDisadvantages of A PartnershipApril NaidaNo ratings yet

- Nature of PartnershipDocument1 pageNature of PartnershipApril NaidaNo ratings yet

- Advantages of A PartnershipDocument1 pageAdvantages of A PartnershipApril NaidaNo ratings yet

- Partnership ExplainedDocument1 pagePartnership ExplainedApril NaidaNo ratings yet

- Allan and Irene Answer KeyDocument9 pagesAllan and Irene Answer KeyApril NaidaNo ratings yet

- Kinds of PartnershipsDocument2 pagesKinds of PartnershipsApril NaidaNo ratings yet

- Accounting For PartnershipsDocument1 pageAccounting For PartnershipsApril NaidaNo ratings yet

- Drawings AccountDocument1 pageDrawings AccountApril NaidaNo ratings yet

- STV Answer KeyDocument4 pagesSTV Answer KeyApril NaidaNo ratings yet

- Perida and Rhoda Answer KeyDocument5 pagesPerida and Rhoda Answer KeyApril NaidaNo ratings yet

- Le 1 Answer KeyDocument8 pagesLe 1 Answer KeyApril NaidaNo ratings yet

- LH 9 - Final Accounts ProblemsDocument29 pagesLH 9 - Final Accounts ProblemsHarshavardhanNo ratings yet

- Accounting For CorporationsDocument9 pagesAccounting For CorporationsUmar ZahidNo ratings yet

- Finals Drill1Document14 pagesFinals Drill1Cedric Legaspi TagalaNo ratings yet

- Intacc 1 Notes - AR StartDocument6 pagesIntacc 1 Notes - AR StartKing BelicarioNo ratings yet

- CH 05Document21 pagesCH 05Muhammad Nur Fazrin50% (2)

- FN 415 Fsa Final Exam Study Questions and Answers RZz2Document10 pagesFN 415 Fsa Final Exam Study Questions and Answers RZz2Chatlyn Kaye MediavilloNo ratings yet

- Analysisoftheperformanceof Kelani Cables PLCDocument28 pagesAnalysisoftheperformanceof Kelani Cables PLCImran ansariNo ratings yet

- Work Sheet AnalysisDocument7 pagesWork Sheet AnalysisMUHAMMAD ARIF BASHIRNo ratings yet

- Lecture Eight Analysis and Interpretation of Financial StatementDocument19 pagesLecture Eight Analysis and Interpretation of Financial StatementSoledad PerezNo ratings yet

- Far2018 AccountingDocument10 pagesFar2018 Accountingjoanna mercado0% (2)

- Practice Exam Pool 1Document11 pagesPractice Exam Pool 1Ey ZalimNo ratings yet

- Short Term Financial PlanningDocument16 pagesShort Term Financial Planningrana sarfaraxNo ratings yet

- Analysis Solutions Acc 411Document13 pagesAnalysis Solutions Acc 411dre_emNo ratings yet

- Fsa AnswersDocument22 pagesFsa AnswersManan GuptaNo ratings yet

- Auditing and Assurance Services 6Th Edition Louwers Solutions Manual Full Chapter PDFDocument44 pagesAuditing and Assurance Services 6Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (10)

- C2 Course Test 5Document16 pagesC2 Course Test 5Tinashe MashoyoyaNo ratings yet

- F9Chap5 TutorSlidesDocument60 pagesF9Chap5 TutorSlidesSeema Parboo-AliNo ratings yet

- Ud Khansa Niaga MuliaDocument60 pagesUd Khansa Niaga MuliaFira aisyah meilaniNo ratings yet

- Recourse Obligation.: RequiredDocument55 pagesRecourse Obligation.: RequiredJude SantosNo ratings yet

- Module 2 - Activity 1 CFASDocument2 pagesModule 2 - Activity 1 CFASJan JanNo ratings yet

- Audit of The Sales and Collection Cycle: Tests of Controls and Substantive Tests of TransactionsDocument29 pagesAudit of The Sales and Collection Cycle: Tests of Controls and Substantive Tests of TransactionsTanya RexanneNo ratings yet

- Discussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueDocument7 pagesDiscussion Questions: Hac311 - Tutorial Solutions Chapter 4: Accounting For RevenueAbdulaziz BsebsuNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Cfab 2022 Ag AnswersDocument23 pagesCfab 2022 Ag AnswersShirah ShahrilNo ratings yet

- Chapter 4-The Revenue Cycle: True/FalseDocument21 pagesChapter 4-The Revenue Cycle: True/False林俊吉No ratings yet

- Acctg1 MidtermDocument6 pagesAcctg1 MidtermKevin Elrey Arce50% (4)

- FAR MerchandisingDocument68 pagesFAR MerchandisingAira DavidNo ratings yet

- Exercise 229: (Credit Account Titles Are Automatically Indented When The Amount Is Entered. Do Not Indent Manually.)Document2 pagesExercise 229: (Credit Account Titles Are Automatically Indented When The Amount Is Entered. Do Not Indent Manually.)Vhia Rashelle GalzoteNo ratings yet

- Chapter 23 Solutions Manual ExamDocument15 pagesChapter 23 Solutions Manual ExamMariance Romaulina Malau67% (3)