Professional Documents

Culture Documents

$serb Bursa: 5279 Reuters: SERB - KL Category: Energy (Oil & Gas Related Equipment and Services)

Uploaded by

Sokri Yussoff0 ratings0% found this document useful (0 votes)

8 views8 pagesOriginal Title

SERB_INCOMESTATEMENT_ANNUAL_20210317

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views8 pages$serb Bursa: 5279 Reuters: SERB - KL Category: Energy (Oil & Gas Related Equipment and Services)

Uploaded by

Sokri YussoffCopyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 8

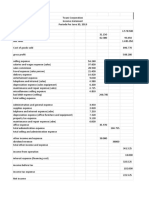

SERBA DINAMIK

$SERB

Bursa: 5279

Reuters: SERB.KL

Category: Energy (Oil & Gas Related Equipment and Services)

INCOME STATEMENT

Annual Standardised in Millions of Malaysian Ringgit

31-Dec-2020 31-Dec-2019

Revenue 6,014.08 4,528.62

Net Sales 6,014.08 4,528.62

Other Revenue, Total - -

Interest Income, Non-Bank - -

Other Revenue - -

Total Revenue 6,014.08 4,528.62

Cost of Revenue, Total 4,960.22 3,717.79

Cost of Revenue 4,960.22 3,717.79

Gross Profit 1,053.85 810.83

Selling/General/Admin. Expenses, Total 162.83 117.37

Selling/General/Administrative Expense 162.83 117.37

Labor & Related Expense - -

Advertising Expense - -

Research & Development - -

Depreciation/Amortization - -

Depreciation - -

Amortization of Acquisition Costs - -

Amortization of Intangibles - -

Interest Expense, Net - Operating - -

Interest Expense - Operating - -

Interest/Investment Income - Operating - -

Interest Income - Operating - -

Investment Income - Operating - -

Interest Expense(Income) - Net Operating - -

Interest Exp.(Inc.),Net-Operating, Total - -

Unusual Expense (Income) - 0.00

Other Unusual Expense (Income) - 0.00

Impairment-Assets Held for Use - -

Impairment-Assets Held for Sale - -

Loss(Gain) on Sale of Assets - Operating - -

Other Operating Expenses, Total -19.52 2.42

Other Operating Expense - 10.80

Other, Net -19.52 -8.38

Total Operating Expense 5,103.53 3,837.58

Operating Income 910.55 691.04

Interest Expense, Net Non-Operating - -202.77

Interest Capitalized - Non-Operating - -

Interest Expense - Non-Operating - -202.77

Interest/Invest Income - Non-Operating -204.21 56.56

Interest Income - Non-Operating - 21.52

Investment Income - Non-Operating -204.21 35.04

Interest Income(Exp), Net Non-Operating - -

Interest Inc.(Exp.),Net-Non-Op., Total -204.21 -146.22

Gain (Loss) on Sale of Assets - -

Other Non-Operating Income (Expense) - -

Net Income Before Taxes 706.34 544.83

Provision for Income Taxes 74.25 46.85

Net Income After Taxes 632.09 497.98

Minority Interest -0.34 -1.34

Equity In Affiliates - -

U.S. GAAP Adjustment - -

Net Income Before Extra. Items 631.75 496.64

Accounting Change - -

Discontinued Operations - -

Extraordinary Item - -

Tax on Extraordinary Items - -

Total Extraordinary Items - -

Net Income 631.75 496.64

Preferred Dividends - -

General Partners' Distributions - -

Miscellaneous Earnings Adjustment - -

Pro Forma Adjustment - -

Interest Adjustment - Primary EPS - -

Total Adjustments to Net Income - -

Income Available to Com Excl ExtraOrd 631.75 496.64

Income Available to Com Incl ExtraOrd 631.75 496.64

Basic Weighted Average Shares 3,709.62 3,083.85

Basic EPS Excluding Extraordinary Items 0.17 0.16

Basic EPS Including Extraordinary Items 0.17 0.16

Dilution Adjustment - -

Diluted Net Income 631.75 496.64

Diluted Weighted Average Shares 3,709.62 3,083.85

Diluted EPS Excluding ExtraOrd Items 0.17 0.16

Diluted EPS Including ExtraOrd Items 0.17 0.16

DPS - Common Stock Primary Issue 0.05 0.05

Dividends per Share - Com Stock Issue 2 - -

Dividends per Share - Com Stock Issue 3 - -

Dividends per Share - Com Stock Issue 4 - -

Special DPS - Common Stock Primary Issue - -

Special DPS - Common Stock Issue 2 - -

Special DPS - Common Stock Issue 3 - -

Special DPS - Common Stock Issue 4 - -

Gross Dividends - Common Stock - 150.70

Pro Forma Stock Compensation Expense - -

Net Income after Stock Based Comp. Exp. - -

Basic EPS after Stock Based Comp. Exp. - -

Diluted EPS after Stock Based Comp. Exp. - -

Stock-Based Compensation, Supplemental - -

Interest Expense, Supplemental - 202.77

Interest Capitalized, Supplemental - -

Interest Expense (Financial Oper), Suppl - -

Net Revenues - -

Depreciation, Supplemental 216.11 143.26

Funds From Operations - REIT - -

(Gain) Loss on Sale of Assets, Suppl. - -

Impairment-Assets Held for Sale, Suppl. - -

Impairment-Assets Held for Use, Suppl. - -

Litigation Charge, Supplemental - -

Purchased R&D Written-Off, Supplemental - -

Restructuring Charge, Supplemental - -

Other Unusual Expense(Income), Suppl. - 0.00

Non-Recurring Items, Supplemental, Total - 0.00

Total Special Items - 0.00

Normalized Income Before Taxes 706.34 544.83

Effect of Special Items on Income Taxes - 0.00

Inc Tax Ex Impact of Sp Items 74.25 46.85

Normalized Income After Taxes 632.09 497.98

Normalized Inc. Avail to Com. 631.75 496.64

Basic Normalized EPS 0.17 0.16

Diluted Normalized EPS 0.17 0.16

Amort of Acquisition Costs, Supplemental - -

Amort of Intangibles, Supplemental 0.00 1.14

Rental Expense, Supplemental - 19.91

Labor & Related Expense Suppl. - 114.94

EPS, Supplemental - -

Advertising Expense, Supplemental - -

Equity in Affiliates, Supplemental -12.57 35.04

Minority Interest, Supplemental -0.34 -1.34

Research & Development Exp, Supplemental - -

Audit Fees - 1.22

Audit-Related Fees - -

Tax Fees - -

All Other Fees - -

Reported Recurring Revenue - -

Reported Net Premiums Written - -

Reported Total Revenue - -

Reported Operating Revenue - -

Reported Total Cost of Revenue - -

Reported Total Sales, General & Admin. - -

Reported Gross Profit - -

Reported Operating Profit - -

Reported Operating Profit Margin - -

Reported Ordinary Profit - -

Reported Net Income After Tax - -

Reported Basic EPS - -

Reported Diluted EPS - -

Reported Net Business Profits - -

Islamic Income - -

Zakat - -

Islamic Section, Supplemental - -

Normalized EBIT 910.55 691.04

Normalized EBITDA 1,126.66 835.45

Current Tax - Total - 46.40

Current Tax - Domestic - 32.25

Current Tax - Foreign - 0.66

Current Tax - Other - 13.49

Deferred Tax - Total - 0.45

Deferred Tax - Domestic - 10.12

Deferred Tax - Other - -9.68

Income Tax - Total - 46.85

Domestic Tax - Other - -

Foreign Tax - Other - -

Other Tax - -

Income Tax by Region - Total - -

Domestic Pension Plan Expense - -

Interest Cost - Domestic - -

Service Cost - Domestic - -

Expected Return on Assets - Domestic - -

Actuarial Gains and Losses - Domestic - -

Curtailments & Settlements - Domestic - -

Other Pension, Net - Domestic - -

Foreign Pension Plan Expense - -

Interest Cost - Foreign - -

Service Cost - Foreign - -

Prior Service Cost - Foreign - -

Expected Return on Assets - Foreign - -

Actuarial Gains and Losses - Foreign - -

Other Pension, Net - Foreign - -

Post-Retirement Plan Expense - -

Total Pension Expense - -

Defined Contribution Expense - Domestic - -

Assumptions - -

Discount Rate - Domestic - -

Expected Rate of Return - Domestic - -

Compensation Rate - Domestic - -

Discount Rate - Foreign - -

Compensation Rate - Foreign - -

Pension Payment Rate - Foreign - -

Total Plan Interest Cost - -

Total Plan Service Cost - -

Total Plan Expected Return - -

Total Plan Other Expense - -

31-Dec-2018 31-Dec-2017 31-Dec-2016

3,283.17 2,722.32 1,408.56

3,283.17 2,722.32 1,408.56

- - -

- - -

- - -

3,283.17 2,722.32 1,408.56

2,700.85 2,238.39 1,173.60

2,700.85 2,238.39 1,173.60

582.32 483.93 234.95

103.72 73.64 51.38

103.72 73.64 51.38

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

-0.82 - -

-0.82 - -

- - -

- - -

- - -

5.27 28.20 -0.54

13.13 32.27 -

-7.87 -4.07 -0.54

2,809.84 2,340.22 1,224.44

473.33 382.10 184.12

-62.12 -37.07 -19.79

- - -

-62.12 -37.07 -19.79

26.42 1.04 2.28

12.54 3.14 2.28

13.88 -2.09 -17.27

- - -

-35.71 -36.03 -17.51

- - -

- - -

437.63 346.07 166.60

44.78 41.28 15.16

392.84 304.79 151.44

-1.37 3.30 0.39

- - -

- - -

391.48 308.09 151.83

- - -

- - -

- - -

- - -

- - -

391.48 308.09 151.83

- - -

- - -

- - -

- - -

- - -

- - -

391.48 308.09 151.83

391.48 308.09 151.83

3,061.52 2,744.11 2,233.52

0.13 0.11 0.07

0.13 0.11 0.07

- - -

391.48 308.09 151.83

3,061.52 2,744.11 2,233.52

0.13 0.11 0.07

0.13 0.11 0.07

0.04 0.03 0.00

- - -

- - -

- - -

- - -

- - -

- - -

- - -

117.48 100.78 0.00

- - -

- - -

- - -

- - -

- - -

62.12 37.07 19.79

- - -

- - -

- - -

89.78 69.03 32.95

- - -

- - -

- - -

- - 16.21

- - -

- - -

- - -

0.82 - -

0.82 - 16.21

0.82 - 16.21

438.44 346.07 182.81

0.08 - 1.47

44.87 41.28 16.64

393.58 304.79 166.17

392.21 308.09 166.56

0.13 0.11 0.07

0.13 0.11 0.07

- - -

2.01 - -

- - 6.63

88.36 67.44 29.03

- - -

- - -

13.88 -2.09 -

-1.37 3.30 0.39

- - -

1.25 0.67 1.56

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

474.15 382.10 200.32

565.94 451.13 233.27

27.40 40.50 14.77

18.88 13.34 15.24

0.56 0.19 -0.14

7.96 26.97 -0.33

17.38 0.78 0.39

17.33 3.38 -0.21

0.05 -2.60 0.61

44.78 41.28 15.16

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

- - -

You might also like

- ESTADOS fINANCIEROS SUPERMERCADOS DIADocument42 pagesESTADOS fINANCIEROS SUPERMERCADOS DIARichard NavarroNo ratings yet

- UMS Income StatementDocument20 pagesUMS Income StatementNour FaizahNo ratings yet

- Income Statement and Balance Sheet for 12 Months Ending 2010-12-31Document4 pagesIncome Statement and Balance Sheet for 12 Months Ending 2010-12-31Jess BautistaNo ratings yet

- NCZ Stock Target $0.38: Period EndingDocument2 pagesNCZ Stock Target $0.38: Period EndingmohsineprrNo ratings yet

- Chapter 3 - Understanding Income StatementDocument63 pagesChapter 3 - Understanding Income StatementMinh Anh NgNo ratings yet

- Group Ratio Analysis and Financial Ratios 2020Document11 pagesGroup Ratio Analysis and Financial Ratios 2020hijab zaidiNo ratings yet

- FinanzasDocument12 pagesFinanzasYamilet Maria InquillaNo ratings yet

- Individual Assignment CocaDocument4 pagesIndividual Assignment CocaMinh Trần Bảo NgọcNo ratings yet

- Income Statement: Khybey Tobacco Company LTDDocument15 pagesIncome Statement: Khybey Tobacco Company LTDMuzamil Ur rehmanNo ratings yet

- Chapter 3 - Understanding The Income StatementDocument68 pagesChapter 3 - Understanding The Income StatementNguyễn Yến NhiNo ratings yet

- In Millions of Euro (Except For Per Share Items) 2008 2008-12-31Document5 pagesIn Millions of Euro (Except For Per Share Items) 2008 2008-12-31William LongNo ratings yet

- GL 31 Des 2018Document2,830 pagesGL 31 Des 2018Julius SiahaanNo ratings yet

- ALI Financial Statements (2021)Document26 pagesALI Financial Statements (2021)Lorey Joy IdongNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- FS NvidiaDocument22 pagesFS NvidiaReza FachrizalNo ratings yet

- The Procter & Gamble Company Consolidated Statements of EarningsDocument5 pagesThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalNo ratings yet

- Kraft Heinz Case VF PDFDocument5 pagesKraft Heinz Case VF PDFNadine ElNo ratings yet

- Tarea - 3 Bis - Caso Dyaton Products - Formato ADocument8 pagesTarea - 3 Bis - Caso Dyaton Products - Formato AMiguel VázquezNo ratings yet

- Week 08Document24 pagesWeek 08shani2010No ratings yet

- Income Statement (In MLN.) : Roic - Ai - AfiDocument11 pagesIncome Statement (In MLN.) : Roic - Ai - AfiJoshua LeeNo ratings yet

- Modern Road Makers P LTD (India) : Emis 14 New Street London, EC2M 4HE, United KingdomDocument3 pagesModern Road Makers P LTD (India) : Emis 14 New Street London, EC2M 4HE, United KingdomLAVISH DHINGRANo ratings yet

- Pres Ratios DataDocument24 pagesPres Ratios Datasamarth chawlaNo ratings yet

- Equity Valuation DCFDocument28 pagesEquity Valuation DCFpriyarajan26100% (1)

- Year 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)Document14 pagesYear 2009 2008: Johnson & Johnson Balance Sheet (In Millions of USD)ujjwal26No ratings yet

- FAD 2022 - Dr. Lisa Su - Opening Final PostDocument38 pagesFAD 2022 - Dr. Lisa Su - Opening Final PostVashishth DudhiaNo ratings yet

- Chapter 5 Solution To Problems and CasesDocument22 pagesChapter 5 Solution To Problems and Caseschandel08No ratings yet

- Income Statement 2009Document1 pageIncome Statement 2009Surbhi AbrolNo ratings yet

- Coca Cola FsDocument5 pagesCoca Cola FsDanah Jane GarciaNo ratings yet

- Bharti Airtel's Financial PerformanceDocument14 pagesBharti Airtel's Financial PerformanceSuresh PandaNo ratings yet

- Session 5 Financial Statement Analysis Part 1-2Document17 pagesSession 5 Financial Statement Analysis Part 1-2Prakriti ChaturvediNo ratings yet

- Income StatementDocument75 pagesIncome StatementAmitNo ratings yet

- Valoracion EcopetrolDocument66 pagesValoracion EcopetrolNicolas SarmientoNo ratings yet

- FinanceDocument2 pagesFinanceShambhawi SinhaNo ratings yet

- CSB Task 2Document21 pagesCSB Task 2Saumya SarkarNo ratings yet

- Chapter 5Document12 pagesChapter 5RishabhNo ratings yet

- Model FS - PFRS For SMEs (2022)Document17 pagesModel FS - PFRS For SMEs (2022)Joel RazNo ratings yet

- Universidad Cooperativa de Colombia balance sheet and income statement analysisDocument258 pagesUniversidad Cooperativa de Colombia balance sheet and income statement analysisDaisy MartinezNo ratings yet

- Homework-M2Document37 pagesHomework-M2Tinatini BakashviliNo ratings yet

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocument1 pageNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNo ratings yet

- JFC Income StatementDocument2 pagesJFC Income StatementAngelie villanuevaNo ratings yet

- Desi Angelika AP w3Document11 pagesDesi Angelika AP w3DESI ANGELIKANo ratings yet

- Pfizer Income StatementDocument1 pagePfizer Income Statementsean_jaggernauth@philliouselwanes.comNo ratings yet

- COMPANY PROFILE@ Vodafone Description and ReportDocument20 pagesCOMPANY PROFILE@ Vodafone Description and ReportAnkur Dubey100% (4)

- Axis Bank 1Document3 pagesAxis Bank 1Mayank RelanNo ratings yet

- Bayerische Landesbank: Global Detailed FormatDocument23 pagesBayerische Landesbank: Global Detailed FormatRawaaNo ratings yet

- Income Statement - The Coca-Cola Company (KO)Document1 pageIncome Statement - The Coca-Cola Company (KO)vijayNo ratings yet

- Kunci Jawaban Pertemuan 3 - AKM PDFDocument6 pagesKunci Jawaban Pertemuan 3 - AKM PDFYulina Bz.No ratings yet

- Kunci Jawaban Pertemuan 3 - AKMDocument6 pagesKunci Jawaban Pertemuan 3 - AKMYulina Bz.No ratings yet

- Problems P 7 2 Jones Petro Company Reports The Following Consolidated Statement of IncomeDocument5 pagesProblems P 7 2 Jones Petro Company Reports The Following Consolidated Statement of IncomeCharlotteNo ratings yet

- Cash Flow Template AS - 3Document142 pagesCash Flow Template AS - 3Dina100% (1)

- Ar-2019 JKTL141060 2Document1 pageAr-2019 JKTL141060 2Alfian Nur HudaNo ratings yet

- MBA 640 - Week 4 - Final Project Milestone OneDocument3 pagesMBA 640 - Week 4 - Final Project Milestone Onewilhelmina baxterNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Income StatementDocument31 pagesIncome Statementzahraa aabedNo ratings yet

- UAS ANALISIS LAP KEUANGAN DARIUS ULIMPATY-dikonversiDocument8 pagesUAS ANALISIS LAP KEUANGAN DARIUS ULIMPATY-dikonversiIyah LyaNo ratings yet

- The Procter & Gamble Company Consolidated Statements of EarningsDocument5 pagesThe Procter & Gamble Company Consolidated Statements of EarningsJustine Maureen AndalNo ratings yet

- Group work ratios analysisDocument10 pagesGroup work ratios analysisEnizel MontrondNo ratings yet

- Twitter Inc Income Statement AnalysisDocument12 pagesTwitter Inc Income Statement AnalysisDeepika PadukoneNo ratings yet

- HRM732 Final Exam Review Practice Questions SUMMER 2022Document12 pagesHRM732 Final Exam Review Practice Questions SUMMER 2022Rajwinder KaurNo ratings yet

- Case of Bond Valuation Kelompok 1Document2 pagesCase of Bond Valuation Kelompok 1kota lainNo ratings yet

- JUVENTUS H1 2014/15 FINANCIAL REPORTDocument62 pagesJUVENTUS H1 2014/15 FINANCIAL REPORTPradiptoTriNugrohohadiNo ratings yet

- 04 Handout 1Document6 pages04 Handout 1Dong RoselloNo ratings yet

- Financial Institution and MarketDocument9 pagesFinancial Institution and MarketBishnu DhamalaNo ratings yet

- Instructional Materials FOR V: Aluation Concepts and MethodsDocument36 pagesInstructional Materials FOR V: Aluation Concepts and MethodsShahida Rodny NoronaNo ratings yet

- Management Advisory Services (MAS)Document10 pagesManagement Advisory Services (MAS)jaymark canaya50% (2)

- Robert Bosch GMBH - Statement of Financial PositionDocument2 pagesRobert Bosch GMBH - Statement of Financial PositionRamesh GowdaNo ratings yet

- Break Even Point AnalysisDocument11 pagesBreak Even Point AnalysisRose Munyasia100% (2)

- Construction Contracts: Connolly - International Financial Accounting and Reporting - 4 EditionDocument47 pagesConstruction Contracts: Connolly - International Financial Accounting and Reporting - 4 EditionJosette Mae AtanacioNo ratings yet

- Fabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Document28 pagesFabm 2: Quarter 3 - Module 3 Statement of Changes of Equity (SCE) and Cash Flow Statement (CFS)Sharlyn Marie An Noble-Badillo100% (1)

- Management and Cost Accounting: Colin DruryDocument18 pagesManagement and Cost Accounting: Colin DruryYasmine MagdiNo ratings yet

- Ratio Analysis Insights for Business PerformanceDocument30 pagesRatio Analysis Insights for Business PerformanceAayush Agrawal100% (3)

- ULTRA TRADINGDocument16 pagesULTRA TRADINGRonNo ratings yet

- Team Project AnalysisDocument28 pagesTeam Project AnalysisRishabh JainNo ratings yet

- Capital and financial transactionsDocument8 pagesCapital and financial transactionsvyshnaviNo ratings yet

- Perhitungan The Mccloud Company T AccountsDocument3 pagesPerhitungan The Mccloud Company T AccountsLiliNo ratings yet

- Standalone-Financial-Statements ItcDocument79 pagesStandalone-Financial-Statements Itcpriyanka valechha100% (1)

- Historical Financial Forecast ResultsDocument10 pagesHistorical Financial Forecast ResultsÄyušheë TŸagïNo ratings yet

- FI504 Case Study 1 - The Complete Accounting Cycle RevisedDocument16 pagesFI504 Case Study 1 - The Complete Accounting Cycle RevisedBrittini Beyondcompare BridgesNo ratings yet

- Additional ProblemsDocument21 pagesAdditional Problemsdarshan jain0% (1)

- Ratio Analysis AS A Tool OF Financial AnalysisDocument88 pagesRatio Analysis AS A Tool OF Financial AnalysisAnjali PrajapatiNo ratings yet

- Afar.3213 Joint ArrangementsDocument5 pagesAfar.3213 Joint ArrangementsYae'kult VIpincepe QuilabNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Discuss The Impact of Depreciation Expense On The Cash Flow AnalysisDocument2 pagesDiscuss The Impact of Depreciation Expense On The Cash Flow AnalysisDjahan RanaNo ratings yet

- Chapter 9 Audit Procedures and Obtaining EvidenceDocument4 pagesChapter 9 Audit Procedures and Obtaining Evidencekevin digumberNo ratings yet

- Liquid Ratios GuideDocument12 pagesLiquid Ratios GuideMAHI LADNo ratings yet

- Financial Analysis TATA STEElDocument18 pagesFinancial Analysis TATA STEElneha mundraNo ratings yet

- Session 9 - Accounting For Fixed AssetsDocument37 pagesSession 9 - Accounting For Fixed AssetsKashish Manish JariwalaNo ratings yet

- Adrian Paul Mayhay (Engineering Economy) PDFDocument3 pagesAdrian Paul Mayhay (Engineering Economy) PDFMAYHAY, ADRIAN PAULNo ratings yet