Professional Documents

Culture Documents

Us Man Confer Nece Paper

Uploaded by

Adnan KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Us Man Confer Nece Paper

Uploaded by

Adnan KhanCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/320652175

Role of ownership structure in firm R&D investment decision: Evidence from

Chinese high-tech industry

Conference Paper · July 2017

DOI: 10.1109/IEIS.2017.8078624

CITATION READS

1 269

4 authors, including:

Muhammad Usman Rana Umair Ashraf

Beijing Institute of Technology Beijing Institute of Technology

6 PUBLICATIONS 21 CITATIONS 21 PUBLICATIONS 121 CITATIONS

SEE PROFILE SEE PROFILE

All content following this page was uploaded by Rana Umair Ashraf on 17 May 2018.

The user has requested enhancement of the downloaded file.

Role of Ownership Structure in Firm R&D

Investment Decision: Evidence from Chinese High-

tech Industry

Muhammad Usman*, Shufang Xiao, Rana Umair Ashraf, Fenni Lian

School of Management and Economics

Beijing Institute of Technology

Beijing, China

usman@bit.edu.cn

Abstract—This empirical study investigates the influence of Empirical results of our research show that institutional and

institutional and managerial ownership structures on firms’ also managerial ownership structures negatively and

R&D investment decision and also moderating influence of state significantly influence on firm R&D investment. Furthermore,

ownership among their relationship. We collect the data of 244 state ownership has positive moderation role in relation among

firms for the period of 2009 to 2015 from Chinese high-tech institutional ownership of firms with R&D investment of firms

industry. We applied the fixed effect panel data model regression while there is no moderating effect of state ownership in

to test three hypothesis of the study. Empirical results of this relationship among managerial ownership and firm R&D

study show that ownership structures such as institutional and investment. So, this study contributes in the literature by three

also managerial have negatively and significantly influence on

ways. First, this study first time examines the different

firm R&D investment. Furthermore, state ownership has positive

ownership structures effect on firms’ R&D investment in

moderation role in relation of institutional ownership with firm

R&D investment while no moderating effect of state ownership in Chinese high-tech industry. Second, this study investigates the

relationship among managerial ownership and firm R&D moderating role of state ownership. Finally, this study will

spending decision. This study will helps the policy makers to contribute in the literature of emerging economy such as China.

understand the various ownership structures effect firms’ R&D Rest of the paper is designed as that second part is related

investment decisions in Chinese high-tech industry. to literature review and study hypotheses, third part is about

research design, fourth part explains the empirical results of the

Keywords—institutional ownership; managerial ownership;

study and final fifth part presents the conclusion.

state ownership; R&D investment; high-tech industry

I. INTRODUCTION II. LITERATURE REVIEW AND HYPOTHESES

R&D investment is a vital issue and a key factor for firm Ownership structure is one of the key factors to determine

performance. As growing importance and worldwide corporate governance of a firm [3]. Most of the previous

recognition of extensive benefits of R&D activities, Chinese literature examined the effect of various kinds of ownership

firms also moves towards innovation strategies and allocate structures on firms’ performance, earnings management and

more investment in R&D projects. Regarding different stock market reactions [3]. But only few empirical studies

contrasting research results, firstly this study suggests and investigate the relationship of different ownership structures

investigates the relationship of institutional and managerial with firms’ R&D expenditures [4]. For instance, few studies

ownership structures with firm R&D investment. Especially in examined role of institutional ownership in firm R&D

an emerging economy, institutional structure has an impact on investment. Our study fills such gap by inspecting the impact

firm performance through mechanism of decision making and of institutional ownership, top management team ownership

choices of different strategies [1]. Currently institutional factor and state or non-state ownership structure on firms’ R&D

as ownership structure gains scholarly attention in the relation investment decision in China’s A-share listed firms of high-

of firm innovation policy. China has various kinds of tech industry.

ownership structures as state and non-state-owned enterprises A. Institutional Ownership and Firm R&D Investment

known as SOEs and non-SOEs respectively. In china state-

In recent decades, institutional investors emerged as very

owned enterprises have different orientation of strategies as

powerful ‘blockholders’ to effect positively on firm

compare to non-state-owned enterprises, how they designed

performance through discipline and monitoring of corporate

corporate governance system and utilize resources for R&D

managers and also influence firm strategy formulation about

investment [2]. Thus, secondly this study examines the R&D investment and diversification [5]. Although there is

moderating role of state ownership in relationship of previous research about effects of institutional ownership over

institutional and managerial ownership with firms’ R&D firms’ R&D strategy, it is extensive but still not conclusive [6].

investment.

978-1-5386-0995-8/17/$31.00 2017 IEEE

As most of the researchers found positive effects of the Chinese government extensively introducing a series of market

institutional ownership on firm R&D expenditure [7]. reforms to promote investment structure and to encourage

institutional investors for industrial innovation.

Whereas, in US and UK short-termism kind of institutional

ownership is also exist, which has negative impact on firm Moreover, in China ownership under state exhibits lagged

R&D investment [8]. So, institutional investors have different positive impacts on firm innovation performance [17]. So,

objectives and can reduce corporate R&D. Other than these based on prior research, our study argument is that the state

findings, in comparison firms of institutional ownership with ownership could play a role of moderation in relation among

dispersed ownership; it was found no significant influence of institutions and managerial ownerships impact on firm

blockholders on firm R&D strategy [9]. In this situation, that innovation. Our argument is based on two reasons. First, SOEs

will be very interesting to test influence of institutional in China have many advantages of utilizing R&D resources

ownership on firms’ R&D investment in transitional and due to direct political connections, easy access of government

emerging economy such as China, where ownership structure financing, distribution channels, tax credits and various other

and corporate governance conditions are very different from government subsidies [18]. Second, almost all Chinese

developed economies. Thus, based on previous literature we research institutes and universities are managed and controlled

propose in our study the following first hypothesis. by government, so such linkage of research institution with

SOEs encourage and support institutional and managerial

H1: Institutional ownership structure significantly influence ownerships firms to enhance their investment in firms’ R&D

firms’ R&D investment. projects [16]. Thus, our study proposes the following third

B. Top Management Team Ownership and Firm R&D hypothesis.

Investment H3: State ownership positively moderates the influence of

Top management team (TMT) ownership is also known as institutional and top management team (TMT) ownership on

insider or managerial ownership. Most of the previous research firms’ R&D investment.

on agency theory focused on managerial ownership to mitigate

agency cost and to enhance firm performance [10]. In contrast, III. RESEARCH METHODOLOGY

this study inspects the effect of managerial ownership on firms’ A. Data and Methodology

R&D investment. Top management will always reluctant to

spend resources in R&D strategy because innovation projects To test our study hypotheses, we select the A-share listed

are long-term and high risk of failure which effect firm short- firms at Shanghai and Shenzhen stock exchanges. We collect

term profit returns [11]. Thus, there will be a high risk of the data from 15 different kinds of high-tech industries as

immediate employment lose due to risky R&D projects. defined by the prior researchers and ‘China Securities

Regulatory Commission’ (CSRS) report. We used two main

Firm financial performance based on its evaluation and Chinese data bases, named as China Stock Market &

control system such as rate of investments’ return, so Accounting Research (CSMAR) and Wind to collect our

management more likely of behavior to select short-term required variables data of the study for the period of 2009 to

projects rather than long-term innovation projects which may 2015. Our study does not include high-tech firms belong to ST

harm current year profitability [12]. Several researchers argued and *ST because these firms have special accounting

that management focus more on to meet investors’ expectations treatment. We also exclude the firms which has yearly missing

of stock prices thus such short-term approach of stockholders data. Thus, finally we get the balanced panel data of 244 high-

may lead management to short-term horizon and as a result top tech firm with total 1708 (2009-2015) yearly number of

managers will reduce R&D investments [13]. Thus, based on observations data. Our data is a balanced panel so follow panel

prior literature we expect and prose the following hypothesis. data analysis techniques. There are two basic panel data models

H2: Top management team ownership structure has fixed effect and random effect. We use the Hausman test to

negative influence on firms’ R&D investment. choose the one appropriate model. Hausman test value 19.90

(0.0058) is significant at 1% level of significance. Thus, we

C. Moderating Role of State Ownership reject and cannot accept null hypothesis, so we select and

Government or state ownership positively influences firm accept alternative hypothesis which is that fixed effect model is

performance both in case of developed economies, as well as an appropriate model for regression analysis. We use the

transitional or emerging economies [14]. In China there are two Stata.12 version for performing our data analysis.

main categories of ownerships which are known as state-owned B. Regression Models and Variables of the Study

enterprises (SOEs) and non-state-owned enterprises (Non-

SOEs). In transitional economies like China, governments play We have developed five equations models to test influence

an important role of promoting innovation strategies in of institutions and managerial ownerships on firms’ innovation

different industries. Broad and extensive government policies and the moderating role of state ownership. First three

and long-term objectives encourage firms’ innovation equations used to test H1 and H2 while fourth and fifth

strategies [15]. For instance, in China state-owned enterprises equations test the H3. The empirical research models of this

have various incentives and direct access to key infrastructure study are as follow:

resources that support firms’ innovation strategies [15]. RD = α +β1 SOF +β 2 CF+β3 FP +β4 GRW+β5 LEV +β6 AG

Chinese state-owned enterprises actively pursue government +β7 IDM +β8 YDM +ε (1)

science and technology (S&T) policies [16]. Currently,

RD = α +β1 IOWN+β2 SOF +β3 CF+β4 FP +β5 GRW+β6 Dummy variables equal to 1 in case of firm is owned by state

LEV +β7 AG +β8 IDM +β9 YDM +ε (2) or then zero otherwise. Controlling variables: Firm size (SOF)

RD = α +β1 IOWN+β2 MOWN +β3 SOF +β4 CF+β5 FP +β6 = Log value of firm total assets. Firm profitability (FP) = Firm

GRW+β7 LEV +β8 AG +β9 IDM +β10 YDM +ε (3) total annual sales divided by total assets. Growth opportunities

(GRW) = Current fiscal year ratio of market over book equity.

RD = α +β1 IOWN+β2 MOWN +β3 STOWN +β4 SOF +β5 Leverage (LEV) = Firm total liabilities at its book value

CF+β6 FP +β7 GRW+β8 LEV +β9 AG +β10 IDM +β11 YDM divided by total firm’s assets. Firm age (AG) = Number of total

+ε (4) years since the firm is performing operations in industry.

RD = α +β1 IOWN+β2 MOWN +β3 STOWN Industry dummies (IDM) = Dummy variables are created for

+β4IOWN*STOWN +β5 MOWN*STOWN +β6 SOF +β7 controlling industry effect. Year dummies (YDM) = Dummy

CF+β8 FP +β9 GRW+β10 LEV +β11 AG +β12 IDM +β13 variables are created for controlling different years effect.

YDM +ε (5)

IV. RESULTS OF DATA ANALYSIS

Independent variable: Research and development (RD) =

Firm current year research & development (R&D) expenditures A. Descriptive Statistics

are divided by firm total sales. Dependent variables: Table I explains our study descriptive statistics such as

Institutional ownership (IOWN) = Percentage of firm shares mean values, standard deviation values and correlation of all

under the ownership of institutional investors. Top key variables of the study. As all values are lower than 5

management team ownership (MOWN) = Percentage of firm which meets the minimum standard of that there is no problem

shares under the ownership of top management team of the of multicollinearity issue in this study variables.

firm. Moderating variable: State ownership (STOWN) =

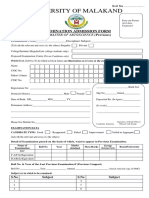

TABLE I. SUMMARY STATISTICS AND CORRELATION

Descriptive Statistics and Correlation Analysis

Variables

Obs. Mean SD 1 2 3 4 5 6 7 8 9

1. RD 1708 7.559804 11.39422 1

2. IOWN 1708 37.5179 22.45323 -0.0695 1

3. MOWN 1708 1.863159 7.383577 -0.0482 -0.0015 1

4. STOWN 1708 .3811475 .4858109 -0.0865 0.3466 -0.0103 1

5. SOF 1708 9.486264 .610796 -0.0681 0.3586 -0.0323 0.3127 1

6. FP 1708 47.19891 19.46919 -0.1493 0.1594 0.0170 0.2005 0.0749 1

7.LEV 1708 38.64881 21.93179 -0.0989 0.2272 -0.0160 0.4031 0.4852 0.2774 1

8.GRW 1708 310.5702 296.3426 -0.0377 0.0866 0.0073 0.0728 -0.1571 0.0853 0.0887 1

9.AG 1708 14.42974 4.595697 -0.0324 0.1234 0.0271 0.1725 0.1386 0.1315 0.2344 0.0283 1

Note: The ***, ** and * represents level of significance at 1%, 5% and 10% respectively

B. Regression Results ownership with firms’ R&D investment while there is no

moderating effect of state ownership in relation between

Table II shows the five different regression models results. managerial ownership and firms’ R&D investment.

In first model we enter all the controlling variables including

industry and year dummy variables. There is 19.96% predict V. CONCLUSION

power of the first model. In second model we enter the This study presents the importance of different ownership

institutional ownership variable along with all controlling structures influence on firm innovation decision. Our study

variables. It proves our first hypothesis that institutional main focus is institutional and managerial ownership structures

ownership significantly influence on firms’ R&D investment effect over the investment decision of firms’ R&D. We conduct

but this effect in our study is negative. The overall predict this empirical study on Chinese high-tech companies and

power of the second model is increased from first model as its explore the ownership structures influence on firm innovation

R-square value is 20.17%. In third model we enter the strategies. Empirical results findings explain that the

institutional ownership with managerial ownership variables institutional and also the managerial ownership structures are

along with all controlling variables. It proves our second significantly and negatively influence on firms’ R&D

hypothesis that managerial ownership significantly and investment. State ownership plays positive role of moderation

negatively effect on firms’ R&D investment. in relation among the institutions’ ownership of firms and

The overall predict power of the third model is increased firms’ R&D investment while no evidence of moderating

from first and second models as its R-square value is 20.62%. effects of state ownerships among the connection of managerial

In fourth and fifth models of the study, we test the moderating ownership of firms with firms’ R&D investment.

impact of state ownership. Results show that state ownership R&D investment planning in firms is associated with many

has positive moderation role among the relation of institutional different issues such as these kinds of investments are

associated with high level of risks, long term and huge experimental testing of study hypotheses and shows in different

financial resources are required. Most importantly, R&D kinds of ownership structures firms’ management attitude and

investment decisions can detrimentally influence the current behavior are different about R&D investment decisions. In

year of profit performance of the firm. On the basis of these all case, China’s state and non-state categories of enterprises are

issues the different ownership structures of firms have different also important to influence relationships among ownership

approaches and behavior about such risky and also long-term structures and firms’ decision about R&D.

investments. Our study proves these theoretical findings by our

TABLE II. REGRESSION RESULTS

Regression Results of Five Models

Variables

Model 1 Model 2 Model 3 Model 4 Model 5

Constant -1.60388 -4.834995 .7043845 4.897301 4.155852

SOF -.0556113 * 1.752878** 1.737193* 1.76884** 1.722008*

FP -.0556113*** -.0557638*** -.0541691*** -.0537093*** -.0543017***

LEV -.0199389 -.0160982 -.0140228 -.016019 -.0140968

GRW .0005846 .0006568 .0006666 .0007005 .0005999

AG -.2883511 -.3030756 -.7687697 -1.107333 -.9394975

IOWN -.0376283* -.0365109* -.0347159* -.0556553**

MOWN -.1022973*** -.1026895*** -.0914817**

STOWN -2.097927 -4.815854

IOWN*STOWN .0697257*

MOWN*STOWN -.0312726

IDM Yes Yes Yes Yes Yes

YDM Yes Yes Yes Yes Yes

R-Square 0.1996 0.2017 0.2062 0.2068 0.2084

Note: The ***,**,* show level of significance at 1%, 5% and 10% level of significance

First, our study findings contribute in the literature about [5] D. Del Guercio and J. Hawkins, “The motivation and impact of pension

how the role of different ownership structures can be fund activism,” Journal of financial economics, vol. 52, no. 3, pp. 293-

340, 1999.

influenced the firms’ R&D investment decisions and how

[6] J. A. Tribo, P. Berrone, and J. Surroca, “Do the type and number of

moderation role plays by the state ownership. Secondly, our blockholders influence R&D investments? New evidence from Spain,”

study will be helpful for policy makers in China to understand Corporate Governance: An International Review, vol. 15, no. 5, pp.

the various ownership structures and their influence on the 828-842, 2007.

decision of firms’ R&D investment in Chinese high-tech [7] P. Aghion, J. Van Reenen, and L. Zingales, “Innovation and institutional

industry. Our study about empirical investigation of such ownership,” The American Economic Review, vol. 103, no. 1, pp. 277-

relation limited to the three kinds of ownership structures only. 304, 2013.

Thus, future studies can include foreign investors’ ownership [8] E. Jones and J. Danbolt, “R&D project announcements and the impact of

ownership structure,” Applied Economics Letters, vol. 10, no. 14, pp.

impact on firms’ technology innovation. 933-936, 2003.

[9] C. G. Holderness and D. P. Sheehan, “The role of majority shareholders

in publicly held corporations: An exploratory analysis,” Journal of

REFERENCES Financial Economics, vol. 20, no. 1-2, pp. 317-346, 1988.

[10] M. C. Jensen and W.H. Meckling, “Theory of the firm: Managerial

[1] M. W. Peng, “Towards an institution-based view of business strategy,”

behavior, agency costs and ownership structure,” Journal of Financial

Asia Pacific Journal of Management, vol. 19, no. 2, pp. 251-267, 2002.

Economics, vol. 3, no. 4, pp. 305-360, 1976.

[2] L. A. Jiang, D.S. Waller, and S. Cai, “Does ownership type matter for

[11] E. Mansfield, R&D and innovation: some empirical findings, Chicago:

innovation? Evidence from China,” Journal of Business Research, vol.

University of Chicago Press, 1984, pp. 127-154.

66, no. 12, pp. 2473-2478, 2013.

[12] B. D. Baysinger, R. D. Kosnik, and T. A. Turk, “Effects of board and

[3] F. A. Gul, J. B. Kim, and A. A. Qiu, “Ownership concentration, foreign

ownership structure on corporate R&D strategy,” Academy of

shareholding, audit quality, and stock price synchronicity: Evidence

Management Journal, vol. 34, no. 1, pp. 205-214, 1991.

from China,” Journal of Financial Economics, vol. 95, no. 3, pp. 425-

442, 2010. [13] K. A. Froot, A. F. Perold, and J. C. Stein, “Shareholder trading practices

and corporate investment horizons,” Journal of Applied Corporate

[4] P. David, M. A. Hitt, and J. Gimeno, “The influence of activism by

Finance, vol. 5, no. 2, pp. 42-58, 1992.

institutional investors on R&D,” Academy of Management Journal, vol.

44, no. 1, pp. 144-157, 2001. [14] Q. Sun, W. H. Tong, and J. Tong, “How does government ownership

affect firm performance? Evidence from China’s privatization

experience,” Journal of Business Finance & Accounting, vol. 29, no. 1- [17] S. B. Choi, S. H. Lee, and C. Williams, “Ownership and firm innovation

2, pp. 1-27, 2002. in a transition economy: Evidence from China,” Research Policy, vol.

[15] S. J. Chang, C. N. Chung, and I. P. Mahmood, “When and how does 40, no. 3, pp. 441-452, 2011.

business group affiliation promote firm innovation? A tale of two [18] P. Boeing, E. Mueller, and P. Sandner, “China's R&D explosion—

emerging economies,” Organization science, vol. 17, no. 5, pp. 637-656, Analyzing productivity effects across ownership types and over time,”

2006. Research Policy, vol. 45, no. 1, pp. 159-176, 2016.

[16] K. Motohashi and X. Yun, “China's innovation system reform and

growing industry and science linkages,” Research Policy, vol. 36, no. 8,

pp. 1251-1260, 2007.

View publication stats

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- CH 4 Research Philosophies & Approaches - pp04-1Document17 pagesCH 4 Research Philosophies & Approaches - pp04-1Abhinav Barik100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- MA MSC PreviousDocument2 pagesMA MSC PreviousAdnan KhanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Tax Letter 71423 13 PDFDocument1 pageTax Letter 71423 13 PDFAdnan KhanNo ratings yet

- Cost Systems and Cost Accumulation: Multiple ChoiceDocument26 pagesCost Systems and Cost Accumulation: Multiple ChoiceAdnan KhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Judicial Review of Legislative ActionDocument14 pagesJudicial Review of Legislative ActionAnushka SinghNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 7 кмжDocument6 pages7 кмжGulzhaina KhabibovnaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFDocument59 pages7 CAAT-AIR-GM03 Guidance-Material-for-Foreign-Approved-Maintenance-Organization - I3R0 - 30oct2019 PDFJindarat KasemsooksakulNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- DB - Empirically Based TheoriesDocument3 pagesDB - Empirically Based TheoriesKayliah BaskervilleNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Signal&Systems - Lab Manual - 2021-1Document121 pagesSignal&Systems - Lab Manual - 2021-1telecom_numl8233No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sikarep® Microcrete-4: Product Data SheetDocument2 pagesSikarep® Microcrete-4: Product Data Sheetsidharthsud28No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- United States Court of Appeals, Third CircuitDocument8 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Bike Chasis DesignDocument7 pagesBike Chasis Designparth sarthyNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Atlantean Dolphins PDFDocument40 pagesAtlantean Dolphins PDFBethany DayNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- EMP Step 2 6 Week CalendarDocument3 pagesEMP Step 2 6 Week CalendarN VNo ratings yet

- Horgolás Minta - PulcsiDocument5 pagesHorgolás Minta - PulcsiCagey Ice-RoyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Does Social Media Influence Consumer Buying Behavior An Investigation of Recommendations and PurchasesDocument7 pagesDoes Social Media Influence Consumer Buying Behavior An Investigation of Recommendations and Purchasesyash_28No ratings yet

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Document2 pagesLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossNo ratings yet

- Surat Textile MillsDocument3 pagesSurat Textile MillsShyam J VyasNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- What Can Tesla Learn From Better Place's FailureDocument54 pagesWhat Can Tesla Learn From Better Place's Failuremail2jose_alex4293No ratings yet

- Inventory Management Final ProjectDocument65 pagesInventory Management Final ProjectMAHESH MUTHYALANo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Filipino Chicken Cordon BleuDocument7 pagesFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorNo ratings yet

- TCS Digital - Quantitative AptitudeDocument39 pagesTCS Digital - Quantitative AptitudeManimegalaiNo ratings yet

- Analysis of Pipe FlowDocument14 pagesAnalysis of Pipe FlowRizwan FaridNo ratings yet

- Army War College PDFDocument282 pagesArmy War College PDFWill100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- RulesDocument508 pagesRulesGiovanni MonteiroNo ratings yet

- Agitha Diva Winampi - Childhood MemoriesDocument2 pagesAgitha Diva Winampi - Childhood MemoriesAgitha Diva WinampiNo ratings yet

- Pesticides 2015 - Full BookDocument297 pagesPesticides 2015 - Full BookTushar Savaliya100% (1)

- Effect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentDocument10 pagesEffect of Innovative Leadership On Teacher's Job Satisfaction Mediated of A Supportive EnvironmentAPJAET JournalNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Baybay - Quiz 1 Code of EthicsDocument2 pagesBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.No ratings yet

- Seven Seas of CommunicationDocument2 pagesSeven Seas of Communicationraaaj500501No ratings yet

- Hoc Volume1Document46 pagesHoc Volume1nordurljosNo ratings yet

- Jesus Hold My Hand EbDocument2 pagesJesus Hold My Hand EbGregg100% (3)

- Garden Club of Virginia RestorationsDocument1 pageGarden Club of Virginia RestorationsGarden Club of VirginiaNo ratings yet

- G.R. No. 186450Document6 pagesG.R. No. 186450Jose Gonzalo SaldajenoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)