Professional Documents

Culture Documents

JuhaynaFoodIndustries irol-fundBalanceA

Uploaded by

Shokry Amin0 ratings0% found this document useful (0 votes)

13 views13 pagesOriginal Title

JuhaynaFoodIndustries_irol-fundBalanceA - Copy

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views13 pagesJuhaynaFoodIndustries irol-fundBalanceA

Uploaded by

Shokry AminCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 13

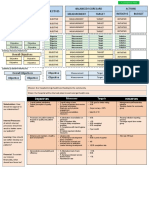

<strong>Juhayna Food Industries</strong><br/><span>Annual Balance

Sheet</span><Table Border="1"><table width="100%" cellpadding="5" cellspacing="0"

class="ccbnRowHoverTbl" Border="1"><tr class="ccbnBgTblTtl"><td align="left"><span

class="ccbnTblTtl">Period Ended</span></td><td align="right"><span

class="ccbnTblTtl">12/31/15</span></td><td align="right"><span

class="ccbnTblTtl">12/31/14</span></td><td align="right"><span

class="ccbnTblTtl">12/31/13</span></td><td align="right"><span

class="ccbnTblTtl">12/31/12</span></td><td align="right"><span

class="ccbnTblTtl">12/31/11</span></td></tr><tr class="ccbnBgTblSubTtl"><td

align="left"> </td><td align="right"><span

class="ccbnTblSubTtl">Update</span></td><td align="right"><span

class="ccbnTblSubTtl">Update</span></td><td align="right"><span

class="ccbnTblSubTtl">Update</span></td><td align="right"><span

class="ccbnTblSubTtl">Update</span></td><td align="right"><span

class="ccbnTblSubTtl">Update</span></td></tr><tr class="ccbnBgTblSubTtl"><td

align="left"> </td><td align="right"><span

class="ccbnTblSubTtl">02/11/16</span></td><td align="right"><span

class="ccbnTblSubTtl">02/03/16</span></td><td align="right"><span

class="ccbnTblSubTtl">02/03/16</span></td><td align="right"><span

class="ccbnTblSubTtl">02/03/16</span></td><td align="right"><span

class="ccbnTblSubTtl">02/03/16</span></td></tr><tr class="ccbnBgTblSubTtl"><td

width="100%" align="left" colspan="6"><span class="ccbnTblSubTtl">In millions of

EGP<br />(except for per share items)</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Cash</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">71.37</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">43.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">12.49</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">14.56</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Cash & Equivalents</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">723.55</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">376.51</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">558.40</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">509.22</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">688.41</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Short Term Investments</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">240.03</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Cash and Short Term

Investments</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">794.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">420.11</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">570.88</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">763.81</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">688.41</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Accounts Receivable - Trade,

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">73.04</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">80.65</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">86.16</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">83.30</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">73.32</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Provision for Doubtful

Accounts</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">-8.57</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">-16.63</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">-14.51</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">-

16.66</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">-17.47</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Accounts Receivable - Trade,

Net</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">64.47</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">64.03</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">71.65</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">66.64</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">55.84</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Notes Receivable - Short

Term</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">16.93</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">33.63</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">8.39</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Receivables - Other</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">90.48</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">80.22</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">74.69</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">79.82</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">133.65</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Total Receivables,

Net</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">171.88</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">177.87</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">154.73</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">146.46</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">189.49</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Inventories - Finished

Goods</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">235.82</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">215.30</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">193.21</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">127.50</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">121.41</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Inventories - Work In

Progress</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.98</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.01</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Inventories - Raw

Materials</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">127.96</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">151.87</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">259.27</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">81.19</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">129.48</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Inventories - Other</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">243.10</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">190.35</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">163.71</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">131.93</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">146.29</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Total Inventory</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">606.88</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">557.52</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">616.19</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">347.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">397.18</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Prepaid Expenses</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">16.13</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">17.70</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">36.55</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Restricted Cash -

Current</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">5.05</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">5.05</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.04</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Discountinued Operations - Current

Asset</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">50.93</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.54</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">3.00</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Other Current Assets,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">50.93</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">5.05</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">5.05</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.58</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">3.00</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Current

Assets</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,640.73</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">1,178.26</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,383.40</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">1,264.44</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,278.09</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Buildings - Gross</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,156.95</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">753.15</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">637.90</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">502.50</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Land / Improvements -

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">209.23</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">199.60</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">151.79</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">124.01</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Machinery / Equipment -

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2,253.07</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,825.51</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1,644.92</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,451.15</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Construction in Progress -

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">430.87</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,067.15</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1,071.43</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">530.58</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">195.15</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Other Property / Plant / Equipment -

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">85.37</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">77.84</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">62.44</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">53.67</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Property / Plant / Equipment, Total -

Gross</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">4,135.48</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">3,923.24</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">3,568.48</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2,661.90</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">195.15</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Accumulated Depreciation,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">-943.34</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">-761.73</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">-798.07</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">-

651.60</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Property / Plant / Equipment,

Total - Net</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">3,246.51</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">3,187.93</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">2,818.50</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2,039.89</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,543.03</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Goodwill, Net</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">97.09</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">97.09</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">97.09</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">97.09</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">97.09</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">LT Investment - Affiliate

Companies</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">10.15</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">50.93</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">47.66</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">43.11</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">42.33</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Long Term

Investments</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">10.15</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">50.93</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">47.66</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">43.11</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">42.33</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Other Long Term Assets</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.77</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.78</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.79</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.80</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.81</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Other Long Term Assets,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.77</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.78</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.79</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.80</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.81</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Assets</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">4,995.26</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">4,515.00</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">4,347.44</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">3,445.34</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">2,961.34</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Accounts Payable</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">197.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">140.40</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">130.74</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">134.87</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">73.57</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Payable / Accrued</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">18.37</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">27.13</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">32.44</span></td><td

align="right" valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--

</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Accrued Expenses</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">68.14</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">66.59</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">53.12</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">55.79</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">40.38</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Notes Payable / Short Term

Debt</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">671.35</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">779.63</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">792.75</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">406.22</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">514.77</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Current Portion of Long Term

Debt / Capital Leases</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">247.35</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">254.16</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">256.90</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">152.03</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">131.81</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Dividends Payable</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.00</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.01</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.70</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.13</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.67</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Customer Advances</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.61</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">5.00</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">4.08</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1.16</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">2.23</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Income Taxes Payable</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">92.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">77.22</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">69.06</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">43.07</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">12.82</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Other Payables</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">4.68</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">2.83</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1.97</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">35.34</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">31.77</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Other Current

Liabilities</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">11.96</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">8.57</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">10.09</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">11.55</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">7.60</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Other Current liabilities,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">116.17</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">93.63</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">85.90</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">91.25</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">55.08</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Current

Liabilities</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,318.98</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">1,361.53</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,351.85</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">840.16</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblHighlight">815.61</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Long Term Debt</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,013.34</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">705.70</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">675.11</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">525.64</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">252.50</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Total Long Term

Debt</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,013.34</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">705.70</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">675.11</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">525.64</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">252.50</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Total Debt</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,932.04</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,739.48</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1,724.76</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,083.89</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">899.08</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Deferred Income Tax – Long Term

Liability</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">154.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">74.84</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">66.95</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">51.97</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">36.07</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Deferred Income

Tax</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">154.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">74.84</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">66.95</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">51.97</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">36.07</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Minority Interest</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.82</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.76</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.64</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.52</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.41</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Other Long Term

Liabilities</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">85.40</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">88.48</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">89.21</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">38.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">44.96</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Other Liabilities,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">85.40</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">88.48</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">89.21</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">38.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">44.96</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total

Liabilities</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">2,573.14</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">2,231.31</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">2,183.76</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">1,457.22</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,149.55</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Common Stock</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">941.41</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">706.05</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">706.05</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">726.42</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Common Stock,

Total</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">941.41</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">706.05</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">706.05</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">726.42</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Additional Paid-In

Capital</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">330.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">330.92</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">330.92</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">330.92</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">404.50</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Retained Earnings (Accumulated

Deficit)</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,149.80</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,011.37</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1,126.71</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">951.15</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">774.82</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Treasury Stock -

Common</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">--</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">--</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.00</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">-93.94</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Equity</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">2,422.13</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">2,283.69</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">2,163.68</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">1,988.12</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">1,811.79</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Liabilities &

Shareholders' Equity</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">4,995.26</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">4,515.00</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">4,347.44</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">3,445.34</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">2,961.34</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLnk"><span class="ccbnTblTxt">Shares Outstanding - Common Stock

Primary Issue</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">941.41</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">941.41</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">968.55</span></td></tr>

<tr><td colspan="6"><table width="100%"

cellpadding="0" cellspacing="0" Border="1"><tr

class="ccbnBgLine"><td></td></tr></table></td></tr>

<tr class="ccbnBgTblHighlight"><td

class="ccbnBgTblHighlightLnk"><span class="ccbnTblTxt">Total Common Shares

Outstanding</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">941.41</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblHighlight">941.41</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblHighlight">941.41</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblHighlight">968.55</span></td></tr>

<tr class="ccbnBgSpacer">

<td colspan="6"></td>

</tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Treasury Shares - Common Stock

Primary Issue</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.00</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.00</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">27.15</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">--</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Deferred Revenue -

Current</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.61</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">5.00</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">4.08</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1.16</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">2.23</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Deferred Revenue - Long

Term</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">15.56</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">3.48</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">5.22</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">6.95</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">8.69</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Total Current Assets less

Inventory</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,033.86</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">620.74</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">767.21</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">916.84</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">880.91</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Quick Ratio</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">.78</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.46</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">.57</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1.09</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1.08</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Current Ratio</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1.24</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">.87</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1.02</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1.51</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1.57</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Net Debt</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,137.94</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,320.13</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">1,154.52</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">320.60</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">211.07</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Tangible Book

Value</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2,325.03</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">2,186.60</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">2,066.59</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">1,891.03</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1,714.70</span></td></tr>

<tr class="ccbnBgTblTxt"><td

class="ccbnBgTblLabelLnk"><span class="ccbnTblTxt">Tangible Book Value per

Share</span></td><td align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2.47</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">2.32</span></td><td align="right"

valign="top" nowrap="nowrap"><span class="ccbnTblTxt">2.20</span></td><td

align="right" valign="top" nowrap="nowrap"><span

class="ccbnTblTxt">2.01</span></td><td align="right" valign="top"

nowrap="nowrap"><span class="ccbnTblTxt">1.77</span></td></tr></table></Table>

You might also like

- MRP SampleDocument11 pagesMRP SampleShokry AminNo ratings yet

- Answer of Question# 1: About The Brand: HistoryDocument5 pagesAnswer of Question# 1: About The Brand: HistoryShokry AminNo ratings yet

- Part 1Document58 pagesPart 1Shokry AminNo ratings yet

- Final Exam Answers: Shokry Ahmed AminDocument13 pagesFinal Exam Answers: Shokry Ahmed AminShokry AminNo ratings yet

- Answers of Chapter-08 PerformanceDocument6 pagesAnswers of Chapter-08 PerformanceShokry AminNo ratings yet

- Answers of Chapter-04-Job AnalysisDocument6 pagesAnswers of Chapter-04-Job AnalysisShokry AminNo ratings yet

- Answers of chapter-02-HR Strategic PlanningDocument12 pagesAnswers of chapter-02-HR Strategic PlanningShokry AminNo ratings yet

- A Brief History of The Balanced ScorecardDocument6 pagesA Brief History of The Balanced ScorecardShokry AminNo ratings yet

- Answers of chapter-01-HR ChallengeDocument10 pagesAnswers of chapter-01-HR ChallengeShokry AminNo ratings yet

- Budget Balanced Scorecard Measurement Target Actions Initiative Strategy Map ObjectivesDocument3 pagesBudget Balanced Scorecard Measurement Target Actions Initiative Strategy Map ObjectivesShokry AminNo ratings yet

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocument50 pagesApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminNo ratings yet

- Unilever HR Project Presentation Group MDocument55 pagesUnilever HR Project Presentation Group MShokry AminNo ratings yet

- HR BSC Case StudyDocument10 pagesHR BSC Case StudyShokry AminNo ratings yet

- Juhayna Food Industries: in Millions of EGP (Except For Per Share Items)Document11 pagesJuhayna Food Industries: in Millions of EGP (Except For Per Share Items)Shokry AminNo ratings yet

- Corporate Governors:: Name Nationality Title StatusDocument12 pagesCorporate Governors:: Name Nationality Title StatusShokry AminNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Beatriz Milhazes Interview: There Is Nothing Simple About What I'm Doing'Document2 pagesBeatriz Milhazes Interview: There Is Nothing Simple About What I'm Doing'C_RigbyNo ratings yet

- A Journey Thru NakshatrasDocument73 pagesA Journey Thru NakshatrasRohit Sharma83% (12)

- Everything About Rest Between Sets PDFDocument2 pagesEverything About Rest Between Sets PDFamirreza jmNo ratings yet

- CIR vs. Magsaysay LinesDocument11 pagesCIR vs. Magsaysay LinesIan LastNo ratings yet

- HorizonView ReferencePorts v1Document5 pagesHorizonView ReferencePorts v1Bahman MirNo ratings yet

- Medico LegalDocument7 pagesMedico LegalJanice Alvarez Gacusan Abbas100% (1)

- Flushing of An Indwelling Catheter and Bladder Washouts KnowbotsDocument5 pagesFlushing of An Indwelling Catheter and Bladder Washouts KnowbotsTanaman PeternakanNo ratings yet

- Kingdeli Adhesive Catalogue 2020Document21 pagesKingdeli Adhesive Catalogue 2020Md Farid AhmedNo ratings yet

- People Vs AbellaDocument12 pagesPeople Vs AbellaRaymond SanchezNo ratings yet

- Macbeth Lesson PlanDocument2 pagesMacbeth Lesson Planrymahoney10No ratings yet

- Rodriguez Pinto v. Cirilo Tirado, 1st Cir. (1993)Document27 pagesRodriguez Pinto v. Cirilo Tirado, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- Unit IV KerberosDocument13 pagesUnit IV KerberosChinamayi ChinmayiNo ratings yet

- PANELDocument2 pagesPANELFabian SolanoNo ratings yet

- Nwaneho Ozioma EstherDocument4 pagesNwaneho Ozioma EstherOziomaNo ratings yet

- Employee Productivity and Organizational Performance Evidence From Pharmaceutical Firms in NigeriaDocument9 pagesEmployee Productivity and Organizational Performance Evidence From Pharmaceutical Firms in NigeriaEditor IJTSRDNo ratings yet

- Shortcomings of The Current Approaches in TH Pre-Service and In-Service Chemistry Teachers TrainingsDocument5 pagesShortcomings of The Current Approaches in TH Pre-Service and In-Service Chemistry Teachers TrainingsZelalemNo ratings yet

- JCB 3CX - 4CX - 214 - 214e - 215 - 217-1Document25 pagesJCB 3CX - 4CX - 214 - 214e - 215 - 217-1lahcen boudaoud100% (6)

- Duty and Power To Address Corruption PDFDocument26 pagesDuty and Power To Address Corruption PDFLau Dreyfus ArbuluNo ratings yet

- 9 Budgets - Budgetary ControlDocument10 pages9 Budgets - Budgetary ControlLakshay SharmaNo ratings yet

- Contemporary Issues in SCM - Vaishali AgarwalDocument21 pagesContemporary Issues in SCM - Vaishali AgarwalNorman SuliNo ratings yet

- AN APPRAISAL OF POPE LEO XIIIS AETERNI PatrisDocument59 pagesAN APPRAISAL OF POPE LEO XIIIS AETERNI PatrisCharles MorrisonNo ratings yet

- AnalogiesDocument12 pagesAnalogiesAamir HussainNo ratings yet

- Blackpink Interview in Rolling StoneDocument8 pagesBlackpink Interview in Rolling StoneNisa Adina RNo ratings yet

- Full Download Financial Accounting 17th Edition Williams Test BankDocument35 pagesFull Download Financial Accounting 17th Edition Williams Test Bankmcalljenaevippro100% (43)

- A Detailed Lesson PlanDocument8 pagesA Detailed Lesson PlanCris LoretoNo ratings yet

- Audi 01J Multitronic CVTDocument99 pagesAudi 01J Multitronic CVTenes_br95% (21)

- Questionnaire Survey About Life Quality of Students in Can Tho CityDocument6 pagesQuestionnaire Survey About Life Quality of Students in Can Tho CityTrọng TrầnNo ratings yet

- 10th STD Science Lesson Plan LDocument31 pages10th STD Science Lesson Plan Lyotoheg662No ratings yet

- SLA Position Paper FinalDocument11 pagesSLA Position Paper FinalLina Shehu100% (1)

- Aremonte Barnett - Beowulf Notetaking GuideDocument4 pagesAremonte Barnett - Beowulf Notetaking Guideapi-550410922No ratings yet