Professional Documents

Culture Documents

FSA Ratio Analysis

Uploaded by

Muskan Hazra0 ratings0% found this document useful (0 votes)

20 views22 pagesRatio Analysis

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRatio Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views22 pagesFSA Ratio Analysis

Uploaded by

Muskan HazraRatio Analysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 22

ATIO ANALYSIS

Introduction

A financial statement depicts the financial position of the concern on a given date. To

understand the financial position one should have Accounting knowledge. And also many

accounting statements on the apparent look do not reveal the actual solvency or profitability

position of the concern. For instance the profitability of the concern cannot just be understood

by looking at the net profit. It will be more meaning full if it is said in relation to the sales or

capital employed in terms of percentages. Similarly operating expenses when it is expressed in

relation to sales it gives more clarity for making decisions like cost control. Hence financial

statements independently cannot serve the purpose of the needy people like Creditors,

Bankers, Investors, and others. So the concept of ratio is more important in the modern

financial transactions and managerial decisions.

Ratio is considered as one of the effective tool of financial analysis. It facilitates for

interpretation of the profitability and solvency position of a concern. The term ratio, is

understood as one number expressed in terms of another. It is an expression of relationship

between two numbers by dividing one figure by another.

Meaning of Ratio Analysis

Ratio is the relationship between two accounting numbers by dividing one number by

another. It is one of the effective tools of financial analysis. It indicates the relationship of

accounting aspects like profit and sales, income and expenses, current assets and liabilities

etc. with each other and reflects the soundness of the concern.

Ratio analysis is the technique of the computation of number of accounting ratios from

the data derived from the financial statements, and comparing those with the ideal or

standard ratios or the previous year’s ratios or the ratios of other similar concerns. It is a

technique of comparative analysis in which current year ratios are compared with the past or

other organisations which are in similar line of operation so as to ascertain the financial

soundness of the concern.

Expression of Ratios

Ratio can be espressed

(i) Time

Current Assets _ 50,000 _9 i nog

Example: Current Liabilities | 25,000 —

-—

Scanned with CamScanner

(i Percentage

Current Assets 50,099

ple: Current Liabilitios ~ pegee * 100 = 2099

Beam Current Liabilities ~ 25,999 “100 = 200%

Gii) Proportion

Current Assets

7 50,000

sxample: Current Liabilities

22.000 |

25,000

0 It is better to express turnover ratio in “I ry

@ Profitability ratio in percentage, Lan TT CRete,

i) Profital m Lete,

ji) Liquidity and solvency ratio botter to i i

Gi Lag expressed in proportion, Example: CR, LR, RR

There is no hard and fast rule expressing +4,

SSI ict il

romiligratis onacten ate pI Ing ratio in Particular form it is convenient to

ime’. Example: §

Example: GPR, NPR, RO)

Significance of Ratio

Ratio analysis has been identified as a very i

__ Ra as beer ry important tool f

fecitating several things, in the issues of simplifying fre tooo

studying the financial health, helping inter-firm ana'inee a i

ying ancia » helping comparisons and abow

helping in co-ordination, communication and control whar are the three C’s of any-bucinaes,

1. Ratio analysis is an important and useful technique to check upon the efficiency with

used in the enterprise. It helps the financial

ol fi agement. accountant,

# financial information, measuring and

3, It is a medium of communication of financial position of @ concern. Financial ratios

communicate the strength and financial standing of the firm to the internal and

external parties.

Ratio analysis is very helpful in financial forecasting. A ratio relating to past sales,

Profits and financial position is the base for future trends,

5. _ Ratio facilitates for comparison. With the help of ratio analysis ideal ratios can be

composed and they can be used for comparison of a particular firm's progress and

performance.

Financial ratios are very helpful in the diagnosis and financial health of a firm. They

highlight the liquidity, solvency, profitability and capital gearing, etc. of the firm. They

are a useful tool of analysis of financial performance.

Uses of Ratio

Ratio analysis is one of the important tools of analyzing the financial statements, It

helps in understanding the financial health and trend of a business. The utility of ratio

analysis may be explained under the following heads:

Scanned with CamScanner

1. Utility to Management

Ratio analysis helps the management in;

a) Formulating the policies,

b) Forecasting and planning.

9 Decision making.

@ Knowing the trends of business.

©) Measuring efficiency.

) Communicating.

2 Controlling.

2. Utility to Shareholders and Investors

An investor would normally assess the financial position of a business before he invests

his money in it. He is interested in the safety, security and profitability of his investment,

Accounting ratios help the prospective investors in selecting best companies to invest their

funds. Ratios enable the shareholders to evaluate the performance and future prospects of the

company. On the basis of some ratios, they are able to calculate the price of their shares,

3. Utility to Creditors

The creditors or suppliers are those who supply goods to the firm on credit basis. They

are interested in the liquidity position of the firm. To know the liquidity position or short term

financial position, they use liquidity ratios.

4, Utility to Employees

The employees are interested in the profitability of the company. Their wages, fringe

benefits, working conditions etc. are related to the profits earned by the company. They want

to ascertain the profitability for demanding wage increase and other benefits. For

understanding the profitability of the company, profitability ratios come to their help.

5. Utility to Government

The government uses ratio analysis for studying the cost structure of the industries. On

the basis of this study, the government can formulate various policies. It can implement the

price control measures to protect the interest of consumers.

Classification of Ratio

Ratio can be classified as per the need and requirement of the users. Ratio are not only

useful for internal users but also to many others like investors, bankers, ereditors and

government. In this view point, ratios can be classified as follows. On the basis of nature and

significance of ratios it can be classified as follows:

Scanned with CamScanner

TYrEs Or Ratio

fa 1p To lp

pau RATIO (Caprrat Structure Acuviry

Rats feo ey

/ «10

Current Ratio Debt Equity Ratio Stock tumover Gr

ee c 088

Quick Ratio Networth Ratio Ratio Profit Ratio

Absolute liquid Fixed Assets to peal eee

Ratio Networth Ratio amen Ratio

Creditor i

Current Assets to ic eee

ae Tumover Ratio Ratio

. . FATumover i

Capital Gearing Ratio i pea

: Ratio Profit Ratio

Solvency Ratio .

a Cash Tumover P/E Ratio

Ratio

Detailed understanding of ratio’s are as follows:

A) Liquidity Ratio

It is the ratio which Measures the short-term solvency position of an organisation. It

brings out the ability of an organisation to meet it’s immediate or short term financial

commitments with it’s short term or liquid resources. Such ratio’s are highly needful for

partis like creditors, Banker's and other private lender's It enables the lender's to know the

repayment ability of an organisation with in short period.

Liquidity ratio can be broadly classified as follows:

i) Current Ratio

ii) Acid test Ratio or Quick Ratio/Liquid Ratio

iii) Absolute Liquid Ratio Cash position Ratio.

the short-term financial Capacity of an enterprise and clearly

Liquidity ratio signifies

ay creditors, Banker's etc. detailed

reflects the short term solvency position for investors,

explanation of each of the liquidity ratio are as follows:

i) Current Ratio

It is the ratio which is computed by taking into consi

current liabilities of an organisation. Current assets and c

following:

deration the current assets and

urrent liabilities included the

Scanned with CamScanner

es

B COM 3 CURRENT LIABILITIES coMPONES=3

Cash in hand bank Bills payable

| Sundry Debtors Creditors

Bills Receivables Bank overdraft

Stock Provision for

Prepaid expenses | O's Incomes Fee een

| Shortterm Investments Outstanding expenses

Income received in advance

It is computed with the help of the following equation:

Current Asset ~

Current Ratio= Gurrent Liability * Ideal Ratio = 2:1

Interpretation of Current ratio: The generally accepted current ratio or Ideal ratio is

2:1, It mean's for every one rupee of current liability, there should be Two rupee of current

assets to ensure better solvency position. An organisation which has current ratio as 2 or more

reflects the sufficient liquidity and enough working capital.

Illustration - 1

Calculate:

Current assets

Current ratio = 2.6:1 and Current liability = 40,000

Solution:

_ _ Current Assets

Current ratio Current

26 _ Current Assets

= 7 *~~40,000

= Current assets = 2.6 x 40,000

=. Current assets = 1,04,000

Illustration - 2

From the following calculate current ratio.

Fixed assets 5,00,000, Total assets of the company 8,00,000, Current liabilities 200,000,

Scanned with CamScanner

not satisfacto}

ii) Aci

seriou! 2

practical, possible

jiguidity ratio i:

entel

prise. It establish r

Current Assets = 8,00,000 — 5,00,000

current Assets = 3,00,000.

Current liability given in the caso ¢2,00,000

Current Assets

! 3,00,000

Gurrent Liabilities 00, oa ae

t the Company short term solvency positio

t assets position.

Current Rati

since the ideal ratio is 2:1, it is clear that

ry. Necessary steps should be taken to improve current 7

d Test Ratio or Quick or Liquid Ratio

t ratio reflects the liquidity position of

includes aspects like stock and prepai

term without financial loss.

id or quick solvency position

mediate solvency position of an

dd quick liabilities. It is computed

the concern, it suffer’s from

Earnings available to equity share holder’s means net profit after tax and ag

dividend to preference share holder's. ae

‘Total Equity Capital

Face Value per Share

= Number of equity share

viii) Price-Earning Ratio ;

he number of times the earning per share is covered by its market

‘This ratio indicates wv u

the market price per share and earning per share,

price. It is the ratio between

Market Price per Equity Share

PIE ratio = —fearning per Equity Share

Interpretation of profitability ratio: Profitability ratios are the measurement of

operational efficiency of an org” isation in a given financial year. It indicates the use of

organisational resources in generating better revenues and achieving organisational goals.

Profitability ratios like, gross profit ratio, net profit ratio, operating profit ratio, price

earning ratio, earning per share ratio, when it is more it is said it is favourable to the

crganisation. Similarly when expenses ratio are less itis said it is favourable to the concern.

‘As such there is no ideal or standard profitability ratio, in general.

Dividend Payout Ratio

‘The Dividend Payout Ratio (DPR) is the amount of dividends paid to shareholders in

relation to the total amount of net income the company generates. In other words, the dividend

avout ratio measures the percentage of net income that is distributed to shareholders in the

form of dividends.

Dividend Payout Ratio Formula

There are several formulas for calculating DPR:

. DPR = Total dividends / Net income

2. DPR=1-Retention ratio (the retention ratio, which measures the percentage of net

income that is kept by the company as retained earnings, is the opposite, or inverse, of

the dividend payout ratio

3. DPR=Dividends per share / Earnings per share

Dividend Yield Ratio

‘The dividend yield is a financial ratio that measures the amount of cash dividends

distributed to common shareholders relative to the market value per share, The dividend yield

is used by investors to show how their investment in stock is generating either cash flows in

the form of dividends or increases in asset value by stock appreciation.

ia

Scanned with CamScanner

ois calculated using the following formula:

yield rat

vidend Per Share/Market Valuo Por Sharo

‘The divide =D

yield Ratio =

form of calculation, you can take the amount of dividend per share and

* it

In the simples’ vt valuo per share to get tho dividend yield ratio.

Dividend

divide it with the ma"

Limitations of .

Ratio analysis is no doubt, useful in many respects to different parties like, Creditors,

tat Banker's and Government. Since ratio’s are not independent and computed based on

data, its reliability can be questioned because, if the basic data itself is

manipulated, then ratio’s will also reflect the manipulated information. Following are some of

The important draw back’s of ratio's.

1) It is based on financial statement: Ratios aro computed based on the financial

statement of an organisation. Hence the ratio’s may not reflect the true and fair

financial position if there are manipulation or window dressing in the basic data itself.

2) Does not reflect the qualitative aspects: Some times it is necessary to evaluate, the

qualitative aspects like, managerial abilities, nature of customers, employees ete., for

making effective decisions. Ratios since deals with quantitative aspects, does not reflect

these in its reports.

Ratios will not give decisions: It is just an information to make effective decisions.

Ratio

Investors, B

the financial

3

4) Ratio’s alone are not adequate for judging the financial position of a business.

5) There is no standardization in ratios: Ratios are interpreted in different ways based

on the situation, requirement and view point of the persons. Hence it cannot give the

same meaning to all.

6) Ratios are based on many assumptions and hence these may mislead the decision

makers.

7) _ Ratios are meaningful only when they are studied with other ratios. A ratio alone cannot

be meaningless by itself.

8) Understanding of ratios needs professional knowledge. Hence, it cannot be used by

‘common people.

Mlustration - 5

il is 7 3,57,500. Calculate the amount of current

Current ratio is 3.75:1 Working capi

assets and current liabilities.

Solution:

Let, Current liabilities = x

. Current assets

Current ratio = Current liabilities

fm

Scanned with CamScanner

SES

. Operating Ratio =

iv) Calculation of Net Profit Ratio

Net Profit 199 = 84.000 _, 199 = 10.8%

Net Sales 6,00,000

v) Operating Profit Ratio

Net Profit =

is jo = Operating Profit 199

Operating profit Ratio= er Gatog —*

Operating profit = Net Sales - Operating Cost

= 6,00,000 — 4,20,000 (as computed above)

= % 80,000

80,000

--Opening profit ratio = x100 = 16%

5,00,000

vi) Calculation of Stock Turnover Ratio

. _ Cost of Goods Sold

Stock Turnover Ratio = “Average Stock

5,0 ,000 :

STR = 76250+98500 STR = 3.43 times

2

Summary of Ratio’s

Ratio | Equation /Formula ‘Standard

4) Current

Solvency Ratio's

. Current Assets ;

ae Current Liabilities a

oa Quick Assets

ee Current Liabilities

Quick assets = CA — (Stock + Prepaid expenses) 1

. Absolute Liquid Assets

Absol Absolute Liquid Assets

to Liu Current Liabilities LL

Ratio Absolute liquid assets = QA — (Debtors + B/R) 05:1

Scanned with CamScanner

B) Long Term

Solvency Ratio's

Debtiequity Ratio

Debt iabititi,

Bquity Debt = Long term Liabilities

+ Short term liabilities

Equity = Share capital + Liability

+ Reserves + P & L A/c Credit balance,

| . Net worth

Proprietary Ratio | Total Asseta Bal

Net worth = Capital + Reserves +

P&L Cr. Bal — Preliminary exp + Accumulate

losses)

Net Fixed Assets

Fixed Assets Networth 223 of

‘to networth Ratio networth

Current Assets wo

Current assets Net worth a . higher the

to networth Ratio . ratio higher

the solvency,

7 a Fixed Committment Securities . .

Capital gearing ~"Wauity share bol Fun higher the ratio

Ratio higher of

= ‘capital gearing

C) Turnover Ratio] : —|-= ~

Cost of Goods Sold : '

Stock turn ‘Avg. Stock higher the ratio

over Ratio CGS = Sales ~ G/P 0 . more favorable

. il arr

Average stock = OPening Stock Clearing stock

Net Annual Credit Sales ©)" 509 |

Act Annual Credit Sales

Debtors turnover Average Tr. Debtors De Plreu Bin higher the

Ratio Credit sales = Total sales ~ Cash sales ratio more

Average Tr. debtors = 205. debtors Clg, Debtory favorable.

irr

Scanned with CamScanner

et Annual Credit Purchases

Net Anne tom

vg. Trade Creditors

Higher the

Creditor? : e ratio

fumover Rat? | Credit purchase = Total purchases ~ Cash purchase} favourable.

Avg.Trereditors = Soe Cer Oh Geetiars

pant calecton 30 days or

eel 1 month

No. of days or month in a year

Average payment Creditor turn over Ratio 30 days or

period o 1 month

: Net Sales

Working capital ‘Working Capital higher the

Ratio . ratio, higher

efficiency

Net Sales ;

‘Total assets Total Assets 2 Times

turn over Ratio

" ~ | _Net Sales :

Fixed assets: ‘Fixed Assets 5 times

turnover Ratio or more

Net Sales ; 5

Current assets CaeaRvAaets higher the ratio

turn over Ratio higher efficiency

D) Profitability

Ratio

| Gross Profit

- ‘ : ,

Gross profit Ratio “Net Sales «100 higher the ratio,

oss profit = Opening stock + Purchase + Direct | higher efficiency

penses ~ (Sales + Closing stock)

Net Profit Ratio Net Profit. 199 higher the ratio,

Net Sales

higher efficiency.

Scanned with CamScanner

Operating Cost

sng Rati Operating Cost , 199

Operating Ratio Net Sales

Operating cost = CGS + Operating expenses,

Operating Profit 14,

Operating Profit Net Sales

Ratio Operating profit = Net profit + Non operating

expenses - Non-operating incomes.

Specific Expenses

i ———_——— «x 100

Expenses Ratio Net Sales

- Return On Capital Employed

Return on Capital Capital Employed

Employed Ratio Capital employed = owner's fund + long term

borrowing — fictitious assets.

Earning per | More the rats

ait ., Harning available to Equity Shareholder

—— No. of Equity Shares more is the

(*= Net profit after tax - Preference Dividend) efficiency

: . | Market price per equityshares

Price Earning Ratio Turning perehave

iE

Scanned with CamScanner

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

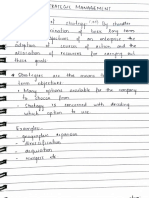

- Strategic Management NotebookDocument19 pagesStrategic Management NotebookMuskan HazraNo ratings yet

- IT Assignnment - Central Board of Direct Tax & Assessing OfficersDocument8 pagesIT Assignnment - Central Board of Direct Tax & Assessing OfficersMuskan HazraNo ratings yet

- Mis - Chap - I - IntroductionDocument24 pagesMis - Chap - I - IntroductionMuskan HazraNo ratings yet

- Australasian Marketing Journal: Ranjit Voola, Gian Casimir, Jamie Carlson, M. Anushree AgnihotriDocument11 pagesAustralasian Marketing Journal: Ranjit Voola, Gian Casimir, Jamie Carlson, M. Anushree AgnihotriMuskan HazraNo ratings yet

- 2021 Stu Copy Chap 3Document75 pages2021 Stu Copy Chap 3Muskan HazraNo ratings yet

- Benefits of Erp SystemsDocument2 pagesBenefits of Erp SystemsMuskan HazraNo ratings yet

- 2014 11 22 9 27 40 - A Study of Financial Inclusion and Financial Literacy Among The Tribal People in Wayanad District in KeralaDocument60 pages2014 11 22 9 27 40 - A Study of Financial Inclusion and Financial Literacy Among The Tribal People in Wayanad District in KeralaMuskan Hazra100% (1)