Professional Documents

Culture Documents

Acc 1 - Financial Accounting and Reporting QUIZ NO. 17 - Partnership Formation (Application)

Uploaded by

nicole bancoroOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 1 - Financial Accounting and Reporting QUIZ NO. 17 - Partnership Formation (Application)

Uploaded by

nicole bancoroCopyright:

Available Formats

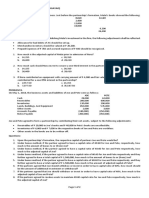

ACC 1 – FINANCIAL ACCOUNTING AND REPORTING

QUIZ NO. 17 – Partnership Formation (Application)

“Integrity is doing the right thing, even when no one is watching.” – C.S. Lewis

INSTRUCTIONS: Read and analyze carefully the problem given below, and accomplish the

requirements that follow. Use worksheet as answer sheet. Write legibly and avoid erasures. Good luck!

Ms. Ann and Mr. Bouy, who are engaged in the same type of business, agree to combine their

resources and form a partnership on January 1, 2018. The partnership is to be named AB Enterprises.

The statements of financial position of Ms. Ann and Mr. Bouy as of January 1, 2018 are as follows:

Ms. Ann Mr. Bouy

Cash ₱ 50,000 ₱ 120,000

Accounts Receivable 360,000 1,080,000

Inventories 216,000 360,000

Land 1,080,000

Building 900,000

Equipment 90,000 90,000

Accounts Payable 336,000 450,000

A, Capital 1,460,000

B, Capital 2,100,000

The partners agreed to the following:

a. The recoverable amounts of the partners’ respective accounts receivable are ₱300,000 and

₱760,000 for Ms. Ann and Mr. Bouy, respectively

b. The inventory contributed by Mr. Bouy includes obsolete items with a recorded cost of ₱20,000.

c. The land contributed by Ms. Ann has an attached mortgage of ₱180,000. The partnership shall

assume the mortgage.

d. The equipment contributed by Mr. Bouy has a fair value of ₱130,000.

e. Ms. Ann has an unrecorded accounts payable of ₱100,000. The partnership assumes the

obligation of settling that account.

Requirements:

1. Prepare the necessary adjusting entries in the books of Ms. Ann and Mr. Bouy.

2. Prepare the journal entries to close the books of Ms. Ann and Mr. Bouy.

3. Prepare the opening journal entries in the books of the partnership.

4. Prepare a statement of financial position for the new partnership.

---END OF QUIZ NO.17---

“Nothing great was ever achieved without enthusiasm.” – Ralph Waldo Emerson

kikoFARQ17

Page 1 of 1

You might also like

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Swing Trading SimplifiedDocument115 pagesSwing Trading Simplified李蘇民79% (34)

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- Invoice 00201 Rolex Watch Companyp LTD Utkarsh AwasthiDocument1 pageInvoice 00201 Rolex Watch Companyp LTD Utkarsh AwasthiHooooo50% (10)

- Chapter 4Document15 pagesChapter 4nicole bancoro100% (1)

- Simple Law Student 2007 2013 Bar Questions On Corporation LawsDocument9 pagesSimple Law Student 2007 2013 Bar Questions On Corporation LawsAlexander Abonado100% (1)

- Partnership Formation OperationsDocument8 pagesPartnership Formation OperationsSherwin Benedict Sebastian100% (1)

- Cambodian Chinese Medical Association: Pay Slip - January, 2022Document25 pagesCambodian Chinese Medical Association: Pay Slip - January, 2022VichhaiJacksonNo ratings yet

- Partnership THEORIES AND PROBLEMSDocument5 pagesPartnership THEORIES AND PROBLEMSMa Teresa B. CerezoNo ratings yet

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADocument33 pagesPractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- Chapter 1 - PartnershipDocument72 pagesChapter 1 - PartnershipJohn Lloyd Yasto100% (5)

- Conceptual Framework Lecture Notes: The Framework at A GlanceDocument11 pagesConceptual Framework Lecture Notes: The Framework at A Glancenicole bancoro100% (1)

- Mep and Civil TenderDocument471 pagesMep and Civil TenderJayadevDamodaran100% (1)

- Investment Industrial Policy West Bengal 2013Document88 pagesInvestment Industrial Policy West Bengal 2013Sarathi PodderNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Accounting Problem SetDocument22 pagesAccounting Problem SetJill SolisNo ratings yet

- MSJG Chap 1 10 QuestionsDocument6 pagesMSJG Chap 1 10 QuestionsMar Sean Jan Gabiosa100% (2)

- Partnership Formation ExercisesDocument8 pagesPartnership Formation ExercisesMarjorie NepomucenoNo ratings yet

- Exercise 5-10Document9 pagesExercise 5-10Aaron HuangNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Partnership FormationDocument4 pagesPartnership FormationDesiree Dawn GabalesNo ratings yet

- Partnership PDFDocument1 pagePartnership PDFAoiNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- Accounting For Special Transactions p1 - CompressDocument10 pagesAccounting For Special Transactions p1 - CompressALINA, Jhon Czery C.No ratings yet

- Advanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipDocument6 pagesAdvanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipFrilincia Maria HosianaNo ratings yet

- P2 01v2Document11 pagesP2 01v2Rhegee Irene RosarioNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- CH6-7 Home QuizDocument5 pagesCH6-7 Home QuizAngel MenodiadoNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- Quiz 32321Document2 pagesQuiz 32321john carlo0% (1)

- Activity Partnership Formation and OperationDocument8 pagesActivity Partnership Formation and OperationSharon AnchetaNo ratings yet

- ACCOUNTING-14Document4 pagesACCOUNTING-14Mila Casandra CastañedaNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Question BankDocument21 pagesQuestion BankIan ChanNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- AssignmentDocument3 pagesAssignmentJayzell MonroyNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- ProblemsDocument12 pagesProblemsJoy MarieNo ratings yet

- MockDocument2 pagesMockfa6613323No ratings yet

- Partnership Formation Discussion ProblemsDocument2 pagesPartnership Formation Discussion ProblemsMicca AndraeNo ratings yet

- Partnership QuizzerDocument21 pagesPartnership QuizzeragbpaulinoNo ratings yet

- CH2 Illustrative Problems-1Document3 pagesCH2 Illustrative Problems-1Joan ClaireNo ratings yet

- Problems Lecture - Partnership FormationDocument4 pagesProblems Lecture - Partnership FormationNiccoRobDeCastroNo ratings yet

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- Chapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualDocument3 pagesChapter 1 - Partnership Formation Partnerhsip Formation - Individual vs. IndividualCamille Stephan BenigaNo ratings yet

- Learning Task No.1Document3 pagesLearning Task No.1scryx bloodNo ratings yet

- ACTBFAR C33A - Unit II Illustrative ExamplesDocument10 pagesACTBFAR C33A - Unit II Illustrative Examplesloi jochebedNo ratings yet

- Activity 1.1 PDFDocument2 pagesActivity 1.1 PDFDe Nev OelNo ratings yet

- Partnership 1 PDFDocument12 pagesPartnership 1 PDFShane TorrieNo ratings yet

- Partnership Formation Answer KeyDocument8 pagesPartnership Formation Answer KeyNichole Joy XielSera TanNo ratings yet

- Refresher Illustrative Problems - Partnership Liquidation LumpsumDocument2 pagesRefresher Illustrative Problems - Partnership Liquidation LumpsumLeiNo ratings yet

- Mock Up Soal Uas Akl II Dan Adv II 2018Document4 pagesMock Up Soal Uas Akl II Dan Adv II 2018nadea06_20679973No ratings yet

- Accounting Quiz 1Document2 pagesAccounting Quiz 1Cjhay MarcosNo ratings yet

- Assignment01 PDFDocument2 pagesAssignment01 PDFAilene MendozaNo ratings yet

- Learning Task No. 1.2Document3 pagesLearning Task No. 1.2Carl Oliver LacanlaleNo ratings yet

- Plantilla Tarea 1 1 ACCO 3150 4mjjDocument5 pagesPlantilla Tarea 1 1 ACCO 3150 4mjjcrispyy turonNo ratings yet

- ICCT Colleges Foundation, Inc.: Profe01-Accounting For Special TransactionsDocument3 pagesICCT Colleges Foundation, Inc.: Profe01-Accounting For Special Transactionsbbrightvc 一ไบร์ทNo ratings yet

- Name: Quiz 1: Ch. 1, 2 and 3 ACCT 405 Spring 2021Document4 pagesName: Quiz 1: Ch. 1, 2 and 3 ACCT 405 Spring 2021Fiveer FreelancerNo ratings yet

- Parcor Quiz 2Document4 pagesParcor Quiz 2JOY LYN REFUGIONo ratings yet

- Exam 3Document5 pagesExam 3MahediNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- Tax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreFrom EverandTax Havens Today: The Benefits and Pitfalls of Banking and Investing OffshoreNo ratings yet

- Organizing: Origin of MakingDocument15 pagesOrganizing: Origin of Makingnicole bancoroNo ratings yet

- Thanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!Document33 pagesThanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!nicole bancoroNo ratings yet

- Accounting For Joint Products and By-ProductsDocument14 pagesAccounting For Joint Products and By-Productsnicole bancoroNo ratings yet

- 2018 Audited Financial StatementDocument73 pages2018 Audited Financial Statementnicole bancoroNo ratings yet

- DocxDocument4 pagesDocxnicole bancoro100% (1)

- Luzon Glass Company December 31, 2010Document6 pagesLuzon Glass Company December 31, 2010nicole bancoroNo ratings yet

- FAR04 01.4 Interim ReportingDocument9 pagesFAR04 01.4 Interim Reportingnicole bancoroNo ratings yet

- FAR04 01.5 Operating SegmentDocument5 pagesFAR04 01.5 Operating Segmentnicole bancoroNo ratings yet

- FAR04-01.2b - Conceptual Framework - QuestionsDocument7 pagesFAR04-01.2b - Conceptual Framework - Questionsnicole bancoroNo ratings yet

- FAR04-01 - Development of Financial Reporting Framework Standard & Regulation of Accountancy ProfessionDocument4 pagesFAR04-01 - Development of Financial Reporting Framework Standard & Regulation of Accountancy Professionnicole bancoro100% (1)

- FAR04-01.3b - Presentation of Financial StatementsDocument14 pagesFAR04-01.3b - Presentation of Financial Statementsnicole bancoroNo ratings yet

- Laila Nicole Bancoro Bsa 4BDocument1 pageLaila Nicole Bancoro Bsa 4Bnicole bancoroNo ratings yet

- Auditing Application Special ExamDocument3 pagesAuditing Application Special Examnicole bancoroNo ratings yet

- Instruction: Answer The Following Questions Problem 1Document11 pagesInstruction: Answer The Following Questions Problem 1nicole bancoroNo ratings yet

- NZ IAS 21 Jan13 IASB 157979.2Document10 pagesNZ IAS 21 Jan13 IASB 157979.2nicole bancoroNo ratings yet

- INCOTAXDocument4 pagesINCOTAXnicole bancoroNo ratings yet

- Laila Nicole Bancoro Auditing ApplicationDocument1 pageLaila Nicole Bancoro Auditing Applicationnicole bancoroNo ratings yet

- Audit of Construction CompaniesDocument2 pagesAudit of Construction Companiesnicole bancoroNo ratings yet

- Full-Time Mba Programs: 2019 Employment ReportDocument6 pagesFull-Time Mba Programs: 2019 Employment ReportPiyush MalhotraNo ratings yet

- Decision Tree Exercise 2 SolDocument5 pagesDecision Tree Exercise 2 SoljitenNo ratings yet

- Income Statement: Financial StatementsDocument5 pagesIncome Statement: Financial StatementsKen DiNo ratings yet

- HelpAge India and Nicholas Piramal CSR Connect..Document42 pagesHelpAge India and Nicholas Piramal CSR Connect..ajinkyadeNo ratings yet

- EFLO Online Learning Session - Role of The BSPDocument25 pagesEFLO Online Learning Session - Role of The BSPJestoni VillareizNo ratings yet

- Properties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDocument28 pagesProperties of High Frequency DAX Returns Intraday Patterns, Philippe MassetDigito DunkeyNo ratings yet

- IAC PPE and Intangible Students FinalDocument4 pagesIAC PPE and Intangible Students FinalJoyce Cagayat100% (1)

- 16.volatility Calculation (Historical) - Zerodha VarsityDocument24 pages16.volatility Calculation (Historical) - Zerodha Varsityravi4paperNo ratings yet

- Merak Fiscal Model Library: Bahrain PSC (1998)Document2 pagesMerak Fiscal Model Library: Bahrain PSC (1998)Libya TripoliNo ratings yet

- Banking Awareness PDF For All Banking Exams - 2141Document26 pagesBanking Awareness PDF For All Banking Exams - 2141AnuuNo ratings yet

- Entrep-Review: Use The Following Information For The Next Two QuestionsDocument3 pagesEntrep-Review: Use The Following Information For The Next Two QuestionsNeil John Santos ParasNo ratings yet

- PT Karya Mandiri SejahteraDocument4 pagesPT Karya Mandiri SejahteraImroatul MufidaNo ratings yet

- Industry Reports OverviewDocument43 pagesIndustry Reports OverviewAkshay ChunodkarNo ratings yet

- Ahmedabad Slum Free City Action Plan RAYDocument222 pagesAhmedabad Slum Free City Action Plan RAYDeepa Balakrishnan100% (1)

- 2010 Oakland A's Ballpark at Jack London Square Howard Terminal Economic Analysis ReportDocument78 pages2010 Oakland A's Ballpark at Jack London Square Howard Terminal Economic Analysis ReportZennie AbrahamNo ratings yet

- Group Worksheet and AssignmentDocument10 pagesGroup Worksheet and AssignmentmohammedNo ratings yet

- Bharath Project COMPLETEDocument52 pagesBharath Project COMPLETENithin GowdaNo ratings yet

- ToaDocument80 pagesToaJuvy Dimaano100% (1)

- FIN353 IntroductionDocument22 pagesFIN353 IntroductionakasNo ratings yet

- TB Bank loans-đã chuyển sang wordDocument8 pagesTB Bank loans-đã chuyển sang wordVi TrươngNo ratings yet

- Practice Questions Accounts ReceivableDocument23 pagesPractice Questions Accounts ReceivableKianJohnCentenoTuricoNo ratings yet

- Accountant Advice 2020Document306 pagesAccountant Advice 2020Jerald MirandaNo ratings yet

- 2015-2014 June 30 The Florida Bar Financial StatementsDocument35 pages2015-2014 June 30 The Florida Bar Financial StatementsNeil GillespieNo ratings yet

- Fundamentals of Accountancy, Business & Management 1Document4 pagesFundamentals of Accountancy, Business & Management 1Rodj Eli Mikael Viernes-IncognitoNo ratings yet