0% found this document useful (0 votes)

1K views8 pagesEarthwear Hands-On Mini-Case: Understanding The Entity and Its Environment

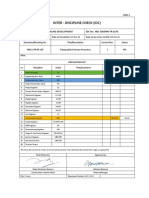

1) EarthWear Clothiers is a company that sells outdoor clothing to affluent, educated customers. It sources products from independent suppliers around the world.

2) The company has a clear organizational structure and its main location is in Boise, Idaho with additional distribution centers in the UK, Germany, and Japan. Its major assets are inventory and accounts payable are its major liabilities.

3) While the competitive market presents some risk, EarthWear manages risks through budgeting and monthly senior management meetings. Management monitors risks adequately and has adopted sound accounting principles.

Uploaded by

Alex NgaiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views8 pagesEarthwear Hands-On Mini-Case: Understanding The Entity and Its Environment

1) EarthWear Clothiers is a company that sells outdoor clothing to affluent, educated customers. It sources products from independent suppliers around the world.

2) The company has a clear organizational structure and its main location is in Boise, Idaho with additional distribution centers in the UK, Germany, and Japan. Its major assets are inventory and accounts payable are its major liabilities.

3) While the competitive market presents some risk, EarthWear manages risks through budgeting and monthly senior management meetings. Management monitors risks adequately and has adopted sound accounting principles.

Uploaded by

Alex NgaiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 8