Professional Documents

Culture Documents

BUSN7054 Take Home Final Exam S1 2020

Uploaded by

Li XiangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BUSN7054 Take Home Final Exam S1 2020

Uploaded by

Li XiangCopyright:

Available Formats

THE AUSTRALIAN NATIONAL UNIVERSITY

Research School of Accounting

College of Business and Economics

First Semester Final Take-home Examination 2020

[BUSN7054] [AUDITING & ASSURANCE SERVICES]

Student Number:

NOTE: Please make sure that you write your student numbers in the space provided

above.

Reading period: 0 minute duration

Writing period: 3 Hours duration

Permitted materials: All materials except for electronic devices

This paper accounts for 40% of the overall course mark

Total marks on paper: 80 marks

INSTRUCTIONS

You must attempt to answer all questions.

Your answers must be typed in the space provided in this exam paper.

Late submission will not be accepted.

QUESTION NUMBER MARKS AVAILABLE STUDENT’S SCORE

1 20

2 20

3 12

4 9

5 14

6 5

TOTAL 80

Page 1 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

• The duration of the exam is 3 hours including time for you to download the exam paper and

to upload your completed exam paper with your answers. Please make sure you allow for

this.

• Remember to frequently save the document you are working on and allow yourself

sufficient time to upload your document.

• During exam time, Lingwei will be contactable on lingwei.li@anu.edu.au (Lingwei will stay

online during the exam time to make sure your email will be replied asap) for you to clarify

any question.

ANU Academic Misconduct Rule

You are expected to have read and understood the ANU's Academic Misconduct Rules. Instances of

alleged misconduct will be investigated and, where misconduct is found to have been committed,

penalties will be imposed to the full extent of the Rule.

Students required to submit a take-home exam, an assignment, or a timed Wattle exam work do so

under a declaration that the work is their own.

As a further academic integrity control, students may be selected for a 15-minute individual oral

examination of their final exam submission.

Page 2 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

QUESTION 1 (20 MARKS)

Your firm is the auditor of Crux Limited who has been manufacturing household products

such as microwave ovens for the Australian market. Below are some extracted notes from

your working papers and some relevant information you may use to assess inherent risk and

plan your audit accordingly.

Due to increased competitive pressures, Crux Limited has recently moved the manufacture of

some of its products out of Melbourne into regional areas. While Crux Limited saves around

20% in costs, the manufacturing process takes longer and, on several occasions, late delivery

has resulted in lost sales.

Over the last 2 months, warranty claims on the M4 have increased from 1.5% to 4.5% of

sales. The problem appears to relate to the glass turntable for one of the best-selling ovens,

which shatters if the oven is constantly used. The average cost of repair has risen by 20% per

claim.

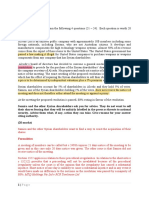

As part of your planning, you have performed the ratio analysis. Three of the ratios are shown

in the table below.

Actual results Previous year Industry average

(1) Receivables turnover ratio 5.5 6.5 6.6

(2) Inventory turnover ratio 6.5 5.2 5.1

(3) Current ratio 2.1 2.5 2.2

REQUIRED:

Using the above information for Crux Limited, complete the table in the following pages (4-

5) detailing FOUR (4) issues that would impact on your assessment of inherent risk. Explain

how each issue would increase inherent risk. Assuming other things unchanged, how would

the issue impact on your audit plan?

Page 3 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

Issues identified Explain how the issue Impact on audit plan

would increase

inherent risk (2 marks each)

(1 mark each) (2 marks each)

Page 4 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

Issues identified Explain how the issue Impact on audit plan

would increase

inherent risk (2 marks each)

(1 mark each) (2 marks each)

QUESTION 2 (20 MARKS)

You are the audit manager for the audit of Big Blue Marina Pty Ltd (BBM) for the year

ending 30 June 2019. BBM owns and operates a marina business that offers berthing services

for privately owned luxury yachts. In addition to berthing services, BBM also offers its

customers cleaning, refuelling and catering services. You are currently planning the audit for

the financial year and have the following information, among others:

For the purchase cycle, an acquisition form needs to be lodged for any purpose of a major

asset and approved by the designated manager. When goods are delivered to its warehouse, a

goods received note (GRN) is prepared and signed by the warehouse foreman. The GRN is dated the

day the goods are received and includes details of the type and number of goods received. A signed

copy of the GRN is then sent together with the supplier’s invoice to its accounts payable department.

The accounts payable clerk matches each GRN to the original purchase order and then immediately

enters the GRN details into the purchasing system, which updates the inventory records and the

accounts payable records. The date the GRN is entered into the system by the accounts department is

the posting date for the transaction. For the sales cycle, any credit sales that exceed $300 must

be approved by the supervisor from an approved credit list after the salesclerk prepares the

Page 5 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

three-part pre-numbered sales order. For the expense cycle, only authorised personnel are

able to access the payroll data in the accounting system and any additional payroll expense

that is not pre-set in the routine system and exceeds $100 needs to be approved by the payroll

manager.

REQUIRED:

Using the table on the following pages (pages 7-8):

(a) identify FOUR (4) specific controls. (4 marks)

(b) for each identified control, state one account and one audit assertion addressed by the

control. (8 marks)

(c) for each identified control, specify one test of control to test its effectiveness.

(4 marks)

(d) state one substantive audit procedure you would perform to gather audit evidence in

relation to the assertion for the account you identified in (ii). (4 marks)

Page 6 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

a) Identify FOUR controls b) One account and one audit c) Test of the control d) One substantive test you would

assertion addressed by the identified in i) perform in relation to the

(1 mark per control) control assertion for the account

(1 mark per test of control) identified in part ii)

(1 mark per account and 1 mark

per assertion) (1 mark per procedure)

Page 7 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

a) Identify FOUR controls b) One account and one audit c) Test of the control d) One substantive test you would

assertion addressed by the identified in i) perform in relation to the

(1 mark per control) control assertion for the account

(1 mark per test of control) identified in part ii)

(1 mark per account and 1 mark

per assertion) (1 mark per procedure)

Page 8 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

QUESTION 3 (12 MARKS)

Trendy Accessories Ltd is a producer of fashion sunglasses. The audit report for the year

ended 30 June 2019 was signed on 5 August 2019 and, along with the financial report, was

mailed to shareholders on 10 August 2019.

Consider the following independent events. Assume that each event is material.

a) Trendy Accessories has invested significant funds in developing a new type of

unbreakable sunglass lens and half of the development costs have been capitalised. On

8 July 2019, Trendy Accessories applied for a patent for the lens, and discovered that a

competitor had lodged a similar application on 20 June 2019. The granting of Trendy

Accessories’ application is now in serious doubt.

b) On 16 August 2019, the court ruled in favour of Trendy Accessories in relation to

deductions claimed on its previous year’s tax return. Trendy Accessories had provided

for the full amount of the potential disallowances in accrued taxes payable. The

Commissioner of Taxation has advised that he will not appeal the court’s ruling.

c) One of Trendy Accessories’ large warehouses suffered a fire on 20 July 2019 and the

inventory was destroyed. The warehouse content was not insured.

REQUIRED:

For each of the above events or transactions, suggest one (1) procedure for auditors to

discover the event/transaction (1 mark each), indicate and justify the action required in the

financial report (2 marks each), and provide one (1) additional procedure you would perform

in relation to each of the events to ensure that the above information was correct (1 mark

each).

Page 9 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

Case One procedure to discover the event Action required and justify Additional procedure to verify the event

(1 mark each) (2 marks each) (1 mark each)

a)

b)

c)

Page 10 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

QUESTION 4 (9 MARKS)

Consider each of the following independent and material situations. Assume that each client is a reporting entity and that a general purpose

financial report has been prepared for the period ended 30 June 2019. Using the table provided, determine the type of audit opinion to be

issued in each situation (1 mark each) and justify the opinion issued with reference to the specific issue on which the opinion is issued

(specifying assertion/account where applicable) (2 marks each):

Independent Situation Audit Opinion (1 mark each) Justification (2 marks each)

(a) Your New Zealand branch office disclaimed

responsibility for the inventory figures for CD Ltd’s New

Zealand division. This is because sudden flooding

prevented the auditors from attending the stocktake and

destroyed documentation that would have enabled them to

substantiate inventory by other means. The New Zealand

division represents about 10% of CD Ltd’s operations.

(b) Spinner Ltd’s accounts receivable balance at 30 June

2019 amounted to $2,540,000. Your testing revealed that

the accountant used an incorrect exchange rate to translate

overseas debtors at 30 June 2019. As a result, the balance

of the accounts receivable account is overstated by

$75,650. Management has indicated that it does not intend

to adjust the financial report in relation to this issue.

(c) Nick Building Ltd discloses in the note to the financial

report the existence of a contingent liability of an amount

of $1.2 million. The directors believe the allegations are

without merit. No provision for the contingent liability has

been made in the current period. The solicitor agrees with

the directors.

Page 11 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

QUESTION 5 (14 MARKS)

5 (a) (5 MARKS)

Aquila Ltd is taking legal action against Crew & Associates (Crew) over the audit of Poultry

Ltd, which went into liquidation owing almost $10 million to its creditors, including $5

million to Aquila. Aquila claimed that the profits recorded were significantly overstated and

inventory were also materially misstated in the financial report of Poultry. Crew has denied

that they were negligent and has argued that they relied heavily on information provided by

Poultry’s management.

REQUIRED:

(i) Do you believe that Crew owes Aquila a duty of care? Provide reasons for your judgment,

citing relevant case law where appropriate. (2 marks)

(ii) Discuss the validity of Crew’s defence, citing relevant case law where appropriate. (3

marks)

Page 12 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

5 (b) (9 MARKS)

You are the audit senior on the audit of Harmony Pty Ltd, a large manufacturing company, for

the year ended 30 June 2019. It is now 25 August 2019 and you are reviewing the audit working

papers prepared by the audit assistant, Susan Meyer, and notice the following matters:

(i) Susan attended the stocktake on 30 June and observed that the client followed the stocktake

instructions. She selected numerous items for test counting from the client’s inventory sheets

and all were found to be correct. Cut-off details were checked and found to be correctly

treated. Susan concluded that inventory is fairly stated.

(ii) To test unrecorded liabilities, Susan tested a random sample of 20 payments made after 30

June 2019 and found 3 instances of cheques that related to services provided in June, which

had not been accrued. However, as the total of the 3 cheques was immaterial, she concluded

that there is no significant concern over unrecorded liabilities and the completeness of

accounts payable is satisfactory.

(iii) Susan selected 20 invoices to test the control that the sales clerk checks that the prices agree

with the authorised price list (tolerable deviation rate is 6%). She found 2 instances where the

sales clerk had not signed the “price checked” box on the invoice. As the prices on all the

invoices agreed with the authorised price list, Susan concluded that the control was operating

satisfactorily.

REQUIRED:

For each of the three (3) scenarios presented above, indicate whether you believe that sufficient

appropriate audit evidence has been obtained to support the conclusions reached and give

reasons for your decision (3 marks each).

Page 13 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

QUESTION 6 (5 MARKS)

The Public Company Accounting Oversight Board sanctioned four auditors for, among other

things, providing bookkeeping to the same client. The Board also sanctioned another auditor

for failing to appropriately plan and perform the audit of a client.

Succinctly comment on the reason for above sanctions, with reference to related course

materials on audit quality. (roughly around 80 words)

____________________________

_____________________

Page 14 of 14—AUDITING & ASSURANCE SERVICES—(BUSN7054)

You might also like

- Understanding Income TaxDocument43 pagesUnderstanding Income TaxMerediths KrisKringleNo ratings yet

- Practise Exam CBA PDFDocument11 pagesPractise Exam CBA PDFasdrecvNo ratings yet

- Day 8 - Class ExerciseDocument7 pagesDay 8 - Class ExerciseJenny Hang Nguyen25% (4)

- ACCO 1152 Audit and Assurance Exam 1 - Exam Paper May 2015Document4 pagesACCO 1152 Audit and Assurance Exam 1 - Exam Paper May 2015kantarubanNo ratings yet

- AUI4861 Assignment 02 Byron Jason 46433597Document18 pagesAUI4861 Assignment 02 Byron Jason 46433597Byron Jason100% (2)

- Electronic Open Assessment FAQsDocument2 pagesElectronic Open Assessment FAQsshiyas M.MNo ratings yet

- ACCA F8 Audit Test - QuestionsDocument4 pagesACCA F8 Audit Test - QuestionsNasTikNo ratings yet

- Mock Exam QuestionsDocument11 pagesMock Exam QuestionsAlina TariqNo ratings yet

- Phrases and idioms for critical thinkingDocument24 pagesPhrases and idioms for critical thinkingKhoa NguyenNo ratings yet

- AUI4861 TL 203 2012 0 eDocument18 pagesAUI4861 TL 203 2012 0 eByron JasonNo ratings yet

- Labour Laws Compliance Checklist-GratuityDocument5 pagesLabour Laws Compliance Checklist-Gratuityairline_maniNo ratings yet

- Assignment On SWOT Analysis of Project Management in BangladeshDocument5 pagesAssignment On SWOT Analysis of Project Management in BangladeshrbkshuvoNo ratings yet

- Final Exam Preparation GuideDocument9 pagesFinal Exam Preparation GuideIbrahim HussainNo ratings yet

- Auditing Notes - UWA ACCT3322Document37 pagesAuditing Notes - UWA ACCT3322parin100% (1)

- SBR Examiner's Report March June 2022Document14 pagesSBR Examiner's Report March June 2022Jony SaifulNo ratings yet

- Questions and AnswersDocument20 pagesQuestions and AnswersJi YuNo ratings yet

- Historical Financial Analysis - CA Rajiv SinghDocument78 pagesHistorical Financial Analysis - CA Rajiv Singhవిజయ్ పి100% (1)

- Audit ProcessDocument21 pagesAudit ProcessCarmelie CumigadNo ratings yet

- CHED ETEEAP application processDocument2 pagesCHED ETEEAP application processMary GeeNo ratings yet

- Domain 2Document20 pagesDomain 2Nagendra KrishnamurthyNo ratings yet

- Cima f1 2012 NotesDocument18 pagesCima f1 2012 NotesThe ExP GroupNo ratings yet

- Auditing the Procurement Plan ProcessDocument8 pagesAuditing the Procurement Plan ProcessnarendraidealNo ratings yet

- ISA 610 Using The Work of Internal AuditorsDocument4 pagesISA 610 Using The Work of Internal AuditorsNURUL FAEIZAH BINTI AHMAD ANWAR / UPMNo ratings yet

- Nguyễn Bùi Thanh Tùng 16071262Document38 pagesNguyễn Bùi Thanh Tùng 16071262Nghiêm Thu HiềnNo ratings yet

- Ohs 18001Document2 pagesOhs 18001Haleem Ur Rashid BangashNo ratings yet

- MCQ'sDocument12 pagesMCQ'shusseinNo ratings yet

- BDP Department Periodic Audit Report .2Document30 pagesBDP Department Periodic Audit Report .2Arefayne WodajoNo ratings yet

- ISO 9001:2015 CS 1 Context, Policy and Objectives - 2017Document2 pagesISO 9001:2015 CS 1 Context, Policy and Objectives - 2017YasirdzNo ratings yet

- Internal ControlDocument36 pagesInternal ControlGotta Patti HouseNo ratings yet

- Project management multiple choice questionsDocument68 pagesProject management multiple choice questionsMohamed Desouky100% (1)

- Top10 Hse Interviewquestions With AnswersDocument21 pagesTop10 Hse Interviewquestions With AnswersramodNo ratings yet

- SBL MJ23 Examiner's ReportDocument21 pagesSBL MJ23 Examiner's ReportAmmar ArifNo ratings yet

- CIA P1 Plan A4 PDFDocument15 pagesCIA P1 Plan A4 PDFMohammed DonzoNo ratings yet

- Pass4Test: IT Certification Guaranteed, The Easy Way!Document8 pagesPass4Test: IT Certification Guaranteed, The Easy Way!Ruther SumiliNo ratings yet

- Sample Question PaperDocument61 pagesSample Question PaperVirender ChaudharyNo ratings yet

- Audit & Assurance: Cheat SheetDocument3 pagesAudit & Assurance: Cheat SheetSyamkrishnanNo ratings yet

- Management Consultant (ANZSCO Code: 224711) : SRGO Occupational Information SheetDocument4 pagesManagement Consultant (ANZSCO Code: 224711) : SRGO Occupational Information SheetPartap0% (1)

- F8 2days Live Online Revision ClassDocument85 pagesF8 2days Live Online Revision Classbillyryan167% (3)

- Auditing AssignmentDocument5 pagesAuditing AssignmentseanNo ratings yet

- Audit Quiz ResultsDocument5 pagesAudit Quiz ResultsTiến Thành NguyễnNo ratings yet

- Bsci Auditing Cycle PDFDocument7 pagesBsci Auditing Cycle PDFShiv Raj Mathur100% (1)

- Iso 9001:2015 Quality Management System Audit Checklist NHADocument3 pagesIso 9001:2015 Quality Management System Audit Checklist NHAsajid waqas100% (2)

- CIA Exam NotesDocument1 pageCIA Exam NotesMahesh ToppaeNo ratings yet

- Fairfield Institute of Management and Technology Audit Principles, Procedures and TechniquesDocument9 pagesFairfield Institute of Management and Technology Audit Principles, Procedures and TechniquesStar BoyNo ratings yet

- Certified Internal Certified Internal Certified Internal Certified Internal Auditor Exam Auditor Exam Auditor Exam Auditor ExamDocument29 pagesCertified Internal Certified Internal Certified Internal Certified Internal Auditor Exam Auditor Exam Auditor Exam Auditor ExamRichard ClarksonNo ratings yet

- The Audit Process - Final ReviewDocument5 pagesThe Audit Process - Final ReviewFazlan Muallif ResnuliusNo ratings yet

- Iso 9000 & Total Quality ManagementDocument13 pagesIso 9000 & Total Quality Managementalifatehitqm100% (1)

- City EMS Internal Audit ReportDocument3 pagesCity EMS Internal Audit ReportKalpesh NahataNo ratings yet

- SBL Exam KitDocument24 pagesSBL Exam KitSIN NI TANNo ratings yet

- ManagementAccounting (TermPaper)Document11 pagesManagementAccounting (TermPaper)Eshfaque Alam Dastagir100% (1)

- p4 - BPP Passcard (2016) byDocument161 pagesp4 - BPP Passcard (2016) byGyörgyi AlbertNo ratings yet

- ACCA F8 Audit Test - AnswersDocument4 pagesACCA F8 Audit Test - Answerskumassa kenyaNo ratings yet

- Abnormal Audit Fee and Audit QualityDocument23 pagesAbnormal Audit Fee and Audit QualityYohaNnesDeSetiyanToNo ratings yet

- Marketing Exam Questions and AnswersDocument2 pagesMarketing Exam Questions and AnswersAAKNo ratings yet

- f1 Acca Lesson2Document8 pagesf1 Acca Lesson2Ganit SimonNo ratings yet

- Audit PlanDocument51 pagesAudit PlanBrian BerryNo ratings yet

- Although I Used To Face Some Unachievable TasksDocument1 pageAlthough I Used To Face Some Unachievable TasksLi XiangNo ratings yet

- Transportation Research Part A: Qiong Zhang, Hangjun Yang, Qiang Wang, Anming ZhangDocument13 pagesTransportation Research Part A: Qiong Zhang, Hangjun Yang, Qiang Wang, Anming ZhangLi XiangNo ratings yet

- Pricing of Regional Airline Services in Australia and New Zealand, 2011 - 2015Document12 pagesPricing of Regional Airline Services in Australia and New Zealand, 2011 - 2015Li XiangNo ratings yet

- 2015 Exam Answer GuideDocument7 pages2015 Exam Answer GuideLi XiangNo ratings yet

- Intermediate Macroeconomics: Economic Growth and the Solow ModelDocument33 pagesIntermediate Macroeconomics: Economic Growth and the Solow ModelLi XiangNo ratings yet

- Busn7005 Final Exam InstructionsDocument2 pagesBusn7005 Final Exam InstructionsLi XiangNo ratings yet

- Economics 1 Problem Set 5 - Suggested AnswersDocument5 pagesEconomics 1 Problem Set 5 - Suggested AnswersLi XiangNo ratings yet

- 8069 Solow Model 2Document30 pages8069 Solow Model 2Li XiangNo ratings yet

- Busn7054 Final Exam S2 2020Document18 pagesBusn7054 Final Exam S2 2020Li XiangNo ratings yet

- Problem Set # 9 Solutions: Chapter 12 #2Document6 pagesProblem Set # 9 Solutions: Chapter 12 #2locomotivetrackNo ratings yet

- Practice exam questions analyzedDocument4 pagesPractice exam questions analyzedLi XiangNo ratings yet

- Question 1 (15 Marks)Document11 pagesQuestion 1 (15 Marks)Li XiangNo ratings yet

- BUSN8003 - 3133 - Advanced Managerial Decision Making - Sem1 - 2021 - CLASS SUMMARY FINALDocument7 pagesBUSN8003 - 3133 - Advanced Managerial Decision Making - Sem1 - 2021 - CLASS SUMMARY FINALLi XiangNo ratings yet

- 7036 Assignment 1 介绍Document4 pages7036 Assignment 1 介绍Li XiangNo ratings yet

- Transportation Research Part A: Qiong Zhang, Hangjun Yang, Qiang Wang, Anming ZhangDocument13 pagesTransportation Research Part A: Qiong Zhang, Hangjun Yang, Qiang Wang, Anming ZhangLi XiangNo ratings yet

- Macroeconomics - Theory Through Application - AttributedDocument494 pagesMacroeconomics - Theory Through Application - AttributedLi XiangNo ratings yet

- The Ielts Scoring CriteriaDocument4 pagesThe Ielts Scoring CriteriaLi XiangNo ratings yet

- Welcome To BUSN8003 Advanced Managerial Decision Making: Introduction To The CourseDocument47 pagesWelcome To BUSN8003 Advanced Managerial Decision Making: Introduction To The CourseLi XiangNo ratings yet

- Fertility and Savings Contractions in China: Long-Run Global ImplicationsDocument27 pagesFertility and Savings Contractions in China: Long-Run Global ImplicationsLi XiangNo ratings yet

- Understanding the Neutral Vowels and Tense Vowels 中性元 ⾳和紧元⾳: / e / 常见组合 (e) /æ/ 常见组合 (a e) 区别这两种元⾳的区别,是改变发⾳最根本的⽅法Document3 pagesUnderstanding the Neutral Vowels and Tense Vowels 中性元 ⾳和紧元⾳: / e / 常见组合 (e) /æ/ 常见组合 (a e) 区别这两种元⾳的区别,是改变发⾳最根本的⽅法Li XiangNo ratings yet

- Childhood Obesity: Educational ProgramsDocument2 pagesChildhood Obesity: Educational ProgramsLi XiangNo ratings yet

- Intermediate Macroeconomics: Economic Growth and the Solow ModelDocument33 pagesIntermediate Macroeconomics: Economic Growth and the Solow ModelLi XiangNo ratings yet

- 7036 字幕Document8 pages7036 字幕Li XiangNo ratings yet

- The Town Is Looking To Us For AnswersDocument1 pageThe Town Is Looking To Us For AnswersLi XiangNo ratings yet

- Can You Afford A Second ChildDocument2 pagesCan You Afford A Second ChildLi XiangNo ratings yet

- 7036 Assignment 1 介绍Document4 pages7036 Assignment 1 介绍Li XiangNo ratings yet

- Industry Analysis Passenger Air Transport Accounted For 86Document8 pagesIndustry Analysis Passenger Air Transport Accounted For 86Li XiangNo ratings yet

- Idioms On CromeDocument2 pagesIdioms On CromeCida FeitosaNo ratings yet

- Welles, Hellenistic Tarsus (1962)Document35 pagesWelles, Hellenistic Tarsus (1962)alverlin100% (1)

- Tangan Vs CADocument1 pageTangan Vs CAjoyNo ratings yet

- Minutes 1 SteagDocument3 pagesMinutes 1 SteagPalashXVNo ratings yet

- Philippine Education and Development Throughout HistoryDocument107 pagesPhilippine Education and Development Throughout HistoryZiennard GeronaNo ratings yet

- Check Your English Vocabulary For Law - No KeysDocument70 pagesCheck Your English Vocabulary For Law - No Keysshako khositashviliNo ratings yet

- CHAPTER 17 - RevisedDocument3 pagesCHAPTER 17 - RevisedJoy ReAliza GuerreroNo ratings yet

- Heirs of Spouses Teofilo M. Reterta and Elisa Reterta vs. Spouses Lorenzo Mores and Virginia Lopez, 655 SCRA 580, August 17, 2011Document20 pagesHeirs of Spouses Teofilo M. Reterta and Elisa Reterta vs. Spouses Lorenzo Mores and Virginia Lopez, 655 SCRA 580, August 17, 2011TNVTRLNo ratings yet

- Under 13, 15 and Open NewDocument3 pagesUnder 13, 15 and Open NewPRADEEP PATHAKNo ratings yet

- Caselman DIY AMG + Multimedia (Copyleft)Document106 pagesCaselman DIY AMG + Multimedia (Copyleft)cliftoncage100% (1)

- 2019 Os Parent Handbook Final 2Document44 pages2019 Os Parent Handbook Final 2api-573823749No ratings yet

- Government Structure in CanadaDocument4 pagesGovernment Structure in CanadaMichelleLawNo ratings yet

- Overview of Financial Services Act 2013Document11 pagesOverview of Financial Services Act 2013FatehahNo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Intercepting Android HTTPDocument13 pagesIntercepting Android HTTPJurgen DesprietNo ratings yet

- Chapter One - RH For Africa Medical College - MPHDocument72 pagesChapter One - RH For Africa Medical College - MPHTex ZgreatNo ratings yet

- Assignment On Speluncean ExplorersDocument4 pagesAssignment On Speluncean Explorersnnabuifedumebi8No ratings yet

- Inspector Order To Merrut From Lucknow Zone 10.10.2014Document3 pagesInspector Order To Merrut From Lucknow Zone 10.10.2014SUSHIL KUMARNo ratings yet

- BL 3 - Final Exam Answer SheetDocument1 pageBL 3 - Final Exam Answer SheetCarren Abiel OberoNo ratings yet

- BS7419 1991 PDFDocument13 pagesBS7419 1991 PDFsurangaNo ratings yet

- Types of Borrowers-Lending ProcessDocument39 pagesTypes of Borrowers-Lending ProcessEr YogendraNo ratings yet

- ECC Online Application Procedures (Category B-IEEC)Document1 pageECC Online Application Procedures (Category B-IEEC)Joseph CajoteNo ratings yet

- Strategic AlliancesDocument20 pagesStrategic Alliancessatyabrat sahoo100% (1)

- Professional Conduct and Ethics F8800 PDFDocument63 pagesProfessional Conduct and Ethics F8800 PDFSimushi Simushi100% (4)

- Review of Related Literature and StudiesDocument11 pagesReview of Related Literature and StudiesDevilo AtutuboNo ratings yet

- Financial Distress (2008)Document24 pagesFinancial Distress (2008)Ira Putri100% (1)

- Badminton Laws SummaryDocument7 pagesBadminton Laws SummarylyubovshankarNo ratings yet

- Chittagong Agent ListDocument11 pagesChittagong Agent ListMuhammad0% (2)

- Financial GlobalizationDocument10 pagesFinancial GlobalizationAlie Lee GeolagaNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Guidelines for Organization of Working Papers on Operational AuditsFrom EverandGuidelines for Organization of Working Papers on Operational AuditsNo ratings yet