Professional Documents

Culture Documents

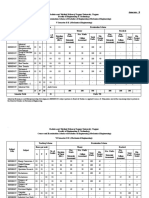

CISC Vs Mark Sensing

Uploaded by

Roger Montero Jr.Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CISC Vs Mark Sensing

Uploaded by

Roger Montero Jr.Copyright:

Available Formats

G.R. No.

192159

Today is Monday, April 08, 51235 Today is Tuesday, March 02, 2021

Constitution

Constitution Statutes

Statutes Executive

Executive Issuances

Issuances Judicial

Judicial Issuances

Issuances Other

OtherIssuances

Issuances Jurisprudence

Jurisprudence International

InternationalLegal Resources AUSL

Legal Resources AUSLExclusive

Exclusive

Constitution

Constitution Statutes

Statutes Executive

Executive Issuances

Issuances Judicial

Judicial Issuances

Issuances Other

OtherIssuances

Issuances Jurisprudence

Jurisprudence International

InternationalLegal Resources AUSL

Legal Resources AUSLExclusive

Exclusive

THIRD DIVISION

January 25, 2017

G.R. No. 192159

COMMUNICATION AND INFORMATIONWe SYSTEMS CORPORATION,

use cookies Petitioner,

to ensure you get the

vs. best experience on Lawphil.net.

MARK SENSING AUSTRALIA PTY. LTD., MARK SENSING

By continuing PHILIPPINES,

to browse INC.

our site, you areand OFELIA B. CAJIGAL,

Respondents. agreeing to our use of cookies.

Find

D E Cout

I S more

I O N here.

JARDELEZA, J.:

OK

OK

This is a petition for review on certiorari1seeking to set aside the Decision2 dated November 25, 2009 and

Resolution3 dated April 23, 2010 of the Court of Appeals (CA) in CA-G.R. SP No. 110511. The question is whether

courts may approve an attachment bond which has been reinsured as to the excess of the issuer's statutory

retention limit.

Petitioner Communication and Information Systems Corporation (CISC) and respondent Mark Sensing Australia Pty.

Ltd. (MSAPL) entered into a Memorandum of Agreement4 (MOA) dated March 1, 2002 whereby MSAPL appointed

CISC as "the exclusive AGENT of [MS APL] to PCSO during the [lifetime] of the recently concluded Memorandum of

Agreement entered into between [MSAPL], PCSO and other parties." The recent agreement referred to in the MOA

is the thermal paper and bet slip supply contract (the Supply Contract) between the Philippine Charity Sweepstakes

Office (PCSO), MSAPL, and three other suppliers, namely Lamco Paper Products Company, Inc. (Lamco Paper),

Consolidated Paper Products, Inc. (Consolidated Paper) and Trojan Computer Forms Manufacturing Corporation

(Trojan Computer Forms). 5 As consideration for CISC's services, MSAPL agreed to pay CISC a commission of

24.5% of future gross sales to PCSO, exclusive of duties and taxes, for six years.6

After initially complying with its obligation under the MOA, MSAPL stopped remitting commissions to CISC during

the second quarter of 2004. MSAPL justified its action by claiming that Carolina de Jesus, President of CISC,

violated her authority when she negotiated the Supply Contract with PCSO and three of MSAPL's competitors.

According to MSAPL, it lost almost one-half of its business with PCSO because the Supply Contract provided that

MSAPL's business with PCSO shall be limited to the latter's Luzon operations, with MSAPL supplying 70% of

thermal rolls and 50% of bet slips. MSAPL pointed out that it used to have a Build Operate Transfer (BOT)

Agreement with PCSO where it undertook to build a thermal paper and bet slip manufacturing facility to supply all

requirements of PCSO. However, PCSO unilaterally cancelled the BOT Agreement and granted supply contracts to

Lamco Paper, Consolidated Paper and Trojan Computer Forms, which ultimately resulted in litigation between the

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

parties.7 The suit was eventually settled when PCSO, MSAPL, and the three other suppliers entered into the Supply

Contract, which was submitted and approved by the Regional Trial Court (RTC), Branch 224 of Quezon City, as a

compromise agreement.8 MSAPL felt shortchanged by CISC's efforts and thus decided to withhold payment of

commissions.

As a result of MSAPL's refusal to pay, CISC filed a complaint before the RTC in Quezon City for specific

performance against MS APL, Mark Sensing Philippines, Inc. (MSPI), Atty. Ofelia Cajigal, and PCS0.9 CISC prayed

that private respondents be ordered to comply with its obligations under the MOA. It also asked the RTC to issue a

writ of preliminary mandatory injunction and/or writ of attachment. 10 The RTC denied CISC's prayer for mandatory

injunctive relief but ordered the PCSO to hold the amount being contested until the final determination of the case. 11

It later reversed itself, holding that its jurisdiction is limited to the amount stated in the complaint and therefore had

no jurisdiction to order PCSO to withhold payments in excess of such amount. 12 This order of reversal became the

subject of a separate petition for certiorari filed by CISC before the CA, docketed as CA-G.R. SP No. 96620. 13 The

CA later reversed the RTC and ordered that the additional docket fees shall constitute a lien on the judgment. 14

On September 10, 2007, the RTC granted CISC's application for issuance of a writ of preliminary attachment,

stating that "the non-payment of the agreed commission constitutes fraud on the part of the defendant MSAPL in

their performance of their obligation to the plaintiff." 15 The RTC found that MSAPL is a foreign corporation based in

Australia, and its Philippine subsidiary, MSPI, has no other asset except for its collectibles from PCSO. Thus, the

RTC concluded that CISC may be left without any security if ever MSAPL is found liable. 16 But the RTC limited the

attachment to ₱4,861,312.00, which is the amount stated in .the complaint, instead of the amount sought to be

attached by CISC, i.e., ?113,197,309.10. 17 The RTC explained that it "will have to await the Supreme Court

judgment over the issue of whether [it] has jurisdiction on the amounts in the excess of the amount prayed for by the

plaintiff in their complaint" since MSAPL appealed the adverse judgment in CA-G.R. SP No. 96620 to us. 18 We later

denied MSAPL's petition for review assailing the CA Decision in CA-G.R. SP No. 96620 (subsequently docketed as

G.R. No. 179073) in a Resolution dated November 12, 2007. 19 It became final and executory on March 25, 2008.20

In view of this development, CISC moved to amend the order of attachment to include unpaid commissions in

excess of the amount stated in the complaint. On December 22, 2008, the RTC granted CISC's motion and issued

1âwphi1

a new writ of preliminary attachment.21 On April 13, 2009, the RTC, acting on the partial motions for reconsideration

by both CISC and MSAPL, modified the amount covered by the writ to reflect the correct amount prayed for by CISC

in its previous motion to amend the attachment order conditioned upon the latter's payment of additional docket

fees. It also denied MSAPL' s opposition to the attachment order for lack of merit. 22 On July 2, 2009, the RTC

modified its order insofar as it allowed CISC to pay docket fees within a reasonable time. 23

On July 8, 2009, CJSC posted a bond in the amount of ₱113,197,309.10 through Plaridel Surety and Insurance

Company (Plaridel)

in favor of MSAPL, which the RTC approved on the same date.24 Two days later, MSAPL filed a motion to determine

the sufficiency of the bond because of questions regarding the financial capacity of Plaridel.25 But before the RTC

could act on this motion, MSAPL, apparently 'getting hold of Plaridel' s latest financial statements, moved to recall

and set aside the approval of the attachment bond on the ground that Plaridel had no capacity to underwrite the

bond pursuant to Section 215 of the old Insurance Code26 because its net worth was only P214,820,566.00 and

could therefore only underwrite up to P42,964, 113.20.27 On September 4, 2009, the RTC denied MSAPL's motion,

finding that although Plaridel cannot underwrite the bond by itself, the amount covered by the attachment bond "was

likewise re-insured to sixteen other insurance companies."28 However, "for the best interest of both parties," the RTC

ordered Plaridel to submit proof that the amount of ₱95,8 l 9,770.91 was reinsured. Plaridel submitted its

compliance on September 11, 2009, attaching therein the reinsurance contracts. 29

On September 18, 2009, MSAPL, MSPI and Atty. Ofelia Cajigal 30 filed a petition for certiorari before the CA,

docketed as CA-G.R. SP No. 11051 l, assailing the Orders of the RTC dated April 13, 2009, July 2, 2009, July 8,

2009, and September 4, 2009. In its now-assailed Decision dated November 25, 2009, the CA granted the petition.31

It concluded that the petition for certiorari was filed on time because MSAPL did not abandon their right to impugn

the evidence submitted in the application for the writ of preliminary attachment, because they filed a motion to

determine the sufficiency of the bond. On the merits, it held that the RTC exceeded its authority when it "ordered the

issuance of the writ [of preliminary attachment] despite a dearth of evidence to clearly establish [CISC's] entitlement

thereto, let alone the latter's failure to comply with all requirements therefor."32 Noting that the posting of the

attachment bond is a jurisdictional requirement, the CA concluded that since Plaridel's capacity for single risk

coverage is limited to 20% of its net worth, or ₱57,866,599.80, the RTC "should have set aside the second writ

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

outright for non-compliance with Sections 3 and 4 of Rule 57."33

After the CA perfunctorily denied CISC's motion for reconsideration on April 23, 2010,34 it filed this petition for review

on certiorari.

II

CISC argues that the CA erred in giving due course to the petition insofar as it challenged the Orders elated April

13, 2009, July 2, 2009, and July 8, 2009 because the reglementary period to challenge these Orders already lapsed

by the time private respondents filed their petition for certiorari below.35 In response, MSAPL contends that since

they continued to assail the additional attachment from the time it was first issued, the 60-day period should be

counted from the final denial of their challenge to the additional attachment, which was on September 4, 2009.36

MSAPL' s theory is similar to that proffered by one of the parties in the case of San Juan, Jr. v. Cruz.37The petitioner

therein filed second and third motions for reconsideration from an interlocutory order by the trial court. When he filed

the petition for certiorari with the CA, he counted the 60-day reglementary period from the notice of denial of his third

motion for reconsideration. He argued that since there is no rule prohibiting the filing of a second or third motion for

reconsideration of an interlocutory order, the 60-day period should be counted from the notice of denial of the last

motion for reconsideration. In resolving the question of when the reglementary period for filing a petition for certiorari

shall be counted, we held that the "60-day period shall be reckoned from the trial court's denial of his first motion for

reconsideration, otherwise indefinite delays will ensue."38

Applying the rule in San Juan, MSAPL's challenge to the order dated April 13, 2009 was clearly time-barred. The

60-day reglementary period for challenging the RTC's issuance of the amended writ of attachment should be

counted from April 27, 2009,39 the date when MSAPL received a copy of the April 13, 2009 Order denying MSAPL's

motion for reconsideration of the December 22, 2008 Order which granted CISC's motion to amend the writ of

preliminary attachment. The CA, however, considered MSAPL's act of filing a motion to determine the sufficiency of

the bond as a definitive indication that private respondents have not "abandoned their right to impugn the evidence

submitted in the application for the second writ."40 This is erroneous for two reasons: first, MSAPL's motion never

impugned the propriety and factual bases of the RTC's issuance of the amended writ of attachment; and second,

even if it did, the motion would be considered as a second motion for reconsideration, which could not have stayed

the reglementary period within which to file a petition for certiorari assailing an interlocutory order. We emphasize

that the provisions on reglementary periods are strictly applied, indispensable as they are to the prevention of

needless delays, and are necessary to the orderly and speedy discharge of judicial business. The timeliness of filing

a petition for certiorari is mandatory and jurisdictional, and should not be trifled with.41

Meanwhile, the Orders dated July 2, 2009 and July 8, 2009 resolved incidental issues with respect to the issuance

of the amended writ of attachment, namely: (1) when the additional docket fees should be paid; and (2) the approval

of the attachment bond. As regards the first incidental issue, the RTC allowed CISC to pay the additional docket

fees "within a reasonable time but in no case beyond its applicable prescriptive or reglementary period. "42 MS APL,

instead of filing a motion for reconsideration of the July 2, 2009 Order, elected to file a motion to compel CISC to

pay the required docket fees on August 14, 2009.43 Evidently, MS APL already recognized the validity of the July 2,

2009 Order and sought CISC's compliance with the Order. Notably, the motion remained pending before the RTC

when MSAPL filed its petition for certiorari with the CA. We find that the petition for certiorari, insofar as it questions

the alleged non-payment of docket fees, was prematurely filed because the RTC has yet to rule on this issue. A

petition for certiorari may be resorted to only when there is no plain, speedy, and adequate remedy in the ordinary

course of law. 44 It is not up to parties to preempt the trial court's action on their motions. Absent any showing of

unreasonable delay on the part of the RTC-and there is none here, considering the short period between the filing of

the motion and the petition for certiorari, as well as the various incidents pending a quo-MSAPL's recourse to the CA

was premature. The more appropriate remedy for MSAPL would have been to move for the RTC to resolve its

pending motion instead of precipitately raising this matter in its petition for certiorari.45

This leaves the July 8, 2009 Order which approved the attachment bond Plaridel submitted. It was directly

challenged by MSAPL when the latter filed a motion to determine the sufficiency of the bond because of questions

regarding Plaridel's financial capacity. Before the RTC could act on the motion, however, MSAPL filed an urgent

motion to recall and set aside the approval of the attachment bond, dated July 21, 2009,46 on the ground that the

attachment bond underwritten by Plaridel exceeded its retention limit under the Insurance Code. The RTC resolved

these two motions jointly in its September 4, 2009 Order, holding that Section 215 allows insurance companies to

insure a single risk in excess of retention limits provided that the excess amount is ceded to reinsurers, and

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

consequently affirming its approval of the attachment bond. In turn, the September 4, 2009 Order became the

anchor of MSAPL's petition for certiorari. Although not captioned as "motions for reconsideration," the twin motions

filed by MSAPL directly challenged the approval of the attachment bond, and the September 4, 2009 Order was the

second time the RTC passed upon the issue concerning the sufficiency of the bond. Therefore, the petition for

certiorari filed by MSAPL on September 18, 2009, insofar as it assailed both the July 8, 2009 and September 4,

2009 Orders, was timely filed.

III

We now resolve the sole substantive issue before us: whether the RTC committed grave abuse of discretion when it

approved the attachment bond whose face amount exceeded the retention limit of the surety.

Section 215 of the old Insurance Code,47 the law in force at the time Plaridel issued the attachment bond, limits the

amount of risk that insurance companies can retain to a maximum of 20% of its net worth. However, in computing

the retention limit, risks that have been ceded to authorized reinsurers are ipso jure deducted.48 In mathematical

terms, the amount of retained risk is computed by deducting ceded/reinsured risk from insurable risk.49 If the

resulting amount is below 20% of the insurer's net worth, then the retention limit is not breached. In this case, both

the RTC and CA determined that, based on Plaridel's financial statement that was attached to its certificate of

authority issued by the Insurance Commission, its net worth is ₱289,332,999.00. 50 Plaridel's retention limit is

therefore ₱57,866,599.80, which is below the ₱113,197,309.10 face value of the attachment bond. However, it only

retained an insurable risk of ₱l7,377,938.19 because the remaining amount of ₱98,819,770.91 was ceded to 16

other insurance companies. 51 Thus, the risk retained by Plaridel is actually ₱40 Million below its maximum retention

limit. Therefore, the approval of the attachment bond by the RTC was in order. Contrary to MSAPL's contention that

the RTC acted with grave abuse of discretion, we find that the RTC not only correctly applied the law but also acted

judiciously when it required Plaridel to submit proof of its reinsurance contracts after MSAPL questioned Plaridel's

capacity to underwrite the attachment bond. Apparently, MSAPL failed to appreciate that by dividing the risk through

reinsurance, Plaridel's attachment bond actually became more reliable-as it is no longer dependent on the financial

stability of one company-and, therefore, more beneficial to MSAPL.

In cancelling Plaridel's insurance bond, the CA also found that because the reinsurance contracts were issued in

favor of Plaridel, and not MSAPL, these failed to comply with the requirement of Section 4, Rule 57 of the Rules of

Court requiring the bond to be executed to the adverse party.52 This led the CA to conclude that "the bond has been

improperly and insufficiently posted."53 We reverse the CA and so hold that the reinsurance contracts were correctly

issued in favor of Plaridel. A contract of reinsurance is one by which an insurer (the "direct insurer" or "cedant")

procures a third person (the "reinsurer") to insure him against loss or liability by reason of such original insurance. 54

It is a separate and distinct arrangement from the original contract of insurance, whose contracted risk is insured in

the reinsurance agreement.55 The reinsurer's contractual relationship is with the direct insurer, not the original

insured, and the latter has no interest in and is generally not privy to the contract of reinsurance. 56 Put simply,

reinsurance is the "insurance of an insurance."57

By its nature, reinsurance contracts are issued in favor of the direct insurer because the subject of such contracts is

the direct insurer's risk-in this case, Plaridel's contingent liability to MSAPL-and not the risk assumed under the

original policy.58 The requirement under Section 4, Rule 57 of the Rules of Court that the applicant's bond be

executed to the adverse party necessarily pertains only to the attachment bond itself and not to any underlying

reinsurance contract. With or without reinsurance, the obligation of the surety to the party against whom the writ of

attachment is issued remains the same.

WHEREFORE, the petition is GRANTED. The Decision dated November 25, 2009 and Resolution dated April 23,

2010 of the Court of Appeals in CA-G.R. SP No. 110511 are SET ASIDE.

SO ORDERED.

FRANCIS H. JARDELEZA

Associate Justice

WE CONCUR:

MARIA LOURDES P.A. SERENO

Associate Justice

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

Chairperson

JOSE C. MENDOZA* ESTELA M. PERLAS-BERNABE*

Associate Justice Associate Justice

ALFREDO BENJAMIN S. CAGUIOA**

Associate Justice

ATTESTATION

I attest that the conclusions in the above Decision had been reached in consultation before the case was assigned

to the writer of the opinion of the Court’s Division.

PRESBITERO J. VELASCO, JR.

Associate Justice

Chairperson, Third Division

CERTIFICATION

Pursuant to the Section 13, Article VIII of the Constitution, and the Division Chairperson’s attestation, it is hereby

certified that the conclusions in the above Decision had been reached in consultation before the case was assigned

to the writer of the opinion of the Court’s Division.

MARIA LOURDES P.A. SERENO

Chief Justice

Footnotes

*

Designated as Additional Members per Raffle dated .January 18, 2017.

**

Designated as Fifth Member of the Third Division per Special Order No. 2417 dated January 4, 2017.

1

Rollo, pp. 15-56.

2

Id. at 57-86. Special Third Division, penned by Associate Justice Ricardo R. Rosario, with Associate

Justices Jose C. Reyes, Jr. and Magdangal M. De Leon concurring.

3

Id. at 87-88.

4

Id. at 100-101. Executed b Gordon Harold Poole, as Chief Executive Officer of MSAPL, and Carolina de

Jesus for CISC.

5

Memorandum of Agreement dated January 17, 2003 executed by Ma. Livia de Leon, Chairman of PCSO,

Gordon H. Poole, Managing Director or MSAPL, Giovanni Tan, President of Trojan Computer Forms, George

Santos, Sales Director of Consolidated Paper, and Terry Sy, Vice-President of Lamco Paper, id. at 510-518.

6

Id. at 100.

7

Id. at 447-448.

8

Docketed as Civil Case No. Q-99-37467. Id. at 519-528.

9

Docketed as Civil Case No. 05-54756 and raffled to Branch 95. Id. at 89-99.

10

Id. at 97-98.

11

Id. at 124-129.

12

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

Id. at 130-146.

13

Decision dated February 7, 2007 penned by Associate Justice Apolinario D. Bruselas, Jr., with Associate

Justices Bienvenido L. Reyes and Aurora Santiago-Lagman, concurring, id. at 178-191.

14

Id

15

Rollo, p. 197.

16

Id

17

Rollo, pp. 23-24; l 97-198.

18

Id. at 198.

19

Id. at 192-193.

20

Id. at 204-205.

21

Id. at 221-229.

22

Id. at 230-232.

23

Id. at241-244.

24

Id. at 245.

25

Id. at 68.

26

Presidential Decree No. 612 (1974).

27

Rollo, pp. 265-268.

28

Id. at 68-69.

29

Id. at 69.

30

For brevity, private respondents MSAPL, MSPI, and Atty. Ofelia Cajigal shall be collectively referred to as

"MSAPL" from hereon.

31

Id. at 32-34; 84-85.

32

Id. at 74.

33

Id. at 83.

34

Supra note 3.

35

Id. at 36-41.

36

Rollo, pp. 461-463.

37

G.R. No. 167321, July 31, 2006, 497 SCRA 410.

38

Id. at 424.

39

Rollo, p. 304.

40

Id. at 73-74.

41

Visayan Electric Company Employees Union-ALU-TUCP v. Visayan Electric Company, Inc. (VECO), G.R.

No. 205575, July 22, 2015, 763 SCRA 566, 577.

G.R. No. 192159.html[02/03/2021 01:30:29]

G.R. No. 192159

42

Rollo, p. 244.

43

Id. at 259-264; 305.

44

RULES OF COURT, Rule 65, Sec. 1.

45

Santos v. Court of Appeals, G.R. No. 155374, November 20, 2007, 537 SCRA 665, 671.

46

Rollo, pp. 265-268.

47

Superseded in 20 l 3 by Republic Act No. l 0607, An Act Strengthening the Insurance Industry, Further

Amending Presidential Decree No. 612, Otherwise Known as "The Insurance Code", as Amended by

Presidential Decree Nos. 1141, 1280, 1455, 1460, 1814, and 1981, and Batas Pambansa Blg. 874, and for

Other Purposes (amended code). Section 215 of the old code was substantially reproduced in Section 221 of

the amended code.

48

Sec. 215. No insurance company other than life, whether foreign or domestic, shall retain any risk on any

one subject of insurance in an amount exceeding twenty per centum of its net worth. For purposes of this

section, the term "subject of insurance" shall include all properties or risks insured by the same insurer that

customarily are considered by non-life company underwriters to be subject to loss or damage from the same

occurrence of any hazard insured against. Reinsurance ceded as authorized under the succeeding title shall

be deducted in determining the risk retained. As to surety risk, deduction shall also be made of the amount

assumed by any other company authorized to transact surety business and the value of any security

mortgage, pledged, or held subject to the surety's control and for the surety's protection.

49

Retained Risk= Insurable Risk - Reinsured Risk

50

Rollo, pp. 69; 82.

51

Id. at 273-292.

52

RULES OF COURT, Rule 57, Sec. 4. Condition of applicant's bond. - The party applying for the order must

thereafter give a bond executed to the adverse party in the amount fixed by the court in its order granting the

issuance of the writ, conditioned that the latter will pay all the costs which may be adjudged to the adverse

party and all damages which he may sustain by reason of the attachment, if the court shall finally adjudge that

the applicant was not entitled thereto.

53

Rollo, p. 84.

54

Presidential Decree No. 612, Sec. 95. Reproduced verbatim in Republic Act No. 10607, Sec. 97.

55

Avon Insurance PLC v. Court of Appeals, G.R. No. 97642, August 29, 1997, 278 SCRA 312, 322.

56

Presidential Decree No. 612, Sec. 98. Reproduced verbatim in Republic Act No. 10607, Sec. 100.

57

De Leon & De Leon, Jr., The Insurance Code of the Philippines, 2014 ed., p. 315.

58

Of course, the reinsurance policy is necessarily based upon the original policy, and the terms and

conditions of the reinsurance policy are greatly affected by those of the original policy. Id. at 322.

The Lawphil Project - Arellano Law Foundation

Drop here!

G.R. No. 192159.html[02/03/2021 01:30:29]

You might also like

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemFrom EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemRating: 4 out of 5 stars4/5 (16)

- ORTEGA VS CAG.R. No. 109248Document5 pagesORTEGA VS CAG.R. No. 109248Roger Montero Jr.No ratings yet

- MAGDUSA G.R. No. L-17526Document2 pagesMAGDUSA G.R. No. L-17526Roger Montero Jr.No ratings yet

- Finman Vs CADocument3 pagesFinman Vs CARoger Montero Jr.No ratings yet

- New World Vs NYK G.R. No. 171468Document6 pagesNew World Vs NYK G.R. No. 171468Roger Montero Jr.No ratings yet

- Today Is Monday3Document2 pagesToday Is Monday3Gabriel EmersonNo ratings yet

- Exhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesDocument5 pagesExhibit 2. Kexuan Yao Retainign Law Firm For Legal Opinion To TRANSFER SharesAdam LemboNo ratings yet

- BILL OF ATTAINDWER CAseDocument1 pageBILL OF ATTAINDWER CAseJayson LanuzaNo ratings yet

- Today is Monday, August 02, 2021 constitution statutes executive judicial other jurisprudence international resources AUSL exclusiveDocument13 pagesToday is Monday, August 02, 2021 constitution statutes executive judicial other jurisprudence international resources AUSL exclusiveNympa VillanuevaNo ratings yet

- By Continuing To Browse Our Site, You Are Agreeing To Our Use of Cookies. Find Out MoreDocument2 pagesBy Continuing To Browse Our Site, You Are Agreeing To Our Use of Cookies. Find Out MoreDat Doria PalerNo ratings yet

- By Continuing To Browse Our Site, You Are Agreeing To Our Use of Cookies. Find Out MoreDocument2 pagesBy Continuing To Browse Our Site, You Are Agreeing To Our Use of Cookies. Find Out MoreDat Doria PalerNo ratings yet

- Today Is MondayDocument1 pageToday Is MondayswityioraxNo ratings yet

- Today's Court Ruling on Surety Company LiabilityDocument6 pagesToday's Court Ruling on Surety Company LiabilityPiayaNo ratings yet

- Supreme Court: W.A. Kincaid, For PetitionerDocument2 pagesSupreme Court: W.A. Kincaid, For PetitionerNova GrailNo ratings yet

- Philippine citizenship granted to Bruce Donald McTavishDocument2 pagesPhilippine citizenship granted to Bruce Donald McTavishApril Elenor JucoNo ratings yet

- Tabango Shell Refinery Employees Association vs. Pilipinas Shell Petroleum CorporationDocument22 pagesTabango Shell Refinery Employees Association vs. Pilipinas Shell Petroleum Corporationlovelycruz yanoNo ratings yet

- Juris On Depostion 4Document5 pagesJuris On Depostion 4dyosaNo ratings yet

- Pacific Rehouse Corporation v. CA, G.R. No. 199687 (2014)Document13 pagesPacific Rehouse Corporation v. CA, G.R. No. 199687 (2014)Ching TanNo ratings yet

- Republic Act No. 11517Document3 pagesRepublic Act No. 11517Joseph Adrian ToqueroNo ratings yet

- Company CRE 1875Document22 pagesCompany CRE 1875Chhavi JainNo ratings yet

- Juris 6Document14 pagesJuris 6Gabriel EmersonNo ratings yet

- Ra 11576Document2 pagesRa 11576Dlos ProNo ratings yet

- GCC Vs ALsonsDocument7 pagesGCC Vs ALsonsKaryl Ann Aquino-CaluyaNo ratings yet

- ..Se'curities'and Exchange Commission.: T. Leonardo C. Santos Associates Law FirmDocument3 pages..Se'curities'and Exchange Commission.: T. Leonardo C. Santos Associates Law FirmJustin Mark ChanNo ratings yet

- En Banc August 28, 2019 G.R. No. 201176 ESTRELLA ABID-BABANO, Petitioner Executive Secretary, Respondent Decision Bersamin, J.Document8 pagesEn Banc August 28, 2019 G.R. No. 201176 ESTRELLA ABID-BABANO, Petitioner Executive Secretary, Respondent Decision Bersamin, J.gsvgsvNo ratings yet

- Custom Search: Today Is Wednesday, July 24, 2019 Today Is Wednesday, July 24, 2019Document31 pagesCustom Search: Today Is Wednesday, July 24, 2019 Today Is Wednesday, July 24, 2019Nikko AlelojoNo ratings yet

- People v. InsuranceDocument7 pagesPeople v. InsuranceRichard BakerNo ratings yet

- COMPANY LAW AryanDocument14 pagesCOMPANY LAW Aryansurima singhNo ratings yet

- Section Wise Jurisprudence On IBC Upto 31.03.2021Document153 pagesSection Wise Jurisprudence On IBC Upto 31.03.2021Tarun SolankiNo ratings yet

- RTC Decision on Lease Contract BreachDocument7 pagesRTC Decision on Lease Contract BreachJeff CruzNo ratings yet

- Zonio v. AcesDocument11 pagesZonio v. AcesRichard BakerNo ratings yet

- Castillon vs Magsaysay: Work-related illness need only reasonable link to seafarer's workDocument21 pagesCastillon vs Magsaysay: Work-related illness need only reasonable link to seafarer's workAudrin Agapito deasisNo ratings yet

- WWW Scribd Com Document 202747687 Court Jurisdiction ChallenDocument1 pageWWW Scribd Com Document 202747687 Court Jurisdiction ChallenJohnnyLarsonNo ratings yet

- Mariano Escueta For Petitioner. No Appearance For The Two Respondent Judges. Alfonso E. Mendoza For The Other RespondentsDocument2 pagesMariano Escueta For Petitioner. No Appearance For The Two Respondent Judges. Alfonso E. Mendoza For The Other RespondentsGabriel EmersonNo ratings yet

- G.R. No. L-5162Document4 pagesG.R. No. L-5162Joffrey UrianNo ratings yet

- Supreme CourtDocument18 pagesSupreme CourtJames Louis MorenoNo ratings yet

- Chuayuco Steel Manufacturing Corporation v. Buklod NG Manggagawa Sa Chuayuco Steel Manufacturing CorporationDocument16 pagesChuayuco Steel Manufacturing Corporation v. Buklod NG Manggagawa Sa Chuayuco Steel Manufacturing CorporationAnnie Herrera-LimNo ratings yet

- EstarijaDocument8 pagesEstarijaKaryl Ann Aquino-CaluyaNo ratings yet

- Presidential Decree No 88Document2 pagesPresidential Decree No 88Brave NeventuraNo ratings yet

- ATlAS V Laguesma PDFDocument5 pagesATlAS V Laguesma PDFWyn DingalNo ratings yet

- Commission On Appointmnet Vs Paler G.R. No. 172623Document7 pagesCommission On Appointmnet Vs Paler G.R. No. 172623Emmanuel FernandezNo ratings yet

- Notable CasesDocument38 pagesNotable CasesNnaji Ugochukwu PaulNo ratings yet

- Bantolino V Coca Cola Bottlers PhilsDocument10 pagesBantolino V Coca Cola Bottlers PhilsHanny LinNo ratings yet

- Acebedo v. CADocument50 pagesAcebedo v. CAJoshuaMaulaNo ratings yet

- Bibiano O. Reynoso Vs CADocument15 pagesBibiano O. Reynoso Vs CARalf Vincent OcañadaNo ratings yet

- Acebedo Optical Company, Inc. vs. Court of AppealsDocument40 pagesAcebedo Optical Company, Inc. vs. Court of Appealsad infinitumNo ratings yet

- Philippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceDocument30 pagesPhilippine Supreme Court Jurisprudence: Home Law Firm Law Library Laws JurisprudenceJulia PoncianoNo ratings yet

- G.R. No. 152753 January 13, 2004 IGLECERIO MAHINAY, Petitioner, ATTY. GABINO A. VELASQUEZ, JR., RespondentDocument3 pagesG.R. No. 152753 January 13, 2004 IGLECERIO MAHINAY, Petitioner, ATTY. GABINO A. VELASQUEZ, JR., RespondentgsvgsvNo ratings yet

- Constitution of National Company Law TribunalDocument12 pagesConstitution of National Company Law TribunalJaskeerat0% (1)

- G.R. No. 230861Document6 pagesG.R. No. 230861KempetsNo ratings yet

- Presidential Decree No 678Document2 pagesPresidential Decree No 678Brave NeventuraNo ratings yet

- 1 Wesleyan University V MaglayaDocument9 pages1 Wesleyan University V MaglayaKimmy YowNo ratings yet

- Juridictions Commerciales en Côte D'ivoire, Cadre Légal Et Enjeux ActuelsDocument15 pagesJuridictions Commerciales en Côte D'ivoire, Cadre Légal Et Enjeux ActuelsKoffi StephaneNo ratings yet

- Role of NCLT and NCLAT in Indian Company LawDocument15 pagesRole of NCLT and NCLAT in Indian Company LawAdarsh HimatsinghkaNo ratings yet

- G.R. No. L-26712-16Document7 pagesG.R. No. L-26712-16Joffrey UrianNo ratings yet

- Rental Dispute Between Landlord and BankDocument18 pagesRental Dispute Between Landlord and BankVernetteNo ratings yet

- Transpo Full Text - Week 1Document43 pagesTranspo Full Text - Week 1Ruby SantillanaNo ratings yet

- SEC v. CA 246 SCRA 738 (1995)Document7 pagesSEC v. CA 246 SCRA 738 (1995)GCan02No ratings yet

- Monsod Vs CayetanoDocument29 pagesMonsod Vs CayetanoSudan TambiacNo ratings yet

- Lawsuit Against NUDocument14 pagesLawsuit Against NUAnonymous 6f8RIS6No ratings yet

- 15 Malayan Insurance v. LinDocument2 pages15 Malayan Insurance v. LinRoger Montero Jr.No ratings yet

- La Chătelier's Principle: Chemical Equilibrium in The BodyDocument2 pagesLa Chătelier's Principle: Chemical Equilibrium in The BodyRoger Montero Jr.No ratings yet

- Petitioners vs. vs. Respondent: Special Third DivisionDocument9 pagesPetitioners vs. vs. Respondent: Special Third DivisionRoger Montero Jr.No ratings yet

- La Chătelier's Principle: Chemical Equilibrium in The BodyDocument2 pagesLa Chătelier's Principle: Chemical Equilibrium in The BodyRoger Montero Jr.No ratings yet

- 24 H.H. Hollero Vs GSISDocument3 pages24 H.H. Hollero Vs GSISRoger Montero Jr.No ratings yet

- Fide Takers of Insurance and The Public in GeneralDocument2 pagesFide Takers of Insurance and The Public in GeneralRoger Montero Jr.No ratings yet

- EMILIA T. BIAGTAN v. INSULAR LIFE ASSURANCE COMPANYDocument3 pagesEMILIA T. BIAGTAN v. INSULAR LIFE ASSURANCE COMPANYRoger Montero Jr.No ratings yet

- Calanoc Vs CA G.R. No. L-8151Document3 pagesCalanoc Vs CA G.R. No. L-8151Roger Montero Jr.No ratings yet

- Aplha Insurance v. CastorDocument3 pagesAplha Insurance v. CastorRoger Montero Jr.No ratings yet

- 15 Malayan Insurance v. LinDocument2 pages15 Malayan Insurance v. LinRoger Montero Jr.No ratings yet

- 13 Gaisano v. Development InsuranceDocument3 pages13 Gaisano v. Development InsuranceRoger Montero Jr.No ratings yet

- Gaisano Vs Dev't InsuranceDocument11 pagesGaisano Vs Dev't InsuranceRoger Montero Jr.No ratings yet

- VILLAREALG.R. No. 144214Document7 pagesVILLAREALG.R. No. 144214Roger Montero Jr.No ratings yet

- 4-5-1 - Alfred Roderick T. ManzanoDocument29 pages4-5-1 - Alfred Roderick T. ManzanoRoger Montero Jr.No ratings yet

- Technology and Livelihood Education Entre Module 5Document22 pagesTechnology and Livelihood Education Entre Module 5Boy Sawaga0% (1)

- CONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0Document196 pagesCONSOLIDATED PUBLIC ATTORNEY%u2019S OFFICE LEGAL FORMS v1 - 0ErrolJohnFaminianoFopalanNo ratings yet

- Passed 133-08-19 Abra Ang Batas MilitarDocument24 pagesPassed 133-08-19 Abra Ang Batas Militarclaire cabatoNo ratings yet

- Subcontract Agreement Energy - R2Document40 pagesSubcontract Agreement Energy - R2Roger Montero Jr.No ratings yet

- Insurance DigestedDocument13 pagesInsurance DigestedJohn Ceasar Ucol ÜNo ratings yet

- Action Plan in Research: Department of EducationDocument3 pagesAction Plan in Research: Department of EducationRoger Montero Jr.No ratings yet

- Philippine prosecutor's office counter-affidavit responseDocument4 pagesPhilippine prosecutor's office counter-affidavit responseRoger Montero Jr.No ratings yet

- Ballaho v. CADocument15 pagesBallaho v. CALIERANo ratings yet

- PLDT Fibr Plan Termination RequestDocument1 pagePLDT Fibr Plan Termination RequestRoger Montero Jr.No ratings yet

- Res Ipsa Loquitor in Medical Negligence CasesDocument4 pagesRes Ipsa Loquitor in Medical Negligence CasesRoger Montero Jr.No ratings yet

- Res Ipsa Loquitor in Medical Negligence CasesDocument4 pagesRes Ipsa Loquitor in Medical Negligence CasesRoger Montero Jr.No ratings yet

- 20-Sdms-02 (Overhead Line Accessories) Rev01Document15 pages20-Sdms-02 (Overhead Line Accessories) Rev01Haytham BafoNo ratings yet

- Soc 1 Report Salesforce Services - 5EwWEDocument75 pagesSoc 1 Report Salesforce Services - 5EwWEArif IqbalNo ratings yet

- MCQ (Trigo)Document10 pagesMCQ (Trigo)RaghavNo ratings yet

- Ir 2101Document14 pagesIr 2101Willard DmpseyNo ratings yet

- Bec Vantage Practice TestsDocument35 pagesBec Vantage Practice TestsHilda FlorNo ratings yet

- Cameron VBR-II (Variable Bore Ram) PackerDocument2 pagesCameron VBR-II (Variable Bore Ram) Packerjuan olarteNo ratings yet

- Career Profile: Nidhi PathakDocument4 pagesCareer Profile: Nidhi PathaknidhipathakNo ratings yet

- ISLAND SAILING CLUB COWES 2012 ROUND THE ISLAND RACE RESULTSDocument64 pagesISLAND SAILING CLUB COWES 2012 ROUND THE ISLAND RACE RESULTSmatthias_25No ratings yet

- Hydrogen Plant For The New MillenniumDocument21 pagesHydrogen Plant For The New Millenniumapi-3799861100% (2)

- PMDC Renewal FormDocument3 pagesPMDC Renewal FormAmjad Ali100% (1)

- Set 1Document4 pagesSet 1insan biasaNo ratings yet

- Lista 04-09-19Document6 pagesLista 04-09-19comunik1977No ratings yet

- Combined SGMA 591Document46 pagesCombined SGMA 591Steve BallerNo ratings yet

- Lb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDocument2 pagesLb-Xp12-350-Pd-En-V1.3-201912 - EquivalenteDaniel Oliveira Freitas RochaNo ratings yet

- Water Quality For Irrigation Free PPT - Google SearchDocument3 pagesWater Quality For Irrigation Free PPT - Google SearchJames NeoNo ratings yet

- RELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEDocument5 pagesRELATED STUDIES AND LITERATURE ON EGGSHELL POWDER USE IN CONCRETEReiBañez100% (2)

- Bayes Slides1Document146 pagesBayes Slides1Panagiotis KarathymiosNo ratings yet

- Themed: MathematicsDocument32 pagesThemed: MathematicsMohamed LamihNo ratings yet

- Personal Financial StatementDocument3 pagesPersonal Financial StatementChristopher MacLeodNo ratings yet

- MCP Lab Manual C-16Document62 pagesMCP Lab Manual C-16siri.pogula67% (6)

- Mechanical Engineering Semester SchemeDocument35 pagesMechanical Engineering Semester Schemesantvan jagtapNo ratings yet

- Subhra Ranjan IR Updated Notes @upscmaterials PDFDocument216 pagesSubhra Ranjan IR Updated Notes @upscmaterials PDFSachin SrivastavaNo ratings yet

- Lecture 9 - StatisticsDocument4 pagesLecture 9 - StatisticsMohanad SulimanNo ratings yet

- Pengembangan Lembar Kegiatan Siswa Berbasis Online Berbantuan Geogebra Book Untuk Siswa SMA Kelas X Pada Materi TrigonometriDocument15 pagesPengembangan Lembar Kegiatan Siswa Berbasis Online Berbantuan Geogebra Book Untuk Siswa SMA Kelas X Pada Materi TrigonometriNovita Rizki YustianiNo ratings yet

- Indexed Addressing & Flow Rate AveragingDocument5 pagesIndexed Addressing & Flow Rate AveragingMestrecal MeloNo ratings yet

- SDSU PhD Research on Soil HealthDocument2 pagesSDSU PhD Research on Soil HealthTiruneh GA25% (4)

- Global Service Learning: M325D MH / M325D L MH Material HandlersDocument52 pagesGlobal Service Learning: M325D MH / M325D L MH Material Handlersanon_828943220100% (2)

- Uti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)Document8 pagesUti MF v. Ito 345 Itr 71 - (2012) 019taxmann - Com00250 (Bom)bharath289No ratings yet

- Petition For ReviewDocument18 pagesPetition For ReviewJay ArNo ratings yet

- The Art of Fact Investigation: Creative Thinking in the Age of Information OverloadFrom EverandThe Art of Fact Investigation: Creative Thinking in the Age of Information OverloadRating: 5 out of 5 stars5/5 (2)

- Courage to Stand: Mastering Trial Strategies and Techniques in the CourtroomFrom EverandCourage to Stand: Mastering Trial Strategies and Techniques in the CourtroomNo ratings yet

- Litigation Story: How to Survive and Thrive Through the Litigation ProcessFrom EverandLitigation Story: How to Survive and Thrive Through the Litigation ProcessRating: 5 out of 5 stars5/5 (1)

- Evil Angels: The Case of Lindy ChamberlainFrom EverandEvil Angels: The Case of Lindy ChamberlainRating: 4.5 out of 5 stars4.5/5 (15)

- Greed on Trial: Doctors and Patients Unite to Fight Big InsuranceFrom EverandGreed on Trial: Doctors and Patients Unite to Fight Big InsuranceNo ratings yet

- 2017 Commercial & Industrial Common Interest Development ActFrom Everand2017 Commercial & Industrial Common Interest Development ActNo ratings yet

- Winning with Financial Damages Experts: A Guide for LitigatorsFrom EverandWinning with Financial Damages Experts: A Guide for LitigatorsNo ratings yet

- Patent Trolls: Predatory Litigation and the Smothering of InnovationFrom EverandPatent Trolls: Predatory Litigation and the Smothering of InnovationNo ratings yet

- After Misogyny: How the Law Fails Women and What to Do about ItFrom EverandAfter Misogyny: How the Law Fails Women and What to Do about ItNo ratings yet

- Strategic Positioning: The Litigant and the Mandated ClientFrom EverandStrategic Positioning: The Litigant and the Mandated ClientRating: 5 out of 5 stars5/5 (1)

- Plaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowFrom EverandPlaintiff 101: The Black Book of Inside Information Your Lawyer Will Want You to KnowNo ratings yet

- Scorched Worth: A True Story of Destruction, Deceit, and Government CorruptionFrom EverandScorched Worth: A True Story of Destruction, Deceit, and Government CorruptionNo ratings yet

- Diary of a DA: The True Story of the Prosecutor Who Took on the Mob, Fought Corruption, and WonFrom EverandDiary of a DA: The True Story of the Prosecutor Who Took on the Mob, Fought Corruption, and WonRating: 3.5 out of 5 stars3.5/5 (2)

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- The Chamberlain Case: the legal saga that transfixed the nationFrom EverandThe Chamberlain Case: the legal saga that transfixed the nationNo ratings yet