Professional Documents

Culture Documents

Partnership Dec 2020 Updated

Uploaded by

binuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Dec 2020 Updated

Uploaded by

binuCopyright:

Available Formats

1

Partnership Accounts

1. A and B are equal partners. They admit C and D as partners with 1/5 and 1/6 share

respectively. What is the profit sharing ratio of all the partners?

Ans: 19:19:12:10

2. A, B and C are partners with profit sharing ratio 5:3:2. A wants to retire, B and C agreed to

continue at 2:1. Find the profit gaining ratio between B and C.

Ans: B:C=11:4

3. Calculate ratios in the following cases:

Case-I A, B & C sharing in the ratio 3:2:1, B retired and his share was taken up by A & C in the

ratio of 3:2. D was admitted and he acquired 1/8th of A’s revised balance and 1/3rd of C’s original

balance in his favor. Find out gaining sacrificing and new ratio.

Ans: A:C:D=441:176:103

Case-II A, B & C are sharing in the ratio of 3:2:1. C retired and his share was taken up by A & B

equally. D admitted and he receives 1/8th shares of original share from A and 1/6th from B.

Calculate new ratio, sacrificing ratio and gaining ratio.

Ans: A:B:D=75:50:19

4. P, Q and R share profit and losses in the ratio of 4:3:2 respectively. Q retires and P and R decide

to share future profits and losses in the ratio of 5:3. Then immediately H is admitted of 3/10

shares of profits half of which was gifted by p and the remaining shares was taken by H equally

from P and R. Calculate the new profit sharing ratio after H’s admission and Gain ratio of P and

R.

Ans: New Ratio =4:3:3

5. A,B and C are partner sharing profit and losses in the ratio of 3:2:1. B retired from the firm.

Partners A and C decided to take his share in 3:1 ratio. What is the new ratio of the partners A

and C?

Ans: New Ratio= 3:1

6. Journalize entries in following cases.

Case-I A& B ratio is 1:1. Goodwill of the firm is Rs. 50,000. C is admitted for 1/5 share new ratio is

2:2:1. New partner brings 50,000 in cash for Capital and goodwill.

Case-II A& B ratio is 1:1. C is admitted a new ratio is 2:2:1, goodwill already appearing is in

balance sheet is Rs. 10,000. Partners want the goodwill should appear in new books at Rs. 40,000

goodwill is valued at Rs. 50,000.

Case-III A and B ratio is 1:1 Goodwill is valued at Rs. 90,000. C admitted and the new ratio is

2:2:1. C brings goodwill Rs. 10,000 and Cash Rs. 15,000.

Case-IV A, B & C sharing in the ratio 1:1:1 goodwill is value at Rs. 60,000. D is admitted and he

brings goodwill Rs. 30,000. B retired and new ratio of A, C, & D is 3:2:1. D brings 30,000 in cash

and B withdraw 25,000 from firm. New firm agrees to show goodwill at Rs. 36,000.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

2

Case-v A, B & C sharing in the ratio of 3:2:1. Goodwill already appearing is Rs. 12,000 re-value at

Rs. 72,000. D & E are admitted who bring Rs. 42,000 goodwill equally. New firm agreed to share

profits in the ratio of 2:2:1:1among. A,C,D & E. B retired and goodwill should appear at Rs. 18,000.

7. i) Ram and Shyam are equal partners. They wanted to admit Mohan as 1/6th Partner. Goodwill

is valued at Rs. 60,000 on the occasion of admission of the new partner. Journalize (study

material)

ii) Vijay and Mohan are equal partners. They wanted to admit Rakesh as 1/3rd partner. He

brought Rs. 60,000 as goodwill. Journalize.

iii) Anand, Bhupesh, Dinesh were equal partners. On 31st December, 2000, Dinesh desired to

retire when goodwill was valued at Rs. 60,000. On Dinesh’s retirement Anand and Bhupesh

agreed to share profit in the ratio of 3:2. Journalize.

iv) Anand, Bhupesh, Ram are in partnership sharing profit and loss at the ratio 2:2:1. They want

to admit Dinesh into partnership with one-fifth share. Dinesh brings in Rs. 30,000.00 as capital

and Rs. 10,000.00 as premium for goodwill.

8. Amit and Sumit are partners sharing profits and losses in the ratio 3:2. Their Balance Sheet as

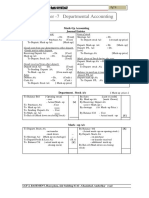

on 31st March 2011 is given below:

Liabilities Amount Assets Amount

Capital Accounts: Land and Building 3,20,000

Amit 1,76,000 Investment(Market value Rs. 50,000

Sumit 55,000)

2,54,000 Debtors 3,00,000

Loan from Puneet 3,00,000 Less: Provision for doubtful

debts 10,000 2,90,000

General Reserve 30,000 Stock 1,10,000

Employer’s Provident 10,000 Cash at Bank 50,000

Creditors 50,000

Total 8,20,000 8,20,000

They decided to admit Puneet as a new partner from 1st April, 2011 on the following terms:

i) Amit will give 1/3rd of his share and Sumit will give 1/4th of his share to Puneet.

ii) Puneet’s loan account will be converted into his capital .

iii) The goodwill of the firm is valued at Rs. 3,00,000. Puneet will bring his share of his

Goodwill in cash and the same was immediately withdrawn by the partners.

iv) Land and building was found undervalued by Rs. 100,000.

v) Stock was found overvalued by Rs. 60,000.

vi) Provision for doubtful debts will be made equal to 5% debtors.

vii) Investments are to be valued at their market price.

It was decided that the total capital of the firm after admission of new partner would be Rs.

10,00,000. Capital accounts of partners will be readjusted on the basis of their profit sharing

ratio and excess or deficiency will be adjusted in cash.

You are required to prepare:

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

3

a) Revaluation A/c

b) Partner’s Capital A/c

c) Balance Sheet of the firm after admission of new partner.

Ans: Contribution Amit- 182,000 Sumit- 18,000 Rev. Profit Amit-24,000 Sumit 16,000

9. A partnership firm earns the following net profit during last 3 years:

Rs.

1997 2,80,000

1998 3,20,000

1999 3,40,000

Partnership capital accounts during the period were as follows:

Rs.

01-01-1997 8,00,000

31-12-1997 9,50,000

31-12-1998 10,80,000

31-12-1999 11,50,000

A similar firm earns 25% on capital.

Required:

i) Valuation of goodwill taking one year’s weighted average profit.

ii) Valuation of goodwill taking 5 years super profit based on weighted average profits.

iii) Valuation of goodwill taking discounted value of 5 years super profit @ 15% p.a.

iv) Valuation of goodwill on capitalization basis.

Ans: i) 3,23,330 ii) 3,64,580 iii) 2,44,429 iv) 2,91,665

10. Lee and Lawson are in equal partnership. They agreed to take Hicks as one-fourth partners.

For this it was decided to find out the value of goodwill. M/s Lee and Lawson earned profits

during 2005-2008 as follows:

Year Profit

2005 1,20,000

2006 1,25,000

2007 1,30,000

2008 1,50,000

On 31-12-2008 capital employed by M/s Lee and Lawson was Rs. 5,00,000. Rate of normal profit is

20%.Find out the value of goodwill following various methods.

11. Calcualte goodwill of a firm on the basis of three years’ purchase of the weighted average

profits of the last four years. Profits of these four year 31st March were:

2006 2007 2008 2009

Rs. 40,400 Rs. 49,600 Rs. 40,000 Rs. 60,000

The weights assigned to each year ended on 31st March are: 2006-1: 2007-2: 2008-3 and

2009-4.

You are provided with the following additional information:

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

4

i) On 31st March, 2008 a major plant repair was undertaken for Rs. 12,000 which was charged to

revenue. The said sum is to be capitalized for goodwill calculation subject to adjustment of

depreciation of 10% p.a. on reducing balance method.

ii) The closing stock for the year 2006-2007 was overvalued by Rs. 4,800

iii) To cover management cost an annual charge of Rs. 9,600 should be made for the purpose of

goodwill valuation.

Ans: Goodwill - 1,31,880

12. From the following information, calculate the value of goodwill of M/s Sharma and Gupta:

i) At three years purchase of Average Profits.

ii) At three years purchase of Super Profits.

iii) On the basis of capitalization of Super Profits.

iv) On the basis of capitalization of Average Profits.

Information:

a) Average capital employed in the business Rs. 7,00,000

b) Net trading results of the firm for the past years: Profit 2007 Rs 147,600; Loss 2008 Rs 148,100;

Profit 2009 Rs 448,700.

c) Rate of interest expected from capital having regard to the risk involved 18%.

d) Remuneration to each partner for his service Rs 500 par month.

e) Assets (excluding goodwill) Rs 754,762. Liabilities 31,329.

13. A and B are equal partners with capitals of Rs 1,60,000 and Rs. 1,20,000 respectively. They

admit C as a partner on 1st January, 2010 for 1/4th share in the profits of the firm. C brings in

Rs. 1,60,000 as his share of capital. Give the Journal entries on C’s admission

Ans: Goodwill - 2,00,000

14. The Balance Sheet of X and Y who share profits and losses In the ratio of 3:2 as on 31st

March 2010 was:

Liabilities Amount Assets Amount

Sundry Creditors 1,00,000 Cash at Bank 10,000

Reserve 60,000 Debtors 50,000

Profit and loss a/c 25,000 Stock 70,000

X’s Capital 48,000 Furniture 20,000

Y’s Capital 32,000 Plant and Machinery 1,00,000

Advertisement 15,000

Expenditure

2,65,000 2,65,000

They admit Z as a partner with 1/5th share in the profits of the firm, Z brings in Rs. 50,000 as his

capital. Give the necessary Journal Entry for the adjustment of goodwill.

Ans: Goodwill 50,000

15. X, Y and Z are three doctors who are running Polyclinic D, E, F and G were then taken in on

payment of Rs. 10,000 by each of them as goodwill and also Rs. 40,000 to be brought in by each

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

5

of them as capital. Goodwill is shared by the existing partners equally. Each of the original

partners also contributed Rs. 40,000 by way of capital. The terms of sharing profits or losses

were as follows:

a) 60% of the visiting fee is to go to the specialist concerned.

b) 40% of the chamber fee will be payable to the individual specialist

c) 50% of operation fees and fees for pathological reports, X-ray and ECG will accrue in favor of

the doctor concerned

d) Balance of profit and loss is shared equally

e) The proportion of fees and charges accruing in favor of individual doctors are to be withdrawn

then and there

f) The receipts for the year after the admission of new partners are:

Fees for

Visiting fees Chamber fees reports

operation etc.

X General practitioner 60,000 80,000

Y Gynecologist 10,000 70,000 40,000

Z Cardiologist 40,000 30,000

D Child Specialist 40,000 60,000

E Pathologist 40,000

F Radiologist 16,000 80,000

G Dentist 10,000 60,000

1,10,000 2,76,000 2,50,000

Expenses for the year are as follows:

Rent 31,000

Light 5,000

Nurses Salary 12,000

Attendance wages 6,000

Telephones 8,200

Printing and stationery 2,000

Medicines, band aids, injections etc. 4,000

Depreciation:

Furniture 2,000

X-Ray Machine 10,000

ECG equipment’s 4,000

Dentist chairs 2,000

Surgical Equipment’s 2,000

20,000

Prepare Profit and Loss Account of the polyclinic, also showing the final distribution of profit or loss

among the partners.

Ans: Net profit to each partner- 35,200

16. Ramesh, Haresh and Suresh are in partnership. Haresh and Suresh are entitled to 15%

commission on net profit to be shared equally for the special service rendered by them to the

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

6

partnership. However, all the partners are entitled to 8% interest on fixed capital of Rs. 5,00,000

each. The business is run at the premises of Mr. Ramesh who is further entitled to get a monthly

rent of Rs. 2,000 to be adjusted against his current account. They share profits and losses

equally. Net profit during the year 2010 was Rs. 7,00,000. During the year they were discussing

to change the profit sharing ratio because Mr Ramesh could not attend to business work. Finally

they decided to increase interest on capital to 12% p.a. with effect from 1st Baishak, 2070 and to

change the profit sharing ratio to 1:2:2 with effect from the same date. With that Heresh and

Suresh would not get any commission. Prepare Profit and Loss Appropriation Account.

17. Amit and sumit commenced business as partners on April 1, 2010. Amit contributed Rs.

40,000 and sumit Rs. 25,000 as their share of capital. The partners decided to share their

profits in the ratio of 2:1. Amit was entitled to salary of Rs. 6,000 p.a. Interest on capital was to

be provided @ 6% p.a. The drawings of Amit and sumit for the year ending March 31, 2011 were

Rs. 4,000 and Rs. 8,000 respectively. The profits of the firm after providing Amit’s salary and

interest on capital were Rs. 12,000.

Draw up the capital accounts of the partners

1. When capitals are fluctuating, and

2. When capitals are fixed.

18. A, B and C are partners of the firm ABC& Co sharing profits and losses in the ratio of 5:3:2.

Following is the Balance Sheet of the firm as at 31-3-2008

Liabilities Amount Assets Amount

Partners Capital A/cs: Goodwill 1,00,000

A 4,50,000 Building 10,50,000

B 1,30,000 Machinery 6,50,000

C 1,70,000 Furniture 2,15,000

Investment Investments(Market value Rs. 60,000

Fluctuation: 75,000)

Reserve 1,00,000 Stock 6,50,000

Contingency Reserve 75,000 Sundry Debtors 6,95,000

Long term loan 15,00,000 Advertising Suspense 25,000

Bank Overdraft 2,20,000

Sundry Creditors 8,00,000

34,45,000 34,45,000

It was decided that B would retire from the partnership on 1.4.2008 and D would be admitted as a

partner on the same date. Following adjustments are agreed amongst the partners for the

retirement/admission:

i) Goodwill is to be valued at Rs. 5,00,000, but the same will not appear as an Asset in the books

of the firm.

ii) Building and Machinery are to be revalued at Rs. 10,00,000 and Rs. 5,20,000 respectively.

iii) Investments are to be taken over by B at the market value.

iv) Provision for doubtful debts to be maintained at 20% on sundry debtors.

v) The capital of the reconstituted firm will be Rs. 10,00,000 to be contributed by the partners A, C

and D in their new profit sharing ratio of 2:2:1.

vi) Surplus funds if any will be used to pay the bank overdraft.

vii) Amount due to retiring partner B will be transferred to his loan account.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

7

Prepare

I) Revaluation Accounts

II) Capital Accounts of the partners and

III) Balance sheet of the firm after reconstitution.

Ans: Revaluation Loss 3,04,000 Balance Sheet Total 34,28,800

19. Ram, Rahim and Robert are partners, sharing profits and losses in the ratio of 5:3:2.

It was decided that Robert would retire on 31-03-2005 and in his place Richard would be admitted

as a partner with new profit sharing ratio between Ram, Rahim and Richard at 3:2:1.

20. The following was the Balance Sheet of A and B who were sharing Profits and Losses in the

ratio of 2:1 on 31.12.2006:

Liabilities Amount Assets Amount

Capital Accounts: Plant and Machinery 12,00,000

A 10,00,000 Building 9,00,000

B 5,00,000 Sundry Debtors 3,00,000

Reserve Fund 9,00,000 Stock 4,00,000

Sundry Creditors 4,00,000 Cash 1,00,000

Bills Payable 1,00,000

29,00,000 29,00,000

They agreed to admit C into the partnership on the following terms:

i) The goodwill of the firm was fixed at Rs. 1,05,000.

ii) That the value of Stock and Plant and Machinery were to be reduced by 10%.

iii) That a provision of 5% was to be created for Doubtful Debts.

iv) That the building account was to be appreciated by 20%.

v) There was an unrecorded Liability of Rs. 10,000

vi) Investments worth Rs. 20,000 (Not mentioned in the Balance Sheet) were taken into account.

vii) That the value of Reserve fund, the values of Liabilities and the values of Assets other than

Cash are not to be altered.

viii) C was to be given one fourth share in the Profit and was to bring capital equal to his share of

Profit after all adjustments.

Prepare Memorandum Revaluation Account, Capital Account of the Partners and the Balance Sheet

of the newly reconstituted firm.

Ans: Revaluation Profit-15,000

21. X, Y and Z were in partnership sharing profits and losses as one half, one fourth and one

fourth respectively. It was agreed that interest should be allowed at the rate of 10% per annum

on partners’ capital accounts and charged at the rate of 8 percent annum on their drawings. No

interest was to be allowed or charged on current accounts.

The following are the particulars of their capital accounts, current accounts and drawings(as

shown by the draft accounts)

Capital Accounts Current Account Drawings for Interest on

balance on 1st Jan. balance on 1st Jan. year to 31st Dec. drawings

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

8

1984 1984 1984

X 1,50,000 cr. 20,000 cr. 30,000 2,000

Y 80,000 cr. 10,000 cr. 20,000 760

Z 60,000 cr. 10,000 cr. 20,000 1,400

The draft accounts for the year to 31st December 1984 showed a net profit of Rs. 1,20,000 before

taking into account interest on partners’ capital account balances and drawings. The audit of the

draft accounts revealed the following errors;

1. The rent of X’s private house, amounting to Rs. 1,500 and paid on 31st December, 1984, had

been included in rents charged in profit and loss account.

2. Repairs amounting to Rs. 20,000 had been treated as additions to machinery, depreciation on

which had been charged at the rate of 20%

3. The premium amount to Rs. 6,000 on Y’s life insurance policy and paid on 30th June, 1984,

had been included under insurance charges in the profit and loss account.

Z-retired from the partnership on 31st December 1984, and agreed to leave the amount due to him

from firm as a loan repayable by agreed installment. X and Y agreed to continue in partnership,

sharing profits and losses as two third and one third.

In ascertaining the amount due to Z from the firm and for the purposes of the new partnership it

was agreed to make the following adujustments:

i) Goodwill to be valued at Rs. 1,44,000 but no account for goodwill to be raised in the books.

ii) The value of freehold premises to be increased by Rs. 40,000.

iii) The provision for bad debts to be increased by Rs. 12,000.

You are required to prepare:

i) The profit and loss appropriation account for the year ended 31st December 1984, making all

the necessary adjustments for the errors revealed and

ii) Partners’ Capital and Current Accounts (in columnar form) for the year ended 31st December,

1984, incorporating the adjustments on Z’s retirement.

22. Dosi and Desai are in partnership as equal partners. Dosi by agreement retires and his son

Dinesh joins the firm on the basis that he would get one third share of the profit.

Dr. Cr.

Goodwill 12,000

Bank 8,000

Debtors 3,000

Stock 26,000

Creditors - 6,000

Capital Accounts:

Dosi - 23,000

Desai - 20,000

Goodwill is agreed at Rs. 30,000 and written up accordingly. Sufficient money is to be introduced

so as to enable Dosi to be paid off and leave Rs. 4,000 in Bank; Desai and Dinesh are to provide

such sum as to make their capitals proportionate to their share of Profit. Dosi agrees to contribute

from his capital half of the amount Dinesh has to provide.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

9

Assuming the agreement was carried out, show the journal entries required and prepare the

Balance Sheet of the firm M/s Desai and Dinesh.

Ans: Cash contribution Desai-9,000 Dinesh-9,500 Cash Payment Dosi 22,500

23. Avinash ,Basuda Ltd. and Chinmoy Ltd. were in partnership sharing profits and losses in the

ratio of 9:4:2. Basuda Ltd. retired from the partnership on 31st March 1998, when the firm’s

balance sheet was as under;

Rs. Rs.

Sundry Creditors 600 Cash and Bank 284

Capital Accounts: Sundry Debtors 400

Avinash 2,700 Stock 800

Basuda Ltd. 1,200 Furniture 266

Chinmoy Ltd 600 4,500 Plant 850

Land & Building 2,500

5,100 5,100

Basuda Ltd.’s share in goodwill and capital was acquired by Avinash and Chinmoy Ltd. in the ratio

of 1:3, the continuing partners bringing in the necessary finance to pay off Basuda Ltd. The

partnership deed provides that on retirement or admission of a partner, the goodwill of the firm is to

be valued at three times the average annual profits of the firm for the four years ended on the date

of retirement or admission. The profits of the firm during the four years ended 31st March 1998 in

thousands of rupees were:

Rs.

1994-95 450

1995-96 250

1996-97 600

1997-98 700

The deed further provided that goodwill account is not to appear in the books of accounts at all.

The continuing partners agreed that with effect from 1st April 1998, Ghanashyam, son of Avinash is

to be admitted as a partner with 25% share of profits.

Avinash gifts to Ghanashyam, by transfer from his capital account, an amount sufficient to cover

up 12.5% of capital and goodwill requirement. The balance 12.5% of capital and goodwill

requirement is purchased by Ghanashyam from Avinash and Chimnoy Ltd. in the ratio of 2:1.

The firm asks to you:

i) Prepare a statement showing the continuing partner’s shares;

ii) Pass journal entries including for bank transactions and

iii) Prepare the balance sheet of the firm after Ghanashyam’s admission.

Ans: New PSR-11:7:6 Total Capital-6,000

24. X and Y are equal partners. X by agreement retires and Z joins the firm on the basis of one

third share of profits on 01-01-1999. The balance of the books as on 31-12-1998 were;

Dr. Cr.

Goodwill 10,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

10

Fixed assets at cost 1,20,000

Current Assets:

Stock 60,000

Debtors 40,000

Bank Balance 8,000

Creditors 20,000

Provision for depreciation 12,000

Capital accounts:

X 1,04,000

Y 1,02,000

2,38,000 2,38,000

Goodwill and fixed assets valued at Rs. 30,000 and Rs. 1,40,000 respectively and it was agreed to

be written up accordingly- sufficient money is to be introduced so as to enable X to be paid off and

leave Rs. 5,000 cash at Bank; Y and Z are to provide such sum as to make their capitals

proportionate to their share of profit. Assuming the agreement was carried out, show the journal

entries required and prepare the balance sheet after admission of z.

Ans: Contribution Y-42,000 Z-85,000 Payment X-1,30,000

25. The following is the Balance Sheet of A, B and C who were partners as on 31-3-1993;

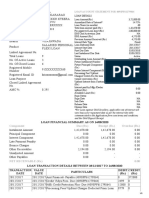

Balance Sheet as at 31-03-1993

Liabilities Amount Assets Amount

A’s capital A/c 33,600 Plant and Machinery 49,000

B’s Capital A/c 25,200 Furniture and fittings 4,800

C’s Capital A/c 12,000 Stock in trade 22,800

Sundry creditors 12,000 Sundry Debtors 21,600

15% Mortgage Loan 16,600 Cash on hand 1,000

Cash at bank 200

99,400 99,400

They share profits and losses in the ratio of 2:2:1. On 1st April, 1993 C retired from the firm and

claimed his share of secret reserve/profit arising out of the following;

a) During the year ended 31-3-1993 purchase of Machinery at a cost of Rs. 10,000 was charged to

purchases account, the erection charges of Rs. 600 being charged to machinery repairs account.

(Depreciation is to be charged at 10% p.a.)

b) Rs. 600 received from Mr. X on 30-3-93 towards rent of the property sublet was credited to his

personal account instead of to rent account so as to reduce his debit balance from Rs. 1,000 to

Rs. 400 debit on 31-3-93.

c) Interest on mortgage loan was paid in advance up to 31-5-93 and the whole amount was

charged to interest account during the year ended 31-3-93. After rectifying the above errors, it

was mutually decided as under;

i) The goodwill of the firm be valued at five times the average profits of the last three years. Such

profits should be correct profits and not the book profits. The book profits for the last three

financial years were:

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

11

1990-91- Rs. 18,380; 1991-92-Rs. 32,000; 1992-93-Rs. 7,471

ii) Plant and Machinery to be depreciated by 10% prov. For bad and doubtful debts to be made at

5% on sundry debtors.

iii) The goodwill should not appear in the books.

iv) There is a liability for Rs. 501 for bills discounted. This has to be accounted for.

v) C should be paid half of his dues in, cash which shall be brought in by A and B in their profit

sharing ratio and the other half shall be left in the business as C’s loan fetching an interest of

18% p.a.

Prepare Profit and Loss Adjustment account, Revaluation account, Capital Accounts of the partners

and the Balance Sheet of A and B after C’s retirement.

Ans: Profit & Loss Adjustment 10,555 Rev. Loss 7,465 B/s- 1,02,991

26. Messrs Dinesh, Bhupesh and Malik is a firm sharing profits and losses in the ratio 2:2:1.

Their Balance Sheet as on 31st March 2000 is as below:

Liabilities Amount Assets Amount

Sundry Creditors 12,850 Land and Building 25,000

Outstanding liabilities 1,500 Furniture 6,500

General Reserve 6,500 Stock of goods 11,750

Capital Account: Sundry Debtors 5,500

Mr.Dinesh 12,000 Cash in hand 140

Mr.Bhupesh 12,000 Cash at Bank 960

Mr. Malik 5,000 29,000

49,850 49,850

The partners have agreed to take Mr. Mayank as a partner with effet from 1st April, 2000 on the

following terms;

i) Mr. Mayank shall bring Rs. 5,000 towards his capital

ii) The value of stock should be increased by Rs. 2,500

iii) Reserve for bad and doubtful debts should be provided at 10% of the debtors.

iv) Furniture should be depreciated by 10%

v) The value of Land and building should be enhanced by 20%

vi) The value of goodwill be fixed at Rs. 15,000

vii) General Reserve will be transferred to the partner’s Capital Accounts

viii) The new profit sharing ratio shall be;

Mr. Dinesh 5/15

Mr. Bhupesh 5/15

Mr. Malik 3/15

Mr. Mayank 2/15

ix) The goodwill account shall not be raised to the partners’ accounts

The outstanding liabilities include Rs. 1000 due to Mr. Sumit which has been paid by Mr. Dinesh.

Necessary entries were not made in the books.

Prepare:

i) Revaluation Account

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

12

ii) The capital Account of the partners

iii) The balance sheet of the firm as newly constituted (Journal entries are not required)

Ans: Rev. Profit- 6,300 Capital 19,120, 18,120, 7,560, 3,000

27. A, B and C are partners sharing profits and losses in the ratio of 2:3:5. On 31st March, 2010

their balance sheet was;

Liabilities Amount Assets Amount

Capital A/c: Cash 18,000

A 36,000 Bills Receivable 24,000

B 44,000 Furniture 28,000

C 52,000 1,32,000 Stock 44,000

Creditors 64,000 Debtors 42,000

Bills payable 32,000 Investments 32,000

Profit and loss a/c 14,000 Machinery 34,000

Goodwill 20,000

2,42,000 2,42,000

They admit D into Partnership on the following

i) Furniture, Investments and Machinery to be depreciated by 15%

ii) Stock is revalued at Rs. 48,000

iii) Outstanding rent amounted to Rs. 1,800

iv) Prepaid salaries Rs. 800

v) D bring in Rs. 32,000 as his capital and Rs. 6,000 for goodwill in cash for 1/6th of the share

future profits of the firm

vi) Adjustment of capitals to be made in cash

vii) Capital of the partners shall be proportionate to their profit sharing ratio taking D’s Capital as

base.

Prepare the revaluation account, partners’ capital accounts, cash account and the balance sheet of

the new firm.

28. A,B and C are partners sharing profits in the ratio of 4:3:1 Balance sheet as on 31st March

2010 is,

Liabilities Amount Assets Amount

Creditors 70,000 Cash in Hand 80,000

bills payable 30,000 Cash at Bank 20,000

Workmen’s compensation 20,000 Stock 75,000

Reserve General reserve 80,000 Debtors 1,30,000

Capital A/c’s Less provision for doubtful 1,25,000

debts 5000

A 2,00,000 Building 1,50,000

B 3,00,000 Joint life policy 1,00,000

C 2,00,000 7,00,000 Investments 1,20,000

Plant and Machinery 2,30,000

9,00,000 9,00,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

13

On the above date B retires from the firm selling his share of profit to A For Rs. 36,000 and to C for

Rs. 45,000 in the ratio of 4:5. For the purpose of B’s retirement it was agreed that:

i) Stock is to be appreciated by 20% and building by 10%

ii) Joint life policy is surrendered to the insurance company for Rs. 70,000

iii) Provision for doubtful debts is increased to 10%

iv) Investment are sold for Rs. 2,30,000

v) Claim on account of workmen’s compensation is Rs. 12,000

vi) Amount due to B is to be settled on the following basis; 50% on retirement and the balance

50% within one year.

vii) The capital of the newly constituted firm is fixed at Rs. 6,00,000 to be divide among A and C in

the profit sharing ratio.

Adjustment is to be made in cash, calculate the new profit sharing ratio and prepare the revaluation

account partners’ capital accounts.

Ans: Rev. Profit 1,10,000

29. P, Q and R have been in partnership for a number of years sharing profits in the ratio 6:5:3.

Work in progress was not brought into the accounts.

The balance sheet of the partnership as on 31st March, 1993 showed the following position:

Rs. Rs.

Capital Accounts: Fixed Assets 22,400

P 25,000 Goodwill 12,950

Q 18,000 Current assets:

R 8,700 Debtors 73,500

Sundry Creditors 67,600 Balance at Bank 10,450

1,19,300 1,19,300

On 31st March, 1993 P retired from the partnership and it was agreed to admit S as a partner on

the following terms:

i) Goodwill in the old partnership was to be revalued at two years purchase of the average profits

over last three years. The profits of the last three years have been Rs. 12,400, Rs. 13,600 and

Rs. 14,005. Goodwill was to be written off in the new company.

ii) P to take car out of the partnership assets at an agreed value of Rs. 1000. The car had been

included in the accounts as on 31st March 1993 at a written down value of Rs. 594

iii) Although work in progress had not been and will not be included in the partnership accounts,

the new partners were to credit P with his share based on an estimate that work in progress was

equivalent to 20% of the debtors

iv) The new partners Q, R and S were to share profits in the ratio of 5:3:2. The new capital is to be

Rs. 25,000 subscribed in the profit sharing ratio.

v) Q, R and S were each to pay P the sum of Rs. 5000 out of their personal resources in part

repayment of his share in the partnership

vi) P to lend to S any amount required to make up his capital in the firm from the monies due to

him and any further balance due to P was to be left in the new partnership as a loan bearing

interest at 9% per annum. Any adjustment required to the capital accounts of Q and R were to

be paid into or withdrawn from the partnership bank account.

You are required to prepare:

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

14

i) The capital accounts in columnar form of the partners reflecting therein the adjustments

required on the change in partnership and

ii) Balance sheet on completion.

30. A,B and C are partners in a firm sharing profits and losses in the ratio of 4:2:1. Their

Balance Sheet on 31-12-92 stands as follows:

Rs. Rs.

Sundry Creditors 15,000 Cash at Bank 5,300

General Reserve 10,000 Sundry Debtors 18,000

Capital Accounts: Less: Provision 300 17,700

A 25,000 Stock in trade 20,000

B 18,000 Furniture 6,000

C 17,000 60,000 Plant and Machinery 16,000

Land and Building 20,000

85,000 85,000

The partners decide to alter their profit sharing ratio to 6:5:5 with effect from 1-1-93 and for that

purpose the following adjustments are agreed upon:

i) The provision for Bad debts is to be raised to 5 % of sundry debtors

ii) Stock, furniture and Plant and Machinery are to be reduced in value by 5 % , 10% and 5%

respectively

iii) Land and building are to be appreciated by Rs. 4000.

iv) There is a joint life policy of the partners the surrender value of which on 31-12-1992 was Rs.

10,000. The annual premium of Rs. 1,500 is charged to Profit and Loss Account.

v) The goodwill of the firm is to be valued at two years’ purchase of the average profits of the last

four years before charging insurance premium.

vi) There is a pending law suit against the firm for damaged goods and a liability of Rs. 1,400 is

likely to arise

The net divisible profit of the firm for the last four year are:

Rs Rs.

1989 15,000 1991 16,000

1990 18,000 1992 21,000

Show by a single journal entry how the accounts of the partners should be adjusted assuming that

the firm decides not to raise Goodwill or Policy account nor to alter any value of assets, claims or

reserves in the books. Also prepare the reconstituted Balance Sheet.

Ans: Debit B- 1,543 C-9,771 Credit A- 11,314

31. X, Y and Z were partners sharing profits and losses in the ratio of 3:2:1. The position of the

firm as on 1st January 1981 was:

Liabilities Amount Assets Amount

X’s Capital 30,000 Fixed Assets 40,000

Y’s Capital 20,000 Debtors 30,000

Z’s Capital 10,000 Stock 40,000

General Reserve 12,000 Bank Balance 10,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

15

Capital Reserve 9,000

Creditors 39,000

1,20,000 1,20,000

On this date the partners decided to change their profit and loss sharing ratio to 1:2:3

Goodwill was valued at Rs. 18,000.

No entries were however passed to give effect to this change.

On 31st December 1981 the balance sheet of the firm were:

Liabilities Amount Assets Amount

X’s Capital 30,000 Fixed Assets 36,000

Less Drawing 5,000 25,000 Debtors 45,000

Y’s Capital 20,000 Stock 55,000

Less Drawing 3,000 17,000 Advances 14,000

Z’s Capital 10,000

Less Drawing 4,000 6,000

General Reserve 36,000

Capital Reserve 9,000

Creditors 50,000

Bank Overdraft 7,000

1,50,000 1,50,000

On 31st December, 1981 the firm was sold as a going concern in Y for Rs. 1,35,000, Y introduced

sufficient funds to pay off X and Z.

You are asked to

1) Pass Journal entries on 31st December, 1981 to give effect to the above changes in the

constitution of the firm on 1-1-1981

2) Prepare the Balance Sheet of Y as on 1st January 1982.

32. A, B and C were partners in a firm sharing profits and losses in the ratio of 5:3:2

resepctively. A died on 29th February 2008. The balance sheet on that date was:

Liabilities Amount Assets Amount

Capital A/cs: Machinery 35,000

A 12,000 Furniture 6,000

B 16,000 Stock 15,000

C 12,000 40,000 Debtors 15,000

General Reserve 12,000 Cash 3,000

Creditors 22,000

74,000 74,000

The firm had a joint life policy in the names of the partners for the insured value of Rs. 60,000.

The premium paid on the policy was debited to the profit and loss account. The Partnership Deed

provided that on the death of a partner the assets and liabilities are to be revalued.

The assets and liabilities were revalued as follows on A’s death:

i) Machinery Rs. 45,000 and Furniture Rs. 7,000

ii) A provision of 10% was created for doubtful debts

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

16

iii) A provision of Rs. 15,000 was made for taxation

iv) The goodwill of the firm was valued at Rs. 15,000 on A’s death

v) Death claim for policy was realized in full

The amount payable to A was transferred to his executor’s account. You are required to prepare

the Revaluation Account, Capital Accounts of the partners and the Balance sheet of B and C.

Ans: Transfer to executor -52,750

33. Ram, Sham and Mohan were partners sharing profits and losses in the ratio of 2:2:1. Their

Balance Sheet as on 1-1-1999 stood as follows:

Liabilities Amount Assets Amount

Capital Accounts: Fixed Assets 1,00,000

Ram Stock 25,000

50,000 Debtors 35,000

Sham 1,20,000 Cash and Bank 10,000

40,000

Mohan

30,000

Reserves 10,000

Creditors 40,000

1,70,000 1,70,000

The firm had taken a Joint Life Policy for Rs. 1 Lacs, the premium amounts on which were charged

to the profit and loss account. On 1st July, 1999 Mohan died. His representatives agreed that;

i) Goodwill of the firm be valued at Rs. 50,000

ii) Fixed assets be written down by Rs. 10,000 and

iii) In lieu of profits up to 1st July, 1999, Mohan should be paid at the rate of 25% per annum on

his capital as on 1-1-1999.

The policy money was received on 31-12-1999 and Mohan’s heirs were paid the total amount due

on the same day. Current years(1999) profit after charging depreciation of Rs. 9,500 (Rs. 5,000

related to the 1st Half) was Rs. 40,500. The year end figures of stock, debtors and creditors and

cash and bank balances were respectively Rs. 33,000, 29,000, 35,000 and 66,217. The particulars

regarding their drawings are given below:

Up to 1-7-1999 After 1-7-1999

Ram 4,125 5,000

Sham 4,125 5,000

Mohan 1,750 -

Prepare the balance sheet of the firm as on 31st December 1999.

34. Following is the balance sheet of Black and White as on 31st March, 2008:

Rs. Rs.

Sundry creditors 20,000 Plant and Machinery 100,000

Reserve fund 32,000 Stock 40,000

Capital a/c’s Sundry debtors 60,000

black Cash at bank 50,000

100,000 Cash in hand 2000

brown 200,000

50,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

17

white

50,000

252,000 252,000

White died on 30th June, 2008. Under the terms of partnership deed, the executors of deceased

partner were entitled to:

(i) Amount standing to the credit to the Partner’s capital account

(ii) Interest on capital at 5% p.a.

(iii) Shares of goodwill on the basis of twice the average of the past three year’s weighted average

profits.

(iv) Share of profits from the closing of the last financial year to the last of death on the basis of

the last’s simple average profits.

(v) White share of goodwill will be adjusted to the accounts of Black and Brown who will maintain

a profit - sharing ratio of 2:1 in the new firm. They decided not to raise any goodwill account.

Profit for the year ended 31st March, 2006, 2007 and 2008 were Rs.80,000, Rs.90,000 and

Rs.100,000 respectively. Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up white’s account to be rendered to his executors.

Ans: Transfer to executor -1,10,917

35. Ram, Rahim and Auntony in partnership sharing profits and losses in the ratio of 1/2 , 1/3

and 1/6 respectively. They decided to dissolve the partnership firm on 31-3-1998, when the

balance sheet of the firm appeared as under

Balance sheet of the firm as on 31-3-1998

Liabilities Amount Assets Amount

Sundry creditors 5,67,000 Goodwill A/c 4,56,300

Bank overdraft 6,06,450 Plant & Machinery 6,07,500

Joint Life policy reserve 2,65,500 Furniture 64,650

Loan from Mrs.Ram 1,50,000 Stock 2,36,700

Capital Account 7,65,000 Sundry Debtors 5,34,000

Ram 4,20,000 Joint Life policy 2,65,500

Rahim 2,25,000 Commission 1,40,550

Auntony 1,20,000 Receivable

Cash on Hand 48,750

23,53,950 23,53,950

The following details are relevant for dissolution:

i) The joint life policy was surrendered for Rs. 2,32,500.

ii) Ram took over goodwill and plant and machinery for Rs. 9,00,000

iii) Ram also agreed to discharge bank overdraft and loan from Mrs.Ram.

iv) Furniture and stocks were divided equally between Ram and Rahim at an agreed

valuation of Rs. 3,60,000.

v) Sundry debtors were assigned to firm’s creditors in full satisfaction of their claims.

vi) Commission receivables was received in time,

vii) A bill discounted was subsequently returned dishonored and proved valueless. Rs.

30,750(including Rs. 500 noting charges).

viii) Ram paid the expenses of dissolution amounting to Rs.18,000.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

18

ix) Auntony agreed to receive Rs. 1,50,000 in full satisfaction of his rights, title and interest

in the firm.

You are required to show the accounts relating to closing of books , on dissolution of the

firm.

Ans: Cash Payment Ram-1,63,410 Rahim-77,640

36. A, B, C carried on business in partnership sharing Profits and Losses in the ratio 1:2:3. They

decided to form a private limited company, AB (P) Ltd. And C is not interested to take over the

shares in AB (P) Ltd. The authorized share capital of the company is Rs. 12,00,000 divided into

12,000 ordinary shares of Rs. 100 each.

The company was incorporated and took over goodwill as valued and certain assets of the

partnership firm on 31.3.2006. The Balance Sheet of the partnership firm on that date was

as follows:

Liabilities Amount Assets Amount

Capital Accounts: Fixed Assets:

A 1,00,000 Machinery 1,20,000

B 2,00,000 Land 1,74,000

C 3,00,000 Motorcycles 30,000

Current Accounts: Furniture & fittings 11,000

A 39,420 Current Assets:

B 60,580 Stock 2,35,000

A’s Loan A/c 28,000 Debtors 43,000

(+) interest accrued 2000 30,000 Cash in hand 87,000

Current Liability: C’s overdrawn 1,00,000

Creditors 70,000

8,00,000 8,00,000

C who retired was presented by the other partners (A and B) with one motorcycle valued in

the books of the firm Rs. 9,000. The remaining motorcycles were sold in the open market for

Rs. 13,000. C also received certain furniture for which he was charged Rs. 2,000. The

debtors which were all considered good were all taken over by C for Rs. 40,000. A and B were

charged in their profit sharing ratio for the book value of Motorcycle presented by them to C.

It was agreed that C who is not willing to take the shares in AB (P) Ltd. Was discharged first

by providing necessary cash. A and B should bring cash, if necessary.

AB (P) Ltd. Took over the remaining furniture and fittings at a price Rs. 13,000 the

machinery for Rs. 1,25,000, the stock at an agreed value of Rs. 2,00,000 and the land at its

book value. The value of the goodwill of the partnership firm was agreed at Rs. 88,000. The

creditors of the firm were settled by the firm for Rs. 70,000. A’s loan account together with

interest accrued was transferred to his capital account.

The purchase consideration was discharged by the company by the issue of equal number of

fully paid up equity shares at par to A and B.

Prepare Realization A/c, Capital A/c of the partners and Cash A/c. Also draw the Balance

Sheet of AB (P) Ltd.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

19

Ans: Purchase Consideration 6,00,000 Realization Profit 51,000 Contribution A-

1,25,080 B-28,420

37. ‘X’ and ‘Y’ carrying on business in partnership sharing profits and losses equally wished to

dissolve the firm and sell the business to ‘X’ Limited Company on 31.3.2006, when the firm’s

position was as follows:

Liabilities Amount Assets Amount

X’s Capital 1,50,000 Land and Building 1,00,000

Y’s Capital 1,00,000 Furniture 40,000

Sundry Creditors 60,000 Stock 1,00,000

Debtors 66,000

Cash 4,000

3,10,000 3,10,000

The arrangement with X Limited Company was as follows:

i) Land and Building was purchased at 20% more than the book value

ii) Furniture and Stock were purchased at book values less 15%

iii) The goodwill of the firm was valued at Rs. 40,000.

iv) The firms’s debtors cash and creditors were not to be taken over but the company agreed

to collect the book debts of the firm and discharge the creditors of the firm as an agent,

for which services, the company was to be paid 5% on all collections from the firm’s

debtors and 3% on cash paid to firms creditors.

v) The purchase price was to be discharged by the company in fully paid equity shares of Rs.

10 each at a premium of Rs. 2 per share.

The company collected all the amounts from debtors. The creditors were paid off less by Rs.

1000 allowed by them as discount. The company paid the balance due to the vendors in cash.

Realization account, the Capital accounts of the partners and the Cash account in the books of

partnership firm.

Ans: Realization Profit 34,930 PC-2,79,000

38. X, Y, and Z are partners of the firm XYZ and Co. sharing profits and Losses in the ratio of

4:3:2. Following is the Balance sheet of the firm as at 31st March, 2008:

Liabilities Amount Assets Amount

Partners’ Capitals: Fixed Assets 5,00,000

X 4,00,000 Stock in trade 3,00,000

Y 3,00,000 Sundry Debtors 5,00,000

Z 2,00,000 Cash in hand 10,000

General Reserve 90,000

Sundry Creditors 3,20,000

13,10,000 13,10,000

Partners of the firm decided to dissolve the firm on the above said date. It was found that a credit

purchase of Rs. 20,000 in January, 2008 had not been recorded in the books of the firm .

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

20

Fixed assets realized Rs. 5,20,000 and book debts Rs. 4,40,000.

Stocks were valued at Rs. 2,50,000 and it was taken over by partner Y.

Creditors allowed discount of 5% and the expenses of realization amounted to Rs. 6,000. You are

required to prepare:

i) Realization account

ii) Partners capital account and

iii) Cash account

Ans: Realization loss 99,000 Payment X-3,96,000 Y-47,000 Z-1,98,000

39. P, Q and R are partners sharing profits and losses in the ratio 2:2:1. Their balance sheet as

on 31st March, 2009 is as follows:

Liabilities Amount Assets Amount

Capital Accounts: Plant and Machinery 1,08,000

P 1,20,000 Fixtures 24,000

Q 48,000 Stock 60,000

R 24,000 Sundry Debtors 48,000

Reserve Fund 60,000 Cash 60,000

Creditors 48,000

3,00,000 3,00,000

They decided to dissolve the firm. The following are the amounts realized from the assets.

Plant and Machinery 1,02,000

Fixtures 18,000

Stock 84,000

Sundry Debtors 44,400

Creditors allowed a discount of 5% and realization expenses amounted to Rs. 1,500. A bill Rs.

4,200 due for sales tax was received during the course of realization and this was also paid.

You are required to prepare:

Realization account Partners capital account

Cash account

Ans: Realization profit 5,100 Payment P-1,46,000 Q-74,040 R-37,020

40. Ajay, Bijay, Ram and Shyam are partners in a firm sharing profits and losses in the ratio of

4:1:2:3. The following is their Balance Sheet as at 31st March, 1996.

Liabilities Amount Assets Amount

Sundry Creditors 3,00,000 Sundry Debtors 3,50,000

Less: Doubtful Debts

50,000

3,00,000

Capital A/c Cash in hand 1,40,000

Ajay 7,00,000 Stocks 2,00,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

21

Shyam 3,00,000 10,00,000 Other Assets 3,10,000

Capital A/c

Vijay 2,00,000

Ram 1,50,000

13,00,000 13,00,000

On 31st March, 1996, the firm is dissolved and the following points are agreed upon:

i) Ajay is to take over sundry debtors at 80% of book value

ii) Shyam is to take over the stocks at 95% of the value and

iii) Ram is to discharge sundry creditors.

Other assets realize Rs.3,00,000 and the expenses of realization come to Rs. 30,000.

Vijay is found insolvent and Rs. 21,900 is realized from his estate

Prepare Realization Account and Capital Accounts of the partners. Show also the Cash A/c.

The loss arising out of capital deficiency may be distributed following the decision in garner vs.

murray.

Ans: Realization Loss 70,000 Loss of Vijay- 1,85,100 Ratio- Ajay : Shyam = 7:3

41. Neptune, Jupiter, Venus and Pluto had been carrying on business in partnership sharing

profits and losses in the ratio of 3:2:1:1. They decide to dissolve the partnership on the basis of

the following Balance Sheet as on 30th April 2003.

Liabilities Amount Assets Amount

Capital Account Premises 1,20,000

Neptune 1,00,000 Furniture 40,000

Jupiter 60,000 1,60,000 Stock 1,00,000

General Reserve 56,000 Debtors 40,000

Capital Reserve 14,000 Cash 8,000

Sundry Creditors 20,000 Capital Overdrawn

Mortgage Loan 80,000 Venus 10,000

Pluto 12,000 22,000

3,30,000 3,30,000

i) The assets were realized as under:

Debtors 24,000

Stock 60,000

Furniture 16,000

Premises 90,000

ii) Expenses of dissolution amounted to Rs. 4,000

iii) Further creditors of Rs. 12,000 had to be met

iv) General Reserve unlike Capital Reserve was built up by appropriation of profits.

You are required to draw up the Realization Account, Partners Capital Accounts and the Cash

Account assuming that venus has became insolvent and nothing was realized from his private

estate. Apply the principles laid down in Garner vs Murray.

Ans: Realization Loss 1,26,000 Ratio- N : J = 13:8

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

22

42. The firm of Kapil and Dev has four partners and as of 31st March, 1995, its Balance sheet

stood as follows:

Liabilities Amount Assets Amount

Capital A/c Land 50,000

F.Kapil 2,00,000 Building 2,50,000

S.Kapil 2,00,000 Office equipment 1,25,000

R.Dev 1,00,000 Computers 70,000

Current A/c: Debtors 4,00,000

F.Kapil 50,000 Stocks 3,00,000

S.Kapil 1,50,000 Cash at Bank 75,000

R.Dev 1,10,000 Other current assets 22,600

Loan from NBFC 5,00,000 Current a/c

Current Liabilties 70,000 B.Dev 87,400

13,80,000 13,80,000

The partners have been sharing profits and losses in the ratio 4:4:1:1. It has been agreed to

dissolve the firm on 1-4-1995 on the basis of the following outstanding:

i) The following assets are to be adjusted to the extent indicated with respect to the book

values

Land 200%

Building 120%

Computers 70%

Debtors 95%

Stocks 90%

ii) In the case of the loan, the lenders are to be paid at their insistence a pre-payment premium

of 1%

iii) B.Dev is insolvent and no amount is recoverable from him. His father R.Dev, however agrees

to bear 50% of his deficiency. The balance of the deficiency is agreed to be apportioned

according to law.

Assuming that the realization of the assets and discharge of liabilities is carried out immediately,

show the cash A/c, Realization A/c and the Partner’s A/c.

Ans: Realization Profit- 24,000 Ratio F:S:R=2:2:1 Deficiency- 85,000

43. The following is the balance sheet as at 30th June, 2000 of Lal, Parveen and Queen, Partners

of a firm sharing profits and losses equally.

Liabilities Amount Assets Amount

Capital Accounts: Plant and 42,000

Lal20,000 Machinery

Parveen30,000 Building 18,000

Queen 5,000 55,000 Motor Car 3,200

Sundry Debtors 23,000

Current Account Stock-in-trade 21,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

23

Lal 16,000 Bank Balance 1,800

Parveen 18,000 34,000 Current Account:

Trade Creditors 17,600 Queen 7,800

Provision for payments of excise 8,400

duty

Creditors for expenses 1,800

1,16,800 1,16,800

The firm accepts an offer from z co. ltd. To take over the following assets at values given opposite

to each:

Plant and Machinery 30,000

Building 40,000

Stock-in-trade 18,000

The company agrees to discharge 75% of the consideration due in equity shares of Rs. 10 each

to be allotted at a premium of Rs. 1 per share. The balance of consideration will be retained by

the company, at an interest of 15% per annum, to be paid six months after the transfer is put

through.

The firm realizes its sundry debtors for Rs. 20,000; motorcar is taken by partner Lal at an

agreed value of Rs. 5000 paid by him in cash; expenses of realization met by the firm came to

Rs. 500; the liability to excise duty was finally discharged at Rs. 10,000.

Queen Private Assets are worth Rs. 15,000 and his individual liabilities and debts amount to Rs.

18,000.

Record the above transactions in the books of the firm and close the books assuming that the

transactions were all put through on 1st July 2000. Show the ledger accounts only. Rule in

Garner Vs. Murray is to be applied.

Ans: Realization Profit- 3,700 Purchase Consideration 88,000

44. A, B, C and D are sharing profits and losses in the ratio 5:5:4:2 frauds committed by C during

the year were found out and it was decided to dissolve the partnership on 31st March 2010

when their Balance sheet was as under:

Liabilities Amount Assets Amount

Capital: Building 1,20,000

A 90,000 Stock 85,500

B 90,000 Investments 29,000

C - Debtors 42,000

D 35,000 Cash 14,500

General Reserve 24,000 C 15,000

Trade Creditors 47,000

Bills Payable 20,000

3,06,000 3,06,000

Following information is given to you:

i) A cheque for Rs. 4,300 received from debtor was not recorded in the books and was

misappropriated by C.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

24

ii) Investments costing Rs. 5,400 were sold by C at 7,900 and the funds transferred to his

personal account. This sale was omitted from the firm’s books.

iii) A creditor agreed to take over investments of the book value of Rs. 5,400 at Rs. 8,400.

The rest of the creditors were paid off at a discount of 2%.

iv) The other assets realized as follows:

Building 105% of book value

Stock Rs. 78,000

Investments - the rest investments were sold at a profit of Rs. 4,800

Debtors - the rest of the debtors were realized at a discount of 12%

v) The bills payable were settled at a discount of Rs. 400

vi) The expenses of dissolution amounted to Rs. 4,900.

vii) It was found out that realization from C’s private assets would only be Rs. 4,000.

Prepare the necessary Ledger Accounts.

Ans: Realization Gain-548

45. A, B, C are partners in A & Company sharing profits and losses in the ratio 2:2:1 respectively.

The Balance Sheet of A & Company as at 31st March , 1993 is as follows:

Liabilities Amount Assets Amount

Capital: Fixed Assets 2,00,000

A 1,46,000 Current Assets:

B 54,000 Stocks 1,25,000

C 50,000 Debtors 1,25,000

C’s loan account 25,000 Cash 5,000

Loan from Mrs. A 50,000 B’s Current A/c 20,000

Sundry Creditors 1,25,000

Provision for Bad Debts 25,000

4,75,000 4,75,000

The firm was dissolved on the date of Balance Sheet due to continued losses. After preparing the

above balance sheet as on 31-3-1993 it was discovered that purchases amounting to Rs. 20,000

in March, 1993 were not recorded in books, though the goods were received during March 1993.

Fixed Assets realized Rs. 100,000, stocks Rs. 1,05,000 and debtors Rs. 102,500 creditors were

paid after deduction of discount @ 2%. The expenses of realization came to Rs. 5,400. A agreed to

take over the loan of Mrs. A, B is insolvent and his estate is unable to contribute anything.

Prepare the relevant accounts to close the books of A and Company applying the decisions of

Garner vs. Murray.

Ans: Realization Loss -1,20,000

46. Tilak, Sham and Farid were in partnership sharing profits and losses in the ratio of 2:2:1. On

30th September , 2000 their Balance sheet was as follows:

Liabilities Amount Assets Amount

Capital Account: Premises 50,000

Tilak 80,000 Fixtures 1,25,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

25

Sham 50,000 Plant 32,500

Farid 20,000 1,50,000 Stock 43,200

Current Accounts: Debtors 54,780

Tilak29,700

Sham 11,300

Farid(Dr.)(14,500) 26,500

Sundry Creditors 84,650

Bank Overdraft 44,330

3,05,480 3,05,480

Tilak decides to retire on 30th September, 2000 and as Fraid appears to be short of private

assets, Sham decides that he does not wish to take over Tilak’s share of partnership so all three

partners decide to dissolve the partnership with effect from 30th September,2000. If then

transpires that farid has no private assets whatsoever.

The premises are sold for Rs. 60,000 and the plant for Rs. 1,07,500. The fixtures realize Rs.

20,000 and the stock is acquired by another firm at book value less 5%. Debtors realize Rs.

45,900. Realization expenses amount to Rs. 4,500.

The bank overdraft is discharged and the creditors are also paid in full.

You are required to write up the following ledger accounts in the partnership books following the

rules in Garner vs. Murray.

i) Realization Account

ii) Partners’ Current Account

iii) Partners’ Capital Accounts showing the closing of the firm’s books.

Ans: Realization Loss -35,540

47. Anand, Bharat and Charan have been suffering losses for many years on December 31, when

their balance sheet was drawn up as given below, they decided to dissolve up partnership. They

shared profits in the ratio of ½, 1/3, 1/6.

Liabilities Amount Assets Amount

Capital accounts Fixed Assets

Anand3,000 Goodwill 3,000

Bharat 1,500 4,600 Fixture and 2,000

Charan100 furniture

Current accounts: Leasehold property 5,000

Anand500 Current Assets:

Bharat 200 Stock 10,000

Charan(Debit) 500 Debtors 25,000

(200) Cash 100

Current liabilities and provisions: 35,000

Trade Creditors 5,000

Bank overdraft

45,100 45,100

There was a contingent liability in respect of a suit filed against the partners for a sum of Rs.

1,000.

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

26

The furniture and fixtures realized Rs. 1,800 on auction. The leasehold property has only there

years to run. Anand agreed to take it over for Rs. 400. The stock realized Rs. 9,000 and Debtors

Rs. 20,000. In the balance of Debtors Rs. 5,000 was not bad, they were slow-paying. It was

mutually agreed that Anand and Bharat should equally take them over at their book values. The

liabilities were discharged at book values. The suit was decided against the firm and the firm paid

Rs. 1,000 to the complainant plus Rs. 80 on account of costs. Anand and Bharat were of means

but charan was insolvent and his estate paid divided of Rs. 25 P. in the rupee.

Prepare Realization Account and close off the books off the firm.

Ans: Realization Loss -9,880

48. P, Q, R and S has been carrying on business in partnership sharing profit and losses in the

ratio of 4:3:2:1. They decide to dissolve the partnership on the basis of following Balance Sheet

as on 30th April, 2011.

Liabilities Amount Assets Amount

Capital Accounts Land and Building 2,46,000

P 1,68,000 Furniture and fixtures 65,000

Q 1,08,000 2,76,000 Stock 1,00,000

General Reserve 95,000 Debtors 72,500

Capital Reserve 25,000 Cash in hand 15,500

Sundry Creditors 36,000 Capital withdrawn:

Mortgage Loan 1,10,000 R 25,000

S 18,000 43,000

5,42,000 5,42,000

i) The assets were realized as under:

Land and building 2,30,000

Furniture and fixture 42,000

Stock 72,000

Debtors 65,000

ii) Expenses of dissolution amounted to Rs. 7,800

iii) Further creditors of Rs. 18,000 had to be met.

iv) R became insolvent and nothing was realized from his private estate

Applying the principles laid down in Garner vs. Murray, prepare the Realization Account,

Partner’s Capital Accounts and Cash Accounts.

Ans: Realization Loss -1,00,300

49. P, Q and R were partners sharing profits and losses in the ratio 3:2:1, no partnership salary or

interest on capital being allowed. Their balance sheet on 30th June, 2011 is as follows:

Liabilities Amount Assets Amount

Fixed Capital Fixed Assets:

P 20,000 Goodwill 40,000

Q 20,000 Freehold property 8,000

R 10,000 50,000 Plant and equipment 12,800

Current Accounts: Motor Vehicle 7,00

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

27

P 500 Current Assets:

Q 9,000 9,500 Stock 3,900

Loan from P 8,000 Trade Debtors 2,000

Trade Creditors 12,400 Less: Provision 100 1,900

Cash at Bank 200

Miscellaneous losses:

R’s Current Account 400

Profit and loss account 12,000

79,900 79,900

On Ist July, 2011 the partnership was dissolved. Motor Vehicle was taken over by Q at a value of

Rs. 500 but no cash passed specifically in respect of this transaction. Sale of other assets

realized the following amounts:

Particulars Amount

Goodwill Nil

Freehold property 7,000

Plant and equipment 5,000

Stock 3,000

Trade Debtors 1,600

Trade creditors were paid Rs. 11,700 in full settlement of their debts. The costs of dissolution

amounted to Rs. 1,500. The loan from P was repaid, P and Q were both fully solvent and able to

bring in any cash required but R was forced into bankruptcy and was only able to pay his

creditors 1/3 of the amount due.

You are required to show:

a) Cash and Bank Account

b) Realization Account and

c) Partners fixed and Current Accounts.

50. Amal and Bimal are in equal partnership. Their Balance Sheet stood as under on 31st March,

2011 when the firm was dissolved:

Liabilities Amount Assets Amount

Creditors A/c 4,800 Plant and Machinery 2,500

Amal’s Capital A/c 750 Furniture 500

Debtors 1,000

Stock 800

Cash 200

Bimal’s Drawings 550

5,550 5,550

The assets realized as under:

Particulars Amount

Plant and machinery 1,250

Furniture 150

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

28

Debtors 400

Stock 500

The expenses of realization amounted to Rs. 175. Amal’s private estate is not sufficient even to

pay his private debts, whereas Bimal’s private estate has a surplus of Rs. 200 only.

51. A, B, C and D were partners sharing profits and losses in the ratio of 3:3:2:2. Following was

their Balance Sheet as on 31.12.2009:

Liabilities Amount Assets Amount

Capital Accounts: Capital Accounts:

A 60,000 C 48,000

B 45,000 1,05,000 D 18,000 66,000

Creditors 46,500 Furniture 12,000

A’s Loan 30,000 Trademarks 21,000

Stock 30,000

Debtors 48,000

Less: Provision for -

Doubtful debts 1,500 46,500

Bank 6,000

On 31.12.2009, the firm was dissolved and B was appointed to realize the assets and to pay off

the liabilities. He was entitled to receive 5% commission on the amount finally paid to other

partners as capital. He agreed to bear the expenses of realization. The assets were realized as

follows: Debtors Rs. 33,000; Stock Rs. 24,000; Furniture Rs. 3,000; Trademarks Rs. 12,000.

Creditors were paid off in full, in addition, a contingent liability for bills receivable discounted

materialized to the extent of Rs. 7,500. Also there was a joint life policy for Rs. 90,000. This was

surrendered for Rs. 9000. Expenses of realization amounted to Rs. 1,500. C was insolvent but

Rs. 11,100 was recovered from his estate.

Prepare Realization Account, Bank Account and Capital Accounts of the partners.

52. Anand and Bhupesh were carrying on business as equal partners. The firm’s Balance Sheet as

on 31st December, 1999 was as follows:

Liabilities Amount Assets Amount

Capital Account: Fixed Assets:

Anand 1,38,000 LeaseholdBuilding 80,000

Bhupesh 1,52,000 Plant and Machinery 1,80,000

Bank Loan 40,000 Furniture 20,000

Current Liabilities : Current Assets:

Sundry Creditors 70,000 Stock 60,000

Bills Payable 10,000 Book Debts 68,000

Cash at Bank 2,000

4,10,000 4,10,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

29

The business was carried on till 30th June, 2000. The partners withdrew in equal amounts half

the amount of profits made during the period of six months(from January 2000) after charging

depreciation on:

Leasehold building 10% per annum

Plant and machinery 10% per annum

Furniture 10% per annum

Meanwhile sundry creditors were reduced By Rs. 15,000, Bills payable by Rs. 2,500 and Bank

loan by Rs. 20,000.

On 30th June stock was valued at Rs. 70,000, book debts were Rs. 75,000 and Cash at bank was

2,500.

On 30th June 2000, the firm sold the business to a limited company for Rs. 4,00,000 payable in

equity shares of Rs. 10 each. The partners decided to take shares in the profits sharing ratio, any

difference to be settled in cash.

You are required to prepare:

i) Balance sheet as on 30th June , 2000

ii) Statement of profit earned during the period six months ended on 30-6-2000.

iii) Realization Account

iv) Capital Accounts of the partners.

Ans: Net Profit earned -82,000

53. Mr.Malik and Mr.Dinesh were carrying on business as equal partners. The firms Balance sheet

as on 31st December, 1999 was as follows:

Liabilities Amount Assets Amount

Sundry Creditors 65,500 Stock 54,000

Bank Overdraft 30,000 Plant and Machinery 1,82,000

Bills payable 12,500 Office furniture 15,000

Capital Accounts: Book Debts 73,000

Malik 1,50,000 Joint Life Policy 9,500

Dinesh 1,48,000 Leasehold premises 34,500

Profit and loss a/c(debit balance) 26,000

Drawings account: 9,000

Malik 3,000

Dinesh

4,06,000 4,06,000

The business was carried on till 30th June 2000. The partners withdraw in equal amounts half

the amount of profits made during the period of six months(from January-June 2000) after 10%

p.a. had been written off leasehold premises, 10% p.a. off plant and machinery and 5% p.a. off

office furniture. Meanwhile sundry creditors were reduced by Rs. 10,000.

On 30th June 2000 stock was valued at Rs. 63,400. Bill payable was reduced by Rs. 2,300 and

Bank overdraft by Rs. 15,000. Book Debts were valued at Rs. 65,000. The joint life policy was

realized for Rs. 9,500 and other items remained the same as on 31st December, 1999.

On 30th June 2000 the firm sold the business to a limited company. The value of the goodwill

was estimated at Rs. 1,08,000 and the rest of the assets were valued on the basis of the Balance

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

30

Sheet as on 30th June, 2000. The company paid the purchase consideration in fully paid equity

shares of Rs. 10 each, at par.

You are required to prepare a Realization Account and Capital Account of the partners as on 30th

June, 2000.

Ans: Profit earned during the period -35,000

54. X, Y and Z are partners sharing profits and losses as 2:1:1. Their Balance Sheet as on 31st

March, 2002 is as below:

Liabilities Amount Assets Amount

Partner’s Capital: Goodwill 15,000

X 90,000 Machineries 75,000

Y 60,000 Investments 5,000

Z 10,000 Current Assets:

Bills Payable 30,000 Cash at Bank 5,000

Sundry Creditors 50,000 Debtors 80,000

Stock 60,000

2,40,000 2,40,000

Repairs Rs. 20,000 incurred three years ago was treated as capital expenditure and debited to

machinery account. Stocks are overvalued by Rs. 10,000. Depreciation at 10% p.a. was charged

on machinery on diminishing balance. Rs. 10,000 collected from debtors was not recorded in

books but taken by Z. The accounts are rectified and then XY ltd. Is formed to take over the

business. Y is to take the investments at Rs. 3000. X will pay the creditors. Bills payable would

be paid by X and Y in their profit sharing ratio.

Goodwill and stocks are valued at Rs. 12,000 and Rs. 42,580 respectively. Debtors are taken at

10% below book value, whereas other assets except cash at bank to be considered at their book

values. XY ltd. Is to pay the firm by issue of equity shares of Rs. 10 each. Z is insolvent, Y agreed

to take 6,000 shares and balance taken over by X. Show profit and loss adjustment account,

realization account and partner’s capital account in the books of the firm.

55. The following is the Balance sheet of Anand, Bharat and Cheema on 31st December, 2000 when

they decided to dissolve the partnership.

Liabilities Amount Assets Amount

Creditors 2,000 Sundry Assets 48,500

Anand Loan 5,000 Cash 500

Capital Account:

Anand 15,000

Bharat 18,000

Cheema 9,000

49,000 49,000

The assets realized the following sums in installments:

I 1,000

II 3,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

31

III 3,900

IV 6,000

V 20,100

34,000

The expenses of realization were expected to be Rs. 500 but ultimately amounted to Rs. 400 only.

Show how at each stage the cash received should be distributed between partners. They share

profits in the ratio of 2:2:1.

56. The firm of LMS was dissolved on 31-3-1995, at which date its Balance Sheet stood as follows:

Liabilities Amount Assets Amount

Creditors 2,00,000 Fixed Assets 45,00,000

Bank Loan 5,00,000 Cash and Bank 2,00,000

L’s Loan 10,00,000

Capital

L 15,00,000

M 10,00,000

S 5,00,000

47,00,000 47,00,000

Partners share profits equally. A firm of Chartered Accountants is retained to realize the assets

and distribute the cash after discharge of liabilities. Their fees which are to include all expenses

is fixed at Rs. 1,00,000. No loss is expected on realization since fixed assets include valuable land

and building.

S.No. Rs.

1 5,00,000

2 15,00,000

3 15,00,000

4 30,00,000

5 30,00,000

The chartered accountant firm decided to pay off the partners in ‘Higher Relative Capital

Method’ You are required to prepare a statement showing distribution of cash with necessary

workings.

Ans: Realization Profit- L,M&S 16,33,333 each

57. The partners Amit, Bhatia and Charan have called upon you to assist them in winding up the

affairs of their partnership on 30th June, 2000. Their Balance Sheet as on that date is given

below:

Liabilities Amount Assets Amount

Sundry Creditors 17,000 Cash at Bank 6,000

Capital Accounts: Sundry Debtors 22,000

Amit 67,000 Stock in trade 14,000

Bhatia 45,000 Plant and equipment 99,000

Charan 31,500 Loan-Amit 12,000

Loan-Bhatia 7,500

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

32

1,60,500 1,60,500

i) The partners share a profit and losses in the ratio of 5:3:2

ii) Cash is distributed to the partners at the end of each month.

iii) A summary of liquidation transactions are as follows

July 2000

Rs. 16,500- collected from Debtors; balance is un-collectable.

Rs. 10,000- received from sale of entire stock

Rs. 1,000-Liquidation expenses paid

Rs. 8,000- cash retained in the business at the end of the month.

August 2000

Rs. 1,500-liquidation expenses paid. As part payment of his capital, charan accepted a piece of

equipment for Rs. 10,000(book value Rs. 4,000)

Rs. 2,500- cash retained in the business at the end of the month.

September 2000

Rs.75,000- received on sale of remaining plant and equipment

Rs. 1,000-liquidation expenses paid. No cash retained in the business.

Required: Prepare a schedule of cash payments as of September 30, showing how the cash was

distributed. Apply HCRM.

58. The firm of Richa presented you with the following Balance Sheet drawn as at 31st March,

1998.

Liabilities Amount Assets Amount

Sundry Creditors 37,000 Cash on hand 3,000

Capital Accounts: Sundry Debtors 34,000

Akram40,000 Stock in trade 39,000

Balram30,000 Plant and Machinery 51,000

Charan27,000 97,000 Current Account:

Balram4,000

Charan3,000 7,000

1,34,000 1,34,000

Partners shared profits and losses in the ratio of 4:3:3. Due to difference among the partners it

was decided to wind up the firm, realize the assets and distribute cash among the partners at the

end of each month.

The following realization was made:

i) May 1998- Rs. 15,000 from debtors and Rs. 20,000 by sale of stock. Expenses on

realization were Rs. 500.

ii) June 1998- Balance of debtors realized Rs. 10,000. Balance of stock fetched Rs. 24,000.

iii) August 1998- part of machinery was sold for Rs. 18,000. Expenses incidental to sale were

Rs. 600.

iv) September 1998- Part of machinery valued in the books at Rs. 5000 was taken by Akram

in part discharge at an agreed value of Rs. 10,000. Balance of machinery was sold for Rs.

30,000(net)

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

33

Partners decided to keep minimum cash balance of Rs. 2,000 in the first 3 months and

Rs. 1,000 thereafter.

Show the amount due to partners will be settled. All working should from part of your

answer.

59. A, B and C are partners sharing profits and losses in the ratio of 5:3:2. Their capitals were Rs.

9,600 ; Rs.6000 ; Rs. 8,400 respectively.

After paying creditors, the liabilities and assets of the firm were;

Liabilities Amount Assets Amount

Liabilities for interest on loans: Investments 1,000

Spouses of partners 2,000 Furniture 2,000

Machinery 1,200

Partners 1,000

Stock 4,000

The assets realized in full in the order in which they are listed above. B is insolvent.

You are required to prepare a statement showing the distribution of cash as and when available,

applying maximum possible loss procedure.

60. Daksh Associates is a reputed firm. On account of certain misunderstanding between the

partners, it was decided to dissolve the firm as on 31st December, 2009 was as follows:

Liabilities Amount Assets Amount

Capitals: Land and building 7,00,000

Daksh3,00,000 Other fixed assets 3,00,000

Yash2,00,000 Stock in trade 2,00,000

Siddhart(Minor) 1,00,000 6,00,000 Debtors 4,00,000

Trade Loans 3,00,000 Bills receivables 1,50,000

Bank overdraft 3,00,000 Goodwill 30,000

Other loans 2,00,000

Creditors 2,00,000 Cash 20,000

Siddhart’s loan 2,00,000

18,00,000 18,00,000

It was decided that Mr.Daksh shall be in-charge of Realization. He shall set apart Rs. 10,000

towards expenses; He shall be paid a remuneration of 5% on the amounts distributed to the

partners towards their contribution other than loans. Assets realized are as under:

Date Particulars Amount

1-1-2010 Debtors 3,50,000

15-1-2010 Fixed Assets 4,00,000

1-2-2010 Debtors 50,000

15-2-2010 Bills Receivable 1,40,000

1-3-2010 Fixed Assets 50,000

15-3-2010 Land and Buildings 8,00,000

Rajan Adhikari, FCA Partnership Accounts (CAP -II Dec 20)

34

Prepare a statement showing how the money received on various dates will be distributed

assuming: