Professional Documents

Culture Documents

Mandiri Investa Equity Movement Fund Fact Sheet Dec 2020

Uploaded by

ulala0 ratings0% found this document useful (0 votes)

9 views1 pageOriginal Title

MIEM

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageMandiri Investa Equity Movement Fund Fact Sheet Dec 2020

Uploaded by

ulalaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

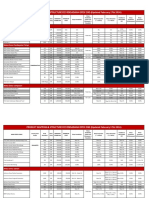

Fund Fact Sheet,December 2020

Mandiri Investa Equity Movement

Equity Fund

Price: IDR 1,503.43 About Mandiri Investasi

Reporting Date PT Mandiri Manajemen Investasi (Mandiri Investasi) is a separate subsidiary of PT Mandiri Sekuritas established in December 28, 2004. PT

30-December-2020 Mandiri Sekuritas is Indonesia’s leading investment bank and a subsidiary of PT Bank Mandiri (Persero) Tbk., the country’s largest

stateowned Bank. Mandiri Investasi and/or its predecessors have been managing investment portfolios since 1993, with Business

Effective Statement

S-8544/BL/2012 License Number : No. Kep-11/PM/MI/2004. Mandiri Investasi is Indonesia’s largest domestic mutual fund, with total assets under

management totaling Rp 62.27 Trillion (as of 30 December 2020).

Effective Date

10-July-2012 Custodian Profile

Custodian Bank Citibank N.A., IndonesiaBranch (“Citibank“) is a branch office of Citibank N.A., a banking institution domiciled and having its headquarter

Citibank, Jakarta in USA. Citibank has a license from the OJK to operate as a custodian in the capital market based on Bapepam Chairman Decision No.

Kep-91/PM/1991 dated 19 October 1991. Citibank is registered and supervised by the OJK.

Inception Date

03-Oct-2012 Investment Objective

Asset Under Management To provide optimal long term capital appreciation primarily through investing in listed Indonesian equities.

IDR 599.51 Billion

Currency

Investment Policy Portfolio Allocation

Indonesian rupiah (IDR) Money Market : 0% - 20% Money Market : 6.40%

Equity : 80% - 100% Equity : 93.60%

Pricing Frequency

Daily Bonds : 0% - 20% Bonds : 0.00%

Investment Minimum

IDR 50.000 Fund Performance Monthly Return

Number of Offered Unit

3.000.000.000 (Three Billion)

MIEM Benchmark*

MIEM Benchmark*

Management Fee 80%

Max. 3.00% p.a 70%

60%

60%

Custodian Fee 50%

40%

Max. 0.15% p.a 40%

30% 20%

Subscription Fee 20%

Min. 1.00% Max. 3.00% 10% 0%

0%

Redemption Fee -10% -20%

Max. 1.00% (< 1 year) *holding period -20% Apr-16 Sep-16 Feb-17 Jul-17 Dec-17 May-18 Oct-18 Mar-19 Aug-19 Feb-20 Jul-20 Dec-20

Oct-12 Jun-13 Jan-14 Aug-14 Apr-15 Nov-15 Jun-16 Feb-17 Sep-17 Apr-18 Dec-18 Jul-19 Feb-20 Dec-20 -40%

Switching Fee

Max. 1.00%

ISIN code

IDN000140209

Top Holding Sector Allocation

Bloomberg code

MANIEMA : IJ In Alphabetical Order Biggest Sector

Astra International Tbk. Equity

Main Risk Factor Bank Central Asia Tbk. Equity

- Risk of Deteriorating Economic and Political Finance, 27.23%

Bank Mandiri Tbk. Equity

Condition Consumer, 14.67%

Bank Negara Indonesia Tbk. Equity

- Risk of Default Infrastructure, 14.18%

Bank Rakyat Indonesia Tbk. Equity

- Risk of Liquidity Basic Industry, 10.56%

- Risk of Diminishing of NAV of each participation Hanjaya Mandala Sampoerna Tbk. Equity

Others, 26.96%

unit Kalbe Farma Tbk. Equity

- Risk of Dissolution and Liquidation Telekomunikasi Indonesia Tbk. Equity

- Market Risk Unilever Indonesia Tbk. Equity

- Risk of Electronic Media Transaction United Tractor Tbk. Equity

Investment Period Performance - 30 December 2020

<3 3-5 >5 1 Month 3 Months 6 Months 1 Year 3 Years 5 Years YTD Since

Inception

> 5 : long term MIEM 5.02% 24.62% 22.29% -9.35% 33.39% 59.52% -9.35% 50.34%

Risk Level Benchmark* 6.53% 22.77% 21.89% -5.09% -5.93% 30.18% -5.09% 40.26%

Best Month Feb-19 53.04% This fund has achieved best performance 53.04% at Feb-19 and achieved worst

Worst Month Mar-20 -22.62% performance -22.62% at Mar-20.

High * JCI

Description Market Outlook

MIEM Fund investing in Equity with Long Term December was the second best performing month in 2020 after November with the increase of 6.5% mtd. The main driver of the rally

and categorized High Risk. This Mutual fund’s

was the flush liquidity in the financial system. Banks have been decreasing the deposit rate causing investors to find other asset that may

Portfolio carries various risks for investor.

provide higher return, such as from stock market. Some of good news like first vaccine delivery arrived in Indonesia and high commodity

Information on Mutual Fund Ownership export became the rationale for local investors, especially retail investor, to add their position in stocks. Additionally, Indonesia has

Information on Mutual Fund Ownership secured 400 million dosages of vaccine from pharmaceutical companies like Pfizer, Novavax, AstraZaneca and Sinovac. 2020 was an

Confirmation letter for subscription,redemption

exceptional year where people around the world experienced the same challenge, which was Covid-19 pandemic. JCI dived -37.8% ytd

and switching of mutual funds are valid legal

proof of mutual fund ownership issued and in March due to the Covid - 19 outbreak, then tried to climb back with strong fiscal and monetary back-up, rallied at last quarter due to

delivered by the custodian bank. In case there is vaccine and closed at level 5,989 or -5.5% ytd.

Securities Ownership (AKSES) facility,

Participation Unit Holders could see Mutual Fund Fund Bank Account

ownership through KSEI Akses web page, Citibank N.A., Indonesia Bank Mandiri Cabang Bursa Efek Indonesia, Jakarta

https://akses.ksei.co.id/

REKSA DANA MANDIRI INVESTA EQUITY MOVEMENT REKSA DANA MANDIRI INVESTA EQUITY

MOVEMENT 0-810-179-007 104-000-4496-845

You might also like

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryFrom EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryRating: 5 out of 5 stars5/5 (1)

- Factsheet - Mandiri Investa Dana SyariahDocument1 pageFactsheet - Mandiri Investa Dana SyariahFitria MeylinaNo ratings yet

- Mandiri Global Sharia Equity Dollar Equity Fund Fact Sheet March 2022Document1 pageMandiri Global Sharia Equity Dollar Equity Fund Fact Sheet March 2022Aristo Elyan TambuwunNo ratings yet

- Mandiri Investa Pasar Uang: Investment Objective Investment Policy Portfolio AllocationDocument1 pageMandiri Investa Pasar Uang: Investment Objective Investment Policy Portfolio AllocationJust ChrisNo ratings yet

- Pinnacle Strategic Equity Fund Factsheet (1) - CONTOHDocument1 pagePinnacle Strategic Equity Fund Factsheet (1) - CONTOHirfanNo ratings yet

- Pinnacle Enhanced Liquid ETF (XPLQ) : Fund Information About PinnacleDocument1 pagePinnacle Enhanced Liquid ETF (XPLQ) : Fund Information About PinnacleWlliam BarrethNo ratings yet

- Shinhan Balance Fund Fact Sheet April 2019Document1 pageShinhan Balance Fund Fact Sheet April 2019joecool87No ratings yet

- Pinnacle FTSE Indonesia ETF (XPFT) : March 2020Document1 pagePinnacle FTSE Indonesia ETF (XPFT) : March 2020Dynand PLNNo ratings yet

- Pinnacle Indonesia Large Cap ETF (XPLC) : March 2020Document1 pagePinnacle Indonesia Large Cap ETF (XPLC) : March 2020putu dediNo ratings yet

- Cash Plus Account InfosheetDocument4 pagesCash Plus Account InfosheetEdmund KohNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetDodi AriyantoroNo ratings yet

- Schroder Dana IstimewaDocument1 pageSchroder Dana IstimewaDadang SuhermanNo ratings yet

- Shinhan Balance Fund - Agustus - 2023 - enDocument1 pageShinhan Balance Fund - Agustus - 2023 - enwongjuliusNo ratings yet

- FFS PMMF 30 November 2020Document1 pageFFS PMMF 30 November 2020teguhsunyotoNo ratings yet

- Jarvis Balanced Fund Desember 2020Document2 pagesJarvis Balanced Fund Desember 2020rinasiahaanNo ratings yet

- 132224994603260076ABFDocument1 page132224994603260076ABFSamuel TobsonNo ratings yet

- Archipelago Equity Growth FactsheetDocument1 pageArchipelago Equity Growth FactsheetDaniel WijayaNo ratings yet

- 2020 Reckoner PriceMaps Mumbai PDFDocument1 page2020 Reckoner PriceMaps Mumbai PDFParin MaruNo ratings yet

- Projected Profit Rates December 2023Document5 pagesProjected Profit Rates December 2023khanthegreat853No ratings yet

- Jarvis Balance Fund - FFS-JUN21Document2 pagesJarvis Balance Fund - FFS-JUN21Triwibowo B NugrohoNo ratings yet

- Ffs-Jambaf Jan2021Document2 pagesFfs-Jambaf Jan2021Johan CahyantoNo ratings yet

- Pinnacle Sharia Money Market Fund performance and portfolio as of 30 November 2020Document1 pagePinnacle Sharia Money Market Fund performance and portfolio as of 30 November 2020teguhsunyotoNo ratings yet

- Data as of 31 July 2021 for PINNACLE STRATEGIC EQUITY FUNDDocument1 pageData as of 31 July 2021 for PINNACLE STRATEGIC EQUITY FUNDHery AdamNo ratings yet

- EFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUDocument1 pageEFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUpderby1No ratings yet

- FactsheetDocument1 pageFactsheetROSSINo ratings yet

- Shinhan Balance Fund JANUARY 2022Document1 pageShinhan Balance Fund JANUARY 2022cuan claluNo ratings yet

- FFS Jambaf Apr22Document2 pagesFFS Jambaf Apr22agcpzdeqpyeaeypxifNo ratings yet

- Schroder 90 Plus Equity Fund AllDocument1 pageSchroder 90 Plus Equity Fund AllDadang SuhermanNo ratings yet

- FFS Jambaf Aug2021Document2 pagesFFS Jambaf Aug2021royescspchiitymmuaNo ratings yet

- Cash Plus Account InfosheetDocument5 pagesCash Plus Account Infosheetmarwane rokhoNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- October 2009Document1 pageOctober 2009kathmandu777No ratings yet

- Majid Elite MENA Equity ADocument1 pageMajid Elite MENA Equity Avelvivek22No ratings yet

- Jarvis Money Market Fund DESEMBER 2022Document4 pagesJarvis Money Market Fund DESEMBER 2022Dhanik JayantiNo ratings yet

- Ffs Jambaf Sept21Document2 pagesFfs Jambaf Sept21Ainsley SantosoNo ratings yet

- MANULIFE DANA EKUITAS INDONESIA CHINA - IDR FUND REPORT FOR JANUARY 2018Document1 pageMANULIFE DANA EKUITAS INDONESIA CHINA - IDR FUND REPORT FOR JANUARY 2018Vaxlr StovNo ratings yet

- FactsheetDocument2 pagesFactsheetMighfari ArlianzaNo ratings yet

- Pinnacle Enhanced Sharia ETF (XPES) : March 2020Document1 pagePinnacle Enhanced Sharia ETF (XPES) : March 2020Kamal FirmansyahNo ratings yet

- Fact SheetDocument1 pageFact SheetfahmiyusufNo ratings yet

- Schroder OKTOBER 2021Document1 pageSchroder OKTOBER 2021Dhanik JayantiNo ratings yet

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9No ratings yet

- Al Meezan Investment Management ReportDocument22 pagesAl Meezan Investment Management ReportSameer AsifNo ratings yet

- Factsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Document1 pageFactsheets Schroder Dana Mantap Plus II SEPTEMBER 2021Dhanik JayantiNo ratings yet

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96No ratings yet

- Syailendra Pendapatan Tetap Premium - DESEMBER - 2021Document1 pageSyailendra Pendapatan Tetap Premium - DESEMBER - 2021Faiz CapturexNo ratings yet

- Cipta Dana Cash: Asset ManagementDocument1 pageCipta Dana Cash: Asset ManagementFerrari .f488No ratings yet

- Shinhan Supreme Balance FundDocument1 pageShinhan Supreme Balance FundhhhahaNo ratings yet

- FFS PINNSEF 30 November 2020Document1 pageFFS PINNSEF 30 November 2020teguhsunyotoNo ratings yet

- Bill Statement: Mobile Number 014-5103103Document4 pagesBill Statement: Mobile Number 014-5103103Asmat ZakariaNo ratings yet

- FFS Jambaf Feb22Document2 pagesFFS Jambaf Feb22Alvarian AdnanNo ratings yet

- Schroder Dana Andalan II: Fund FactsheetDocument1 pageSchroder Dana Andalan II: Fund Factsheetainun endarwatiNo ratings yet

- PMSBazaar PMSPerformance December 2020Document15 pagesPMSBazaar PMSPerformance December 2020MoneycomeNo ratings yet

- FFS Jambaf Okt23Document4 pagesFFS Jambaf Okt23Fri Wardara van HoutenNo ratings yet

- Mridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMDocument4 pagesMridul Tiwari - Mridul Tiwari - PGPGM03 - 13 - IE - FMekta agarwalNo ratings yet

- Commodity Murabahah Rates-SavingsDocument1 pageCommodity Murabahah Rates-SavingsEe ZhaiNo ratings yet

- Liquidity FundDocument3 pagesLiquidity Fundtangkc09No ratings yet

- CAPITAL ADEQUECY GraphDocument2 pagesCAPITAL ADEQUECY GraphRupkatha Podder (181011114)No ratings yet

- Effective Date 01/06/2020 - 30/06/2020 Loan RatesDocument210 pagesEffective Date 01/06/2020 - 30/06/2020 Loan RatesNazhiif NazmieNo ratings yet

- Product Mapping & Structure Fee Reksadana Open End (Updated February 17Th 2014)Document3 pagesProduct Mapping & Structure Fee Reksadana Open End (Updated February 17Th 2014)AndrianNo ratings yet

- PRODUCTMAPPINGand STRUCTUREFEEREKSADANAOPENEND (UpdatedFeb17th2014) PDFDocument3 pagesPRODUCTMAPPINGand STRUCTUREFEEREKSADANAOPENEND (UpdatedFeb17th2014) PDFZulkifliNo ratings yet

- House No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedDocument4 pagesHouse No. 123-A,, Street No. 12, Lane # 4, Chaklala Scheme 3, Rawalpindi, Cantonement. Adnan AhmedAdnan AfridiNo ratings yet

- PPP Law ReviewDocument23 pagesPPP Law ReviewTommy DoncilaNo ratings yet

- University of Adelaide Business School Year in Review 2010Document76 pagesUniversity of Adelaide Business School Year in Review 2010Faculty of the ProfessionsNo ratings yet

- 0452 s12 QP 22Document20 pages0452 s12 QP 22Faisal RaoNo ratings yet

- Tano Santos Value Investing MBA Spring 2023 1stversion Term ADocument11 pagesTano Santos Value Investing MBA Spring 2023 1stversion Term AUddeshya GoelNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- PSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Basic Earnings Per ShareDocument2 pagesPSBA Integrated Review Financial Accounting and Reporting - Theory Christian Aris Valix Basic Earnings Per ShareThalia UyNo ratings yet

- CH 15Document45 pagesCH 15Mohamed AdelNo ratings yet

- 55966bos45368may20 p5 cp3 PDFDocument26 pages55966bos45368may20 p5 cp3 PDFankush sharmaNo ratings yet

- Income Statement - ExDocument14 pagesIncome Statement - ExQuân Uông Đình MinhNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Axis Mutual Fund PDFDocument2 pagesAxis Mutual Fund PDFSunil KoricherlaNo ratings yet

- Working Capital Management in HCL Infosystems Limited DeepakDocument74 pagesWorking Capital Management in HCL Infosystems Limited DeepakDeepak BhatiaNo ratings yet

- Brac Bank PresentationDocument24 pagesBrac Bank PresentationSumi Islam100% (2)

- Ijirt154811 PaperDocument4 pagesIjirt154811 PaperAshutosh LandeNo ratings yet

- Corporate Governance in Financing and Banking in BangladeshDocument22 pagesCorporate Governance in Financing and Banking in BangladeshAsrafia Mim 1813026630No ratings yet

- Exchange Rate Calculations: Exercise 1Document3 pagesExchange Rate Calculations: Exercise 1Rohit AggarwalNo ratings yet

- Lesson 3c The Statement of Comprehensive Income - Merchandising BusinessDocument11 pagesLesson 3c The Statement of Comprehensive Income - Merchandising BusinessBenedict CladoNo ratings yet

- S6-10 Digital Lending - Lending Club and AffirmDocument22 pagesS6-10 Digital Lending - Lending Club and AffirmVivek SinghNo ratings yet

- Working Capital ManagementDocument82 pagesWorking Capital ManagementAnacristina PincaNo ratings yet

- NHR New Resident 10 Year Tax HolidayDocument14 pagesNHR New Resident 10 Year Tax HolidaycoetzeesandersNo ratings yet

- Hire Purchase PDFDocument12 pagesHire Purchase PDFliamNo ratings yet

- ALGOGENE - A Trend Following Strategy Based On Volatility ApproachDocument7 pagesALGOGENE - A Trend Following Strategy Based On Volatility Approachde deNo ratings yet

- Role of GovtDocument4 pagesRole of Govtakshay kharteNo ratings yet

- Applied factory overheadDocument4 pagesApplied factory overheadralfgerwin inesaNo ratings yet

- Money - December 2015 VK Com EnglishmagazinesDocument92 pagesMoney - December 2015 VK Com EnglishmagazinesshyamsailusNo ratings yet

- SZABIST Need-Based Scholarship Application Form: 1. Candidate'S InformationDocument14 pagesSZABIST Need-Based Scholarship Application Form: 1. Candidate'S InformationKaran KumarNo ratings yet

- The Global Capitalist Crisis:: Its Origins, Nature and ImpactDocument45 pagesThe Global Capitalist Crisis:: Its Origins, Nature and Impactanmol149No ratings yet

- Rules For Doctrine of Marshalling and Co PDFDocument5 pagesRules For Doctrine of Marshalling and Co PDFneha guptaNo ratings yet

- NBFC Group 2 (Sales Incentive Structure)Document9 pagesNBFC Group 2 (Sales Incentive Structure)jay jariwalaNo ratings yet