Professional Documents

Culture Documents

Share Capital and Debentures

Uploaded by

Vijay SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Share Capital and Debentures

Uploaded by

Vijay SinghCopyright:

Available Formats

Share Capital and Debentures

A share has been defined under Section 2(84) of the CA 2013 as a share in in the share

capital of a company, and includes stock except where a distinction between stock and

shares is express or implied.

The word Capital herein for company law, means the share capital of the company.

The Companies Act under Section 43 permits issuance of two types of shares only:

1. Equity Share Capital –

(i) With voting rights; or

(ii) With differential rights as to dividend, voting or otherwise in accordance with

such rules and subject to such conditions as may be prescribed.

As per the explanation provided to Section 43, equity share capital of any company limited

by shares is all that shares which are not preference share capital. Dividend is paid to equity

shareholders after payment of dividend to preference shareholders. In the event of winding

up of company, they are ranked after the preference shareholders.

Equity share capital may be with different or equal voting rights as prescribed under Rule 4

of Companies (Share Capital and Debentures) Rules, 2014. No company limited by shares

shall issue equity shares with differential rights as to dividend, voting or otherwise, unless

the following conditions are complied with:

2. Preference Share Capital

The capital that a company raises through the issuance of preference shares is termed as

preference share capital.

Types of Preference Shares:

The following are the major types of preference share –

Cumulative Preference Shares

Non-cumulative Preference Shares

Redeemable Preference Shares

Compulsorily Convertible Preference Shares

It must be noted that dividends paid on preference shares are not deducted from taxes. Also,

redeeming such shares creates a financial burden on the company and erodes its capital.

Similarly, when profits are earned, companies must pay off the arrears dividends, especially

in case of Cumulative Preference Shares.

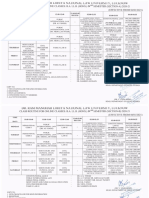

Difference between PREFERENCE SHARES AND EQUITY SHARES

Other differences to add in case of long question:

Definition Equity share is the Preference shares are the shares which

foundation of the promise the holder a preference over the

company as it raises equity shares. These can be converted to

fund. These cannot be equity shares.

converted to preference

shares.

Types of Shares These are considered as These come in various types like:

ordinary shares and Convertible and non-convertible

thus they do not have Cumulative and Cumulative and non –

any types in specific. cumulative.

Participation rights They are primarily Do not have any participation rights in the

responsible for the company’s management.

management of the

company.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Cyber Crime Cyber Security and Cyber LawsDocument23 pagesCyber Crime Cyber Security and Cyber LawsVijay SinghNo ratings yet

- Grievance Analysis Report For Higher Education DepartmentDocument15 pagesGrievance Analysis Report For Higher Education DepartmentVijay Singh100% (1)

- Doctrine of Lifting The Corporate VeilDocument12 pagesDoctrine of Lifting The Corporate VeilVijay SinghNo ratings yet

- Civil Society in India: Making Good Governance A RealityDocument45 pagesCivil Society in India: Making Good Governance A RealityVijay SinghNo ratings yet

- Foss V HarbottleDocument6 pagesFoss V HarbottleVijay SinghNo ratings yet

- MEMORANDUM OF ASSOCIATIasfsdfDocument13 pagesMEMORANDUM OF ASSOCIATIasfsdfVijay SinghNo ratings yet

- PromotersDocument5 pagesPromotersVijay SinghNo ratings yet

- Impact of Exports and Imports On Growth Rate of India: An Empirical EnquiryDocument6 pagesImpact of Exports and Imports On Growth Rate of India: An Empirical EnquiryVijay SinghNo ratings yet

- Fundamental Interpersonal Relations Orientation (FIRO) Is A Theory ofDocument30 pagesFundamental Interpersonal Relations Orientation (FIRO) Is A Theory ofVijay SinghNo ratings yet

- Class-Routine 040121Document14 pagesClass-Routine 040121Vijay SinghNo ratings yet

- RiskDocument1 pageRiskVijay SinghNo ratings yet

- Position of DirectorsDocument31 pagesPosition of DirectorsVijay SinghNo ratings yet

- Workmen CompensationDocument18 pagesWorkmen CompensationVijay SinghNo ratings yet

- RCH MDocument1 pageRCH MVijay SinghNo ratings yet

- MakersDocument1 pageMakersVijay SinghNo ratings yet

- Risk PDFDocument1 pageRisk PDFVijay SinghNo ratings yet

- Quick PDFDocument1 pageQuick PDFVijay SinghNo ratings yet

- RCHM PDFDocument1 pageRCHM PDFVijay SinghNo ratings yet

- GamesDocument1 pageGamesVijay SinghNo ratings yet

- File JKDocument1 pageFile JKVijay SinghNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Emmett T.J. Fibonacci Based Forecasts 1985Document4 pagesEmmett T.J. Fibonacci Based Forecasts 1985Om PrakashNo ratings yet

- UGBA103 Final Fall 2016Document5 pagesUGBA103 Final Fall 2016Billy bobNo ratings yet

- Chapter 04 Testbank: of Mcgraw-Hill EducationDocument59 pagesChapter 04 Testbank: of Mcgraw-Hill EducationshivnilNo ratings yet

- Stocks&Commodities S&C 03-2017Document64 pagesStocks&Commodities S&C 03-2017Edgar Santiesteban Collado50% (2)

- Industrial Internship Program: FinlaticsDocument7 pagesIndustrial Internship Program: FinlaticsRevanth GupthaNo ratings yet

- Indian Security Markets NSEDocument238 pagesIndian Security Markets NSEPurnendu SinghNo ratings yet

- Technical Analysis by Leavitt BrothersDocument441 pagesTechnical Analysis by Leavitt Brothersvinodtp100% (2)

- Options Trading Strategies - Book Review - Sheldon Natenberg, Option Volatility and PricingDocument3 pagesOptions Trading Strategies - Book Review - Sheldon Natenberg, Option Volatility and PricingHome Options Trading100% (2)

- Glossary Ec SimplifiedDocument163 pagesGlossary Ec Simplifiedwomoli6850No ratings yet

- Exercises On Stock Valuation With AnswersDocument6 pagesExercises On Stock Valuation With AnswersfatehahNo ratings yet

- Costful Trading: HangukquantDocument26 pagesCostful Trading: HangukquantmimmoNo ratings yet

- Inter Depository Transfer Details: International Infotech Park, Tower 7, 5Th Floor, Vashi, Navi Mumbai, Maharashtra-400703Document4 pagesInter Depository Transfer Details: International Infotech Park, Tower 7, 5Th Floor, Vashi, Navi Mumbai, Maharashtra-400703tessytNo ratings yet

- 202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Document2 pages202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Huế ThùyNo ratings yet

- Factsheet Nifty High Beta50 PDFDocument2 pagesFactsheet Nifty High Beta50 PDFRajeshNo ratings yet

- Problem 1Document4 pagesProblem 1andrei jude matullanoNo ratings yet

- Comperative Analysis B/W On-Line & Off-Line Trading: A Project Report ONDocument73 pagesComperative Analysis B/W On-Line & Off-Line Trading: A Project Report ONMadan MishraNo ratings yet

- Perfect Competition Case Study On Stock ExchangeDocument29 pagesPerfect Competition Case Study On Stock Exchangegagan3211100% (1)

- Earnings Per Share (EPS) : RCJ Chapter 15 (836-842)Document16 pagesEarnings Per Share (EPS) : RCJ Chapter 15 (836-842)Nikhil ShahNo ratings yet

- MCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDocument2 pagesMCQ On Buy Back of Shares - Multiple Choice Questions and AnswerDhawal RajNo ratings yet

- Technical AnalysisDocument39 pagesTechnical AnalysisharishNo ratings yet

- DisclaimerDocument13 pagesDisclaimerAK CREATIONSNo ratings yet

- Santander Volatility Trading Primer Part IDocument118 pagesSantander Volatility Trading Primer Part ISakura2709No ratings yet

- She 110Document24 pagesShe 110You're WelcomeNo ratings yet

- Financial Institutions Management - Chap024Document20 pagesFinancial Institutions Management - Chap024Wendy YipNo ratings yet

- Advanced Fixed Income Analytics For Professionals: What Is This Course About?Document12 pagesAdvanced Fixed Income Analytics For Professionals: What Is This Course About?Raman IyerNo ratings yet

- 07 14 21 Petron Top 100 Stockholders As of June 30 2021 PCOR.Document9 pages07 14 21 Petron Top 100 Stockholders As of June 30 2021 PCOR.Kelvin Dacasin100% (1)

- 2.0 Stock ValuationDocument29 pages2.0 Stock ValuationPartha Protim SahaNo ratings yet

- Barclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondDocument20 pagesBarclays CMBS Strategy Weekly Comparing Moodys and Kroll Valuations On 2015 CondykkwonNo ratings yet

- Eventcombo - Series A Term Sheet - DraftDocument4 pagesEventcombo - Series A Term Sheet - DrafteduNo ratings yet

- SOA Exam MFE - Yufeng Guo (Fall 2008)Document432 pagesSOA Exam MFE - Yufeng Guo (Fall 2008)Joseph Guy Evans HilaireNo ratings yet