Professional Documents

Culture Documents

Tutorial Questions

Tutorial Questions

Uploaded by

Nishika KaranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial Questions

Tutorial Questions

Uploaded by

Nishika KaranCopyright:

Available Formats

FIJI NATIONAL UNIVERSITY

COLLEGE OF BUSINESS, HOSPITALITY AND TOURISM STUDIES

DEPARTMENT OF ACCOUNTING

ACC601 CORPORATE ACCOUNTING

SEMESTER 1 – 2021

Tutorial: Topic 4

Accounting for Income Tax

1. Outline the different treatments for accounting and tax purposes of the following items:

(a) Depreciation of non-current assets

(b) Goodwill

(c) Long-service leave payable

(d) Allowance for doubtful debts

(e) Entertainment costs

(f) Prepaid insurance

(g) Warranties liability

(h) Rent received in advance.

2. What are the main principles of tax-effect accounting?

3. Current tax liability in four cases

For each of the four cases, calculate taxable income and prepare the journal entry for current tax

payable. (The tax rate is 30%)

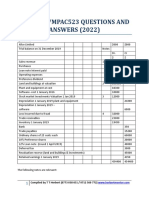

Case 1 Case 2 Case 3 Case 4

Accounting profit (loss) $40000 $20000 $5000 $(10000)

After debiting as expense:

Goodwill impairment * 6000 - - 8000

Entertainment costs * - 6000 7000 -

Donation to political party* 1000 3000 - -

Depreciation of new plant (10%) 4000 2000 10000 2000

Long service leave expense 600 600 600 1200

For tax purposes:

Deprecation rate allowable 20% 20% 20% 20%

Long service leave paid - - - 2400

*these items are non-deductible for tax purpose.

4. Worksheet and adjusting entry for deferred tax

CRADLE LTD

Statement of Financial Position (draft)

as at 30 June 2010

2010 2009

$ $

Assets

Cash 65 000 52 000

Accounts Receivables 885 000 858 000

Allowance for doubtful debts (80 000) (70 000)

Inventory 640 000 749 000

Prepaid insurance 4 000 3 000

Dividends Receivable 36 000 21 000

Plant 1240 000 918 000

Accumulated depreciation-Plant (380 000) (315 000)

Goodwill 78 000 97 500

Shares in listed companies 140 000 110 000

Deferred tax asset ? 87 125

Liabilities

Bank O’draft 209 300 175 500

A/cs payable 191 100 156 000

Current tax liability 50 985 46 270

Div payable 65 000 52 000

Convertible notes - 260 000

LSL payable 137 800 130 000

Def tax liability ? 7 200

Additional information

a) Plant and equipment is depreciated at 20% p.a. straight-line method for accounting

purpose but the allowable rate for taxation is 15% p.a. The plant and equipment sold

originally cost $32500

b) Accumulated depreciation for taxation purpose was $285000 at 30 June 2010.

c) The company taxation rate is 30%

d) Cradle ltd had overestimated its income tax payable for the year ended 30 June 2009 by

$2800. The overprovision was caused by an incorrectly calculated temporary difference

that resulted in the recognition of a deferred tax asset. All necessary adjustments to

correct the overprovision have been posted to the accounting records.

Required:

Determine and record the movements in deferred tax assets and liabilities for Cradle Ltd for the

year ended 30 June 2010 using an appropriate worksheet. Do not net off deferred tax assets and

liabilities.

The End

You might also like

- Wrap Promissory Note - EquityDocument4 pagesWrap Promissory Note - EquityEthan BarnesNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Fabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosDocument23 pagesFabm 2: Quarter 3 - Module 6 Computing and Interpreting Financial RatiosMaria Nikka GarciaNo ratings yet

- Chapter 6-Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument25 pagesChapter 6-Liquidity of Short-Term Assets Related Debt-Paying AbilityAriel ZamoraNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Chap 1 Part 4 - Installment Liquidation ProblemsDocument3 pagesChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (64)

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- ACCY200, Autumn, 2011 Past Exam QuestionsDocument21 pagesACCY200, Autumn, 2011 Past Exam QuestionsJohn TomNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Sem I Acc - NEP-UGCF 2022Document8 pagesSem I Acc - NEP-UGCF 2022Raj AbhishekNo ratings yet

- Mock ExamDocument4 pagesMock ExamAna-Maria GhNo ratings yet

- Ias 12 Practice QuestionsDocument9 pagesIas 12 Practice QuestionsKeith P. KatsandeNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Ratio AnalysisDocument3 pagesRatio AnalysisYash AgarwalNo ratings yet

- Hba 2302 Advanced TaxationDocument4 pagesHba 2302 Advanced TaxationprescoviaNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Afar JNDocument2 pagesAfar JNjasonnumahnalkelNo ratings yet

- Toaz - Info 89bf91d5 1612761367237 PRDocument7 pagesToaz - Info 89bf91d5 1612761367237 PRAEHYUN YENVYNo ratings yet

- Afar Assign#01. H - JikDocument5 pagesAfar Assign#01. H - JikjasonnumahnalkelNo ratings yet

- Solvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionDocument9 pagesSolvay Adv Acc Exercises Case 3 Deferred - Taxes IAS 12 - SolutionlolaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- Acaccountancy and Advanced AccounatcnyDocument323 pagesAcaccountancy and Advanced AccounatcnyAayush GhdoliyaNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- BU51009 (5BA) - Assessed Coursework - EBT 2019-20Document2 pagesBU51009 (5BA) - Assessed Coursework - EBT 2019-20Sravya MagantiNo ratings yet

- Compilation Pyq - Far570Document109 pagesCompilation Pyq - Far570Nur SyafiqahNo ratings yet

- Worked Example Chap12Document8 pagesWorked Example Chap12Giang Thái HươngNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Pricilla AFAR Question PaperDocument2 pagesPricilla AFAR Question PaperjasonnumahnalkelNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Solved StatamentsDocument16 pagesSolved StatamentsHaris AhnedNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ACCT 1107 - Assignment #4Document3 pagesACCT 1107 - Assignment #4hkarim8641No ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Bai Tap - IAS 12 - Tu LuanDocument14 pagesBai Tap - IAS 12 - Tu LuanTrần Nguyễn Tuệ MinhNo ratings yet

- National University of Science and TechnologyDocument8 pagesNational University of Science and TechnologyPATIENCE MUSHONGANo ratings yet

- FR111. FFA Solution CMA January 2022 ExaminationDocument5 pagesFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- Advanced AccountsDocument3 pagesAdvanced AccountsArun SankarNo ratings yet

- Net Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentDocument6 pagesNet Sales Cash Accounts Receivable Merchandise Inventory Preapid Expense Property, Palnt, and EquipmentMadina MamasalievaNo ratings yet

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulNo ratings yet

- Tutorial QuestionsDocument3 pagesTutorial QuestionsNishika KaranNo ratings yet

- Week 3 - Flexi Budgets MOCVDocument36 pagesWeek 3 - Flexi Budgets MOCVNishika KaranNo ratings yet

- Week 11 - Capital Budgeting DecisionsDocument25 pagesWeek 11 - Capital Budgeting DecisionsNishika KaranNo ratings yet

- ACC602-Topic 6 (CED) PDFDocument23 pagesACC602-Topic 6 (CED) PDFNishika KaranNo ratings yet

- Discussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Document4 pagesDiscussion:: 1. Explain How Capital Budgeting Can Impact On A Firm's Competitiveness 2Nishika KaranNo ratings yet

- Internship Report On General Banking of Agrani Bank Limited: Submitted ToDocument41 pagesInternship Report On General Banking of Agrani Bank Limited: Submitted ToDipto Kumar BiswasNo ratings yet

- Far-Quiz 2Document9 pagesFar-Quiz 2Ferdinand MangaoangNo ratings yet

- Loan Documentation - Customer Copy - KB230619RHZFJDocument33 pagesLoan Documentation - Customer Copy - KB230619RHZFJSubhraNo ratings yet

- Mid-Term Examination Financial Accounting II Duration:90mnDocument3 pagesMid-Term Examination Financial Accounting II Duration:90mnDavin HornNo ratings yet

- Air Canada vs. Cir, G. R. No. 169507 (2016 J. Leonen)Document1 pageAir Canada vs. Cir, G. R. No. 169507 (2016 J. Leonen)Y P Dela PeñaNo ratings yet

- Application For Credit Facility: Tel: Dubai: (971-4) 8855001 Fax: (971-4) 8855230Document4 pagesApplication For Credit Facility: Tel: Dubai: (971-4) 8855001 Fax: (971-4) 8855230dev dasNo ratings yet

- 1.1 Definition of ObligationDocument36 pages1.1 Definition of ObligationMarcos DmitriNo ratings yet

- Pro Gandhi Final 1Document79 pagesPro Gandhi Final 1Adapaka SahithiNo ratings yet

- QUIZ FinanceDocument39 pagesQUIZ FinanceAbhishek YadavNo ratings yet

- MCQ - Issue of SharesDocument7 pagesMCQ - Issue of SharesHarshal KaramchandaniNo ratings yet

- THE NEGOTIABLE INSTRUMENTS LAW - Codal ProvDocument2 pagesTHE NEGOTIABLE INSTRUMENTS LAW - Codal Provluis capulongNo ratings yet

- CF Week4Document41 pagesCF Week4Pol 馬魄 MattostarNo ratings yet

- Rights and Duties of MortgagorDocument9 pagesRights and Duties of MortgagorHarshpreet KaurNo ratings yet

- Case Study 2Document10 pagesCase Study 2Cheveem Grace Emnace100% (1)

- Solution Q2a PYQ ACC106 (Jun2019-Jan2018)Document2 pagesSolution Q2a PYQ ACC106 (Jun2019-Jan2018)Syafika Masrom-4F100% (1)

- Accounting 9 (Cambridge) : Monthlytest - OCTOBER 2020Document9 pagesAccounting 9 (Cambridge) : Monthlytest - OCTOBER 2020Mohamed MubarakNo ratings yet

- PROBLEM NO. 1 - Pistons Company: Note: Prepare "T" Accounts Then Post Identified AdjustmentsDocument13 pagesPROBLEM NO. 1 - Pistons Company: Note: Prepare "T" Accounts Then Post Identified AdjustmentsShiela Mae BautistaNo ratings yet

- Assignment 7 FinanceDocument3 pagesAssignment 7 FinanceAhmedNo ratings yet

- Abhay SirDocument20 pagesAbhay Sirneetish singhNo ratings yet

- UntitledDocument8 pagesUntitledhelen socayenNo ratings yet

- Running Head: FASB PROJECT: ACCT 310Document4 pagesRunning Head: FASB PROJECT: ACCT 310Kenny MainaNo ratings yet

- A Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstDocument18 pagesA Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstNavneet NandaNo ratings yet

- Mba520 Project 3 Financial Reporting and Analysis 3Document3 pagesMba520 Project 3 Financial Reporting and Analysis 3CharlotteNo ratings yet

- LNS 2011-1-1197Document19 pagesLNS 2011-1-1197CYLNo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document25 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- Business Vocabulary Exercise Financial Verbs: Borrow, Lend, Owe, Invoice, Afford Ex. 1Document4 pagesBusiness Vocabulary Exercise Financial Verbs: Borrow, Lend, Owe, Invoice, Afford Ex. 1Alejandra Pintos SartoreNo ratings yet