Professional Documents

Culture Documents

Chapter 7 Notes

Uploaded by

Mark SmithCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7 Notes

Uploaded by

Mark SmithCopyright:

Available Formats

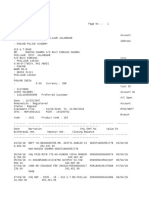

Chapter 7 Business Organizations

Sunday, September 17, 2017 7:41 PM

Chapter Objectives

1. To know the primary types of legal structures used by business organizations

2. To understand the advantages and disadvantages of each type of legal structure

3. To understand the business, legal, and tax reasons for selecting one legal structure over another

4. To know the circumstances under which creditors may pierce the veil of a corporation or a limited

liability company

5. To understand the nature and purpose of the business judgment rule, the rights of minority

shareholders in a closely held corporation, and the rights of shareholders to initiate derivative

lawsuits

Sole Proprietorship

• A proprietor is someone who has legal title to property (such as a business)

• Sole proprietorship is a business structure where one person owns "property" in the form of a

business enterprise

○ Simple and cheapest way to start a business

○ The business does not have a legal identity separate from the person

○ The person is the owner, manager, and enjoys profit or loss

• Advantages: not required to file a tax return for business (same identity as owner), no need to

worry about expenses relating to business funds

• Disadvantage: owner is personally liable for the debts of the business

• Allowed to use a business or trade name different from the name of the owner

• Operating a sole proprietorship does not require the preparation of a written document or any

other kind of organizational formalities

General Partnership

• A general partnership provides the simplest organization structure for starting a business when

two or more individuals decide to associate for the purpose of owning and operating a business

○ More expensive than a sole proprietorship

○ Administrative costs (prepare tax return, prepare internal system of control)

○ Managerial need for a written partnership agreement (roadmap for directing the

affairs and operations of the partnership)

□ Components of a partnership agreement: ownership interest, sharing of profits

and losses, managerial decision making, partnership valuation, partnership

dissolution

○ The business is not legally separate from its owners

○ Partners are personally reliable for the business

• Share common attributes with sole proprietorship

○ Difference is in the amount of people owning and operating the business

• Does not require preparation of written documents

○ Can exist when people with common goals join forces

• A pass-through entity is a partnership that is a nontaxable entity

○ Profits and losses are reported on the partners' individual tax returns

○ However, partnerships are required to file a tax return which discloses the revenue earned

by the partnership and reports the various deductible expenses

○ Partnership tax does not calculate a tax liability

Limited Partnership

• Limited partnerships provide a legal structure that has characteristics of both a corporation and a

general partnership

• Two classes of partners comprise a limited partnership:

1. The general partners have unlimited liability and responsibility for managing the business

Class Notes Page 1

1. The general partners have unlimited liability and responsibility for managing the business

2. The limited partners have limited liability and no responsibility for managing the

partnership

i. Their financial exposure is restricted to their capital investment

• Most states require the preparation of a written partnership agreement for a limited partnership

• Unpopular due to the cost of complying with state and federal laws

Limited Liability Partnership (LLP)

• A limited liability partnership operates like a general partnership except statutes provide that

non-negligent partners are not liable for the negligent conduct of another partner

○ A partner is not liable for the negligent conduct of an employee of the firm, unless the

employee is under the direct supervision of a partner

The assets of non-negligent partners are insulated from the party injured by a

negligent partner

Limited Liability Company (LLC)

• State statues authorize the formation of a limited liability company to operate as unincorporated

entities with legal identities separate and distinct from their members

• Characteristics

○ Possess characteristics of both partnerships and corporations

Partnership: an LLC is a pass-through entity for tax purposes

Corporation: LLCs' members enjoy limited liability as do the shareholders of a

corporation

□ Corporation's shareholders = LLC's members

LLC's members may include individuals, corporations, and other limited

liability companies

• Formation

○ Easy and cheap

○ To form, 1 or more of the promoters must prepare and file an LLC's articles of organization

(certificate of organization) with the appropriate state agency

○ LLC comes into legal existence at the time of the filing of the articles of organization with the

appropriate state agency

Once formed, an LLC continues as a separate legal entity until an authorized

member(s) officially terminate the LLC by canceling its articles of organization

○ Has limited life

○ Members usually make contribution to an LLC through investing

• Management

○ Small LLCs rely on member management, in which individual members participate equally in

the management of the company

○ Big LLCs form a management team which comprise of active members (members involved

in day-to-day operations), while the remaining members assume a more passive role as

holders of an ownership interest

As an alternate model, some LLCs will designate 1 member to serve as the manager

○ LLC must maintain the following types of records as part of its management policies and

procedure:

A current membership list: full name and last known address of each member

A copy of the LLC's articles of organization

A copy of the LLC's operating agreement, assuming that a separate operating

agreement has been prepared

Copies of the LLC's federal, state, and local income tax returns and other official

reports for the 3 most recent years

Copies of LLC's financial statements for the 3 most recent years

• Operating Agreement

○ An operating agreement is typically a written document regarding the management of the

company and the conduct of its business

Provide guidelines about the LLC's operating policies, practices, procedures

Class Notes Page 2

Provide guidelines about the LLC's operating policies, practices, procedures

Provide guidance for how members will share profits and losses, the percentage of

ownership of each member, and the rights, privileges, duties, and responsibilities of

each member

○ A comprehensive operating agreement:

Helps to preserve the relationship among the members of the LLC by providing a

clarity and instructions about the running of the business

Provides information about how new members may join the LLC and how existing

members may leave

• Taxation

○ An LLC is a nontax entity (its profits or losses are reported on its members' individual tax

returns)

The LLC files an annual tax return to report relevant tax data to the IRS

The LLC reports each members share of the profits or losses annually on an IRS Form

K-1

○ An LLC is allowed to choose how it will be treated for tax purposes (either a corporation or a

partnership)

• Termination

○ An LLC terminates automatically by operation of law when one member leaves

If the members want to prevent this automatic dissolution, the operating agreement

must specify the means by which the LLC will continue

□ Thus, the default option is dissolution

○ The most common way to avoid automatic dissolution is to include in the operating

agreement a process referred to as a "buyout" agreement

A "buyout" agreement addresses future situations involving the possible departure of

a member

Corporations

• A corporation is an organization (often a business) that has a legal existence separate and distinct

from its owners

○ The owners (shareholders) share in the profits and losses (owners can work for the

company)

○ By centralizing the management function of an enterprise, corporations attract capital

investment from passive investors who seek a return on their investment without engaging

in the day-to-day activities of the business

• Characteristics

○ The law recognizes corporations as having legal characteristics similar to a person ( can own

property, enter contracts, etc.)

Corporations are required to file annual tax returns in their own names

Corporate shareholders enjoy limited liability

○ A new corporation is referred to as closely held corporations, in which the investors often

serve as corporate officers and help manage the business

○ In publicly traded corporations, the management team operates separately and distinctly

from the shareholders

○ The corporate form of organization encourages the creation of new enterprises by

minimizing the risk of starting and running a business

By separating the management of a business from the owners, two important

features of corporate law emerge:

1) A legal shield (corporate veil) insulates owners from corporate creditors

2) Managers of the business have duties and responsibilities that differ from those

of the owners

• Starting a Corporation

○ A promoter is commonly used to describe the person or persons who start a business

Starting a corporation also requires a business purpose, a business plan, a source of

capital and financing, a physical place to house the corporation, a source of customers

Class Notes Page 3

capital and financing, a physical place to house the corporation, a source of customers

and vendors, and generally a cadre of experience and skilled managers and workers,

an attorney to draft the corporation's articles of incorporations, its bylaws, and other

documents

□ A corporation's articles of incorporation serve as a type of constitution for a

corporation which establish basic terms of the corporation's structure and

operations and define its purpose

□ A corporation's bylaws provide guidance to officers and directors regarding a

corporation's internal affairs and operations and its external relations

Bylaws set forth a corporation's most important policy statements and

serve as the "terms of reference" for directors, officers, and managers

when developing strategic plans and making significant business decisions

• Where to Incorporate

○ Owners of a corporation usually incorporate their business in the state in which they live

and work

○ Promoters of a corporation may decide to go forum shopping (search for a state that is

business friendly)

Delaware is viewed as the most "friendly" state to incorporate a business

• Shareholders

○ The shareholders of a corporation are the owners of the corporation

They provide initial capital and subsequent capital for the business to start and sustain

Shareholders possess certain powers regarding the corporation (elect e-board

members, etc.)

• Directors

○ Directors set the strategic vision for the corporation (where to expand or reduce, where to

make investments, etc.)

Hire corporate officers such as CEO, CFO, etc.

Set the officers' levels of compensation

Establish corporate policies and strategic goals

Determine when to declare dividends and decide the amount of dividend distributions

○ Directors operate as a unit, commonly referred as the board of directors

Comprised of committees (audit committee, nominating committee, compensation

committee)

• Officers

○ Corporate officers take directions from the board of directors and run the corporation on a

day-to-day basis

Have the authority to commit the corporation to perform services, sell goods, and

assume financial obligations, all within their stated levels of authority as set forth in

the corporation's bylaws

Allocate the resources of the corporation through a comprehensive budgeting process

and system of internal controls

Hire managers who report to them, often delegating duties to managers to implement

the goals and objectives established by the officers

• Stock

○ Ownership of a corporation is represented by shares of stock

A corporation may issue common stock (owners have voting rights, but are usually

subordinate to preferred stockholders regarding dividends and corporate assets)

A corporation may issue preferred stock (owners have a "preferred" claim to

dividends and assets, but typically have no voting rights)

○ Closely held corporation: shareholder may agree to restrict the ownership of stock through

a separate shareholder agreement

○ Publicly held corporation: the value of a corporation's stock is determined through an open

market as the shares are traded on one of the public exchanges

• Dividends

Class Notes Page 4

• Dividends

○ Dividends represent a distribution of the corporation's earnings to the shareholders

The amounts of dividends received by shareholders depends on the number of shares

owned

• Taxation

○ Federal income tax laws and regulations impose taxes on corporations differently depending

on whether an election has been made to have the corporation taxed as an S corporation

If a corporation has made an S election, it becomes a flow-through entity for tax

purposes with taxation occurring only at the shareholder level

If an election has not been made, then the corporation will be taxed as a C

corporation (taxed on its taxable income)

○ When dividends are distributed to shareholders, a possibility exists for double taxation:

1. The corporation pays an income tax on its net income (taxable income)

2. When some or all of that income is distributed to taxpayers in the form of a dividend,

the shareholders also pay an income tax

• Dissolution

○ Dissolution requires the board of directors to prepare and adopt a resolution of dissolution

The shareholders must then approve the resolution

○ Corporate offices and the directors prepare a plan of dissolution, which is commonly

referred to as a winding-up period, in which the corporation provides employees with

notice of the expected duration of their employment with the corporation

Creditors are paid to the extent the corporation has liquidity

All necessary state and federal filings occur including the preparation and filing of

"final" tax returns

○ Then, to the extent that assets remain in the corporation, a final liquidating dividend is

made to the shareholders

• External Influences on Corporate Management Practices

○ The Dodd-Frank Wall Street Reform and Consumer Protection Act affects the corporate

governance of all public companies regarding the disclosure to stockholders of executive

compensation

Business Judgment Rule, Minority Shareholder Rights, and Shareholder Derivative Actions

• 3 major theories affect the decisions and actions of the directors, officers, and shareholders:

1. The business judgment rule

2. Minority shareholder rights

3. Shareholder derivative actions

• Business Judgment Rule

○ The business judgment rule is the standard used in the United States to judge the decisions

of corporate directors and officers

○ The business judgment rule protects directors and officers of a corporation against the risk

of personal liability for making business decisions that others might find imprudent, unwise,

and inappropriate

Provides immunity for business judgments and decision that corporate directors and

officers make as long as they acted on an informed basis, in good faith, and within the

scope of their authority

Imposes on directors a duty of care and a duty of loyalty to the corporation and the

shareholders

Expects directors and officers to act on the belief that their decisions and actions are

in the best interests of the corporation and the shareholders

□ Without this protection, a sense of paralysis would permeate the boardrooms

and corporate offices of nearly every corporation in the United States

○ Directors and officers seek further insulation from personal liability through the use of

directors and officers liability insurance, which provides financial protection from the

consequences of litigation involving wrongful acts on the part of directors and officers

Constituency statutes (stakeholder statutes) allow directors and officers of a corporation to

Class Notes Page 5

○ Constituency statutes (stakeholder statutes) allow directors and officers of a corporation to

make non-shareholder-oriented decisions about a company's resources

• Minority Shareholder Rights

• Shareholder Derivative Action

○ A shareholder derivative action is a legal claim brought by the shareholders of a

corporation against the corporation's directors and officers

The essence of the claim is that the directors and officers failed to discharge their

duties to the benefit of the corporation and its shareholders

○ To be successful in a derivative suit, shareholders generally must prove that the directors

and officers committed fraud, engaged in self-dealing, or otherwise breached a fiduciary

duty owed to the corporation and its shareholders

In a shareholder derivative action, the shareholders must satisfy a number of legal

requirements

Piercing the Corporate Veil

• What is the Corporate Veil?

○ The corporate veil is a legal assumption that the actions and obligations of a corporation are

separate and distinct from the corporation's principals

Exists to protect the individuals who manage, direct, or own a corporation

○ The corporate veil affords individuals the opportunity to start a business and assume the

risks associated with a startup business without the fear of jeopardizing personal assets

• Piercing the Corporate Veil

○ Creditors may find it necessary to seek recover by "piercing the corporate veil" when the

assets of a corporation are insufficient to satisfy their rightful and legitimate demand

○ Credits of a corporation may be able to "breach the shield" (the veil) through an equitable

action known as piercing the corporate veil

Once this happened, the personal assets of the principals fall within the reach of the

corporation's creditors

Global Perspective: Global Business Organizations

• Factors Influencing Decisions to Expand Internationally

○ What product or service is the business planning to export or import?

○ What is the desired level of control over overseas operations?

○ How mature is the business and how much experience does it have working internationally?

○ How much risk is the business willing and able to bear?

○ How much capital is available to invest?

○ How does the international expansion fit with the company's long-term goals and strategy?

• Factors Influencing Geographic Choice

○ Economic ,political, and cultural factors, historic context

• Legal Structures for International Expansion

○ Options are listed in order of increasing presence in the foreign market (from min. to max.

involvement)

Import/Export

□ Direct import/export sales

□ Sales representatives and sales agents

□ Distributorship

□ Export trading company

□ Branch office

Licensing and Franchising

□ Licensing (the right to use, manufacture, and/or distribute the licensor's product

in exchange for royalty payments)

□ Franchising (a trademark license)

Foreign Direct Investment (directly investing in and actively controlling at least a

portion of an ongoing business in another country)

□ Joint ventures (companies contractually agree to work together on a business,

sharing profits and liabilities)

Class Notes Page 6

sharing profits and liabilities)

□ Subsidiaries (a corporation, the controlling majority of whose stock is owned by

another corporation)

Class Notes Page 7

You might also like

- Forms of Ownership: Sole ProprietorshipDocument3 pagesForms of Ownership: Sole ProprietorshipAjay KaundalNo ratings yet

- UET Entrepreneurship 5Document16 pagesUET Entrepreneurship 5Zain GhummanNo ratings yet

- Busi Law Ch15-1Document52 pagesBusi Law Ch15-1chuacasNo ratings yet

- Chapter - 3: Industrial OwnershipDocument11 pagesChapter - 3: Industrial Ownershipashish.nigam120893No ratings yet

- Business Structures in OntarioDocument7 pagesBusiness Structures in OntariocorecorpNo ratings yet

- Commercial Law in UsDocument19 pagesCommercial Law in Usg.petryszak1No ratings yet

- Forms of Tourism and Hospitality Business Ownership and FranchisingDocument27 pagesForms of Tourism and Hospitality Business Ownership and FranchisingJulie Mae Guanga Lpt100% (1)

- Business StructuresDocument22 pagesBusiness StructuresDerrick Maatla MoadiNo ratings yet

- Handout01 Introduction To Business and AccountingDocument9 pagesHandout01 Introduction To Business and AccountingRyzha JoyNo ratings yet

- Forms of Business OrganizationsDocument15 pagesForms of Business OrganizationsReiner MagdadaroNo ratings yet

- BusinessDocument12 pagesBusinesstahaNo ratings yet

- Org A BDocument8 pagesOrg A BsaraNo ratings yet

- Chapter 3Document50 pagesChapter 3kennedyNo ratings yet

- Types of Business Organisations For ArchitectsDocument14 pagesTypes of Business Organisations For ArchitectsANSLEM ALBERTNo ratings yet

- Company Law: Shortened Version For Mba StudentsDocument134 pagesCompany Law: Shortened Version For Mba Studentsgaurav bishtNo ratings yet

- Lecture 2Document18 pagesLecture 2Maaz NasirNo ratings yet

- Entrepreneurship Unit 1 Understanding Businesses: DR Ella Kangaude-NkataDocument24 pagesEntrepreneurship Unit 1 Understanding Businesses: DR Ella Kangaude-NkataMartin ChikumbeniNo ratings yet

- Forms of Business OrganizationDocument6 pagesForms of Business Organizationconstancio asnaNo ratings yet

- Forms of Business OrganizationDocument4 pagesForms of Business Organization바스리카No ratings yet

- Lecture 1 Types of CompanyDocument18 pagesLecture 1 Types of CompanyFaint MokgokongNo ratings yet

- Forms of Business NSTPDocument13 pagesForms of Business NSTPLyra BerzaNo ratings yet

- Chapter 7 CorprationDocument15 pagesChapter 7 CorprationBiru EsheteNo ratings yet

- Legal Consequences of Incorporation: 1 Corporate GovernanceDocument19 pagesLegal Consequences of Incorporation: 1 Corporate GovernanceHayder AhmedNo ratings yet

- Limited Libility Partnership PresentationDocument48 pagesLimited Libility Partnership PresentationShubham PhophaliaNo ratings yet

- Chapter 7 CorprationDocument15 pagesChapter 7 CorprationSisay Belong To JesusNo ratings yet

- Business 1.2Document44 pagesBusiness 1.2samerNo ratings yet

- Business Entities SP 21 MBADocument21 pagesBusiness Entities SP 21 MBAMimiNo ratings yet

- Man Project ParthDocument8 pagesMan Project ParthParth KshirsagarNo ratings yet

- Chapter 1Document10 pagesChapter 1intanNo ratings yet

- Brief Description Ex: The Doctor Opens The Business and Practices His LicenseDocument4 pagesBrief Description Ex: The Doctor Opens The Business and Practices His LicensehenryNo ratings yet

- Chapter 4 Forms of Business OrganizationDocument19 pagesChapter 4 Forms of Business OrganizationJoy BeronioNo ratings yet

- Corporate Governance and Business OrganizationDocument18 pagesCorporate Governance and Business OrganizationMadiha IqbalNo ratings yet

- Tax Considerations:: Factors Affecting The ChoiceDocument26 pagesTax Considerations:: Factors Affecting The ChoiceAnonymous jrIMYSz9No ratings yet

- Functions of Business FinanceDocument6 pagesFunctions of Business FinancePrincess AudreyNo ratings yet

- FBM Module 1Document19 pagesFBM Module 1Sassy BitchNo ratings yet

- Legal Business FormsDocument20 pagesLegal Business FormsAnkur AryaNo ratings yet

- Lecture 9Document42 pagesLecture 9Trí NguyễnNo ratings yet

- LLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCFrom EverandLLC: A Complete Guide To Limited Liability Companies And Setting Up Your Own LLCNo ratings yet

- Forms of Business OrganizationDocument7 pagesForms of Business OrganizationAIML waheedNo ratings yet

- Business OrganizationsDocument20 pagesBusiness OrganizationswerewaroNo ratings yet

- Business Organization-1Document18 pagesBusiness Organization-1faizy24No ratings yet

- CH 5 PartnershipDocument16 pagesCH 5 PartnershipIdiris H. AliNo ratings yet

- Accounting 1: Lesson 1 What Is Accounting?Document7 pagesAccounting 1: Lesson 1 What Is Accounting?Jameckayy VlogsNo ratings yet

- Akshay - Types of Business OrganiZationsDocument13 pagesAkshay - Types of Business OrganiZationsblip2604No ratings yet

- Business StructureDocument43 pagesBusiness StructureRisty Ridharty DimanNo ratings yet

- Presentation 3Document53 pagesPresentation 3Airon PorlayNo ratings yet

- Chapter - Three: Business & Business EntitiesDocument18 pagesChapter - Three: Business & Business Entitiesbelay abebeNo ratings yet

- Choosing A Business Structure in TrinidadDocument6 pagesChoosing A Business Structure in TrinidadHaydn DunnNo ratings yet

- Module Three Forms of Legal Business OwnershipDocument68 pagesModule Three Forms of Legal Business OwnershipsifakiwoveleNo ratings yet

- Forms of Business OrganizationDocument1 pageForms of Business OrganizationElla Simone100% (3)

- FIN600 Module 1 Notes - Introduction To Financial ManagementDocument28 pagesFIN600 Module 1 Notes - Introduction To Financial ManagementInés Tetuá TralleroNo ratings yet

- What Is A Business Partnership?Document3 pagesWhat Is A Business Partnership?Skylar FunnelNo ratings yet

- Acc Ch-5 Lecture NoteDocument14 pagesAcc Ch-5 Lecture NoteBlen tesfayeNo ratings yet

- L-04 Industrial ManagementDocument12 pagesL-04 Industrial ManagementTanyaMathurNo ratings yet

- Sole ProprietorshipDocument3 pagesSole ProprietorshipjeromeencioNo ratings yet

- Lecture#2Document34 pagesLecture#2SULEMAN BUTTNo ratings yet

- Engineering EconomyDocument20 pagesEngineering EconomyApril LynNo ratings yet

- Professional Practices: "The Structure of Organizations"Document28 pagesProfessional Practices: "The Structure of Organizations"Shad KhanNo ratings yet

- ADM1301 Final ReviewDocument35 pagesADM1301 Final ReviewCameron BelangerNo ratings yet

- City of Highland Park 2020 Affordable Housing PlanDocument6 pagesCity of Highland Park 2020 Affordable Housing PlanJonah MeadowsNo ratings yet

- Inclusionary Housing: A Case Study On New York CityDocument8 pagesInclusionary Housing: A Case Study On New York CityNandana L SNo ratings yet

- Ged105 MRR1Document3 pagesGed105 MRR1Cy100% (1)

- Project Cooperative BankDocument33 pagesProject Cooperative BankPradeepPrinceraj100% (1)

- Practice 4a EPS & Dilutive EPSDocument2 pagesPractice 4a EPS & Dilutive EPSParal Fabio MikhaNo ratings yet

- Mcdonald's SCMDocument28 pagesMcdonald's SCMMaria KerawalaNo ratings yet

- Topic 5 Answer Key and SolutionsDocument6 pagesTopic 5 Answer Key and SolutionscykenNo ratings yet

- 1538139921616Document6 pages1538139921616Hena SharmaNo ratings yet

- Questions p.38 1.: NSS Exploring Economics 6 Money Supply and Money CreationDocument18 pagesQuestions p.38 1.: NSS Exploring Economics 6 Money Supply and Money CreationkamanNo ratings yet

- Shape of The MEC CurveDocument3 pagesShape of The MEC CurveYashas Mp100% (2)

- A Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariDocument9 pagesA Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariArjun BaniyaNo ratings yet

- PPFAS Monthly Portfolio Report February 28 2023Document44 pagesPPFAS Monthly Portfolio Report February 28 2023DevendraNo ratings yet

- Skill Shortage Is A Crucial Social IssueDocument21 pagesSkill Shortage Is A Crucial Social Issuead4w8rlNo ratings yet

- Brunei Country ReportDocument41 pagesBrunei Country ReportIndra MuraliNo ratings yet

- Inventory MCQDocument6 pagesInventory MCQsan0z100% (2)

- Individual and Group Incentive PlansDocument47 pagesIndividual and Group Incentive Plansankita78100% (4)

- 10 CIR V CitytrustDocument1 page10 CIR V CitytrustAnn QuebecNo ratings yet

- FB Cash FlowsDocument3 pagesFB Cash FlowsTk KimNo ratings yet

- Kunci Jawaban P 6.5Document7 pagesKunci Jawaban P 6.5Vahrul DavidNo ratings yet

- 111Document5 pages111Din Rose GonzalesNo ratings yet

- Plans and Policies 2080 81englishDocument52 pagesPlans and Policies 2080 81englishYagya Raj BaduNo ratings yet

- Cash Management: A Qualitative Case Study of Two Small Consulting FirmsDocument50 pagesCash Management: A Qualitative Case Study of Two Small Consulting FirmsChristofferBengtssonNo ratings yet

- Operating ExposureDocument33 pagesOperating ExposureAnkit GoelNo ratings yet

- Ather Energy Series E Round of 128mnDocument2 pagesAther Energy Series E Round of 128mnManojNo ratings yet

- MAS-04 Relevant CostingDocument10 pagesMAS-04 Relevant CostingPaupauNo ratings yet

- Dodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033Document1 pageDodla Dairy Limited: #8-2-293/82/A, Plot No.270-Q, Road No.10-C, Jubilee Hills Hyderabad-500033yamanura hNo ratings yet

- FY23 Q4 Consolidated Financial StatementsDocument3 pagesFY23 Q4 Consolidated Financial StatementsJack PurcherNo ratings yet

- Test Bank For Supply Chain Management A Logistics Perspective 9th Edition CoyleDocument8 pagesTest Bank For Supply Chain Management A Logistics Perspective 9th Edition Coylea385904759No ratings yet

- Qatar Airways PresentationDocument13 pagesQatar Airways PresentationDerrick NjorogeNo ratings yet

- Basic Accounting GuideDocument76 pagesBasic Accounting GuideBSA3Tagum MariletNo ratings yet