Professional Documents

Culture Documents

What Is Unearned Revenue?

What Is Unearned Revenue?

Uploaded by

JOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Unearned Revenue?

What Is Unearned Revenue?

Uploaded by

JCopyright:

Available Formats

Unearned Revenue

By

DANIEL LIBERTO

Reviewed by

THOMAS BROCK

Updated Nov 5, 2020

What Is Unearned Revenue?

Unearned revenue is money received by an individual or company for a service

or product that has yet to be provided or delivered. It can be thought of as a

"prepayment" for goods or services that a person or company is expected to

supply to the purchaser at a later date. As a result of this prepayment, the seller

has a liability equal to the revenue earned until the good or service is delivered.

This liability is noted under current liabilities, as it is expected to be settled within

a year.

Unearned revenue is also referred to as deferred revenue and advance

payments.

KEY TAKEAWAYS

Unearned revenue is money received by an individual or company for a

service or product that has yet to be provided or delivered.

It is recorded on a company’s balance sheet as a liability because it

represents a debt owed to the customer.

Once the product or service is delivered, unearned revenue becomes

revenue on the income statement.

Receiving funds early is beneficial to a company as it increases its cash

flow that can be used for a variety of business functions.

Sorry, the video player failed to load.(Error Code: 101104)

Unearned Revenue

Understanding Unearned Revenue

Unearned revenue is most common among companies selling subscription-

based products or other services that require prepayments. Classic examples

include rent payments made in advance, prepaid insurance, legal retainers,

airline tickets, prepayment for newspaper subscriptions, and annual prepayment

for the use of software.

Receiving money before a service is fulfilled can be beneficial. The early receipt

of cash flow can be used for any number of activities, such as paying interest on

debt and purchasing more inventory.

Recording Unearned Revenue

Unearned revenue is recorded on a company’s balance sheet as a liability. It is

treated as a liability because the revenue has still not been earned and

represents products or services owed to a customer. As the prepaid service or

product is gradually delivered over time, it is recognized as revenue on

the income statement.

If a publishing company accepts $1,200 for a one-year subscription, the amount

is recorded as an increase in cash and an increase in unearned revenue. Both

are balance sheet accounts, so the transaction does not immediately affect the

income statement. If it is a monthly publication, as each periodical is delivered,

the liability or unearned revenue is reduced by $100 ($1,200 divided by 12

months) while revenue is increased by the same amount.

Unearned revenue is usually disclosed as a current liability on a company’s

balance sheet. This changes if advance payments are made for services or

goods due to be provided 12 months or more after the payment date. In such

cases, the unearned revenue will appear as a long-term liability on the balance

sheet.

Unearned Revenue Reporting Requirements

There are several criteria established by the U.S. Securities and Exchange

Commission (SEC) that a public company must meet to recognize revenue. If

these are not met, revenue recognition is deferred.

According to the SEC, there must be collection probability, or the ability to make

a reasonable estimate of an amount for the allowance for doubtful accounts,

completed delivery, or ownership shifted to the buyer, persuasive evidence of an

arrangement, and a determined price.

Example of Unearned Revenue

Morningstar Inc. (MORN) offers a line of products and services for the financial

industry, including financial advisors and asset managers. Many of its products

are sold through subscriptions. Under this arrangement, many subscribers pay

upfront and receive the product over time. This creates a situation in which the

amount is recorded as unearned revenue or, as Morningstar calls it, deferred

revenue.

At the end of the second quarter of 2020, Morningstar had $287 million in

unearned revenue, up from $250 million from the prior-year end. The company

classifies the revenue as a short-term liability, meaning it expects the amount to

be paid over one year for services to be provided over the same period.

You might also like

- Full Download Book The Four Pillars of Investing Second Edition Lessons For Building A Winning Portfolio PDFDocument41 pagesFull Download Book The Four Pillars of Investing Second Edition Lessons For Building A Winning Portfolio PDFwilliam.rose150100% (18)

- Statement 01-DEC-22 AC 50882755 03042555 PDFDocument5 pagesStatement 01-DEC-22 AC 50882755 03042555 PDFferuzbekNo ratings yet

- Accounting For Non-Profit OrganizationsDocument39 pagesAccounting For Non-Profit Organizationsrevel_13193% (29)

- Mercer Expatriate Compensation IntroDocument4 pagesMercer Expatriate Compensation Intromehdipirata100% (1)

- Notes To FSDocument3 pagesNotes To FSdhez10No ratings yet

- Pag Ibig Loan Form 1 MULTI-PURPOSE LOAN (MPL)Document2 pagesPag Ibig Loan Form 1 MULTI-PURPOSE LOAN (MPL)Mansoor GeorgeNo ratings yet

- SprottGoldBook PDFDocument203 pagesSprottGoldBook PDFrguyNo ratings yet

- Acctg 4 P&M ProjetDocument10 pagesAcctg 4 P&M ProjetJohn Kenneth Escober BentirNo ratings yet

- Examples of LiabilitiesDocument11 pagesExamples of LiabilitiesSuzette MamangunNo ratings yet

- Asset Account: Property, Plant, and Equipments (PP&E)Document4 pagesAsset Account: Property, Plant, and Equipments (PP&E)Ahsan AliNo ratings yet

- Admas University: Individual Assignment Prepare Financial ReportDocument7 pagesAdmas University: Individual Assignment Prepare Financial ReportephaNo ratings yet

- 1) Accrued Expense: Types of Accrued ExpensesDocument4 pages1) Accrued Expense: Types of Accrued ExpensesbNo ratings yet

- RECEIVABLESDocument4 pagesRECEIVABLESCyril DE LA VEGANo ratings yet

- Functional AccountingDocument9 pagesFunctional Accountingayesha shafaqatNo ratings yet

- What Is Unearned Revenue?: Deferred Revenue Accrual AccountingDocument7 pagesWhat Is Unearned Revenue?: Deferred Revenue Accrual AccountingravisankarNo ratings yet

- Chapter 9 LiabilitiesDocument10 pagesChapter 9 LiabilitiesMarine De CocquéauNo ratings yet

- Current LiabilitiesDocument5 pagesCurrent LiabilitiesHimanshu KumarNo ratings yet

- Accounts Payble and Receivable.Document8 pagesAccounts Payble and Receivable.haris123786No ratings yet

- Chapter One: Current Liabilities, Provisions, and Contingencies The Nature, Type and Valuation of Current LiabilitiesDocument12 pagesChapter One: Current Liabilities, Provisions, and Contingencies The Nature, Type and Valuation of Current LiabilitiesJuan KermaNo ratings yet

- Unit 6 Audit of LiabilitiesDocument6 pagesUnit 6 Audit of Liabilitiessolomon adamuNo ratings yet

- Complete FinanceDocument5 pagesComplete FinanceKappala AbhishekNo ratings yet

- Questions 14,54,81, and 114Document5 pagesQuestions 14,54,81, and 114Damian Sheila MaeNo ratings yet

- Accounting Basics: For Beginners Dr. P. SreelakshmiDocument19 pagesAccounting Basics: For Beginners Dr. P. SreelakshmiridhiNo ratings yet

- Residual Equity TheoryDocument3 pagesResidual Equity Theorybrix simeonNo ratings yet

- "Running Head:" Accounting For Current LiabilitiesDocument7 pages"Running Head:" Accounting For Current Liabilitieskeysha2009No ratings yet

- Definition of Reconciling An AccountDocument10 pagesDefinition of Reconciling An Accountዳግማዊ ጌታነህ ግዛው ባይህNo ratings yet

- FM 101 Chapter 3Document41 pagesFM 101 Chapter 3maryjoymayo494No ratings yet

- CPA Financial Accounting and Reporting: Second EditionFrom EverandCPA Financial Accounting and Reporting: Second EditionNo ratings yet

- Assignment No. 3 All About LiabilitiesDocument2 pagesAssignment No. 3 All About Liabilitiesadie2thalesNo ratings yet

- Cash Flow StatementDocument13 pagesCash Flow StatementMuhammed IbrahimNo ratings yet

- Non-Current Liabilities: Warranty Liability: Some Liabilities Are Not As Exact As AP and Have To BeDocument2 pagesNon-Current Liabilities: Warranty Liability: Some Liabilities Are Not As Exact As AP and Have To BeJustine Airra OndoyNo ratings yet

- Factoring 101 - What Is Anticipation of Payment Receivables in Brazil - Insights - Worldpay From FISDocument3 pagesFactoring 101 - What Is Anticipation of Payment Receivables in Brazil - Insights - Worldpay From FISjimmyyzhuNo ratings yet

- REC3Document4 pagesREC3Zyrene YanezNo ratings yet

- Assignment 2 - Jaimin PandyaDocument14 pagesAssignment 2 - Jaimin PandyajaiminNo ratings yet

- Liability Receipt Invoice Losses Capital Expenditure Long-Term Asset Capitalization Limit RecognizingDocument3 pagesLiability Receipt Invoice Losses Capital Expenditure Long-Term Asset Capitalization Limit RecognizingAbu TayeabNo ratings yet

- Deferred Revenue and Accrual AccountingDocument3 pagesDeferred Revenue and Accrual AccountingGomathi NagendrakumarNo ratings yet

- Corporate FininanceDocument10 pagesCorporate FininanceMohan KottuNo ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- Types and Effects Of: Transacti ONSDocument62 pagesTypes and Effects Of: Transacti ONSJeremy MacalaladNo ratings yet

- SITXFIN002 Interpret Financial InformationDocument12 pagesSITXFIN002 Interpret Financial Informationsampath lewkeNo ratings yet

- Balance Sheet and Financial StatementDocument3 pagesBalance Sheet and Financial StatementRochelle AntoinetteNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- The Recognition and Measurement of The FFDocument4 pagesThe Recognition and Measurement of The FFLourdios EdullantesNo ratings yet

- What Is An Advance Payment?Document2 pagesWhat Is An Advance Payment?Niño Rey LopezNo ratings yet

- Financial Services Unit 4Document12 pagesFinancial Services Unit 4diwakaranurag20No ratings yet

- Unit 5Document9 pagesUnit 5Nayan kakiNo ratings yet

- What Is Accounts ReceivableDocument3 pagesWhat Is Accounts ReceivableHsin Wua ChiNo ratings yet

- On The First and Second Page of The CaseDocument5 pagesOn The First and Second Page of The CaseSammy GitauNo ratings yet

- Technical Interview Questions Prepared by Fahad IrfanDocument8 pagesTechnical Interview Questions Prepared by Fahad Irfanzohaibaf337No ratings yet

- Account ReceivablesDocument5 pagesAccount Receivablessubbu2raj3372No ratings yet

- Principles of AccountsDocument7 pagesPrinciples of AccountsJadeja ChatrieNo ratings yet

- What Is Factoring?Document6 pagesWhat Is Factoring?Nokia PokiaNo ratings yet

- Five Accounting Principles That You Should KnowDocument4 pagesFive Accounting Principles That You Should KnowRomnick Pascua TuboNo ratings yet

- Corporate Financial Statements IDocument43 pagesCorporate Financial Statements IArpit SidhuNo ratings yet

- Technical Interview Questions Prepared by Fahad Irfan - PDF Version 1Document4 pagesTechnical Interview Questions Prepared by Fahad Irfan - PDF Version 1Muhammad Khizzar KhanNo ratings yet

- Ia2 Current LiabilitiesDocument26 pagesIa2 Current LiabilitiesNicole Ann MercurioNo ratings yet

- CHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Document14 pagesCHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Chona MarcosNo ratings yet

- Static 1Document16 pagesStatic 1Anurag SinghNo ratings yet

- Accounts Receivable ManagementDocument4 pagesAccounts Receivable Managementsubbu2raj3372No ratings yet

- DECA Entrepreneurship Finance Performance Indicator ContentDocument34 pagesDECA Entrepreneurship Finance Performance Indicator Contentnickname: RamnotramNo ratings yet

- DECA Finance ContentDocument11 pagesDECA Finance Contentnickname: RamnotramNo ratings yet

- Accounts PayableDocument4 pagesAccounts PayableTina ParkNo ratings yet

- Fundamentals AccountingDocument5 pagesFundamentals AccountingAngelica SamaniegoNo ratings yet

- Notes - Introduction To Financial Statements, Ratio Analysis, Business OrganisationDocument8 pagesNotes - Introduction To Financial Statements, Ratio Analysis, Business OrganisationSilke HerbertNo ratings yet

- Personal Assets: AssetDocument6 pagesPersonal Assets: AssetDipak NandeshwarNo ratings yet

- Accounting ConceptsDocument11 pagesAccounting ConceptssyedasadaligardeziNo ratings yet

- What Is An Asset Ledger?Document4 pagesWhat Is An Asset Ledger?JNo ratings yet

- Classification of Trees: Oaks Sequoias Earth Biomass Earth Root Carbon Dioxide Carbon EcologyDocument5 pagesClassification of Trees: Oaks Sequoias Earth Biomass Earth Root Carbon Dioxide Carbon EcologyJNo ratings yet

- What Is Accrued Revenue?Document3 pagesWhat Is Accrued Revenue?JNo ratings yet

- What Is An Asset Ledger?Document4 pagesWhat Is An Asset Ledger?JNo ratings yet

- What Is The Importance of Financial Management?: We've Switched Our Classes To Live Online. For More Covid-19 UpdatesDocument7 pagesWhat Is The Importance of Financial Management?: We've Switched Our Classes To Live Online. For More Covid-19 UpdatesJNo ratings yet

- What Are Financial Ratios?: Corporate Finance InstituteDocument9 pagesWhat Are Financial Ratios?: Corporate Finance InstituteJNo ratings yet

- Contracts That We Give A Value ToDocument3 pagesContracts That We Give A Value ToJNo ratings yet

- What Is Hedging?: Hedging Can Help You Protect Your Investments From LossesDocument2 pagesWhat Is Hedging?: Hedging Can Help You Protect Your Investments From LossesJNo ratings yet

- How To Conduct A Market Analysis The Right WayDocument7 pagesHow To Conduct A Market Analysis The Right WayJNo ratings yet

- What Is A Risk Assessment?Document9 pagesWhat Is A Risk Assessment?JNo ratings yet

- What Is Nominal Yield?Document2 pagesWhat Is Nominal Yield?JNo ratings yet

- What Is Bond Yield?Document5 pagesWhat Is Bond Yield?JNo ratings yet

- Effective InterestDocument1 pageEffective InterestJNo ratings yet

- What Is A Debt Security?Document3 pagesWhat Is A Debt Security?JNo ratings yet

- Theoritical Market PriceDocument3 pagesTheoritical Market PriceJNo ratings yet

- What Is Capital Structure?Document2 pagesWhat Is Capital Structure?JNo ratings yet

- What Is Financial Structure?Document3 pagesWhat Is Financial Structure?JNo ratings yet

- Analyzing A Company's Capital Structure: When Seeking Investment Quality, The Balance Sheet Tells The StoryDocument4 pagesAnalyzing A Company's Capital Structure: When Seeking Investment Quality, The Balance Sheet Tells The StoryJNo ratings yet

- Sl-03 Del Proc - Deletion From RegisterDocument4 pagesSl-03 Del Proc - Deletion From RegisterMehmet Erdem ErimezNo ratings yet

- Report Piper Sandler On QualcommDocument9 pagesReport Piper Sandler On QualcommLuigi NocitaNo ratings yet

- Macroeconomic Parameters: Gilbert R. HufanaDocument14 pagesMacroeconomic Parameters: Gilbert R. Hufanagilberthufana446877No ratings yet

- "YES BANK" Case Analysis: Strategic ManagementDocument30 pages"YES BANK" Case Analysis: Strategic ManagementTejas TamoreNo ratings yet

- Princess Marie A. Juan BS Accountancy: Current RatioDocument9 pagesPrincess Marie A. Juan BS Accountancy: Current RatioPrincess Marie JuanNo ratings yet

- Slides of Internship Report NBPDocument51 pagesSlides of Internship Report NBPUmm E MaryamNo ratings yet

- US Internal Revenue Service: I2555ez - 2001Document3 pagesUS Internal Revenue Service: I2555ez - 2001IRSNo ratings yet

- GuestDocument2 pagesGuestDenisa Adriana NechitaNo ratings yet

- Bank of America NT & SA v. American Realty Corporation (GR 133876, December 29, 1999)Document2 pagesBank of America NT & SA v. American Realty Corporation (GR 133876, December 29, 1999)Gelo MNo ratings yet

- Leveraged Buyout LBO Model For Private Equity FirmsDocument22 pagesLeveraged Buyout LBO Model For Private Equity Firmsgesona4324No ratings yet

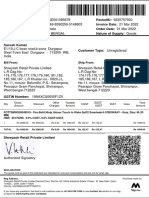

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountIndrajit RanaNo ratings yet

- Poly EnsaeDocument139 pagesPoly EnsaeSolo HakunaNo ratings yet

- Zoom Febrero 2016 PDFDocument1 pageZoom Febrero 2016 PDFjuanluismegaNo ratings yet

- 003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFDocument2 pages003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFRomarie AbrazaldoNo ratings yet

- Gonzales - Assignment 2 (BSMA 3-8) ANSWERSDocument6 pagesGonzales - Assignment 2 (BSMA 3-8) ANSWERSGONZALES, IAN ROGEL L.No ratings yet

- A Statement From The Family of Anshu Jain 13 August 2022Document2 pagesA Statement From The Family of Anshu Jain 13 August 2022Swam T WNo ratings yet

- Public Policy Course Outline Prof. Tarun DasDocument32 pagesPublic Policy Course Outline Prof. Tarun DasProfessor Tarun DasNo ratings yet

- Invest Grow Harvest: Annual Report 2009Document108 pagesInvest Grow Harvest: Annual Report 2009vinuthapNo ratings yet

- Jugnoo: Expansion or Consolidation: Sushmita Biswal Waraich Ajay ChaturvediDocument11 pagesJugnoo: Expansion or Consolidation: Sushmita Biswal Waraich Ajay ChaturvediValeria FloresNo ratings yet

- Meaning of Financial PlanningDocument4 pagesMeaning of Financial PlanningSakshi AgarwalNo ratings yet

- Mitrais Mining Newsletter 39Document9 pagesMitrais Mining Newsletter 39FauzanWiraNo ratings yet

- Business Plan Template Excel FreeDocument13 pagesBusiness Plan Template Excel FreeUsmanNo ratings yet

- Accounting Standard Notes by Anand R. BhangariyaDocument96 pagesAccounting Standard Notes by Anand R. BhangariyaSanjana SharmaNo ratings yet

- Classification of TaxesDocument19 pagesClassification of TaxesMohanned Abd AlrahmanNo ratings yet