Professional Documents

Culture Documents

Bank Reconciliation - First Time v1.2

Uploaded by

Hiren MazumdarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Reconciliation - First Time v1.2

Uploaded by

Hiren MazumdarCopyright:

Available Formats

Bank Reconciliation

First time use

Scope Systems Pty Ltd

Copyright © Scope Systems Pty Ltd, 2008

PO Box 422, Scarborough WA 6922

Level 3, 1 Manning St (Cnr The Esplanade)

Scarborough WA 6019

Tel: (08) 9245-9900

Fax: (08) 9245-5022

Email: support@scopesystems.com.au

URL: www.scopesystems.com.au

Pronto is a registered trademark, and PRONTO-Xi is a trademark, of Pronto Software Pty. Ltd.

MS Access, MS Excel, MS PowerPoint, MS Project, MS Windows, MS Word and MS Visio are products of

Microsoft Corporation

All other products mentioned may have trademarks, or registered trademarks, by their respective owners.

Author rikh

Creation Date 12 November 2008

Document C:\#Rik\Documentation\Work Instructions\Bank reconciliation - first time

v1.2.doc

Version Number v 1.0

Revised Date

Last Saved 13 November 2008

Document template Document Template v2.2 without Appendix.dot

Bank Reconciliation

Table of Contents

1. Overview ........................................................................................................................................................1

2. The first Bank Reconciliation ......................................................................................................................2

3. Traps ..............................................................................................................................................................6

3.1. Debit or Credit .........................................................................................................................................6

THE Mining ERP Specialists

3.2. Bank transfer ...........................................................................................................................................6

3.3. Un-presented Journals ............................................................................................................................8

3.4. Payment/Deposit Register maintenance .................................................................................................8

3.5. Immediate posting ...................................................................................................................................8

4. Security Settings ..........................................................................................................................................9

5. Reports ........................................................................................................................................................10

5.1. Bank statement report ...........................................................................................................................10

5.2. Print Reconciliation................................................................................................................................11

File: Bank reconciliation - first time v1.2.doc i

Bank Reconciliation

Document History

Version Date Author Changes

1.0 September 2008 R. Hilhorst Created Bank Reconciliation setup document.

1.1 November 2008 R. Hilhorst Updated the process of bank reconciliation, clarified

some of the text and included additional traps to be

careful of and added a section of the different types of

transactions.

1.2 November 2008 R. Hilhorst Updated the process for transferring funds between

Scope Systems Pty Ltd

banks.

ii File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

1. Overview

The bank reconciliation process has been overhauled in Pronto-Xi 660.

While the entry of reconciling entries may be similar, how those options work has been changed. For

example, some transaction types will now invoke the standard Pronto-Xi program for that function and post

THE Mining ERP Specialists

the transaction immediately, whereas previously the transaction was stored and the GL was not updated until

the reconciliation was posted, the transactions that are posted immediately cannot be removed from the bank

reconciliation (regardless of whether the reconciliation has been posted or not).

It is advisable to review Bank Reconciliation manual for Pronto-Xi 660 to determine which transaction types

are posted immediately, which are not posted at all, and which are posted when the bank reconciliation is

posted. A short list appears in section 3.5.

In addition to the above, when a reconciliation is started, it is locked to that user, to unlock the reconciliation

the Bank Reconciliation Control options must be used. This is controlled by a separate security role and so

can be allocated to a single person. There are also new roles to control who can use bank reconciliation,

who has access to the pay-in slip functions and who has bank reconciliation “System Administration”.

File: Bank reconciliation - first time v1.2.doc Page 1 of 11

Bank Reconciliation

2. The first Bank Reconciliation

When the first bank reconciliation is performed in Pronto-Xi 660, there are no bank balances available for the

program to use. Generally the first problem is that the reconciliation will expect you to enter transactions to

account for the zero balance to the current balance of the account. Initially you can setup a bank balance as

of the last successfully completed bank reconciliation and then perform the bank reconciliation from that point

onwards.

The first step is to identify the date of the last successful bank reconciliation for each bank account. You

Scope Systems Pty Ltd

require the statement from the bank to get this figure.

To enter the figure into Pronto, open the Statement Reconciliation option.

The bank reconciliation menu option can be found in both Account Payable and General ledger.

General Ledger location Accounts Payable location

Selecting the Statement Reconciliation option shows a list of the Banks available.

Select the appropriate bank account.

Page 2 of 11 File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

THE Mining ERP Specialists

Enter the date of the last successful bank reconciliation, in this example 1 May 2008 is used.

Do not put a figure in the closing balance. Click on the OK button. At this point we do not enter a closing

balance for the reconciliation, we are going to get Pronto-Xi to tell us what the closing balance is.

On the next screen press escape to cancel the transaction entry.

File: Bank reconciliation - first time v1.2.doc Page 3 of 11

Bank Reconciliation

It is possible that transactions that were entered into the bank reconciliation before the upgrade was done

appear on the transaction screen. This is ok as these transactions would have been posted already, so no

action is required to be taken (i.e. they should be left there). If this is a concern you can contact Scope

Systems to confirm that the transactions have been posted.

Click on the Reconcile Bank button.

Scope Systems Pty Ltd

Pronto will show the above screen. Note the Calculated Closing Balance figure. This is -1,230,848.73 in the

above example (if you click on the number in the yellow box with the right mouse button, you can select the

Copy option from the pop-up menu).

Exit the bank reconciliation back to the first screen where the bank account was selected.

Select the bank account, enter the date for the last successful bank reconciliation (in this example it is 1 May

2008), in the closing balance field enter the balance that was notes on the Reconcile Bank screen (if you

copied this figure it can now be pasted into the Closing Balance field).

Click on the OK button.

Page 4 of 11 File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

Click cancel on the next screen and then click on the Reconcile bank button.

THE Mining ERP Specialists

The Calculated Closing Balance and the Closing balance per bank statement should now match and a green

tick appear. Click on the Post button to post the reconciliation.

Because there are no transactions there is nothing to post in the batch.

When you next enter the bank reconciliation for that account, the closing balance that was posted will now be

picked up as the opening balance for the next bank reconciliation.

To start the new reconciliation, enter the date that the reconciliation is being done for, enter the new closing

balance and then enter the transactions (in the example used here the next date entered would be 2 May

2008).

File: Bank reconciliation - first time v1.2.doc Page 5 of 11

Bank Reconciliation

3. Traps

3.1. Debit or Credit

When entering a transaction into the bank reconciliation, the statement determines whether the amount is a

debit or credit, i.e. if it appears as a debit on the bank statement, then enter it as a debit in the bank

reconciliation.

This can be problematic for some transaction types, for example when entering an Interest earned

Scope Systems Pty Ltd

transaction the cursor moves to the Debit column first, prompting a value to be entered.

Do not be tempted to enter a value in the Debit column, this would normally appear as a credit on the bank

statement, tab over the Debit field to the Credit field and enter the amount of interest earned.

3.2. Bank transfer

If you wish to transfer funds between bank accounts, this can be performed from within the Bank

reconciliation.

Note that this is an immediate posting transaction – i.e. the transfer is posted to the GL account when the

bank transfer enter is completed and not when the bank reconciliation is posted.

Page 6 of 11 File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

Depending on whether this is the bank account is receiving the funds to transferring the funds impacts on

how the entry is done. The chart below shows how the entry of the transaction is reflected in the bank

statement and the GL account.

Shown in bank

Transfer value Shown in GL as Effect

reconciliation as

THE Mining ERP Specialists

+ ve Debit Credit transfer funds from this account

- ve Credit Debit transfer funds into this account

When you perform the reconciliation on the other bank account involved in the transfer, enter a transaction

type of J (present journal) , this will let you select from a list of journals for the bank account that have not yet

been presented, the transfer of funds will appear on the list of journals.

If one of the accounts involved in the bank transfer is not setup as a bank account, then a journal is required

(performed outside of the bank reconciliation and requires the journal to be presented in the bank

reconciliation) or GL direct post transaction type (O) is entered (the debit or credit indicates whether is

amount is shown as a debit or a credit on the bank statement).

If transferring between two foreign bank accounts, you will be asked for two exchange rates. The first

exchange rate is to convert from the foreign currency to the local currency, the second is to convert from the

local currency into the destination foreign currency.

The exchange rate from DM to local currency is 0.98.

i.e. DM 100 / 0.98 = AUD 102.04

The exchange rate from local currency to NZD is 1.18.

i.e. AUD 102.24 * 1.18 = NZD 120.41

File: Bank reconciliation - first time v1.2.doc Page 7 of 11

Bank Reconciliation

If a mistake is made when entering a transfer between the banks it can be removed before the reconciliation

is posted by removing the transaction. If the journal has been presented in the other bank account effected,

then remove the presentation of the journal from that bank account, and then remove the transfer from the

initiating bank reconciliation.

3.3. Un-presented Journals

Un-presented journals are, generally, journals that have been entered outside of the bank reconciliation

process, which should be included in the bank reconciliation.

Scope Systems Pty Ltd

To present an un-presented journal, enter a transaction using the transaction type J (present journal), this will

present a list of the un-presented journals from which you can select the journal to present, one at a time.

3.4. Payment/Deposit Register maintenance

Do not use the payment register maintenance or deposit register maintenance programs, these functions

should now be done through the bank reconciliation.

If you present or cancel cheques in the payment register maintenance program then the bank reconciliation

process does not include the cheque as a transaction in the bank reconciliation, and it does not appear as an

un-presented payment.

In addition to now being able to see the cheque, the Account balance from the GL is adjusted by the amount

of the cheque or payment, so if the account balance from the bank statement is entered as the closing

balance when starting the bank reconciliation you will not be able to account for the difference.

A cheque presented or cancelled from the payment register will still appear in the payment transaction listing.

3.5. Immediate posting

The following transaction types are posted immediately and cannot be removed once used in the bank

reconciliation because they are posted as soon as the entry is completed. In most cases they start the

Pronto-Xi program that normally performs this task.

These transactions will be assumed to be automatically presented when entered from within the bank

reconciliation and will be posted to the respective Sub Ledger accounts upon completion of that specific

transaction.

• A – Customer Direct Post;

• P – Supplier Direct Post;

• H – Post Dated Transaction Allocation;

• T – Transfers Between Banks;

Page 8 of 11 File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

• X – Dishonoured Cheques.

Refer to the Pronto-Xi Bank Reconciliation manual for more information on the different transaction types.

4. Security Settings

THE Mining ERP Specialists

Three new roles have been included in Pronto-Xi 660 that relate to the bank reconciliation. As part of the

configuration of the Pronto-Xi 660 setup three additional roles should have been created that can be applied

to staff user profiles. These are;

• BANKREC - given to any user that is expected to perform bank reconciliations.

• BANKRECS - given to any user that is expected to unlock a bank reconciliation. If a user is given

BANKRECS they are not required to have BANKREC.

• BANKRECP - given to users instead of the BANKREC role if bank pay-in slips are used. This gives

access to additional options used to setup and generate the bank pay-in slips.

To unlock a locked bank reconciliation, go to the Unlock Bank Reconciliation option from within the Bank

Reconciliation Control menu.

Select the Bank account that is locked, click on the Correct button and remove the user name in the Modified

By field.

Press F4 to complete. The bank reconciliation is now unlocked. There are some occasions when this is not

sufficient, in these cases, contact Scope Systems to reset the Bank Reconciliation.

File: Bank reconciliation - first time v1.2.doc Page 9 of 11

Bank Reconciliation

5. Reports

There are a number of reports available for the bank reconciliation, the two more common reports are a list of

the entries entered into the bank reconciliation and the listing of the details of the reconciliation.

5.1. Bank statement report

The bank statement is a list of the entries entered into the bank reconciliation within Pronto-Xi. This can be

run for the current reconciliation, or any previous reconciliation on that bank account (as long as the

Scope Systems Pty Ltd

statement data has not been cleared).

To print a bank statement report, go into the bank reconciliation, select the bank account and continue as

though you are entering transactions from the bank statement. At the transaction entre screen, press the

Escape key so as not to enter a transaction, and click on the Statement Print button.

This next window that appears shows a list of the previous bank reconciliations, both those posted and not

posted. Select reconciliation date that you would like to print the statement for and click on the Select button,

this will print the report.

Page 10 of 11 File: Bank reconciliation - first time v1.2.doc

Bank Reconciliation

5.2. Print Reconciliation

To print the reconciliation details for the current bank reconciliation, click on the Reconcile Bank button, from

the Bank Reconciliation for Bank Account window, click on the Print Reconciliation button. This will print a

report that contains the same details as the window that is open.

THE Mining ERP Specialists

It can be useful to print these two reports when about to post the bank reconciliation and file the reports with

the bank statement.

It is possible to reprint the Bank Statement report after a Bank Reconciliation is posted, however it is not

possible to re-print the Reconciliation report after a Bank Reconciliation is posted.

File: Bank reconciliation - first time v1.2.doc Page 11 of 11

You might also like

- Revised AccountingDocument46 pagesRevised AccountingAli NasarNo ratings yet

- Bank ReconciliationDocument118 pagesBank ReconciliationShaheen SultanaNo ratings yet

- CTP Candidate Handbook: Certified Treasury ProfessionalDocument28 pagesCTP Candidate Handbook: Certified Treasury ProfessionalAparnaBhattNo ratings yet

- Generation Gap!!: Presented by Group 1 Minu, Krithika, Rahul, Suraj & AjithDocument21 pagesGeneration Gap!!: Presented by Group 1 Minu, Krithika, Rahul, Suraj & Ajithm_dattaias100% (2)

- Fixed Assets Management PDFDocument20 pagesFixed Assets Management PDFDnukumNo ratings yet

- Pronto Release - Notes - 670 - 2Document87 pagesPronto Release - Notes - 670 - 2DavidNo ratings yet

- Treasury Management FOPDocument17 pagesTreasury Management FOPnocerinoNo ratings yet

- Treasury Management FunctionDocument26 pagesTreasury Management FunctionKiran MehfoozNo ratings yet

- Alert Intelligence Xi 660Document92 pagesAlert Intelligence Xi 660Ejuest SiousNo ratings yet

- EPIS Merchant AcquiringDocument3 pagesEPIS Merchant AcquiringyadbhavishyaNo ratings yet

- Ffp-English-Finance and Accounting Manual - v3 PDFDocument78 pagesFfp-English-Finance and Accounting Manual - v3 PDFTin Zaw ThantNo ratings yet

- User Guide - Reuters Fundamentals PDFDocument631 pagesUser Guide - Reuters Fundamentals PDFHimadri ShuklaNo ratings yet

- FR Balance Sheet Reconciliations InstructionsDocument10 pagesFR Balance Sheet Reconciliations Instructionsnarendra990% (1)

- Pronto Release - Notes - 670 - 6Document82 pagesPronto Release - Notes - 670 - 6DavidNo ratings yet

- Accounts Payable ReviewDocument36 pagesAccounts Payable ReviewMuditNo ratings yet

- Installing Pronto Xi BI AddonsDocument24 pagesInstalling Pronto Xi BI AddonsAnonymous rLmr9GRM2No ratings yet

- The Chart of Accounts For Banks and Other Financial Institutions of The Republic of MoldovaDocument87 pagesThe Chart of Accounts For Banks and Other Financial Institutions of The Republic of MoldovaPedro PrietoNo ratings yet

- Managing Core Risks in Banking: Internal ControlDocument54 pagesManaging Core Risks in Banking: Internal ControlatiqultitoNo ratings yet

- 602910-EdiEnterprise Account Operational GuideDocument363 pages602910-EdiEnterprise Account Operational GuideAndrés Karabin100% (3)

- Accounts PayableDocument890 pagesAccounts Payablessanik1100% (1)

- Corporate - TreasuryDocument49 pagesCorporate - TreasuryArif AhmedNo ratings yet

- Bills Receivable PDFDocument47 pagesBills Receivable PDFSenthil NNo ratings yet

- Sop For Manual DaybookDocument2 pagesSop For Manual DaybookAudit helpNo ratings yet

- Treasury Management: Transmittal LetterDocument56 pagesTreasury Management: Transmittal Lettermashael abanmiNo ratings yet

- Creative Accounting Branka RemenaricDocument7 pagesCreative Accounting Branka RemenaricgiansaNo ratings yet

- Reply-Wesco - FICO AMDocument165 pagesReply-Wesco - FICO AMJit GhoshNo ratings yet

- Wegagen Bank, S.C.: August 2010Document40 pagesWegagen Bank, S.C.: August 2010Addis Alemayehu100% (1)

- Project Financial Management Manual: Exposure DraftDocument44 pagesProject Financial Management Manual: Exposure DraftkokeedsNo ratings yet

- Pronto Release - Notes - 670 - 3Document84 pagesPronto Release - Notes - 670 - 3DavidNo ratings yet

- SAP FICO (AP) Procurement Cycle ProcessDocument21 pagesSAP FICO (AP) Procurement Cycle ProcessVinod MNNo ratings yet

- Coa Mapping Int enDocument26 pagesCoa Mapping Int enMuhammad Javed IqbalNo ratings yet

- Cash Management: A Qualitative Case Study of Two Small Consulting FirmsDocument50 pagesCash Management: A Qualitative Case Study of Two Small Consulting FirmsChristofferBengtssonNo ratings yet

- General Banking TermsDocument17 pagesGeneral Banking TermsVineeth JoseNo ratings yet

- Key Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMDocument35 pagesKey Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMABT SuppNo ratings yet

- Day 2 - Accounts ReceivableDocument28 pagesDay 2 - Accounts ReceivableLý BằngNo ratings yet

- Purchasing GuideDocument206 pagesPurchasing GuideAlex GuevaraNo ratings yet

- PeopleSoft GL PointsDocument14 pagesPeopleSoft GL PointsVenkateswara Rao Balla100% (1)

- Accounting Department ManualDocument11 pagesAccounting Department Manualapi-491139136No ratings yet

- Cash Flow AnalysisDocument31 pagesCash Flow AnalysisLu CasNo ratings yet

- Pronto Xi 740 Solutions Overview 7 Asset FacilityDocument60 pagesPronto Xi 740 Solutions Overview 7 Asset FacilityMarita TimothyNo ratings yet

- Flow Chart - Trial Balance - WikiAccountingDocument6 pagesFlow Chart - Trial Balance - WikiAccountingmatthew mafaraNo ratings yet

- Accounts Payables 3 DocumentsDocument4 pagesAccounts Payables 3 DocumentsHerald GangcuangcoNo ratings yet

- New Edited Cash ManagementDocument59 pagesNew Edited Cash Managementdominic wurdaNo ratings yet

- CE Order RMA Wireframes111913v7 PDFDocument28 pagesCE Order RMA Wireframes111913v7 PDFjwinsorNo ratings yet

- Treasury Management and Financial Accounting Practices of Berger Paints Bangladesh LimitedDocument48 pagesTreasury Management and Financial Accounting Practices of Berger Paints Bangladesh LimitedNazah Saiyara Ahmed100% (1)

- Concurrent Audit in BanksDocument14 pagesConcurrent Audit in Bankssukumar basuNo ratings yet

- Treasury ManagementDocument9 pagesTreasury ManagementpareshgholapNo ratings yet

- Standard Chartered BankDocument28 pagesStandard Chartered BankRajni YadavNo ratings yet

- Using Accounts Payable 9.01Document126 pagesUsing Accounts Payable 9.01Nguyen Quang HungNo ratings yet

- BRD - Loan & Loan RepaymentDocument8 pagesBRD - Loan & Loan RepaymentSunisha YadavNo ratings yet

- SAP Concur: The Complete Smart Solution For Your Business TravelDocument1 pageSAP Concur: The Complete Smart Solution For Your Business Traveljakkula rameshNo ratings yet

- Types of Bank Accounts in IndiaDocument18 pagesTypes of Bank Accounts in IndiaPriya SharmaNo ratings yet

- Quiz-2 Financial Acctg & ReportingDocument3 pagesQuiz-2 Financial Acctg & ReportingDanica Saraus DomughoNo ratings yet

- 03 Procure To PayDocument22 pages03 Procure To PayKalaignar ThangarajuNo ratings yet

- Sap Financial StatementsDocument9 pagesSap Financial StatementsJose Luis GonzalezNo ratings yet

- Ifrs BankingDocument11 pagesIfrs Bankingsharanabasappa1No ratings yet

- Accounting ManualDocument65 pagesAccounting ManualTonye Mac PeppleNo ratings yet

- Diamond Accounting Readthedocs Io en LatestDocument26 pagesDiamond Accounting Readthedocs Io en LatestidaishemichaelNo ratings yet

- Treasury Bank GuranteeDocument32 pagesTreasury Bank GuranteesundargowdaNo ratings yet

- 9 Pro Tips To Get Started With Low-Code App Development: Ebook SeriesDocument14 pages9 Pro Tips To Get Started With Low-Code App Development: Ebook SeriesHiren MazumdarNo ratings yet

- Budgeting Education Guide 720Document119 pagesBudgeting Education Guide 720Hiren MazumdarNo ratings yet

- Budgeting Education Guide 720Document119 pagesBudgeting Education Guide 720Hiren MazumdarNo ratings yet

- Budgeting Education Guide 720Document119 pagesBudgeting Education Guide 720Hiren MazumdarNo ratings yet

- ClientfileformatsDocument118 pagesClientfileformatsPrachi SaxenaNo ratings yet

- ClientfileformatsDocument118 pagesClientfileformatsPrachi SaxenaNo ratings yet

- HSBCnet File Upload Basic - Customer Guide v4.0Document12 pagesHSBCnet File Upload Basic - Customer Guide v4.0Hiren MazumdarNo ratings yet

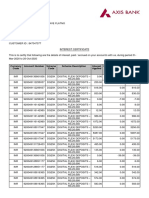

- Interest CertificateDocument2 pagesInterest CertificatesumitNo ratings yet

- Ratio Analysis at Amararaja Batteries Limited (Arbl) A Project ReportDocument79 pagesRatio Analysis at Amararaja Batteries Limited (Arbl) A Project Reportfahim zamanNo ratings yet

- JAIIB Paper 4 Module A Retail Banking PDFDocument21 pagesJAIIB Paper 4 Module A Retail Banking PDFAssr Murty100% (1)

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument5 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNo ratings yet

- NissanDocument31 pagesNissanRomilio CarpioNo ratings yet

- Module 4 - Forms of Business OrganizationDocument6 pagesModule 4 - Forms of Business OrganizationMarjon DimafilisNo ratings yet

- Conceptual Framework PPT 090719 PDFDocument53 pagesConceptual Framework PPT 090719 PDFSheena OroNo ratings yet

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDocument1 page1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaNo ratings yet

- Earnings Management: A Review of Selected Cases: July 2018Document15 pagesEarnings Management: A Review of Selected Cases: July 2018Andre SetiawanNo ratings yet

- Taizya RevisionDocument2 pagesTaizya Revisiongostavis chilamoNo ratings yet

- 14 Reinsurance PDFDocument28 pages14 Reinsurance PDFHalfani MoshiNo ratings yet

- Sunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesSunson Textile Manufacturer TBK.: Company Report: January 2019 As of 31 January 2019Anisah AmeliaNo ratings yet

- Prop Firm Drawdown Limitations - Forex Prop ReviewsDocument9 pagesProp Firm Drawdown Limitations - Forex Prop ReviewsMye RakNo ratings yet

- 3 - Valuation of Equity Shares - Assignment (26-04-19)Document4 pages3 - Valuation of Equity Shares - Assignment (26-04-19)AakashNo ratings yet

- Credit Union Performance - L Dean Odle 2Document2 pagesCredit Union Performance - L Dean Odle 2api-413534603No ratings yet

- Technical Analysis in Forex TradingDocument7 pagesTechnical Analysis in Forex TradingIFCMarketsNo ratings yet

- 01 CTD Intercompany72Document33 pages01 CTD Intercompany72Sumanth AmbatiNo ratings yet

- P2 07Document3 pagesP2 07rietzhel22No ratings yet

- LESSON PLAN 7 - Saving and InvestingDocument19 pagesLESSON PLAN 7 - Saving and InvestingNikita MundadaNo ratings yet

- Credit Report ExplanationDocument3 pagesCredit Report ExplanationthalhaNo ratings yet

- Banking AwarenessDocument130 pagesBanking AwarenessDAX LABORATORY100% (2)

- Risk Management Framework For Indian BanksDocument8 pagesRisk Management Framework For Indian BankstapanroutrayNo ratings yet

- IDBI Empanelment Notice (Annexure-A) 18-01-2019Document14 pagesIDBI Empanelment Notice (Annexure-A) 18-01-2019Jatan JoshiNo ratings yet

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- CashflowFK Broad Game 1Document24 pagesCashflowFK Broad Game 1TerenceNo ratings yet

- Lecture Outline: Share-Based Compensation and Earnings Per ShareDocument3 pagesLecture Outline: Share-Based Compensation and Earnings Per ShareFranz AppleNo ratings yet

- Contract CostingDocument18 pagesContract CostingAnant Jain100% (2)

- Seatwork 5Document2 pagesSeatwork 5Jasmine ManingoNo ratings yet

- My Cash: Balance TotalDocument9 pagesMy Cash: Balance TotalDahlan MuksinNo ratings yet

- California Apartment Association - Renting ManualDocument11 pagesCalifornia Apartment Association - Renting Manualiam_narayananNo ratings yet