Professional Documents

Culture Documents

Ebtex and Ebty - The Sensex and Nifty Equivalent of Debt Funds

Ebtex and Ebty - The Sensex and Nifty Equivalent of Debt Funds

Uploaded by

Panache ZOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ebtex and Ebty - The Sensex and Nifty Equivalent of Debt Funds

Ebtex and Ebty - The Sensex and Nifty Equivalent of Debt Funds

Uploaded by

Panache ZCopyright:

Available Formats

Arpit Agarwal is the Founder of KELP-Decoding Investments and has held the position of

CEO of Bajaj Finserv Wealth Management, MD & CEO of Dawnay Day AV, Head of Wealth

Management at ICICI Bank Ltd, BNP Paribas and DSP Merrill Lynch in the past.

Write to me on @CoachArpit or on CoachArpit@kelpmail.com

https://www.linkedin.com/in/arpitkelp/

Disclosure: My personal money is also invested in Mutual Funds.

May 5, 2020

DEBTEX30 and DEBTY50 - The Sensex and Nifty equivalent of Debt Funds

When it comes to equity investing, investors know the S&P BSE Sensex and NIFTY50. They use them

either as references to buy the largest Industry leading listed companies in India or to benchmark the

performance of their equity portfolios. The stocks in the Sensex and Nifty account for almost 50% and

58% of the total market capitalisation respectively. These companies attract the maximum investments

from FII’s and DII’s and are also the most researched. The 30 stocks of Sensex are also part of the Nifty.

I have always recommended that individual investors should have a large portion of their equity

portfolios in these stocks directly or through mutual funds that invest in them. In reality, many individual

investors land up chasing low priced stocks or selecting equity funds just on the basis of past returns

instead of studying their underlying portfolios.

When market conditions become extremely adverse, either in the case of Equity or Debt, there is flight

to safety. In case of Equity the flight is towards Large Caps and in case of Debt its towards the highest

credit quality and most liquid instruments. In 2018 and 2019, investors suffered sharp and large losses

in Small and Mid-Cap funds. Large-Cap and Multi-Cap funds that predominantly had the NIFTY50 stocks

performed much better. This in a way, is similar to what happened with the 6 Franklin Templeton Debt

fund as their exposure to Sub AAA paper was very high and the liquidity for those dried up.

In case of equity, there is an exit for investors at some price, but in case of debt, especially at times like

these, there are simply no buyers left. Debt Investing is more complicated than equities and there is

very little research available on corporate bonds in public domain for the investors to analyse even if

they wanted to. The several corporate bond downgrades during the last one year that led to the fall in

several Debt Fund NAVs and now, the recent Franklin Templeton event have come as a wake-up call to

investors for selecting debt funds. This had set me thinking on how to simplify the process of investing

in Debt Funds and come up with a quality subset like the equity indices above.

In my last article, I mentioned my mantra for investing “Manage Investment Risk and treat Return as

only a by-product”. Using the same principle, I present DEBTEX30 and DEBTY50 with the objective of

reducing Investment Risk across investment time horizons in Debt Funds.

DEBTEX30 and DEBTY50 will help you choose funds with the largest AUM (amount of money managed)

and highest Credit Quality of investments compared to their peer group.

In this report I will cover the list of funds in DEBTEX30 and DEBTY50 and their shortlisting process.

Types of Debt Funds and Investments Risks: Please watch my YouTube video of 25th May 2019 to

understand this in more detail. https://www.youtube.com/watch?v=5b9srikTvFQ

KELP Decoding Investments Page 1|5

The big picture of Open-Ended Debt Funds in India looks fairly complex.

1. Money Managed More than Rupees 10 Lakh crores

2. AMCs managing this money Over 39

3. Categories of Debt Funds 15

4. Number of plans More than 3200 i.e. Direct, Regular, Growth, Dividend….

For investing in Debt Funds, you have to look at scheme ratings from several agencies. You should also

look at Credit Ratings of the securities in their portfolio and their potential downgrade risk and Liquidity

Risk. To add to this, a single company will usually have just one equity listing but may issue several debt

papers of varying maturity and interest rates which adds far more complexity to the process of

evaluating debt funds and their underlying portfolios. You may also need to have a view on future

Interest rates to finally arrive at an informed decision about which ones to invest in.

And to top all this, each scheme has variations like Regular, Direct, Growth, Dividend plans of varying

frequencies, Retail, Institutional plans and so on. Figure 1:

So how does one evaluate over 3200 different

plans to arrive at the 3-5 that need to be

selected for investing? DEBTEX30 and 320 Schemes

DEBTY50 does that for you.

< 5%

Sub >1000Cr

As a first step, we selected only the Direct Plans

AAA

and Growth options of all the open-ended debt

funds and this brought our list down from over

3200 to 320. To this, we applied our filtration

criteria and were left with a scheme list of 85. > 1 Yr

1. Sub AAA Investments < 5%

2. AUM > Rupees 1000 Crores

3. Track record > 1 year

Criteria 1: Sub AAA Investments less than 5% 85 Scheme List

My business partner asked me “why even allow

5% Sub AAA investments?” My view is that even

though a Fund Manager may want 100% of the

highest rated investments, it is possible that some of the corporate debt they are holding may get

downgraded by the rating agencies. It is also possible that they may find some good quality Sub AAA

paper and after meeting the management and looking the company financials, they are convinced about

taking an informed decision of investing in it. The limits of 5% is within the 20% normal borrowing limit

prescribed by SEBI in case of liquidity constraints.

Criteria 2: AUM greater than Rupees 1000cr

Size gives confidence to the investor, buying power to the FM and possibly increased liquidity in the

event of redemptions compared to much smaller funds.

Criteria 3: Track record greater than 1-year

This is to ensure we get enough data points to analyse the scheme.

KELP Decoding Investments Page 2|5

Next, by looking at the Average Maturities of these funds across all 15 categories, it is easy to conclude

that just 5 categories may meet the fixed income investment requirements of most retail investors. I

believe that 30 schemes across these 5 categories and 12 fund houses provide enough choice for

investors.

This led to the creation of the DEBTEX30.

For simplicity, the table below gives us a list of the 5 categories above and a ‘Needs map’ to refer to

below.

Figure 2: Needs map

Recommended Liquidity Credit Interest Rate Alternative For Bank

Category Risk Quality Risk Risk Money

Overnight Fund Low Almost Zero Zero Savings Account

Liquid Low Low Low 3 Mths Deposit

Money Market Low Low Low 3 Mths to 1 Yr FD

Banking and PSU Fund Medium Medium Medium 3 Yrs FD

Gilt Medium Zero High 3 to 5 Yrs FD

For the Informed Investors who may have more specific investment objectives and need a lot more

choice with respect to categories, I decided to add 20 more schemes representing the balance 8

categories of debt funds. None of the Credit Risk and Long Duration Funds made it to the shortlist of 85

due to either insufficient corpus or the credit quality threshold of the underlying portfolio.

This led to the creation of the DEBTY50. In Figure 3 below, is the category-wise composition of both.

DEBTEX30 is a stepping stone Open Ended Debt Fund Avg Maturity Sub AAA DEBTEX30 DEBTY50

for investors from simpler Categories in Months Paper % Schemes Schemes

investments to more complex Overnight Fund 0.08 6 6

ones in DEBTY50 without Liquid 1.78 0.21 12 12

increasing the Sub AAA credit risk Ultra Short Duration 6.87 2

exposure limit of 5%. Money Market 7.88 0.17 6 6

Low Duration 15.18 1.36 2

The average maturities of each Floating Rate 25.74 0.15 2

category of funds help as a Short Duration 31.21 3

reference for the time horizon for Banking and PSU Fund 38.94 0.79 4 4

which the investments in them Corporate Bond 47.95 0.31 7

could be made. As the Average Medium Duration 56.76 1

Medium to Long Duration 63.48 1

Maturity of a fund goes up, the

Dynamic Bond 106.51 2

interest rate risk also increases.

Gilt 131.34 2 2

Further there are 2 other risks in Scheme Count 30 50

Debt Funds viz. Liquidity Risk and Percentage of AUM represented 43% 57%

Credit Risk. The Debt Fund

Managers manage investors’ money and they get more money to manage if they give better returns

than their peer group. Now in the quest of being the best in what they do, they have to make decisions

of what to buy with the scheme money. They will at times take calculated investment decisions to invest

the money in Sub AAA investments with the objective of increasing scheme returns. This increases the

Liquidity Risk and Credit Risk of the scheme. By keeping our limit of Sub AAA paper at 5%, we are trying

to control those risks for investors.

KELP Decoding Investments Page 3|5

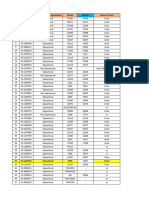

Figure 4: Shortlisting Process from 320 to the DEBTY50 and DEBTEX30

Open Ended Debt Fund Scheme 31 Mar 2020 Selected 31 Mar 2020 DEBTY50 31 Mar 2020 DEBTEX30 31 Mar 2020

Categories Count AUM Crores Shortlist AUM Crores Count AUM Crores Count AUM Crores

Overnight Fund 30 80,179 13 75,566 6 56,036 6 56,036

Liquid 39 334,659 21 319,744 12 292,059 12 292,059

Ultra Short Duration 29 71,103 4 15,323 2 11,336 6 43,169

Money Market 20 55,418 9 51,985 6 43,169

Low Duration 26 80,581 5 15,033 2 8,620

Floating Rate 7 32,429 3 15,494 2 14,382

Credit Risk Fund 20 55,178

Short Duration 28 93,236 4 28,210 3 25,877

Corporate Bond 19 81,531 10 77,386 7 74,185

Banking and PSU Fund 19 72,065 6 44,463 4 40,889 4 40,889

Medium Duration 16 28,016 1 3,006 1 3,006

Dynamic Bond 28 18,045 3 4,634 2 3,444

Medium to Long Duration 13 9,784 2 4,661 1 3,363

Gilt 24 10,150 4 5,863 2 3,656 2 3,656

Long Duration 2 1,668

Grand Total 320 1,024,043 85 661,367 50 580,023 30 435,809

From this data we conclude the following:

1. A significant part Debt Fund AUMs is in very good quality debt securities as on 31st March 2020.

2. Shortlisted 85 of the 320 schemes account for almost 65% of the total AUM.

3. DEBTY50 represents about 15% of the total schemes and 56% of the total AUM.

4. DEBTEX30 represents about 10% of the total schemes and 42% of the total AUM.

The detailed list of the funds in DEBTEX30 and DEBTY50 is given in Table 5 on page 5. We will update

this on a half yearly basis or if there is an extraordinary event which forces a change in any of these

schemes. Investors may select Growth or Dividend plans as per their investment needs.

I will explain the returns of these schemes and compare them to their benchmark indices in a future

article to show you that for the possibility of a small percentage increase in returns, it may not be worth

taking higher risk.

The easiest things are always the hardest to do. Even though doing them is very easy, doing them

consistently is the hard part. Following investment rules is one such thing.

Happy Knowledge Based Investing. Click on the links below to download KELP-Decoding Investments,

our Mobile Application and watch our YouTube channel to become a more informed investor.

Apple App Store Android Play Store

Data in this report is as on 31st March 2020 and is from various sources including AceMF. I cannot vouch

for the accuracy of the data so please exercise caution in making investment decisions. Read the offer

documents of Mutual Fund Schemes carefully before investing.

KELP Decoding Investments Page 4|5

Figure 5:

Avg

DEBTEX30 & DEBTY50 List of Schemes (Data as on 31 Mar 2020) Corpus Sub AAA

Maturity

S. No. Category Scheme Name (Rupees Cr) %

in Months

1 HDFC Overnight Fund(G) 15,372 0.07

2 ICICI Pru Overnight Fund(G) 10,321 0.12

3 SBI Overnight Fund-Reg(G) 9,436 0.03

Overnight Fund

4 Aditya Birla SL Overnight Fund-Reg(G) 9,054 0.03

5 Kotak Overnight Fund-Reg(G) 6,434 0.12

6 Nippon India Overnight Fund-Reg(G) 5,418 0.10

7 HDFC Liquid Fund(G) 71,319 0.30 1.93

8 ICICI Pru Liquid Fund(G) 37,995 0.92 2.21

9 SBI Liquid Fund(G) D 37,768 1.56

10 Aditya Birla SL Liquid Fund(G) 30,612 0.76 1.56

11 Kotak Liquid Fund-Reg(G) E 23,622 1.92

12 Nippon India Liquid Fund(G) 21,754 1.87

13

Liquid

Axis Liquid Fund-Reg(G) B 19,980 0.50 1.77

14 UTI Liquid Cash Plan-Reg(G) 18,287 1.59

15 Tata Liquid Fund-Reg(G) T 9,430 1.70

16 DSP Liquidity Fund-Reg(G) 8,191 1.80

17 IDFC Cash Fund-Reg(G) E 7,003 1.53

18 L&T Liquid Fund(G) 6,098 1.92

19 SBI Savings Fund-Reg(G) X 10,868 1.02 6.36

20

21

Aditya Birla SL Money Manager Fund(G)

Kotak Money Market Fund(G) 3 D 8,318

7,188

9.60

4.92

0 E

Money Market

22 HDFC Money Market Fund(G) 6,692 10.47

23 ICICI Pru Money Market Fund(G) 5,529 10.57

24 UTI Money Market Fund-Reg(G) B 4,575 5.39

25 IDFC Banking & PSU Debt Fund-Reg(G) 13,750 35.88

26

Banking and PSU Fund

Axis Banking & PSU Debt Fund-Reg(G) T 13,089 28.80

27 Aditya Birla SL Banking & PSU Debt(G) 9,773 3.20 52.08

28 Nippon India Banking & PSU Debt Fund(G) Y 4,276 39.00

29 SBI Magnum Gilt Fund-Reg(G) 2,251 122.52

30

Gilt

ICICI Pru Gilt Fund(G) 5 1,405 140.16

31 HDFC Ultra Short Term Fund-Reg(G) 7,155 7.90

32

Ultra Short Duration

IDFC Ultra Short Term Fund-Reg(G) 0 4,182 5.83

33 Nippon India Floating Rate Fund(G) 7,676 35.52

Floating Rate

34 Aditya Birla SL Floating Rate Fund(G) 6,706 0.37 15.96

35 IDFC Bond Fund - Short Term Plan-Reg(G) 11,573 27.72

36 Short Duration Kotak Bond Short Term Fund(G) 9,526 36.00

37 L&T Short Term Bond Fund-Reg(G) 4,778 29.88

38 IDFC Low Duration Fund-Reg(G) 4,391 15.97

Low Duration

39 Axis Treasury Advantage Fund-Reg(G) 4,229 2.71 14.40

40 Aditya Birla SL Corp Bond Fund(G) 16,895 2.19 42.84

41 HDFC Corp Bond Fund(G) 12,828 52.44

42 IDFC Corp Bond Fund-Reg(G) 12,817 45.36

43 Corporate Bond SBI Corp Bond Fund-Reg(G) 12,435 40.92

44 ICICI Pru Corp Bond Fund(G) 11,736 38.16

45 Kotak Corporate Bond Fund(G) 4,306 19.20

46 L&T Triple Ace Bond Fund-Reg(G) 3,168 96.72

47 Medium Duration IDFC Bond Fund - Medium Term Plan-Reg(G) 3,006 56.76

48 IDFC Dynamic Bond Fund-Reg(G) 2,102 96.96

Dynamic Bond

49 SBI Dynamic Bond Fund-Reg(G) 1,342 116.04

50 Medium to Long Duration ICICI Pru Bond Fund(G) 3,363 63.48

KELP Decoding Investments Page 5|5

You might also like

- Report of Internship Hedge PDFDocument56 pagesReport of Internship Hedge PDFGopi Krishnan.n100% (1)

- Project Report On Factor Affecting Stock Market VolatilityDocument154 pagesProject Report On Factor Affecting Stock Market VolatilityPritesh Mapara87% (15)

- Debt SchemeDocument12 pagesDebt SchemeSamdarshi KumarNo ratings yet

- Corporate Perpetual Bonds Education NoteDocument6 pagesCorporate Perpetual Bonds Education NoteSam RalstonNo ratings yet

- Mutual Fund AssignmentDocument7 pagesMutual Fund AssignmentBhargav PathakNo ratings yet

- Mfi TP Q&aDocument25 pagesMfi TP Q&amonizaNo ratings yet

- SBI Mutual FundsDocument37 pagesSBI Mutual FundsWahab KukaswadiaNo ratings yet

- Capital Sta - Ultratech - 24Document92 pagesCapital Sta - Ultratech - 24Sahithi PNo ratings yet

- How I Chose The Best Mutual FundDocument6 pagesHow I Chose The Best Mutual Fundiamketul6340No ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- MF PDFDocument27 pagesMF PDFPk AroraNo ratings yet

- Capital Structure Ultratech Cement Sahithi Project 111111Document85 pagesCapital Structure Ultratech Cement Sahithi Project 111111Sahithi PNo ratings yet

- AFE-7-IFI International Financial Market: Student NumberDocument14 pagesAFE-7-IFI International Financial Market: Student NumberPratik BasakNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryhowellstechNo ratings yet

- Cases For AssignmentDocument10 pagesCases For AssignmentShravya T SNo ratings yet

- INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFDocument4 pagesINVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFVidushi ThapliyalNo ratings yet

- 2000 PraceticeDocument24 pages2000 PraceticePom JungNo ratings yet

- Mutual Funds NotesDocument27 pagesMutual Funds NotesAnkit SharmaNo ratings yet

- HermoPaoloQuiz No2 MUTUAL FUNDDocument4 pagesHermoPaoloQuiz No2 MUTUAL FUNDPaolo Nico P HermoNo ratings yet

- 3/21/2012 Mutual Fund 1Document28 pages3/21/2012 Mutual Fund 1Paresh KamatNo ratings yet

- Path To Financial Independence "Saving Prudently and Investing Wisely Hold The Key To Monetary Emancipation"Document6 pagesPath To Financial Independence "Saving Prudently and Investing Wisely Hold The Key To Monetary Emancipation"sakinajamNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- 2048065828final MF FACT SHEET November 2015Document13 pages2048065828final MF FACT SHEET November 2015Dhiraj AhujaNo ratings yet

- B.M Collage of B.B.ADocument12 pagesB.M Collage of B.B.AnilamgajiwalaNo ratings yet

- Advisorkhoj Nippon India Mutual Fund ArticleDocument4 pagesAdvisorkhoj Nippon India Mutual Fund ArticleRanjan SharmaNo ratings yet

- Balanced Funds Demystified: Part 2: Send Via E-Mail Download As PDFDocument4 pagesBalanced Funds Demystified: Part 2: Send Via E-Mail Download As PDFshahpinkalNo ratings yet

- How To Build WealthDocument12 pagesHow To Build WealthsushilNo ratings yet

- 4 Debt ManagementDocument122 pages4 Debt ManagementAquesha TirmiziNo ratings yet

- Executive Summary: Chapter-1Document68 pagesExecutive Summary: Chapter-1Satish PenumarthiNo ratings yet

- Ecco - Faq Ver3Document3 pagesEcco - Faq Ver3sumitkumtha123No ratings yet

- Portfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisDocument22 pagesPortfolio Management: Different Types of Secured Investments Plan, and Types of AnalysisAnkita ModiNo ratings yet

- Letter From Cio Rajeev Thakkar Unitholders Meet 2023Document13 pagesLetter From Cio Rajeev Thakkar Unitholders Meet 2023azuredevops1155No ratings yet

- PORTFOLIO MANAGEMENT SERVICES - AN INVESTMENT OPTION Sharekhan 2Document73 pagesPORTFOLIO MANAGEMENT SERVICES - AN INVESTMENT OPTION Sharekhan 2niceprachi0% (1)

- NISM Paper 7 Without AnsDocument5 pagesNISM Paper 7 Without AnsHemang LimbachiyaNo ratings yet

- MF Selection TheRight ApproachDocument2 pagesMF Selection TheRight ApproachMahesh NarayananNo ratings yet

- Capital Structure Theories VivaDocument43 pagesCapital Structure Theories VivaPuttu Guru PrasadNo ratings yet

- Fin Report 11904567Document9 pagesFin Report 11904567vinayNo ratings yet

- Mutual Fund Performance - An Empirical StudyDocument10 pagesMutual Fund Performance - An Empirical StudyAmeya ThakurNo ratings yet

- Fund SummaryDocument6 pagesFund SummaryhowellstechNo ratings yet

- Project Report ON A Comparitive of Mutual Funds With Other Investment OptionsDocument15 pagesProject Report ON A Comparitive of Mutual Funds With Other Investment OptionsmollymitraNo ratings yet

- Titan SecuDocument17 pagesTitan Secuapi-555390406No ratings yet

- HDFC Mutual FundsDocument68 pagesHDFC Mutual FundsMohammed Dasthagir MNo ratings yet

- Do You Know How To Select Debt Funds: Understanding The RiskDocument4 pagesDo You Know How To Select Debt Funds: Understanding The RiskPrashantPachpandeNo ratings yet

- Seref Turen: Performance and Risk Analysis of Islamic Banks: The Case of Bahrain Islamic BankDocument3 pagesSeref Turen: Performance and Risk Analysis of Islamic Banks: The Case of Bahrain Islamic BankMahmood KhanNo ratings yet

- Firststepblue 010622Document3 pagesFirststepblue 010622boss savla VikmaniNo ratings yet

- MCO 07 EM 2024 @ignouallqueries1Document10 pagesMCO 07 EM 2024 @ignouallqueries1surbhi_sharma_2613No ratings yet

- What To Evaluate in A Mutual Fund Factsheet - Investor EducationDocument3 pagesWhat To Evaluate in A Mutual Fund Factsheet - Investor EducationAnkit SharmaNo ratings yet

- Senior Analyst-FMS Finance MagazineDocument47 pagesSenior Analyst-FMS Finance MagazineShas RockstoneNo ratings yet

- Executive SummaryDocument6 pagesExecutive SummaryhowellstechNo ratings yet

- New 1212Document86 pagesNew 1212Waseem AnsariNo ratings yet

- RBC Emerging FundsDocument3 pagesRBC Emerging FundsNikal upNo ratings yet

- NiSM QuestionzssDocument709 pagesNiSM Questionzssatingoyal1No ratings yet

- Security Analysis 1 To 30 ConsolidatedDocument151 pagesSecurity Analysis 1 To 30 ConsolidatedPRACHI DASNo ratings yet

- Concept ChecksDocument8 pagesConcept ChecksAshraful AlamNo ratings yet

- Liquid Money Guide For Banks, Corporates and SMEsDocument9 pagesLiquid Money Guide For Banks, Corporates and SMEsSameer RastogiNo ratings yet

- Venture Capital Deal Structuring PDFDocument5 pagesVenture Capital Deal Structuring PDFmonaNo ratings yet

- Investment Analysis & Portfolio MGTDocument104 pagesInvestment Analysis & Portfolio MGTkhusbuNo ratings yet

- 11 Portofolio Management An OverviewDocument6 pages11 Portofolio Management An OverviewAditya NugrohoNo ratings yet

- Mutual Fund......Document113 pagesMutual Fund......Amrin ChaudharyNo ratings yet

- Capital Letter May 2011Document6 pagesCapital Letter May 2011marketingNo ratings yet

- What Every CEO Needs To Know About Financing An ESOPDocument6 pagesWhat Every CEO Needs To Know About Financing An ESOPheenaieibsNo ratings yet

- HDFC ProjectDocument97 pagesHDFC ProjectAamir KhanNo ratings yet

- January 2021Document20 pagesJanuary 2021Panache ZNo ratings yet

- Ai - AuDocument42 pagesAi - AuPanache ZNo ratings yet

- DurationDocument2 pagesDurationPanache ZNo ratings yet

- Monthly Performance Report: MonthDocument7 pagesMonthly Performance Report: MonthPanache ZNo ratings yet

- Idfc Bond Fund - Short Term Plan (30 June, 2020) 12715.90 CrsDocument1 pageIdfc Bond Fund - Short Term Plan (30 June, 2020) 12715.90 CrsPanache ZNo ratings yet

- Friends, Romans, Countrymen, Lend Me Your EarsDocument3 pagesFriends, Romans, Countrymen, Lend Me Your EarsPanache Z0% (1)

- Concall Outcome PDFDocument3 pagesConcall Outcome PDFPanache ZNo ratings yet

- Edelweiss SP - ARC - Jul'19 PMS PDFDocument12 pagesEdelweiss SP - ARC - Jul'19 PMS PDFPanache ZNo ratings yet

- Sarvekshana 3oct18Document85 pagesSarvekshana 3oct18Panache ZNo ratings yet

- Economic Survey Report 2019-20Document14 pagesEconomic Survey Report 2019-20Panache ZNo ratings yet

- 106th Issue of Sarvekshana - FinalDocument72 pages106th Issue of Sarvekshana - FinalPanache ZNo ratings yet

- Final TR 74th Round - CompressedDocument241 pagesFinal TR 74th Round - CompressedPanache ZNo ratings yet

- Case, The Crash That Shook The NationDocument3 pagesCase, The Crash That Shook The NationSamanBrarNo ratings yet

- Ergo May 18Document16 pagesErgo May 18api-12351425100% (1)

- Ketan Parekh ScamDocument8 pagesKetan Parekh ScamSuraj ChopraNo ratings yet

- Money Times MagazineDocument22 pagesMoney Times MagazineNIKHIL JAINNo ratings yet

- Electrical Standard Products (ESP) OfficesDocument1 pageElectrical Standard Products (ESP) OfficesVijayNo ratings yet

- 10 ExamplesDocument8 pages10 ExamplespmlprasadNo ratings yet

- Ketan Parekh ScamDocument10 pagesKetan Parekh ScamTusharNo ratings yet

- What Are Some of The Most Mind-Blowing Facts About The Indian Stock Market - QuoraDocument38 pagesWhat Are Some of The Most Mind-Blowing Facts About The Indian Stock Market - QuoraAchint KumarNo ratings yet

- Metropolis Share Price - Google SearchDocument1 pageMetropolis Share Price - Google SearchVikram Kumar JapaNo ratings yet

- T I M E S: Earnings To Drive Market TrendDocument21 pagesT I M E S: Earnings To Drive Market TrendAbhijeet PatilNo ratings yet

- Vipul World Plots Sec 48Document36 pagesVipul World Plots Sec 48Disha100% (1)

- Abstracts NNC 2013Document69 pagesAbstracts NNC 2013Suniel KumarNo ratings yet

- Frames 07Document107 pagesFrames 07Md ShaNo ratings yet

- THE Complete Beginner'S Guide: Simple StockmarketDocument37 pagesTHE Complete Beginner'S Guide: Simple StockmarketDharshiniNo ratings yet

- LimitDocument2 pagesLimitYoginder KumarNo ratings yet

- All India HDFC Ifsc CodeDocument156 pagesAll India HDFC Ifsc CodeBunty ShahNo ratings yet

- Wealth Plus Analysis by Neeta DoshiDocument20 pagesWealth Plus Analysis by Neeta DoshiBankim DoshiNo ratings yet

- OpTransactionHistoryTpr18 03 2021Document6 pagesOpTransactionHistoryTpr18 03 2021Tanisha GuptaNo ratings yet

- Indus Tech & FSE Details - OCT23Document1,195 pagesIndus Tech & FSE Details - OCT23omprakashom63No ratings yet

- 07 Vol III Section 6 4 RAD Group A Part 1Document100 pages07 Vol III Section 6 4 RAD Group A Part 1Joseley D'souzaNo ratings yet

- Research Via Equity: Daily Market AnalysisDocument6 pagesResearch Via Equity: Daily Market AnalysisresearchviaNo ratings yet

- Delhi SNO File - No Unit - Nam AddressDocument9 pagesDelhi SNO File - No Unit - Nam AddressDexter Anki SinghNo ratings yet

- List of CPIOs and AAs - 23!01!18Document3 pagesList of CPIOs and AAs - 23!01!18Karan Pratap100% (1)

- SBI BhavDocument24 pagesSBI BhavhrdksniNo ratings yet

- My SCDL Project-ReadyDocument69 pagesMy SCDL Project-ReadyVedanth Tk100% (1)

- DSIJ3407Document84 pagesDSIJ3407sharma.hansrajNo ratings yet

- Bhopal Circle & BranchesDocument105 pagesBhopal Circle & BranchesMranal MeshramNo ratings yet