Professional Documents

Culture Documents

Improving Financial Techniques To Contribute To Implementing Financial Changes To Avoid or

Uploaded by

Muhibur's Entertainment0 ratings0% found this document useful (0 votes)

5 views3 pagesFin

Original Title

zFdbsfgg

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFin

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesImproving Financial Techniques To Contribute To Implementing Financial Changes To Avoid or

Uploaded by

Muhibur's EntertainmentFin

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

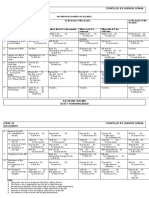

What is managerial finance?

Managerial finance can be defined as the process of

gauging finance techniques to determine how they

can influence a business internally as well as

externally. Managerial finance has two primary

objectives which are:

Improving financial techniques to contribute to

the organisation’s growth;

Implementing financial changes to avoid or

reduce losses.

Managerial finance is a mixture of financial

management and corporate financing.

Fundamentals of managerial finance

Managerial finance helps with business decision-

making as it directly influences profits, losses, cash

flow and revenue generation in an organisation. It

contributes to a company’s overall growth

significantly. The four key fundamentals of managerial

finance are:

Capital structure: organisations employ

managerial finance as an integral business

function to determine three factors that influence

business operations which are:

o Which capital type is best suited for funding an

endeavour – equity, debt or both;

o Amount of capital required;

o Event or time when the capital will be required.

The capital structure of an organisation is key to its

growth and can be acquired either through equity

shares or other financial instruments such as cash

and bond.

Cash flow: the primary objective of the cash

management function is to ensure that an

organisation has adequate resources to meet the

company’s financial obligations. For a firm to run

smoothly and churn profits, it is essential that the

cash flow is uninterrupted. In the event of a cash

deficit, business operations might get stalled and

this may adversely influence the credibility of the

organisation. Hence, it is important that financial

obligations are met within the stipulated time.

Plan and forecast: organisations depend on

managerial finance to implement planning

strategies. These strategies are used to predict:

o Monthly, quarterly and yearly budgets;

o Expected revenue generation;

o Future expenses;

o Expected profits.

While devising strategies, financial management

professionals must be prepared for unprecedented

events. If the aforementioned parameters don’t yield

predicted results, the strategies must be modified to

suit the current situation.

Financial reporting: financial reporting is a crucial

component of managerial finance, as it

significantly contributes to business decision-

making. Organisations rely on financial reports

for precise and detailed information about the

current situation of the organisation. These

reports must be easy to understand and should

vividly reflect how a particular parameter affects

business operations and functioning.

You might also like

- G NZCVNDocument3 pagesG NZCVNMuhibur's EntertainmentNo ratings yet

- SDBDFDDocument2 pagesSDBDFDMuhibur's EntertainmentNo ratings yet

- SDVSDDocument1 pageSDVSDMuhibur's EntertainmentNo ratings yet

- SFBSGFDocument1 pageSFBSGFMuhibur's EntertainmentNo ratings yet

- SDBZDFDocument1 pageSDBZDFMuhibur's EntertainmentNo ratings yet

- DVSDVDocument2 pagesDVSDVMuhibur's EntertainmentNo ratings yet

- SDVSDDocument2 pagesSDVSDMuhibur's EntertainmentNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Heidi Jara Opened Jara S Cleaning Service On July 1 2015Document1 pageHeidi Jara Opened Jara S Cleaning Service On July 1 2015trilocksp SinghNo ratings yet

- Mergers and AcquisitionsDocument16 pagesMergers and Acquisitionsnaman somaniNo ratings yet

- Cambridge Associates PE BenchmarksDocument11 pagesCambridge Associates PE BenchmarksDan Primack100% (1)

- Fixed Assets PolicyDocument3 pagesFixed Assets PolicyShinil Nambrath100% (1)

- Gmail - Palawan Pawnshop Payment InstructionsDocument3 pagesGmail - Palawan Pawnshop Payment InstructionsLei VillanuevaNo ratings yet

- Tds Details For The Year 2019-20: This Report Is Generated On 30-Mar-2021 17:15:09 PMDocument2 pagesTds Details For The Year 2019-20: This Report Is Generated On 30-Mar-2021 17:15:09 PMSaksham SinghalNo ratings yet

- Request Letter For Visa Issuance PDFDocument2 pagesRequest Letter For Visa Issuance PDFMohammad Al-khatibNo ratings yet

- Mbto LK Q1 2019Document86 pagesMbto LK Q1 2019Ridwan PutraNo ratings yet

- Question 5: Ias 7 Statements of Cash FlowsDocument4 pagesQuestion 5: Ias 7 Statements of Cash FlowsShiza ArifNo ratings yet

- FInancial Management1 - PrelimDocument52 pagesFInancial Management1 - PrelimEscalante, Alliah S.No ratings yet

- Financial Inclusion & Financial Literacy: SBI InitiativesDocument5 pagesFinancial Inclusion & Financial Literacy: SBI Initiativesprashaant4uNo ratings yet

- Lesson 11 9.2 Compound Interest Future ValueDocument7 pagesLesson 11 9.2 Compound Interest Future ValueSandro SerdiñaNo ratings yet

- The Harvest CakeDocument171 pagesThe Harvest CakeEka DarmadiNo ratings yet

- CSCSummarized - Invoice - 387273date10022022inamount2,44552Document16 pagesCSCSummarized - Invoice - 387273date10022022inamount2,44552Penélope FatimaNo ratings yet

- Ic 86 Real Feel TestDocument54 pagesIc 86 Real Feel TestSamba SivaNo ratings yet

- B291 TMA - Fall - 2022-2023 (AutoRecovered)Document12 pagesB291 TMA - Fall - 2022-2023 (AutoRecovered)Reham AbdelazizNo ratings yet

- Example Prob, NPV, IRR&PIDocument10 pagesExample Prob, NPV, IRR&PITin Bernadette DominicoNo ratings yet

- Retired NPS: Life Ka Sahara, HamaraDocument1 pageRetired NPS: Life Ka Sahara, HamaraAarav AkashNo ratings yet

- Week 11Document12 pagesWeek 11Matthew MaNo ratings yet

- What Is Factoring?Document6 pagesWhat Is Factoring?Nokia PokiaNo ratings yet

- Individual Taxation Problem SolvingDocument7 pagesIndividual Taxation Problem SolvingSecret-uploader50% (2)

- An Introduction To Equity ValuationDocument37 pagesAn Introduction To Equity ValuationAamir Hamza MehediNo ratings yet

- Shivani SharmaDocument92 pagesShivani SharmaadhbawaNo ratings yet

- Cbse Xi Compiled by Sudhir Sinha AccountsDocument2 pagesCbse Xi Compiled by Sudhir Sinha AccountsSudhir SinhaNo ratings yet

- NEFT Vs RTGS PaymentsDocument4 pagesNEFT Vs RTGS PaymentsrajeevjprNo ratings yet

- LAC - Sub-Committee - Retirement Age Recommendations - FINAL - 9oct18Document18 pagesLAC - Sub-Committee - Retirement Age Recommendations - FINAL - 9oct18BernewsAdminNo ratings yet

- IIAP Mock Exam Reviewer Answer Key - LifeDocument13 pagesIIAP Mock Exam Reviewer Answer Key - LifeJanine Semper100% (1)

- 015 CAMIST SamplePaper Qs Amndd HS PP 313-326 BW SecDocument14 pages015 CAMIST SamplePaper Qs Amndd HS PP 313-326 BW SecMd Salahuddin HowladerNo ratings yet

- Quiz 1 & 2 (Aud) - MarcoletaDocument4 pagesQuiz 1 & 2 (Aud) - MarcoletaLeane MarcoletaNo ratings yet

- BPML List Best PracticeDocument38 pagesBPML List Best PracticePrashant KumarNo ratings yet