Professional Documents

Culture Documents

Cred Trans Part 9

Uploaded by

averellabrasaldoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cred Trans Part 9

Uploaded by

averellabrasaldoCopyright:

Available Formats

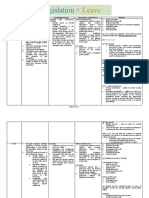

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

G.R. No. 110053 October 16, 1995 of respondent spouses. Said document contained a waiver of It further averred that the annulment of the sale and the

the seller's warranty against eviction.2 return of the purchase price to respondent spouses would

redound to their benefit but would result in petitioner's

DEVELOPMENT BANK OF THE PHILIPPINES, petitioner,

prejudice, since it had already released P118,540.00 to the

vs. Thereafter, respondent spouses applied for an industrial tree

former while it would be left without any security for the

COURT OF APPEALS, CELEBRADA MANGUBAT and planting loan with DBP. The latter required the former to

P140,000.00 loan; and that in the remote possibility that the

ABNER MANGUBAT, respondents. submit a certification from the Bureau of Forest Development

land is reverted to the public domain, respondent spouses

that the land is alienable and disposable. However, on

should be made to immediately pay, jointly and severally, the

October 29, 1981, said office issued a certificate attesting to

REGALADO, J.: total amount of P118,540.00 with interest at 15% per annum,

the fact that the said property was classified as timberland,

plus charges and other expenses.6

hence not subject to disposition.3

This appeal by certiorari sprouted from the judgment of

respondent Court of Appeals promulgated on September 9, On May 25, 1990, the trial court rendered judgment annulling

The loan application of respondent spouses was

1992 in CA-G.R. CV No. 28311, and its resolution dated April the subject deed of absolute sale and ordering DBP to return

nevertheless eventually approved by DBP in the sum of

7, 1993 denying petitioner's motion for reconsideration. 1 Said the P25,500.00 purchase price, plus interest; to reimburse to

P140,000.00, despite the aforesaid certification of the

adjudgments, in turn, were rooted in the factual groundwork respondent spouses the taxes paid by them, the cost of the

bureau, on the understanding of the parties that DBP would

of this case which is laid out hereunder. relocation survey, incidental expenses and other damages in

work for the release of the land by the former Ministry of

the amount of P50,000.00; and to further pay them attorney's

Natural Resources. To secure payment of the loan,

fees and litigation expenses in the amount of P10,000.00,

On July 20, 1981, herein petitioner Development Bank of the respondent spouses executed a real estate mortgage over

and the costs of suit.7

Philippines (DBP) executed a "Deed of Absolute Sale" in the land on March 17, 1982, which document was registered

favor of respondent spouses Celebrada and Abner in the Registry of Deeds pursuant to Act No. 3344.

Mangubat over a parcel of unregistered land identified as Lot In its recourse to the Court of Appeals, DBP raised the

1, PSU-142380, situated in the Barrio of Toytoy, Municipality following assignment of errors:

The loan was then released to respondent spouses on a

of Garchitorena, Province of Camarines Sur, containing an

staggered basis. After a substantial sum of P118,540.00 had

area of 55.5057 hectares, more or less.

been received by private respondents, they asked for the 1. The trial court erred in declaring the

release of the remaining amount of the loan. It does not deed of absolute sale executed between

The land, covered only by a tax declaration, is known to have appear that their request was acted upon by DBP, ostensibly the parties canceled and annulled on the

been originally owned by one Presentacion Cordovez, who, because the release of the land from the then Ministry of ground that therein defendant-appellant

on February 4, 1937, donated it to Luciano Sarmiento. On Natural Resources had not been obtained. had no title over the property subject of

June 8, 1964, Luciano Sarmiento sold the land to Pacifico the sale.

Chica.

On July 7, 1983, respondent spouses, as plaintiffs, filed a

complaint against DBP in the trial court 4 seeking the 2. The trial court erred in finding that

On April 27, 1965, Pacifico Chica mortgaged the land to DBP annulment of the subject deed of absolute sale on the defendant-appellant DBP acted

to secure a loan of P6,000.00. However, he defaulted in the ground that the object thereof was verified to be timberland fraudulently and in bad faith or that it

payment of the loan, hence DBP caused the extrajudicial and, therefore, is in law an inalienable part of the public had misrepresented facts since it had

foreclosure of the mortgage. In the auction sale held on domain. They also alleged that petitioner, as defendant prior knowledge that subject property

September 9, 1970, DBP acquired the property as the therein, acted fraudulently and in bad faith by was part of the public domain at the time

highest bidder and was issued a certificate of sale on misrepresenting itself as the absolute owner of the land and of sale to therein plaintiffs-appellees.

September 17, 1970 by the sheriff. The certificate of sale in incorporating the waiver of warranty against eviction in the

was entered in the Book of Unregistered Property on deed of sale.5

3. The trial court erred in finding said

September 23, 1970. Pacifico Chica failed to redeem the

plaintiffs-appellees' waiver of warranty

property, and DBP consolidated its ownership over the

In its answer, DBP contended that it was actually the against eviction void.

same.

absolute owner of the land, having purchased it for value at

an auction sale pursuant to an extrajudicial foreclosure of

4. The trial court erred awarding to

On October 14, 1980, respondent spouses offered to buy the mortgage; that there was neither malice nor fraud in the sale

therein plaintiffs-appellees damages

property for P18,599.99. DBP made a counter-offer of of the land under the terms mutually agreed upon by the

arising from an alleged breach of

P25,500.00 which was accepted by respondent spouses. parties; that assuming arguendo that there was a flaw in its

contract.

The parties further agreed that payment was to be made title, DBP can not be held liable for anything inasmuch as

within six months thereafter for it to be considered as cash respondent spouses had full knowledge of the extent and

payment. On July 20, 1981, the deed of absolute sale, which nature of DBP's rights, title and interest over the land.

is now being assailed herein, was executed by DBP in favor

Averell B. Abrasaldo – II-Sanchez Roman 1

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

5. The trial court erred in not ordering rule with respect to the right of a party to recover the amount any stage of the proceedings, since it was vigorously

said plaintiffs-appellees to pay their loan given as consideration has been passed upon in the case objected to by DBP.

obligation to defendant-appellant DBP in of Leather Manufacturers National Bank vs. Merchants

the amount of P118,540. 8 National Bank 14 where it was held that: "Whenever money is

Contrary to the claim of petitioner, the list of damages was

paid upon the representation of the receiver that he has

presented in the trial court and was correspondingly marked

either a certain title in property transferred in consideration of

As substantially stated at the outset, respondent Court of as "Exhibit P." 20 The said exhibit was, thereafter, admitted by

the payment or a certain authority to receive the money paid,

Appeals rendered judgment modifying the disposition of the the trial court but only as part of the testimonial evidence for

when in fact he has no such title or authority, then, although

court below by deleting the award for damages, attorney's private respondents, as stated in its Order dated August 16,

there be no fraud or intentional misrepresentation on his part,

fees, litigation expenses and the costs, but affirming the 1988.21

yet there is no consideration for the payment, the money

same in all its other aspects. 9 On April 7, 1993, said

remains, in equity and good conscience, the property of the

appellate court also denied petitioner's motion for

payer and may be recovered back by him." However, despite that admission of the said list of damages

reconsideration. 10

as evidence, we agree with petitioner that the same cannot

constitute sufficient legal basis for an award of P4,000.00

Therefore, the purchaser is entitled to recover the money

Not satisfied therewith, DBP interposed the instant petition and P7,980.00 as reimbursement for land taxes and

paid by him where the contract is set aside by reason of the

for review on certiorari, raising the following issues: expenses for the relocation survey, respectively. The list of

mutual material mistake of the parties as to the identity or

damages was prepared extrajudicially by respondent

quantity of the land sold. 15 And where a purchaser recovers

spouses by themselves without any supporting receipts as

1. Whether or not private respondent the purchase money from a vendor who fails or refuses to

bases thereof or to substantiate the same. That list, per se,

spouses Celebrada and Abner deliver the title, he is entitled as a general rule to interest on

is necessarily self-serving and, on that account, should have

Mangubat should be ordered to pay the money paid from the time of payment. 16

been declared inadmissible in evidence as thefactum

petitioner DBP their loan obligation due

probans.

under the mortgage contract executed

A contract which the law denounces as void is necessarily no

between them and DBP; and

contract whatever, and the acts of the parties in an effort to

In order that damages may be recovered, the best evidence

create one can in no wise bring about a change of their legal

obtainable by the injured party must be presented. Actual or

2. Whether or not petitioner should status. The parties and the subject matter of the contract

compensatory damages cannot be presumed, but must be

reimburse respondent spouses the remain in all particulars just as they did before any act was

duly proved, and so proved with a reasonable degree of

purchase price of the property and the performed in relation thereto. 17

certainty. A court cannot rely on speculation, conjecture or

amount of P11,980.00 for taxes and

guesswork as to the fact and amount of damages, but must

expenses for the relocation Survey. 11

An action for money had and received lies to recover back depend upon competent proof that they have been suffered

money paid on a contract, the consideration of which has and on evidence of the actual amount thereof. If the proof is

Considering that neither party questioned the legality and failed. 18 As a general rule, if one buys the land of another, to flimsy and unsubstantial, no damages will be awarded. 22

correctness of the judgment of the court a quo, as affirmed which the latter is supposed to have a good title, and, in

by respondent court, ordering the annulment of the deed of consequence of facts unknown alike to both parties, he has

Turning now to the issue of whether or not private

absolute sale, such decreed nullification of the document has no title at all, equity will cancel the transaction and cause the

respondents should be made to pay petitioner their loan

already achieved finality. We only need purchase money to be restored to the buyer, putting both

obligation amounting to P118,540.00, we answer in the

parties in status quo. 19

affirmative.

The Court of Appeals, after an extensive discussion, found

that there had been no bad faith on the part of either party, Thus, on both local and foreign legal principles, the return by

In its legal context, the contract of loan executed between

and this r, therefore, to dwell on the effects of that DBP to respondent spouses of the purchase price, plus

the parties is entirely different and discrete from the deed of

declaration of nullity.emains uncontroverted as a fact in the corresponding interest thereon, is ineluctably called for.

sale they entered into. The annulment of the sale will not

case at bar. Correspondingly, respondent court correctly

have an effect on the existence and demandability of the

applied the rule that if both parties have no fault or are not

Petitioner likewise contends that the trial court and loan. One who has received money as a loan is bound to pay

guilty, the restoration of what was given by each of them to

respondent Court of Appeals erred in ordering the to the creditor an equal amount of the same kind and

the other is consequently in order. 12 This is because the

reimbursement of taxes and the cost of the relocation survey, quality. 23

declaration of nullity of a contract which is void ab

there being no factual or legal basis therefor. It argues that

initio operates to restore things to the state and condition in

private respondents merely submitted a "list of damages"

which they were found before the execution thereof. 13 The fact that the annulment of the sale will also result in the

allegedly incurred by them, and not official receipts of

invalidity of the mortgage does not have an effect on the

expenses for taxes and said survey. Furthermore, the same

validity and efficacy of the principal obligation, for even an

We also find ample support for said propositions in American list has allegedly not been identified or even presented at

obligation that is unsupported by any security of the debtor

jurisprudence. The effect of an application of the aforequoted

may also be enforced by means of an ordinary action. Where

Averell B. Abrasaldo – II-Sanchez Roman 2

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

a mortgage is not valid, as where it is executed by one who It is also worth noting that the adjustment and allowance of Dissatisfied, petitioner filed the instant petition for

is not the owner of the petitioner's demand by counterclaim or set-off in the present review on certiorari.

property, 24 or the consideration of the contract is action, rather than by another independent action, is favored

25 26

simulated or false, the principal obligation which it or encouraged by law. Such a practice serves to avoid Respondent Ricardo Galit contracted a loan from

guarantees is not thereby rendered null and void. That circuitry of action, multiplicity of suits, inconvenience, petitioner Marcelo Soriano, in the total sum of P480,000.00,

obligation matures and becomes demandable in accordance expense, and unwarranted consumption of the time of the evidenced by four promissory notes in the amount of

with the stipulations pertaining to it. court. The trend of judicial decisions is toward a liberal P120,000.00 each dated August 2, 1996;[3] August 15, 1996;

[4]

extension of the right to avail of counterclaims or set-offs. 31 September 4, 1996[5] and September 14, 1996.[6] This loan

was secured by a real estate mortgage over a parcel of land

Under the foregoing circumstances, what is lost is only the covered by Original Certificate of Title No. 569. [7]After he

right to foreclose the mortgage as a special remedy for The rules on counterclaim are designed to achieve the failed to pay his obligation, Soriano filed a complaint for sum

satisfying or settling the indebtedness which is the principal disposition of a whole controversy of the conflicting claims of of money against him with

obligation. In case of nullity, the mortgage deed remains as interested parties at one time and in one action, provided all the Regional Trial Court of Balanga City, Branch 1, which

evidence or proof of a personal obligation of the debtor, and parties can be brought before the court and the matter was docketed as Civil Case No. 6643.[8]

the amount due to the creditor may be enforced in an decided without prejudicing the rights of any party. 32

ordinary personal action. 27 Respondents, the Spouses Ricardo and

Rosalina Galit, failed to file their answer. Hence, upon motion

WHEREFORE, the judgment appealed from is hereby

of Marcelo Soriano, the trial court declared the spouses in

It was likewise incorrect for the Court of Appeals to deny the MODIFIED, by deleting the award of P11,980.00 as

default and proceeded to receive evidence for

claim of petitioner for payment of the loan on the ground that reimbursement for taxes and expenses for the relocation

petitioner Soriano ex parte.

it failed to present the promissory note therefor. While survey, and ordering respondent spouses Celebrada and

respondent court also made the concession that its judgment Abner Mangubat to pay petitioner Development Bank of the On July 7, 1997, the Regional Trial Court

was accordingly without prejudice to the filing by petitioner of Philippines the amount of P118,540.00, representing the of Balanga City, Branch 1 rendered judgment[9] in favor of

a separate action for the collection of that amount, this does total amount of the loan released to them, with interest of petitioner Soriano, the dispositive portion of which reads:

not detract from the adverse effects of that erroneous ruling 15% per annum plus charges and other expenses in

on the proper course of action in this case. accordance with their mortgage contract. In all other

respects, the said judgment of respondent Court of Appeals WHEREFORE, judgment is hereby rendered in favor of the

is AFFIRMED. plaintiff and against the defendant ordering the latter to pay:

The fact is that a reading of the mortgage

contract 28 executed by respondent spouses in favor of

petitioner, dated March 17, 1982, will readily show that it SO ORDERED. 1. the plaintiff the amount of P350,000.00 plus

embodies not only the mortgage but the complete terms and 12% interest to be computed from the

conditions of the loan agreement as well. The provisions of dates of maturity of the promissory notes

[G.R. No. 156295. September 23, 2003] until the same are fully paid;

said contract, specifically paragraphs 16 and 28 thereof, are

so precise and clear as to thereby render unnecessary the

introduction of the promissory note which would merely serve MARCELO R. SORIANO, petitioner, vs. SPOUSES 2. the plaintiff P20,000.00, as attorneys fees; and

the same purpose. RICARDO and ROSALINA GALIT, respondents.

3. the costs of suit.

Furthermore, respondent Celebrada Mangubat expressly DECISION

acknowledged in her testimony that she and her husband are

indebted to petitioner in the amount of P118,000.00, more or YNARES-SANTIAGO, J.: SO ORDERED.[10]

less. 29 Admissions made by the parties in the pleadings or in

the course of the trial or other proceedings do not require The judgment became final

Petitioner was issued a writ of possession in Civil Case

proof and can not be contradicted unless previously shown and executory. Accordingly, the trial court issued a writ of

No. 6643[1] for Sum of Money by the Regional Trial Court

to have been made through palpable mistake. 30 execution in due course, by virtue of which, Deputy

of Balanga, Bataan, Branch 1. The writ of possession was,

however, nullified by the Court of Appeals in CA-G.R. SP No. Sheriff Renato E. Robles levied on the following real

Thus, the mortgage contract which embodies the terms and 65891[2] because it included a parcel of land which was not properties of the Galit spouses:

conditions of the loan obligation of respondent spouses, as among those explicitly enumerated in the Certificate of Sale

well as respondent Celebrada Mangubat's admission in open issued by the Deputy Sheriff, but on which stand

1. A parcel of land covered by Original

court, are more than adequate evidence to sustain the immovables covered by the said Certificate. Petitioner

Certificate of Title No. T-569

petitioner's claim for payment of private respondents' contends that the sale of these immovables necessarily

(Homestead Patent No. 14692) situated

aforestated indebtedness and for the adjudication of DBP's encompasses the land on which they stand.

in the Bo.

claim therefor in the very same action now before us. of Tapulac, Orani, Bataan. Bounded on

Averell B. Abrasaldo – II-Sanchez Roman 3

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

the SW, along line 1-2 by Lot No. 3, ORIGINAL CERTIFICATE OF TITLE NO. T-569 ORIGINAL CERTIFICATE OF TITLE NO. T-40785

Cad. 145; containing an area of THIRTY

FIVE THOUSAND SEVEN HUNDRED

A parcel of land (Homestead Patent No. 14692) situated in A parcel of land (Lot No. 1103 of the Cadastral Survey

FIFTY NINE (35,759) SQUARE

the Bo. of Tapulac, Orani, Bataan, x x x. Bounded on the of Orani) , with the improvements thereon, situated in the

METERS, more or less x x x;

SW., along line 1-2 by Lot No. 3, Cad. 145, containing an Municipality of Orani, Bounded on the NE; by Calle P.

area of THIRTY FIVE THOUSAND SEVEN HUNDRED Gomez; on the E. by Lot No. 1104; on the SE

2. STORE/HOUSE CONSTRUCTED on Lot No. FIFTY NINE (35,759) SQUARE METERS, more or less x x x by Calle Washington; and on the W. by Lot 4102, containing

1103 made of strong materials G.I. an area of ONE HUNDRED THIRTY NINE (139) SQUARE

roofing situated at Centro METERS, more or less. All points referred to are indicated

TAX DEC. NO. PROPERTY INDEX NO. 018-09-001-02

I, Orani, Bataan, x x x containing an on the plan; bearing true; declination 0 deg. 40E., date of

area of 30 sq. meters, more or less survey, February 191-March 1920.

x x x (constructed on TCT No. T40785); STOREHOUSE constructed on Lot 1103, made of strong

materials G.I. roofing situated at Centro

On February 23, 2001, ten months from the time the

I, Orani, Bataan x x x containing an area of 30 sq. meters,

3. BODEGA constructed on Lot 1103, made of Certificate of Sale on Execution was registered with the

more or less x x (constructed on TCT No. 40785)

strong materials, G.I. roofing, situated in Registry of Deeds, petitioner moved[14] for the issuance of a

Centro I, Orani, Bataan, x x x with a floor writ of possession. He averred that the one-year period of

area of 42.75 sq. m. more or less x x x. TAX DEC. NO. 86 PROPERTY INDEX No. 018-09-001-02 redemption had elapsed without the respondents having

[11]

redeemed the properties sold at public auction; thus, the sale

of said properties had already become final.He also argued

BODEGA constructed on Lot 1103, made of strong materials that after the lapse of the redemption period, the titles to the

At the sale of the above-enumerated properties at G.I. roofing situated in Centro I, Orani, Bataan, x x x with a properties should be considered, for all legal intents and

public auction held on December 23, 1998, petitioner was floor area of 42.75 sq. m. more or less x x x purposes, in his name and favor.[15]

the highest and only bidder with a bid price of

P483,000.00. Accordingly, on February 4, 1999, Deputy On June 4, 2001, the Regional Trial Court

IT IS FURTHER CERTIFIED, that the aforesaid highest and

Sheriff Robles issued a Certificate of Sale of Execution of of Balanga City, Branch 1 granted the motion for issuance of

lone bidder, Marcelo Soriano, being the plaintiff did not pay

Real Property,[12] which reads: writ of possession.[16] Subsequently, on July 18, 2001, a writ

to the Provincial Sheriff of Bataan the amount of

P483,000.00, the sale price of the above-described property of possession[17] was issued in petitioners favor which reads:

CERTIFICATE OF SALE ON EXECUTION OF REAL which amount was credited to partial/full satisfaction of the

PROPERTY judgment embodied in the writ of execution. WRIT OF POSSESSION

TO ALL WHO MAY SEE THESE PRESENTS: The period of redemption of the above described real Mr. Renato E. Robles

properties together with all the improvements thereon will Deputy Sheriff

expire One (1) year from and after the registration of this RTC, Br. 1, Balanga City

GREETINGS:

Certificate of Sale with the Register of Deeds.

I HEREBY that (sic) by virtue of the writ of execution dated Greetings :

This Certificate of Sheriffs Sale is issued to the highest and

October 16, 1998, issued in the above-entitled case by the

lone bidder, Marcelo Soriano, under guarantees prescribed

HON. BENJAMIN T. VIANZON, ordering the Provincial WHEREAS on February 3, 2001, the counsel for plaintiff filed

by law.

Sheriff of Bataan or her authorized Deputy Sheriff to cause to Motion for the Issuance of Writ of Possession;

be made (sic) the sum of P350,000.00 plus 12% interest to

be computed from the date of maturity of the promissory Balanga, Bataan, February 4, 1999.

notes until the same are fully paid; P20,000.00 as attorneys WHEREAS on June 4, 2001, this court issued an order

fees plus legal expenses in the implementation of the writ of granting the issuance of the Writ of Possession;

On April 23, 1999, petitioner caused the registration of

execution, the undersigned Deputy Sheriff sold at public

the Certificate of Sale on Execution of Real Property with the

auction on December 23, 1998 the rights and interests of WHEREFORE, you are hereby commanded to place the

Registry of Deeds.

defendants Sps. Ricardo and Rosalina Galit, to the plaintiff herein plaintiff Marcelo Soriano in possession of the property

Marcelo Soriano, the highest and only bidder for the amount The said Certificate of Sale registered with the involved in this case situated (sic) more particularly

of FOUR HNDRED EIGHTY THREE THOUSAND PESOS Register of Deeds includes at the dorsal portion thereof the described as:

(P483,000.00, Philippine Currency), the following real estate following entry, not found in the Certificate of Sale on file with

properties more particularly described as follows : Deputy Sheriff Renato E. Robles:[13]

1. STORE HOUSE constructed on Lot No. 1103

situated at Centro

Averell B. Abrasaldo – II-Sanchez Roman 4

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

1, Orani, Bataan covered by TCT No. In the event that the questioned writ of possession has On the first ground, petitioner contends that

40785; already been implemented, the Deputy Sheriff of respondents were not without remedy before the trial

the Regional Trial Court of Balanga City, Branch 1, and court. He points out that respondents could have filed a

private respondent Marcelo Soriano are hereby ordered to motion for reconsideration of the Order dated June 4, 1999,

2. BODEGA constructed on Lot No. 1103 with an

cause the redelivery of Transfer Certificate of Title No. T- but they did not do so. Respondents could also have filed an

area of 42.75 square meters under Tax

40785 to the petitioners. appeal but they, likewise, did not do so. When the writ of

Declaration No. 86 situated at Centro

possession was issued, respondents could have filed a

1, Orani, Bataan;

motion to quash the writ. Again they did not. Respondents

SO ORDERED.[19]

cannot now avail of the special civil action for certiorari as a

3. Original Certificate of Title No. 40785 with an substitute for these remedies. They should suffer the

area of 134 square meters known as Lot Aggrieved, petitioner now comes to this Court consequences for sleeping on their rights.

No. 1103 of the Cadastral Survey maintaining that

of Orani We disagree.

1.) THE SPECIAL CIVIL ACTION OF Concededly, those who seek to avail of the procedural

against the mortgagor/former owners Sps. Ricardo and CERTIORARI UNDER RULE 65 IS NOT remedies provided by the rules must adhere to the

Rosalinda (sic) Galit, her (sic) heirs, successors, assigns and THE PLAIN, SPEEDY AND ADEQUATE requirements thereof, failing which the right to do so is lost. It

all persons claiming rights and interests adverse to the REMEDY OF THE RESPONDENTS IN is, however, equally settled that the Rules of Court seek to

petitioner and make a return of this writ every thirty (30) days ASSAILING THE WRIT OF eliminate undue reliance on technical rules and to make

from receipt hereof together with all the proceedings thereon POSSESSION ISSUED BY THE litigation as inexpensive as practicable and as convenient as

until the same has been fully satisfied. LOWER COURT BUT THERE WERE can be done.[20] This is in accordance with the primary

STILL OTHER REMEDIES AVAILABLE purpose of the 1997 Rules of Civil Procedure as provided in

TO THEM AND WHICH WERE NOT Rule 1, Section 6, which reads:

WITNESS THE HONORABLE BENJAMIN T. VIANZON,

RESORTED TO LIKE THE FILING OF A

Presiding Judge, this 18th day of July 2001, at Balanga City.

MOTION FOR RECONSIDERATION

Section 6. Construction. These rules shall be liberally

OR MOTION TO QUASH OR EVEN

construed in order to promote their objective of securing a

(Sgd) GILBERT S. ARGONZA APPEAL.

just, speedy and inexpensive determination of every action

and proceeding.[21]

IC

2.) THE HONORABLE COURT OF APPEALS

Respondents filed a petition for certiorari with the Court of GRAVELY ERRED IN DECLARAING

The rules of procedure are not to be applied in a very

Appeals, which was docketed as CA-G.R. SP No. 65891, THE CERTIFICATE OF SALE ON

rigid, technical sense and are used only to help secure

assailing the inclusion of the parcel of land covered by EXECUTION OF REAL PROPERTY AS

substantial justice. If a technical and rigid enforcement of the

Transfer Certificate of Title No. T-40785 among the list of NULL AND VOID AND

rules is made, their aim would be defeated.[22] They should

real properties in the writ of possession. [18] Respondents SUBSEQUENTLY THE WRIT OF

be liberally construed so that litigants can have ample

argued that said property was not among those sold on POSSESSION BECAUSE THE SAME

opportunity to prove their claims and thus prevent a denial of

execution by Deputy Sheriff Renato E. Robles as reflected in IS A PUBLIC DOCUMENT WHICH

justice due to technicalities.[23] Thus, in China Banking

the Certificate of Sale on Execution of Real Property. ENJOYS THE PRESUMPTION OF

Corporation v. Members of the Board of Trustees of Home

REGULARITY AND IT CANNOT BE

Development Mutual Fund,[24] it was held:

In opposition, petitioner prayed for the dismissal of the OVERCOME BY A MERE STRANGE

petition because respondent spouses failed to move for the FEELING THAT SOMETHING IS

reconsideration of the assailed order prior to the filing of the AMISS ON ITS SURFACE SIMPLY while certiorari as a remedy may not be used as a substitute

petition. Moreover, the proper remedy against the assailed BECAUSE THE TYPEWRITTEN for an appeal, especially for a lost appeal, this rule should

order of the trial court is an appeal, or a motion to quash the WORDS ON THE FRONT PAGE AND not be strictly enforced if the petition is genuinely

writ of possession. AT THE DORSAL PORTION THEREOF meritorious.[25] It has been said that where the rigid

IS DIFFERENT OR THAT IT IS application of the rules would frustrate substantial

On May 13, 2002, the Court of Appeals rendered UNLIKELY FOR THE SHERIFF TO USE justice, or bar the vindication of a legitimate grievance,

judgment as follows: THE DORSAL PORTION OF THE the courts are justified in exempting a particular case

FIRST PAGE BECAUSE THE SECOND from the operation of the rules.[26] (Emphasis ours)

WHEREFORE, the instant petition is hereby PAGE IS MERELY HALF FILLED AND

GRANTED. Accordingly, the writ of possession issued by THE NOTATION ON *STILL BE MADE

the Regional Trial Court of Balanga City, Branch 1, on 18 AT THE SECOND PAGE.

July 2001 is declared NULL and VOID.

Averell B. Abrasaldo – II-Sanchez Roman 5

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

Indeed, well-known is the rule that departures from describing a parcel of land covered by OCT No. T- Underscoring the irregularity of the intercalation is the clearly

procedure may be forgiven where they do not appear to have 40785 not found in the Certificate of Sale of Real Properties devious attempt to let such an insertion pass unnoticed by

impaired the substantial rights of the parties.[27] Apropos in on file with the sheriff. typing the same at the back of the first page instead of on the

this regard is Cometa v.CA,[28] where we said that second page which was merely half-filled and could

True, public documents by themselves may be accommodate the entry with room to spare.

adequate to establish the presumption of their validity.

There is no question that petitioners were remiss in attending However, their probative weight must be evaluated not in The argument that the land on which the buildings

with dispatch to the protection of their interests as regards isolation but in conjunction with other evidence adduced by levied upon in execution is necessarily included is, likewise,

the subject lots, and for that reason the case in the lower the parties in the controversy, much more so in this case tenuous. Article 415 of the Civil Code provides:

court was dismissed on a technicality and no definitive where the contents of a copy thereof subsequently

pronouncement on the inadequacy of the price paid for the registered for documentation purposes is being contested.

levied properties was ever made. In this regard, it bears ART. 415. The following are immovable property:

No reason has been offered how and why the questioned

stressing that procedural rules are not to be belittled or entry was subsequently intercalated in the copy of the

dismissed simply because their non-observance may have certificate of sale subsequently registered with the Registry (1) Land, buildings, roads and constructions of all kinds

resulted in prejudice to a partys substantive rights as in this of Deeds. Absent any satisfactory explanation as to why said adhered to the soil.

case. Like all rules, they are required to be followed except entry was belatedly inserted, the surreptitiousness of its

when only for the most persuasive of reasons they may inclusion coupled with the furtive manner of its intercalation

be relaxed to relieve a litigant of an injustice not x x x x x x x x x

casts serious doubt on the authenticity of petitioners copy of

commensurate with the degree of his thoughtlessness the Certificate of Sale. Thus, it has been held that while a

in not complying with the procedure prescribed. public document like a notarized deed of sale is vested with (3) Everything attached to an immovable in a fixed manner,

[29]

(emphasis and italics supplied.) the presumption of regularity, this is not a guarantee of the in such a way that it cannot be separated therefrom without

validity of its contents.[34] breaking them material or deterioration of the object;

In short, since rules of procedure are mere tools

It must be pointed out in this regard that the issuance

designed to facilitate the attainment of justice, their strict and (4) Statues, reliefs, paintings or other objects for use or

of a Certificate of Sale is an end result of judicial foreclosure

rigid application which would result in technicalities that tend ornamentation, placed in buildings or on lands by the owner

where statutory requirements are strictly adhered to; where

to frustrate rather than promote substantial justice must of the immovable in such a manner that it reveals the

even the slightest deviations therefrom will invalidate the

always be avoided.[30] Technicality should not be allowed to intention to attach them permanently to the tenements;

proceeding[35] and the sale.[36] Among these requirements is

stand in the way of equitably and completely resolving the

an explicit enumeration and correct description of what

rights and obligations of the parties.[31]

properties are to be sold stated in the notice. (5) Machinery, receptacles, instruments or implements

Eschewing, therefore, the procedural objections raised The stringence in the observance of these requirements is intended by the owner of the tenement for an industry or

by petitioner, it behooves us to address the issue of whether such that an incorrect title number together with a correct works which may be carried on in a building or on a piece of

or not the questioned writ of possession is in fact a nullity technical description of the property to be sold and vice land, and which tend directly to meet the needs of the said

considering that it includes real property not expressly versa is deemed a substantial and fatal error which results in industry or works;

mentioned in the Certificate of Sale of Real Property. the invalidation of the sale.[37]

Petitioner, in sum, dwells on the general proposition The certificate of sale is an accurate record of what (6) Animal houses, pigeon houses, beehives, fish ponds or

that since the certificate of sale is a public document, it properties were actually sold to satisfy the debt. The breeding places of similar nature, in case their owner has

enjoys the presumption of regularity and all entries therein strictness in the observance of accuracy and correctness in placed them or preserves them with the intention to have

are presumed to be done in the performance of regular the description of the properties renders the enumeration in them permanently attached to the land, and forming a

functions. the certificate exclusive. Thus, subsequently including permanent part of it; the animals in these places are also

properties which have not been explicitly mentioned therein included;

The argument is not persuasive. for registration purposes under suspicious circumstances

smacks of fraud. The explanation that the land on which the

There are actually two (2) copies of the Certificate of properties sold is necessarily included and, hence, was x x x x x x x x x

Sale on Execution of Real Properties issued on February 4, belatedly typed on the dorsal portion of the copy of the

1999 involved, namely: (a) copy which is on file with the certificate subsequently registered is at best a lame excuse (9) Docks and structures which, though floating, are intended

deputy sheriff; and (b) copy registered with the Registry of unworthy of belief. by their nature and object to remain at a fixed place on a

Deeds. The object of scrutiny, however, is not the copy of the river, lake or coast;

Certificate of Sale on Execution of Real Properties issued by The appellate court correctly observed that there was

the deputy sheriff on February 4, 1999, [32] but the copy a marked difference in the appearance of the typewritten

thereof subsequently registered by petitioner with the words appearing on the first page of the copy of the x x x x x x x x x.

Registry of Deeds on April 23, 1999, [33] which included an Certificate of Sale registered with the Registry of

entry on the dorsal portion of the first page thereof Deeds[38] and those appearing at the dorsal portion thereof.

Averell B. Abrasaldo – II-Sanchez Roman 6

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

The foregoing provision of the Civil Code enumerates Petitioner Danilo D. Mendoza is engaged in the domestic however, reserves the right to raise the interest charges at

land and buildings separately. This can only mean that a and international trading of raw materials and chemicals. He any time depending on whatever policy it may follow in the

building is, by itself, considered immovable.[39] Thus, it has operates under the business name Atlantic Exchange future."7

been held that Philippines (Atlantic), a single proprietorship registered with

the Department of Trade and Industry (DTI). Sometime in

In a letter dated January 3, 1980 and signed by Branch

1978 he was granted by respondent Philippine National Bank

. . . while it is true that a mortgage of land necessarily Manager Fil S. Carreon Jr., respondent PNB advised

(PNB) a Five Hundred Thousand Pesos (P500,000.00) credit

includes, in the absence of stipulation of the improvements petitioner Mendoza that effective December 1, 1979, the

line and a One Million Pesos (P1,000,000.00) Letter of

thereon, buildings, still a building by itself may be bank raised its interest rates to 14% per annum, in line with

Credit/Trust Receipt (LC/TR) line.

mortgaged apart from the land on which it has been Central Bank's Monetary Board Resolution No. 2126 dated

built. Such mortgage would be still a real estate mortgage November 29, 1979.

for the building would still be considered immovable As security for the credit accommodations and for those

property even if dealt with separately and apart from the which may thereinafter be granted, petitioner mortgaged to

On March 9, 1981, he wrote a letter to respondent PNB

land.[40] (emphasis and italics supplied) respondent PNB the following: 1) three (3) parcels of

requesting for the restructuring of his past due accounts into

land3 with improvements in F. Pasco Avenue, Santolan,

a five-year term loan and for an additional LC/TR line of Two

Pasig; 2) his house and lot in Quezon City; and 3) several

In this case, considering that what was sold by virtue Million Pesos (P2,000,000.00).8 According to the letter,

pieces of machinery and equipment in his Pasig coco-

of the writ of execution issued by the trial court was merely because of the shut-down of his end-user companies and the

chemical plant.

the storehouse and bodega constructed on the parcel of land huge amount spent for the expansion of his business,

covered by Transfer Certificate of Title No. T-40785, which petitioner failed to pay to respondent bank his LC/TR

by themselves are real properties of respondents spouses, The real estate mortgage4 provided the following escalation accounts as they became due and demandable.

the same should be regarded as separate and distinct from clause:

the conveyance of the lot on which they stand.

Ceferino D. Cura, Branch Manager of PNB Mandaluyong

WHEREFORE, in view of all the foregoing, the petition (f) The rate of interest charged on the obligation replied on behalf of the respondent bank and required

is hereby DENIED for lack of merit. The Decision dated May secured by this mortgage as well as the interest on petitioner to submit the following documents before the bank

13, 2002 of the Court of Appeals in CA-G.R. SP No. 65891, the amount which may have been advanced by the would act on his request: 1) Audited Financial Statements for

which declared the writ of possession issued by Mortgagee in accordance with paragraph (d) of the 1979 and 1980; 2) Projected cash flow (cash in - cash out)

the Regional Trial Court of Balanga City, Branch 1, on July conditions herein stipulated shall be subject during for five (5) years detailed yearly; and 3) List of additional

18, 2001, null and void, is AFFIRMED in toto. the life of this contract to such increase within the machinery and equipment and proof of ownership thereof.

rates allowed by law, as the Board of Directors of Cura also suggested that petitioner reduce his total loan

SO ORDERED. the Mortgagee may prescribe for its debtors. obligations to Three Million Pesos (P3,000,000.00) "to give

us more justification in recommending a plan of payment or

restructuring of your accounts to higher authorities of the

G.R. No. 116710 June 25, 2001 Petitioner executed in favor of respondent PNB three (3)

Bank."9

promissory notes covering the Five Hundred Thousand

Pesos (P500,000.00) credit line, one dated March 8, 1979 for

DANILO D. MENDOZA, also doing business under the Three Hundred Ten Thousand Pesos (P310,000.00); another On September 25, 1981, petitioner sent another letter

name and style of ATLANTIC EXCHANGE PHILIPPINES, dated March 30, 1979 for Forty Thousand Pesos addressed to PNB Vice-President Jose Salvador, regarding

petitioner, (P40,000.00); and the last dated September 27, 1979 for his request for restructuring of his loans. He offered

vs. One Hundred Fifty Thousand Pesos (P150,000.00). The said respondent PNB the following proposals: 1) the disposal of

COURT OF APPEALS, PHILIPPINE NATIONAL BANK, 1979 promissory notes uniformly stipulated: "with interest some of the mortgaged properties, more particularly, his

FERNANDO MARAMAG, JR., RICARDO G. DECEPIDA thereon at the rate of 12% per annum, until paid, which house and lot and a vacant lot in order to pay the overdue

and BAYANI A. BAUTISTA, respondents. interest rate the Bank may, at any time, without notice, raise trust receipts; 2) capitalization and conversion of the balance

within the limits allowed by law xxx."5 into a 5-year term loan payable semi-annually or on annual

DE LEON, JR., J.: installments; 3) a new Two Million Pesos (P2,000,000.00)

LC/TR line in order to enable Atlantic Exchange Philippines

Petitioner made use of his LC/TR line to purchase raw

to operate at full capacity; 4) assignment of all his

Before us is a petition for review on certiorari of the materials from foreign importers. He signed a total of eleven

receivables to PNB from all domestic and export sales

Decision1 dated August 8, 1994 of the respondent Court of (11) documents denominated as "Application and Agreement

generated by the LC/TR line; and 5) maintenance of the

Appeals (Tenth Division) in CA-G.R. CV No. 38036 reversing for Commercial Letter of Credit," 6 on various dates from

existing Five Hundred Thousand Pesos (P500,000.00) credit

the judgment2 of the Regional Trial Court (RTC) and February 8 to September 11, 1979, which uniformly

line.

dismissing the complaint therein. contained the following clause: "Interest shall be at the rate

of 9% per annum from the date(s) of the draft(s) to the

date(s) of arrival of payment therefor in New York. The Bank,

Averell B. Abrasaldo – II-Sanchez Roman 7

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

The petitioner testified that respondent PNB Mandaluyong Eighteen Pesos and Eighty Six Centavos (P2,651,118.86) 29% on May 28, 1984, and to 32% on July 3, 1984 while the

Branch found his proposal favorable and recommended the and One Million Five Hundred Thirty Six Thousand Seven interest rate on the accrued interest per Promissory Note No.

implementation of the agreement. However, Fernando Hundred Ninety Eight and Seventy Three Centavos 128/82 was increased from 18% to 29% on May 28, 1984,

Maramag, PNB Executive Vice-President, disapproved the (P1,536,798.73) respectively and marked Exhibits "BB" and and to 32% on July 3, 1984.

proposed release of the mortgaged properties and reduced "CC" respectively, were payable on equal semi-annual

the proposed new LC/TR line to One Million Pesos amortization and contained the following escalation clause:

Petitioner failed to pay the subject two (2) Promissory Notes

(P1,000,000.00).10 Petitioner claimed he was forced to agree

Nos. 127/82 and 128/82 (Exhibits "BB" and "CC") as they fell

to these changes and that he was required to submit a new

x x x which interest rate the BANK may increase due. Respondent PNB extra-judicially foreclosed the real and

formal proposal and to sign two (2) blank promissory notes.

within the limits allowed by law at any time chattel mortgages, and the mortgaged properties were sold

depending on whatever policy it may adopt in the at public auction to respondent PNB, as highest bidder, for a

In a letter dated July 2, 1982, petitioner offered the following future; Provided, that, the interest rate on this note total of Three Million Seven Hundred Ninety Eight Thousand

revised proposals to respondent bank: 1) the restructuring of shall be correspondingly decreased in the event Seven Hundred Nineteen Pesos and Fifty Centavos

past due accounts including interests and penalties into a 5- that the applicable maximum interest rate is (P3,798,719.50).

year term loan, payable semi-annually with one year grace reduced by law or by the Monetary Board. In either

period on the principal; 2) payment of Four Hundred case, the adjustment in the interest rate agreed

The petitioner filed in the RTC in Pasig, Rizal a complaint for

Thousand Pesos (P400,000.00) upon the approval of the upon shall take effect on the effectivity date of the

specific performance, nullification of the extra-judicial

proposal; 3) reduction of penalty from 3% to 1%; 4) increase or decrease in the maximum interest rate.

foreclosure and damages against respondents PNB,

capitalization of the interest component with interest rate at xxx

Fernando Maramag Jr., Ricardo C. Decepida, Vice-President

16% per annum; 5) establishment of a One Million Pesos

for Metropolitan Branches, and Bayani A. Bautista. He

(P1,000,000.00) LC/TR line against the mortgaged

It appears from the record that the subject Promissory Notes alleged that the Extrajudicial Foreclosure Sale of the

properties; 6) assignment of all his export proceeds to

Nos. 127/82 and 128/82 superseded and novated the three mortgaged properties was null and void since his loans were

respondent bank to guarantee payment of his loans.

(3) 1979 promissory notes and the eleven (11) 1979 restructured to a five-year term loan; hence, it was not yet

"Application and Agreement for Commercial Letter of Credit" due and demandable; that the escalation clauses in the

According to petitioner, respondent PNB approved his which the petitioner executed in favor of respondent PNB. subject two (2) Promissory Notes Nos. 127/82 and 128/82

proposal. He further claimed that he and his wife were asked were null and void, that the total amount presented by PNB

to sign two (2) blank promissory note forms. According to as basis of the foreclosure sale did not reflect the actual loan

According to the petitioner, sometime in June 1983 the new

petitioner, they were made to believe that the blank obligations of the plaintiff to PNB; that Bautista purposely

PNB Mandaluyong Branch Manager Bayani A. Bautista

promissory notes were to be filled out by respondent PNB to delayed payments on his exports and caused delays in the

suggested that he sell the coco-chemical plant so that he

conform with the 5-year restructuring plan allegedly agreed shipment of materials; that PNB withheld certain personal

could keep up with the semi-annual amortizations. On three

upon. The first Promissory Note,11 No. 127/82, covered the properties not covered by the chattel mortgage; and that the

(3) occasions, Bautista even showed up at the plant with

principal while the second Promissory Note,12No. 128/82, foreclosure of his mortgages was premature so that he was

some unidentified persons who claimed that they were

represented the accrued interest. unable to service his foreign clients, resulting in actual

interested in buying the plant.

damages amounting to Two Million Four Thousand Four

Hundred Sixty One Pesos (P2,004,461.00).

Petitioner testified that respondent PNB allegedly

Petitioner testified that when he confronted the PNB

contravened their verbal agreement by 1) affixing dates on

management about the two (2) Promissory Notes Nos.

the two (2) subject promissory notes to make them mature in On March 16, 1992, the trial court rendered judgment in

127/82 and 128/82 (marked Exhibits "BB" and "CC"

two (2) years instead of five (5) years as supposedly agreed favor of the petitioner and ordered the nullification of the

respectively) which he claimed were improperly filled out,

upon; 2) inserting in the first Promissory Note No. 127/82 an extrajudicial foreclosure of the real estate mortgage, the

Bautista and Maramag assured him that the five-year

interest rate of 21% instead of 18%; 3) inserting in the Sheriff’s sale of the mortgaged real properties by virtue of

restructuring agreement would be implemented on the

second Promissory Note No. 128/82, the amount stated consolidation thereof and the cancellation of the new titles

condition that he assigns 10% of his export earnings to the

therein representing the accrued interest as One Million Five issued to PNB; that PNB vacate the subject premises in

Bank.13 In a letter dated August 22, 1983, petitioner Mendoza

Hundred Thirty Six Thousand Four Hundred Ninety Eight Pasig and turn the same over to the petitioner; and also the

consented to assign 10% of the net export proceeds of a

Pesos and Seventy Three Centavos (P1,536,498.73) when it nullification of the extrajudicial foreclosure and sheriff's sale

Letter of Credit covering goods amounting to One Hundred

should only be Seven Hundred Sixty Thousand Three of the mortgaged chattels, and that the chattels be returned

Fourteen Thousand Dollars ($114,000.00).14 However,

Hundred Ninety Eight Pesos and Twenty Three Centavos to petitioner Mendoza if they were removed from his Pasig

petitioner claimed that respondent PNB subsequently

(P760,398.23) and pegging the interest rate thereon at 18% premises or be paid for if they were lost or rendered

debited 14% instead of 10% from his export proceeds.15

instead of 12%. unserviceable.

Pursuant to the escalation clauses of the subject two (2)

The subject Promissory Notes Nos. 127/82 and 128/82 both The trial court also ordered respondent PNB to restructure to

promissory notes, the interest rate on the principal amount in

dated December 29, 1982 in the principal amounts of Two five-years petitioner's principal loan of Two Million Six

Promissory Note No. 127/82 was increased from 21% to

Million Six Hundred Fifty One Thousand One Hundred Hundred Fifty One Thousand One Hundred Eighteen Pesos

Averell B. Abrasaldo – II-Sanchez Roman 8

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

and Eighty Six Centavos (P2,651,118.86) and the responses were not categorical that the appellee's request We are currently evaluating the proposal

accumulated capitalized interest on the same in the amount had been favorably accepted by the bank." of the client to re-structure his accounts

of Seven Hundred Sixty Thousand Three Hundred Eighty with us into a five-year plan.

Nine Pesos and Twenty Three Centavos (P760,389.23) as of

Contending that respondent PNB had allegedly approved his

December 1982, and that respondent PNB should compute

proposed five-year restructuring plan, petitioner presented We hope that the above information will guide you

the additional interest from January 1983 up to October 15,

three (3) documents executed by respondent PNB officials. in evaluating the proposals of Mr. Danilo Mendoza.

1984 only when respondent PNB took possession of the said

The first document is a letter dated March 16, 1981

properties, at the rate of 12% and 9% respectively.

addressed to the petitioner and signed by Ceferino D. Cura,

xxx

Branch Manager of PNB Mandaluyong, which states:

The trial court also ordered respondent PNB to grant

petitioner Mendoza an additional Two Million Pesos The third document is a letter dated July 8, 1981 addressed

x x x In order to study intelligently the feasibility of

(P2,000,000.00) loan in order for him to have the necessary to petitioner and signed by PNB Assistant Vice-President

your above request, please submit the following

capital to resume operation. It also ordered respondents Apolonio B. Francisco.

documents/papers within thirty (30) days from the

PNB, Bayani A. Bautista and Ricardo C. Decepida to pay to

date thereof, viz:

petitioner actual damages in the amount of Two Million One

xxx

Hundred Thirteen Thousand Nine Hundred Sixty One Pesos

(P2,113,961.00) and the peso equivalent of Six Thousand 1. Audited Financial Statements for 1979

Two Hundred Fifteen Dollars ($6,215.00) at the prevailing and 1980; Considering that your accounts/accommodations

foreign exchange rate on October 11, 1983; and exemplary were granted and carried in the books of our

damages in the amount of Two Hundred Thousand Pesos Mandaluyong Branch, we would suggest that your

2. Projected cash flow (cash in - cash

(P200,000.00). requests and proposals be directed to Ceferino

out) for five years detailed yearly; and

Cura, Manager of our said Branch.

Respondent PNB appealed this decision of the trial court to

3. List of additional machinery and

the Court of Appeals. And the Court of Appeals reversed the We feel certain that Mr. Cura will be pleased to

equipment and proof of ownership

decision of the trial court and dismissed the complaint. discuss matters of mutual interest with you.

thereof.

Hence, this petition.

xxx

We would strongly suggest, however, that you

It is the petitioner’s contention that the PNB management

reduce your total obligations to at least P3 million

restructured his existing loan obligations to a five-year term

(principal and interest and other charges) to give Petitioner also presented a letter which he addressed to Mr.

loan and granted him another Two Million Pesos

us more justification in recommending a plan of Jose Salvador, Vice-President of the Metropolitan Branches

(P2,000,000.00) LC/TR line; that the Promissory Notes Nos.

payment or restructuring of your accounts to of PNB, dated September 24, 1981, which reads:

127/82 and 128/82 evidencing a 2-year restructuring period

higher authorities of this bank.

or with the due maturity date "December 29, 1984" were

filled out fraudulently by respondent PNB, and contrary to his Re: Restructuring of our Account into a 5-year

verbal agreement with respondent PNB; hence, his The second document is a letter dated May 11, 1981 Term Loan and Request for the Establishment of a

indebtedness to respondent PNB was not yet due and the addressed to Mr. S. Pe Benito, Jr., Managing Director of the P2.0 Million LC/TR Line

extrajudicial foreclosure of his real estate and chattel Technological Resources Center and signed by said PNB

mortgages was premature. On the other hand, respondent Branch Manager, Ceferino D. Cura. According to petitioner,

PNB denies that petitioner's loan obligations were Dear Sir:

this letter showed that respondent PNB seriously considered

restructured to five (5) years and maintains that the subject the restructuring of his loan obligations to a five-year term

two (2) Promissory Notes Nos. 127/82 and 128/82 were filled loan, to wit: In compliance with our discussion last September

out regularly and became due as of December 29, 1984 as 17, we would like to formalize our proposal to

shown on the face thereof. support our above requested assistance from the

xxx

Philippine National Bank.

Respondent Court of Appeals held that there is no evidence

of a promise from respondent PNB, admittedly a banking At the request of our client, we would like to furnish

xxx

corporation, that it had accepted the proposals of the you with the following information pertinent to his

petitioner to have a five-year restructuring of his overdue accounts with us:

loan obligations. It found and held, on the basis of the

evidence adduced, that "appellee's (Mendoza) xxx

communications were mere proposals while the bank's

Averell B. Abrasaldo – II-Sanchez Roman 9

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

Again we wish to express our sincere appreciation upon, and if a refusal to enforce it would be understanding that they were to be subsequently filled out to

for your open-minded approach towards the virtually to sanction the perpetration of fraud or conform with his alleged oral agreements with PNB officials,

solution of this problem which we know and will be would result in other injustice. In this respect, the among which is that they were to become due only after five

beneficial and to the best interest of the bank and reliance by the promisee is generally evidenced by (5) years. If petitioner were to be believed, the PNB officials

mutually advantageous to your client. action or forbearance on his part, and the idea has concerned committed a fraudulent act in filling out the

been expressed that such action or forbearance subject two (2) promissory notes in question. Private

would reasonably have been expected by the transactions are presumed to be fair and regular. 24 The

xxx

promissor. xxx burden of presenting evidence to overcome this presumption

falls upon petitioner. Considering that petitioner imputes a

Petitioner argues that he submitted the requirements serious act of fraud on respondent PNB, which is a banking

The doctrine of promissory estoppel is an exception to the

according to the instructions given to him and that upon corporation, this court will not be satisfied with anything but

general rule that a promise of future conduct does not

submission thereof, his proposed five-year restructuring plan the most convincing evidence. However, apart from

constitute an estoppel. In some jurisdictions, in order to

was deemed automatically approved by respondent PNB. petitioner's self-serving verbal declarations, we find no

make out a claim of promissory estoppel, a party bears the

sufficient proof that the subject two (2) Promissory Notes

burden of establishing the following elements: (1) a promise

Nos. 127/82 and 128/82 were completed irregularly.

We disagree. reasonably expected to induce action or forebearance; (2)

Therefore, we rule that the presumption has not been

such promise did in fact induce such action or forebearance,

rebutted.

and (3) the party suffered detriment as a result.19

Nowhere in those letters is there a categorical statement that

respondent PNB had approved the petitioner’s proposed Besides, it could be gleaned from the record that the

five-year restructuring plan. It is stretching the imagination to It is clear from the forgoing that the doctrine of promissory

petitioner is an astute businessman who took care to reduce

construe them as evidence that his proposed five-year estoppel presupposes the existence of a promise on the part

in writing his business proposals to the respondent bank. It is

restructuring plan has been approved by the respondent of one against whom estoppel is claimed. The promise must

unthinkable that the same person would commit the careless

PNB which is admittedly a banking corporation. Only an be plain and unambiguous and sufficiently specific so that

mistake of leaving his subject two (2) promissory notes in

absolute and unqualified acceptance of a definite offer the Judiciary can understand the obligation assumed and

blank in the hands of other persons. As the respondent Court

manifests the consent necessary to perfect a contract.16 If enforce the promise according to its terms.20 For petitioner to

of Appeals correctly pointed out:

anything, those correspondences only prove that the parties claim that respondent PNB is estopped to deny the five-year

had not gone beyond the preparation stage, which is the restructuring plan, he must first prove that respondent PNB

period from the start of the negotiations until the moment just had promised to approve the plan in exchange for the Surely, plaintiff-appellee who is a C.P.A and a Tax

before the agreement of the parties.17 submission of the proposal. As discussed earlier, no such Consultant (p. 3 TSN, January 9, 1990) will insist

promise was proven, therefore, the doctrine does not apply that the details of the two promissory notes he and

to the case at bar. A cause of action for promissory estoppel his wife executed in 1982 should be specific to

There is nothing in the record that even suggests that does not lie where an alleged oral promise was conditional, enable them to make the precise computation in

respondent PNB assented to the alleged five-year so that reliance upon it was not reasonable.21 It does not the event of default as in the case at bench. In

restructure of petitioner’s overdue loan obligations to PNB. operate to create liability where it does not otherwise exist.22 fact, his alleged omission as a C.P.A. and a Tax

However, the trial court ruled in favor of petitioner Mendoza, Consultant to insist that the two promissory notes

holding that since petitioner has complied with the conditions be filled up on important details like the rates of

of the alleged oral contract, the latter may not renege on its Since there is no basis to rule that petitioner's overdue loan

interest is inconsistent with the legal presumption

obligation to honor the five-year restructuring period, under obligations were restructured to mature in a period of five (5)

of a person who takes ordinary care of his

the rule of promissory estoppel. Citing Ramos v. Central years, we see no other option but to respect the two-year

concerns (Section 3 (c), Rule 131, Revised Rules

Bank,18 the trial court said: period as contained in the two (2) subject Promissory Notes

on Evidence).

Nos. 127/82 and 128/82, marked as Exhibits "BB" and "CC"

respectively which superseded and novated all prior loan

The broad general rule to the effect that a promise documents signed by petitioner in favor of respondent PNB. As pointed out by the Court of Appeals, Orlando Montecillo,

to do or not to do something in the future does not Petitioner argues, in his memorandum, that "respondent Chief, Loans and Discounts, PNB Mandaluyong Branch,

work an estoppel must be qualified, since there are Court of Appeals had no basis in saying that the acceptance testified that the said Promissory Notes Nos. 127/82 and

numerous cases in which an estoppel has been of the five-year restructuring is totally absent from the 128/82 were completely filled out when Danilo Mendoza

predicated on promises or assurances as to future record."23 On the contrary, the subject Promissory Notes signed them (Rollo, p. 14).

conduct. The doctrine of ‘promissory estoppel’ is Nos. 127/82 and 128/82 are clear on their face that they

by no means new, although the name has been were due on December 29, 1984 or two (2) years from the

adopted only in comparatively recent years. In a last-ditch effort to save his five-year loan restructuring

date of the signing of the said notes on December 29, 1982.

According to that doctrine, an estoppel may arise theory, petitioner contends that respondent PNB's action of

from the making of a promise, even though without withholding 10% from his export proceeds is proof that his

consideration, if it was intended that the promise Petitioner claims that the two (2) subject Promissory Notes proposal had been accepted and the contract had been

should be relied upon and in fact it was relied Nos. 127/82 and 128/82 were signed by him in blank with the partially executed. He claims that he would not have

Averell B. Abrasaldo – II-Sanchez Roman 10

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

consented to the additional burden if there were no It has been held that no one receiving a proposal to change A stipulation in the mortgage, extending its scope and effect

corresponding benefit. This contention is not well taken. a contract to which he is a party is obliged to answer the to after-acquired property is valid and binding where the

There is no credible proof that the 10% assignment of his proposal, and his silence per se cannot be construed as an after-acquired property is in renewal of, or in substitution for,

export proceeds was not part of the conditions of the two- acceptance.28 Estoppel will not lie against the petitioner goods on hand when the mortgage was executed, or is

year restructuring deal. Considering that the resulting regarding the increase in the stipulated interest on the purchased with the proceeds of the sale of such goods. 30 As

amount obtained from this assignment of export proceeds subject Promissory Notes Nos. 127/82 and 128/82 inasmuch earlier pointed out, the petitioner did not present any proof as

was not even enough to cover the interest for the as he was not even informed beforehand by respondent to when the subject movables were acquired.

corresponding month,25 we are hard-pressed to construe it bank of the change in the stipulated interest rates. However,

as the required proof that respondent PNB allegedly we also note that the said two (2) subject Promissory Notes

More importantly, respondent bank makes a valid argument

approved the proposed five-year restructuring of petitioner’s Nos. 127/82 and 128/82 expressly provide for a penalty

for the retention of the subject movables. Respondent PNB

overdue loan obligations. charge of 3% per annum to be imposed on any unpaid

asserts that those movables were in fact "immovables by

amount when due.

destination" under Art. 415 (5) of the Civil Code. 31 It is an

It is interesting to note that in his Complaint, petitioner made established rule that a mortgage constituted on an

no mention that the assignment of his export proceeds was a Petitioner prays for the release of some of his immovable includes not only the land but also the buildings,

condition for the alleged approval of his proposed five-year movables29 being withheld by respondent PNB, alleging that machinery and accessories installed at the time the

loan restructuring plan. The Complaint merely alleged that they were not included among the chattels he mortgaged to mortgage was constituted as well as the buildings,

"plaintiff in a sincere effort to make payments on his respondent bank. However, petitioner did not present any machinery and accessories belonging to the mortgagor,

obligations agreed to assign 10% of his export proceeds to proof as to when he acquired the subject movables and installed after the constitution thereof.32

defendant PNB." This curious omission leads the court to hence, we are not disposed to believe that the same were

believe that the alleged link between the petitioner’s "after-acquired" chattels not covered by the chattel and real

Petitioner also contends that respondent PNB’s bid prices for

assignment of export proceeds and the alleged five-year estate mortgages.

this foreclosed properties in the total amount of Three Million

restructuring of his overdue loans was more contrived than

Seven Hundred Ninety Eight Thousand Seven Hundred

real.

In asserting its rights over the subject movables, respondent Nineteen Pesos and Fifty Centavos (P3,798,719.50), were

PNB relies on a common provision in the two (2) subject allegedly "unconscionable and shocking to the conscience of

It appears that respondent bank increased the interest rates Promissory Notes Nos. 127/82 and 128/82 which states: men". He claims that the fair market appraisal of his

on the two (2) subject Promissory Notes Nos. 127/82 and foreclosed plant site together with the improvements thereon

128/82 without the prior consent of the petitioner. The located in Pasig, Metro Manila amounted to Five Million Four

In the event that this note is not paid at maturity or

petitioner did not agree to the increase in the stipulated Hundred Forty One Thousand Six Hundred Fifty Pesos

when the same becomes due under any of the

interest rate of 21% per annum on Promissory Note No. (P5,441,650.00) while that of his house and lot in Quezon

provisions hereof, we hereby authorized the BANK

127/82 and 18% per annum on Promissory Note No. 128/82. City amounted to Seven Hundred Twenty Two Thousand

at its option and without notice, to apply to the

As held in several cases, the unilateral determination and Pesos (P722,000.00) per the appraisal report dated

payment of this note, any and all moneys,

imposition of increased interest rates by respondent bank is September 20, 1990 of Cuervo Appraisers, Inc. 33 That

securities and things of value which may be in its

violative of the principle of mutuality of contracts ordained in contention is not well taken considering that:

hands on deposit or otherwise belonging to me/us

Article 1308 of the Civil Code.26 As held in one case:27

and for this purpose. We hereby, jointly and

severally, irrevocably constitute and appoint the 1. The total of the principal amounts alone of

It is basic that there can be no contract in the true BANK to be our true Attorney-in-Fact with full petitioner’s subject Promissory Notes Nos. 127/82

sense in the absence of the element of agreement, power and authority for us in our name and behalf and 128/82 which are both overdue amounted to

or of mutual assent of the parties. If this assent is and without prior notice to negotiate, sell and Four Million One Hundred Eighty Seven Thousand

wanting on the part of one who contracts, his act transfer any moneys securities and things of value Nine Hundred Seventeen Pesos and Fifty Nine

has no more efficacy than if it had been done which it may hold, by public or private sale and Centavos (P 4,187,917.59).

under duress or by a person of unsound mind. apply the proceeds thereof to the payment of this

note.

2. While the appraisal of Cuervo Appraisers, Inc.

Similarly, contract changes must be made with the was undertaken in September 1990, the

consent of the contracting parties. The minds of all It is clear, however, from the above-quoted provision of the extrajudicial foreclosure of petitioner’s real estate

the parties must meet as to the proposed said promissory notes that respondent bank is authorized, in and chattel mortgages have been effected way

modification, especially when it affects an case of default, to sell "things of value" belonging to the back on October 15, 1984, October 23, 1984 and

important aspect of the agreement. In the case of mortgagor "which may be on its hands for deposit or December 21, 1984.34 Common experience shows

loan contracts, it cannot be gainsaid that the rate otherwise belonging to me/us and for this purpose." Besides that real estate values especially in Metro Manila

of interest is always a vital component, for it can the petitioner executed not only a chattel mortgage but also a tend to go upward due to developments in the

make or break a capital venture. real estate mortgage to secure his loan obligations to locality.1âwphi1.nêt

respondent bank.

Averell B. Abrasaldo – II-Sanchez Roman 11

CREDIT TRANSACTIONS – PART 9: REAL MORTGAGE (Articles 2124 – 2131), ACT 3135 & FORECLOSURE OF REAL ESTATE MORTGAGE

Assigned case

3. In the public auction/foreclosure sales, spouses Leopoldo and Mercedita Viola (petitioners) obtained The mortgaged properties were sold on April 10, 2003

respondent PNB, as mortgagee, was not obliged a loan through a credit line facility in the maximum amount for P4,284,000.00 at public auction to respondent, after

to bid more than its claims or more than the of P4,700,000.00 from the Philippine Commercial which a Certificate of Sale dated April 21, 20034 was issued.

amount of petitioner’s loan obligations which are International Bank (PCI Bank), which was later merged with

all overdue. The foreclosed real estate and chattel Equitable Bank and became known as Equitable PCI Bank,