Professional Documents

Culture Documents

1019 PRTC Mas PW

1019 PRTC Mas PW

Uploaded by

King Mercado0 ratings0% found this document useful (0 votes)

31 views11 pagesOriginal Title

1019 Prtc Mas Pw

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views11 pages1019 PRTC Mas PW

1019 PRTC Mas PW

Uploaded by

King MercadoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

Fr.

Excel Professional Services, Inc.

Management Firm of Professional Review and ining Center (PRTC)

(LUZON) Manila be pe seat Se Te

* Banaras iy cae

(uasatAShGaclad iy (oss) sacozas Cons CRY O85) RNS he, 218

nee 9

(MINDANAO) Cagayan De Oro City (0995) 0570499 * Davao City (082) 2250049 saad

MANAGEMENT ADVISORY SERVICES (U/BT

ee CPAREVIEW ah oxo

E tak pease resect on 5759, HO Products, The needs to purchase these units to continue

feling prec oF SAE: The second asa

unk varie cece oS

Ber Unt, and toes

Be UM, td tocatd mee coe a gs ot PS

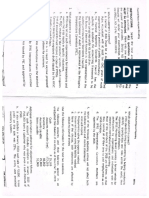

2. Black Co.'s breakeven point

Was 780,000, varia

SaRaNERS averanes 60% oF sales, anc te mete

38S, and the margin of

safety was P15

‘contribution margin pee ee Mace

2. P 364,000 °

8. P 548,000 &. br sb0.0

3. Madden Company nas projected its income

taxes for next Year as shown below re out

Subject to a 40% income tox ae

le (260,000 unto

Sates (280000 ta) 8,000,000

Varibie costs 2,000,000,

noe costs .o00‘000

“Total costs 5.000.000

Income before taxes 5.000.000

Madden's net assets are 936,000,000. The peso

eles that must be achieved for Madden to cares

20% after tax return on assets would be

2. P8,800,000 «. P46,000,000

. P12,000,000 4. 76,880,000

4. Metalcraft produces three inexpensive socket

Wrench sets that are popular with do-t-yourselves

‘Budgeted information for the upcoming years 05

‘follows.

Estimated

Model Selling —Vanabie

Brice Cost

No.19 P40 P 550 30,000 sets

No. 45 158.00 ——_75,000 sets

No. 53 20 P1400 45,000 sets

Total fixed costs for the socket wrench product line

's P961,000. "If the company’s actual experience

remains consistent with the estimated sales volume

Percentage distribution, and the firm desires to

Generate total operating income of 161,200, how

many Model No, 153 socket sets will MetalCraft have

to sell?

2. 54,300 c. 26,000

b. 155,000 d. 181,000

5. Gardener Company currently is using its full capacity

of 25,000 machine hours to manufacture product

XR-2000. JE} Corporation placed an order with

Gardener for the manufacture of 1,000 units of KT-

6500. JE) would normally manufacture this

component. However, due to a fire at its plant, JE)

- Signay Corporation is

manufacturing other products. This is 9 one- time |

Sspeaal order. The following reflects unit cost data,

{and seling prices.

ixcss00 — xg.2000

Material 727 P24

Direct labor 2 10

Variable overhead 6 5

Fixed overneas “6 o

Variable s & A 5 4

Fea 8A 2 Fa

Normal seling price Piz5 pus

Machine hours requires 3 4

What is the minimum unit price thet Gardener

should charge JE) to manufacture 1,000 unis of eT

500?

2. P33.09 «110.00

. P96.50 4. 125.00

Rotak co. is a manufacturer of industrial

Components. One of thelr pracucts that Is Used a6 2

sub-component in auto manufacturing is KB-96. This

Product has the following financial structure per

nv

Selling rice aso

Direct matenals 720

Direct bor 15

Vanabie overneae 2

Fixes overnead 0

Shipping & handling 3

Fixed sling & san =10

Total costs 220

Rotak Co, nas received a one-time specs! order for

Assume tia Ratak open

Bt ful capacty and the next bes Starnes

ter eapacty’ on existing equipment a toees hee

wnoule "reduce" conenbuton af piace’ Se

minimum price tat ig acceptable, using the orgie

‘ita, forts onetime special order eh oxen

o beo ees

2 bay 8. Pico

2 table _manvtacturing

company that has the following cost structure 1

Producing table tops

Unit Costs

Direct materais P23

Direct labor 2

Variable OH 19

Fixed On 7

Variable aamin. Cost 2

Fixed admin. Cost <3

Total unt costs Pez

Recently, Bignay Corporation received an offer fror

Dunat Corporation to supply the table tops t

Bignay. Bignay is considering buying the table to}

from Dunat instead of manufacturing the

Internally. Assume tat Bignay Corporation ¥

Operating at full capacity. IF Bignay had i

adcitional capacity, they could manufacture che

nich have costs per unit as:

www.

Page 1 of 8

rtc.com.ph

MAS.PREW

EXCEL PROFESSIONAL SERVICES, INC,

Pex Unit

Seting price 2100.00

Direct materials 38.00

Direct labor 22.00

Variable OH 49.50

Foxes OF 475

Variable admin. Cost 250

Flxed admin. Cost zs

Operating margin 10.00

Ung the above data, reconsider the offer that

Blan recenee tram bu Catnriy Seeey tnt

{Be abe tops instead of elf manutaruling thay

tern

What isthe maximum pric from Ounat that Bignay

would be witing to accept?

2. P68.00 67.09

B. 60.00 J. P65.00

Bigstan Nes. 8 through 20 are bases on the following

The following

pertains to

Jasmin Corporation

Partial Balance Sheet

December 33, 20:8,

Liabilities ana stoexnolcers"

Equity

Current iabiities P 60,000,

Long-term liatiities 30,000,

‘oders" equity 150,009

Total liabilities ana stockholders: Paoa.0c9

equity

Jasmin Corporetion

Income Statement

For the Year Ended December 31, 2018

Net sales

than the corporate HOF vetove th

onstred aaa

6. ba neared because st produces. 6:2

Isnt ina rine thn

cy bce

© unos AOL and reeouel

postive numbere

in operations and

12, Vented, nc, made soma chonges in 09

rowded the following formation

provided tn oR

900,000

Operating revenues

Operating expense: 239.500

Operating asser 200

What parcontage represents

Investment for year 37

4. 26.57% ‘

b. 25.00% 4

19-4 ammonal manager receives 9 bons

20% of the rasidual Income froth

Tesults of the division include

1,000,000,

divisional xpenian, Bebo

(000,000, and tha rexuned cat

aivisional assets, 2,000, a

Of return is 38%, "What sinount reprenants. the

manager's bonus? ;

200,000 © 100,000

b. P140,000 4. pa0,009

ems 14 and 15 are based on the following int

The bass

year 2019.

Larnings not

Interest eape

Preferred stock dividend

Common stack

dividend payout rat c

80,000 Common shares outst andy

ost of goods sold 45.009 EMtective corporate tins box sate ‘

Gross margin 35.000

Operating expenses t3.009 Peeled common stock sven per share t

Income before income taxés P2000 18 Corporation or ote &

Income taxes 5.000 M4 ©. 'P3.90

Netincome Bis.000 72.99 6 bat

isu. Sod Sete, ies 6900 shares of cmon sock 15,11 bavaon Corporation's common stock Is expecten

Common a SANG. The market pce ot hasan 1S th rear yal 8 PHiezaarninge rote @tteten

bald aurdangs Gr stsgee, gt, 2008, as Pa, jamin, 8 BNE ber share (othe nearest pean, te

RBI dlvidends oF P2.00'per share during sin be

BB Sgt to ecu ratio tor this corporation? p15 © p72

2.0.4 umes < LO times b. Pse oboe

5 06 times 4. 25 times

26.02 Telecom is considering a projet fy a ‘9

Ferm i gtt® Phee/earnings (P/E) ratio tor thy tne cH a cost P50 mitnon Qe ne Coming

corporation? Man QlQntng, combination dade aha £9 8

2.8.20 times © 7.20 times finance tha nvestmnan

b/ 10.70 mes 4. 9.20 times * TUE PLS tion of 20-year bonds ot « rice og

i Hocsuet COUPON ate of gto Me oF

4} 10. What is the dividends yiela ofthis ‘corporation? Notation cowts of 2 percent ot dat

2.870% ©. 9.900 * Ghe P35 mon Pot tunde Cenereted thom

B. 660%, 3. 495% aaroinge,

14. Sunrise Corporation on investment of SAMY Markel Is expected to earn 19 >,

ROT” uni avon, wien current pecan ot muy wont ara nae Yielding pate

‘ “ ss beta cootficient for OQ w estimated tot

Coneriaun wit Subject t0'an effective corporate it

(1) reduce a Breduce P120,000 atv et 4gUis,'®

enc fan Fs BOM TH Cop Aare Pncing. eae {saan o

uence, {ha expected return on a becunty Sy adoiny

Peau Because reduces divisonai {ha expecta faturn to the ere

SsDected market return, winch ndjuy

companys beta Compute’

rare

wouw.prtecom.oh

MAS.PREWEEK

© fous

4. Pa3.b6

considering ether teasing oF

Gear ease, ‘The burcnsee

1000. "The Treaser nas 8 @-yoer ive once

ime it Is expectea to have a resate vole er

0. The Burger soint “uses atone

SepFeciation, borrows money at 7:5 percent Ses tee

SuMiclent tax ioss carryovers to offeat any’ poten

{arable income tne firm might have over he rene

2

019. Te Auto Mart is trying to decide whether to lease or 2

uy ‘some new ‘euoment the aula ees

Pek.co, nen S-year ie, and wit bo werness

ther the 3 years, the aferan alecount rae’ Ss

Bercent, The annal deprecation ta cheid 653

and the aftertax annual lease payment 1s 26,033. 026. What \s the net cash flow

What is the net advantage to leasing?

2. =P3,508 ce Payana

8 cpaiz a. P7453

D 20. knight Motors is considering either leasing or buying

some new equipment. The lease payments would be () 27. What is the net cash flow for the tenth yeer of the

14,500 a year for 3 years. The purchase price is,

52000. ‘The equipment has a 3-year life and then

Is expected to have 2 resale value of P12,000.

Knight Motors uses straight-line | depreciation,

orrows money at 9 percent, and has a 35 percent

tax rate. What is the net advantage to leasing?

a. -P2,742, c. P3529,

b. -p2i2a2 P3898

©21. Crossing Corporation recently sold 3 used machine

for P40,000. The machine had a book value of

60,000 at the time of the sale. What is the after

tax cash flow from the sale, assuming the company's

‘marginal tax rate Is 20 percent?

a. P40,000 c. Pa4,000

b. P60,000 d. P32,000

percent.

Percent as its discount rate.

amount of the cash flow in year 4?

a. Pi5,181 c. P9868

b. P23,356 d. P43,375

following projects (on January 1, 2016:

Jan. 1, 2016, Dec. 31, 2020,

Cash outflow. Cash inflow IRR

P-A 3,500,000 —_P7,400,000. 15%

P-B P4,000,000 9,950,000 ?

age 3 of 8

(etnies ot €22. Uaing tne nat present vive method, Project hs oat

Wine spe (rete, markt C24, Project's interna rate of return ie anasto

oG2 few machine. The machine san’ ce purchase

Blane and P3.005"

witha salling price of PSOO and cominnes wan

labor’ costs of F480 par unit. The Bureas atten

Revenue permits machines

Yyoerg, wnat ts tho net savertage to leasing? Revenue permits machines of | mis. type tee

2. “2,008 eBa407 with no estimated “salvage value." Gienaste Wan"

B “prige0 a. B95 196 value Glenmore Neos

1822. Kent Corporation faces @ marginal tax rate of 35

One project that is currently under

evaluation has @ cash flow in the fourth year of its

life that has a present value of P10,000 (after-tax)

Kent Corporation assumes that all cash flows occur

at the end of the year and the company uses 11.

What Is the pre-tax

Items 23 and 24 are based on the following information:

A firm, with an 18% cost of capital, Is considering the

www. prte.com.ph

mtd sans te

‘Whats the net cash oulfiow at te beginning of the

first year that Glenmore Corporation souls te S's

‘apital budgeting enelysise

3." P(@3,000) ©

236,000)

B. P(30;000) 4

C105 000)

for the third year that

Gtenmore. Corporation. should “use in. % captal

Dudgeting analysis?

3. P8400

BL P6420

é

53,700

Pa7,400,

Project that Glenmore Corporation shoud use ies

capital budgeting analysis?

3. P81,000 c. 963,000 =

B. P68,400 6. P50,000

Hems 28 thru 30 are based on the following

Information:

Capital Invest Inc. uses a 12% hurdle rate for all capital

‘expenditures and has done the following analysis tor

four projects for the upcoming year

Initial Cash Outlay (

Project 1 Project 2 Projex3 Project 4

200,000 298,000 248,000 P272,000

Annual net cash inflows

ri P65,000 P100,000 80,000 P 95,000

Ye2 70,000 135,000 95,000 125,000

Yr3 80,000 80,000 90,000 30,000

Yr4 40,000 65,000 80,000 60,000

NPV (3,798) 4.276 14.064 14.652

PL 98% 101% 106% 105%.

IRR 11% 13% 14% = 15%

(C28. Which project(s) should Capital Invest Inc.

undertake during the upcoming year assuming it has

no budget restrictions?

a. All of the projects.

b. Projects 1, 2, and 3,

¢. Projects 2, 3, and 4,

4. Projects 1, 3, and 4,

) 29.Which project(s) should Capital Invest inc.

undertake during the upcoming year if it has only

600,000 of funds available?

a. Projects tand3. ——_c, Projects 2 and 3.

b. Projects 2,3, and 4. d, Projects 3 and 4.

MAS. PREWEEK

Senta G SERVICES, INC.

Dro. wnich project(s)

ould capi

Sderake daring ta uptomisg ee eM, Bo.

300,000 of capital funds availapies* N8S only

@. Project 1, ed

Projet, 3, ana 4.

© prec 3 ona

d. Project 3.

a1. ™e omant company pans to invest ina dupteaing

machine that costs P120,000. The following ave

Sxpected. annual cash Inflows thet. ere “Caey

feesived each month and the estimated. ssivayl

Value at any point. of each year

Year Cash inflows vs

+ 'P40,000 50,000

2 36,000 40,000

3 32,000 28,000

4 28,000 20,000

5 25,000 5,000

What Is the bail-out period for this project?

2. 2.50 years 257 years

b. 2.43 years 4d. 1.83 years

Items 32 and 33 are based on the following information:

Ethan, Inc. has seasonal demand for its products and

management is considering whether level production or

‘seasonal production should be implemented. The firms’

short term interest cost is 8%, and management has

developed the following information to make the

decision:

Alternative 2

Level ‘Seasonal

roduction production

Average inventory 2,000,000 1,500,000

Production costs P6,000,000 6,050,000

9.32. Which alternative should be acceoted and how much

Is saves over the other alternative?

sr

oe

the thy

woul sa

ever the Would £2¥e £24,000 In collection expenses

esate 2 Astume the fon and itera re not

884 On the foi

4 ling nforrnin

ating 95 0 coreg Sye208N nts Sesena!

wholesale customers to make’ pursmmuy wai, amin

Sauling payment unt the retalselnng vest

Sales occur as follows: ‘selling season

Date ofsale quant

September: gun

Sciober 100 uns

November dum

December: so uma

Senuary So-unts

Each unit has 2 selling price of

fen yo 8 price of P10 regards of the

The terms of sale are 2/10 net 20, tanuary 3 cat

All sales are on create eaters

Al eustomers ake the discount and abide bythe terms

or the ascount poicy. oe

All customers ake advantage of the new seasonal

dating poy. gue

‘The ‘peak. seling season for ai customers is. mide

November to late December.

836. For the seling firm, whicn of the following 's not an

expected advantage to initiating seasonal cating?

2. Reduced storage costs.

D. Reguced creit costs

©. Attractive credit terms for customers

4. Reduced uncertainty about sales volume.

ea

For sales after the inttation of

e seasonal cating

o: Aeamaoe to eaeece ryt ae ees ee cere

©. Alternative 2 with P10,000 in savings. pais ae 76,860 t

& Arena Fun e100 neavings 2 g R588 5

029 tent ve amas? 0. nina open os meee traf

a. 6% G ee 500 per month occurs, and the individual spends

to 7300 ot rats marge! propeety fe Save

34. Newman Products has received proposals from 9.) é

C34 Noman rogues spasm sroccoax system to speed OE 98 ‘

Svar] banks 10 eign receives an averoge of 700 :

checks per day averaging P1.800 each, and its COS fag Tomas Corporation produces skincare products for“

Is 7% per year. Assuming that

‘produce equivalent processing

560-day year, which one of the

Newman?

fof short-term funds

results and using &

following proposals is optimal for

‘a. A PO.SO fee per check.

B.A fat fee of P125,000 per year.

€._ A fee of 0.03% of the amount collected.

6. A compensating balance of P1.750.000.

the Frame Supply Company has just acquired 3

Tange account. and needs 0 increase its working

waittal by 100,000. The company controler nas

‘of funds which s given below

pany’s receivables, which

ih and have an average

factor will advance

men and women, An incredibly smooth moisturiang

Cream has come onto the market that the company

‘S anxious to. produce and sell. Enough capacity

‘exists in the company’s plant to produce 40,000

nits of the cream each month. Vanable costs to

manufacture and sell one unit would be P3.50, and

fixed costs associated with the cream would total

340,000 per month. The company’s Marketing

Depertment predicts that demand for the new cream

wil exzees the 40,000 units that the company is

ble to produce. Additional manufacturing space can

Be rented from another company at 0 fixed cost of

14.000 per month, Variable costs in the rented

faciity would total P4.00 per unt, due to somennat

fess efncent operations than in the main plant, The

ew cream wil sell for P42.00 per unit.

‘The monthly break-even point forthe new cream

units is:

MAS. PREWEEK

Tas REM |

EL PROPESSIONAL SERVICES

O40 ranganven

Oat Junatine. Company is cannderng «

TPR $1 SrouRS reject val equiva ey tance

Tee Pattee a,go0, co "sushi

842.4 learning curve of BO assumes that dee

SoNE"re: reduced. by 30% for each, doubling, o

Qutput What te incremental cont of ke LE 4

Srogucee ay_an approximate percentage of the

Chit reduced? PAN unis within & atch ave

Considered to have the average complet

hatoaten aim °

ary Ste .

BL 386 a, 64%

‘Question No, 43 and 44 are based on the following

wnat is the expected net present vaive to

project?

{\s0.motatie Company is considering four indepencen

83,000

(108,200)

(152,200) ®

(442,000)

Sropayiine Project Investment ‘NPY. he oa

1 a0 ae oo P $00,000 FP 40,004 th

3er = 600 Se u P 900,000 P120,00¢ 7

tbat om Ww 1,600,000 — P150,000 E

6, using the micpoint of each range as the best

truiate for that range, whet ls the best estimate of

the expected sales of the new product?

2 “ase 800

3. 380 @. 800

45.Glare Company's net accounts receivable were

500,000 at December 31, 2019 and P600,000 at

December 31, 2020, Net cash sales for 2020 were

P200,000, ‘The accounts receivable turnover for

Projects 1, Li, and 111 only

b. Projects [, KY'ana Lv only

Projects fl, {tl, and IV only

©. Projects Ill and Iv only

1051. West Company has a subunit that reported the

following data for 2015.

Investment turnover

15x

Sales, 750,000

Return on sales, 8%

‘The imputed interest rate \s 12%

What is the

2020 was 5.0. What were Glare’s total net sales for divisions residual income for 20197

20207 a. 60,000 €. P20,000

2,950,000 ¢. P3,200,000 'b, P30,000 a. PO

b. P3,000,000 d.P5,500,000 Ose,

8.46, During 2020 Rock Company purchased P960,000 of

Inventory. The cost of goods sold for the year was.

900,000, and the ending inventory at December 31

was P180,000. What was the Inventory turnover for

the year?

a 64 7.2

bd. 6.0 4, 5.0

Question No. 47 and 48 are based on the following

Information,

Silver Company needs to pay a supplier's invoice of

60,000 and wants to take @ cash discount of 2/10, net.

40. The firm can borrow the money for 30 days at 11%

Der annum plus a 9 percent compensating balance.

Page 5 of 8

www. prte.com.ph

Grand Company prepared the following preliminary

forecast concerning product X for 2020 assuming no

expenditure for advertising.

Selling price per unit

P10

Unit sales 100,000

Variable cost 600,000

Fixed costs 300,000

Based on a market study In November 2019, Grand

estimated that it could increase the unit selling price

by 15% and incraase the unit sales volume by 10%

Mf P100,000 were spent on advertising. Assuming

that Grand incorporated these changes in its 2020

forecast, what should be the operating income from

product x?

@. P175,000

¢, P205,000

b, P190,000

4. P365,000

MAS.PREWEE

mn'2020 as in SOM

e8raLing income Farge

1388 33 § "P840,000

800 Pess,o0e

4.116% Company ug

con ergo Sung S029 ot 40

Srrheoa Cone meted x8

Puy, 40,000 bavipoine gpa unt

Ith. ving pl

28aitional une

‘one E

edaition

Special

ng aeaRRI*s OF 400.000 vaipoint

‘manutactoring

Ber unit, and fixed

A Soe

ach Was received to

Os.

‘al “cost of ‘pS

ton 9

were accepteas

2. P280. 000,

P240,00

Bs.

Increase

& 760,000 increase

O decrease G, PiS0; 009 Nerease,

Company currentiy opera

which had a uies foe"

A company obtainin

credit wil! pays

everything else be

‘The ascount pe

8

Naher bercertage’

Which toot woule: most

the ‘best. course “or

uncertainty?

2% Cost-volume-profit analysis

B. Expected vaive (aus

Wely be used to 3:

‘action “under

Seekeam evaluation ona review technique pene

the yeas ons. Seattergenrnvation ana ae

PPSTELING resus for the yaadsions

December 31/2019" a5 ans, N7- tn stustons nen management muse 0 ym

Nort ‘ere ete FEECING cnestimeconiy ee EEE

ae 600,000 p300o0 where tase ssh se pee,

arable costs 310/909, 2° auowtng is nok relevame es Pay wmeN ene

Sontribution 2s0;000 ToeSe8 B Beseoton cass VE tae Bion

‘agin Direct costs . Incremental

Sepmarecots gasagg "alan oo

Segment margin 180,000 30900 Oe. in a weParison of 2019 with, 2018, Boho:

Allocated costs £0,000 “a5'999 SoRENY'S "Inventory areave” Fatio increases

Net peat Panbog eg aee wore coy gTMOUR salen and in SCS amounts “6

Stetemenngt2lY unehanges, “Wnige eee following pe

ios dhe South alvision also sustained an erasing Satemans ecierne ae, imereased ~ inventory

ss during 2018, Wimbly's too Management is turnover ratio? cn

that the ne limination of thi aiveiogemert st Gost of goods sold decreaseg 1

Pie each division fed coats couie be Aum e. gunts receivable Wimoverincreasea

ciiminaee ated. I the South diver soy cee G. QB esse turnover increseee

Would ae, _AUALY %, 2009, ‘Wimayereeeee Sioes Prott percentage decieaseg

would have oer? 69. An advantage of tn

2 15,000 higher. 45,000 lower

D. P30,000 higher loner

. P60,000 higher

THEORY

41. The amount of inventory that a company would tend

to hold in stock would increase as th

2. Cost of carrying inventory decreases,

b. Variability of sales decreases

§ Cost of running out of stock decreases,

4. Length of time that goods arc’'in transit

decreases.

2. An appropriate technique for Planning and

mraegclling manufacturing inventories, such as one

«= Materials, components,

and subassemblies, whose

«demand depends on the |

level of production is,

Moterials requirements planning.

Fe

the internal rate of

rate that

Cash inflows with the outflows.

YS88 discounted cash flows whereas the internal

rate of return model does not.

equates the discounted

10. In evaluating a cay

pital budget project, the use of th:

et present value

Model is generally not affected b

Method of funding the project.

b, Initial cost of the project.

wwi

MAS.PREWEES

das ae Te er et

© oi see 9x

Cate a ernest tastes

Beets a ma

Seiee"

Peet rau at

5 Een a gcen a

5 Seal aatone!

eva .eetas”

‘ota. nianagers shat auipate oreais“Srucade ome

Mopagerforred 10 a5 NewS

ok cc. isk seeking

aspen mrenee -. ‘ad: coment

ana ;

vc opjective of

cas creamy gas ie

: on Cer a4 of perfogivision maximize 2

ee sega tnt

om Reeders os =

ow sarees cmere ree © Bios vanes momen, Sad

stent Ss aoe

~h anys wo erage cot var sadvantag® 7 .

a ore nan ‘the compeny’s “weighted average 2a. wnat 6 ane gas 43 0 oe,

Sinan rere! rn. Whestment (ROL) rather eh Ce

FE crete eae

» Eetceggrammeracnws tee Eis ae SS

Seater tan cura. managers’, percentage, while £

a. Sater Bre pecs neat oe oe Rol Hay tae to resectng

Bositive cash f1OW5.

Cana arrmwesore conaity cunment meas 2 ROL does oe OW ani el

2 an lowes ee am mveszment aernatve, Rh does oot Chea

Investor Is Satee ‘Rsk seaking: 4, BOE SbaE nat reflect all economic

Bee pane raz. tne benefits of debt tinancing over SOUCY ve

‘O18. mvestrent managers devel penises oS, hu Benya be Maes eanies oe

rnvestment anager cestaat ana meredy eaves Sh aaa

eeetak. Noe and tneeby Neigh margins tax rates ang eur NOTIN

vera sk: 3 porte, sks, that cant Be benemts eae «

developmen ough a portal are called: o. Bmrmaioal tax rates an few rons rest 12%

temarnet sks. nef

BUeoyotematie rks. crefiesrginal tax rates ané many noninterest

2 Fimespeciic risks tax benefts

& Systemetic risks. a. Dhrmarginal tax rates and many noninterest tex

benents

17. wnien one of the following factors might, conse

wren one of, he flowing cnancil suture? 023. The ootimal captatzation for an organization wSusiy

firm eo increase in the corporate income tax rate. can be determined by the:

3: “increased economic uncertainty. o. Maximum degree of financial leverage (OFL)

2b Aninerease in the price/earnings ratio. ‘b. Maximum degree of total leverage (OTL).

§ Agecrease in the times interest earned ratio. @. Lowest total weighted-average cost of capital

qwace),

(a0. gyvan Corporation nas the following capital, Intersection of the marginal cost of capital and

structure: the marginal efficiency of tn

Soe nore rioongo : iclency of investment.

‘equity 1,000,000 24. Which of the following formulas should be used

Common equity 39,000,000 Saleulate the aconomnic rave of return ot ena

st \t

The financial leverage of Sylvan Corp. would (Dividends + ct Wwided

: ange in pri re

Ineraase 259 result of: Ceatnning price. print Se MN

Tssuing common stock and using the proceeds to b. (Net income - preferred dividend) divided by \"

m preferred stock common shares 0

o. Tung common sock and using the proceeds to franwat peice per snare clviged

c. Fnstcg fue vesmens a eee

7 itn

Seca cg mimrrea's wm 6. Bent a war ten by mere eno

Page 7 of 8

MAS. PREWEEK

(8-25. wnien of tne roiwing factors, |

ee Sfaranoise

ime foreae, iin rer 2

ort ace, re goa staal nr

ee sears mar mca we

© alee et ama ofc” Fpl etal tee

See ee ee etre manne Bin companies a0

mee tle ee esy 4g, Excimer very NON TY

Sean ey inane oes reese a

poses SF en baes he Matanes cae yen 2 eae eave ne protuc

Pertasenconase Sten soc sre ee pe of tte =o

BRR bb. Arise in average NOUseNON comme. plementary

aeons A neat "

commas he population ;

“me composition of th

re comets seatemant depend mort Nee

raises wneerest rates

828.

iit mast WKely

central bank of 2 country,

firm's

irae working capital policies.

2: financing and dividend policies: fhe. the, 1 park of 8 rane

Be EeSired revel of liquidity: 3 sherpa OUT vate

forking capital polices: sharpltegase in relative Valu ;

ee ree o. Komain unchanged 1 Yalu: sa

in relative value:

jue at first and when

GSpital budgeting anc

a

(029. Aipha and Bet

way except for

er

nt payout ratio.

ayerorit margin next year

e) Decrease

@. Decrease

return to

are equal in every reatve,

are two igend payout, cates. APIS ‘rarply inv

aivegtio wine Beta nes 2 40 ve neal value

"even this differences:

SNE aed the C37 IF tne US collar

Currencies of many

are two firms that

fe relative to the

jectines in. valu

ners, the likely

‘of its trading part

a Beas profit marai

"profit margin.

F Beis Baier surtmnabe rate of STOW? fesuitethat

than does Beta. eu Pt urrencies wil depreciate against (he

c. btass plowback ratio Is less an Beta's dollar.

plowback ratio. bee Us balance of payments deficit will become

0 rene as nigher internal rate OF growth than worse.

oes Beta c. US exports will tend to increase.

$. Us imports will tend to Increase.

5 30. firm ts, currently OPeranng at full capacity and =

A firm spicient. assets to Just SUDPOT, capacity vy g 38. If the value of the US, dollar 1 feraien currency Sit

wns fe are expected fo Increase °e at feveraal markets changes from $1 =6 marks Xo $1 =4 marks Benn

sales: Parowth next year. Net woreed the ieand «The Garman mark has depreciated against the ai

rate ing. costs are expected tO Vere directly dollar.

operat “Tne interest expense, the Oe direct, —_p,_ German imported produets in the US will pecome fs:

with f2tgend payout ratio are fixed. The net income more expensive. ‘ive

the couuve. Assume you are COmPa0S net inmars cS tourists in Germany will find thelr dollars will Oc

sitive, Agratements to this year’s financial buy more German products. *¢

Preements. Which one of the folowing Values _-d-_ US exports to Germany should decrease: :

sad be unchanged from this year? . P

{9 39. Which of the following factors is least ely Xo affect

2. profit margin

b. capital intensity ratio.

c. debt-equity ratio

d. plowback amount

31. The market for outstanding,

called the

a, Primary market.

b. New issue market.

as a percentage of sales

listed common stock is

¢. Over-the-counter market.

d. Secondary market.

2 country's currency foreign exchange rates?

a. Interest rates In the country.

b. Political stability in the country,

¢._ Inflation in the country.

d. The tax rate in the country.

(C40. Which of the follo

supply chain management?

2, Information technology.

b. Accurate forecasts.

wing is not an Important aspect of

132.19

a competitive market for labor in which demand is

stable, If wor

rkers try to increase their wage c. Customer relations.

Employment must fall.

of e

d. Communications.

www. prtc.com.ph MAS.PREWEEK

MANAGEMENT ADVISORY SERVICES

DEAN APOLINARIO D. BOBADILLA

Preweek — Oct. 2019

Siarerunn arn scateaay§

pret 200-75 aBn0 feces

—o NO. 8 Answer. C

as D/E ratio; 150/159 o

Sales: 780,000 + 130,000 = 910,000

oacaogetd amas et ae

P/E: 23/250 920% :

No.3

cma: (av—2M)+8M 075 Noo

Rea. profit before tax: 36M*.15.6 6M nawer : :

Target sales: (3M + 6M/.75 uM Dividend yield: 2/23 0.087 :

Answer: 8

No. 12

No.4 Inorder to have goal congruence, investimen

Composite weight: decision should be evaluated in terms of res

No. 19 30/150 20 incorne

No. 5 75/150 50 Answer: ©

No. 53 45/150 30

WACM per unit: (2°4.5) + (57) + (3°6) No.12

=6.20 Ave. Investment: (1.2M +2M)/2 = .6M

No.4 ‘Oper. income: 1.1M-.7M = 400,000

Target sales: (961,000 + 161,200)/6.2 . ROI: 400,000/1.6M 25%

181,000 Answer: 8

Model $3: 181,000°.3 54,300

Answer: A NO. 13

‘Oper. income: 1M -.5M 500,000

No. Less: Minimum returns 2M*.15 300,000

105-(20410+5+ 4) =62 Residual income 200,000

(CM/MH, XR2000: 62/4 15.50 Bonus: 200,000°.2 49,000

Variable cost per unit, Answer: ©

KT6500 27412 +645 50.00

Opportunity cost 3 hrs.*15.5 46.50 No.14

Minimum price 96.50 Net income: (35M ~5M).6 em

Answer: B Income to common: 18M — aM. 14M

Dividend per share — common

No.6 14M*.30+2M 2.20

Variable cost (20 +15 +12 +3)= 50 Answer: D

‘Opp. cost (10,000/1,000) 10

Relevant cost per unit co) No. 15

Answer: A EPS: 14M 32M. 7.0x

Market price: 7*8 P56

No. 7 Answer: B

om 23

DL R No. 16

vou 10 KS = Kar + BlKaaa— Kae)

Var. admin. Cost 2, = 5% + 6(12%-5%)

Total 47 Answer: A.

Opportunity cost

(100~38-22-19.5+25 18 NO. 17 Ks = 6% + 1.3(11% - 6%) =12.5%

30.67

Maximum price 6

Page 1 of 3

samy

an2%6

7933

Lotet purchase 52,000

2,000*.65* 44320 03

Deprec tax shieig ee

6.067+2 ean (as.202

PV, Lease payments a

14,500" 652 6a0e4 25.26

Advantage ~ Lease 3698

No. 21

uv 40,000

72x shield: (40,000. 60,000,2 “eave

Net proceeds 44,000

Answer ¢

No. 22

10,000 + 6587 + 0.65, 23,356

Answer: 8

No. 23

(7.4M*.4371)- 3.5 = 265,460

Answer: ¢

No. 26

Cash flow before tax: 2,000°50 100,000

‘Annual ATCF:

(100,000*.6) + (20,000°.4) = 68,000

‘Note: Recalculate by ignoring the salvage value

in the computation of depreciation,

Deprec: (105,000/5) 21,000

AATCR: (100,000*.6) + (21,000*.4) = 68,400

No.3

Inditference Rave:

Dit incost/DAL in investment }

(6,050,000 6,000,010}/(000

No. 34

Alternative

‘8 360*700) 126,000 ™

8 125,000

© 360*700%1,800% 0003 Lye gn, 1

D_3,750,000%.07 122,500

Answer: D

owest co

No. 35

Interest: 100,000¢ 1

Service fee: 125,000*.02+12

Total

Less cost savings,

Net cost

k= 16000/100000

Answer:

10,000

30,000

40,000

24,000

46,090

16%

NO. 37

Net collections: 700 units x 10 x.98,

Answer: ¢

6,860

No. 38

Marginal propensity to save:

Increase in savings/increase in income

Increase in savings: 500 ~ (2,800 - 2,500)

Answer: A 200

Marginal propensity to save: 200/500 40%

No. 27 Answer: B

The deprec. period used is 5 years though the life

1s 10 years, NO. 39

After tax annual cash inflow Current breakeven units: ae

100,000°.6 60,000 340,000 + (123.50) J

TF ata = ~~ Page 2 of 8

herrea)

a ad te,

3s Siz (earn

fe 2036 (siz

(20.96 x2) 512 Sov%

(Not) + (300".48) + (500"-25) + (700°.35)

Sto

Brower: 8

ote (500,06 500,000)/

ne AE ayn (500,000 + 620,0001/2

red 550,000

ccountsaies: $50,000°5 2,750,000

ash sales 709.090

ota sales 3.950,000

answer: A

coos” 300,000

Aad inventory end 180,000

Wir ovatieie for sale 1,080,000

Less purcheses 950,000

120,000

Beginning inventory

‘ave. inventory:(1207 + 180T}/2 = 150,000

Inventory turnover: 900,000/150,000 = 6X

No. 47

k211+ (100-9) 12.09%

Answer: C

No. 48

Cost of foregoing cash discount

K = 2/98 x 360+ 30 29.49%

No. 49

Present value:

Years 1-5 (420,000*3.79) 1,591,800

Year 6 (100,000"0.56) 56,000

Total 1,647,800

Investment 1,800,000

Negative NPV 152,200)

Answer: C

Werreet cena %

New Unit ast 900"5 5) ~400,000 = 205.000

No38 -

Sie Pree qggot/aer =

Seat gene OO sys. 00 2 é

s 1

Profit per unit 26

Order size 35,000

Excess capacity ‘42.002

‘Regular sales given up 3.000

No. 53

Additional profit (15,0026) 380,000

Current profit 315,000

New profit 705,000

Answer: B

No. 54

Sales price ~ special sale 23

Deduct:

Regular variable cost 16

Additional OT cost a

Profit per unit 4

Unit sales 40,900

Additional profit 169,009

Answer: C

No. 55

The closure of South Division would mean to give

Up the segment margin of P30,000. As there is

no avoidable common cost, the profit for the

company would decrease by P30,000.

‘Answer: P30,000 lower

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HshshjaaDocument6 pagesHshshjaaPaula Villarubia0% (1)

- EmeyesDocument6 pagesEmeyesPaula Villarubia100% (2)

- P S P C: Ilipinas Hell Etroleum OrporationDocument16 pagesP S P C: Ilipinas Hell Etroleum OrporationPaula VillarubiaNo ratings yet

- ArefbitiDocument7 pagesArefbitiPaula Villarubia100% (1)

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- NakakaxDocument3 pagesNakakaxPaula Villarubia100% (1)

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Document4 pagesTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNo ratings yet

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Document4 pagesTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNo ratings yet

- Mas 2804 PDFDocument19 pagesMas 2804 PDFPaula VillarubiaNo ratings yet

- Assignment No. 4Document3 pagesAssignment No. 4Paula VillarubiaNo ratings yet

- ScholarshipsponsorDocument1 pageScholarshipsponsorPaula VillarubiaNo ratings yet

- At 2503Document43 pagesAt 2503Paula VillarubiaNo ratings yet

- AFAR Preweek PDFDocument8 pagesAFAR Preweek PDFPaula VillarubiaNo ratings yet

- JV ZZZZDocument32 pagesJV ZZZZPaula VillarubiaNo ratings yet

- ApaDocument2 pagesApaPaula Villarubia100% (1)

- AT L. R. Cabarles/J.M. D. Maglinao Quiz 3 SET A OCTOBER 2019Document2 pagesAT L. R. Cabarles/J.M. D. Maglinao Quiz 3 SET A OCTOBER 2019Paula VillarubiaNo ratings yet

- Ap Set ADocument2 pagesAp Set APaula VillarubiaNo ratings yet

- 1pb - AfarDocument12 pages1pb - AfarPaula VillarubiaNo ratings yet

- V MG AnalysisDocument2 pagesV MG AnalysisPaula VillarubiaNo ratings yet

- First Pb-FarDocument16 pagesFirst Pb-FarPaula VillarubiaNo ratings yet

- 01 - Time Value of Money AKDocument1 page01 - Time Value of Money AKPaula VillarubiaNo ratings yet

- SUBWAYDocument1 pageSUBWAYPaula VillarubiaNo ratings yet