Professional Documents

Culture Documents

Law of Contract (Mid) - 1

Law of Contract (Mid) - 1

Uploaded by

enduardoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law of Contract (Mid) - 1

Law of Contract (Mid) - 1

Uploaded by

enduardoCopyright:

Available Formats

Prepared by: Fareed Khan Tareen Page 1

Contract of Indemnity

A contract in which one party promises to save the other from loss.

Caused to him by the conduct of promisor himself, or by the conduct of any other person.

Contingent contract – future contract.

Deals with loss caused by the conduct of a person.

Loss not caused by events or accidents.

Parties in Contract of Indemnity

There are two parties in contract of Indemnity.

1) Indemnifier or promisor

The person who will save the loss of another by his conduct

2) Indemnity holder or promisee

The person be saved from loss by conduct of indemnifier

Example:

“A” contracts to indemnify “B” against the consequences of any proceedings which “C”

may take against “B” in respect of a certain sum of 200 Rupees. This is a contract of

indemnity

Contract of Guarantee

A contract of guarantee is a contract to perform the promise, or discharge the liability of a

third person.

Parties in Contract of Guarantee

There are three parties in contract of guarantee.

1) Creditor

The person to whom guarantee is given

2) Principal debtor

The person in respect of whose default the guarantee is given.

3) Surety

The person who gives guarantee is called surety.

A guarantee may be either oral or written.

What is difference between Contract of indemnity and surety?

In both contracts loss is saved.

There are two parties in contract of indemnity and three in contract of Guarantee.

In contract of Indemnity person is not specified, who will save the loss meanwhile in

contract of Guarantee the person is specified, who will save the loss that is surety.

Prepared by: Fareed Khan Tareen Page 2

Consideration of Guarantee

Anything done or any promise made for the benefit of creditor or principal debtor.

Consideration of surety.

Example

“A” requests B”” to sell and deliver to him goods on credit. “A” agrees to do so, provided

“C” will guarantee the payment of the price of the goods. “C” promises to guarantee the

payment in consideration of A’s promise to deliver the goods.

Surety’s Liability

The liability of surety is co-extensive with that of principal debtor.

Example: -

“A” guarantees to “B” the payment of a bill of exchange by “C”, the acceptor. The bill is

dishonored by “C”; “A” is liable not only for the amount of the bill but also for any

interest and charges which may have become due on it.

Continuing guarantee

A guarantee which extends to a series of transactions is called continuing guarantee.

Example

A” in consideration that “B” will employ “C” in collecting the rent of B’s Zamindari,

promises “B” to be responsible, to the amount of 5000 rupees for the due collection and

payment by “C” of those rents. This is a continuing guarantee.

Revocation of continuing guarantee

A continuing guarantee may, at any time be revoked by surety,

As to future transactions,

By notice to the creditor.

Revocation of continuing guarantee by surety’s death

Death of surety revokes guarantee.

Liability of two persons as co-surety’s

Two are more than two sureties and make arrangement between them.

Or second contract made between two surety’s so cannot affect first contract.

Discharge of surety by variance in terms of contract

Any variance (change), made without the surety’s consent in terms of the contract

between principal debtor and the creditor, discharges the surety as to transactions.

Example

“C” agrees to appoint “B” as his clerk to sell goods at a yearly salary, upon A’s becoming

surety to “C” for B’s duly accounting for moneys received by him as such clerk.

Afterwards without A.s consent, “C” and “B” agree that “B” should be paid by a

commission on the goods sold by him and not by a fixed salary. “A” is not liable for

subsequent misconduct of “B”.

Prepared by: Fareed Khan Tareen Page 3

Discharge of surety by release or discharge of principal debtor

The surety is discharged by any contract between the creditor and principal debtor by

which the principal debtor is released or by an act or omission of creditor.

Principal debtor is discharged by the non performance of creditor so surety is also

discharged.

Principal debtor released after payment of amount so surety discharged.

Example

“A” gives a guarantee to “C” for goods to be supplied by “C” to “B”. “C” supplies goods

to “B”, and afterwards “B” becomes embarrassed and contracts with his creditors

(including C) to assign to them his property in consideration of their releasing him from

their demands. Here “B” is released from his debt by the contract with “C”, and “A” is

discharged from his surety ship.

Discharge of Surety when creditor compound with principal debtor

Creditor compounds in which creditor makes a composition with, or promises to give

time.

Or agrees not to sue principal debtor.

Without the consent of surety.

Discharges the surety.

Surety not discharged when agreement made with third person to give time to principal

debtor

Where a contract to give time to principal debtor is made by the creditor with a third

person, and not with principal debtor, the surety is not discharged.

Creditor’s forbearance to sue does not discharge surety

Mere forbearance on the part of the creditor to sue the principal debtor or to enforce any

other remedy against him does not discharge the surety.

Example

“B” owes to “C” a debt guaranteed by “A”. The debt becomes payable. “C” does not sue

“B” for a year after the debt has become payable. “A” is not discharged from surety ship.

Release of one co-surety does not discharge others

Where there are co-sureties, a release by the creditor of one of them does not discharge

the others; neither does it free the surety so released from his responsibility to other

sureties.

Discharge of surety by creditors act or omission

If the creditor does any act which is inconsistent with the rights of the surety, or omits to

do, any act which his duty to the surety requires him to do, and the eventual remedy of

the surety himself against the principal debtor is there by impaired the surety is

discharged.

Example

“B” contracts to build a ship for “C” for a given sum, to be paid by installments as the

work reaches certain stages. “A” becomes surety to “C” for B, s due performance of the

Prepared by: Fareed Khan Tareen Page 4

contract. “C” without the knowledge of “A” prepays to “B” the last two installments. “A”

is discharged of prepayment.

Rights of surety on payment or performances

Where a guaranteed debt has been due.

Or default of the principal debtor to perform a guaranteed duty has taken place.

The surety is liable for performance or payment.

All the rights invested which creditor had against principal debtor.

Surety’s right to benefit of creditors securities

Surety is liable for the security of creditor which has against the principal debtor at the

time of surety ship.

Security given to creditor by principal debtor.

Default committed by principal debtor.

Surety liable to pay.

Security discharge to extent of value of security.

Example

“C”, a creditor whose advance to “B” is secured by decree, receives also a guarantee for

that advance from “A”. “C” afterwards takes B’s goods in execution under the decree,

and then, without the knowledge of “A”, withdraws the execution. “A” is discharged.

Guarantee obtained by misrepresentation invalid

Any guarantee which has been obtained by means of misrepresentation made by the

creditor or with his knowledge concerning a transaction is invalid.

Guarantee obtained by concealment invalid

Any guarantee which the creditor has obtained by means of keeping silence as to material

circumstances is invalid.

Guarantee on contract that a creditor shall not act on it until co-surety

joins

Where a person gives a guarantee upon a contract that the creditor shall not act upon it

until another person has joined in it as co-surety the guarantee is not valid if that other

person does not join.

Implied promise to indemnify surety

In every contract of guarantee there is an implied promise by the principal debtor to

indemnify the surety: and the surety is entitled to recover from the principal debtor

whatever sum he has rightfully paid under the guarantee.

Co-sureties liable to contribute equally

Where two or more persons are co-sureties for the same debt, either jointly or severally

and whether under the same or different contracts and whether with or without the

knowledge of each other the co-sureties in the absence of any contract to the contrary, are

liable as between themselves to pay each an equal share of the whole debt.

Prepared by: Fareed Khan Tareen Page 5

Sale and agreement to sell

A contract of sale of goods is a contract.

Where the seller transfers or agrees to transfer the property to the buyer for price.

A contract of sale may be absolute or conditional.

Where under a contract of sale property transferred from the seller to buyer the contract is

called sale.

But where property to be transferred in future then it is agreement to sale.

Contract of sale

When a property delivered or condition fulfilled it is sale.

Agreement to sell when property or goods ready to be delivered then it becomes contract

of sale and if Goods delivered then it is sale.

Sale of goods

Contract of sale

Absolute

Goods delivered

Sale.

Agreement to Sale

Conditional

Goods not ready deliver in future

In future Goods ready or condition fulfilled

Contract of sale

Goods delivered

Sale

Ingredients of contract of sale

The possession must be transferred.

Seller and buyer should be different persons.

Goods in exchange of money are sale.

Goods in exchange of Goods are not sale.

Money in exchange of money is not sale.

Definitions of the following terms

1) Buyer

Buyer means a person who buys or agrees to buy goods.

2) Delivery

Delivery means voluntary transfer of possession from one person to another.

Prepared by: Fareed Khan Tareen Page 6

3) Deliverable state

Goods are said to be in a deliverable state when they are in such state that the buyer

would under the contract be bound to delivery of them.

4) Fault

Means wrongful act or default

5) Future goods

Future goods mean goods to be manufactured or produced by the seller after making the

contract of sale.

6) Goods

Goods mean every kind of property.

7) Price

Price means the money consideration for a sale of goods.

8) Property

Property means every kind of moveable and immovable property.

9) Quality of goods

Quality of goods includes their state and conditions.

10) Seller

Seller means a person who sells or agrees to sell goods.

11) Specific goods

Means goods identified and agreed upon at the time a contract of sale is made.

Contract of sale how made

Contract of sale is made by an offer to buy or ,

Offer to sell for a price.

Then acceptance of such offer.

The contract may provide for the immediate delivery of the goods or immediate payment

or both.

Payment by the installments.

Delivery or payment both in future.

A contract of sale may be made in writing or by words of mouth.

Existing or Future goods

The goods in contract of sale may be either existing goods, owned or possessed by the

seller.

Or future goods to be prepared in future.

Goods perishing before making of contract

Where there is a contract for sale of specific goods, the contract is void if the goods

without the knowledge of the seller have at the time when the contract was made,

perished or become so damaged.

Prepared by: Fareed Khan Tareen Page 7

Goods perishing before sale but after agreement

Where there is an agreement to sell specific goods, and subsequently the goods without

any fault on the part of seller or buyer perish or become so damaged therefore the

agreement is void.

Ascertainment of price

The price in a contract may be fixed or ,

May be left to be fixed.

Where price is not determined reasonable price shall be paid by the buyer to the seller.

Implied undertaking as to title

On part of seller he has the right to sell.

An implied warranty that the buyer shall have and enjoy quiet possession of goods.

Goods shall be free from any charge in favor of third party.

Sale by description

Where there is a contract for the sale of goods by description there is an implied

condition that the goods shall correspond with the description.

If goods not corresponds buyer may reject goods and claim damages.

Implied condition as to quality of fitness

Buyer expressly make known to the seller the particular purpose for which the goods are

required.

There is an implied condition that the goods shall be reasonably fit for such purpose.

If the particular patent or trade name given so no implied condition as to fitness.

Seller to inform buyer of defect in goods.

Sale by Sample

If there is a contract of sale by sample.

Then implied condition is that the bulk (whole stock or products) shall correspond with

the sample in quality.

That the buyer shall have a reasonable opportunity of comparing the bulk with sample.

That the goods shall be free from any defect.

Prepared by: Fareed Khan Tareen Page 8

Duties of Seller and Buyer

It is the duty of Seller to deliver goods.

And duty of Buyer to accept and pay for them.

Payment and delivery are concurrent (parallel)

Seller shall be ready and willing to give possession and at the same time Buyer shall be

ready and willing to pay the price in exchange of possession.

Buyer may apply for delivery

Seller not bound to deliver.

Until and unless Buyer apply for delivery.

Rule as to delivery

Goods sold are to be delivered at a place fixed in contract.

Or at the place goods manufactured.

Seller may apply to appoint a place.

Seller bound to send goods in if the time is not fixed.

Or seller may apply for time to be fixed or he may send goods in a reasonable time.

Expenses of putting goods in deliverable state borne by seller.

Delivery of wrong quantity

Where the seller delivers to the buyer a quantity of goods less then contracted buyer may

reject them.

Or may accept the goods and pay for them at contract rate.

Quantity of goods larger than contracted buyer may accept the quantity of goods

contracted and reject the rest extra one.

Difficult to separate the goods he may reject or accept the whole pay on contract rate.

The goods contracted to sell are mixed with goods of different descriptions.

Buyer may accept the goods contracted and reject the rest or may reject the whole.

Buyers right of examining the goods

Not deemed to accept them unless and until he has had a reasonable opportunity of

examining goods be given.

Buyer not bound to return rejected goods

If goods are delivered to the buyer and he refuses to accept them.

It is sufficient to intimates seller.

It is not his duty to send them back.

Prepared by: Fareed Khan Tareen Page 9

Liability of buyer for neglecting or refusing delivery of goods

When seller is ready and willing to deliver the goods.

Requests buyer to take delivery.

Buyer does not accept it.

Buyer is responsible for loss.

Reasonable charge be paid for custody.

Suit for price

Goods passed by buyer.

Buyer wrongfully neglects to pay for the goods.

Seller may sue him for the price of goods.

Damages for non-performance

Buyer wrongfully neglects and pay for goods.

Seller may sue for damages for non-acceptance.

Damages for non-delivery

Seller wrongfully neglects to deliver goods to buyer,

Buyer may sue seller for damages for non-delivery.

Specific performance

In any suit of breach specific performance of contract be demanded by plaintiff.

Prepared by: Fareed Khan Tareen Page 10

You might also like

- Bank of Nova Scotia Vs Hellenic Mutual War Risks AUKHL910043COM137144Document18 pagesBank of Nova Scotia Vs Hellenic Mutual War Risks AUKHL910043COM137144Samaksh KhannaNo ratings yet

- Accounting Entries in R12 Account Receivables - Oracle Apps Knowledge SharingDocument6 pagesAccounting Entries in R12 Account Receivables - Oracle Apps Knowledge Sharingdevender143No ratings yet

- First Preboard: Mark Alyson B. Ngina, Cpa CmaDocument11 pagesFirst Preboard: Mark Alyson B. Ngina, Cpa CmaSer Crz JyNo ratings yet

- GuaranteeDocument86 pagesGuaranteeManjeev Singh SahniNo ratings yet

- Unit-Ii Indemnity and GuaranteeDocument11 pagesUnit-Ii Indemnity and Guaranteepravin awalkondeNo ratings yet

- Contract SsDocument20 pagesContract SsMir Mahbubur RahmanNo ratings yet

- Indemnity and GuaranteeDocument11 pagesIndemnity and GuaranteeTrishala SinghNo ratings yet

- Special ContractsDocument49 pagesSpecial ContractsVIJAYA M100% (1)

- GuaranteeDocument3 pagesGuaranteeJwalin Desai0% (1)

- Law of Contract, 1872 IIDocument41 pagesLaw of Contract, 1872 IIM ayoubNo ratings yet

- Indemnity and Gurantee BL Week 6 06032023 102419amDocument33 pagesIndemnity and Gurantee BL Week 6 06032023 102419amDaym MehmoodNo ratings yet

- Contract of Indemnity and GuaranteeDocument35 pagesContract of Indemnity and GuaranteeDileep ChowdaryNo ratings yet

- Indeminity and GuaranteeDocument18 pagesIndeminity and GuaranteeAanika AeryNo ratings yet

- Reference Material For Contracts II Guarantee Part 1Document5 pagesReference Material For Contracts II Guarantee Part 1RajnishNo ratings yet

- Contract 2Document21 pagesContract 2E S ArunimaNo ratings yet

- Contract Ii Model Answer PaperDocument34 pagesContract Ii Model Answer PaperShubham PandeyNo ratings yet

- Contracts of Indemnity and GuaranteeDocument30 pagesContracts of Indemnity and GuaranteetarushnicheNo ratings yet

- Indemnity and Guarantee - PresentationDocument16 pagesIndemnity and Guarantee - PresentationDure ShahwarNo ratings yet

- Week 2-5 - GuaranteeDocument118 pagesWeek 2-5 - GuaranteePrateek KhandelwalNo ratings yet

- Contract of Indemnity and Guarantee AutosavedDocument41 pagesContract of Indemnity and Guarantee AutosavedKathuria AmanNo ratings yet

- Contract LawDocument57 pagesContract LawJannat ZaidiNo ratings yet

- GuaranteeDocument48 pagesGuaranteetanujdeswal27No ratings yet

- Contract MidDocument3 pagesContract Midchandra sekharNo ratings yet

- Contract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheDocument9 pagesContract of Guarantee Definition of Contract of Guarantee: It Is A Contract To Perform The Promise or Discharge TheSuchitra SureshNo ratings yet

- Indemnity & GuaranteeDocument21 pagesIndemnity & GuaranteeSushmita DasNo ratings yet

- Unit Objectives Learning OutcomesDocument20 pagesUnit Objectives Learning OutcomesAkash BaratheNo ratings yet

- Contract (Bare Act) ExamDocument11 pagesContract (Bare Act) Exammehakjain.ballb2022No ratings yet

- Submitted ToDocument7 pagesSubmitted Tozamir zamirNo ratings yet

- 6 Indemnity Guarantee Bailment Pledge PDFDocument11 pages6 Indemnity Guarantee Bailment Pledge PDFPavan BasundeNo ratings yet

- Characteristics: State Etc. v. Bank of India. IDocument9 pagesCharacteristics: State Etc. v. Bank of India. IChaitu ChaituNo ratings yet

- Define Contract of IndemnityDocument1 pageDefine Contract of IndemnityKai VaipheiNo ratings yet

- GuaranteeDocument6 pagesGuaranteeSoumya RathoreNo ratings yet

- Business Law FinalDocument80 pagesBusiness Law FinalFakhira ShehzadiNo ratings yet

- Contract of Indemnity and Law of GuaranteeDocument7 pagesContract of Indemnity and Law of GuaranteeBilawal Mughal100% (1)

- Week 3-5 GuaranteeDocument108 pagesWeek 3-5 GuaranteeRamkumaar MadhavanNo ratings yet

- Contract of Indemnity and GuaranteeDocument20 pagesContract of Indemnity and Guaranteebhawanar3950No ratings yet

- Securities Law Contracts of GuaranteeDocument6 pagesSecurities Law Contracts of GuaranteesteNo ratings yet

- Contracts of IndemnityDocument17 pagesContracts of IndemnityShekhar ShrivastavaNo ratings yet

- LawDocument11 pagesLawSaad ArshadNo ratings yet

- Corporate and Other Laws - Notes - CA Inter (New) (1) ICADocument34 pagesCorporate and Other Laws - Notes - CA Inter (New) (1) ICADivyanshu SharmaNo ratings yet

- Special Contracts NotesDocument61 pagesSpecial Contracts NotesSHRAAY BHUSHANNo ratings yet

- The Surety Is Discharged From His Liability On 6 CircumstancesDocument5 pagesThe Surety Is Discharged From His Liability On 6 CircumstancesPriyankaJain100% (2)

- DTL LB 090419Document32 pagesDTL LB 090419Palak ChawlaNo ratings yet

- Indemnity and Guarantee PPT LawDocument37 pagesIndemnity and Guarantee PPT Lawshreeya salunkeNo ratings yet

- Contract Law-2 Internal Assignment 2yr - Sem-04 - LLBDocument33 pagesContract Law-2 Internal Assignment 2yr - Sem-04 - LLBMayur KumarNo ratings yet

- Fybms 157 Law Project Jai LilaniDocument6 pagesFybms 157 Law Project Jai LilaniDeesha MirwaniNo ratings yet

- Indemnity and Guarantee BbaDocument11 pagesIndemnity and Guarantee BbaTanureema DebNo ratings yet

- Important Circumstances Under Which A Surety Is Discharged From His Liability Are Given BelowDocument15 pagesImportant Circumstances Under Which A Surety Is Discharged From His Liability Are Given BelowPriyankaJain100% (1)

- CA Intermediate Other Laws Indian Contract ActDocument33 pagesCA Intermediate Other Laws Indian Contract ActAayush BiyaniNo ratings yet

- Business Law Week 6Document20 pagesBusiness Law Week 6s wNo ratings yet

- Indemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.Document6 pagesIndemnity and Guarantee by Asif Khan Qurtuba University Peshawar... BUSINESS LAW.shinwarrikhanNo ratings yet

- Module 2 - Law of Contract IIDocument54 pagesModule 2 - Law of Contract IIAnkitNo ratings yet

- Contract II Questions & Answers ReDocument48 pagesContract II Questions & Answers ReCATalystNo ratings yet

- SPECIAL CONTRACT Book NotesDocument30 pagesSPECIAL CONTRACT Book NotesPrateek MishraNo ratings yet

- Contract of Indemnity and GuaranteeDocument13 pagesContract of Indemnity and GuaranteeSudipta Bhuyan100% (1)

- B Law Unit 3 ColouredDocument30 pagesB Law Unit 3 ColouredRaghvendra SinghNo ratings yet

- 13, Contracts of Indemnity and GuaranteeDocument20 pages13, Contracts of Indemnity and GuaranteeGhulam Hassan0% (1)

- Contract of GuaranteeDocument66 pagesContract of Guaranteemalavikasa19No ratings yet

- Contract of Indemnity Contract of Guarantee Contract of Bailment Contract of Pledge Contract of AgencyDocument16 pagesContract of Indemnity Contract of Guarantee Contract of Bailment Contract of Pledge Contract of AgencyyashuNo ratings yet

- Contract-II Model AnswerDocument49 pagesContract-II Model AnswerRazal Nadeem100% (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- 03-OrmocCity2018 Executive SummaryDocument6 pages03-OrmocCity2018 Executive Summarysandra bolokNo ratings yet

- Vanraj Samrt Task 1Document7 pagesVanraj Samrt Task 1Vanraj MakwanaNo ratings yet

- Cookie Creations Adjusted Trial Balance Tuesday, December 31, 2013Document17 pagesCookie Creations Adjusted Trial Balance Tuesday, December 31, 2013Christopher ColumbusNo ratings yet

- FM ECO MarathonDocument98 pagesFM ECO MarathonShreyas PatelNo ratings yet

- Estimation ProcessDocument33 pagesEstimation ProcessMd. Mokbul HossainNo ratings yet

- Ch3 - test bank: corporate finance (ةقراشلا ةعماج)Document25 pagesCh3 - test bank: corporate finance (ةقراشلا ةعماج)sameerNo ratings yet

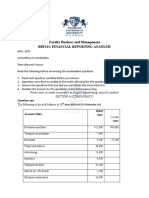

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- EXCHANGE Control Regulations, 1996 - Statutory Instrument 109 of 1996Document37 pagesEXCHANGE Control Regulations, 1996 - Statutory Instrument 109 of 1996Riana Theron MossNo ratings yet

- Sales I. Definition and Essential Requisites of A Contract of SaleDocument15 pagesSales I. Definition and Essential Requisites of A Contract of SaleCai TeeNo ratings yet

- Sd159 BondsDocument217 pagesSd159 BondsBurton PhillipsNo ratings yet

- Pure and Conditional ObligationsDocument5 pagesPure and Conditional ObligationsFelicity CabreraNo ratings yet

- U1A3-Assignment: (Cells Will Expand As You Type)Document2 pagesU1A3-Assignment: (Cells Will Expand As You Type)SerenaNo ratings yet

- Don Honorio Ventura State University: Name: Date: Professor: Section: Sex at Birth: ScoreDocument15 pagesDon Honorio Ventura State University: Name: Date: Professor: Section: Sex at Birth: ScoreAnabelle LacanlaleNo ratings yet

- Liabilities - Overview Accrual and Deferred Revenue - Handout PresentationDocument15 pagesLiabilities - Overview Accrual and Deferred Revenue - Handout PresentationZaira PerezNo ratings yet

- BPI Salary Loan App FormDocument2 pagesBPI Salary Loan App FormJeric VendiolaNo ratings yet

- Lembar Kerja Ud AbadiDocument40 pagesLembar Kerja Ud AbadiMelianaWanda041 aristaNo ratings yet

- Notes Land Titles and DeedsDocument5 pagesNotes Land Titles and DeedsMaria Fiona Duran MerquitaNo ratings yet

- PFRS 12 Disclosures of Interest in Other EntitiesDocument32 pagesPFRS 12 Disclosures of Interest in Other EntitiesRenge TañaNo ratings yet

- Article 1210 - Article 1213Document2 pagesArticle 1210 - Article 1213EricaNo ratings yet

- CLJ 2014 9 429 JyiscoDocument13 pagesCLJ 2014 9 429 JyiscojNo ratings yet

- Accounts Receivable Management ThesisDocument8 pagesAccounts Receivable Management Thesisdonnacastrotopeka100% (1)

- Finance For Decision Making Final ExamDocument7 pagesFinance For Decision Making Final ExamZinou HarcheNo ratings yet

- ART. 1197 o oDocument27 pagesART. 1197 o oAdriana Del rosarioNo ratings yet

- RTFDocument14 pagesRTFKarysse Arielle Noel JalaoNo ratings yet

- Tax Quiz 4Document61 pagesTax Quiz 4Seri CrisologoNo ratings yet

- Assignment, ANdallo, Ransey Ace DDocument3 pagesAssignment, ANdallo, Ransey Ace DRansey Ace AndalloNo ratings yet

- 2021 PDFDocument9 pages2021 PDFNekhavhambe MartinNo ratings yet