Professional Documents

Culture Documents

Instruccion Q 6

Instruccion Q 6

Uploaded by

Juan Estean RodriguezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instruccion Q 6

Instruccion Q 6

Uploaded by

Juan Estean RodriguezCopyright:

Available Formats

1.

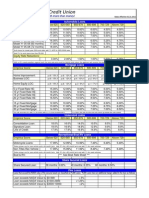

ZASUNI BhD is appraising an investment project which has an expected life of four

years. The initial investment, payable at the start of the first year of operation, is RM4

million. Scrap value of RM400,000 is expected to arise at the end of four years.

There is some uncertainty about what price can be charged for the units produced by the

investment project, as this is expected to depend on the future state of the economy. The

following forecast of selling prices and their probabilities has been prepared :

Future economic state Weak Medium Strong

Probability of future economic state 35% 50% 15%

Selling price in current price terms RM25/unit RM30 /unit RM35/unit

These selling prices are expected to be subject to annual inflation of 4% per year, regardless

of which economic state prevails in the future.

These selling prices are expected to be subject to annual inflation of 4% per year, regardless

of which economic state prevails in the future.

Forecast sales and production volumes, and total variable costs, have already been forecast,

as follows:

Year 1 2 3 4

Sales and production (units) 150,000 250,000 400,000 300,000

Variable cost (RM000) 2,385 4,200 7,080 5,730

Incremental overheads of RM400,000 per year in current price terms will arise as a result of

undertaking the investment project. A large proportion of these overheads relate to energy costs

which are expected to increase sharply in the future because of energy supply shortages, so

overhead inflation of 10% per year is expected.

The initial investment will attract tax-allowable depreciation on a straight-line basis over the

four-year project life. The rate of corporation tax is 20% and tax liabilities are paid in the year

in which they arise. ZASUNI has traditionally used an after-tax discount rate of 12% per year

for investment appraisal.

Required:

Calculate the expected net present value of the investment project and comment on its financial

acceptability.

The directors of ADDA Bhd are considering a planned investment project costing RM25m, payable at

the start of the first year of operation. The following information relates to the investment project:

Year 1 Year 2 Year 3 Year 4

Sales Volume 520000 624000 717000 788000

(units/year)

Year 1 Year 2 Year 3 Year 4

Sales Volume 520000 624000 717000 788000

(units/year)

You might also like

- Credit and Collection Policy: Multiple ChoiceDocument26 pagesCredit and Collection Policy: Multiple Choicepaul zosimoNo ratings yet

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Cold Steel: Lakshmi Mittal and The Multi-Billion-Dollar Battle For A Global EmpireDocument494 pagesCold Steel: Lakshmi Mittal and The Multi-Billion-Dollar Battle For A Global Empiredfhjsdkfhsdjfh88% (8)

- Dansk MinoxDocument1 pageDansk MinoxAksha Anand100% (2)

- Adidascorporatestrategy 1Document35 pagesAdidascorporatestrategy 1flinks100% (3)

- FM Lesson 3Document2 pagesFM Lesson 3asif iqbalNo ratings yet

- Case 1 - Capital BudetingDocument3 pagesCase 1 - Capital BudetingPooja KhimaniNo ratings yet

- Chapter 2 Problems On Capital InvestmentDocument2 pagesChapter 2 Problems On Capital InvestmentamananandxNo ratings yet

- Exercise2 - Q - Shares ValuationDocument2 pagesExercise2 - Q - Shares Valuationmiss aindatNo ratings yet

- Question One Acca 2014 June QN 1Document4 pagesQuestion One Acca 2014 June QN 1Joseph Timasi ChachaNo ratings yet

- Tutorial 8 QDocument2 pagesTutorial 8 QJason LimNo ratings yet

- MAF603 COC - StudentsDocument12 pagesMAF603 COC - StudentsZoe McKenzieNo ratings yet

- Afm QT Ans June 2022Document12 pagesAfm QT Ans June 2022Bijay AgrawalNo ratings yet

- b1 Free Solving (May 2019) - Set 3Document5 pagesb1 Free Solving (May 2019) - Set 3paul sagudaNo ratings yet

- TOPIC 4 Discussion Questions APRIL 2023Document2 pagesTOPIC 4 Discussion Questions APRIL 2023Miera FrnhNo ratings yet

- Case StudiesDocument47 pagesCase StudiesVIVEK KUMARNo ratings yet

- E&o - 2013 06 3 - RR - 4qfy13Document3 pagesE&o - 2013 06 3 - RR - 4qfy13Priesilia PresleyNo ratings yet

- Stocksview Report On JiyaDocument3 pagesStocksview Report On JiyaMuralidhar RayapeddiNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1rohini jha0% (1)

- Assignment 2 - March - 2021Document3 pagesAssignment 2 - March - 2021Joseph SelasieNo ratings yet

- Question Sheet: (Net Profit Before Depreciation and After Tax)Document11 pagesQuestion Sheet: (Net Profit Before Depreciation and After Tax)Vinay SemwalNo ratings yet

- CV Et QP 2022 - PGPFDocument7 pagesCV Et QP 2022 - PGPFanish mahtoNo ratings yet

- Cost of Capital QuestionsDocument4 pagesCost of Capital QuestionsNDIFREKE UFOTNo ratings yet

- Amended Jan 2022 BBF20103 Introduction To Financial Management A2QPDocument6 pagesAmended Jan 2022 BBF20103 Introduction To Financial Management A2QPJane HoNo ratings yet

- Exercise Chapter 6Document3 pagesExercise Chapter 6Siti AishahNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Ex.C.BudgetDocument3 pagesEx.C.BudgetGeethika NayanaprabhaNo ratings yet

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirNo ratings yet

- CAP II Group II June 2022Document97 pagesCAP II Group II June 2022aneupane465No ratings yet

- Reliance Infrastructure 091113 01Document4 pagesReliance Infrastructure 091113 01Vishakha KhannaNo ratings yet

- 1.1 Spartan QuestionDocument1 page1.1 Spartan QuestionMohammed Akhtab Ul HudaNo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Group Assignment FMDocument3 pagesGroup Assignment FMSarah ShiphrahNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- CBE - Corporate Finance - SPJG - FinalDocument16 pagesCBE - Corporate Finance - SPJG - FinalNguyễn QuyênNo ratings yet

- Revision BBMF2813Document3 pagesRevision BBMF2813Fred LeletNo ratings yet

- Premium Textile MillDocument12 pagesPremium Textile MillBushra KhursheedNo ratings yet

- AFM Year Wise RTP Compilation 2015 Dec To 2021 DecDocument412 pagesAFM Year Wise RTP Compilation 2015 Dec To 2021 Decmeme.arena786No ratings yet

- Client Arya CZ Investment AnalysisDocument11 pagesClient Arya CZ Investment AnalysisniayooNo ratings yet

- RHB Equity 360: Top StoryDocument5 pagesRHB Equity 360: Top StoryRhb InvestNo ratings yet

- YYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Document4 pagesYYH (KWSP) - EPF Records RM34.05 Billion in Investment Income For 1H 2021Calvin YeohNo ratings yet

- MAF653-Test 1 MCQ MAY 2022 QuestionDocument9 pagesMAF653-Test 1 MCQ MAY 2022 QuestionAyunieazahaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Jayanth Appi KNo ratings yet

- RHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Document4 pagesRHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Rhb InvestNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Asc453 Financial MathematicsDocument4 pagesAsc453 Financial MathematicsNurFatihah Nadirah Noor AzlanNo ratings yet

- Case: Roger: (Reference Date: 1st April, 2019)Document6 pagesCase: Roger: (Reference Date: 1st April, 2019)Krish BhutaNo ratings yet

- FY20 Media Release - 260620 (F)Document5 pagesFY20 Media Release - 260620 (F)Gan Zhi HanNo ratings yet

- Finance Cap 2Document19 pagesFinance Cap 2Dj babuNo ratings yet

- Name - Anup Sharma UID - 19BBA1302: Analysis of Rain Industries LTDDocument14 pagesName - Anup Sharma UID - 19BBA1302: Analysis of Rain Industries LTDKartik GuleriaNo ratings yet

- Estimation of Project Cash Flows: RequiredDocument4 pagesEstimation of Project Cash Flows: Requiredjjayakumar_vjNo ratings yet

- Name - Anup Sharma UID - 19BBA1299: Analysis of Prime Securities LTDDocument14 pagesName - Anup Sharma UID - 19BBA1299: Analysis of Prime Securities LTDKartik GuleriaNo ratings yet

- Medium Term Business Plan 3Document16 pagesMedium Term Business Plan 3Ravi HettigeNo ratings yet

- This Question Paper Comprises of One Section. (40 Marks) Answer ALL QuestionsDocument3 pagesThis Question Paper Comprises of One Section. (40 Marks) Answer ALL QuestionsmamatNo ratings yet

- ASSIGNMENT of CFDocument15 pagesASSIGNMENT of CFShubham AgarwalNo ratings yet

- ASSIGNMENT of CFDocument15 pagesASSIGNMENT of CFShubham AgarwalNo ratings yet

- Capital BudgetingDocument2 pagesCapital BudgetingSteven MalimbwiNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- ConfidentialDocument6 pagesConfidentialabel khuloane nhlapoNo ratings yet

- PGP CF 2019 Additional Practice Questions - Nov 2019Document4 pagesPGP CF 2019 Additional Practice Questions - Nov 2019Deepannita ChakrabortyNo ratings yet

- Sree Chaitanya College of Engineering Mba Iv Semester - Mid Ii Examination Sub: Strategic Investment & Financing DecisionsDocument1 pageSree Chaitanya College of Engineering Mba Iv Semester - Mid Ii Examination Sub: Strategic Investment & Financing Decisionsbhanu.chanduNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- The Benami Transactions (Prohibition) Amendment Act, 2016: India - PropertyDocument2 pagesThe Benami Transactions (Prohibition) Amendment Act, 2016: India - Propertysubhash parasharNo ratings yet

- Material Didactic Engleza FABBVDocument6 pagesMaterial Didactic Engleza FABBVMarius-Mihai DUMITRACHENo ratings yet

- Week 5: Asset PricingDocument26 pagesWeek 5: Asset Pricingmike chanNo ratings yet

- No La Pro StartDocument17 pagesNo La Pro StartFarah Hanim Abu HassanNo ratings yet

- Updated BAFS Supplementary Notes PDFDocument26 pagesUpdated BAFS Supplementary Notes PDFChloe Hiu Lam TamNo ratings yet

- Caso Haiman El Troudi - Odebrecht - Cresswell OverseasDocument14 pagesCaso Haiman El Troudi - Odebrecht - Cresswell OverseasCuentasClarasDigital.orgNo ratings yet

- Indian Accounting Standands V/S. International Accounting StandardsDocument70 pagesIndian Accounting Standands V/S. International Accounting StandardsVishal ChandakNo ratings yet

- 02 J. Amernic - A Case Study in Corporate Financial Reporting - Massey-Ferguson's Visible Accounting Decisions 1970-1987Document43 pages02 J. Amernic - A Case Study in Corporate Financial Reporting - Massey-Ferguson's Visible Accounting Decisions 1970-1987Fabian QuincheNo ratings yet

- FABM 2nd Sem Long QuizzesDocument8 pagesFABM 2nd Sem Long QuizzesJeamie SayotoNo ratings yet

- English Exercises and VocabularyDocument7 pagesEnglish Exercises and VocabularyJasna KlaužarNo ratings yet

- Marginal CostingDocument63 pagesMarginal Costingprachi aroraNo ratings yet

- Summer Training Report: Working Capital ManagementDocument73 pagesSummer Training Report: Working Capital ManagementanilkavitadagarNo ratings yet

- 2022 10 20 PH S CNVRGDocument7 pages2022 10 20 PH S CNVRGValiente RandzNo ratings yet

- Notes On Non-Profit OrganizationsDocument6 pagesNotes On Non-Profit OrganizationsJonathanTipayNo ratings yet

- CPFR ConceptDocument5 pagesCPFR ConceptGanesh PajweNo ratings yet

- Private Equity Valuation - BrochureDocument5 pagesPrivate Equity Valuation - BrochureJustine9910% (1)

- SyllabusDocument2 pagesSyllabusDedi SupiyadiNo ratings yet

- 1620053718MBA Syllabus 2019-20Document17 pages1620053718MBA Syllabus 2019-20Shaade91No ratings yet

- Stop LossDocument29 pagesStop LossAayush BhattaraiNo ratings yet

- Working Capital Finance-Recommendations of Various Committees.Document33 pagesWorking Capital Finance-Recommendations of Various Committees.Ranaque JahanNo ratings yet

- Working Capital ManagementDocument26 pagesWorking Capital ManagementMrinal KalitaNo ratings yet

- Google Corporate Social ResponsibilityDocument13 pagesGoogle Corporate Social ResponsibilitynkrguptaNo ratings yet

- International Capital BudgetingDocument27 pagesInternational Capital Budgetingshuaib20No ratings yet

- Office of The White House Office of Science and Technology Policy Exit Memo 010517Document3 pagesOffice of The White House Office of Science and Technology Policy Exit Memo 010517Dr. John " Jack" driscollNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Loan RatesDocument1 pageLoan RatesAndrew ChambersNo ratings yet