Professional Documents

Culture Documents

Market Makers Methods of Stock Manipulation

Market Makers Methods of Stock Manipulation

Uploaded by

Paul Bao Vinciano NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Makers Methods of Stock Manipulation

Market Makers Methods of Stock Manipulation

Uploaded by

Paul Bao Vinciano NguyenCopyright:

Available Formats

Market Makers’

Methods of Stock

Manipulation

B Y A . J . C ATA L D O , P H . D . , C M A , C PA , AND LARRY N.

K I L L O U G H , P H . D . , C PA

HOW TRADING MANIPULATIONS CAN ADVERSELY AFFECT A FIRM’S EQUITIES AND WHAT

FINANCE MANAGERS CAN DO ABOUT IT.

f you are involved in the decision to finance assets firms have underwritten, continue to trade, or make a

I with debt or equity and your company’s shares are

publicly traded or may be, you should watch for

and guard against exposure to broker-dealer or

market maker manipulation (MMM). In this arti-

cle, we offer you a primer on MMM, “naked shorting,”

and Internet-based sources of additional information.1

By increasing your awareness of market maker manipu-

market in. They buy and sell these inventories for prof-

it. In theory, they will buy low, which reduces the

decline in price per share (PPS), and sell high, which

reduces the rise in PPS. Therefore, these profit-making

behaviors are presumed to provide a stabilizing effect

on changes in the PPS of the stocks they make a

market in.

lation, you may be able to (1) better recognize and Second, they post the bid and ask prices at which

defeat the adverse effects of MMM on your firm’s equi- others are willing to buy or sell and match incoming

ty securities, (2) dramatically reduce the risks associated buy and sell orders. In return for performing these func-

with your firm’s failure to maintain market-based debt tions, market makers or specialists generate revenue for

covenant ratios with lenders, and (3) avoid the need to their firm through various order-flow or transaction-fee

recapitalize with additional equity issues at a manipulat- schemes.

ed or artificially low price per share. But like the conflicts apparent in the dual role of an

analyst-broker or auditor-consultant, the broker-dealer is

THE MARKET MAKER faced with an opportunity to sell his or her firm’s inven-

A market maker, who handles small-sized and micro- tory before others in a declining market or buy for his or

cap stocks; an exchange floor specialist, who is involved her firm’s inventory before others in a rising market.

with mid-sized or large-capitalized stocks; or a broker- This practice is one form of market maker manipula-

dealer, who handles all stocks, performs two separate tion. It is illegal, difficult to detect, but alleged in many

and, apparently, incompatible functions. instances—both correctly and, often, incorrectly—on

First, all maintain an inventory of the stocks their Internet stock-chat message boards. One relatively

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 10 SUMMER 2003, VOL.4, NO.4

highly publicized example of MMM is referred to as stock. The broker-dealer merely floods the market with

front running. cheap, nonexistent shares of your firm’s stock. The seller

of these nonexistent shares keeps the proceeds.3

FRONT RUNNING For example, on August 13, 2002, GeneMax Corp.

In front running, specialist market makers use their announced concerns over naked shorting and took mea-

knowledge of private, incoming order-flow information sures to ensure that trading in their shares occurred in a

revealed by limit orders to generate monopolistic trad- “fair and appropriate manner.”4 Records indicated that

ing profits. Though front running per se may not be as of August 2, 2002, shareholders of record held

particularly damaging to your firm, it illustrates the 400,820 shares, where only 265,654 were available, free-

abuse of the conflicting roles of the broker-dealer as trading shares, leaving the Depository Trust Corpora-

both a facilitator of an orderly market (matching incom- tion and Canadian Depository for Securities Limited

ing orders from other investors to buy and sell) and as with a net deficiency of more than 168,000 shares.

someone with the desire to generate profits from the On August 16, 2002, a two-year federal sting led to

inventories traded for their firm’s account.2 the indictment of 58 stock brokers and corporate execu-

On June 4, 2002, The Wall Street Journal reported that tives. The unsealed indictment alleged stock manipula-

Knight Trading Group, which handled more than 11% tion of JagNotes.com, Softsquad Software Ltd., and C

of all the buy and sell orders for Nasdaq-listed stocks in Me Run Corp. On January 23, 2003, Jag Media Hold-

2000, was under investigation by the Securities & ings, Inc., the parent company of JagNotes.com,

Exchange Commission (SEC) and the National Associa- announced that it would allow “custody only” trading

tion of Securities Dealers (NASD) for alleged front run- of its stock to protect stockholders against naked short

ning. Knight’s former head of institutional trading selling. Under custody-only trading, a company’s stock

accused Knight traders of front running. He alleged that is issued only in the name of beneficial owners in physi-

the traders placed their own orders for stock before cal certificate form.

placing the same orders for Knight’s customers, profit- Even the once large-capitalization, business-to-busi-

ing in advance from customer orders they knew would ness firm PurchasePro.com, in an open letter from the

push the stock of a company up or down, costing CEO, suggested that shareholders move their holdings

investors millions of dollars. The day the Journal story to cash accounts or request delivery of their share cer-

was published, Knight’s chief executive issued a state- tificates to prevent the shares from being legitimately

ment denying the allegations. In November 2002, shorted.

Knight announced that the SEC began formally investi-

gating the front-running charges. The investigation has S T O C K - C H AT M E S S A G E B O A R D S

not yet been concluded. We recommend that publicly traded firms, particularly

Another type of market manipulation is the naked small-caps and micro-caps, monitor the Yahoo! Finance

short sale. Firms with a declining PPS are targeted for and Raging Bull stock-chat message boards. This addi-

naked short selling. This practice is very damaging to the tional task doesn’t need to be onerous but requires

publicly traded firm and may be popular among the off- some understanding or review of the history and sophis-

shore brokerage firms where U.S. securities laws are less tication of the person who is posting the message. For

easily enforced or do not apply. It is similar to the coun- example, an unsophisticated investor attempting to pur-

terfeiting of currencies. In a naked short sale of stock, chase 5,000 shares of your firm’s stock may receive what

short positions are not declared or disclosed, shares are is referred to as an automatic execution or a partial fill

not borrowed to cover the short sale, and the stock is of a larger limit-price day order for 100 or 200 shares.5

never delivered to the purchaser. The result is dilutive in Here, for example, is one message:

that it results in an artificial, unauthorized, and illegal OT: I can’t believe that someone bought $2 worth of

increase in the number of shares issued and outstanding stock (100 shares) and paid a minimum $8 dollar (sic)

and in a manipulated decline in the PPS of the firm’s commission.6

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 11 SUMMER 2003, VOL. 4, NO. 4

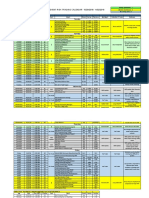

Table 1: Stock-Chat Message Board Summary Worksheet

Message Board Message Number Date Time Author or Alias Issue or Content Our Comments

Raging Bull 94231 4/12/2002 11:17 a.m. Aim4theFence Small Trade Auto Execution.

Unsophisticated.

Yahoo! Finance 19751 8/1/2002 6:23 p.m. wall street guy Stop Losses Market maker

takes out stops.

Sophisticated.

This unsophisticated investor failed to understand that you periodically review. Table 1 provides a simple

that an automatic execution caused the transaction for example of the format you may want to use to monitor

100 shares of a stock selling at two cents per share. This people on stock-chat message boards. You can modify

was a partial fill from a larger order but was misinter- this format as your experiences require.

preted as a completed trade. These transactions are

often blamed on MMM but result only from a buyer’s DETECTION METHODOLOGY

failure to place an all-or-none order. The simplest way to detect MMM in your company’s

Another message is about a large spread between the stock is to have one or more of your administrative per-

best bid and lower bids: sonnel monitor the stock-chat message boards for com-

Some unfortunate traders were thought (sic) a sorry ments or complaints about trading of it. Only unusual

lesson today using stops. Use stops on IWAV and you commentary or atypical stock price or volume activity

will be taken out. would be cause to investigate further.

This sophisticated investor is referring to stop loss We recommend monitoring trading in your compa-

market orders for the stock of Interwave Communica- ny’s stock on L2 when posting activity increases, stock

tions International, suggesting that the market maker price or volume behavior is atypical, or a large number

was able to sell a few shares (even to himself or herself) of complaints are detected on the stock-chat message

to reach or activate the stop loss orders, buy a large boards. The level of sophistication can often be deter-

quantity of cheap shares, and allow the PPS to rise mined by reviewing the aliases’ posting history, a fea-

quickly, rebounding to the appropriate market value per ture available on both Raging Bull and Yahoo! Finance

share. These trades are very profitable for the market stock-chat message boards.

maker but could also have been made by sophisticated Finally, you should not respond directly to stock-chat

individual investors who use the Nasdaq Level II quote message-board complaints because, as a company insid-

system (L2).7 L2 provides additional information to er, you may violate the SEC’s Regulation FD (Fair

those buying or selling a security, including the depth Disclosure). ■

of bid-ask spreads, by broker-dealer.

Repeated complaints of these types of trades on the The research leading to the development of this article was

stock-chat message boards may suggest that the issuer partially supported by a 2002 Oakland University School of

do a preliminary investigation into the day’s trading log Business Administration research grant.

and MMM.8 One form of market maker manipulation

may be a predictor of future, more damaging cases of The material for this article comes from a forthcoming

MMM. In any case, high frequencies of trading com- monograph, Information Asymmetry: A Unifying Con-

plaints may lead new or potential investors to avoid cept for Financial & Managerial Accounting Theories

investments in your firm’s stock. (Including Illustrative Case Studies), to be published by

We recommend you develop a checklist summary Elsevier Science.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 12 SUMMER 2003, VOL. 4, NO. 4

A.J. Cataldo, Ph.D., CMA, CPA, is assistant professor of

accounting at Oakland University in Rochester, Mich. He

can be reached at (248) 370-3509 or cataldoi@oakland.edu.

Larry N. Killough, Ph.D., CPA, is the KPMG Professor of

Accounting at Virginia Polytechnic Institute and State Uni-

versity in Blacksburg, Va. He can be reached at (540) 231-

2511 or Larry@vt.edu.

1 For example, see: http://www.nakedshortselling.com/.

An example of an NASD Regulation complaint, hearing

details, and their findings of fact may be found at

http://www.nasdr.com/pdf-text/nac0599—02.txt.

2 Individual investors discuss these behaviors on stock-chat mes-

sage boards. Even when the period of front running is brief, it

rarely goes unnoticed. Individual investors post messages about

their own trades and the failures of market makers to honor

their trades in the legally required sequence. In fact, one of the

authors has had personal experiences with this behavior, which

was later corrected after complaints were filed with myTrack, an

online broker. In that case, market makers refused to honor the

trade, which was in the money at the time of the complaint. But

myTrack resolved the matter prior to the close of the trading

day.

3 This and other trading manipulations are governed by restric-

tions enforced by the SEC, the New York Stock Exchange, and

the NASD. For example, short sales cannot be executed in a

declining market, and manipulation is specifically prohibited.

See SEC rules 10a-1 (the uptick rule) and 10a-2 (the availability/

delivery rule), NASD rule 3350 (the best bid rule), and Rule 105

of Regulation M.

4 For GeneMax’s announcement and its discussion about naked

shorting of its shares and a tabular accounting of them, see

http://www.genemax.com/pdf/genemax—pr—08-13-02.PDF.

5 An automatic execution is a trade for 100 or 200 shares—a par-

tial fill of a larger order—regardless of the size of the order

above 200 shares. For example, a 5,000-share buy order may

have had 100 shares filled immediately. The remaining 4,900

shares of the order may or may not have ever been filled or the

original order completed. The broker will advise customers that

the automatic execution is designed to increase or broaden par-

ticipation in a firm’s stock. An alternative or less positive view is

that it maximizes broker commissions and order flow, particular-

ly in cases of low-priced or penny stocks.

6 OT is an abbreviation for “off-topic,” used, for example, to sug-

gest or provide tips or insights on other stocks.

7 Market makers are often blamed for these trades because they

are presumed to have access to the execution price of stop loss

orders. Some explanatory materials about L2 are located at

http://daytrading.about.com/library/weekly/aa061900a.htm?

PM=ss13—daytrading.

8 For example, myTrack, an online broker, provides a detailed

transaction log for the prior and current trading day. For an addi-

tional monthly fee, the market maker, through which the trades

were executed on L2, can be identified in real time. Other

online brokers may also provide this free service, and the

issuer’s investor relations department may make inquiries with

their exchange or transfer agent.

M A N A G E M E N T A C C O U N T I N G Q U A R T E R LY 13 SUMMER 2003, VOL. 4, NO. 4

You might also like

- Market Makers Method (Order Blocks) English PDFDocument165 pagesMarket Makers Method (Order Blocks) English PDFFibo Forex86% (72)

- Mark Douglas - Trading in The Zone PDFDocument52 pagesMark Douglas - Trading in The Zone PDFFibo Forex65% (23)

- Inner Circle Trader - The Power of ThreeDocument2 pagesInner Circle Trader - The Power of ThreeKagan Can100% (5)

- Keys To Directional BiasDocument29 pagesKeys To Directional Biasj93% (28)

- Beat Market Maker PDFDocument15 pagesBeat Market Maker PDFdorin0victor0vasile67% (3)

- Economic Survey CooperativeDocument7 pagesEconomic Survey Cooperativejoanne rivera100% (5)

- The Smart Money Method: How to pick stocks like a hedge fund proFrom EverandThe Smart Money Method: How to pick stocks like a hedge fund proRating: 5 out of 5 stars5/5 (3)

- Market Maker Traps PDFDocument7 pagesMarket Maker Traps PDFSantiago Tiago100% (6)

- Market Maker Method - Summary by Tebogo MotlhaleDocument4 pagesMarket Maker Method - Summary by Tebogo Motlhaleprospectingrights87% (15)

- Inner Circle Trader - WENT 01 PDFDocument2 pagesInner Circle Trader - WENT 01 PDFOJavier Mejia100% (4)

- MM Sir ZoneDocument29 pagesMM Sir ZoneHai To Thanh100% (13)

- Market Maker PsychologyDocument26 pagesMarket Maker PsychologyAhmed Nabil50% (10)

- Market Makers Made SimpleDocument30 pagesMarket Makers Made SimpleJacob Shete93% (14)

- Busi 330-b02 CMP Final Draft Group 1Document29 pagesBusi 330-b02 CMP Final Draft Group 1api-306091452100% (1)

- Inner CircleDocument96 pagesInner Circlemr.ajeetsingh20% (5)

- Forexia Academy Proudly Presents: Golden Pips Generator'S DmahackDocument26 pagesForexia Academy Proudly Presents: Golden Pips Generator'S DmahackVoiture German50% (4)

- How to Beat the Market Makers at Their Own Game: Uncovering the Mysteries of Day TradingFrom EverandHow to Beat the Market Makers at Their Own Game: Uncovering the Mysteries of Day TradingRating: 4 out of 5 stars4/5 (10)

- The Market MakersDocument13 pagesThe Market Makerssocio cursos93% (14)

- Trading Major ReactionsDocument29 pagesTrading Major ReactionsAdhetya Pratama85% (13)

- Inner Circle Trader - Precision Trading Volume 3Document1 pageInner Circle Trader - Precision Trading Volume 3Steve Smith100% (1)

- StopHunt Mastery PDFDocument115 pagesStopHunt Mastery PDFoli100% (10)

- How The Large Instituions Operate in The Forex Market PDFDocument48 pagesHow The Large Instituions Operate in The Forex Market PDFRyan100% (6)

- The Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeFrom EverandThe Market Maker's Edge: A Wall Street Insider Reveals How to: Time Entry and Exit Points for Minimum Risk, Maximum Profit; Combine Fundamental and Technical Analysis; Control Your Trading Environment Every Day, Every TradeRating: 2.5 out of 5 stars2.5/5 (3)

- Understanding Level 2 and Market MakersDocument4 pagesUnderstanding Level 2 and Market Makers5_percenter100% (14)

- How The Market Really WorksDocument81 pagesHow The Market Really WorksSana Agarwal100% (11)

- Order Flow Trading For Fun and Profit PDFDocument30 pagesOrder Flow Trading For Fun and Profit PDFtsehai378% (9)

- Beat The MarketDocument12 pagesBeat The Marketjayjonbeach75% (4)

- Pivot Calculator 16044 16014 16037: High LOW CloseDocument2 pagesPivot Calculator 16044 16014 16037: High LOW CloseSekhar Reddy100% (1)

- ICT VidsDocument4 pagesICT VidsTri Nur DayaNo ratings yet

- ++inner Circle Trader - Trading The FigureDocument2 pages++inner Circle Trader - Trading The FigureCr Ht100% (1)

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerFrom EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerRating: 4 out of 5 stars4/5 (3)

- The Market Taker's Edge: Insider Strategies from the Options Trading FloorFrom EverandThe Market Taker's Edge: Insider Strategies from the Options Trading FloorNo ratings yet

- Linotype's Compatil Type SystemDocument16 pagesLinotype's Compatil Type SystemnalafodimosNo ratings yet

- Running Head: Financial Statement Analysis of Samsung 1Document19 pagesRunning Head: Financial Statement Analysis of Samsung 1Sangita GautamNo ratings yet

- The Market Maker MethodDocument4 pagesThe Market Maker Methodrsousa1100% (1)

- Market Maker TrapsDocument109 pagesMarket Maker TrapsFarid Taufiq93% (14)

- Big Banks Strategy PDFDocument18 pagesBig Banks Strategy PDFGaro Ohanoglu100% (1)

- 4 5949794731742463536 PDFDocument22 pages4 5949794731742463536 PDFAnastasia Nikoláyevna100% (12)

- The Only Game in Town (Market Makers Lose To Insiders)Document3 pagesThe Only Game in Town (Market Makers Lose To Insiders)Mikhail Iliev100% (2)

- Stop-Limit Order: High-Frequency TradingDocument5 pagesStop-Limit Order: High-Frequency TradingPeter KwagalaNo ratings yet

- Inner Circle Trader - TPDS 2Document3 pagesInner Circle Trader - TPDS 2Sonja Moran83% (6)

- Understand Order FlowDocument36 pagesUnderstand Order Flowmindchi80% (5)

- Inner Circle Trader - Progressive Risk ReductionDocument2 pagesInner Circle Trader - Progressive Risk ReductionSteve Smith100% (1)

- Telegram Cloud Document 4 5774082087745225801 PDFDocument75 pagesTelegram Cloud Document 4 5774082087745225801 PDFBen Willmott100% (2)

- Rules of Trading High Probability TradesDocument1 pageRules of Trading High Probability TradesStephen ShekwonuDuza HoSeaNo ratings yet

- Market Liquidity and MMDocument13 pagesMarket Liquidity and MMErikNo ratings yet

- Notes 2014-12-11Document15 pagesNotes 2014-12-11Sandra GivensNo ratings yet

- Secrets of A Market Maker: Presented by Andrew KeeneDocument20 pagesSecrets of A Market Maker: Presented by Andrew KeeneSei King100% (3)

- Market Maker TrapsDocument6 pagesMarket Maker Trapsmajidy100% (3)

- Inner Circle Trader - 20110201 PTC PDFDocument1 pageInner Circle Trader - 20110201 PTC PDFRory BrownNo ratings yet

- Inner Circle Trader - 20110213 PTC PDFDocument1 pageInner Circle Trader - 20110213 PTC PDFRory BrownNo ratings yet

- Inner Circle Trader - Sniper Course, Field NavigationDocument3 pagesInner Circle Trader - Sniper Course, Field NavigationKasjan Marks100% (1)

- The Market Makers (Review and Analysis of Spluber's Book)From EverandThe Market Makers (Review and Analysis of Spluber's Book)No ratings yet

- Breaking Free in Forex: How you can Make 400k+in the Forex Market with just $100 Start and Set a Platform for a Life of Wealth!From EverandBreaking Free in Forex: How you can Make 400k+in the Forex Market with just $100 Start and Set a Platform for a Life of Wealth!No ratings yet

- Trading Forex like a Wall $treet Bank for Beginners: Brand New Day Traders Learning Series, #1From EverandTrading Forex like a Wall $treet Bank for Beginners: Brand New Day Traders Learning Series, #1No ratings yet

- Market Players: A Guide to the Institutions in Today's Financial MarketsFrom EverandMarket Players: A Guide to the Institutions in Today's Financial MarketsRating: 5 out of 5 stars5/5 (4)

- 102188 RuderDocument16 pages102188 RuderAgazziNo ratings yet

- Top Three Triggers To Identify Front-Running: Do You Know Who Is Trading Ahead of You?Document5 pagesTop Three Triggers To Identify Front-Running: Do You Know Who Is Trading Ahead of You?j3585873No ratings yet

- How Securities Are TradedDocument27 pagesHow Securities Are TradedRizqa RahmawatiNo ratings yet

- Refund of Franking Credits Instructions and Application For IndividualsDocument16 pagesRefund of Franking Credits Instructions and Application For Individualsuly01 cubillaNo ratings yet

- DOTS Guppy QuickStartDocument23 pagesDOTS Guppy QuickStartaldhosutra100% (1)

- Ac1 1-1 3Document2 pagesAc1 1-1 3Adeirehs Eyemarket BrissettNo ratings yet

- Chapter 4 - Capital Allocation To Risky AssetsDocument32 pagesChapter 4 - Capital Allocation To Risky AssetsBùi Thái SơnNo ratings yet

- Topic06 - APT and Multifactor ModelsDocument28 pagesTopic06 - APT and Multifactor Modelsmatthiaskoerner19No ratings yet

- Certificate of DepositsDocument23 pagesCertificate of DepositssashaathrgNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document23 pagesWhy Study Money, Banking, and Financial Markets?Ahmad RahhalNo ratings yet

- 005 - BAV Mr. Dipak KapurDocument4 pages005 - BAV Mr. Dipak KapurGaurav KhatriNo ratings yet

- In Search of Prima Facie, Authority of Bryan J. Bly and Crystal Moore To Assign MortgagesDocument27 pagesIn Search of Prima Facie, Authority of Bryan J. Bly and Crystal Moore To Assign MortgagesBj Alexander Lister100% (2)

- CORPORATE FINANCE Mba 2nd NotesDocument100 pagesCORPORATE FINANCE Mba 2nd Noteskunal roxNo ratings yet

- IOC Annual Report 2013-14 PDFDocument216 pagesIOC Annual Report 2013-14 PDFvijayakumarjNo ratings yet

- Intellectual Property Rights and EntrepreneurshipDocument8 pagesIntellectual Property Rights and EntrepreneurshipAliza FatimaNo ratings yet

- Repurchase Intent: Brand EquityDocument5 pagesRepurchase Intent: Brand Equityparul0% (1)

- Kimlun Corp: Wins RM1.5bil Pan Borneo Job With ZeconDocument5 pagesKimlun Corp: Wins RM1.5bil Pan Borneo Job With Zeconjhtan84No ratings yet

- Aarti Brochure 2009Document4 pagesAarti Brochure 2009Sabari MarketingNo ratings yet

- Booklet FABM 2 Module 1Document17 pagesBooklet FABM 2 Module 1Rubelyn MoralesNo ratings yet

- Compensation For Executive and Supervisory Board MembersDocument2 pagesCompensation For Executive and Supervisory Board MembersProjNo ratings yet

- Nido Home Finance LimitedDocument640 pagesNido Home Finance LimitedchhedamalayNo ratings yet

- Bullion Series brochure190710ICICIDocument23 pagesBullion Series brochure190710ICICIsanthosh_eleNo ratings yet

- Kiran KonherDocument10 pagesKiran KonherBharat InturiNo ratings yet

- Intellectual Property Rights in PakistanDocument23 pagesIntellectual Property Rights in PakistanSaad Naeem100% (1)

- Marketing PinkyDocument10 pagesMarketing PinkySingh PinkyNo ratings yet

- 10 Biggest Accounting Scandals in Recent Years in The PhilsDocument13 pages10 Biggest Accounting Scandals in Recent Years in The PhilsDeirdreNo ratings yet

- AAA Master Agreement For Derivates Trading and Forward TransactionsDocument3 pagesAAA Master Agreement For Derivates Trading and Forward TransactionsjarrmexicoNo ratings yet

- History of Credit RatingDocument3 pagesHistory of Credit RatingAzhar KhanNo ratings yet

- 17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam enDocument15 pages17 F F6 Vietnam Tax FCT Answers For Multiple Choice Questions 2015 Exam endomNo ratings yet