Professional Documents

Culture Documents

(English) ACCOUNTING BASICS - A Guide To (Almost) Everything (DownSub - Com)

Uploaded by

Kenneth Mallari0 ratings0% found this document useful (0 votes)

11 views11 pagessubtitle

Original Title

[English] ACCOUNTING BASICS_ a Guide to (Almost) Everything [DownSub.com]

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsubtitle

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views11 pages(English) ACCOUNTING BASICS - A Guide To (Almost) Everything (DownSub - Com)

Uploaded by

Kenneth Mallarisubtitle

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 11

Accounting is like a big tree

it's been around for ages

and it has lots of branches

There's financial accounting

managerial, tax, audit

and bookkeeping

But generally I think when

people say accounting they

usually mean financial accounting

So what is financial accounting?

It's the process of

identifying, recording,

summarizing and analyzing

an entity's financial transactions and

reporting them in financial statements

Hey I'm James and if this definition

doesn't mean much to you

it's all good

stick around me for the next

ten minutes or so and you'll see

exactly how financial accounting works

We've got lots cover but I do recommend

watching this right through to the end

at least once so that you can get

an idea of the big picture

Let's do this!

Imagine that you own Ruff Times

a tabloid newspaper covering all

the latest gossip on our furry friends

During March you run a promotional

offer for annual subscriptions

that begin on April 1st

People can't get enough of your stories

and you end up with $40,000

in new subscriptions

all paid for in cash

The first step in financial accounting

is to identify the transaction

Well that's easy

I just mentioned one you made

$40,000 in new annual subscriptions

these start on April 1st and continue

through to March 31st next year

So what next then?

It's time to prepare a journal entry

A journal is a record of a

financial transaction and it looks like this

You have a unique journal number,

a date, a description, the accounts affected

in this case that's cash and

subscription revenue

and then you have your debits and credits

which are both $40,000

Ruff Times is a serious business so

you're using double entry accounting

which means this transaction affects

at least two accounts and the

total debits are equal to the total credits

But why do we do it this way?

What is double entry accounting?

The first thing you need to know

is that Financial Accounting

is built on one simple idea

The stuff that your business owns is equal

to the stuff that your business owes

We call the stuff that your business owns

Assets these are valuable resources that you'll

benefit from in the future

things like cash and inventory

but on the other side of this formula

we use two different words to describe

the stuff that your business owes

Liabilities when you owe stuff to

third-party lenders or suppliers

these are your obligations that you'll

need to fulfil in the future

and equity when Ruff Times

owes stuff to you

the owner

this represents your claim on the

business's net assets

So assets equal liabilities plus equity

this little formula is called

the accounting equation and it

has big implications

It was written down a long time ago

by this guy in this book and it

revolutionised the way we record transactions

It’s the foundation of double-entry accounting

the theory that there are at least

two equal and opposite sides to

every transaction because this

accounting equation is always true

it must always balance

Debits and credits are the words we use

to reflect these two sides

Credits represents the sources

that economic benefit flows from

whereas debits represent the

destinations that it flows to

Nowadays pretty much every

large business in the world uses

double entry accounting and so

does Ruff Times

In this case you debit cash by $40,000

to increase your assets and you

credit subscription revenue by $40,000

to record your income

Are you hanging in there?

I know there's a lot to take in

and some of these terms might not

make sense right away

that's okay just give it some time

and let it all seep in

After this you can always jump into

my accounting bases playlist

and explore everything

I mention in a lot more detail

I drop a link to that down below

in the description

just below that big red subscribe button

I don’t know what that voice that was but...

anyway...

the next step is to post the journal

into your general ledger

The general ledger is a place where you

store all of your financial data

It contains a complete record of your

accounts and journal entries

Back in the day it used to be this

huge book that you’d fill out by hand

but thankfully we've moved on now

and businesses like yours

use accounting software

which treats the general ledger

as kind of a central database

So how do we get this journal

into your general ledger?

You post it to your accounts

Accounts of places where you

record, sort and store all transactions

that affect a related group of items

Broadly speaking there are

six types of account

assets, liabilities and equity which we

already know from the accounting equation

and then there's revenue,

expenses and withdrawals

also known as dividends

These feed into the equity

part of the equation

If you'd like to see how and why that works

then you can check out my

video on equity I'll pop a link to

that in the description

This journal affects two accounts

and we can picture what they look like

by drawing out two T’s

and labelling them

cash and subscription revenue

These are called T accounts

and they help us visualise what your

accounts look like

Debits go on the left and

credits go on the right

When you post this journal

you debit the left-hand side of your

cash account by $40,000 and you

credit the right-hand side of your

subscription revenue account

by $40,000 as well

When we total these up you now have

$48,000 in cash and you've made

$75,000 in subscription revenue

But Ruff Times has other accounts too

it has a whole collection of

assets, liabilities, equity,

revenue and expense accounts

stored in your general ledger

You post this journal during March

when you collect the cash

but now let's fast-forward to the

end of your financial year

to December 31st

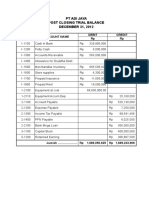

We need to put together your

unadjusted trial balance

What's a trial balance?

It's an internal report that summarises

the closing numbers in all of your

general ledger accounts

It can help us check for errors

but ultimately we use it to make

financial statements as you'll soon see

But what does it look like?

Here's your general ledger again

and now let's jump ahead to the

end of December

Building a trial balance is

actually quite simple

you list out all of your accounts

and their closing balances and

that's all there is to it

A closing balance is the

cumulative total of all transactions

affecting an account

As usual debits are on the left

and credits are on the right

At the bottom of your trial balance

you have your total debits and total credits

these should match each other exactly

because the accounting equation

is always true

Trial is another way of saying test

which is what the trial balance was

originally used for

as a test to check your debits

and credits are in balance

and this is an unadjusted trial balance

because we haven't adjusted it yet

but we will

now actually because you've ended

a financial year so we need to

post some adjusting entries

Adjusting entries are journal entries

that bring your books in line with

something called the

accrual method of accounting

What's that?

To understand you really need to know

about the accounting rule books

Yes accountants have to be good

and follow the rules

but the rules change a bit depending

on where you're based

you might follow the

international financial reporting standards

or some variation of the

generally accepted accounting principles

IFRS or GAAP

These two rule books make sure that

your financial statements reflect

a true and fair view of your business

which is important because a lot of people

rely on financial statements

particularly those who’ve lent you money

or invested in your business

Anyway IFRS and GAAP have one

major thing in common

they both want you to follow

the accrual method of accounting

which means you need to recognise

your revenue as you earn it

and record your expenses

as you incur them

This is the most accurate way to

calculate your profit

but here's the thing

Ruff Times hasn't been

playing by the rules

In March you ran a promotion on annual

subscriptions starting on April 1st

You collected $40,000 in cash and

posted a journal to recognise that

whole amount as revenue on March 31st

This is called cash accounting

and it's not the same as accrual accounting

in cash accounting you

recognise your revenue as you receive cash

and record your expenses as you pay it out

But receiving cash is not the same as

earning revenue

let me show you

You received $40,000 of cash during March

but you actually earn that revenue

over the next twelve months

this is when you do the work

this is when you release each issue of Ruff Times

So today as things stand on December 31st

you've recognised 12 months of income

this financial year but you haven't

earned three months of it yet

and you won't until the end of March next year

But it's all good

that's what adjusting entries are for

These are the journal entries that you post

to bring your books in line

with the accrual method

We can fix this situation by reversing

3 out of the 12 months of your

subscription revenue which is $10,000

and temporarily holding it as a liability

in an account called deferred revenue

or unearned revenue

This is a liability account because you

still have an obligation at the end

of the year to provide your customers

with Ruff Times from January to March

Let's post this one to your general ledger

and run ourselves a

new adjusted trial balance

This time is adjusted because

you’ve posted your adjusting entries

We can see that your subscription revenue

has gone down by $10,000 and your

liabilities have gone up by $10,000

Your debit and credit totals still

match each other because there are

two equal and opposite sides to the journal

and now you're playing by the rules

because you're following the

accrual method of accounting

Nice one!

Now we can create your financial statements

Financial statements are

accounting reports that summarise your

business's activities over a period of time

These are external reports

designed to give your

investors, lenders and creditors

and an understanding of your

business's financial health

The three main financial statements

are called the balance sheet,

the income statement and the

cash flow statement

We can build all of these

using your adjusted trial balance

Your balance sheet looks like this

it gives us a snapshot of your

business's assets, liabilities and equity

at a single point in time

which can teach the readers about

your financial position

they can see what you own and what

you owe at the end of your financial year

Now let's check out your income statement

this summarises your business's revenues

and expenses over a period of time

Here that's the previous year

and it gives the readers a glimpse of your

financial performance and profitability

If you were cash accounting

then this income statement would also

mirror your cash flows

but you're using the accrual method so

profit and cash flow aren't the same thing

You keep track of your cash flow

separately in a cash flow statement

This report summarises your cash inflows

and outflows over the same period of time

Once you've created these three

financial statements you can send

them out to your

investors, lenders and creditors

if Ruff Times was listed on a

stock exchange then investors

all around the world would compare

your performance against their

expectations and decide whether to

buy or sell shares in your business

They'd analyse your statements

using financial ratios which is

something that we haven't covered

on this channel yet

so if you'd like see some videos on that

then by all means

please let me know down in the comments

But we're not finished yet

Once you're done with your

financial statements you need to

post some closing entries

to prepare your books for next year

A closing entry is a journal entry

that you post to clear out all of your

temporary accounts like

revenues, expenses and dividends

For Ruff Times your journal would look

something like this

You’d debit your revenue accounts and

you’d credits your expense accounts

to clear them down to zero

The balance of $26,440 goes to

retained earnings in the equity section

of your balance sheet

These are your profits that you're

holding on to for the future

So if we look at your trial balance again

then we can see your

revenue and expense accounts have been

reset to nil and now you're ready to

tackle the new year

Together these steps make up the

accounting cycle and this is

what Financial Accounting is all about

It’s the process of identifying, recording

summarising and analysing your

business's financial transactions and

reporting them in financial statements

Shout out to Munesh at home food maniacs

for requesting this one

a long time ago

so thanks for being so patient with me

and thank you for subscribing

We've now hit a hundred thousand

subscribers on this channel

which is mental

If you'd like to support this channel

then you're welcome to buy my cheat sheets

I've added a new one covering the

accounting cycle which we just went through

or you can hit that join button below

and if you'd like to learn more about

accounting then I recommend

starting right here

Thanks for watching and

I'll see you in the next one!

You might also like

- This Study Resource WasDocument4 pagesThis Study Resource WasKenneth MallariNo ratings yet

- History of BasketballDocument9 pagesHistory of BasketballKenneth MallariNo ratings yet

- This Study Resource Was: Trabasas, Jynx Cs Czar Gsts Bs CSM 2CDocument2 pagesThis Study Resource Was: Trabasas, Jynx Cs Czar Gsts Bs CSM 2CKenneth MallariNo ratings yet

- Internal Control and Risk Assessment: Introductory Scenario: Suggested Solutions To QuestionsDocument18 pagesInternal Control and Risk Assessment: Introductory Scenario: Suggested Solutions To QuestionsKenneth MallariNo ratings yet

- Ac 3103 Business Tax Mock ExamDocument14 pagesAc 3103 Business Tax Mock ExamChristine NionesNo ratings yet

- Rizal at USTDocument4 pagesRizal at USTKenneth MallariNo ratings yet

- Rizal - First Visit at ParisDocument8 pagesRizal - First Visit at ParisKenneth MallariNo ratings yet

- Community Development Program Plan: Juan Dela Cruz June 2, 2020 MT1-Bravo Mr. A. SantosDocument2 pagesCommunity Development Program Plan: Juan Dela Cruz June 2, 2020 MT1-Bravo Mr. A. SantosKenneth MallariNo ratings yet

- Rizal ChildhoodDocument2 pagesRizal ChildhoodKenneth MallariNo ratings yet

- (English) What Is SQL - (In 4 Minutes For Beginners) (DownSub - Com)Document5 pages(English) What Is SQL - (In 4 Minutes For Beginners) (DownSub - Com)Kenneth MallariNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Overview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeDocument35 pagesOverview of Financial Reporting Environment Environment: FRS Course DR Sudershan Kuntluru IIM KozhikodeKumar PrashantNo ratings yet

- MBA AssignmentDocument2 pagesMBA Assignmentg_d_dubeyciaNo ratings yet

- Ais LessonsDocument9 pagesAis LessonsKesiah FortunaNo ratings yet

- Kashato ShirtsDocument40 pagesKashato ShirtsLiana Abad100% (3)

- New Heritage Doll Capital Budgeting Case SolutionDocument5 pagesNew Heritage Doll Capital Budgeting Case Solutionalka murarka50% (14)

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Answer and Question Financial Accounting Chapter 6 InventoryDocument7 pagesAnswer and Question Financial Accounting Chapter 6 Inventoryukandi rukmanaNo ratings yet

- MATIAS Marcelo Transport ServicesDocument3 pagesMATIAS Marcelo Transport ServicesPaulene Abegail MatiasNo ratings yet

- Pam 61 eDocument1 pagePam 61 eNaga RajNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- Arens14e Ch10 PPT GeDocument50 pagesArens14e Ch10 PPT GeGabrielaNo ratings yet

- T or F FARDocument5 pagesT or F FARChjxksjsgskNo ratings yet

- Ho and Branch and Agency AcctgDocument38 pagesHo and Branch and Agency AcctgNiño Dwayne TuboNo ratings yet

- Unilever Pakistan LimitedDocument126 pagesUnilever Pakistan LimitedXohaib UQNo ratings yet

- p2 Long SeatworkDocument6 pagesp2 Long SeatworkLeisleiRagoNo ratings yet

- Name Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDDocument28 pagesName Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDraja farhanNo ratings yet

- Chapter 1 Double Entry System For Income & ExpensesDocument2 pagesChapter 1 Double Entry System For Income & ExpensesDeveender Kaur JudgeNo ratings yet

- What Is ExcelDocument7 pagesWhat Is Excelapi-239136457No ratings yet

- MAS.05 Drill Variable and Absorption CostingDocument5 pagesMAS.05 Drill Variable and Absorption Costingace ender zeroNo ratings yet

- Capital Stack Syndication Audit Report - David Rubin - EprodigyDocument21 pagesCapital Stack Syndication Audit Report - David Rubin - EprodigyTim MelnoffNo ratings yet

- Skripsi Khairunisa Armstrong (Inggris)Document47 pagesSkripsi Khairunisa Armstrong (Inggris)CharlotteNo ratings yet

- Jawaban Silus Adijaya 2015Document15 pagesJawaban Silus Adijaya 2015natsu dragnelNo ratings yet

- CH 16Document46 pagesCH 16Kim TranNo ratings yet

- Debits and Credits - Wikipedia, The Free EncyclopediaDocument17 pagesDebits and Credits - Wikipedia, The Free EncyclopediaspkanurNo ratings yet

- Cash Flow Statement - Indirect MethodDocument5 pagesCash Flow Statement - Indirect MethodBimal KrishnaNo ratings yet

- Recibo de Transferencia Maraton Castello Ivan EspañaDocument2 pagesRecibo de Transferencia Maraton Castello Ivan EspañaDoryan William Chavez SalgueiroNo ratings yet

- Accounting Standard - 21Document14 pagesAccounting Standard - 21Devmalya MazumderNo ratings yet

- Baps March 2021Document34 pagesBaps March 2021Adjin LomoteyNo ratings yet

- FA1 Syllabus and Study Guide Sept23 - Aug24Document15 pagesFA1 Syllabus and Study Guide Sept23 - Aug24cuongaccNo ratings yet

- Intercompany Organizations Associations With Legal Entities, Suppliers and CustomersDocument15 pagesIntercompany Organizations Associations With Legal Entities, Suppliers and CustomersRajasekharNo ratings yet