Professional Documents

Culture Documents

Mongolia Inflation Summary

Uploaded by

Leigh Anne AlinsodCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mongolia Inflation Summary

Uploaded by

Leigh Anne AlinsodCopyright:

Available Formats

MONGOLIA INFLATION SUMMARY

Introduction

- Goal is to keep Mongolia stable daw. Also, because of their location and climate which is too

cold. I guess this has effects on their GDP ofcourse, and thus their economy as a whole din.

Malamig, walang work, stagnant, or wala masyadong natural resources.

- Because of this they are highly seasonal nga, so nag ffluctuate economy madalas. The

authorizes keep it at bay by making practical (needed, pilit) approach sa mga monetary

policies.

- This study will examine the relationship between the monetary policies (indicators) AND

inflation

Thoughts

- First of all, the grammar.

- I was surprised that natural or geographical location has significant effects on inflation or

monetary policies pala. It never occurred to me kasi I have never really given it a thought

and I somehow live in a neutral country. Where extremes of weathers don’t come about.

And I realized it was real, na may correlation yung policies sa weather kasi it is affecting the

productivity of the people which in turn has effects on the economy as a whole like a

domino effect.

- Expected na naman yung results, in my opinion. Lit rev pa lang e dami na niya sinabi, so

malamang sa malamang no, may fuction talaga na makikita.

The main goal of the study was to know the relationship of money supply, exchange

rate, and inflation of Mongolia. The researchers used data from 1994 to 2004, and

used it in their formulas, indicators, and such to find a correlation between the three.

While reading halfway into the journal, I kind of expected the results, which is indeed,

there is a high correlation between money supply, exchange rate, and inflation in the

said country. This is because the literature review indicated similar studies and

investigations like this and the results were somehow expected or at least in line with

the basic theory of finance, money, and the economy. This lead me to think that

there is an invisible function that the finance industry and economy in general is

following, and this is where we see patterns that makes real life events and decisions

less risky, and somehow converts an opinion into a fact. I realized that while these

theories are “just” theories, they are not there and they are not studied, for the sake

of just being there or just to be studied, and that these things happen in real life.

Another thing that got my attention was stated in the introduction part. I was

surprised that natural or geographical location has significant effects on inflation or

monetary policies. It never occurred to me because, in all honesty, I have never

really given it a thought and I guess because I live in a neutral country, in terms of

climate, where extremes of weathers don’t come about. And I realized that it was

theoretically and partially true because climate really does affect the movement of

people, their productivity, and even the natural resources. And this, in turn will have

a domino effect on the prices of commodities, the GDP of the country, and of course,

the economy as a whole.

You might also like

- Ra 9710Document26 pagesRa 9710WeGovern InstituteNo ratings yet

- 034 UP and UP School of Economics Vs Hon. Teodor Regino GR 88167Document1 page034 UP and UP School of Economics Vs Hon. Teodor Regino GR 88167MelgenNo ratings yet

- Javier v. Court of AppealsDocument5 pagesJavier v. Court of AppealsJerry CaneNo ratings yet

- Valenzuela Vs PeopleDocument1 pageValenzuela Vs PeopleTaJheng BardeNo ratings yet

- Environmental Destruction (SOURCE PAPER)Document42 pagesEnvironmental Destruction (SOURCE PAPER)Min Sio PaoNo ratings yet

- City of Manila V Intermediate Appellate CourtDocument4 pagesCity of Manila V Intermediate Appellate CourtJamiah HulipasNo ratings yet

- Exploring The Linkage Between Philosophical Assumptions and Methodological Adaptations in HRM ResearchDocument6 pagesExploring The Linkage Between Philosophical Assumptions and Methodological Adaptations in HRM ResearchtikainiNo ratings yet

- Guingona Vs CaraqueDocument9 pagesGuingona Vs CaraqueJohn GarciaNo ratings yet

- Political and Leadership StructureDocument14 pagesPolitical and Leadership StructureJustine Roswinnie CruzNo ratings yet

- Aguado vs. City of ManilaDocument1 pageAguado vs. City of ManilaJoseph Tangga-an GiduquioNo ratings yet

- Jalojos (Digest)Document1 pageJalojos (Digest)Anonymous joeguHlNo ratings yet

- C9 - Torio v. FonatillaDocument2 pagesC9 - Torio v. FonatillaJairus LacabaNo ratings yet

- Almelor Vs RTCDocument17 pagesAlmelor Vs RTCKye GarciaNo ratings yet

- Executive Order No 2Document4 pagesExecutive Order No 2Nafiesa ImlaniNo ratings yet

- PP Vs RabaoDocument3 pagesPP Vs RabaoRalph VelosoNo ratings yet

- Pesca vs. Pesca, G.R. No. 136921. April 17, 2001Document3 pagesPesca vs. Pesca, G.R. No. 136921. April 17, 2001Mark Rainer Yongis LozaresNo ratings yet

- Philippines Mining or Food Case Study Conclusions and Recommendations v3Document5 pagesPhilippines Mining or Food Case Study Conclusions and Recommendations v3Munib Brahim Jr.No ratings yet

- Ma - Persons Page1Document29 pagesMa - Persons Page1Nereus Sanaani CAñeda Jr.No ratings yet

- The Judicial Branch - Official Gazette of The Republic of The PhilippinesDocument20 pagesThe Judicial Branch - Official Gazette of The Republic of The PhilippinesgraceNo ratings yet

- (DIGEST) Whitelight Corporation vs. City of Manila 576 SCRA 416 (2009)Document1 page(DIGEST) Whitelight Corporation vs. City of Manila 576 SCRA 416 (2009)Harold Q. GardonNo ratings yet

- Oposa v. Factoran 224 Scra 792Document2 pagesOposa v. Factoran 224 Scra 792Ali BastiNo ratings yet

- Eugenio v. DrilonDocument1 pageEugenio v. DrilonJashen TangunanNo ratings yet

- Commissioner of Customs vs. Hypermix Feeds CorpDocument7 pagesCommissioner of Customs vs. Hypermix Feeds CorpJonjon BeeNo ratings yet

- Philippine Mining Act of 1995Document4 pagesPhilippine Mining Act of 1995jhanel bacquianNo ratings yet

- Arigo V SwiftDocument2 pagesArigo V SwiftJawwada Pandapatan MacatangcopNo ratings yet

- Habana vs. RoblesDocument2 pagesHabana vs. RoblesLloyd David P. VicedoNo ratings yet

- The Family As A Basic Autonomous Social InstitutionDocument9 pagesThe Family As A Basic Autonomous Social InstitutionJen DeeNo ratings yet

- Luz Farms Vs Sec of DARDocument15 pagesLuz Farms Vs Sec of DARRK RamosNo ratings yet

- Cariño vs. Insular Government of The Philippine IslandsDocument6 pagesCariño vs. Insular Government of The Philippine IslandsAmanda ButtkissNo ratings yet

- People Vs DisimbanDocument3 pagesPeople Vs DisimbanFar AwayNo ratings yet

- Recentjuris Remedial LawDocument81 pagesRecentjuris Remedial LawChai CabralNo ratings yet

- Clinton v. Jones, 520 U.S. 681 (1997)Document4 pagesClinton v. Jones, 520 U.S. 681 (1997)Ryuzaki HidekiNo ratings yet

- Hustler Magazine, Inc. v. Falwell, 485 U.S. 46 (1988)Document10 pagesHustler Magazine, Inc. v. Falwell, 485 U.S. 46 (1988)Scribd Government DocsNo ratings yet

- Calalang v. Williams G.R. 47800, December 2, 1940 - Constitutional LawDocument6 pagesCalalang v. Williams G.R. 47800, December 2, 1940 - Constitutional LawrafNo ratings yet

- De Agbayani vs. PNBDocument5 pagesDe Agbayani vs. PNBPrince CayabyabNo ratings yet

- Local Government ReviewerDocument182 pagesLocal Government ReviewerClaire Balacdao Dales100% (1)

- Disomangcop Vs SecretaryDocument3 pagesDisomangcop Vs SecretaryEuna GallardoNo ratings yet

- JBL Vs BAGATSING - Full Text and Case DigestDocument15 pagesJBL Vs BAGATSING - Full Text and Case DigestaudreyracelaNo ratings yet

- 1-People Vs PunoDocument17 pages1-People Vs PunoLexter CruzNo ratings yet

- 040-Standard Chartered Bank v. Standard Chartered Bank Employees Union, G.R. No. 165550, October 8, 2008Document8 pages040-Standard Chartered Bank v. Standard Chartered Bank Employees Union, G.R. No. 165550, October 8, 2008Jopan SJNo ratings yet

- Digested CasesDocument38 pagesDigested CasesJaelein Nicey A. Monteclaro100% (1)

- People vs. UdangDocument1 pagePeople vs. UdangAthea Justine YuNo ratings yet

- 00consti1 1Document30 pages00consti1 1liboaninoNo ratings yet

- PNB v. Cir 81 S 314Document4 pagesPNB v. Cir 81 S 314Marian's PreloveNo ratings yet

- Engendering Development:: An Overview of The Philippine ExperienceDocument26 pagesEngendering Development:: An Overview of The Philippine ExperienceYieMaghirang100% (1)

- Gender SensitivityDocument2 pagesGender Sensitivitykram nasladingNo ratings yet

- Philippine Government and Constitutioncourse GuideDocument9 pagesPhilippine Government and Constitutioncourse GuideMarilie Joy Aguipo-AlfaroNo ratings yet

- Unravel of Political Dynasty in Public GovernanceDocument8 pagesUnravel of Political Dynasty in Public GovernanceSyrel SantosNo ratings yet

- Mata LamDocument3 pagesMata LamVinci SicariiNo ratings yet

- Alexandria Condominium Corporation v. Laguna Lake Development AuthorityDocument6 pagesAlexandria Condominium Corporation v. Laguna Lake Development AuthorityMichael Derence PabalateNo ratings yet

- GR NO. 144707, July 2004: People of The Philippines, Petitioner, VsDocument3 pagesGR NO. 144707, July 2004: People of The Philippines, Petitioner, VsmaresNo ratings yet

- 3admin - 7Document13 pages3admin - 7JMXNo ratings yet

- Datu Guimid P. Matalam, Petitioner, V. People of The Philippines, Respondent. Resolution Leonen, J.Document6 pagesDatu Guimid P. Matalam, Petitioner, V. People of The Philippines, Respondent. Resolution Leonen, J.Lind SayNo ratings yet

- Mallin Vs JamesolaminDocument2 pagesMallin Vs JamesolaminPam Miraflor100% (1)

- Goodridge BakerDocument1 pageGoodridge Bakercmv mendozaNo ratings yet

- Appellant, vs. Shell Company of The Philippine Islands, LTD., Defendant-Appellee, Yek Hua TradingDocument2 pagesAppellant, vs. Shell Company of The Philippine Islands, LTD., Defendant-Appellee, Yek Hua TradingKevin Patrick Magalona DegayoNo ratings yet

- Final ThesisDocument38 pagesFinal ThesisLouie Francisco75% (8)

- The Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013Document25 pagesThe Effect of Inflation On The Economic Growth of The Philippines For Year 1984 UP TO 2013qwerty1785No ratings yet

- ROSALINDADocument10 pagesROSALINDAIan PaduaNo ratings yet

- Thousand Suns Starships - Chapter 3 Cheat SheetDocument16 pagesThousand Suns Starships - Chapter 3 Cheat SheetRogue GamesNo ratings yet

- (IMP) Ancient Indian JurisprudenceDocument28 pages(IMP) Ancient Indian JurisprudenceSuraj AgarwalNo ratings yet

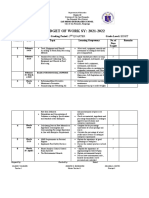

- BUDGET OF WORK SY: 2021-2022: Subject: Tle 8 Grading Period: 3Document2 pagesBUDGET OF WORK SY: 2021-2022: Subject: Tle 8 Grading Period: 3michelle dayritNo ratings yet

- YR7 Revision Sheet - Working ScietificallyDocument6 pagesYR7 Revision Sheet - Working ScietificallyNisha zehra100% (1)

- NDX DolsonDocument67 pagesNDX DolsonMahanta BorahNo ratings yet

- MCR3U Unit #1 NotesDocument12 pagesMCR3U Unit #1 NotespersonNo ratings yet

- AS Level Mathematics Statistics (New)Document49 pagesAS Level Mathematics Statistics (New)Alex GoldsmithNo ratings yet

- Geography Worksheet 1 Rural SettlementsDocument14 pagesGeography Worksheet 1 Rural SettlementsLelethuNo ratings yet

- 6480 49 35800 2 10 20230801Document12 pages6480 49 35800 2 10 20230801samsidar nidarNo ratings yet

- Radiation Protection in Dental RadiologyDocument52 pagesRadiation Protection in Dental Radiologyivan dario ardila martinezNo ratings yet

- Presentation by SHIVAM SHAHDocument23 pagesPresentation by SHIVAM SHAHmikojiNo ratings yet

- Bump Grade Force On Wire Student-1Document3 pagesBump Grade Force On Wire Student-1Benjamin WatsonNo ratings yet

- Study of PomeloDocument30 pagesStudy of PomeloKyle Cabusbusan75% (4)

- TanDocument8 pagesTanShourya RathodNo ratings yet

- Design Manual Is-800 Chapter 5Document92 pagesDesign Manual Is-800 Chapter 5Vivek Kumar GopeNo ratings yet

- Product Data Sheet: Product Description Technical SpecificationDocument1 pageProduct Data Sheet: Product Description Technical SpecificationYASHICA VAITTIANATHANNo ratings yet

- Wre MCQDocument136 pagesWre MCQsurendranath jadhavNo ratings yet

- AE 2018-19 Syll PDFDocument118 pagesAE 2018-19 Syll PDFHARI KRISHNA SNo ratings yet

- R.M. M, J. C, S.L. I S.M. H R C. M P J. M G : Aier Horover Verson AND Ayes Odney Aier and Eter C OldrickDocument1 pageR.M. M, J. C, S.L. I S.M. H R C. M P J. M G : Aier Horover Verson AND Ayes Odney Aier and Eter C OldrickPeter McGoldrickNo ratings yet

- Chapter 2 PDFDocument21 pagesChapter 2 PDFMahdi BanjakNo ratings yet

- Rosela Rowell, Carlos Rodriguez, Mark Salpeter, Chet Michals, Sarah KiddDocument5 pagesRosela Rowell, Carlos Rodriguez, Mark Salpeter, Chet Michals, Sarah KiddRosela De Jesus RowellNo ratings yet

- Humanistic TheoryDocument28 pagesHumanistic TheoryNano KaNo ratings yet

- Đề Trung Học Thực Hành Đại Học Sư Phạm 2020-2021Document8 pagesĐề Trung Học Thực Hành Đại Học Sư Phạm 2020-2021Chi Vũ LinhNo ratings yet

- Strategic Management Text and Cases 7th Edition Dess Solutions ManualDocument25 pagesStrategic Management Text and Cases 7th Edition Dess Solutions ManualNataliePowelljdmb100% (32)

- 7931-Article Text-15767-2-10-20191101Document13 pages7931-Article Text-15767-2-10-20191101Fatunde BukolaNo ratings yet

- Timetable 12 Jan 2022Document54 pagesTimetable 12 Jan 2022abcNo ratings yet

- Venkateshetal 2003Document56 pagesVenkateshetal 2003Gilang KemalNo ratings yet

- I Learned Chapter 8-The Power of GuidanceDocument1 pageI Learned Chapter 8-The Power of Guidanceapi-295870335No ratings yet

- DTZZIII User's GuideDocument4 pagesDTZZIII User's GuideDiego BaezNo ratings yet

- Soal TPS Bahasa InggrisDocument3 pagesSoal TPS Bahasa InggrisMaya Putri EkasariNo ratings yet