Professional Documents

Culture Documents

Alt Code (0247) On The Numeric Keypad. For Divide: Control+Shift+Plus Sign To Do Small Numbers

Uploaded by

rahimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Alt Code (0247) On The Numeric Keypad. For Divide: Control+Shift+Plus Sign To Do Small Numbers

Uploaded by

rahimCopyright:

Available Formats

Formula

Control+Shift+Plus Sign to do small numbers

Alt Code (0247) on the numeric keypad. For divide

Lecture 2

Measuring Interest Rates: Present Value

Present value (PV): The value today (t = 0) of a payment to be received in the future (t = n). PV of

$100 to be paid at t = n $100 t = 0 t = n 𝑷𝑽 = 𝑭𝑽/ 𝟏 + 𝒊 𝒏

Where: • 𝑃𝑉 = Present value • 𝐹𝑉 = Future value • 𝑖 = interest rate • 𝑛 = number of years until

maturity Here, we are discounting to determine the present value.

Interest rate is always 0. Because it is less than 100 for example 20 % is 0.20.

Compounding is usually 1.

𝑷𝑽 = 𝑭𝑽/( 𝟏 + 𝒊) 𝒏

Measuring Interest Rates: Future Value

Future value (FV): The value in the future (t = n) of an amount invested today (t = 0). $100 FV of $100

invested at t = 0 t = 0 t = n 𝑭𝑽 = 𝑷𝑽 𝟏 + 𝒊 𝒏

Where: • 𝑃𝑉 = Present value • 𝐹𝑉 = Future value • 𝑖 = interest rate • 𝑛 = number of years until

maturity Here, we are compounding to determine the future value.

Same as above just different order for formular.

𝑭𝑽 = 𝑷𝑽 (𝟏 + 𝒊) 𝒏

Measuring Interest Rates: YTM of Bonds

𝑷 = 𝑭 𝟏 + 𝒊 𝒏 $𝟗𝟎𝟎 = $𝟏𝟎𝟎𝟎 (𝟏 + 𝒊) Solving for 𝒊 gives a YTM of 11.11% Measuring Interest Rates:

YTM of Bonds

In this example of a one-year discount bond: • 𝑃 = Bond price • 𝐹 = Face value of bond • 𝑖 = annual

interest rate • 𝑛 = number of years until maturity

𝑷 = 𝑭 ÷(𝟏 + 𝒊)𝒏 $ 𝟗𝟎𝟎 = $𝟏𝟎𝟎𝟎 ÷(𝟏 + 𝒊)

Measuring Interest Rates: YTM of Bonds

In this example of a perpetuity or consol bond: • 𝑃 = Consol price • 𝐶 = Coupon payment • 𝑖 = annual

interest rate

Real Interest Rates

The real interest rate is calculated as: 𝒊𝒓 = 𝒊 – 𝝅e• Where: 𝒊𝒓 = real interest rate 𝒊 = nominal interest

rate 𝝅 𝒆 = expected inflation rate

𝒊𝒓 = 𝒊 – 𝝅e

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

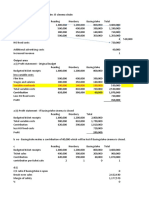

- BUS 239 Week 5 Rel Costing Del A Seg and Limiting Factors ANSDocument4 pagesBUS 239 Week 5 Rel Costing Del A Seg and Limiting Factors ANSrahimNo ratings yet

- BUS245 Lecture 10 Exam RevisionDocument99 pagesBUS245 Lecture 10 Exam RevisionrahimNo ratings yet

- Chapters in Module Chapter 1, 2,7,8,9,11Document13 pagesChapters in Module Chapter 1, 2,7,8,9,11rahimNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Flipmode ABC Week 3 SolutionDocument4 pagesFlipmode ABC Week 3 SolutionrahimNo ratings yet

- Discussion QuestionsDocument19 pagesDiscussion QuestionsrahimNo ratings yet

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- Week 3 Lecture Notes ABCDocument6 pagesWeek 3 Lecture Notes ABCrahimNo ratings yet

- Seminar 3Document1 pageSeminar 3rahimNo ratings yet

- Seminar 2 Activity Data FileDocument2 pagesSeminar 2 Activity Data FilerahimNo ratings yet

- Week 2 Real World View Solution GuideDocument3 pagesWeek 2 Real World View Solution GuiderahimNo ratings yet

- Week 1 Introduction and ActivitiesDocument4 pagesWeek 1 Introduction and ActivitiesrahimNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Week 1 Seminar Material 22nd and 24th Sept. SessionsDocument2 pagesWeek 1 Seminar Material 22nd and 24th Sept. SessionsrahimNo ratings yet

- (BUS260) Seminar Solutioins For Week 03 - Excel Solver TemplateDocument2 pages(BUS260) Seminar Solutioins For Week 03 - Excel Solver TemplaterahimNo ratings yet

- BUS208 Microeconomics For Managers: Market Structures: Oligopoly Lecture 10b: Roman Matousek R.matousek@qmul - Ac.ukDocument16 pagesBUS208 Microeconomics For Managers: Market Structures: Oligopoly Lecture 10b: Roman Matousek R.matousek@qmul - Ac.ukrahimNo ratings yet

- Seminar 3Document1 pageSeminar 3rahimNo ratings yet

- Week 3 Lecture Notes ABCDocument6 pagesWeek 3 Lecture Notes ABCrahimNo ratings yet

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- Week 2 Real World View Solution GuideDocument3 pagesWeek 2 Real World View Solution GuiderahimNo ratings yet

- Week 2 - One Direction SolutionDocument2 pagesWeek 2 - One Direction SolutionrahimNo ratings yet

- Week 1 Introduction and ActivitiesDocument4 pagesWeek 1 Introduction and ActivitiesrahimNo ratings yet

- Product Units: Source: Drury Chapter 15Document1 pageProduct Units: Source: Drury Chapter 15rahimNo ratings yet

- BUS208 Microeconomics For ManagersDocument21 pagesBUS208 Microeconomics For ManagersrahimNo ratings yet

- BUS239 2018 Main Marking SchemeDocument13 pagesBUS239 2018 Main Marking SchemerahimNo ratings yet

- Answer ANY THREE Questions: Chandres Tejura BUS 239 Management Accounting For Decision MakingDocument9 pagesAnswer ANY THREE Questions: Chandres Tejura BUS 239 Management Accounting For Decision MakingrahimNo ratings yet

- Solution Manual For Financial Accounting Global Edition 8th Edition by Libby and Short DownloadDocument32 pagesSolution Manual For Financial Accounting Global Edition 8th Edition by Libby and Short DownloadrahimNo ratings yet

- Seminar Activity DataDocument1 pageSeminar Activity DatarahimNo ratings yet

- Capital Investment Decisions: 1: Question IM 13.1 AdvancedDocument7 pagesCapital Investment Decisions: 1: Question IM 13.1 AdvancedrahimNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)