Professional Documents

Culture Documents

Instructions:: C. Submission Date: 19 April

Uploaded by

Tamzidul Islam0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

Assignment on Midterm

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesInstructions:: C. Submission Date: 19 April

Uploaded by

Tamzidul IslamCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

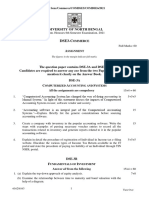

Brac University

Department of Economics and Social Sciences

School of Humanities and Social Sciences

Midterm Assignment (ECO 623)

Winter Semester, 2021

Instructions:

a. Write on a plain paper and then scan and then submit from Q 1 to 8

b. Q 9 in excel file

c. Submission Date: 19 April

Questions (1 to 8, 10 marks, Q 9: 20 marks)

1. Why is it useful to disassociate consumption and income across time?

2. Define Consumption smoothing. How financial institutions play an important role in

determining consumption smoothing across time.

3. Explain the shape (graph) of risk averse, risk neutral and risk loving investors.

4. Derive the function of absolute risk aversion and relative aversion by using consumption

smoothing under uncertainty model and in the context of risk premium and certainty

equivalent wealth.

5. What do you mean my prudence? Explain the concept of relative and absolute prudence.

6. Explain the saving problem in the following two scenarios:

a. Concave utility function: when the investor is risk averse

b. Convex utility function: when the investor is risk loving

7. Explain the portfolio problem and relevant theorems with real life examples.

8. Explain the risk diversification through portfolio construction. In this case, which risk is

relevant and which risk is not. Can we create a zero risk portfolio? If yes, what are the

necessary conditions and formulations?

9. Assignment on Excel: You have to optimize of portfolio stocks including the followings:

a. Select 5 stocks from different industry in Bangladesh for creating a portfolio. (Sheet 2)

b. Estimate the portfolio return and risk after considering the equal weight for each stock.

(Sheet 2)

c. Explain the reasoning behind selecting these stocks? (Sheet 1)

d. Do you choose stocks with positive correlation or negative correlation? Calculate the

coefficient of correlation among these stocks (Sheet 3)

e. By using the solver estimate the followings: (Sheet 4)

i. Optimize the portfolio for given risk, maximize return

ii. Optimize the portfolio for given return, minimize risk

iii. Maximize the Sharpe ratio

f. Summarize the results of b, e(i), e (ii), e (iii). (sample is given below, however you can

make your own) (Sheet 5)

g. Did you find any differences among the results in part (f), why? Explain. (Sheet 6)

h. Are you risk averse, risk neutral and risk taker? Tell me in the context of your portfolio

choice. (Sheet 7)

Portfolio Return Portfolio Risk

b.

e (i)

e (ii)

e (iii)

You might also like

- Comman Sense Investing With Stock ScreenersDocument46 pagesComman Sense Investing With Stock Screenersdelta_scope100% (10)

- Ccounting Basics and Interview Questions AnswersDocument18 pagesCcounting Basics and Interview Questions AnswersAamir100% (1)

- Basics of Spreading: Ratio Spreads and BackspreadsDocument20 pagesBasics of Spreading: Ratio Spreads and BackspreadspkkothariNo ratings yet

- MEED GCC Captive InsuranceDocument44 pagesMEED GCC Captive InsurancemacoceanNo ratings yet

- Cadence Wealth Management PDFDocument25 pagesCadence Wealth Management PDFYizhenNo ratings yet

- Olympiad Sample Paper 3: Useful for Olympiad conducted at School, National & International levelsFrom EverandOlympiad Sample Paper 3: Useful for Olympiad conducted at School, National & International levelsRating: 1 out of 5 stars1/5 (1)

- Leverages: Solutions To Assignment ProblemsDocument7 pagesLeverages: Solutions To Assignment ProblemsPalash BairagiNo ratings yet

- Continental Carriers IncDocument7 pagesContinental Carriers IncYetunde JamesNo ratings yet

- Summer Training Report at NJ INDIA INVESDocument144 pagesSummer Training Report at NJ INDIA INVESAmar AgrawalNo ratings yet

- FN2190 Ota Final Exam PaperDocument7 pagesFN2190 Ota Final Exam PaperNoor NoorNo ratings yet

- BFC5935 - SAMPLE EXAM Solutions PDFDocument10 pagesBFC5935 - SAMPLE EXAM Solutions PDFXue Xu0% (1)

- FNCE 249: Assignment 1: InstructionsDocument8 pagesFNCE 249: Assignment 1: Instructionsmicrobiology biotechnology0% (1)

- FN1024 ZB - 2019Document7 pagesFN1024 ZB - 2019Ha PhuongNo ratings yet

- ECN801 - F2009 Final ExamDocument3 pagesECN801 - F2009 Final ExamDSFS DSFSDFDSF NNo ratings yet

- Isc Assignment Class 12 - DDocument3 pagesIsc Assignment Class 12 - DPrakhar SrivastavaNo ratings yet

- Sample Examination PaperDocument3 pagesSample Examination PaperHa PhuongNo ratings yet

- Exam IA 27032012 - Example For BBDocument6 pagesExam IA 27032012 - Example For BBJerry K FloaterNo ratings yet

- UKFF3013 Assignment 202401Document5 pagesUKFF3013 Assignment 202401jiayiwang0221No ratings yet

- Hillwoods Academy: Class XiiDocument7 pagesHillwoods Academy: Class XiiPrabhjeet SinghNo ratings yet

- BD5 SM12Document10 pagesBD5 SM12didiajaNo ratings yet

- 92 Za - Corporate Finance.2007Document6 pages92 Za - Corporate Finance.2007Tamara OrlovaNo ratings yet

- Tutorial 1 Course Plan & AssignmentDocument7 pagesTutorial 1 Course Plan & Assignmentjiayiwang0221No ratings yet

- 11.mec-1st Eng2017Document10 pages11.mec-1st Eng2017Anurag SrivastavaNo ratings yet

- Training ExercisesDocument4 pagesTraining ExercisesnyNo ratings yet

- Assignment 1, Mgtf402 Investment Analysis (Due October 9, 2017)Document2 pagesAssignment 1, Mgtf402 Investment Analysis (Due October 9, 2017)minghui0% (1)

- 13 Comm 308 Final Exam (Summer 1, 2012) SolutionsDocument17 pages13 Comm 308 Final Exam (Summer 1, 2012) SolutionsAfafe ElNo ratings yet

- 2021 ZB PaperDocument11 pages2021 ZB Papermandy YiuNo ratings yet

- AS - SAMPLE FINAL EXAM PAPER - FIN700 - Finl MGT - T318Document20 pagesAS - SAMPLE FINAL EXAM PAPER - FIN700 - Finl MGT - T318Mahbub Zaman AshrafiNo ratings yet

- Mock Exam 1Document11 pagesMock Exam 1Marion Van SchooteNo ratings yet

- Mock Test 19 Paper 1 - EngDocument12 pagesMock Test 19 Paper 1 - Enghiu chingNo ratings yet

- MBA Finance 1st Semester Final Previous QuestionDocument8 pagesMBA Finance 1st Semester Final Previous Questionmuhammad shahid ullahNo ratings yet

- Investment Analysis (FIN 670) Fall 2009Document13 pagesInvestment Analysis (FIN 670) Fall 2009BAHADUR singhNo ratings yet

- Problem Set 3Document4 pagesProblem Set 3Tram Gia PhatNo ratings yet

- Assignment FIN205 S2 - 2017Document4 pagesAssignment FIN205 S2 - 2017Japheth CapatiNo ratings yet

- 4 - Problem - Set FRM - PS PDFDocument3 pages4 - Problem - Set FRM - PS PDFValentin IsNo ratings yet

- Problem Set 5 Financial Management - Financial AnalysisDocument4 pagesProblem Set 5 Financial Management - Financial AnalysisValentin IsNo ratings yet

- Midterm 2021Document10 pagesMidterm 2021miguelNo ratings yet

- 2013-Main EQP and CommentariesDocument71 pages2013-Main EQP and CommentariesrowanabdeldayemNo ratings yet

- II PUC Vacation Assignment May - 2022Document3 pagesII PUC Vacation Assignment May - 2022Resh RamNo ratings yet

- FN3092 - Corporate Finance - 2008 Exam - Zone-ADocument5 pagesFN3092 - Corporate Finance - 2008 Exam - Zone-AAishwarya PotdarNo ratings yet

- Final Exam Questions Portfolio ManagementDocument9 pagesFinal Exam Questions Portfolio ManagementThảo Như Trần NgọcNo ratings yet

- Add MathDocument20 pagesAdd MathSiti Nurfaizah Piei100% (1)

- Assignment 5 2020Document5 pagesAssignment 5 2020林昀妤No ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/42Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/42Lewis HankinNo ratings yet

- End Sem Derivatives 2021Document2 pagesEnd Sem Derivatives 2021vinayNo ratings yet

- Comm 308 Final Exam (Winter 2015)Document18 pagesComm 308 Final Exam (Winter 2015)Mike TremblayNo ratings yet

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocument18 pages04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElNo ratings yet

- ECF1100 Practice Exam - Tri B 2021Document14 pagesECF1100 Practice Exam - Tri B 2021jongkimyuNo ratings yet

- Academic Writing June 2019 ExamDocument7 pagesAcademic Writing June 2019 Examchinyamazangi878No ratings yet

- N Risky Assets Is Given by V, Express The Individual's Expected Utility Maximization Problem AsDocument1 pageN Risky Assets Is Given by V, Express The Individual's Expected Utility Maximization Problem AsSiddharth VishwanathNo ratings yet

- FM423 - 2020 ExamDocument7 pagesFM423 - 2020 ExamSimon GalvizNo ratings yet

- Sample Midterm Exam For Engineering Economics PDFDocument9 pagesSample Midterm Exam For Engineering Economics PDFAyah RamiNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- Mock Exam 2022Document6 pagesMock Exam 2022LucNo ratings yet

- LL Write NO MORE THAN FIVE WORDS For Each AnswerDocument8 pagesLL Write NO MORE THAN FIVE WORDS For Each AnswerCucNguyen100% (1)

- Fundamentals of Investment Question PaperDocument2 pagesFundamentals of Investment Question Paperehtisham735202No ratings yet

- FIN3080AB - Sample FinalDocument2 pagesFIN3080AB - Sample FinalLCT Gaming717No ratings yet

- Class X - 402, Sample Paper - 1Document3 pagesClass X - 402, Sample Paper - 1Manya jain100% (1)

- Northcentral University Assignment Cover Sheet: LearnerDocument15 pagesNorthcentral University Assignment Cover Sheet: LearnerMorcy Jones100% (1)

- Y12 Eco QPDocument17 pagesY12 Eco QPRainald Avish chandNo ratings yet

- Study Guide 10-17Document22 pagesStudy Guide 10-17minisizekevNo ratings yet

- II Pu Economics QPDocument8 pagesII Pu Economics QPBharathi RNo ratings yet

- ECON1095 Assignment 1 Sem 2 2018 1 82122208Document3 pagesECON1095 Assignment 1 Sem 2 2018 1 82122208iNeel0% (1)

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanNo ratings yet

- EIA1010 FM Group AssignmentDocument10 pagesEIA1010 FM Group AssignmentAEISY ISKANDAR MAZLANNo ratings yet

- Overview and Purpose: Solve Real-World Problems While Clearly Communicating Financial Math Processes and CalculationsDocument5 pagesOverview and Purpose: Solve Real-World Problems While Clearly Communicating Financial Math Processes and Calculationsayushi kNo ratings yet

- Sample Final UPF Financial Econ 22-23Document6 pagesSample Final UPF Financial Econ 22-23Cristina TortesNo ratings yet

- FM212 2017 PaperDocument5 pagesFM212 2017 PaperSam HanNo ratings yet

- Eco514 Assignment 3 Tamzidul IslamDocument6 pagesEco514 Assignment 3 Tamzidul IslamTamzidul IslamNo ratings yet

- Assignment 6 Tamzidul Islam 20175010Document8 pagesAssignment 6 Tamzidul Islam 20175010Tamzidul IslamNo ratings yet

- Chapter 5 Solutions Tamzidul IslamDocument18 pagesChapter 5 Solutions Tamzidul IslamTamzidul IslamNo ratings yet

- Chapter 11 Tamzidul IslamDocument10 pagesChapter 11 Tamzidul IslamTamzidul IslamNo ratings yet

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- ACCT 2010: Principles of Accounting I Mini Exam 1 Monday September 26, 2016 8-9 P.M. LTADocument6 pagesACCT 2010: Principles of Accounting I Mini Exam 1 Monday September 26, 2016 8-9 P.M. LTAPak HoNo ratings yet

- Equity Research: Q.1 Top Down and Bottom Up ApproachDocument10 pagesEquity Research: Q.1 Top Down and Bottom Up Approachpuja bhatNo ratings yet

- Chapter Seven Sources Aand Cost of Project FinanceDocument11 pagesChapter Seven Sources Aand Cost of Project FinanceMahamoud HassenNo ratings yet

- NRCA - Annual Report - 2015 PDFDocument218 pagesNRCA - Annual Report - 2015 PDFdeboraNo ratings yet

- Chapter 3Document48 pagesChapter 3SundaraMathavanNo ratings yet

- Broll Property Group - Group ProfileDocument16 pagesBroll Property Group - Group ProfileItzy CortizoNo ratings yet

- XPRS Xpress Annual Report 2011 - From A Ripple in Singapore, To A Wave in AsiaDocument30 pagesXPRS Xpress Annual Report 2011 - From A Ripple in Singapore, To A Wave in AsiaWeR1 Consultants Pte LtdNo ratings yet

- Mergers, Etc.1Document4 pagesMergers, Etc.1Sebi CosminNo ratings yet

- Some of The Accounting Recits PointersDocument7 pagesSome of The Accounting Recits PointersJoseNo ratings yet

- SciDocument3 pagesSciDonita BinayNo ratings yet

- FTP Corporation Private Limited: - ProspectusDocument2 pagesFTP Corporation Private Limited: - ProspectusSwaggy JattNo ratings yet

- Annual Report Emea PLC PDFDocument550 pagesAnnual Report Emea PLC PDFNikhil ChaudharyNo ratings yet

- Sources of Financing For Real Estate in SingaporeDocument17 pagesSources of Financing For Real Estate in Singaporesita deliyana FirmialyNo ratings yet

- 2019 Infrastructure Investment PlanDocument132 pages2019 Infrastructure Investment PlanRobert MadhlopaNo ratings yet

- Global Firm DefinitionDocument8 pagesGlobal Firm DefinitionAmir HamzahNo ratings yet

- ISSN: 1804-0527 (Online) 1804-0519 (Print) : Study On Relevance of Demographic Factors in Investment DecisionsDocument14 pagesISSN: 1804-0527 (Online) 1804-0519 (Print) : Study On Relevance of Demographic Factors in Investment DecisionsRohini VNo ratings yet

- E-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Document50 pagesE-PAPER - NON-BANKING ISLAMIC FINANCIAL INSTITUTIONS - Research Center For Islamic Economics (IKAM)Muhammad QuraisyNo ratings yet

- Portfolio Theory Creates New Investment OpportunitiesDocument3 pagesPortfolio Theory Creates New Investment OpportunitiesCardoso PenhaNo ratings yet

- 2015 Annual Report PDFDocument312 pages2015 Annual Report PDFNicolaas StrydomNo ratings yet

- Ns Industry ChampDocument2 pagesNs Industry ChampBina ShahNo ratings yet

- ReturnDocument15 pagesReturnNurqasrina AisyahNo ratings yet

- Applicant AspatriaDocument34 pagesApplicant AspatriaNelia Mae S. VillenaNo ratings yet