Professional Documents

Culture Documents

Dasdsa

Dasdsa

Uploaded by

CleinJonTiuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dasdsa

Dasdsa

Uploaded by

CleinJonTiuCopyright:

Available Formats

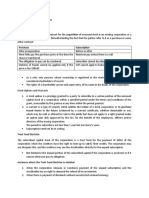

Closed Corporations

One whose articles of incorporation provides that:

a. All the corporations issued stock of all classes, exclusive of treasury shares, shall be held of

record by not more than a specified number of people, not exceeding 20;

b. All the issued stocks of all classes shall be subject to one or more specified restrictions on

transfers permitted by title 12 of RCCP, a preemption of shares is restricted in favor of any

stockholder or of the corporation;

c. The listing of the corporation stocks in any stock exchange or making a public offering of

those stocks is prohibited.

Difference between Close corporation and Ordinary Corporation

1. Not more than 20

2. Restriction on the transfer of shares

3. Specific Qualifications to be eligible as stockholders are usually provided for

4. Public offering is prohibited.

5. May be directly managed by the stockholders, as the AOI may provide

6. There are rules on deadlock

7. A shareholder may withdraw his shares and may ask the corporation to purchase his shares.

Who cannot be a close corporation

1. Those corporation wherein at least 2/3 of the of its voting stock is owned by a corporation which

is not a close corporation

2. Banks

3. Insurance companies

4. Mining or oil companies

5. Public utilities

6. Educational Institutions

7. Stock markets

8. Corporations declared to be vested with public utilities

Other contents of AOI

a. Classification of shares or rights and the qualifications for owning or holding the same and

restrictions on their transfers;

b. Classifications of directors into one or more classes each of whom may be voted for or elected

solely by a particular class of each stock

c. Greater quorum or voting requirements in meetings of stockholders or directors than those

provided in the RCCP;

d. That the business shall be managed by the stockholders of the corporation rather than the

directors

e. That all officers or employees shall be elected by the stockholders, not by board of directors

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 05 MWSS Vs DawayDocument3 pages05 MWSS Vs DawayCleinJonTiuNo ratings yet

- DdaadsDocument3 pagesDdaadsCleinJonTiuNo ratings yet

- Offer of Exhibits in WritingDocument1 pageOffer of Exhibits in WritingCleinJonTiuNo ratings yet

- 02 BPI Vs de Reny FabricsDocument2 pages02 BPI Vs de Reny FabricsCleinJonTiuNo ratings yet

- Crime Against PersonDocument1 pageCrime Against PersonCleinJonTiuNo ratings yet

- Hon. Anabel Carmen S. Casi: Letter of IntentDocument2 pagesHon. Anabel Carmen S. Casi: Letter of IntentCleinJonTiu100% (1)

- Attorney's Lien: Rayos Vs Hernandez. G.R. No. 169079, February 12, 2007Document1 pageAttorney's Lien: Rayos Vs Hernandez. G.R. No. 169079, February 12, 2007CleinJonTiuNo ratings yet

- Reyes Vs RTCDocument18 pagesReyes Vs RTCCleinJonTiuNo ratings yet

- 09 BPI vs. CIRDocument2 pages09 BPI vs. CIRCleinJonTiuNo ratings yet

- 01 HSBC Vs NSCDocument2 pages01 HSBC Vs NSCCleinJonTiuNo ratings yet

- 03 FEATI Bank and Trust Co Vs CADocument4 pages03 FEATI Bank and Trust Co Vs CACleinJonTiuNo ratings yet

- Miral, Christopher Torts - C Odchigue, Alex Rey Midterms Ondong, Michelle FlorenceDocument8 pagesMiral, Christopher Torts - C Odchigue, Alex Rey Midterms Ondong, Michelle FlorenceCleinJonTiuNo ratings yet

- G.R. No. 191109 July 18, 2012 Republic of The Philippines, Represented by The Philippine Reclamation Authority (Pra) vs. City of ParanaqueDocument11 pagesG.R. No. 191109 July 18, 2012 Republic of The Philippines, Represented by The Philippine Reclamation Authority (Pra) vs. City of ParanaqueCleinJonTiuNo ratings yet

- DasdsaDocument3 pagesDasdsaCleinJonTiuNo ratings yet

- 13 Dynamic Builders Vs PresbiteroDocument2 pages13 Dynamic Builders Vs PresbiteroCleinJonTiuNo ratings yet

- Reyes Vs RTCDocument11 pagesReyes Vs RTCCleinJonTiuNo ratings yet

- April 23, 2020Document7 pagesApril 23, 2020CleinJonTiuNo ratings yet

- Case 1Document3 pagesCase 1CleinJonTiuNo ratings yet

- Object or Real Evidence Nature of Object EvidenceDocument6 pagesObject or Real Evidence Nature of Object EvidenceCleinJonTiuNo ratings yet

- First Case Julia Baretto Anderson vs. Rene Descartes: March 3, 2021, 6:00-7:30pmDocument9 pagesFirst Case Julia Baretto Anderson vs. Rene Descartes: March 3, 2021, 6:00-7:30pmCleinJonTiuNo ratings yet

- Stocks and StockholdersDocument4 pagesStocks and StockholdersCleinJonTiuNo ratings yet

- Tiu Corpo C Case SummaryDocument1 pageTiu Corpo C Case SummaryCleinJonTiuNo ratings yet

- What Is A Corporation?Document30 pagesWhat Is A Corporation?CleinJonTiuNo ratings yet