Professional Documents

Culture Documents

ECON 2001 MIDSEMESTER EXAM EQUATIONS AND ANALYSIS

Uploaded by

sandrae brownOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ECON 2001 MIDSEMESTER EXAM EQUATIONS AND ANALYSIS

Uploaded by

sandrae brownCopyright:

Available Formats

ECON 2001 MIDSEMESTER MARATHON

Equations

Analysis of Competitive Markets

• For taxes, subtract the tax from the targeted side of the market

Eg if Govt wants to reduce consumption : Demand curve -Tax = Supply Curve

The tax per unit is the difference between what the Consumers pay and what the Supplier

receives.

• For subsidies, add the tax to the targeted side of the market

Eg. If government wants to protect farmers: Demand Curve= Supply Curve

The tax per unit is the difference between what the Supplier gets and what the Consumer

pays.

Competition (Monopoly, Oligopoly, Monopolistic Competition, Perfect Competition)

• Profit= (P-AC)Q

• TR= P*Q

• MR= f-1(TR) wrt Q

• AR=Demand (in all models)

• MR=AR (ONLY IN PREFECT COMPETITION)

• TC=AC x Q

• AC= TC/Q

• MC= f-1(TC) wrt Q

• Profit maximization point MC=MR

• To find the Cournot reaction curves:

a) Equate MR=MC, then

b) Rewrite the new equation in terms of each firm’s Q

Chapter 8 (Analysis of Competitive Markets)

1. Suppose that a competitive firm’s marginal cost of producing output q is given by

MC(q) = 3 + 2q. Assume that the market price of the firm’s product is $9.

a. What level of output will the firm produce?

b. What is the firm’s producer surplus?

c. Suppose that the average variable cost of the firm is given by AVC(q) = 3 + q.

Suppose that the firm’s fixed costs are known to be $3. Will the firm be earning a

positive, negative, or zero profit in the short run?

2. Suppose you are given the following information about a particular industry:

QD = 6500 - 100P Market demand

QS = 1200P Market supply

C(q) = 722 + q2/200 Firm total cost function

MC(q) = 2q/ 200 Firm marginal cost function

Assume that all firms are identical and that the market is characterized by perfect

competition.

a) Find the equilibrium price, the equilibrium quantity, the output supplied by the

firm, and the profit of each firm.

b) Would you expect to see entry into or exit from the industry in the long run?

Explain. What effect will entry or exit have on market equilibrium?

c) What is the lowest price at which each firm would sell its output in the long run?

Is profit positive, negative, or zero at this price? Explain.

3. (MCQ)

Chapter 9 (Perfect Competition)

4. Suppose the market for widgets can be described by the following equations:

Demand: P = 10 - Q

Supply: P = Q - 4

where P is the price in dollars per unit and Q is the quantity in thousands of units. Then:

a. What is the equilibrium price and quantity?

b. Suppose the government imposes a tax of $1 per unit to reduce widget consumption

and raise government revenues. What will the new equilibrium quantity be? What price

will the buyer pay? What amount per unit will the seller receive?

c. Suppose the government has a change of heart about the importance of widgets to the

happiness of the American public. The tax is removed and a subsidy of $1 per unit

granted to widget producers. What will the equilibrium quantity be? What price will the

buyer pay? What amount per unit (including the subsidy) will the seller receive? What

will be the total cost to the government?

5. (MCQ)

Chapter 10 (Monopoly)

6. A firm faces the following average revenue (demand) curve:

P = 120 - 0.02Q

where Q is weekly production and P is price, measured in cents per unit. The firm’s cost

function is given by C = 60Q + 25,000. Assume that the firm maximizes profits. What is

the level of production, price, and total profit per week?

7. (MCQ)

Chapter 12 (Oligopoly and Monopolistic Competition)

8. A monopolist can produce at a constant average (and marginal) cost of AC = MC = $5. It

faces a market demand curve given by Q = 53 - P.

a) Calculate the profit-maximizing price and quantity for this monopolist. Also

calculate its profits.

b) Suppose a second firm enters the market. Let Q1 be the output of the first firm

and Q2 be the output of the second. Market demand is now given by Q1 + Q2 =

53 – P. Assuming that this second firm has the same costs as the first, write the

profits of each firm as functions of Q1 and Q2.

c) Suppose (as in the Cournot model) that each firm chooses its profit-maximizing

level of output on the assumption that its competitor’s output is fixed. Find each

firm’s “reaction curve” (i.e., the rule that gives its desired output in terms of its

competitor’s output).

d) Calculate the Cournot equilibrium (i.e., the values of Q1 and Q2 for which each

firm is doing as well as it can given its competitor’s output). What are the

resulting market price and profits of each firm?

9. (MCQ)

You might also like

- Fake Credit Card StatementDocument17 pagesFake Credit Card Statementvishal sharmaNo ratings yet

- Competitive Firms and MarketsDocument21 pagesCompetitive Firms and MarketsSarthakNo ratings yet

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- Q1. Cadila Co. Has Three Production Departments A, B and C and Two ServiceDocument5 pagesQ1. Cadila Co. Has Three Production Departments A, B and C and Two Servicemedha surNo ratings yet

- Ateneo Law JournalDocument58 pagesAteneo Law JournalCiara De LeonNo ratings yet

- Chapter 2 Gross EstateDocument4 pagesChapter 2 Gross EstateMary Anne KazuyaNo ratings yet

- tổng hợp đề KTQT 2Document43 pagestổng hợp đề KTQT 2Ly BùiNo ratings yet

- Influence of Inflation On The Financial Challenges Faced by StudentsDocument4 pagesInfluence of Inflation On The Financial Challenges Faced by StudentsNobara AkatsukiNo ratings yet

- AralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Document14 pagesAralPan8 - Q4 - Wk8 - ANG UNITED NATIONS AT IBA PANG PANDAIGDIGANG ORGANISASYON, PANGKAT AT ALYANSA - WINNIE S. BALUDEN - CONNIE TULAN-1Jaiz Cadang100% (1)

- 621904314547 (2)Document6 pages621904314547 (2)Furkan NazırNo ratings yet

- Eco101a Tutorial Problem Set 12Document2 pagesEco101a Tutorial Problem Set 12Rhythm's PathakNo ratings yet

- Eco101a Tutorial Problem Set 06 Summer Term 2018 (16079)Document4 pagesEco101a Tutorial Problem Set 06 Summer Term 2018 (16079)Mukul Chandra0% (1)

- Problem Set VI (PGP Micro)Document2 pagesProblem Set VI (PGP Micro)CatIimNo ratings yet

- Practice: + 10Q and FC ($) 200, Where Q Is inDocument2 pagesPractice: + 10Q and FC ($) 200, Where Q Is insơn trầnNo ratings yet

- MICRO Economics Group AssignmentDocument4 pagesMICRO Economics Group Assignmentbeth elNo ratings yet

- ME Problems PC MonopolyDocument7 pagesME Problems PC MonopolyDevan BhallaNo ratings yet

- ECON 357 Assignment 2B: Monopoly, Perfect Competition, Price Controls and Factor MarketsDocument16 pagesECON 357 Assignment 2B: Monopoly, Perfect Competition, Price Controls and Factor MarketshannahNo ratings yet

- Micro Chapter 8 P SetDocument2 pagesMicro Chapter 8 P SetRuthra KumarNo ratings yet

- ECO101A Intro Economics Assignment 6 Key QuestionsDocument2 pagesECO101A Intro Economics Assignment 6 Key QuestionsPratik RajNo ratings yet

- Advanced Microeconomics II Q & ADocument34 pagesAdvanced Microeconomics II Q & AZemichael SeltanNo ratings yet

- CH 08Document36 pagesCH 08Xiaojie CaiNo ratings yet

- CH 9Document9 pagesCH 9ceoji100% (1)

- 28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014Document9 pages28d8633c121419cda48c0d9a622614d6_27f68bd319e3aca1d3f97af3bbb90014deepakdohare1011No ratings yet

- Problem Set 1Document3 pagesProblem Set 1陳柏字No ratings yet

- University of Dar Es Salaam Business School perfectly competitive market revision questionsDocument6 pagesUniversity of Dar Es Salaam Business School perfectly competitive market revision questionsPETRONo ratings yet

- Monopoly and oligopoly market analysisDocument2 pagesMonopoly and oligopoly market analysisMuskaanNo ratings yet

- Worksheet Imperfect CompetitionDocument2 pagesWorksheet Imperfect CompetitionMuskaanNo ratings yet

- Tutorial 8 - SchemeDocument7 pagesTutorial 8 - SchemeTeo ShengNo ratings yet

- Market Structure and Game Theory (Part 4)Document7 pagesMarket Structure and Game Theory (Part 4)Srijita GhoshNo ratings yet

- Economics ExamDocument15 pagesEconomics ExamИСЛАМБЕК СЕРІКҰЛЫNo ratings yet

- EC3099 - Industrial Economics - 2007 Exam - Zone-ADocument4 pagesEC3099 - Industrial Economics - 2007 Exam - Zone-AAishwarya PotdarNo ratings yet

- M.A. and B.Sc. Examination School of Economics & Finance EC2001 Intermediate MicroeconomicsDocument5 pagesM.A. and B.Sc. Examination School of Economics & Finance EC2001 Intermediate Microeconomicssjassemi1No ratings yet

- Tutorial 7 - SchemeDocument6 pagesTutorial 7 - SchemeTeo ShengNo ratings yet

- Tutorial Sheet 1Document2 pagesTutorial Sheet 1Samar EissaNo ratings yet

- Problem Set 7Document1 pageProblem Set 7Shubham VishwakarmaNo ratings yet

- Solutions Strategic Pricing TechniquesDocument7 pagesSolutions Strategic Pricing Techniquesarun ladeNo ratings yet

- Eco 301 QuestionsDocument16 pagesEco 301 QuestionsSamuel Ato-MensahNo ratings yet

- Izmir University of Economics BA415 Problem Set II KeyDocument6 pagesIzmir University of Economics BA415 Problem Set II KeySina TempioraryNo ratings yet

- Manager's Guide to Maximizing Profits in Different Market StructuresDocument4 pagesManager's Guide to Maximizing Profits in Different Market StructuresdeeznutsNo ratings yet

- ME Problem Set-6Document5 pagesME Problem Set-6Akash Deep100% (1)

- Answers To Summer 2010 Perfect Competition QuestionsDocument7 pagesAnswers To Summer 2010 Perfect Competition QuestionsNikhil Darak100% (1)

- Tutorial 11 Suggested SolutionsDocument6 pagesTutorial 11 Suggested SolutionsChloe GuilaNo ratings yet

- Managerial decisions in various market structuresDocument2 pagesManagerial decisions in various market structuresdeeznutsNo ratings yet

- Economics 310 ExamDocument6 pagesEconomics 310 ExamMarjser Planta SagarinoNo ratings yet

- Handout For Chapter 2Document3 pagesHandout For Chapter 2SamerNo ratings yet

- MICROECONOMICS EXERCISES ON MONOPOLYDocument10 pagesMICROECONOMICS EXERCISES ON MONOPOLYfedericodtNo ratings yet

- Theory of The FirmDocument56 pagesTheory of The FirmoogafelixNo ratings yet

- Perfect Competition Market Structure"TITLE"Monopoly Market Analysis" TITLE"Oligopoly Industry Pricing"TITLE"Monopolistic Competition ProfitDocument2 pagesPerfect Competition Market Structure"TITLE"Monopoly Market Analysis" TITLE"Oligopoly Industry Pricing"TITLE"Monopolistic Competition Profitpiyush kumarNo ratings yet

- Perfect Competition Key ConceptsDocument17 pagesPerfect Competition Key ConceptsFloyd Jason0% (1)

- REVENUE & PROFIT MAXIMIZATION WORKSHEETDocument1 pageREVENUE & PROFIT MAXIMIZATION WORKSHEETsweta singhNo ratings yet

- EC304 Assignment1 W12Document3 pagesEC304 Assignment1 W12Moatez HabayebNo ratings yet

- Managing Competitive Markets ChapterDocument46 pagesManaging Competitive Markets ChapterPratama YaasyfahNo ratings yet

- Market Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresDocument19 pagesMarket Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresLove Rabbyt100% (1)

- Worksheet I On MICRO I 2015-16 A.Y@AAU - NMDDocument7 pagesWorksheet I On MICRO I 2015-16 A.Y@AAU - NMDabdiimohammedadamNo ratings yet

- ME Tutorial 14Document2 pagesME Tutorial 14Tamanna SinghNo ratings yet

- EC203 - Problem Set 8Document2 pagesEC203 - Problem Set 8Yiğit KocamanNo ratings yet

- 100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryDocument6 pages100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryKristina Phillpotts-BrownNo ratings yet

- EC2066 Commentary 2008 - ZBDocument27 pagesEC2066 Commentary 2008 - ZBtabonemoira88No ratings yet

- ECON 315 Practice For FinalDocument9 pagesECON 315 Practice For Finaldimitra triantos0% (1)

- ECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkDocument20 pagesECO402 FinalTerm QuestionsandAnswersPreparationbyVirtualiansSocialNetworkranashair9919No ratings yet

- 2.consider Two Firms Facing The Demand Curve P 50 5Q, Where Q Q1 + Q2. The Firms' CostDocument3 pages2.consider Two Firms Facing The Demand Curve P 50 5Q, Where Q Q1 + Q2. The Firms' CostarunNo ratings yet

- Assgnmt 5Document4 pagesAssgnmt 5Heap Ke XinNo ratings yet

- Econ203 Lab 081Document36 pagesEcon203 Lab 081api-235832666No ratings yet

- Lesson 5 MarketsDocument39 pagesLesson 5 MarketsiitNo ratings yet

- Tgerfwd 3 RtgerfwdeDocument2 pagesTgerfwd 3 RtgerfwdejamesNo ratings yet

- Answerstosummer2010perfectcompetitionquestions PDFDocument7 pagesAnswerstosummer2010perfectcompetitionquestions PDFMohammad Javed QuraishiNo ratings yet

- Problem Set 1Document1 pageProblem Set 1peanut yayNo ratings yet

- ECON 20031 Problem Set 4 AnswersDocument1 pageECON 20031 Problem Set 4 Answerssandrae brownNo ratings yet

- ECON 20031 - Problem Set 5 AnswersDocument2 pagesECON 20031 - Problem Set 5 Answerssandrae brown100% (1)

- ChartDocument1 pageChartsandrae brownNo ratings yet

- Budget worksheet for Woods household suppliesDocument2 pagesBudget worksheet for Woods household suppliessandrae brownNo ratings yet

- Budget worksheet for Woods household suppliesDocument2 pagesBudget worksheet for Woods household suppliessandrae brownNo ratings yet

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Online mid-semester exams scheduleDocument2 pagesOnline mid-semester exams schedulesandrae brownNo ratings yet

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Online mid-semester exams scheduleDocument2 pagesOnline mid-semester exams schedulesandrae brownNo ratings yet

- Brandywine by LawsDocument16 pagesBrandywine by Lawsapi-681087199No ratings yet

- Which Risk Analysis Tool is Most Effective for Calculating Investment Risk: Variance, Standard Deviation, or VaRDocument1 pageWhich Risk Analysis Tool is Most Effective for Calculating Investment Risk: Variance, Standard Deviation, or VaRsajidschannelNo ratings yet

- Tax Guidance On Red Hill ReimbursementsDocument5 pagesTax Guidance On Red Hill ReimbursementsHNNNo ratings yet

- Non-Integrated Cost AccountsDocument20 pagesNon-Integrated Cost Accountsriya thakurNo ratings yet

- Genentech Account StatementDocument1 pageGenentech Account StatementThanh ĐứcNo ratings yet

- Advantages of GlobalizationDocument8 pagesAdvantages of GlobalizationKen Star100% (1)

- AsterDM Annual Report FY 2019-20Document280 pagesAsterDM Annual Report FY 2019-20Jayaprakash MuthuvatNo ratings yet

- SIP FileDocument62 pagesSIP FileswetaNo ratings yet

- HBL-Vertical & Horizontal AnlyisDocument10 pagesHBL-Vertical & Horizontal AnlyismughalsairaNo ratings yet

- PA Induction Ready ReckonerDocument173 pagesPA Induction Ready Reckonersushant guptaNo ratings yet

- Principles of Costs and CostingDocument50 pagesPrinciples of Costs and CostingSOOMA OSMANNo ratings yet

- Conceptual Framework For Financial ReportingDocument5 pagesConceptual Framework For Financial ReportingRaina OsorioNo ratings yet

- Dilg-Lgu Lupon: Statement of AccountDocument4 pagesDilg-Lgu Lupon: Statement of AccountDilg LuponNo ratings yet

- Tour Costing and QuotationDocument2 pagesTour Costing and Quotation21Ni Made Dinda Puan Maharani100% (1)

- Independent University, Bangladesh (Iub) : Assignment On Income Per Capita Along With Comparison of Another SAARC CountryDocument9 pagesIndependent University, Bangladesh (Iub) : Assignment On Income Per Capita Along With Comparison of Another SAARC CountryMd. Mejbahul AliNo ratings yet

- Beyond Empirical New: Comparative AdvantageDocument20 pagesBeyond Empirical New: Comparative AdvantageAnjali sharmaNo ratings yet

- FIN323 Project 2021-2022Document6 pagesFIN323 Project 2021-2022saleem razaNo ratings yet

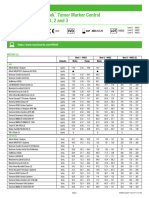

- Valores de Referencia Tumorales Bio RadDocument3 pagesValores de Referencia Tumorales Bio RadorthincoatzaNo ratings yet

- Marc - International Corporate Governance (2012, Pearson)Document337 pagesMarc - International Corporate Governance (2012, Pearson)Irsa AritaniaNo ratings yet

- Small Business An Entrepreneurs Plan 6th Edition Knowles Solutions ManualDocument23 pagesSmall Business An Entrepreneurs Plan 6th Edition Knowles Solutions Manualroryytpvk5g100% (28)

- Pas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition MeasurementDocument4 pagesPas 16-Property, Plant, & Equipment 1. Objective, Scope, and Definition Measurementmarilyn wallaceNo ratings yet

- Residency Final / On Account WHT Tax Code Rate %Document3 pagesResidency Final / On Account WHT Tax Code Rate %wilberforceNo ratings yet