Professional Documents

Culture Documents

Reales - Assignment No. 6

Uploaded by

Jethroret Reales0 ratings0% found this document useful (0 votes)

4 views6 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views6 pagesReales - Assignment No. 6

Uploaded by

Jethroret RealesCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

1. What is Corporate Governance?

Corporate Governance – the system of stewardship and control to guide

organizations in fulfilling their long-term economic, moral, legal and social

obligations towards their stakeholders.

Corporate governance is a system of direction, feedback and control using

regulations, performance standards and ethical guidelines to hold the

Board and senior management accountable for ensuring ethical behavior –

reconciling long-term customer satisfaction with shareholder value – to the

benefit of all stakeholders and society.

Its purpose is to maximize the organization’s long-term success, creating

sustainable value for its shareholders, stakeholders and the nation.

2. Rationale of SEC Code of Corporate Governance for Publicly Listed

Companies. (SEC MC No. 19, Series of 2016)

The Code of Corporate Governance is intended to raise the corporate

governance standards of Philippine corporations to a level at par with its

regional and global counterparts.

3. What are the Board's Governance Responsibilities?

THE BOARD’S GOVERNANCE RESPONSIBILITIES

Principle 1: The company should be headed by a competent, working

board to foster the long-term success of the corporation, and to sustain

its competitiveness and profitability in a manner consistent with its

corporate objectives and the long-term best interests of its

shareholders and other stakeholders.

Principle 2: The fiduciary roles, responsibilities and accountabilities of

the Board as provided under the law, the company’s articles and by-

laws, and other legal pronouncements and guidelines should be clearly

made known to all directors as well as to stockholders and other

stakeholders.

Principle 3: Board committees should be set up to the extent possible

to support the effective performance of the Board’s functions,

particularly with respect to audit, risk management, related party

transactions, and other key corporate governance concerns, such as

nomination and remuneration. The composition, functions and

responsibilities of all committees established should be contained in a

publicly available Committee Charter.

Principle 4: To show full commitment to the company, the directors

should devote the time and attention necessary to properly and

effectively perform their duties and responsibilities, including

sufficient time to be familiar with the corporation’s business.

Principle 5: The Board should endeavor to exercise objective and

independent judgment on all corporate affairs.

Principle 6: The best measure of the Board’s effectiveness is through an

assessment process. The Board should regularly carry out evaluations

to appraise its performance as a body, and assess whether it possesses

the right mix of backgrounds and competencies.

Principle 7: Members of the Board are duty-bound to apply high ethical

standards, taking into account the interests of all stakeholders.

4. What are the principles relating to disclosure and transparency?

DISCLOSURE AND TRANSPARENCY

Principle 8: The company should establish corporate disclosure policies

and procedures that are practical and in accordance with best practices and

regulatory expectations.

Principle 9: The company should establish standards for the appropriate

selection of an external auditor, and exercise effective oversight of the same

to strengthen the external auditor’s independence and enhance audit

quality.

Principle10: The company should ensure that material and reportable non-

financial and sustainability issues are disclosed.

Principle 11: The company should maintain a comprehensive and cost-

efficient communication channel for disseminating relevant information.

This channel is crucial for informed decision-making by investors,

stakeholders and other interested users.

5. What is the principle relating to internal control system and risk

management?

INTERNAL CONTROL SYSTEM AND RISK MANAGEMENT

FRAMEWORK

Principle 12: To ensure the integrity, transparency and proper governance

in the conduct of its affairs, the company should have a strong and effective

internal control system and enterprise risk management framework.

6. What is the principle relating to cultivating a synergic relationship with

shareholders?

CULTIVATING A SYNERGIC RELATIONSHIP WITH SHAREHOLDERS

Principle 13: The company should treat all shareholders fairly and

equitably, and also recognize, protect and facilitate the exercise of their

rights.

7. What are the duties of the corporation to stakeholders as mandated by

the Code of Corporate Governance for Publicly Listed Companies?

DUTIES TO STAKEHOLDERS

Principle 14: The rights of stakeholders established by law, by contractual

relations and through voluntary commitments must be respected. Where

stakeholders’ rights and/or interests are at stake, stakeholders should have

the opportunity to obtain prompt effective redress for the violation of their

rights.

Principle 15: A mechanism for employee participation should be developed

to create a symbiotic environment, realize the company’s goals and

participate in its corporate governance processes.

Principle 16: The company should be socially responsible in all its dealings

with the communities where it operates. It should ensure that its

interactions serve its environment and stakeholders in a positive and

progressive manner that is fully supportive of its comprehensive and

balanced development.

8. Definition of terms as used by this Code of Corporate Governance:

a) Board of Directors

Board of Directors – the governing body elected by the stockholders that

exercises the corporate powers of a corporation, conducts all its business

and controls its properties.

b) Management

Management – a group of executives given the authority by the Board of

Directors to implement the policies it has laid down in the conduct of the

business of the corporation.

c) Independent Director

Independent director – a person who is independent of management and

the controlling shareholder, and is free from any business or other

relationship which could, or could reasonably be perceived to, materially

interfere with his exercise of independent judgment in carrying out his

responsibilities as a director.

d) Executive Director

Executive director – a director who has executive responsibility of day-to-

day operations of a part or the whole of the organization.

e) Non-Executive Director

Non-executive director – a director who has no executive responsibility and

does not perform any work related to the operations of the corporation.

f) Conglomerate

Conglomerate – a group of corporations that has diversified business

activities in varied industries, whereby the operations of such businesses

are controlled and managed by a parent corporate entity.

g) Internal Control

Internal control – a process designed and effected by the board of directors,

senior management, and all levels of personnel to provide reasonable

assurance on the achievement of objectives through efficient and effective

operations; reliable, complete and timely financial and management

information; and compliance with applicable laws, regulations, and the

organization’s policies and procedures.

h) Enterprise Risk Management

Enterprise Risk Management – a process, effected by an entity’s Board of

Directors, management and other personnel, applied in strategy setting and

across the enterprise that is designed to identify potential events that may

affect the entity, manage risks to be within its risk appetite, and provide

reasonable assurance regarding the achievement of entity objectives

i) Related Party

Related Party – shall cover the company’s subsidiaries, as well as affiliates

and any party (including their subsidiaries, affiliates and special purpose

entities), that the company exerts direct or indirect control over or that

exerts direct or indirect control over the company; the company’s directors;

officers; shareholders and related interests (DOSRI), and their close family

members, as well as corresponding persons in affiliated companies. This

shall also include such other person or juridical entity whose interest may

pose a potential conflict with the interest of the company.

j) Related Party Transaction

Related Party Transactions – a transfer of resources, services or obligations

between a reporting entity and a related party, regardless of whether a price

is charged. It should be interpreted broadly to include not only transactions

that are entered into with related parties, but also outstanding transactions

that are entered into with an unrelated party that subsequently becomes a

related party.

k) Stakeholders

Stakeholders – any individual, organization or society at large who can

either affect and/or be affected by the company’s strategies, policies,

business decisions and operations, in general. This includes, among others,

customers, creditors, employees, suppliers, investors, as well as the

government and community in which it operates.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFDocument29 pagesCIMA F3 Notes - Financial Strategy - Chapters 1 and 2 PDFLuzuko Terence Nelani100% (8)

- Financial Accounting Fundamentals: John J. Wild 2009 EditionDocument39 pagesFinancial Accounting Fundamentals: John J. Wild 2009 EditionKhvichaKopinadze100% (1)

- R10 Rogers Et Al., 2002, HBR, Lessons From Private-Equity MastersDocument9 pagesR10 Rogers Et Al., 2002, HBR, Lessons From Private-Equity MastersRitwik KumarNo ratings yet

- Apollo Food Holdings BerhadDocument21 pagesApollo Food Holdings BerhadAzilah UsmanNo ratings yet

- Contract of UsufructDocument3 pagesContract of UsufructJethroret RealesNo ratings yet

- Constitutional ProhibitionsDocument1 pageConstitutional ProhibitionsJethroret RealesNo ratings yet

- Reales Tax Rev Computation ExerciseDocument4 pagesReales Tax Rev Computation ExerciseJethroret RealesNo ratings yet

- Part 1: Recruitment and Placement " Refers To Any Act of Workers, andDocument1 pagePart 1: Recruitment and Placement " Refers To Any Act of Workers, andJethroret RealesNo ratings yet

- REALES, Jethro QUIZ 3Document1 pageREALES, Jethro QUIZ 3Jethroret RealesNo ratings yet

- Supreme Court: Annex ADocument39 pagesSupreme Court: Annex AJethroret RealesNo ratings yet

- Pertinent Papers For Teacher I: Department of EducationDocument1 pagePertinent Papers For Teacher I: Department of EducationJethroret RealesNo ratings yet

- Syllabus Intellectual Property Law: OrganizationDocument7 pagesSyllabus Intellectual Property Law: OrganizationJethroret RealesNo ratings yet

- Supreme Court: Annex ADocument39 pagesSupreme Court: Annex AJethroret RealesNo ratings yet

- Introduction To SHE and Issuance of SharesDocument1 pageIntroduction To SHE and Issuance of Shareslei dcNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- Introduction To Investment BankingDocument45 pagesIntroduction To Investment BankingHuế ThùyNo ratings yet

- Beams 12ge LN09Document36 pagesBeams 12ge LN09dian kusumaNo ratings yet

- Revised CAM Format Salaried SENP Version 1 - FinalDocument58 pagesRevised CAM Format Salaried SENP Version 1 - FinalJatin PithadiyaNo ratings yet

- Ch. 13 Financial Risk Management (Part 1)Document5 pagesCh. 13 Financial Risk Management (Part 1)Daud AminNo ratings yet

- The Philippine Stock Exchange (PSE) Is The Only Stock Exchange in The Philippines. It Is One of The OldestDocument7 pagesThe Philippine Stock Exchange (PSE) Is The Only Stock Exchange in The Philippines. It Is One of The OldestDaren TolentinoNo ratings yet

- Taxation-I: Question No.1Document10 pagesTaxation-I: Question No.1Prithvi PrasadNo ratings yet

- Substantive Procedures Related To Year End Bank BalancesDocument3 pagesSubstantive Procedures Related To Year End Bank BalancesMoeer razaNo ratings yet

- Managerial Accounting 13th Edition by Warren Reeve and Duchac Solution ManualDocument16 pagesManagerial Accounting 13th Edition by Warren Reeve and Duchac Solution Manualroger100% (29)

- Working of Stock Market and Depository ServicesDocument59 pagesWorking of Stock Market and Depository ServicesSweta Singh0% (1)

- Asset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFDocument60 pagesAsset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFHarpreet GillNo ratings yet

- Chapter 21 - Investment PropertyDocument3 pagesChapter 21 - Investment PropertyXiena67% (3)

- 2014 Annual Report enDocument21 pages2014 Annual Report enMax meNo ratings yet

- Audit Procedures For Revenue CyclesDocument2 pagesAudit Procedures For Revenue CyclesJulie-Ann SalinasNo ratings yet

- A Report: Standard Chartered BankDocument77 pagesA Report: Standard Chartered BankVinay Singh80% (5)

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Bonds PayableDocument20 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Bonds PayablePillos Jr., ElimarNo ratings yet

- Ass Assessment of Companies.Document11 pagesAss Assessment of Companies.SafaNo ratings yet

- Application For Registration As An Australian Company: 1 State/territory of RegistrationDocument10 pagesApplication For Registration As An Australian Company: 1 State/territory of Registrationquaz4No ratings yet

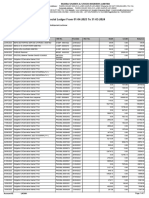

- FinancialLedger LK3061Document2 pagesFinancialLedger LK3061aman.pandey17092009No ratings yet

- Valeura Energy Inc. TSXVLE ReportsDocument88 pagesValeura Energy Inc. TSXVLE Reportsxavier xaviNo ratings yet

- Annual Report Klia 2011Document410 pagesAnnual Report Klia 2011Mohd Nazmi CeoNo ratings yet

- Capital RationingDocument14 pagesCapital RationingJamia MilaNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- Case 1 New Signal Cable CompanyDocument6 pagesCase 1 New Signal Cable Companymilk teaNo ratings yet

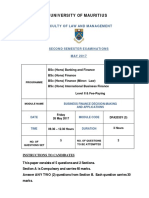

- BF PP 2017Document4 pagesBF PP 2017Revatee HurilNo ratings yet