Professional Documents

Culture Documents

Accountancy & Auditing-II 2020

Uploaded by

Zeeshan Ashraf MalikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accountancy & Auditing-II 2020

Uploaded by

Zeeshan Ashraf MalikCopyright:

Available Formats

FEDERAL PUBLIC SERVICE COMMISSION Roll Number

COMPETITIVE EXAMINATION-2020

FOR RECRUITMENT TO POSTS IN BS-17

UNDER THE FEDERAL GOVERNMENT

ACCOUNTANCY & AUDITING, PAPER-II

TIME ALLOWED: THREE HOURS PART-I (MCQS) MAXIMUM MARKS = 20

PART-I(MCQS): MAXIMUM 30 MINUTES PART-II MAXIMUM MARKS = 80

NOTE: (i) Part-II is to be attempted on the separate Answer Book.

(ii) Attempt ONLY FOUR questions from PART-II by selecting at least ONE question from EACH

SECTION. ALL questions carry EQUAL marks.

(iii) All the parts (if any) of each Question must be attempted at one place instead of at different places.

(iv) Write Q. No. in the Answer Book in accordance with Q. No. in the Q.Paper.

(v) No Page/Space be left blank between the answers. All the blank pages of Answer Book must be crossed.

(vi) Extra attempt of any question or any part of the question will not be considered.

(vii) Use of Calculator is allowed.

PART – II

SECTION – I (AUDITING)

Q. 2. Why computerized audit is required in the presence of manual audit? Elaborate the (20)

computerized auditing by application of Computer Assisted Audit Techniques (CAAT).

Q. 3. Define audit and auditing. Comment on the auditor’s (dependence) consideration of “reasonable (20)

assurance” and “True & Fair view” for the financial audit of a corporate entity.

Q. 4. Write notes on any TWO of the followings: (10 marks each) (20)

(a) Audit materiality

(b) Misstatement and Fraud

(c) Test of Control and Substantive Procedures

SECTION – II (BUSINESS TAXATION)

Q. 5. Elaborate the following fundamental definitions/terminologies as defined under Section 2 of the (20)

Income Tax Ordinance 2001.

(a) Heads of Income [Section 11]

(b) Tax Credits [Section 61 to 65]

(c) Capital Gains [Section 37 to 38]

Q. 6. ABC (Pvt) Limited has earned income from business amounting to Rs. 75056000 during the tax (20)

year 2019. It also has a plaza situated in Faisalabad. The rent receivable from plaza amounts

Rs. 47543000. Moreover, Company claims the following deductions (in Rs.):

1. Property repair expenses 4324200

2. Lawyer fee to defend the title of property 6050000

3. Insurance premium of the property 1477500

4. Property tax paid 5422300

5. Tax with held by the tenants @17.5% 8320025

6. Rental income paid to HBFC 3600000

7. Administrative and collection charges 2900000

Required: Calculate Total income and the Tax payable by the Company for the tax year 2019.

The company is a Non-filer.

SECTION – III (BUSINESS STUDIES AND FINANCE)

Q. 7. How many legal forms of Business Entity exist in Pakistan? Explain the features of Joint Stock (20)

Company and its procedure of formation (stages for formation of a Joint Stock Company-both

Public limited and Private Limited companies).

Q. 8. XYZ Co. has Rs. 400 million in outstanding debt and Rs. 100 million in preferred stock. Its total (20)

value is Rs. 800 million. Its cost of debt (rd) is 8%, its cost of preferred stock is (rps) 9%, and its

cost of common stock (rcs) is 12%. The firm has recently had numerous depreciation tax shields

as well as low earnings. Consequently, it does not pay taxes.

What is its Weighted Average Cost of Capital (WACC) assuming it will continue to not pay

taxes?

**************

You might also like

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- Haitoglou BrosDocument25 pagesHaitoglou BrosEva MercedesNo ratings yet

- BOROSIL GlasswareDocument86 pagesBOROSIL GlasswareushadgsNo ratings yet

- Your Airbnb ReceiptDocument1 pageYour Airbnb ReceiptAnurag Kumar ReloadedNo ratings yet

- Index (2014)Document3,905 pagesIndex (2014)NocoJoeNo ratings yet

- National Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiDocument2 pagesNational Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiAli KaziNo ratings yet

- Accountancy Paper II 2014Document2 pagesAccountancy Paper II 2014Qasim IbrarNo ratings yet

- CSS Accounting Papers-1Document2 pagesCSS Accounting Papers-1rabia khanNo ratings yet

- Accounting-II - March - 2022Document2 pagesAccounting-II - March - 2022Ishmaal KhanNo ratings yet

- Business Administration CSS 2000 2020Document32 pagesBusiness Administration CSS 2000 2020Jelly FishNo ratings yet

- AccountancyDocument2 pagesAccountancyUmarmaharNo ratings yet

- Accountancy & Auditing-II 2023Document2 pagesAccountancy & Auditing-II 2023rabia khanNo ratings yet

- FEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATION 2021 ACCOUNTANCY & AUDITING PAPER-IIDocument2 pagesFEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATION 2021 ACCOUNTANCY & AUDITING PAPER-IIZeeshan Ashraf MalikNo ratings yet

- Css Accountancy2 2018 PDFDocument2 pagesCss Accountancy2 2018 PDFMaria NazNo ratings yet

- Auditing AnalysisDocument13 pagesAuditing AnalysisAmmarah Rajput ParhiarNo ratings yet

- Crescent - AuditingDocument2 pagesCrescent - AuditingMuhammad Uzair AbbasiNo ratings yet

- Css Business Administration 2021Document1 pageCss Business Administration 2021Zahid Shan BughioNo ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- Paper-2 International Tax Practice-NOV 20Document22 pagesPaper-2 International Tax Practice-NOV 20dhawaljaniNo ratings yet

- Test Paper - 3 CA FinalDocument3 pagesTest Paper - 3 CA FinalyeidaindschemeNo ratings yet

- P17 Icwa QPDocument34 pagesP17 Icwa QPAnuradha NatooNo ratings yet

- Accountancy and Auditing-2020Document5 pagesAccountancy and Auditing-2020PARAS JANNo ratings yet

- Accountancy & Auditing-I 2020Document4 pagesAccountancy & Auditing-I 2020Zeeshan Ashraf MalikNo ratings yet

- Accountancy and Auditing-2020Document5 pagesAccountancy and Auditing-2020Bakhita MaryamNo ratings yet

- 1-F-A Auditing - (E)Document4 pages1-F-A Auditing - (E)Hamid MahmoodNo ratings yet

- Test 6Document3 pagesTest 6eimannaveed6No ratings yet

- Paper - 7: Direct Tax Laws: Financial Year Business Loss DepreciationDocument33 pagesPaper - 7: Direct Tax Laws: Financial Year Business Loss DepreciationVenkatesh NadimpalliNo ratings yet

- Accountancy Auditing 2020Document6 pagesAccountancy Auditing 2020Abdul basitNo ratings yet

- Solved Question Paper For November 2018 EXAM (New Syllabus)Document21 pagesSolved Question Paper For November 2018 EXAM (New Syllabus)Ravi PrakashNo ratings yet

- SFM ScannerDocument23 pagesSFM ScannerArchana KhapreNo ratings yet

- F1 FIOO - L-December-2020Document8 pagesF1 FIOO - L-December-2020Laskar REAZNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Direct Tax MCQsDocument112 pagesDirect Tax MCQsspam mailNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument19 pagesFinal Examination: Suggested Answers To Questions9959988632No ratings yet

- Paper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1Document5 pagesPaper 16 - Direct Tax Laws and International Taxation: MTP - Final - Syllabus 2016 - Jun 2020 - Set 1GODWIN VIJUNo ratings yet

- © The Institute of Chartered Accountants of India: TH STDocument46 pages© The Institute of Chartered Accountants of India: TH STheikNo ratings yet

- Direct Tax or Indirect TaxDocument14 pagesDirect Tax or Indirect Taxyashmehta206No ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Accountancy & Auditing-II-2017Document2 pagesAccountancy & Auditing-II-2017Mahnoor SaleemNo ratings yet

- Paper 19Document6 pagesPaper 19mohanraj parthasarathyNo ratings yet

- P13 QpmaDocument4 pagesP13 QpmaOmkar PednekarNo ratings yet

- DT Nov 2022 PaperDocument26 pagesDT Nov 2022 PaperPoonam Sunil Lalwani LalwaniNo ratings yet

- 18552pcc Sugg Paper Nov09 2 PDFDocument14 pages18552pcc Sugg Paper Nov09 2 PDFGaurang AgarwalNo ratings yet

- P16MMDocument23 pagesP16MMidealNo ratings yet

- Corporate Tax Planning - 2Document3 pagesCorporate Tax Planning - 2sarthak guptaNo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- Auditing Past Paper QuestionsDocument3 pagesAuditing Past Paper QuestionsHasanAbdullahNo ratings yet

- Paper 18Document153 pagesPaper 18ahmedNo ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- Accountancy-I SubjectiveDocument2 pagesAccountancy-I SubjectiveAhmedNo ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7india1965No ratings yet

- Accountancy and Auditing-2019Document4 pagesAccountancy and Auditing-2019PARAS JANNo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- FEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATION 2021 ACCOUNTANCY & AUDITING PAPER-IIDocument2 pagesFEDERAL PUBLIC SERVICE COMMISSION COMPETITIVE EXAMINATION 2021 ACCOUNTANCY & AUDITING PAPER-IIZeeshan Ashraf MalikNo ratings yet

- Accountancy & Auditing-I 2021Document2 pagesAccountancy & Auditing-I 2021Zeeshan Ashraf MalikNo ratings yet

- AccountancyDocument2 pagesAccountancyUmarmaharNo ratings yet

- Accountancy & Auditing-I 2020Document4 pagesAccountancy & Auditing-I 2020Zeeshan Ashraf MalikNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- FMCG Industry Growth Driven by Rising Awareness and AccessibilityDocument6 pagesFMCG Industry Growth Driven by Rising Awareness and AccessibilityPrateek SabharwalNo ratings yet

- 03 Activity 1Document1 page03 Activity 1bea santiagoNo ratings yet

- T11F CHP 03 1 Income Sources 2011Document140 pagesT11F CHP 03 1 Income Sources 2011jessie1614No ratings yet

- Payment SlipDocument1 pagePayment Slipchepkoechmourine100No ratings yet

- Income Tax NotificationDocument5 pagesIncome Tax NotificationjaksandcoNo ratings yet

- PFC - Assignment – part 1 Income tax calulator with Functions and Robus validationDocument4 pagesPFC - Assignment – part 1 Income tax calulator with Functions and Robus validationtran nguyenNo ratings yet

- Consti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Document3 pagesConsti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Lu CasNo ratings yet

- PBCOM vs. CIR: Supreme Court upholds two-year period for tax refund claimsDocument1 pagePBCOM vs. CIR: Supreme Court upholds two-year period for tax refund claimsRonnie Garcia Del RosarioNo ratings yet

- Summer Internship Training at SafexpressDocument36 pagesSummer Internship Training at SafexpressSmrita Rai100% (1)

- A Comparative Study of Fiscal Decentralization in China and India A Comparative Study of Fiscal Decentralization in China and IndiaDocument109 pagesA Comparative Study of Fiscal Decentralization in China and India A Comparative Study of Fiscal Decentralization in China and IndiaAbdullahKadirNo ratings yet

- GST ChallanDocument2 pagesGST ChallannavinNo ratings yet

- Macroeconomics Handout 1 2019aafDocument17 pagesMacroeconomics Handout 1 2019aafDaphneNo ratings yet

- 2014 Mock Exam - AM - AnswersDocument25 pages2014 Mock Exam - AM - Answers12jdNo ratings yet

- Wolt Partners TutorialDocument34 pagesWolt Partners TutorialdiNo ratings yet

- Study Unit 1 FAC1601Document18 pagesStudy Unit 1 FAC1601andreqwNo ratings yet

- Ch 11 Fiscal Policy and the Federal BudgetDocument15 pagesCh 11 Fiscal Policy and the Federal BudgetNabeel IqbalNo ratings yet

- CIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.Document2 pagesCIR and Commissioner of Customs vs. Botelho Shipping Corp. & General Shipping Co., Inc.preiquency100% (1)

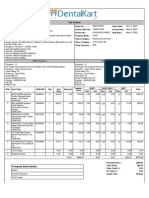

- Tax Invoice for Dental SuppliesDocument2 pagesTax Invoice for Dental SuppliesPriyanka GandhiNo ratings yet

- The Calculating A Fair Price For You and Your Students WorkbookDocument5 pagesThe Calculating A Fair Price For You and Your Students WorkbookEmmanuella ConteNo ratings yet

- Minicase 1.4 # China's Ageing PopulationDocument9 pagesMinicase 1.4 # China's Ageing PopulationHa TranNo ratings yet

- GAR-7 Service Tax Challan in ExcelDocument2 pagesGAR-7 Service Tax Challan in Excelvirendra3699975% (8)

- Ag Econ Mock TestDocument7 pagesAg Econ Mock TestGeg AbrenicaNo ratings yet

- CIR vs. Algue, Inc.Document2 pagesCIR vs. Algue, Inc.Leyard100% (1)

- Budget Template and Samples GuideDocument5 pagesBudget Template and Samples GuidebelijobNo ratings yet

- IB Economics Unit 1 ToolkitDocument9 pagesIB Economics Unit 1 ToolkitBen GoodmanNo ratings yet