Professional Documents

Culture Documents

Sensitivity Analysis: C. Pichery, In, 2014

Uploaded by

Carl Karlo CaraigOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sensitivity Analysis: C. Pichery, In, 2014

Uploaded by

Carl Karlo CaraigCopyright:

Available Formats

SENSITIVITY ANALYSIS

There are several reasons to perform a sensitivity analysis by entering multiple values for a

particular input variable. First, you might not know the exact value of a variable. By

specifying a range of values, you can determine how important that variable is, and how the

solution changes depending on its value. In other words, you can determine how "sensitive"

the outputs are to changes in that variable.

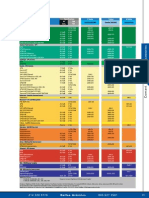

For example, a modeler doing a preliminary analysis of a wind-diesel system is uncertain

about three variables: the annual average wind speed, the average fuel price over the life of

the project, and the interest rate. To determine the sensitivity of the system's cost of energy

to those three variables, the modeler performs a sensitivity analysis using HOMER. Her

best estimate for the wind speed is 6 m/s; for the fuel price, $0.50/L; and for the discount

rate, 8%. She enters multiple values for each variable, covering the range of uncertainty of

each (by entering "0%" for the Expected Inflation Rate, the Nominal Discount Rate input

maps directly to the Real Discount Rate). HOMER produces the Spider Graph below,

showing that the cost of energy is most sensitive to the wind speed (the wind speed line is

the steepest). As a result, the modeler chooses to invest more time and money to obtain a

more accurate estimate of the wind speed.

Another reason for performing a sensitivity analysis is to make a single analysis applicable

to more than one installation. For example, imagine you are designing small renewable

power systems for six telecommunication sites. If the sites are similar in most respects but

there is some variation in wind speed from one site to another, you can specify several wind

speeds spanning the appropriate range. Then a single analysis is sufficient to design all six

hybrid systems. The results of such an analysis might look like the example below, where

HOMER has suggested a PV/storage/generator system for the site with the lowest wind

speed, wind/PV/storage/generator systems for the sites with higher wind speeds, and a

wind/storage/generator system for the highest wind speed.

C. Pichery, in Encyclopedia of Toxicology (Third Edition), 2014

Sensitivity Analysis: Definition and Properties

In a numerical (or otherwise) model, the Sensitivity Analysis (SA) is a method that measures

how the impact of uncertainties of one or more input variables can lead to uncertainties on the

output variables. This analysis is useful because it improves the prediction of the model, or

reduces it by studying qualitatively and/or quantitatively the model response to change in input

variables, or by understanding the phenomenon studied by the analysis of interactions between

variables. However, the target of interest must not be the model output per se, but the question

that the model has been called to answer.

In other words, the expected values of various parameters involved can be used to evaluate the

robustness, i.e., ‘sensitivity’ of the results from these changes and identify the values beyond

which the results change significantly. SA identifies priority needs for improving knowledge.

Indeed, this analysis reduces the uncertainties of the parameters of the assessment and then,

decisions about the phenomenon under study can be taken.

Advanced Methodological Aspects in the Economic Evaluation

VasiliosFragoulakisChristinaMitropoulouMarc S.WilliamsGeorge P.Patrinos in Economic

Evaluation in Genomic Medicine, 201

Sensitivity Analysis

The term “sensitivity” essentially refers to the way in which our results

change when we change our model’s assumptions. If sensitivity is

high, then the results vary greatly when we change certain

assumptions; these assumptions must be very robustly established for

our model to have any validity.

To put it concisely and intuitively, we could say that economic

evaluation is beset by many kinds of uncertainties. First, there is

uncertainty about the structure of the model we have created

(structural uncertainty). For example, is our approach to the issue the

correct one? Does our analysis reflect reality? Is our model of clinical

practice incorrect? To answer such questions, we need to critically

evaluate our model and perform various sensitivity analyses, changing

its structure to judge its value.

Another source of uncertainty is heterogeneity between the various

subgroups to which the model refers (variability due to heterogeneity).

If we want to compare the cost and effectiveness of a new cardiology

drug with the standard treatment for the management of acute

myocardial infarction, then perhaps we should perform separate

analyses for men and women, young and elderly patients, patients

with previous infarctions, and so on, because these groups will give

different results. Because heterogeneity is important for economic

models, it should be included in economic evaluation. Such

subanalyses (men vs. women, etc.) are sensitivity analyses for

heterogeneity.

Uncertainty also exists between patients. We cannot be sure how long

a patient will actually live after a procedure, and even “similar” patients

do not survive for the same length of time, nor does their care cost the

same. This type of uncertainty is called first-order uncertainty. This

would theoretically decrease if data from studies with large samples or

valid meta-analyses were available. Realistically, there will always be

some first-order uncertainty because nature is inherently stochastic.

The uncertainty that is associated with the exact value of a statistical

parameter (and that is estimated by the standard deviation) is called

second-order uncertainty. This type of uncertainty is of significant

interest. For example, if we estimate that the cost of the treatment of a

chemotherapy patient is €10,000±2,000 (mean±standard deviation),

then we have entered second-order uncertainty.

Sensitivity analysis in this case is a technique that estimates the effect

that different values of an independent variable have on the end

results (Jain et al., 2011). Sensitivity analysis is very important when

examining the robustness and validity of our conclusions based on the

significance of the initial parameters (Meltzer, 2001; Yoder, 2008). It

needs to be performed mostly for three purposes:

•

First, when the evaluator wants to determine the range of values

in which the proposition of the economic model is valid

•

Second, to increase the model’s reliability when the input data

are elastic (e.g., when estimates are used)

•

Third, to make the model evaluation convenient to the end user.

The sensitivity analysis methodology consists of three steps. First, the

uncertainty parameters are determined. Second, the range of variation

is determined. Third, the results are calculated based on the most

likely prediction as well as the “direction” of the results. This means

that we examine whether one of the interventions is superior to the

other according to a certain statistical probability—usually the 95% or

99% significance level.

The most common forms of sensitivity analysis are:

•

Single sensitivity analysis: Single analysis explores ICER

variations when a single variable of the model—a different one

each time—is altered. The variation values are usually within the

variation range of the confidence interval, or alternatively they

can include all the values found in the literature.

•

Multiple sensitivity analysis: A multiple analysis is performed to

assess simultaneous changes in two or more variables, such as

effectiveness and cost. Similarly, the variation values are

obtained from the confidence intervals or determined from the

literature.

•

Probabilistic sensitivity analysis: Probabilistic sensitivity analysis

(PSA) deals with the significant problem of statistical estimation

of quantities, as in the example of the chemotherapy patient we

mentioned previously, and should always be included in any

reliable economic analysis. For example, when the variables

examined are strongly correlated, are uncertain, or follow

distributions, then single sensitivity analysis is not appropriate.

The same is true for data originating from different sources.

Based on the reasoning used so far, the ICER was calculated in a

deterministic way—with only one point estimate—with no uncertainty

when drawing conclusions. In practice, the ICER has a probabilistic

nature because the types of costs and the benefit from each

intervention follow theoretical or empirical distributions (Briggs and

Fenn, 1998). Furthermore, the introduction of a new intervention into

the health system entails assuming certain risks, in which case this

type of analysis is indicated for handling the uncertainty associated

with those options. PSA takes into account the mean value, the

standard deviation, and the distribution of each variable, creating

thousands of results under computer simulation by selecting random

cases based on the defined assumptions. It then summarizes and

displays the results obtained, despite its limitations, through the use of

the acceptability curve (O’Hagan et al., 2000; Fenwick et al., 2004;

Barton et al., 2008).

We present a conceptual example of the necessity and understanding

of the method. We assume that the reader is familiar with the concept

of distribution. In this simple example, we assume that the cost

consists of only one factor (e.g., only the drug). If the cost comprised

many factors, then we would need to generalize the method for each

one separately and obtain the total sum of the individual distributions.

You might also like

- ComantDocument134 pagesComantsoniaxNo ratings yet

- Business StatisticsDocument20 pagesBusiness StatisticsdmomsdNo ratings yet

- The Rite of ShaitanDocument2 pagesThe Rite of Shaitand2203275100% (1)

- Factor AnalysisDocument26 pagesFactor AnalysisAishatu Musa AbbaNo ratings yet

- Republic Act 8749 Salient FeaturesDocument34 pagesRepublic Act 8749 Salient Featuresdenr02legal88% (8)

- Procedure of Testing HypothesisDocument5 pagesProcedure of Testing Hypothesismohapatra82100% (1)

- Sensitivity Analysis: Presented by BHARGAV SEERAM, 121202079Document20 pagesSensitivity Analysis: Presented by BHARGAV SEERAM, 121202079Sohail Ahmed SoomroNo ratings yet

- Pertcpm 4Document70 pagesPertcpm 4John BanielNo ratings yet

- Factor AnalysisDocument35 pagesFactor AnalysisAlia Al Zghoul100% (1)

- Alcolyzer Beer Analyzing SystemDocument6 pagesAlcolyzer Beer Analyzing SystemAndrés MárquezNo ratings yet

- Sensitivity AnalysisDocument4 pagesSensitivity AnalysisjhllkjlghkjlNo ratings yet

- DBA-5102 Statistics - For - Management AssignmentDocument12 pagesDBA-5102 Statistics - For - Management AssignmentPrasanth K SNo ratings yet

- 01 Multivariate AnalysisDocument40 pages01 Multivariate Analysisxc123544100% (1)

- What and Who Is A Human PersonDocument22 pagesWhat and Who Is A Human Personjay100% (1)

- SENSITIVITY ANALYSIS Kk.Document11 pagesSENSITIVITY ANALYSIS Kk.Kunle OketoboNo ratings yet

- Research+Methodology+ +Multivariate+AnalysisDocument13 pagesResearch+Methodology+ +Multivariate+AnalysisSaigayathrti VembuNo ratings yet

- Libien, Jenny - Momeni, Amir - Pincus, Matthew R - Introduction To Statistical Methods in Pathology (2018, Springer)Document322 pagesLibien, Jenny - Momeni, Amir - Pincus, Matthew R - Introduction To Statistical Methods in Pathology (2018, Springer)Cristi Popescu100% (2)

- CHAPTER 12 Analysis of VarianceDocument49 pagesCHAPTER 12 Analysis of VarianceAyushi JangpangiNo ratings yet

- Sensitivity Analysis: C. Pichery, In, 2014Document5 pagesSensitivity Analysis: C. Pichery, In, 2014Carl Karlo CaraigNo ratings yet

- Sensitivity Analysis: C. Pichery, In, 2014Document5 pagesSensitivity Analysis: C. Pichery, In, 2014Carl Karlo CaraigNo ratings yet

- Health Technnology Assessment Module5Document7 pagesHealth Technnology Assessment Module5jenkenny00sNo ratings yet

- BRM Unit 4 ExtraDocument10 pagesBRM Unit 4 Extraprem nathNo ratings yet

- Aravind Rangamreddy 500195259 cs4Document7 pagesAravind Rangamreddy 500195259 cs4Aravind Kumar ReddyNo ratings yet

- Research Methodology - Multi Variate Analysis 13 10 23Document17 pagesResearch Methodology - Multi Variate Analysis 13 10 23Muthu KumarNo ratings yet

- Sensitivity AnalysisDocument4 pagesSensitivity AnalysisfasilistheoNo ratings yet

- Discriminant AnalysisDocument8 pagesDiscriminant Analysis04 Shaina SachdevaNo ratings yet

- Multi VariateDocument4 pagesMulti VariatePankaj2cNo ratings yet

- Data Collection: SamplingDocument8 pagesData Collection: SamplingskyNo ratings yet

- Paper 34Document20 pagesPaper 34ajayiit2010No ratings yet

- Bio StatisticsDocument20 pagesBio StatisticskatyNo ratings yet

- Lecture 13 UncertaintyDocument46 pagesLecture 13 UncertaintysangeethasNo ratings yet

- Sensitivity AnalysisDocument17 pagesSensitivity AnalysisBOBBY212No ratings yet

- Unit 333Document18 pagesUnit 333HimajanaiduNo ratings yet

- Univariate Analysis: Quantitative (Statistical) Analysis. Variable Unit of AnalysisDocument5 pagesUnivariate Analysis: Quantitative (Statistical) Analysis. Variable Unit of AnalysisShisht UpadhyayNo ratings yet

- Module 3 - MeasurementDocument10 pagesModule 3 - MeasurementCaleb KimNo ratings yet

- Decision Making or Development of Recommendations For Decision MakersDocument4 pagesDecision Making or Development of Recommendations For Decision Makersraghav_bhatt8817No ratings yet

- Goodness of Fit in Regression Analysis - R and Reconsidered: Quality & Quantity 32: 229-245, 1998Document18 pagesGoodness of Fit in Regression Analysis - R and Reconsidered: Quality & Quantity 32: 229-245, 1998pavlov2No ratings yet

- Ijl2 PDFDocument10 pagesIjl2 PDFMateo BallestaNo ratings yet

- Heinze 2016Document8 pagesHeinze 2016Igor EckertNo ratings yet

- Two Variable Regression Analysis PDFDocument13 pagesTwo Variable Regression Analysis PDFHameem KhanNo ratings yet

- Jsmith Microbe 09Document0 pagesJsmith Microbe 09Lionel PinuerNo ratings yet

- Statistical Concepts You Need For Life After This Course Is OverDocument3 pagesStatistical Concepts You Need For Life After This Course Is OverMichael WelkerNo ratings yet

- Hamby1994 Article AReviewOfTechniquesForParamete PDFDocument20 pagesHamby1994 Article AReviewOfTechniquesForParamete PDFKaan YamanNo ratings yet

- Dose Response AssessmentDocument3 pagesDose Response Assessmentjaji tadzNo ratings yet

- Meta Analysis FormulaDocument16 pagesMeta Analysis Formulachoijohnyxz499No ratings yet

- Ane 127 569Document7 pagesAne 127 569mina shahiNo ratings yet

- Sensitivity Analysis Chapter 11Document16 pagesSensitivity Analysis Chapter 11landabureNo ratings yet

- What Is Econometrics?: Taking A Theory and Quantifying ItDocument2 pagesWhat Is Econometrics?: Taking A Theory and Quantifying ItsamityNo ratings yet

- What Is Sens AnalyDocument8 pagesWhat Is Sens AnalyKu Li ChengNo ratings yet

- Dose Response AssessmentDocument3 pagesDose Response Assessmentjaji tadzNo ratings yet

- Guj - Econometrics Ch01 The Nature of Regression AnalysisDocument22 pagesGuj - Econometrics Ch01 The Nature of Regression AnalysisHafiz Dzaky RadithyaNo ratings yet

- Nature of Regression AnalysisDocument22 pagesNature of Regression Analysiswhoosh2008No ratings yet

- What Is Econometrics?: Hypotheses ForecastingDocument6 pagesWhat Is Econometrics?: Hypotheses ForecastingAnvi GandhiNo ratings yet

- Wichmann (2001) The Psycho Metric Function. II. Bootstrap-Based Confidence Intervals and SamplingDocument16 pagesWichmann (2001) The Psycho Metric Function. II. Bootstrap-Based Confidence Intervals and SamplingJoseph C.FNo ratings yet

- Biostatics Freework - Ahlin AshrafDocument16 pagesBiostatics Freework - Ahlin Ashrafab JafarNo ratings yet

- Interpretation of Data by SurakshyaDocument13 pagesInterpretation of Data by Surakshyasubash karkiNo ratings yet

- Unit IVDocument132 pagesUnit IVShay ShayNo ratings yet

- Fulltext PDFDocument38 pagesFulltext PDFmphil.rameshNo ratings yet

- Analysis of VarianceDocument5 pagesAnalysis of VarianceMIKINo ratings yet

- TinuDocument5 pagesTinutinsae kebedeNo ratings yet

- Unit 3 Ipr - 240119 - 163827Document19 pagesUnit 3 Ipr - 240119 - 163827RuccaiyatasleemaNo ratings yet

- Statistical Quality Control Is Defined As "TheDocument17 pagesStatistical Quality Control Is Defined As "TheDeepak KumarNo ratings yet

- Variable Selection Biometrical 2018Document19 pagesVariable Selection Biometrical 2018joaotellesNo ratings yet

- Analyses Based On Combining Similar Information From Multiple SurveysDocument10 pagesAnalyses Based On Combining Similar Information From Multiple SurveysTewfik SeidNo ratings yet

- Qual For Researchgate StatisticsDocument22 pagesQual For Researchgate Statisticsrusudanzazadze7No ratings yet

- Work From Home Project: Peshawar Model SchoolDocument4 pagesWork From Home Project: Peshawar Model SchoolShabir RizwanNo ratings yet

- Mock Test 7 - Answer KeyDocument6 pagesMock Test 7 - Answer KeyThuỳ Linh Đinh TháiNo ratings yet

- In-Depth: How Does A Child Get A Pectus Excavatum?Document12 pagesIn-Depth: How Does A Child Get A Pectus Excavatum?Gino VillanuevaNo ratings yet

- Unit 1: Energy and Motion: Chapter 5: Work and Machines 5.1: 5.2Document78 pagesUnit 1: Energy and Motion: Chapter 5: Work and Machines 5.1: 5.2Tomboy ReginaNo ratings yet

- Capgemini TestsDocument50 pagesCapgemini TestsObli Narasimha RajanNo ratings yet

- 2.1 History of The Company: Part Two 2. Company BackgroundDocument7 pages2.1 History of The Company: Part Two 2. Company Backgroundhabtamu100% (2)

- Laughlin - A Comparison of Turbine Pulley Design Philosophies With Historical PerspectiveDocument3 pagesLaughlin - A Comparison of Turbine Pulley Design Philosophies With Historical Perspectivedarkwing888No ratings yet

- 68 - Guideline Handling of Level Crossings With BL3 v1.0 - FinalDocument37 pages68 - Guideline Handling of Level Crossings With BL3 v1.0 - Finalhay902No ratings yet

- BrevetDocument13 pagesBrevettyby77No ratings yet

- Escherichia Coli O157:H7 Issues and Ramifications: Executive SummaryDocument12 pagesEscherichia Coli O157:H7 Issues and Ramifications: Executive SummaryTinnysumardiNo ratings yet

- Siemens Connect Box Dispozitiv Supraveghere Monitorizare CWG Box Eu FT EngDocument14 pagesSiemens Connect Box Dispozitiv Supraveghere Monitorizare CWG Box Eu FT EnggeorgenikitaNo ratings yet

- E1 Tensile TestDocument13 pagesE1 Tensile TestFirzana AmiraNo ratings yet

- Mock 1 QP (PQ, Kine, Dyna)Document28 pagesMock 1 QP (PQ, Kine, Dyna)Tahmedul Hasan TanvirNo ratings yet

- T1001W6F011Document1 pageT1001W6F011Asim SaleemNo ratings yet

- Favipiravir Tablet Manual: Please Read The Instructions Carefully and Use Under The Guidance of A PhysicianDocument4 pagesFavipiravir Tablet Manual: Please Read The Instructions Carefully and Use Under The Guidance of A Physicianchard xuNo ratings yet

- Works) : SABS 1200Document10 pagesWorks) : SABS 1200Palesa TshetlanyaneNo ratings yet

- Typical Malfunctions of BWMSDocument2 pagesTypical Malfunctions of BWMSPyaeSoneHtunNo ratings yet

- Course Task - Week 7Document34 pagesCourse Task - Week 7JoelynMacalintalNo ratings yet

- Integral AKDocument22 pagesIntegral AKkatherine anne ortiz100% (1)

- Mekong Arcc Main Report Printed - FinalDocument294 pagesMekong Arcc Main Report Printed - FinalChioma UcheNo ratings yet

- Service Tool Screens: JS1 PVE JoystickDocument20 pagesService Tool Screens: JS1 PVE JoystickPitupyNo ratings yet

- Past-Sensitive Pointer Analysis For Symbolic ExecutionDocument12 pagesPast-Sensitive Pointer Analysis For Symbolic Execution石远翔No ratings yet

- Krishna Kathamrita Bindu 167Document5 pagesKrishna Kathamrita Bindu 167Citraka dasaNo ratings yet

- Electrical Systems Instructions Manual Sames DRT6364 UkDocument26 pagesElectrical Systems Instructions Manual Sames DRT6364 UkGermando NUNESNo ratings yet