Professional Documents

Culture Documents

Audprob Cash Bsa4 2

Uploaded by

Mark Gelo WinchesterOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audprob Cash Bsa4 2

Uploaded by

Mark Gelo WinchesterCopyright:

Available Formats

Audit of Cash and Cash Equivalents

1. You were able to gather the following from the December 31, 2020

trial balance of Anna Corporation in connection with your audit of

the company:

Cash on hand P 372,000

Petty cash fund 10,000

BPI current account 950,000

Security Bank current account #1 1.280,000

Security Bank current account #2 (40,000)

PNB savings account 500,000

PNB time deposit 300,000

Cash on hand includes the following items:

a. Customer's check for P60,000 returned by bank on December 26,

2020 due to insufficient fund but subsequently redeposited and

cleared by bank on January 8, 2021.

b. Customer's check for P30,000 dated January 2, 2021, received

December 29, 2020.

c. Postal money orders received from customers, P36,000.

The petty cash fund consisted of the following items as of

December 31, 2020:

Currency and coins P 2,100

Employees' vales 1,600

Currency in an envelope marked "collection for

charity" with names attached 1,200

Unreplenished petty cash vouchers 800

Check drawn by Anna Corporation, payable to the

petty cashier 4,600

Total P10,300

Included among the checks drawn by Anna Corporation against the

BPI current account and recorded in December 2020 are the following:

a. Check written and dated December 29, 2020 and delivered to

payee on January 2, 2021, P50,000.

b. Check written on December 27, 2020, dated January 2, 2021,

delivered to payee on December 29, 2020, P86,000.

The credit balance in the Security Bank current account #2 represents

checks drawn in excess of the deposit balance. These checks were

still outstanding as of December 31, 2020.

The savings account deposit in PNB has been set aside by the board

of directors for acquisitions of new equipment. This account is

expected to be disbursed in the next 3 months from the balance

sheet date.

Required:

Based on the above and the result of your audit, compute the

adjusted balances of the following:

a. Cash on hand

b. Petty cash fund

c. BPI current account

d. Cash and cash equivalents

2. Dakak Corporation was organized on February 1, 2020 and started its

operation soon thereafter. The company cashier who also acted as

the bookkeeper had kept the accounting records very haphazardly.

The manager suspects him of defalcation and engaged you to audit

his account to find out the extent of the fraud, if there is any.

On October 15, when you started the examination of the accounts,

you find the cash on hand to be P4,497.50. From inquiry at the bank,

it was ascertained that the balance of the company's bank deposit

in current account on the same date was P23,037. Verification

revealed that a check issued for P1,620.50 is not yet paid by the bank.

Dakak Corporation sells at 40% above cost.

Your examination of the available records disclosed the following

information:

Capital stock issued at par for cash 280,000.00

Real estate purchased and paid in full 175,000.00

Mortgage liability secured by real estate 70,000.00

Furniture and fixtures (gross) bought, on which

there is still a balance unpaid of P5,250 25,375.00

Outstanding notes due to bank 28,000.00

Total amount owed to creditors on open account 40,498.50

Total sales 282,632.00

Total amount still due from customers 74,707.50

Inventory of merchandise on October 15 at cost 82,180.00

Expenses paid excluding purchases 53,161.50

Required:

Based on the above and the result of your audit, compute for the

following as of October 15, 2020:

a. Payments for purchases

b. Collection from sales

c. Cash accountability

d. Cash accounted

e. Cash shortage, if any

3. On May 1, Siargao, Inc. has a balance of P2,000 in First Bank. On

June 1, the bank statement showed an overdraft of P1,810.

Outstanding checks on May 1 totaled P920 and on June 1, P206.

The proceeds of a 6% , P1,800, 90 day note receivable was

discounted at 6% eleven days after the day of the note. Undeposited

cash on May 31 was P802. Total checks drawn during the month of

May amounted to P11,634 (all payments by checks).

Required:

a. Compute the total bank deposits in May.

b. Calculate the total cash receipts per books in May.

c. Compute the correct cash balance on June 1.

4. You obtained the following information on the current account of

Puerto Galera Company during your examination of its financial

statements for the year ended December 31, 2021.

The bank statement on November 30, 2021 showed a balance of

P306,000. Among the bank credits in November was customer's

note for P100,000 collected for the account of the company which

the company recognized in December among its receipts. Included

in the bank debits were cost of checkbooks amounting to P1,200

and a P40,000 check which was charged by the bank in error

against Puerto Galera Company account. Also in November, you

ascertained that there were deposits in transit amounting to P80,000

and outstanding checks totaling P170,000.

The bank statement for the month of December showed total

credits of P416,000 and total charges of P204,000. The company's

books for December showed total debits of P735,600, total credits

of P407,200 and a balance of P485,600. Bank debit memos for

December were: No. 1201 for service charges , P1,600 and No. 1223

on a customer's returned check marked "Refer to Drawer" for

P24,000.

On December 31, 2021, the company placed with the bank a

customer's promissory note with the face value of P120,000 for

collection. The company treated this note as part of its receipts

although the bank was able to collect the note only in January, 2022.

A check for P3,960 was recorded in the company cash payment

books in December as P39,600.

Required:

Based on the application of the necessary audit procedures and

appreciation of the data above, you are to provide the answers to

the following:

a. How much is the undeposited collections as of December 31,

2021?

b. How much is the outstanding checks as of December 31, 2021?

c. How much is the adjusted cash balance as of November 30,

2021?

d. How much is the adjusted bank receipts for December?

e. How much is the adjusted book disbursements for December?

f. How much is the adjusted cash balance as of December 31,

2021?

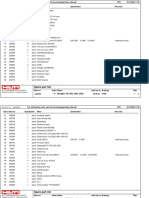

ANSWERS

Cash

on hand PCF BPI C & CE

Unadjusted balances 372,000 10,000 950,000 3,372,000

Customer's NSF check (60,000) (60,000)

Customer's PD check (30,000) (30,000)

Employees' vales (1,600) (1,600)

Unreplenished PCVs (800) (800)

Shortage (900) (900)

Undelivered check 50,000 50,000

Postdated check 86,000 86,000

Restricted for new equipment (500,000)

282,000 6,700 1,086,000 2,914,700

You might also like

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Quizzer Cash and Cash EquivalentsDocument10 pagesQuizzer Cash and Cash EquivalentsJoshua TorillaNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- QUIZ 1. Audit of Cash ManuscriptDocument4 pagesQUIZ 1. Audit of Cash ManuscriptJulie Mae Caling MalitNo ratings yet

- AACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Document4 pagesAACONAPPS2 Quiz No. 01 - Audit of Cash Problem Questions (2022)Dawson Dela CruzNo ratings yet

- Iii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)Document20 pagesIii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)nena cabañesNo ratings yet

- Cash and Cash Equivalents ReviewDocument3 pagesCash and Cash Equivalents ReviewashlyNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- QUIZ Cash APDocument11 pagesQUIZ Cash APJanelleNo ratings yet

- Cce Board WorkDocument3 pagesCce Board WorkNicole VinaraoNo ratings yet

- PA QE - CCE HandoutsDocument6 pagesPA QE - CCE HandoutsBenicel Lane M. D. V.No ratings yet

- Audit of Cash QuizDocument4 pagesAudit of Cash QuizAndy LaluNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Final inDocument7 pagesFinal inSofia GadoyNo ratings yet

- Reconciling Cash Balances Practice ProblemsDocument3 pagesReconciling Cash Balances Practice Problemsdarren sanchezNo ratings yet

- Audit of Cash and Cash Equivalents - Prelims Exam ProblemsDocument4 pagesAudit of Cash and Cash Equivalents - Prelims Exam ProblemsMa Yra YmataNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsJessica JamonNo ratings yet

- Adjust Cash Balances and Accounts for Auditing ProblemsDocument8 pagesAdjust Cash Balances and Accounts for Auditing ProblemsAiahNo ratings yet

- ACP103 Task 1Document3 pagesACP103 Task 1Joshuji LaneNo ratings yet

- Auditing Problems: First PreboardDocument8 pagesAuditing Problems: First PreboardCarlo AgravanteNo ratings yet

- Cash and Cash Equivalents: Intermediate Accounting 1Document3 pagesCash and Cash Equivalents: Intermediate Accounting 1Hershey GalvezNo ratings yet

- Substantive Testing For Cash and Cash EquivalentDocument20 pagesSubstantive Testing For Cash and Cash EquivalentPaul Anthony AspuriaNo ratings yet

- INTACC1Document2 pagesINTACC1Ronalyn LajomNo ratings yet

- ACC 140 1 Period - Quiz 2Document7 pagesACC 140 1 Period - Quiz 2Rica Mille MartinNo ratings yet

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocument8 pagesQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsNMCartNo ratings yet

- 3-Cash and Cash Equiv ExercisesDocument8 pages3-Cash and Cash Equiv ExercisesAngelica CastilloNo ratings yet

- Gdhsjsiidbebrvrkld PDFDocument19 pagesGdhsjsiidbebrvrkld PDFNuarin JJNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- Questions - Level 1Document2 pagesQuestions - Level 1didiaenNo ratings yet

- CCE Quiz Batasan SetDocument3 pagesCCE Quiz Batasan SetJoovs JoovhoNo ratings yet

- Financial_Accounting_and_Reporting_With_Answers.docxDocument11 pagesFinancial_Accounting_and_Reporting_With_Answers.docxHades MercadejasNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- Composition of cash and petty cash fundsDocument7 pagesComposition of cash and petty cash fundsRyou ShinodaNo ratings yet

- Cash and Proof of Cash ProblemsDocument2 pagesCash and Proof of Cash ProblemsDivine MungcalNo ratings yet

- Cash and Cash EquivalentsDocument8 pagesCash and Cash EquivalentsmissyNo ratings yet

- NoteDocument16 pagesNoteJay-an AntipoloNo ratings yet

- Reviewees IntaccDocument6 pagesReviewees IntaccMarvic Cabangunay0% (2)

- Problem SolvingDocument4 pagesProblem SolvingsunflowerNo ratings yet

- FINANCIAL ACCOUNTING - Cash To Receivables Problems and SolutionsDocument8 pagesFINANCIAL ACCOUNTING - Cash To Receivables Problems and Solutionsstan iKONNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- 5 6248879817396060958Document6 pages5 6248879817396060958Jeff GonzalesNo ratings yet

- Practice Set - Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set - Audit of Cash and Cash EquivalentsnikkaNo ratings yet

- Practice Set: Audit of Cash and Cash EquivalentsDocument2 pagesPractice Set: Audit of Cash and Cash EquivalentsANGELU RANE BAGARES INTOLNo ratings yet

- Intermediate Accounting 1 - Cash and Cash EquivalentsDocument14 pagesIntermediate Accounting 1 - Cash and Cash EquivalentsKristine Jewel MirandaNo ratings yet

- Ap Cash Cash Equivalents QuizDocument8 pagesAp Cash Cash Equivalents QuizJenny BernardinoNo ratings yet

- Cash & Cash EquivalentsDocument10 pagesCash & Cash EquivalentsKristine Valerie BonghanoyNo ratings yet

- Audit of Cash: Problem No. 1Document4 pagesAudit of Cash: Problem No. 1Kathrina RoxasNo ratings yet

- Cash EquivalentsDocument10 pagesCash EquivalentsCarel Joy AndalajaoNo ratings yet

- CCE ReceivablesDocument5 pagesCCE ReceivablesJane TuazonNo ratings yet

- Chapter 2 Cash and Cash Equivalents Exercises T3AY2021Document7 pagesChapter 2 Cash and Cash Equivalents Exercises T3AY2021Carl Vincent BarituaNo ratings yet

- Handout - Cash and Cash EquivalentsDocument5 pagesHandout - Cash and Cash Equivalentsandrea arapocNo ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- Auditing Application Special ExamDocument3 pagesAuditing Application Special Examnicole bancoroNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 9th Annual Conference of The EuroMed Academy of BusinessDocument2,168 pages9th Annual Conference of The EuroMed Academy of BusinessMark Gelo WinchesterNo ratings yet

- Business and Management Standard Level Paper 2Document9 pagesBusiness and Management Standard Level Paper 2Mark Gelo WinchesterNo ratings yet

- PDF Financial Aspect Feasibility StudyDocument63 pagesPDF Financial Aspect Feasibility StudyMark Gelo WinchesterNo ratings yet

- Bauli's Panettone Case Study: Benefits of Scale vs FocusDocument2 pagesBauli's Panettone Case Study: Benefits of Scale vs FocusMark Gelo WinchesterNo ratings yet

- Which Capacity Management Option (Level Capacity, Chase Demand, Manage Demand) Is Used by The Company?Document5 pagesWhich Capacity Management Option (Level Capacity, Chase Demand, Manage Demand) Is Used by The Company?Mark Gelo WinchesterNo ratings yet

- Chapter11 Capacity ManagementDocument71 pagesChapter11 Capacity ManagementMark Gelo WinchesterNo ratings yet

- Private label strategies influence manufacturing decisionsDocument18 pagesPrivate label strategies influence manufacturing decisionsMark Gelo WinchesterNo ratings yet

- 6 Case Analysis FormatDocument1 page6 Case Analysis FormatMark Gelo WinchesterNo ratings yet

- Draft Human Resource Management Challenges With Regard To Organizational EfficiencyDocument51 pagesDraft Human Resource Management Challenges With Regard To Organizational EfficiencyMark Gelo WinchesterNo ratings yet

- Case Analysis (Om-Tqm) : Topic Company Region SectorDocument2 pagesCase Analysis (Om-Tqm) : Topic Company Region SectorMark Gelo WinchesterNo ratings yet

- Management 1: Key Components and Elements of An Employee ManualDocument4 pagesManagement 1: Key Components and Elements of An Employee ManualMark Gelo WinchesterNo ratings yet

- Operation Management (TQM) : Topics OutlineDocument3 pagesOperation Management (TQM) : Topics OutlineLJBernardoNo ratings yet

- Benjamin Small Vs Large OrganizationsDocument2 pagesBenjamin Small Vs Large OrganizationsMark Gelo WinchesterNo ratings yet

- Case Analysis: Preparing For ADocument15 pagesCase Analysis: Preparing For AMark Gelo WinchesterNo ratings yet

- Audit-Report-By Marc Angelo Santos - November 28, 2020Document124 pagesAudit-Report-By Marc Angelo Santos - November 28, 2020Mark Gelo WinchesterNo ratings yet

- Acquisition of PPE CostsDocument64 pagesAcquisition of PPE CostsMark Gelo WinchesterNo ratings yet

- 1 Panettone: The Tradition of PanettoneDocument6 pages1 Panettone: The Tradition of PanettoneMark Gelo WinchesterNo ratings yet

- PAS 16 Property, Plant & Equipment ReviewDocument21 pagesPAS 16 Property, Plant & Equipment ReviewMakoy BixenmanNo ratings yet

- Matery Class AFAR Revised Version 1Document94 pagesMatery Class AFAR Revised Version 1Mark Gelo WinchesterNo ratings yet

- iCARE Special Lecture Considering The Work of Other PractitionersDocument24 pagesiCARE Special Lecture Considering The Work of Other PractitionersMark Gelo WinchesterNo ratings yet

- Notes On Tax Remedies of The Government and TaxpayersDocument74 pagesNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- Relevant Costing ICARE 11.22.2020Document39 pagesRelevant Costing ICARE 11.22.2020Makoy BixenmanNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- Mastery Class in Auditing Problems Part 2 Prob 10 15Document34 pagesMastery Class in Auditing Problems Part 2 Prob 10 15Mark Gelo WinchesterNo ratings yet

- iCare-Special-Lecture-VAT by Andrew Gil AmbrayDocument73 pagesiCare-Special-Lecture-VAT by Andrew Gil AmbrayMark Gelo WinchesterNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Sample ProblemsDocument12 pagesSample ProblemsMark Gelo WinchesterNo ratings yet

- Investments-In-Associate by Justine Louie SantiagoDocument30 pagesInvestments-In-Associate by Justine Louie SantiagoMark Gelo WinchesterNo ratings yet

- Full PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesDocument101 pagesFull PFRS vs. PFRS For Medium Entities vs. PFRS For Small EntitiesMark Gelo WinchesterNo ratings yet

- Key differences between PFRS, PFRS for SMEs and PFRS for SEsDocument2 pagesKey differences between PFRS, PFRS for SMEs and PFRS for SEsFuturamaramaNo ratings yet

- Credit Limit Inc ReqDocument2 pagesCredit Limit Inc Reqmatt luiNo ratings yet

- Spare Part List: Breaker TE 705 120V USADocument7 pagesSpare Part List: Breaker TE 705 120V USAJoseLuisCarrilloMenaNo ratings yet

- 412 Supreme Court Reports Annotated: Ang vs. PacunioDocument10 pages412 Supreme Court Reports Annotated: Ang vs. PacunioCarla June GarciaNo ratings yet

- Pro-choice or pro-life? The case for women's rights and rape victimsDocument2 pagesPro-choice or pro-life? The case for women's rights and rape victimsTreseaNo ratings yet

- Mardin Jeovany Moz Giron, A047 300 159 (BIA Jan. 15, 2015)Document4 pagesMardin Jeovany Moz Giron, A047 300 159 (BIA Jan. 15, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Earl 12Document4 pagesEarl 12Shaira DaleNo ratings yet

- GARVICH, Javier. El Caracter Chicha en La Cultura Peruana ContemporaneaDocument10 pagesGARVICH, Javier. El Caracter Chicha en La Cultura Peruana ContemporaneaDarloxNo ratings yet

- Itinerary DetailsDocument4 pagesItinerary Detailsbravo16893No ratings yet

- Meghans LawDocument4 pagesMeghans LawNick MuhohoNo ratings yet

- Kobelco 30SR Service ManualDocument6 pagesKobelco 30SR Service ManualG NEELAKANDANNo ratings yet

- Modules 13, 14 and 15Document11 pagesModules 13, 14 and 15George EvangelistaNo ratings yet

- VA StartUp Checklist PDFDocument4 pagesVA StartUp Checklist PDFNatalia PelenkahuNo ratings yet

- Patrick Caronan Vs Richard CaronanDocument8 pagesPatrick Caronan Vs Richard CaronanJosh CabreraNo ratings yet

- SC Rules Premarital Relations Not Gross ImmoralityDocument3 pagesSC Rules Premarital Relations Not Gross ImmoralityGinalyn MaraguinotNo ratings yet

- Model UnDocument2 pagesModel Unapi-313748366No ratings yet

- Menka Jha - LinkedInDocument9 pagesMenka Jha - LinkedInVVB MULTI VENTURE FINANCENo ratings yet

- Crash Course: Wolf Girl 7 by Anh Do Chapter SamplerDocument10 pagesCrash Course: Wolf Girl 7 by Anh Do Chapter SamplerAllen & UnwinNo ratings yet

- Tax Filing Basics For Stock Plan TransactionsDocument8 pagesTax Filing Basics For Stock Plan Transactionshananahmad114No ratings yet

- Your English Pal ESL Lesson Plan Press Freedom Student v3Document4 pagesYour English Pal ESL Lesson Plan Press Freedom Student v3999 MTHNo ratings yet

- Best Judgment TC05266Document7 pagesBest Judgment TC05266SifuOktarNo ratings yet

- Marques v. Far East BankDocument3 pagesMarques v. Far East Bankmiles1280100% (1)

- Barangay Samara: Office of The Sangguniang Barangay Series of 2018Document1 pageBarangay Samara: Office of The Sangguniang Barangay Series of 2018Maria RinaNo ratings yet

- Assignment 2 Answer KeyDocument2 pagesAssignment 2 Answer KeyAbdulakbar Ganzon BrigoleNo ratings yet

- Epson Surecolor S30670: Quick Reference Guide Guía de Referencia Rápida Guia de Referência RápidaDocument111 pagesEpson Surecolor S30670: Quick Reference Guide Guía de Referencia Rápida Guia de Referência RápidaVinicius MeversNo ratings yet

- Management of Rape VictimsDocument21 pagesManagement of Rape VictimsAndreea Ioana BogdanNo ratings yet

- Lecture Notes On Ethics and Nigerian Legal SystemDocument39 pagesLecture Notes On Ethics and Nigerian Legal Systemolaoluwalawal19No ratings yet

- AQA A Level Law 2nd Edition MRN SampleDocument19 pagesAQA A Level Law 2nd Edition MRN SampleNatalie MudavanhuNo ratings yet

- Steve Nigg AppealDocument19 pagesSteve Nigg Appealtom clearyNo ratings yet

- Chapter 3.1 - Proposal and AcceptanceDocument67 pagesChapter 3.1 - Proposal and AcceptanceJanani VenkatNo ratings yet

- Tax Return Engagement LetterDocument2 pagesTax Return Engagement LetterAshru AshrafNo ratings yet